Middle East Africa Polyurethane Foam Market

Taille du marché en milliards USD

TCAC :

%

USD

2.20 Billion

USD

3.37 Billion

2024

2032

USD

2.20 Billion

USD

3.37 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 3.37 Billion | |

|

|

|

Segmentation du marché de la mousse de polyuréthane au Moyen-Orient et en Afrique, par produit (mousse flexible, mousse rigide et mousse pulvérisée), catégorie (cellules ouvertes et cellules fermées), composition de densité (composition à faible densité, composition à densité moyenne et composition à haute densité), processus (mousse moulée, mousse en plaque, pulvérisation et laminage), utilisateur final (literie et meubles, bâtiment et construction, automobile, électronique, emballage, chaussures et autres) - Tendances et prévisions de l'industrie jusqu'en 2032.

Analyse du marché de la mousse de polyuréthane

Le marché de la mousse de polyuréthane connaît une croissance soutenue, portée par une demande croissante de secteurs tels que la construction, l'automobile et l'ameublement, en raison de ses excellentes propriétés d'isolation et de rembourrage. Le marché se divise en deux catégories : les mousses rigides et les mousses souples, les mousses rigides étant fortement adoptées pour les applications d'isolation, tandis que les mousses souples sont largement utilisées dans la literie et l'ameublement. Les préoccupations croissantes en matière de développement durable et les réglementations environnementales encouragent le développement d'alternatives biosourcées et à faibles émissions. La région Asie-Pacifique domine le marché, portée par une urbanisation rapide, le développement des infrastructures et la croissance industrielle. De plus, les innovations en matière de mousses légères et économes en énergie continuent de façonner l'avenir du secteur.

Taille du marché de la mousse de polyuréthane

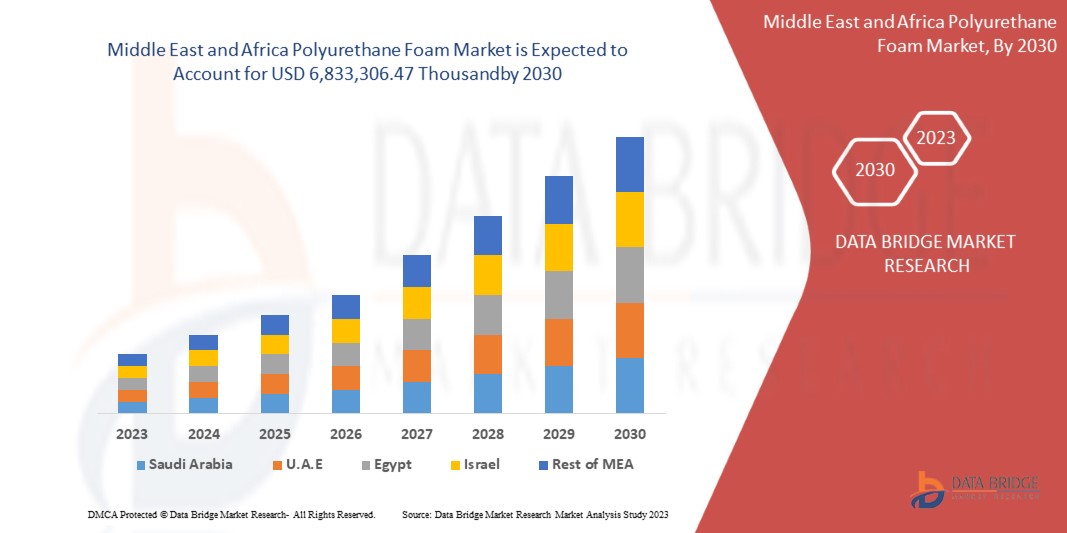

Le marché de la mousse de polyuréthane au Moyen-Orient et en Afrique devrait atteindre 3,37 milliards USD d'ici 2032, contre 2,20 milliards USD en 2024, avec un TCAC substantiel de 5,6 % au cours de la période de prévision de 2025 à 2032. Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire.

Tendances du marché de la mousse de polyuréthane

« Perspectives positives pour le secteur de la construction »

Le secteur de la construction peut être un moteur majeur de l'expansion du marché de la mousse polyuréthane. Les activités liées à la construction sont en plein essor grâce aux investissements directs étrangers dans les économies émergentes. Le ciment, le bois, le verre, les métaux et l'argile comptent parmi les matériaux les plus couramment utilisés dans le secteur de la construction. Le polyuréthane est utilisé dans la construction pour créer des produits haute performance, à la fois résistants et légers, fonctionnels, durables et adaptables. La mousse polyuréthane est un produit chimique flexible utilisé dans de nombreuses applications courantes de la construction, telles que le collage, le remplissage, l'étanchéité et l'isolation. Ses excellentes capacités d'isolation thermique et acoustique en font un produit idéal pour l'isolation des conduites d'eau, le collage et l'étanchéité des toitures et des murs, et, surtout, l'installation de cadres de fenêtres et de portes. Cette croissance des activités liées à la construction et la large utilisation de la mousse polyuréthane dans le secteur de la construction ont stimulé la croissance du marché de la mousse polyuréthane.

Portée du rapport et segmentation du marché de la mousse de polyuréthane

|

Attributs |

Aperçu du marché de la mousse de polyuréthane |

|

Segments couverts |

|

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Principaux acteurs du marché |

Henkel AG & Co. KGaA (Allemagne), Saint-Gobain (France), Huntsman International LLC (États-Unis), BASF (Allemagne), INOAC CORPORATION (Japon), Dow (États-Unis), SEKISUI CHEMICAL CO., LTD. (Japon), Sunpreeth Engineers (Inde), Recticel NV/SA (Belgique), Sheela Foam Ltd. (Inde), Eurofoam Srl (Italie), Rogers Corporation (États-Unis), UFP Technologies, Inc. (États-Unis), General Plastics Manufacturing Company, Inc. (États-Unis), Meenakshi Polymers Pvt. Ltd. (Inde), Foamcraft Inc. (États-Unis), ALSTONE INDUSTRIES PVT. LTD. (Inde), Wisconsin Foam Products (États-Unis), Tirupati Foam Ltd (Inde) |

|

Opportunités de marché |

|

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché de la mousse de polyuréthane

La mousse de polyuréthane est un polymère obtenu par réaction de diisocyanate et de polyol. Elle est généralement appelée mousse PU ou mousse PUR. Elle isole et protège les matériaux contre les facteurs externes de corrosion. Le type de réactif ou de catalyseur utilisé avec l'isocyanate dans la production de mousse de polyuréthane dépend de l'application de la mousse. Il existe trois types de mousse de polyuréthane : rigide, flexible et pulvérisée.

Dynamique du marché de la mousse de polyuréthane

Conducteurs

- Acceptation croissante dans les secteurs de l'automobile et de l'aviation

La mousse de polyuréthane est un matériau polymère doté d'une résistance à la traction élevée, d'un faible poids, d'une résistance chimique, d'une aptitude à la transformation et de caractéristiques mécaniques. Elle est utilisée dans diverses applications. Grâce à ses propriétés uniques, la demande de matériaux légers et performants dans les secteurs aéronautique et automobile est en constante augmentation. Dans ce secteur, la mousse joue un rôle essentiel, contribuant de manière significative à la sécurité et au confort des passagers, des sièges aux sous-couches de moquette. Elle est utilisée pour les garnitures, les sièges, les appuis-tête, l'isolation acoustique et les filtres de climatisation. En effet, la mousse offre un large éventail de propriétés, telles que le blocage des vibrations, l'absorption acoustique et l'isolation. Les mousses à cellules ouvertes et fermées peuvent être utilisées pour les coussins et les sièges des voitures modernes. La mousse de polyuréthane présente dans les automobiles actuelles offre un meilleur kilométrage grâce à sa durabilité et à son extrême légèreté, réduisant ainsi le poids total du véhicule. Par conséquent, la consommation de carburant est améliorée et l'impact environnemental est réduit. Ces applications haut de gamme dans le secteur automobile stimuleront la croissance du marché de la mousse de polyuréthane.

Les applications de la mousse de polyuréthane dans l'industrie aéronautique sont très variées. Elle est utilisée dans des pièces structurelles telles que les parois des cabines passagers, les compartiments à bagages, les plafonds, les éléments de toilettes, les protections de poste de pilotage et les cloisons de séparation. La mousse protège l'avion et ses passagers des variations de température excessives. Sa densité contribue également à prévenir les fuites d'air entrant et sortant de l'avion, préservant ainsi la pression de la cabine. Elle peut également servir de barrière acoustique pour protéger les passagers des niveaux sonores élevés des moteurs d'avion. Par exemple, selon un article publié en juin 2022 par Linden Industries, LLC, la mousse de polyuréthane est largement utilisée dans les intérieurs automobiles pour ses propriétés d'amortissement, de durabilité et d'insonorisation. Elle améliore le confort et le soutien des sièges et des appuie-têtes, tout en absorbant les chocs. Les tableaux de bord et les panneaux de porte l'utilisent pour isoler et atténuer le bruit de la route. Sa durabilité garantit une longévité accrue malgré une utilisation fréquente. Essentielle pour améliorer la sécurité et l'expérience des passagers, elle reste un matériau clé dans la construction automobile.

- Demande croissante pour diverses applications d'ameublement

L'ameublement désigne les objets placés dans une pièce pour la rendre plus confortable et agréable. Il comprend tous les éléments mobiles tels que les meubles, les rideaux, les tapis et les objets de décoration qui complètent le design de la pièce. Les mousses de polyuréthane sont largement utilisées dans l'ameublement en raison de leurs caractéristiques uniques, telles qu'une faible densité, des propriétés mécaniques élevées et une faible conductivité thermique. Les mousses de polyuréthane sont des matériaux poreux légers aux performances prometteuses. Ces matériaux sont également utilisés dans les coussins de meubles tels que les canapés et les fauteuils, ce qui stimule la croissance du marché de la mousse de polyuréthane.

Des facteurs tels que la croissance démographique, l'urbanisation croissante, la demande de matelas de qualité et l'amélioration des infrastructures institutionnelles stimulent les ventes de matelas dans les secteurs de l'immobilier et de l'hôtellerie. La mousse de polyuréthane flexible possède une structure cellulaire qui permet une certaine compression et résilience, ce qui procure un effet amortissant. Cette caractéristique est largement utilisée dans les meubles, les matelas, les oreillers et les moquettes. La croissance de secteurs tels que le logement, l'hôtellerie et le ferroviaire est également un facteur de croissance du marché des matelas en mousse de polyuréthane. Par exemple, Selon l'ISPF, une étude a été menée par la Fédération indienne des produits du sommeil. En Inde, le marché global des matelas s'élevait à environ 18,6 millions d'unités, avec une nouvelle demande prévue de 7 millions d'unités par an. De plus, le cycle de remplacement moyen des matelas était de 12 ans, et la demande de remplacement de matelas s'élevait à 11,6 millions d'unités. L'étude a également révélé que le secteur de l'ameublement est essentiel à la nouvelle demande, représentant 50 % des ventes totales de matelas. De plus, les matelas à base de mousse représentaient 52,6 % des ventes totales, tandis que les matelas à ressorts représentaient 13,5 % et les matelas à base de fibre de coco 34 %.

Opportunités

- Perspectives lucratives vers des mousses respectueuses de l'environnement

Les mousses de polyuréthane sont devenues l'un des matériaux les plus essentiels de l'industrie, car elles comptent parmi les polymères les plus adaptables. Elles sont utilisées dans l'industrie automobile pour les sièges, les garnitures et les pare-chocs ; dans l'ameublement comme matériaux de remplissage pour les coussins d'assise, les canapés et les matelas ; dans le secteur de l'emballage ; dans la construction pour l'isolation thermique et acoustique ; et bien d'autres applications. Outre leur faible densité, leur faible conductivité thermique et leurs excellentes caractéristiques mécaniques, l'un des principaux avantages des mousses de polyuréthane est leur capacité à ajuster leur densité et leur rigidité aux exigences du marché.

Ce polymère est cependant principalement issu du pétrole. Les préoccupations environnementales exigent que les polyuréthanes soient fabriqués de manière plus durable, notamment grâce à l'utilisation de ressources renouvelables ou au recyclage des mousses de polyuréthane. L'évolution des comportements des consommateurs vers des matériaux durables, les réglementations gouvernementales strictes et les mesures prises par les fabricants pour réduire l'utilisation de matières premières dérivées du pétrole dans la production de mousses sont autant de facteurs qui ont contribué à l'essor des mousses respectueuses de l'environnement. Ces mesures permettront de développer des mousses de polyuréthane biodégradables et respectueuses de l'environnement. Les fabricants collaborent également avec d'autres entreprises et développent des installations de recyclage de la mousse de polyuréthane. Par exemple, en septembre 2023, selon un article publié par Crain Communications, Inc., Covestro a collaboré avec Selena Group pour développer des mousses de polyuréthane (PU) durables destinées à l'isolation des bâtiments. L'entreprise a utilisé le MDI bio-attribué de Covestro dans une mousse Ultra-Fast 70 améliorée, réduisant ainsi son empreinte carbone de 60 %. La mousse a durci en 90 minutes et a offert un rendement de 70 litres par conteneur. Sa qualité était comparable à celle des mousses fossiles et sa conception permettait une intégration harmonieuse. Selena a intégré des polyols biosourcés et du PET recyclé à sa gamme de mousses.

- Politiques gouvernementales favorables à l'investissement sur les marchés intérieurs

L'augmentation du revenu disponible, l'urbanisation rapide, la diversité des applications industrielles, la forte consommation, l'augmentation des investissements directs étrangers et le potentiel d'exportation prometteur sont autant de facteurs qui favorisent la croissance de l'industrie chimique dans les économies en développement comme l'Inde et la Chine. Les nombreuses opportunités à venir dans la fabrication de produits chimiques de spécialité et de polymères créeront une forte demande intérieure. Les pays en développement seront autonomes dans la production de matières premières et de produits finis. De plus, les investissements des pays développés ou l'implantation d'usines chimiques dans les économies émergentes peuvent offrir de vastes opportunités de croissance pour le marché de la mousse de polyuréthane au Moyen-Orient et en Afrique.

La mousse de polyuréthane est utilisée dans divers secteurs, tels que l'automobile, l'ameublement, la construction, l'emballage, le textile, la chaussure, etc. La croissance de ces marchés stimulera l'économie des pays en développement. Les activités de recherche et développement, les avancées technologiques, la hausse de la demande des industries utilisatrices finales et des politiques et cadres favorables ont influencé la croissance de l'industrie chimique dans ces pays. Par exemple, selon Arab News, en septembre 2022, avec des dépenses globales de 1 100 milliards de dollars en projets d'infrastructures et d'immobilier depuis l'annonce de la Vision 2030 de l'Arabie saoudite en 2016, l'Arabie saoudite est en passe de devenir le plus grand chantier de construction du monde. L'Arabie saoudite deviendra facilement le plus grand chantier de construction du monde, avec plus de 555 000 logements, plus de 275 000 clés d'hôtel, plus de 4,3 millions de mètres carrés de commerces et plus de 6,1 millions de mètres carrés de bureaux prévus dans le royaume. Une infrastructure d'une telle ampleur entraînera une large utilisation de la mousse de polyuréthane dans le secteur de la construction dans les années à venir.

Contraintes/Défis

- Utilisation de produits chimiques nocifs dans la production de mousse de polyuréthane

Les mousses de polyuréthane sont utilisées dans diverses applications, allant de l'ameublement à l'isolation. Cependant, l'utilisation de divers produits chimiques dans leur production soulève des préoccupations environnementales et sanitaires pour les travailleurs impliqués dans la production. Le polyuréthane est un produit de polymérisation entre divers polyols et diisocyanates dérivés du pétrole brut. Différents agents gonflants, agents de durcissement, retardateurs de flamme, tensioactifs et catalyseurs interviennent dans le processus. Les polyols couramment utilisés sont le polyéthylène glycol, le polypropylène glycol et le polytétraméthylène glycol. Le toluène diisocyanate (TDI) et le méthylène diphényl diisocyanate (MDI) sont également des diisocyanates couramment utilisés. Par exemple, en mars 2023, selon l'Agence américaine de protection de l'environnement (EPA), les diisocyanates tels que le MDI et le TDI seraient à l'origine d'asthme, de lésions pulmonaires, voire de décès chez les travailleurs concernés. L'EPA a élaboré un plan d'action pour leur contrôle protecteur dans les unités de production. Le rejet de composés organiques volatils lors du processus de production serait source de préoccupations environnementales.

- Volatilité des prix des matières premières

Dans tout secteur, le processus de fabrication dépend du prix des matières premières. Plus le prix des matières premières est volatile, plus le risque de fluctuation du coût des produits et de la croissance du marché est élevé.

Les principales matières premières utilisées pour la production de mousse de polyuréthane sont les polyols et les diisocyanates dérivés du pétrole brut. Plusieurs facteurs, tels que le climat, la chaîne d'approvisionnement, la demande, la disponibilité, les contraintes et la situation économique du pays, déterminent le prix de ces matières premières. Par exemple, en novembre 2024, selon un article publié par Polymerupdate, les entreprises de transformation du pétrole ont subi une baisse significative de leur rentabilité au troisième trimestre 2024 en raison de faibles marges de raffinage, le prix du baril de pétrole brut (GRM) chutant à 1,3 USD en septembre 2024, son plus bas niveau depuis le pic de la Covid-19. Cette baisse s'explique par la faiblesse des prix du pétrole brut, l'augmentation de la disponibilité du brut russe et la faiblesse de la demande, notamment chinoise. La croissance économique au Moyen-Orient et en Afrique est restée stable à 3,1 % en 2024, malgré les risques de baisse liés aux tensions géopolitiques et au secteur immobilier chinois. Elle a également souffert de la baisse de la demande de carburants pétroliers en Asie et en Europe due à l'adoption des véhicules électriques, des biocarburants et du GNL. L'arrivée de nouvelles capacités de raffinage a encore pesé sur les marges.

Impact et scénario actuel du marché en cas de pénurie de matières premières et de retards d'expédition

Data Bridge Market Research propose une analyse de haut niveau du marché et fournit des informations en tenant compte de l'impact et de l'environnement actuel du marché en matière de pénurie de matières premières et de retards d'expédition. Cela se traduit par l'évaluation des possibilités stratégiques, la création de plans d'action efficaces et l'assistance aux entreprises dans la prise de décisions importantes.

Outre le rapport standard, nous proposons également une analyse approfondie du niveau d'approvisionnement à partir des retards d'expédition prévus, de la cartographie des distributeurs par région, de l'analyse des produits de base, de l'analyse de la production, des tendances de la cartographie des prix, de l'approvisionnement, de l'analyse des performances des catégories, des solutions de gestion des risques de la chaîne d'approvisionnement, de l'analyse comparative avancée et d'autres services d'approvisionnement et de soutien stratégique.

Impact attendu du ralentissement économique sur les prix et la disponibilité des produits

Lorsque l'activité économique ralentit, les industries commencent à souffrir. Les effets prévus du ralentissement économique sur les prix et l'accessibilité des produits sont pris en compte dans les rapports d'analyse du marché et les services de renseignements fournis par DBMR. Grâce à cela, nos clients peuvent généralement garder une longueur d'avance sur leurs concurrents, projeter leurs ventes et leurs revenus et estimer leurs dépenses de profits et pertes.

Portée du marché de la mousse de polyuréthane

Le marché est segmenté selon le produit, la catégorie, la densité, le procédé et l'utilisateur final. La croissance de ces segments vous aidera à analyser les segments à faible croissance des secteurs et à fournir aux utilisateurs une vue d'ensemble et des informations précieuses sur le marché, les aidant ainsi à prendre des décisions stratégiques pour identifier les applications clés du marché.

Produit

- Mousse flexible

- Mousse rigide

- Mousse pulvérisée

Catégorie

- Cellule ouverte

- Cellule fermée

Composition de la densité

- Composition à faible densité

- Composition de densité moyenne

- Composition à haute densité

Processus

- Mousse moulée

- Mousse en plaques

- Pulvérisation

- Laminage

Utilisateur final

- Literie et meubles

- Bâtiment et construction

- Automobile

- Électronique

- Conditionnement

- Chaussure

- Autres

Analyse régionale du marché de la mousse de polyuréthane

Le marché est analysé et des informations sur la taille et les tendances du marché sont fournies par produit, catégorie, composition de densité, processus et utilisateur final, comme référencé ci-dessus.

Les pays couverts par le marché sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, l’Égypte, Israël et le reste du Moyen-Orient et de l’Afrique.

L'Afrique du Sud devrait dominer le marché du polyuréthane au Moyen-Orient et en Afrique grâce à ses secteurs bien développés de la construction, de l'automobile et de l'ameublement. Le pays dispose d'un solide tissu manufacturier, soutenu par une demande croissante de matériaux durables et économes en énergie. De plus, la présence de producteurs clés de polyuréthane et l'accès aux matières premières renforcent encore la position de leader de l'Afrique du Sud dans la région.

L'Afrique du Sud devrait connaître la croissance la plus rapide grâce à l'urbanisation rapide, au développement des infrastructures et à la demande croissante de matériaux haute performance dans divers secteurs. Les initiatives gouvernementales favorisant la croissance industrielle et les investissements étrangers dans le secteur manufacturier contribuent également à l'essor du marché du polyuréthane dans le pays.

La section pays du rapport présente également les facteurs d'impact sur les marchés individuels et les évolutions réglementaires nationales qui influencent les tendances actuelles et futures du marché. Des données telles que l'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. De plus, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique, ainsi que les difficultés rencontrées en raison de la concurrence forte ou faible des marques locales et nationales, de l'impact des tarifs douaniers nationaux et des routes commerciales, sont prises en compte lors de l'analyse prévisionnelle des données nationales.

Part de marché de la mousse de polyuréthane

Le paysage concurrentiel du marché fournit des informations détaillées par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence au Moyen-Orient et en Afrique, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la prédominance de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les leaders du marché de la mousse de polyuréthane opérant sur le marché sont :

- Henkel AG & Co. KGaA (Allemagne)

- Saint-Gobain (France)

- Huntsman International LLC (États-Unis)

- BASF (Allemagne)

- INOAC CORPORATION (Japon)

- Dow (États-Unis)

- SEKISUI CHEMICAL CO., LTD. (Japon)

- Sunpreeth Engineers (Inde)

- Recticel NV/SA (Belgique)

- Sheela Foam Ltd. (Inde)

- Eurofoam Srl (Italie)

- Rogers Corporation (États-Unis)

- UFP Technologies, Inc. (États-Unis)

- General Plastics Manufacturing Company, Inc. (États-Unis)

- Meenakshi Polymers Pvt. Ltd. (Inde)

- Foamcraft Inc. (États-Unis)

- ALSTONE INDUSTRIES PVT. LTD. (Inde)

- Wisconsin Foam Products (États-Unis)

- Tirupati Foam Ltd (Inde)

Derniers développements sur le marché de la mousse de polyuréthane :

- En septembre 2022, Saint-Gobain a reçu toutes les autorisations nécessaires des autorités compétentes pour l'acquisition de GCP Applied Technologies Inc. (acteur majeur des produits chimiques pour la construction au Moyen-Orient et en Afrique). Cette acquisition renforce la notoriété de l'entreprise dans ce secteur.

- En mai 2020, Huntsman Corporation a annoncé le changement de nom de son activité de mousse de polyuréthane pulvérisée, leader mondial, sous le nom de Huntsman Building Solutions. Huntsman Building Solutions est une plateforme mondiale rattachée à la division Polyuréthanes de Huntsman. Ce changement de nom a permis à l'entreprise de développer ses activités dans le secteur de la mousse de polyuréthane.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.6.1 RAW MATERIAL COVERAGE

4.7 PRICING ANALYSIS

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 PRODUCTION CAPACITY ANALYSIS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 POSITIVE OUTLOOK TOWARD THE CONSTRUCTION SECTOR

6.1.2 GROWING ACCEPTANCE IN THE AUTOMOTIVE AND AVIATION SECTOR

6.1.3 RISING DEMAND FOR VARIOUS HOME FURNISHING APPLICATIONS

6.1.4 INCREASING DEMAND FOR PROTECTIVE PACKAGING

6.1.5 RISING ADOPTION OF POLYURETHANE FOAMS IN THE TEXTILE AND FOOTWEAR INDUSTRY

6.2 RESTRAINTS

6.2.1 ENVIRONMENTAL AND HEALTH HAZARDS ASSOCIATED WITH THE USAGE OF POLYURETHANE FOAM

6.2.2 AVAILABILITY OF SUBSTITUTES IN MARKET

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS ENVIRONMENTALLY FRIENDLY FOAMS

6.3.2 SUPPORTIVE GOVERNMENT POLICIES REGARDING INVESTMENT IN DOMESTIC MARKETS, INCLUDING CHINA AND INDIA

6.4 CHALLENGES

6.4.1 HARMFUL CHEMICAL USAGE IN POLYURETHANE FOAM PRODUCTION

6.4.2 VOLATILITY IN RAW MATERIAL PRICES

6.4.3 STRINGENT RULES AND REGULATIONS FOR POLYURETHANE FOAMS

7 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLEXIBLE FOAM

7.3 RIGID FOAM

7.4 SPRAY FOAM

8 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 OPEN CELL

8.3 CLOSED CELL

9 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION

9.1 OVERVIEW

9.2 LOW-DENSITY COMPOSITION

9.3 MEDIUM-DENSITY COMPOSITION

9.4 HIGH-DENSITY COMPOSITION

10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PROCESS

10.1 OVERVIEW

10.2 MOLDED FOAM

10.3 SLABSTOCK FOAM

10.4 SPRAYING

10.5 LAMINATION

11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY END-USER

11.1 OVERVIEW

11.2 BEDDING & FURNITURE

11.3 BUILDING & CONSTRUCTION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.6 PACKAGING

11.7 FOOTWEAR

11.8 OTHERS

12 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 UNITED ARAB EMIRATES

12.1.4 EGYPT

12.1.5 QATAR

12.1.6 OMAN

12.1.7 KUWAIT

12.1.8 BAHRAIN

12.1.9 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 COMPANY PROFILES

14.1 HENKEL AG & CO. KGAA

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 COMPANY SHARE ANALYSIS

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 SAINT-GOBAIN

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 SWOT ANALYSIS

14.2.6 RECENT DEVELOPMENT

14.3 HUNTSMAN INTERNATIONAL LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SWOT ANALYSIS

14.3.5 PRODUCT PORTFOLIO

14.3.6 RECENT DEVELOPMENTS

14.4 BASF

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 SWOT ANALYSIS

14.4.6 RECENT DEVELOPMENT

14.5 INOAC CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 SWOT ANALYSIS

14.5.5 RECENT DEVELOPMENT

14.6 ALSTONE INDUSTRIES PVT. LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 SWOT ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DOW

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.8 EUROFOAM S.R.L.

14.8.1 COMPANY SNAPSHOT

14.8.2 SWOT ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 FOAMCRAFT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT ANALYSIS

14.9.4 RECENT DEVELOPMENTS

14.1 GENERAL PLASTICS MANUFACTURING COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 SWOT ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 MEENAKSHI POLYMERS PVT. LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 RECTICEL NV/SA

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SWOT ANALYSIS

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 ROGERS CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE ANALYSIS

14.13.4 SWOT ANALYSIS

14.13.5 RECENT DEVELOPMENTS

14.14 SEKISUI CHEMICAL CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 SWOT ANALYSIS

14.14.5 RECENT DEVELOPMENT

14.15 SHEELA FOAM LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 SWOT ANALYSIS

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 SUNPREETH ENGINEERS

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 TIRUPATI FOAM LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT ANALYSIS

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 UFP TECHNOLOGIES, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 SWOT ANALYSIS

14.18.5 RECENT DEVELOPMENT

14.19 WISCONSIN FOAM PRODUCTS

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 SWOT ANALYSIS

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (TONS)

TABLE 4 MIDDLE EAST AND AFRICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 6 MIDDLE EAST AND AFRICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 8 MIDDLE EAST AND AFRICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 14 MIDDLE EAST AND AFRICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 16 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 18 MIDDLE EAST AND AFRICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 20 MIDDLE EAST AND AFRICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 22 MIDDLE EAST AND AFRICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 24 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (TONS)

TABLE 26 MIDDLE EAST AND AFRICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 28 MIDDLE EAST AND AFRICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 30 MIDDLE EAST AND AFRICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 32 MIDDLE EAST AND AFRICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 34 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (TONS)

TABLE 36 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 38 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 42 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 46 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 53 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 57 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 61 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 64 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 66 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 68 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 70 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 74 MIDDLE EAST & AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST & AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST & AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST & AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST & AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST & AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST & AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST & AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST & AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 87 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 88 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 90 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 92 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 94 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 96 SOUTH AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 110 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 111 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 112 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 113 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 114 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 115 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 116 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 118 SAUDI ARABIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 132 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 134 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 135 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 136 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 137 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 138 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 139 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 140 UNITED ARAB EMIRATES BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 141 UNITED ARAB EMIRATES BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 UNITED ARAB EMIRATES BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 143 UNITED ARAB EMIRATES BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 UNITED ARAB EMIRATES AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 145 UNITED ARAB EMIRATES AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 UNITED ARAB EMIRATES ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 UNITED ARAB EMIRATES PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 148 UNITED ARAB EMIRATES PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 UNITED ARAB EMIRATES FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 150 UNITED ARAB EMIRATES FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 UNITED ARAB EMIRATES OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 EGYPT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 153 EGYPT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 154 EGYPT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 155 EGYPT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 156 EGYPT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 157 EGYPT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 158 EGYPT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 159 EGYPT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 160 EGYPT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 161 EGYPT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 162 EGYPT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 163 EGYPT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 EGYPT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 165 EGYPT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 EGYPT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 167 EGYPT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 EGYPT ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EGYPT PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 170 EGYPT PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EGYPT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 172 EGYPT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 QATAR POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 175 QATAR POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 176 QATAR POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 QATAR POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 178 QATAR POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 179 QATAR POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 180 QATAR POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 181 QATAR POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 182 QATAR POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 183 QATAR POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 184 QATAR BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 185 QATAR BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 QATAR BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 187 QATAR BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 QATAR AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 189 QATAR AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 QATAR ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 QATAR PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 192 QATAR PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 QATAR FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 194 QATAR FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 QATAR OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 OMAN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 197 OMAN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 198 OMAN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 199 OMAN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 200 OMAN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 201 OMAN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 202 OMAN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 203 OMAN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 204 OMAN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 205 OMAN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 206 OMAN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 207 OMAN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 OMAN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 209 OMAN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 OMAN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 211 OMAN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 OMAN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 OMAN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 214 OMAN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 OMAN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 216 OMAN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 OMAN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 KUWAIT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 219 KUWAIT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 220 KUWAIT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 221 KUWAIT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 222 KUWAIT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 223 KUWAIT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 224 KUWAIT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 225 KUWAIT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 226 KUWAIT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 227 KUWAIT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 228 KUWAIT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 229 KUWAIT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 KUWAIT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 231 KUWAIT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 KUWAIT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 233 KUWAIT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 KUWAIT ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 KUWAIT PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 236 KUWAIT PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 KUWAIT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 238 KUWAIT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 KUWAIT OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 BAHRAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 241 BAHRAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 242 BAHRAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 243 BAHRAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 244 BAHRAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 245 BAHRAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 246 BAHRAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 247 BAHRAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 248 BAHRAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 249 BAHRAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 250 BAHRAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 251 BAHRAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 BAHRAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 253 BAHRAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 BAHRAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 255 BAHRAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 BAHRAIN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 BAHRAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 258 BAHRAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 BAHRAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 260 BAHRAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 BAHRAIN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 REST OF MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 263 REST OF MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

Liste des figures

FIGURE 1 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET

FIGURE 2 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: SEGMENTATION

FIGURE 13 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET EXECUTIVE SUMMARY

FIGURE 14 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 A POSITIVE OUTLOOK TOWARDS THE BUILDING AND CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET IN THE FORECAST PERIOD

FIGURE 17 THE FLEXIBLE FOAM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET IN 2025 AND 2032

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET

FIGURE 21 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2024

FIGURE 22 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2024

FIGURE 23 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2024

FIGURE 24 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2024

FIGURE 25 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2024

FIGURE 26 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: SNAPSHOT (2024)

FIGURE 27 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.