Global Wax Emulsion Market

Taille du marché en milliards USD

TCAC :

%

USD

3.38 Billion

USD

4.29 Billion

2024

2032

USD

3.38 Billion

USD

4.29 Billion

2024

2032

| 2025 –2032 | |

| USD 3.38 Billion | |

| USD 4.29 Billion | |

|

|

|

|

Segmentation du marché mondial des émulsions de cire, par matériau (émulsions de cire synthétiques et naturelles), type (paraffine, carnauba, polyéthylène, polypropylène, etc.), application (peintures et revêtements, adhésifs et produits d'étanchéité, cosmétiques), secteur d'utilisation (peintures et revêtements, textiles, cosmétiques, adhésifs et produits d'étanchéité, construction et travail du bois, agroalimentaire, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des émulsions de cire

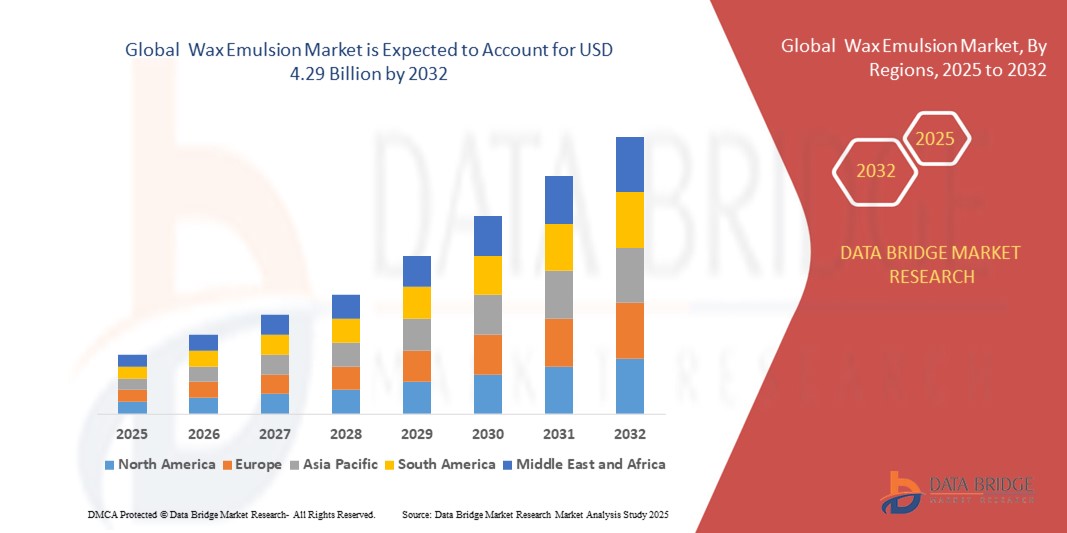

- La taille du marché mondial des émulsions de cire était évaluée à 3,38 milliards USD en 2024 et devrait atteindre 4,29 milliards USD d'ici 2032 , à un TCAC de 3,00 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de formulations respectueuses de l'environnement et à base d'eau dans les secteurs des revêtements, des adhésifs, des textiles et de l'emballage.

- La réglementation croissante sur les composés organiques volatils (COV), associée à une préférence croissante pour les solutions de traitement de surface durables, contribue à l'expansion du marché des émulsions de cire.

Analyse du marché des émulsions de cire

- La demande d'émulsions de cire est stimulée par leurs excellentes propriétés telles que la résistance à l'eau, la brillance de surface, la résistance à l'abrasion et les effets anti-blocage, ce qui les rend très précieuses dans les applications industrielles et grand public.

- L'utilisation croissante dans la construction et les revêtements décoratifs, ainsi que l'expansion des applications dans le traitement du bois et du papier, renforcent la croissance du marché à l'échelle mondiale.

- L'Asie-Pacifique a dominé le marché des émulsions de cire avec la plus grande part de revenus en 2024, grâce à une industrialisation rapide, à l'expansion de l'activité de construction et à une forte demande des secteurs du textile et du revêtement.

- L'Amérique du Nord devrait connaître le taux de croissance le plus élevé sur le marché mondial des émulsions de cire, grâce aux innovations technologiques, à l'accent croissant mis sur les formulations durables et biosourcées et à l'expansion des applications dans les secteurs de l'emballage, des cosmétiques et des adhésifs.

- Le segment des émulsions de cires synthétiques a représenté la plus grande part de chiffre d'affaires en 2024, grâce à sa large disponibilité, ses performances constantes et sa résistance supérieure à la chaleur et aux produits chimiques. Ces émulsions sont largement utilisées dans des applications industrielles telles que les revêtements, les adhésifs et les produits de polissage, où durabilité et précision sont essentielles. Les fabricants privilégient également les options synthétiques pour leur capacité à assurer une dispersion stable et leur compatibilité avec divers systèmes de formulation.

Portée du rapport et segmentation du marché des émulsions de cire

|

Attributs |

Informations clés sur le marché des émulsions de cire |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

• ALTANA (Allemagne) • Walker Industries (Canada) |

|

Opportunités de marché |

• Expansion des émulsions de cire biosourcées et durables |

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des émulsions de cire

Adoption croissante des émulsions de cire dans les revêtements à base d'eau

- L'évolution vers des formulations écologiques à base d'eau pour les peintures et revêtements stimule la demande d'émulsions de cire offrant une protection de surface, une meilleure résistance aux rayures et des propriétés anti-adhérentes. Cette transition transforme profondément l'industrie des revêtements, les organismes de réglementation exigeant une réduction des émissions de composés organiques volatils (COV).

- Les fabricants intègrent des émulsions de cire dans leurs revêtements architecturaux et industriels afin d'améliorer leurs performances et leur durabilité, tout en respectant les objectifs de développement durable. Ces émulsions sont compatibles avec divers liants et additifs, ce qui les rend adaptées à des formulations flexibles sur tous types de supports.

- La polyvalence des émulsions de cire pour produire des effets matifiants, hydrofuges et antidérapants est attrayante pour les formulateurs qui cherchent à développer des revêtements haute performance sans compromettre la conformité environnementale.

- Par exemple, en 2023, plusieurs fabricants européens de peinture ont lancé des peintures à l'eau enrichies en émulsions de polyéthylène et de cire de carnauba, ciblant les segments résidentiel et commercial. Ces produits ont démontré une résistance accrue à l'usure et aux taches.

- Alors que l'industrie des revêtements évolue vers des formulations plus écologiques, les émulsions de cire devraient jouer un rôle de plus en plus vital, soutenues par les investissements en R&D dans les dispersions de cires biosourcées et synthétiques qui peuvent fonctionner dans diverses conditions environnementales et opérationnelles.

Dynamique du marché des émulsions de cire

Conducteur

Demande croissante de formulations durables et à base d'eau dans tous les secteurs

L'importance croissante accordée à la sécurité environnementale et au développement durable alimente la demande de systèmes à base d'eau, dont les émulsions de cire sont des composants essentiels. Des industries comme celles des peintures et revêtements, des adhésifs et du textile délaissent les produits à base de solvants au profit de produits à base d'eau afin de répondre aux normes réglementaires mondiales et aux attentes des consommateurs.

Les émulsions de cire offrent une faible teneur en COV et un impact environnemental réduit, tout en offrant des propriétés de surface améliorées, ce qui les rend idéales pour les fabricants soucieux de l'environnement. Leur utilisation dans les applications d'emballage, de papier et de textile est en plein essor grâce à leur caractère non toxique et biodégradable.

Les initiatives gouvernementales favorisant la production écologique et la réduction des déchets accélèrent l'adoption de technologies à base d'eau, notamment dans les régions développées. Plusieurs pays ont mis en place des réglementations strictes en matière de COV, incitant les entreprises à reformuler leurs produits avec des matières premières compatibles avec l'eau, comme les émulsions de cire.

• Par exemple, en 2022, l'Agence américaine de protection de l'environnement a resserré les limites de COV pour les revêtements architecturaux, ce qui a entraîné une augmentation de la demande d'émulsions de cire haute performance conformes aux nouvelles normes

• Bien que ce moteur soutienne la croissance du marché, la complexité de la formulation des systèmes à base d'eau nécessite une innovation continue dans la chimie des émulsions pour garantir la stabilité, la performance et la compatibilité avec d'autres composants

Retenue/Défi

Limitations de performance dans des conditions de stress élevé et extrêmes

Malgré leur attrait écologique, les émulsions de cire peuvent présenter des limites de performance en cas de températures extrêmes, d'exposition aux UV ou d'environnements fortement abrasifs. Cela limite leur application dans certains cas d'utilisation industrielle ou extérieure, où les systèmes à base de solvants dominent actuellement.

• La stabilité thermique et la résistance à l'eau des émulsions de cire, notamment celles d'origine biologique, peuvent ne pas égaler celles des alternatives conventionnelles dans des environnements très exigeants. Cela suscite des réticences chez les utilisateurs finaux de secteurs tels que l'automobile et les revêtements pour charges lourdes.

• Les fabricants doivent également relever le défi d'obtenir une distribution granulométrique homogène, une bonne stabilité de la dispersion et une compatibilité avec d'autres ingrédients. Ces facteurs peuvent affecter la brillance, la dureté ou les propriétés barrières, nécessitant une expertise en formulation plus pointue.

• Par exemple, en 2023, une importante entreprise asiatique d'emballage a signalé une usure prématurée du revêtement du carton de qualité alimentaire traité avec des émulsions de cire biosourcées, ce qui a incité à réévaluer les spécifications du produit en matière de résistance à l'humidité et à la graisse.

• Pour surmonter ces obstacles, les acteurs de l'industrie doivent investir dans des technologies de polymérisation avancées et des systèmes de cire hybrides qui comblent le fossé entre la durabilité et les exigences de haute performance dans diverses conditions de fonctionnement

Portée du marché des émulsions de cire

Le marché est segmenté en fonction de la base matérielle, du type, de l'application et de l'industrie de l'utilisateur final.

- Par base matérielle

En fonction du matériau de base, le marché des émulsions de cire se segmente en émulsions de cire synthétiques et émulsions de cire naturelles. Le segment des émulsions de cire synthétiques a représenté la plus grande part de chiffre d'affaires en 2024, grâce à sa large disponibilité, ses performances constantes et sa résistance supérieure à la chaleur et aux produits chimiques. Ces émulsions sont largement utilisées dans des applications industrielles telles que les revêtements, les adhésifs et les produits de polissage, où durabilité et précision sont essentielles. Les fabricants privilégient également les options synthétiques pour leur capacité à offrir une dispersion stable et leur compatibilité avec divers systèmes de formulation.

Le segment des émulsions de cires naturelles devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par la demande croissante de matériaux biosourcés et respectueux de l'environnement. Issues de sources renouvelables comme la cire de carnauba et la cire d'abeille, ces émulsions gagnent du terrain dans les cosmétiques, les emballages alimentaires et les applications textiles. Leurs propriétés non toxiques et biodégradables répondent à la préférence croissante des consommateurs et des autorités réglementaires pour des alternatives durables.

- Par type

Le marché mondial des émulsions de cire se segmente en fonction de leur type : cire de paraffine, cire de carnauba, cire de polyéthylène, cire de polypropylène, etc. En 2024, la cire de polyéthylène a représenté la plus grande part de chiffre d'affaires, grâce à son utilisation répandue dans les peintures, les revêtements et les encres, grâce à son excellente résistance à l'abrasion et à son effet matifiant. Sa stabilité chimique et sa compatibilité avec diverses formulations en font un choix privilégié pour les systèmes à base d'eau et de solvants, favorisant son adoption dans des secteurs tels que l'emballage et l'automobile.

Le segment de la cire de carnauba devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la demande croissante du secteur des cosmétiques et des soins personnels. Issue de sources naturelles, l'émulsion de cire de carnauba est appréciée pour son point de fusion élevé, sa brillance et ses propriétés hydrofuges, ce qui la rend idéale pour les formulations de soins de la peau, des cheveux et des lèvres. La préférence croissante des consommateurs pour les ingrédients d'origine végétale et durables stimule encore davantage la croissance de ce segment.

- Par application

En fonction de leurs applications, le marché mondial des émulsions de cire se segmente en peintures et revêtements, adhésifs et mastics, et cosmétiques. En 2024, ce segment a dominé le marché avec la plus grande part de chiffre d'affaires, soutenu par la croissance des activités mondiales dans les secteurs de la construction et de l'automobile. Les émulsions de cire sont utilisées pour améliorer la résistance aux rayures, l'imperméabilité et le lissé des surfaces des revêtements architecturaux et industriels. De plus, la demande de formulations aqueuses respectueuses de l'environnement continue de stimuler leur utilisation dans ce segment.

Le segment des cosmétiques devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la demande croissante d'ingrédients naturels et multifonctionnels dans les formules de soins personnels. Les émulsions de cire offrent des propriétés filmogènes, hydratantes et sensorielles, ce qui les rend idéales pour les lotions, les crèmes et les cosmétiques décoratifs. L'évolution vers une beauté propre et l'innovation croissante des produits devraient soutenir la dynamique de ce segment.

- Par secteur d'activité de l'utilisateur final

En fonction de l'industrie d'utilisation finale, le marché des émulsions de cire est segmenté en peintures et revêtements, textiles, cosmétiques, adhésifs et mastics, construction et menuiserie, industrie agroalimentaire, etc. En 2024, ce segment a dominé le marché en raison de la demande croissante de formulations aqueuses à faible teneur en COV, utilisant des émulsions de cire pour la résistance aux rayures, le matage et l'imperméabilité. Leur application assure une meilleure durabilité et une meilleure esthétique des revêtements architecturaux et industriels.

Le secteur des cosmétiques devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la demande croissante de formules sûres et respectueuses de la peau. Les émulsions de cire sont largement utilisées dans les produits de soins personnels tels que les lotions, les crèmes et les soins capillaires pour leurs propriétés émulsifiantes, filmogènes et hydratantes. La sensibilisation croissante des consommateurs aux ingrédients naturels stimule également l'innovation dans le domaine des émulsions de cire cosmétiques biosourcées.

Analyse régionale du marché des émulsions de cire

• L'Asie-Pacifique a dominé le marché des émulsions de cire avec la plus grande part de revenus en 2024, grâce à une industrialisation rapide, à l'expansion de l'activité de construction et à une forte demande des secteurs du textile et du revêtement

• La région bénéficie d'une base manufacturière bien établie et de politiques gouvernementales favorables soutenant la production chimique et industrielle

• L'augmentation des investissements dans les peintures et les revêtements, les emballages et le traitement du bois, ainsi que la disponibilité de matières premières rentables, continuent de soutenir la croissance du marché dans des pays comme la Chine, l'Inde et le Japon.

Aperçu du marché chinois des émulsions de cire

En 2024, le marché chinois des émulsions de cire détenait la plus grande part de marché en Asie-Pacifique, soutenu par un développement robuste des infrastructures, une production textile en pleine expansion et une forte demande des industries des peintures et des revêtements. Le leadership manufacturier chinois, associé à la demande croissante de formulations écologiques et aqueuses, stimule l'innovation produit dans le domaine des émulsions de cire synthétiques et naturelles. De plus, la présence de nombreux producteurs nationaux et un écosystème d'exportation florissant positionnent la Chine comme un fournisseur mondial incontournable dans le secteur des émulsions de cire.

Aperçu du marché japonais des émulsions de cire

Le marché japonais des émulsions de cire devrait connaître sa croissance la plus rapide entre 2025 et 2032, porté par la demande croissante des industries des peintures et revêtements, du textile et des cosmétiques. L'accent mis par le pays sur des formulations de haute qualité et respectueuses de l'environnement encourage l'adoption d'émulsions de cire à base d'eau. De plus, les capacités de fabrication avancées et la solide infrastructure de R&D du Japon soutiennent l'innovation continue dans les mélanges de cires synthétiques et naturelles. L'accent mis sur les matériaux durables et à faible teneur en COV, notamment pour les applications grand public et industrielles haut de gamme, stimule l'expansion du marché dans la région.

Aperçu du marché nord-américain des émulsions de cire

Le marché nord-américain des émulsions de cire devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la préférence croissante pour les formulations écologiques dans les industries d'utilisation finale. La région affiche une forte demande de la part des secteurs des adhésifs, des revêtements et de l'emballage, notamment aux États-Unis, où les tendances en matière de construction écologique et la réglementation sur les COV favorisent l'utilisation accrue d'émulsions aqueuses. Les avancées technologiques, ainsi que l'intégration de cires améliorant les performances dans les applications haut de gamme, soutiennent l'expansion régionale.

Aperçu du marché américain des émulsions de cire

Le marché américain des émulsions de cire devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce aux progrès des technologies de formulation et à l'adoption croissante de systèmes de revêtement haute performance. Les secteurs de la construction et de l'automobile, déjà bien établis, continuent de stimuler la demande d'émulsions de cire durables et à faible teneur en COV. De plus, l'accent mis sur les sources biodégradables et renouvelables encourage l'innovation dans les produits à base de cire naturelle, positionnant les États-Unis comme un marché clé pour le développement durable dans le secteur des émulsions de cire.

Aperçu du marché européen des émulsions de cire

Le marché européen des émulsions de cire devrait connaître sa croissance la plus rapide entre 2025 et 2032, en raison des réglementations environnementales strictes et de la demande croissante de matériaux durables dans des secteurs tels que les cosmétiques, la construction et le papier. Des pays comme l'Allemagne, la France et l'Italie constatent une incorporation croissante d'émulsions de cire dans les peintures haut de gamme, les matériaux d'emballage et les finitions textiles hydrofuges. De plus, la sensibilisation croissante aux certifications écolabel favorise la transition vers des émulsions naturelles et synthétiques à faible impact environnemental.

Aperçu du marché allemand des émulsions de cire

Le marché allemand des émulsions de cire devrait connaître la croissance la plus rapide entre 2025 et 2032, soutenu par des normes industrielles strictes et des initiatives en matière de développement durable. La forte présence de l'Allemagne dans les secteurs de l'automobile, de l'emballage et de la construction entraîne une demande constante d'émulsions de cire offrant durabilité, résistance à l'humidité et faible toxicité. L'accent mis sur les revêtements à base d'eau et l'innovation dans les revêtements haute performance contribuent à la dynamique du marché dans le pays.

Aperçu du marché britannique des émulsions de cire

Le marché britannique des émulsions de cire devrait connaître sa croissance la plus rapide entre 2025 et 2032, grâce à la transition du pays vers des pratiques de construction et des solutions d'emballage durables. Face à l'importance croissante accordée par les utilisateurs finaux au respect des normes environnementales, les fabricants innovent en proposant des émulsions de cire biosourcées à faible teneur en COV pour répondre à la demande. Le développement des initiatives de construction écologique au Royaume-Uni et l'intérêt croissant des consommateurs pour les produits de soins personnels respectueux de l'environnement devraient stimuler la croissance du marché.

Part de marché des émulsions de cire

L'industrie des émulsions de cire est principalement dirigée par des entreprises bien établies, notamment :

• ALTANA (Allemagne)

• H&R GROUP (Allemagne)

• The Lubrizol Corporation (États-Unis)

• Wacker Chemie AG (Allemagne)

• PMC Group, Inc. (États-Unis)

• Walker Industries (Canada)

• NIPPON SEIRO CO., LTD. (Japon)

• BASF SE (Allemagne)

• Sasol Limited (Afrique du Sud)

• Hexion (États-Unis)

• Michelman, Inc. (États-Unis)

• Repsol (Espagne)

• Paramelt RMC BV (Pays-Bas)

• CHT Germany GmbH (Allemagne)

• Micro Powders, Inc. (États-Unis) •

Henry Company (États-Unis)

• Govi (Belgique)

• SHAMROCK (États-Unis)

• Paraffinwaxco, Inc. (filiale du groupe RAHA) (États-Unis)

• King Honor International Ltd. (Chine)

• Nanjing Tianshi New Material Technologies Co., Ltd (Chine)

Derniers développements sur le marché mondial des émulsions de cire

- En décembre 2023, PetroNaft Co. a présenté un développement produit mettant en avant le rôle des émulsions de cire dans l'amélioration de la texture, de la stabilité et des propriétés hydratantes des produits de soins personnels tels que les crèmes, les lotions et les produits capillaires. Leur intégration dans des cosmétiques comme les rouges à lèvres et les fards à paupières améliore la fluidité de l'application et prolonge la tenue du produit. Cela renforce l'utilisation croissante des émulsions de cire dans le secteur cosmétique, favorisant ainsi l'expansion du marché.

- En novembre 2022, Elsevier BV a publié une mise à jour de recherche soulignant l'importance croissante des émulsions de cire finement dispersées ou submicroniques dans les industries pharmaceutique et cosmétique. Ces émulsions sont de plus en plus utilisées dans les onguents et crèmes cicatrisantes grâce à leur homogénéité et leur absorption améliorées. Cette évolution devrait stimuler la demande en formulations médicales et de soins de la peau, stimulant ainsi l'innovation sur le marché des émulsions de cire.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.