Affichage 2D pour le marché de la défense et de l'aérospatiale au Moyen-Orient et en Afrique, par technologie d'affichage (écrans à cristaux liquides (LCD), diode électroluminescente (LED), LED organique (OLED) , micro-LED et autres), type (tactile et non tactile), résolution (Full HD, HD, 4K et autres), taille du panneau (5 pouces à 10 pouces, supérieur à 10 pouces et inférieur à 5 pouces), type d'affichage (écran conventionnel et écran intelligent), canal de vente (OEM et détaillant), application (aérospatiale et défense) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de la défense et de l'aérospatiale au Moyen-Orient et en Afrique

Le marché des écrans 2D pour l'aérospatiale et la défense est un marché spécialisé qui fournit des écrans pour les applications aérospatiales militaires et commerciales. Les écrans utilisés sur ce marché doivent répondre à des exigences strictes en matière de fiabilité, de performances et de durabilité, ainsi qu'être conformes à diverses normes réglementaires. Le marché des écrans 2D pour l'aérospatiale et la défense devrait connaître une croissance régulière dans les années à venir, tirée par la demande croissante de technologies d'affichage avancées, la croissance de l'industrie aérospatiale et de défense et le besoin d'améliorer la connaissance de la situation et les capacités de communication dans l'aviation militaire et commerciale. L'émergence de nouvelles technologies, telles que les écrans haute résolution, les écrans tactiles et les écrans de réalité augmentée, devrait également stimuler la croissance de ce marché.

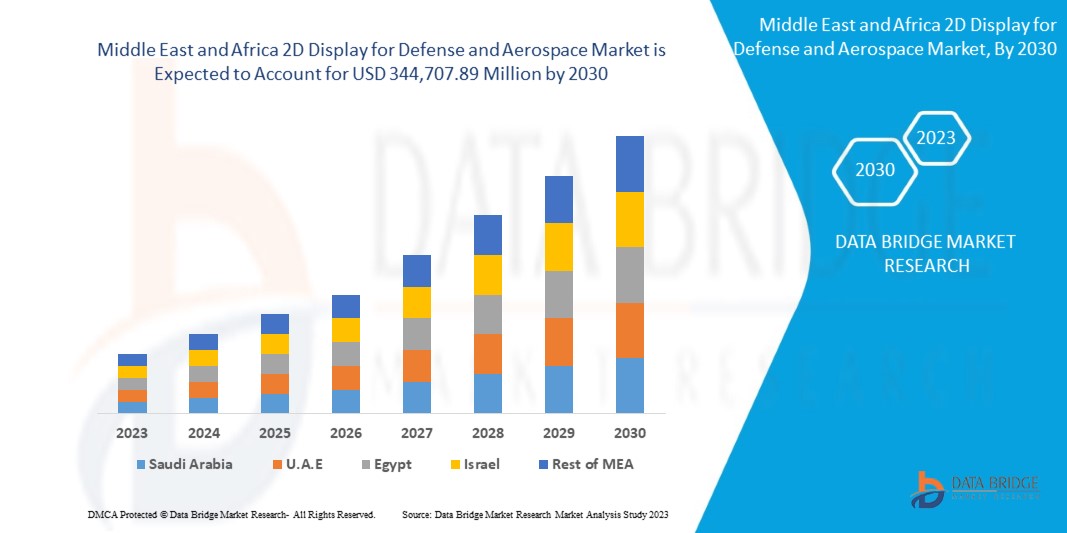

Selon les analyses de Data Bridge Market Research, le marché des écrans 2D pour la défense et l'aérospatiale au Moyen-Orient et en Afrique devrait atteindre une valeur de 344 707,89 millions USD d'ici 2030, à un TCAC de 3,8 % au cours de la période de prévision. Le rapport sur le marché des écrans 2D pour la défense et l'aérospatiale au Moyen-Orient et en Afrique couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par technologie d'affichage (écrans à cristaux liquides (LCD), diodes électroluminescentes (LED), LED organiques (OLED), micro-LED, autres), type (tactile, non tactile), résolution (Full HD, HD, 4K, autres), taille du panneau (5 pouces à 10 pouces, supérieur à 10 pouces, inférieur à 5 pouces), type d'affichage (écran conventionnel, écran intelligent), canal de vente (OEM, détaillant), application (aérospatiale, défense) |

|

Pays couverts |

Émirats arabes unis, Arabie saoudite, Israël, Égypte, Afrique du Sud, Bahreïn, Qatar, Koweït, Oman, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Astronautics Corporation of America, FDS Avionics Corp., Honeywell International Inc., Barco, BAE Systems, Thales, Garmin Ltd., Collins Aerospace et Elbit Systems Ltd.

|

Définition du marché

Un dispositif d'affichage est un périphérique de sortie permettant de présenter des informations sous forme visuelle ou tactile. Lorsque les informations d'entrée fournies comportent un signal électrique, l'affichage est appelé affichage électronique. Un visiocasque 2D (HMD) est un dispositif d'affichage porté sur la tête ou dans le cadre d'un casque doté d'une petite optique d'affichage devant un œil (HMD monoculaire) ou chaque œil (HMD binoculaire). Un HMD a de nombreuses utilisations, notamment dans les jeux, l'aviation, l'ingénierie et la médecine. Les casques de réalité virtuelle sont des HMD combinés à des IMU. Il existe également un visiocasque optique (OHMD), un écran portable qui peut refléter des images projetées et permettre à un utilisateur de voir à travers.

Affichage 2D de la dynamique du marché de la défense et de l'aérospatiale au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

- CROISSANCE DES PROGRAMMES DE MODERNISATION MILITAIRE DANS LE MONDE

La modernisation militaire consiste à mettre à jour et à améliorer les capacités et les équipements militaires d'une nation afin de mieux répondre aux défis de sécurité actuels et futurs. Elle implique l'acquisition de nouveaux systèmes d'armes, de nouvelles technologies et de nouvelles infrastructures, ainsi que le développement de nouvelles stratégies et doctrines. La modernisation militaire est importante pour une nation car elle permet de maintenir une capacité de dissuasion crédible contre des adversaires potentiels, d'améliorer la préparation et l'efficacité militaires et de garantir que l'armée peut s'acquitter des rôles et des missions qui lui sont assignés. Alors que les nations du monde entier augmentent leurs budgets de défense respectifs, le nombre de programmes de modernisation militaire augmente également.

- CROISSANCE DE LA DEMANDE EN TECHNOLOGIES D'AFFICHAGE AVANCÉES

La défense des gouvernements du monde entier et l'industrie aérospatiale nécessitent des écrans avancés capables de fournir des images haute résolution, des informations en temps réel et une meilleure connaissance de la situation aux pilotes et aux soldats. Il existe donc une demande croissante d'écrans 2D capables de répondre à ces exigences.

OPPORTUNITÉ

- AUGMENTATION DE LA DEMANDE DE SYSTÈMES DE SIMULATION ET DE FORMATION

Les systèmes de simulation et de formation dans le secteur de la défense et de l'aérospatiale sont des outils et des technologies utilisés pour simuler des scénarios réels et former le personnel militaire et les pilotes. Ces systèmes peuvent simuler divers scénarios, des opérations de routine aux scénarios complexes du champ de bataille, et permettent au personnel militaire de s'entraîner et de perfectionner ses compétences dans un environnement sûr et contrôlé. L'importance des systèmes de simulation et de formation dans le secteur de la défense et de l'aérospatiale ne peut être surestimée. Ces systèmes permettent de garantir que le personnel militaire est bien formé et préparé à toute situation qu'il peut rencontrer. En outre, ils contribuent à réduire le risque d'accidents ou de mésaventures lors d'exercices d'entraînement ou de missions.

RESTRICTIONS/DÉFIS

- RÉGLEMENTATIONS GOUVERNEMENTALES STRICTES

Des réglementations gouvernementales strictes devraient restreindre l'affichage 2D au Moyen-Orient et en Afrique pour le marché de la défense et de l'aérospatiale en créant des obstacles à l'achat et à l'utilisation de certaines technologies d'affichage 2D. Ces réglementations sont mises en place pour garantir que les technologies utilisées dans l'industrie de la défense et de l'aérospatiale répondent à certaines normes de sécurité et de sûreté

- OBSOLESCENCE TECHNOLOGIQUE ÉLEVÉE DANS LE SECTEUR DE LA DÉFENSE ET DE L'AÉROSPATIAL

L'obsolescence technologique fait référence au fait d'être obsolète en raison des progrès technologiques. Cela signifie qu'une technologie, un produit ou un service autrefois populaire et très demandé peut devenir obsolète et inutilisable à mesure que des technologies plus récentes et plus avancées sont développées et largement disponibles. Dans le contexte du marché, l'obsolescence technologique peut se produire lorsque la technologie d'affichage 2D utilisée dans la défense et l'aérospatiale devient obsolète et est remplacée par des technologies plus récentes et plus avancées, ce qui entraîne une baisse de la demande pour l'ancienne technologie. Il s'agit d'un défi dans l'industrie de la défense et de l'aérospatiale, où la technologie doit être constamment mise à jour et améliorée pour s'adapter aux besoins et aux exigences changeants de l'armée. Dans le cas des écrans 2D pour la défense et l'aérospatiale, l'obsolescence technologique peut limiter la croissance du marché de plusieurs manières.

Impact post-COVID-19 sur le marché de l'affichage 2D pour la défense et l'aérospatiale au Moyen-Orient et en Afrique

La pandémie de COVID-19 a eu un impact considérable sur l'industrie aérospatiale et de défense, notamment sur le marché des écrans 2D. La pandémie a entraîné une baisse du trafic aérien et une réduction des dépenses de défense, ce qui a eu un impact sur la demande d'écrans 2D utilisés dans les avions et les applications de défense. L'un des principaux impacts de la pandémie a été la perturbation de la chaîne d'approvisionnement au Moyen-Orient et en Afrique, qui a entraîné des pénuries de matières premières et de composants utilisés dans la fabrication d'écrans 2D. Cela a entraîné des retards dans la production et la livraison des écrans, ce qui a eu un impact sur la capacité des entreprises de l'aérospatiale et de la défense à terminer leurs projets à temps. La pandémie a également entraîné une baisse de la demande d'avions commerciaux, ce qui a affecté la demande d'écrans 2D utilisés dans les écrans de cockpit et d'autres applications. En outre, la réduction des dépenses de défense a entraîné un ralentissement des achats militaires, ce qui a eu un impact sur la demande d'écrans utilisés dans les applications militaires.

Développements récents

- En mars 2022, Nighthawk Flight Systems, Inc. a annoncé que la société avait obtenu la certification AS9100/ISO9001. Cette certification a permis à l'entreprise de concevoir et de fabriquer des systèmes d'affichage intégrés compacts. Qui est utilisé pour l'aviation générale, l'aviation d'affaires, l'armée, le transport aérien et les avions régionaux dans le cadre de l'affichage 2D au Moyen-Orient et en Afrique pour le marché de la défense et de l'aérospatiale

- En août 2020, Aspen Avionics, Inc. a annoncé que la société avait conclu un accord avec le groupe de sociétés aérospatiales AIRO. Cette étape a permis d'élargir les investissements et les ressources de l'entreprise et d'accroître ses technologies non seulement dans le domaine de l'avionique pour l'aviation générale, mais également pour proposer des produits avioniques pour les plates-formes de vol habitées et sans pilote pour les avions commerciaux, militaires, robotiques et multimodaux sous Affichage 2D au Moyen-Orient et en Afrique pour le marché de la défense et de l'aérospatiale

Affichage 2D pour le marché de la défense et de l'aérospatiale au Moyen-Orient et en Afrique

Le marché de l'affichage 2D pour la défense et l'aérospatiale au Moyen-Orient et en Afrique est segmenté en fonction de la technologie d'affichage, du type, de la résolution, de la taille du panneau, du type d'affichage, du canal de vente et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu et des informations précieuses sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par technologie d'affichage

- Écrans à cristaux liquides (LCD)

- Diode électroluminescente (DEL)

- LED organique (OLED)

- Micro-LED

- Autres

Sur la base de la technologie d'affichage, l'affichage 2D du Moyen-Orient et de l'Afrique pour le marché de la défense et de l'aérospatiale est segmenté en écrans à cristaux liquides (LCD), diodes électroluminescentes (LED), LED organiques (OLED), micro-LED et autres.

Par type

- Touche

- Sans contact

Sur la base du type, l'affichage 2D pour le marché de la défense et de l'aérospatiale du Moyen-Orient et de l'Afrique est segmenté en tactile et non tactile.

Par résolution

- Full HD

- Haute définition

- 4K

- Autres

Sur la base de la résolution, l'affichage 2D du Moyen-Orient et de l'Afrique pour le marché de la défense et de l'aérospatiale est segmenté en Full HD, HD, 4K et autres.

Par taille de panneau

- 5 pouces à 10 pouces

- Plus de 10 pouces

- Moins de 5 pouces

Sur la base de la taille du panneau, l'affichage 2D du Moyen-Orient et de l'Afrique pour le marché de la défense et de l'aérospatiale est segmenté en 5 à 10 pouces, plus de 10 pouces et moins de 5 pouces.

Par type d'affichage

- Affichage conventionnel

- Affichage intelligent

Sur la base du type d'affichage, l'affichage 2D du Moyen-Orient et de l'Afrique pour le marché de la défense et de l'aérospatiale est segmenté en affichage conventionnel et affichage intelligent.

Par canal de vente

- OEM

- Détaillant

Sur la base du canal de vente, le marché de l'affichage 2D pour la défense et l'aérospatiale du Moyen-Orient et de l'Afrique est segmenté en OEM et détaillants.

Par application

- Aérospatial

- Défense

Sur la base de l'application, le marché de l'affichage 2D pour la défense et l'aérospatiale du Moyen-Orient et de l'Afrique est segmenté en aérospatiale et défense

Analyse/perspectives régionales du marché de la défense et de l'aérospatiale au Moyen-Orient et en Afrique

Le marché de l’affichage 2D pour la défense et l’aérospatiale au Moyen-Orient et en Afrique est analysé. Comme indiqué ci-dessus, des informations sur la taille et les tendances du marché sont fournies par technologie d’affichage, type, résolution, taille du panneau, type d’affichage, canal de vente et application.

Les pays couverts dans le rapport sur le marché de la défense et de l'aérospatiale du Moyen-Orient et de l'Afrique en 2D sont les Émirats arabes unis, l'Arabie saoudite, Israël, l'Égypte, l'Afrique du Sud, Bahreïn, le Qatar, le Koweït, Oman et le reste du Moyen-Orient et de l'Afrique.

L'Arabie saoudite domine la région du Moyen-Orient et de l'Afrique car l'Arabie saoudite est stratégiquement située dans la région MEA, ce qui en fait une plaque tournante pour les activités aérospatiales et de défense dans la région et une industrie militaire et aérospatiale forte, avec de nombreuses entreprises leaders impliquées dans la conception, le développement et la fabrication d'écrans 2D, devrait stimuler la croissance du marché.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données régionales.

Paysage concurrentiel et analyse des parts de marché de l'affichage 2D pour la défense et l'aérospatiale au Moyen-Orient et en Afrique

Moyen-Orient et Afrique Affichage 2D pour la défense et l'aérospatiale Le paysage concurrentiel du marché fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché de l'affichage 2D pour la défense et l'aérospatiale au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché de l'affichage 2D pour la défense et l'aérospatiale au Moyen-Orient et en Afrique sont Astronautics Corporation of America, FDS Avionics Corp., Honeywell International Inc., Barco, BAE Systems, Thales, Garmin Ltd., Collins Aerospace et Elbit Systems Ltd., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 TECHNOLOGICAL TRENDS

4.3 COMPANY COMPARATIVE ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PATENT ANALYSIS

4.6 CASE STUDY

4.7 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MILITARY MODERNIZATION PROGRAMS ACROSS THE GLOBE

5.1.2 GROWING DEMAND FOR ADVANCED DISPLAY TECHNOLOGIES

5.1.3 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS

5.1.4 INCREASE IN TECHNOLOGICAL ADVANCEMENTS IN DISPLAY TECHNOLOGY

5.2 RESTRAINTS

5.2.1 HIGH DEVELOPMENT AND MANUFACTURING COSTS ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN DEMAND FOR SIMULATION AND TRAINING SYSTEMS

5.3.2 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 RISE IN DEMAND FOR HEAD-MOUNTED DISPLAYS (HMDS)

5.3.4 EXPANSION OF THE DEFENSE AND AEROSPACE INDUSTRY ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INTEGRATION CHALLENGES ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.4.2 HIGH TECHNOLOGICAL OBSOLESCENCE IN DEFENCE AND AEROSPACE SECTOR

6 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

6.1 OVERVIEW

6.2 LIQUID CRYSTAL DISPLAYS (LCD)

6.3 LIGHT EMITTING DIODE (LED)

6.4 ORGANIC LED (OLED)

6.4.1 RIGID

6.4.2 FLEXIBLE

6.4.3 FOLDABLE

6.5 MICRO-LED

6.6 OTHERS

7 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

7.1 OVERVIEW

7.2 TOUCH

7.3 NON-TOUCH

8 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION

8.1 OVERVIEW

8.2 FULL HD

8.3 HD

8.4 4K

8.5 OTHERS

9 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE

9.1 OVERVIEW

9.2 5 INCHES TO 10 INCHES

9.3 GREATER THAN 10 INCHES

9.4 LESS THAN 5 INCHES

10 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE

10.1 OVERVIEW

10.2 CONVENTIONAL DISPLAY

10.3 SMART DISPLAY

11 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 OEMS

11.3 RETAIL

12 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 AEROSPACE

12.2.1 BY TYPE

12.2.1.1 PRIMARY FLIGHT DISPLAY

12.2.1.2 MULTI-FUNCTIONAL DISPLAY

12.2.1.3 BACKUP DISPLAY

12.2.1.4 MISSION DISPLAY

12.2.2 BY TYPE

12.2.2.1 AIRCRAFT

12.2.2.2 HELICOPTERS

12.2.2.3 OTHERS

12.3 DEFENCE

12.3.1 BY TYPE

12.3.1.1 LAND

12.3.1.2 AIRBORNE

12.3.1.3 NAVAL

13 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 U.A.E.

13.1.3 EGYPT

13.1.4 SOUTH AFRICA

13.1.5 ISRAEL

13.1.6 BAHRAIN

13.1.7 KUWAIT

13.1.8 QATAR

13.1.9 OMAN

13.1.10 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 HONEYWELL INTERNATIONAL INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THALES

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SOLUTION PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 COLLINS AEROSPACE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SOLUTION PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 EXCELITAS TECHNOLOGIES CORP.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCTS PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 BAE SYSTEMS

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCTS PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASPEN AVIONICS, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ASTRONAUTICS CORPORATION OF AMERICA

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCTS PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 AVMAP SRL

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCTS PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BARCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SOLUTION PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 DIEHL STIFTUNG & CO. KG

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 D&T INC

16.11.1 COMPANY SNAPSHOT

16.11.2 SOLUTION PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 ELBIT SYSTEMS LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 BUSINESS PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 FDS AVIONICS CORP.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCTS PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GARMIN LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KORRY

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MEGGIT PLC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCTS PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NIGHTHAWK FLIGHT SYSTEMS, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ROSEN AVIATION.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SCIOTEQ

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 US MICRO PRODUCTS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 WINMATE INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 PATENT ANALYSIS

TABLE 2 REGULATORY STANDARDS

TABLE 3 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA LIQUID CRYSTAL DISPLAYS (LCD) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA LIGHT EMITTING DIODE (LED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA MICRO-LED IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA OTHERS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA NON-TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA FULL HD IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA HD IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA 4K IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA 5 INCHES TO 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA GREATER THAN 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA LESS THAN 5 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA CONVENTIONAL DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA SMART DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA OEMS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA RETAIL IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 47 SAUDI ARABIA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 50 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 51 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 53 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 54 SAUDI ARABIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 SAUDI ARABIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SAUDI ARABIA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 58 U.A.E. ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 61 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 62 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 64 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 65 U.A.E. AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 U.A.E. AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 U.A.E. DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 69 EGYPT ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 72 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 73 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 75 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 76 EGYPT AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 EGYPT AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 EGYPT DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH AFRICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 86 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 SOUTH AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 SOUTH AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 SOUTH AFRICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 91 ISRAEL ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 94 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 95 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 97 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 98 ISRAEL AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 ISRAEL AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 ISRAEL DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 102 BAHRAIN ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 105 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 106 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 108 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 109 BAHRAIN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 BAHRAIN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 BAHRAIN DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 113 KUWAIT ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 116 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 117 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 119 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 120 KUWAIT AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 KUWAIT AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 KUWAIT DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 124 QATAR ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 127 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 128 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 130 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 131 QATAR AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 QATAR AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 QATAR DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 135 OMAN ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 138 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 139 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 141 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 142 OMAN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 OMAN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 OMAN DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 REST OF MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA 2D DIPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MULTIVARIATE MODELLING

FIGURE 10 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DISPLAY TECHNOLOGY CURVE

FIGURE 11 THE MARKET CHALLENGE MATRIX BY DISPLAY TECHNOLOGY

FIGURE 12 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 13 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 14 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS IS EXPECTED TO BE A KEY DRIVER FOR MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 LIQUID CRYSTAL DISPLAYS (LCD) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET IN 2023 TO 2030

FIGURE 16 TECHNOLOGY TRENDS IN 2D DISPLAY FOR AEROSPACE AND DEFENSE

FIGURE 17 COMPANY COMPARISON

FIGURE 18 VALUE CHAIN FOR THE MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 20 TOP 7 DEFENSE BUDGET OF NATION ACROSS THE GLOBE OF 2023 (IN USD)

FIGURE 21 MILITARY EXPENDITURE (% OF GDP) OF U.S., U.K., INDIA, CHINA, AND RUSSIA (2013-2021)

FIGURE 22 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TECHNOLOGY, 2022

FIGURE 23 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY TYPE, 2022

FIGURE 24 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY RESOLUTION, 2022

FIGURE 25 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY PANEL SIZE, 2022

FIGURE 26 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TYPE, 2022

FIGURE 27 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY SALES CHANNEL, 2022

FIGURE 28 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY APPLICATION, 2022

FIGURE 29 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SNAPSHOT (2022)

FIGURE 30 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022)

FIGURE 31 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY DISPLAY TECHNOLOGY (2023-2030)

FIGURE 34 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.