Global Vitamins Market

Taille du marché en milliards USD

TCAC :

%

USD

8.20 Billion

USD

14.95 Billion

2024

2032

USD

8.20 Billion

USD

14.95 Billion

2024

2032

| 2025 –2032 | |

| USD 8.20 Billion | |

| USD 14.95 Billion | |

|

|

|

|

Segmentation du marché mondial des vitamines, par type (vitamine B, vitamine E, vitamine D, vitamine C, vitamine A et vitamine K), application (produits de santé, produits pharmaceutiques, aliments et boissons, alimentation animale et soins personnels), source (synthétique, naturelle, végétale, animale et autres), canal de distribution (hypermarchés, supermarchés, grandes surfaces, magasins spécialisés et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des vitamines

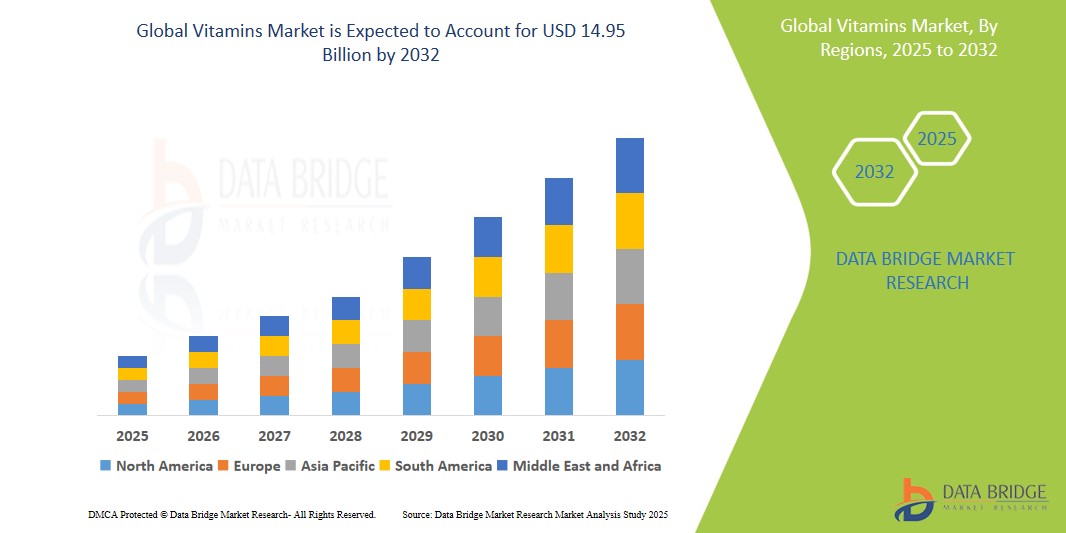

- La taille du marché mondial des vitamines était évaluée à 8,20 milliards USD en 2024 et devrait atteindre 14,95 milliards USD d'ici 2032 , à un TCAC de 7,80 % au cours de la période de prévision.

- Cette croissance est tirée par des facteurs tels que la sensibilisation croissante aux questions de santé, la croissance de la population gériatrique, l'utilisation accrue d'aliments enrichis, la demande de nutrition personnalisée, l'expansion de la disponibilité au détail et en ligne, et les initiatives gouvernementales de soutien.

Analyse du marché des vitamines

- Les vitamines sont des micronutriments essentiels nécessaires à diverses fonctions physiologiques, notamment l'immunité, le métabolisme et la santé cellulaire. Elles sont couramment consommées sous forme de compléments alimentaires, d'aliments enrichis et de produits pharmaceutiques pour prévenir les carences et favoriser le bien-être général.

- Le marché des vitamines connaît une croissance constante, portée par l'intérêt croissant des consommateurs pour les soins de santé préventifs, la demande croissante d'aliments enrichis et fonctionnels, la sensibilisation croissante à la santé dans tous les groupes démographiques et l'utilisation croissante des vitamines dans les secteurs pharmaceutique, des soins personnels et de la nutrition animale.

- L'Amérique du Nord devrait dominer le marché des vitamines en raison de la préférence croissante des consommateurs pour les produits à haute valeur nutritionnelle et faibles en calories.

- L'Asie-Pacifique devrait être la région connaissant la croissance la plus rapide sur le marché des vitamines au cours de la période de prévision en raison de l'importance croissante accordée aux soins de santé préventifs et d'une meilleure sensibilisation nutritionnelle dans les économies émergentes.

- Le segment synthétique devrait dominer le marché avec une part de marché de 65,5 % grâce à sa rentabilité, sa qualité constante et sa capacité de production évolutive. Contrairement aux vitamines naturelles, qui nécessitent des procédés d'extraction complexes à partir de sources végétales ou animales, les vitamines synthétiques peuvent être produites en masse par synthèse chimique, ce qui réduit considérablement les coûts de fabrication. Cela permet aux entreprises de proposer des produits abordables tout en répondant à la demande mondiale croissante de compléments alimentaires et d'aliments enrichis.

Portée du rapport et segmentation du marché des vitamines

|

Attributs |

Informations clés sur le marché des vitamines |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire. |

Tendances du marché des vitamines

« La popularité croissante des vitamines personnalisées »

- L’une des tendances marquantes du marché mondial des vitamines est la popularité croissante des vitamines personnalisées.

- Cette tendance est motivée par l’intérêt croissant des consommateurs pour les produits de santé et de bien-être sur mesure, les progrès de la science nutritionnelle et l’utilisation croissante de plateformes de santé numériques qui offrent des recommandations de suppléments individualisées.

- Par exemple, des entreprises telles que Care/of et Persona Nutrition proposent des packs de vitamines personnalisés en fonction de facteurs tels que l'âge, le mode de vie, les objectifs de santé et même l'analyse ADN, attirant ainsi les consommateurs soucieux de leur santé et recherchant un soutien personnalisé.

- La demande de vitamines personnalisées augmente à la fois sur les marchés matures, comme les États-Unis et l'Europe, et sur les marchés émergents, où l'adoption du numérique et la sensibilisation au bien-être augmentent rapidement.

- Alors que les consommateurs continuent de rechercher la commodité, la précision et l'efficacité dans leurs routines de santé, la nutrition personnalisée devrait stimuler l'innovation des produits et façonner la croissance future du marché des vitamines.

Dynamique du marché des vitamines

Conducteur

« Accroître la sensibilisation des consommateurs à la santé »

- La conscience croissante des consommateurs en matière de santé est un moteur clé du marché des vitamines, car de plus en plus de personnes recherchent des suppléments pour soutenir leur bien-être général et leurs besoins nutritionnels.

- Ce changement prend de l'ampleur dans le monde entier, les consommateurs accordant de plus en plus la priorité aux soins de santé préventifs et au bien-être holistique, ce qui entraîne une demande accrue de vitamines et de compléments alimentaires.

- À mesure que la sensibilisation à la santé augmente, le marché connaît une évolution vers des produits vitaminiques plus personnalisés et ciblés, les consommateurs recherchant des solutions qui répondent à des problèmes de santé spécifiques, tels que l'immunité, la santé de la peau et le vieillissement.

- Les fabricants réagissent en investissant dans la recherche et le développement pour créer des formulations de vitamines plus efficaces et fondées sur la science qui répondent à ces besoins en constante évolution.

- L'accent mis sur la durabilité stimule également la demande de vitamines végétales et biologiques, car les consommateurs soucieux de l'environnement recherchent des produits respectueux de l'environnement et issus de sources éthiques.

Par exemple,

- Des entreprises telles que Garden of Life se concentrent sur les vitamines biologiques et sans OGM, garantissant que leurs produits sont conformes aux valeurs sanitaires et environnementales des consommateurs.

- La recherche sur la biodisponibilité et les taux d'absorption des vitamines progresse, conduisant à des suppléments plus efficaces et plus performants qui répondent à la demande des consommateurs en matière de qualité.

- Alors que la conscience de la santé continue de façonner le comportement des consommateurs, le marché des vitamines est sur le point de connaître une croissance significative, l'innovation dans les offres de produits et la durabilité jouant un rôle majeur.

Opportunité

« L'accent est mis de plus en plus sur les ingrédients naturels et biologiques »

- L'importance croissante accordée aux ingrédients naturels et biologiques représente une opportunité importante pour le marché des vitamines, car les consommateurs recherchent de plus en plus des alternatives propres et végétales aux suppléments synthétiques.

- Les entreprises de vitamines capitalisent sur ce changement en incorporant des ingrédients naturels et biologiques, tels que des extraits à base de plantes et des composants issus de sources durables, dans leurs produits, répondant ainsi aux besoins des consommateurs soucieux de leur santé qui privilégient les options écologiques et à étiquette propre.

- Cette opportunité s'inscrit dans la tendance générale vers le bien-être, alors que de plus en plus de personnes adoptent des régimes biologiques, réduisent les produits chimiques synthétiques dans leur routine quotidienne et recherchent des suppléments qui correspondent à leurs choix de vie durables.

Par exemple,

- Des entreprises telles que New Chapter et MegaFood proposent des compléments vitaminiques biologiques à base d'aliments complets, exploitant ainsi la préférence croissante pour les produits de santé naturels.

- L'inclusion d'ingrédients biologiques et naturels dans des suppléments tels que les multivitamines et les remèdes à base de plantes gagne en popularité, permettant aux marques de répondre aux besoins d'une population croissante soucieuse de sa santé.

- Alors que la demande des consommateurs en vitamines naturelles et biologiques continue d'augmenter, le marché est bien placé pour profiter de cette tendance en élargissant ses gammes de produits, en augmentant la confiance des consommateurs et en renforçant sa présence dans le segment du bien-être naturel.

Retenue/Défi

« Augmentation des coûts des matières premières »

- L'augmentation des coûts des matières premières constitue un défi important pour le marché des vitamines, car les prix des ingrédients clés, notamment les extraits de plantes, les minéraux et les composés synthétiques, continuent d'augmenter en raison des perturbations de la chaîne d'approvisionnement, de l'inflation et de la demande accrue.

- La fluctuation du coût des matières premières, en particulier celles provenant de régions spécifiques, peut entraîner une volatilité des prix, affectant les coûts de production et les prix de détail des produits vitaminiques.

- Ce défi est particulièrement prononcé sur les marchés fortement dépendants d'ingrédients spécifiques, où l'approvisionnement dans des zones géographiques limitées ou le recours à des fournisseurs uniques rend le marché vulnérable aux perturbations et aux augmentations de prix.

Par exemple,

- L'augmentation du coût de la vitamine C, qui provient principalement des agrumes et d'autres sources végétales, a entraîné une augmentation des coûts de production des compléments vitaminiques, affectant ainsi le prix des produits.

- Sans résoudre ces problèmes par des stratégies telles que la diversification des fournisseurs, l'investissement dans un approvisionnement durable ou l'adoption de techniques de fabrication plus efficaces, la hausse des coûts des matières premières pourrait entraver la croissance et la rentabilité du marché des vitamines.

Portée du marché des vitamines

Le marché est segmenté en fonction du type, de l’application, de la source et du canal de distribution.

|

Segmentation |

Sous-segmentation |

|

Par type |

|

|

Par application |

|

|

Par source |

|

|

Par canal de distribution |

|

En 2025, la chirurgie de la cataracte devrait dominer le marché avec une part de marché la plus importante dans le segment source

Le segment synthétique devrait dominer le marché des vitamines avec une part de marché de 65,5 % en 2025, grâce à sa rentabilité, sa qualité constante et sa capacité de production évolutive. Contrairement aux vitamines naturelles, qui nécessitent des procédés d'extraction complexes à partir de sources végétales ou animales, les vitamines synthétiques peuvent être produites en masse par synthèse chimique, ce qui réduit considérablement les coûts de fabrication. Cela permet aux entreprises de proposer des produits abordables tout en répondant à la demande mondiale croissante de compléments alimentaires et d'aliments enrichis.

La vitamine B devrait représenter la part la plus importante au cours de la période de prévision dans le segment de type

En 2025, le segment des vitamines B devrait dominer le marché avec une part de marché de 38,7 %. Son rôle essentiel dans le métabolisme énergétique, les fonctions neurologiques et la formation des globules rouges explique sa forte demande pour les compléments alimentaires, les aliments fonctionnels et les produits pharmaceutiques. La prévalence croissante des troubles liés au mode de vie, de la fatigue et du stress, ainsi que la sensibilisation croissante aux bienfaits des vitamines du complexe B, telles que B1, B6, B9 et B12, favorisent leur utilisation généralisée et la croissance de leur marché.

Analyse régionale du marché des vitamines

« L'Amérique du Nord détient la plus grande part du marché des vitamines »

-

L'Amérique du Nord domine le marché des vitamines, portée par la préférence croissante des consommateurs pour les produits à haute valeur nutritionnelle et faibles en calories

- Les États-Unis détiennent une part importante en raison d'une sensibilisation accrue aux bienfaits des compléments alimentaires pour la santé, de l'incidence croissante des maladies liées au mode de vie et d'une industrie nutraceutique bien établie qui favorise l'apport quotidien en vitamines.

- Le leadership régional est également soutenu par une infrastructure de soins de santé mature, une forte présence de fabricants clés de vitamines, une disponibilité généralisée au détail et un soutien réglementaire pour les compléments alimentaires.

- Avec l’intégration croissante des vitamines dans les routines quotidiennes et l’intérêt croissant des consommateurs pour les soins de santé préventifs, l’Amérique du Nord devrait maintenir sa position dominante sur le marché mondial des vitamines jusqu’en 2032.

« L'Asie-Pacifique devrait enregistrer le TCAC le plus élevé sur le marché des vitamines »

-

L'Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché des vitamines, grâce à l'importance croissante accordée aux soins de santé préventifs et à une meilleure sensibilisation nutritionnelle dans les économies émergentes.

- L'Inde détient une part importante en raison de la croissance rapide de sa population de classe moyenne, de la sensibilisation croissante à la santé et de l'accessibilité croissante à des suppléments vitaminiques abordables.

- L'expansion du marché de la région est également soutenue par l'amélioration des réseaux de distribution, les initiatives de santé menées par le gouvernement et la pénétration croissante du commerce électronique offrant diverses options de produits.

- Avec des investissements continus dans la santé publique, des revenus disponibles en hausse et une demande croissante d'aliments enrichis et de nutrition personnalisée, l'Asie-Pacifique est sur le point de mener la croissance du marché mondial des vitamines jusqu'en 2032.

Part de marché des vitamines

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- BASF (Allemagne)

- dsm-firmenich (Pays-Bas)

- ADM (États-Unis)

- SternVitamin GmbH & Co. KG (Allemagne)

- Glanbia PLC (États-Unis)

- Lonza (Suisse)

- Vitablend (Pays-Bas)

- Zagro (Singapour)

- Wright Enrichment Inc. (États-Unis)

- Adisseo (Chine)

- Resonac Holdings Corporation (Japon)

- Marques Farbest (États-Unis)

- Jubilant Pharmova Limited (Inde)

- Aurorium (États-Unis)

Derniers développements sur le marché mondial des vitamines

- En février 2024, Perelel Health, acteur majeur du marché des vitamines prénatales et postnatales basé à Los Angeles, a annoncé une levée de fonds de série A de 6 millions de dollars américains. Ce tour de table a été soutenu par des entreprises de renom, dont Unilever Ventures, Willow Growth et Selva Ventures. Ce financement permettra à Perelel Health d'enrichir son offre de produits et d'étendre sa présence dans le secteur en pleine croissance de la santé et du bien-être, notamment en santé maternelle.

- En février 2023, DSM-Firmenich (née de la fusion de Koninklijke DSM NV et de Firmenich) a annoncé la reprise de la production de vitamine A Rovimix sur son site de Sisseln, en Suisse. L'entreprise avait déjà annoncé une suspension temporaire de la production de vitamine A sur ce site en novembre 2022.

- En août 2022, MD Pharmaceuticals, distributeur de produits de santé basé à Singapour, a lancé un nouveau complément de vitamine D, Rapid-D, en collaboration avec DSM. Ce partenariat vise à renforcer la présence de DSM sur le marché des vitamines en Asie-Pacifique et à attirer une clientèle plus large.

- En avril 2022, Farbest-Tallman Brands a été nommé distributeur exclusif de ZMC pour le bêta-carotène 1 % et 22 % en Amérique du Nord. Cet accord d'exclusivité couvrira deux produits spécifiques de la gamme bêta-carotène : l'huile de bêta-carotène, dont la concentration en vitamine A est de 366 740 UI/g.

- En mars 2021, DSM a lancé Ampli-D, un complément alimentaire à action rapide en vitamine D formulé à base de calcifediol, ou 25-hydroxyvitamine D3. Ce produit innovant permet à DSM de maintenir son avantage concurrentiel en répondant aux besoins de ses clients grâce à un complément alimentaire unique.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.