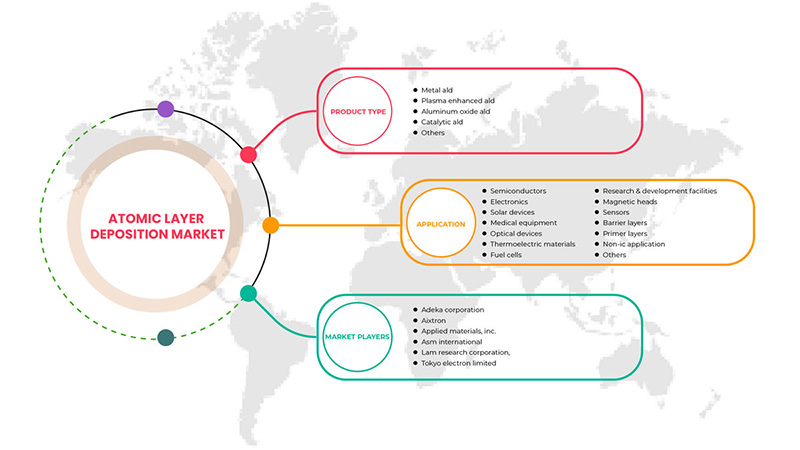

Marché du dépôt de couches atomiques au Moyen-Orient et en Afrique, par type de produit (ALD métallique, ALD à l'oxyde d'aluminium, ALD amélioré par plasma, ALD catalytique, autres), application (semi-conducteurs, dispositifs solaires, électronique, équipement médical, installations de recherche et développement, piles à combustible, dispositifs optiques, matériaux thermoélectriques, têtes magnétiques, capteurs, couches barrières, couches d'apprêt, applications non IC, autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché du dépôt de couches atomiques au Moyen-Orient et en Afrique

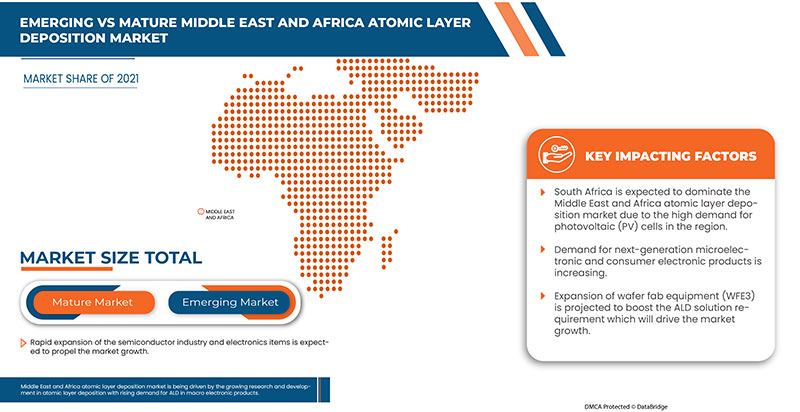

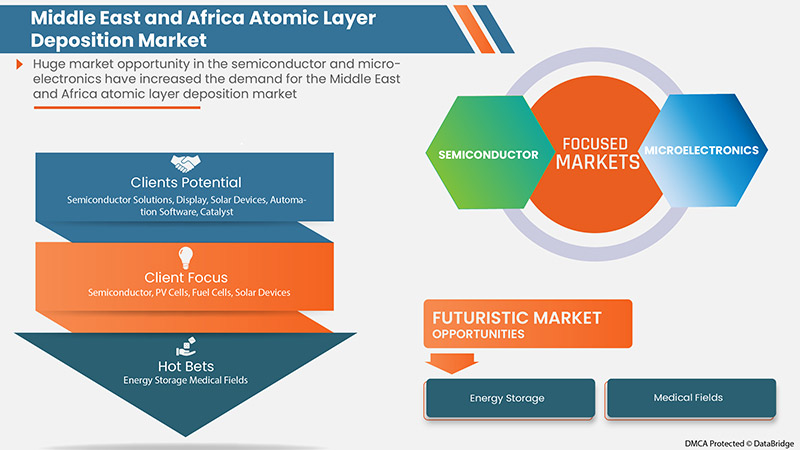

Le marché du dépôt de couches atomiques au Moyen-Orient et en Afrique devrait connaître une croissance en raison d'une augmentation de la demande des industries des semi-conducteurs. Les semi-conducteurs étant le principal composant ou application de l'ALD, l'augmentation de la demande de semi-conducteurs contribue à accroître la demande d'ALD. D'autres facteurs qui devraient stimuler la croissance du marché suscitent des inquiétudes quant aux résultats de la récupération d'énergie dans la forte croissance des cellules photovoltaïques (PV).

Le principal facteur susceptible de limiter le marché est le coût d’investissement initial élevé dans la production d’ALD, qui a affecté la croissance du marché.

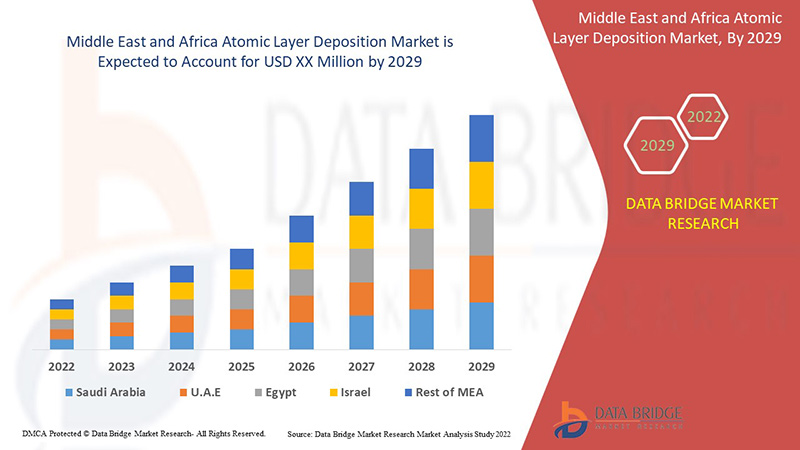

Data Bridge Market Research analyse que le marché du dépôt de couches atomiques au Moyen-Orient et en Afrique connaîtra un TCAC de 12,6 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de produit (ALD métallique, ALD à l'oxyde d'aluminium, ALD amélioré par plasma, ALD catalytique, autres), application (semi-conducteurs, dispositifs solaires, électronique, équipement médical, installations de recherche et développement, piles à combustible, dispositifs optiques, matériaux thermoélectriques, têtes magnétiques, capteurs, couches barrières, couches d'apprêt, applications non IC, autres). |

|

Pays couverts |

Arabie saoudite, Afrique du Sud, Égypte, Émirats arabes unis, Israël et le reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

LAM RESEARCH CORPORATION, Kurt J. Lesker Company, ANRIC TECH., Forge Nano Inc., Merck KGaA, entre autres. |

Définition du marché

Le dépôt de couches atomiques (ALD) fait référence au processus de dépôt de matériaux précurseurs sur des substrats pour améliorer ou modifier des propriétés telles que la résistance chimique, la solidité et la conductivité. Le processus est considéré comme une sous-division du dépôt chimique en phase vapeur (CVD) dans le dépôt de couches atomiques. La plupart du temps, deux produits chimiques sont utilisés pour la réaction, généralement appelés précurseurs.

Dynamique du marché des dépôts de couches atomiques au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs :

- FORTE DEMANDE EN MICROÉLECTRONIQUE ET ÉLECTRONIQUE GRAND PUBLIC

La microélectronique est un processus de fabrication de composants électroniques au niveau microscopique. Le marché de la microélectronique connaît une croissance rapide en raison de la demande d'équipements peu coûteux et légers. Les composants microélectroniques comprennent des transistors, des condensateurs, des diodes, des résistances, des inducteurs et autres. Tous ces composants électroniques sont utilisés pour fabriquer des téléphones portables, des ordinateurs portables, des jouets électroniques et autres.

- L'inquiétude suscitée par la production d'énergie entraîne une forte croissance des cellules photovoltaïques (PV)

Le photovoltaïque (PV) est communément appelé une technologie de récupération d'énergie et est utilisé pour convertir l'énergie solaire en énergie électrique, c'est-à-dire en électricité. La demande de cellules photovoltaïques a augmenté en raison de leur prix relativement bas et de leur large gamme d'applications telles que les feux de circulation solaires, les pompes à énergie solaire, les lampes solaires, les calculateurs d'énergie solaire et autres.

Retenue:

- COÛTS D'INVESTISSEMENT INITIAUX ÉLEVÉS

Le dépôt de couches atomiques (ALD) est le dépôt de matériaux précurseurs sur des substrats pour améliorer/modifier des propriétés telles que la conductivité, la résistance chimique et la solidité. Pour fournir des services ALD, le fournisseur doit acheter des équipements pour le processus de dépôt de couches atomiques, tels que le système de dépôt de couches atomiques Cambridge NanoTech Fiji F200, le système ALD à charge ouverte : OpAL, la série ALD 200L de Kurt J. Lesker Company, le système de dépôt de couches atomiques Cambridge NanoTech Savannah Series, le système ALD plasma et thermique : FlexAL, le système de dépôt par faisceau ionique : IonFab IBD et le système de dépôt de couches atomiques Cambridge NanoTech Savannah Series.

Le prix de chaque équipement est d'environ 10 000 USD, et le fournisseur doit acheter tout l'équipement pour fournir tous les types de services de dépôt de couches atomiques. Le coût de l'équipement serait très élevé pour fournir tous les types de services de dépôt de couches atomiques. Ainsi, de nombreux acheteurs éviteront d'acheter en raison du coût élevé par rapport au mobilier ordinaire.

Opportunité

- TENDANCE À LA MINIATURISATION

La miniaturisation est le processus de fabrication des plus petits dispositifs mécaniques, électroniques et optiques. En d'autres termes, il s'agit de rendre les appareils électroniques plus petits. La miniaturisation est à la mode car tout le monde veut des appareils plus petits, plus compacts et plus portables. Aujourd'hui, la nanotechnologie a le potentiel de transformer le faisceau moléculaire en nano-dispositifs (fonctionnels). Il s'agit d'un grand pas vers la miniaturisation.

Défi

- ALTERNATIVES AU DÉPÔT DE COUCHE ATOMIQUE

Le procédé de dépôt chimique en phase vapeur est largement utilisé pour produire des films minces de haute qualité et de haute performance. Le procédé de dépôt chimique en phase vapeur est couramment utilisé dans l'industrie des semi-conducteurs. D'autre part, le dépôt physique en phase vapeur (PVD) est une méthode utilisée pour produire des films minces et des revêtements à haute température, haute résistance, excellente résistance à l'abrasion, etc. Le dépôt chimique en phase vapeur et le dépôt physique en phase vapeur peuvent être utilisés comme alternatives au dépôt de couche atomique en raison des avantages ci-dessous par rapport au dépôt de couche atomique.

- Le dépôt chimique en phase vapeur a un taux de dépôt plus élevé que le dépôt par couche atomique

- Dans le dépôt chimique en phase vapeur, le matériau déposé est difficile à évaporer

- Le processus de dépôt physique en phase vapeur peut fonctionner à basse température par rapport au dépôt par couche atomique

- Le dépôt physique en phase vapeur peut contrôler la composition chimique

Développement récent

- En septembre 2020, Lam Research a présenté la technologie avancée de remplissage des interstices diélectriques pour permettre la création d'appareils de nouvelle génération. Cette technologie combine la capacité de produire des films d'oxyde de haute qualité avec des performances de remplissage des interstices supérieures dans un seul système de traitement avec les avantages de productivité offerts par notre architecture de module à quatre stations, leader du secteur. Son objectif est de fournir aux clients la technologie ALD la plus performante.

Portée du marché du dépôt de couches atomiques au Moyen-Orient et en Afrique

Le marché du dépôt de couches atomiques au Moyen-Orient et en Afrique est segmenté en fonction du type de produit et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Métal ALD

- Oxyde d'aluminium ALD

- ALD améliorée par plasma

- ALD catalytique

- Autres

Sur la base du type de produit, le marché du dépôt de couches atomiques au Moyen-Orient et en Afrique est classé en ALD métallique, ALD à l'oxyde d'aluminium, ALD amélioré par plasma, ALD catalytique et autres.

Application

- Semi-conducteurs

- Électronique

- Appareils solaires

- Équipement médical

- Dispositifs optiques

- Matériaux thermoélectriques

- Piles à combustible

- Installations de recherche et développement

- Têtes magnétiques

- Capteurs

- Couches barrières

- Couches d'apprêt

- Demande non IC

- Autres

Sur la base de l'application, le marché du dépôt de couches atomiques du Moyen-Orient et de l'Afrique est classé en semi-conducteurs, dispositifs solaires, électronique, équipements médicaux, installations de recherche et développement, piles à combustible, dispositifs optiques, matériaux thermoélectriques , têtes magnétiques, capteurs, couches barrières, couches d'apprêt, applications non IC et autres.

Analyse/perspectives régionales du marché du dépôt de couches atomiques au Moyen-Orient et en Afrique

Le marché du dépôt de couches atomiques au Moyen-Orient et en Afrique est analysé et des informations et tendances sur la taille du marché sont fournies en fonction du pays, du type de produit et de l’application, comme référencé ci-dessus.

Certains pays couverts dans le rapport sur le marché du dépôt de couches atomiques au Moyen-Orient et en Afrique sont l’Arabie saoudite, l’Afrique du Sud, l’Égypte, les Émirats arabes unis, Israël et le reste du Moyen-Orient et de l’Afrique.

L'Afrique du Sud devrait dominer le marché du dépôt de couches atomiques au Moyen-Orient et en Afrique en termes de part de marché et de chiffre d'affaires. Elle devrait maintenir sa domination au cours de la période de prévision en raison de la forte demande de la région en microélectronique et en électronique grand public.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques africaines du Moyen-Orient et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du dépôt de couches atomiques au Moyen-Orient et en Afrique

Le marché concurrentiel du dépôt de couches atomiques au Moyen-Orient et en Afrique fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par l'entreprise sur le marché du dépôt de couches atomiques au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché du dépôt de couches atomiques au Moyen-Orient et en Afrique sont LAM RESEARCH CORPORATION, Kurt J. Lesker Company, ANRIC TECH., Forge Nano Inc., Merck KGaA, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, le Moyen-Orient et l'Afrique par rapport à la région et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH DEMAND FOR MICROELECTRONICS AND CONSUMER ELECTRONICS

5.1.2 RAISING CONCERN ON ENERGY HARVESTING RESULTS IN HIGH GROWTH OF PHOTOVOLTAIC (PV) CELLS

5.1.3 RAPID EXPANSION OF THE SEMICONDUCTOR INDUSTRY

5.2 RESTRAINT

5.2.1 HIGH INITIAL INVESTMENT COSTS

5.3 OPPORTUNITIES

5.3.1 TREND OF MINIATURIZATION

5.3.2 GROWING RESEARCH AND DEVELOPMENT IN ATOMIC LAYER DEPOSITION TECHNOLOGY

5.4 CHALLENGE

5.4.1 ALTERNATIVES OF ATOMIC LAYER DEPOSITION

6 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 METAL ALD

6.3 ALUMINUM OXIDE ALD

6.4 PLASMA ENHANCED ALD

6.5 CATALYTIC ALD

6.6 OTHERS

7 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SEMICONDUCTORS

7.2.1 METAL ALD

7.2.2 ALUMINUM OXIDE ALD

7.2.3 CATALYTIC ALD

7.2.4 PLASMA ENHANCED ALD

7.2.5 OTHERS

7.3 ELECTRONICS

7.3.1 METAL ALD

7.3.2 ALUMINUM OXIDE ALD

7.3.3 CATALYTIC ALD

7.3.4 PLASMA ENHANCED ALD

7.3.5 OTHERS

7.4 SOLAR DEVICES

7.4.1 ALUMINUM OXIDE ALD

7.4.2 PLASMA ENHANCED ALD

7.4.3 METAL ALD

7.4.4 CATALYTIC ALD

7.4.5 OTHERS

7.5 MEDICAL EQUIPMENT

7.5.1 METAL ALD

7.5.2 ALUMINUM OXIDE ALD

7.5.3 CATALYTIC ALD

7.5.4 PLASMA ENHANCED ALD

7.5.5 OTHERS

7.6 OPTICAL DEVICES

7.6.1 METAL ALD

7.6.2 ALUMINUM OXIDE ALD

7.6.3 CATALYTIC ALD

7.6.4 PLASMA ENHANCED ALD

7.6.5 OTHERS

7.7 THERMOELECTRIC MATERIALS

7.7.1 METAL ALD

7.7.2 ALUMINUM OXIDE ALD

7.7.3 CATALYTIC ALD

7.7.4 PLASMA ENHANCED ALD

7.7.5 OTHERS

7.8 MAGNETIC HEADS

7.8.1 METAL ALD

7.8.2 ALUMINUM OXIDE ALD

7.8.3 CATALYTIC ALD

7.8.4 PLASMA ENHANCED ALD

7.8.5 OTHERS

7.9 RESEARCH & DEVELOPMENT FACILITIES

7.9.1 METAL ALD

7.9.2 ALUMINUM OXIDE ALD

7.9.3 CATALYTIC ALD

7.9.4 PLASMA ENHANCED ALD

7.9.5 OTHERS

7.1 FUEL CELLS

7.10.1 METAL ALD

7.10.2 ALUMINUM OXIDE ALD

7.10.3 CATALYTIC ALD

7.10.4 PLASMA ENHANCED ALD

7.10.5 OTHERS

7.11 SENSORS

7.11.1 METAL ALD

7.11.2 ALUMINUM OXIDE ALD

7.11.3 CATALYTIC ALD

7.11.4 PLASMA ENHANCED ALD

7.11.5 OTHERS

7.12 BARRIER LAYERS

7.12.1 METAL ALD

7.12.2 ALUMINUM OXIDE ALD

7.12.3 CATALYTIC ALD

7.12.4 PLASMA ENHANCED ALD

7.12.5 OTHERS

7.13 PRIMER LAYERS

7.13.1 METAL ALD

7.13.2 ALUMINUM ALD

7.13.3 CATALYTIC ALD

7.13.4 PLASMA ENHANCED ALD

7.13.5 OTHERS

7.14 NON-IC APPLICATION

7.14.1 METAL ALD

7.14.2 ALUMINUM ALD

7.14.3 CATALYTIC ALD

7.14.4 PLASMA ENHANCED ALD

7.14.5 OTHERS

7.15 OTHERS

7.15.1 METAL ALD

7.15.2 ALUMINUM ALD

7.15.3 CATALYTIC ALD

7.15.4 PLASMA ENHANCED ALD

7.15.5 OTHERS

8 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY REGION

8.1 MIDDLE EAST & AFRICA

8.1.1 SOUTH AFRICA

8.1.2 SAUDI ARABIA

8.1.3 UNITED ARAB EMIRATES

8.1.4 EGYPT

8.1.5 ISRAEL

8.1.6 REST OF MIDDLE EAST & AFRICA

9 COMPANY LANDSCAPE: MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET

9.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

9.2 NEW PRODUCT LAUNCH

9.3 MERGERS,AWARDS AND ACQUISITIONS

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 LAM RESEARCH CORPORATION.

11.1.1 COMPANY SNAPSHOT

11.1.2 RECENT FINANCIALS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATE

11.2 APPLIED MATERIALS, INC.

11.2.1 COMPANY SNAPSHOT

11.2.2 RECENT FINANCIALS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATES

11.3 TOKYO ELECTRON LIMITED

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATES

11.4 ASM INTERNATIONAL

11.4.1 COMPANY SNAPSHOT

11.4.2 RECENT FINANCIALS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT UPDATE

11.5 AIXTRON

11.5.1 COMPANY SNAPSHOT

11.5.2 RECENT FINANCIALS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT UPDATE

11.6 ADEKA CORPORATION

11.6.1 COMPANY SNAPSHOT

11.6.2 RECENT FINANCIALS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT UPDATE

11.7 ANRIC TECH.

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT UPDATES

11.8 BENEQ

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 ENCAPSULIX

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT UPDATE

11.1 FORGE NANO INC.

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT UPDATES

11.11 HZO INC.

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT UPDATE

11.12 KURT J. LESKER COMPANY

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT UPDATE

11.13 MERCK KGAA

11.13.1 COMPANY SNAPSHOT

11.13.2 RECENT FINANCIALS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT UPDATES

11.14 OXFORD INSTRUMENTS

11.14.1 COMPANY SNAPSHOT

11.14.2 RECENT FINANCIALS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT UPDATE

11.15 PICOSUN OY.

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT UPDATES

11.16 SENTECH INSTRUMENTS GMBH

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT UPDATE

11.17 VEECO INSTRUMENTS INC.

11.17.1 COMPANY SNAPSHOT

11.17.2 RECENT FINANCIALS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT UPDATES

12 QUESTIONNAIRE

13 RELATED REPORT

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA METAL ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA ALUMINUM OXIDE ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PLASMA ENHANCED ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CATALYTIC ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MAGNETIC HEADS ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA RESEARCH & DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA RESEARCH & DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 SAUDI ARABIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 SAUDI ARABIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 UNITED ARAB EMIRATES ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 UNITED ARAB EMIRATES ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 UNITED ARAB EMIRATES SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 UNITED ARAB EMIRATES ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 UNITED ARAB EMIRATES SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 UNITED ARAB EMIRATES MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 UNITED ARAB EMIRATES OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 UNITED ARAB EMIRATES THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 UNITED ARAB EMIRATES FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 UNITED ARAB EMIRATES RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 UNITED ARAB EMIRATES MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 UNITED ARAB EMIRATES SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 UNITED ARAB EMIRATES BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 UNITED ARAB EMIRATES PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 UNITED ARAB EMIRATES NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 UNITED ARAB EMIRATES OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 EGYPT ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 EGYPT ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 EGYPT SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 EGYPT ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 EGYPT SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 EGYPT MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 EGYPT OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 EGYPT THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 EGYPT FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 EGYPT RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 EGYPT MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 EGYPT SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 EGYPT BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 EGYPT PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 EGYPT NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 EGYPT OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 ISRAEL ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 118 ISRAEL ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 ISRAEL SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 ISRAEL ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 ISRAEL SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 ISRAEL MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 ISRAEL OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 ISRAEL THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 ISRAEL FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 ISRAEL RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 ISRAEL MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 ISRAEL SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 ISRAEL BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 ISRAEL PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 ISRAEL NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 ISRAEL OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 REST OF MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: SEGMENTATION

FIGURE 14 HIGH DEMAND FOR MICROELECTRONICS AND CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET IN THE FORECAST PERIOD

FIGURE 15 METAL ALD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET

FIGURE 17 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.