Global Used Car Market

Taille du marché en milliards USD

TCAC :

%

USD

996,906.42 Billion

USD

1,700,106.13 Billion

2022

2030

USD

996,906.42 Billion

USD

1,700,106.13 Billion

2022

2030

| 2023 –2030 | |

| USD 996,906.42 Billion | |

| USD 1,700,106.13 Billion | |

|

|

|

|

Marché mondial des voitures d'occasion, par type de fournisseur (organisé, non organisé), propulsion (essence, diesel, GNC, GPL, électrique et autres), cylindrée (grande taille (plus de 2 500 CC), moyenne taille (entre 1 500 et 2 499 CC), petite taille (moins de 1 499 CC)), concessionnaire (franchisé, indépendant), canal de vente (en ligne, hors ligne), type de véhicule (voiture de tourisme, VUL, VHC et véhicule électrique) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des voitures d'occasion

L’augmentation du revenu disponible des travailleurs accroît la croissance du marché, car elle permet aux particuliers d’acheter des véhicules avec un budget limité. Selon Statistique Canada, les revenus disponibles des ménages de la classe inférieure ont augmenté respectivement de 3 % et de 3,3 % au cours de la phase initiale de 2021. En revanche, les revenus des ménages de la classe supérieure ont diminué de 6,4 %, puis ont augmenté de 3,9 % au cours de la même période. La croissance du marché des voitures d’occasion a connu une croissance substantielle au cours des dernières années en raison de la compétitivité des dépenses entre les nouveaux acteurs du marché ainsi que de l’incapacité d’une grande partie des clients à acheter une voiture neuve.

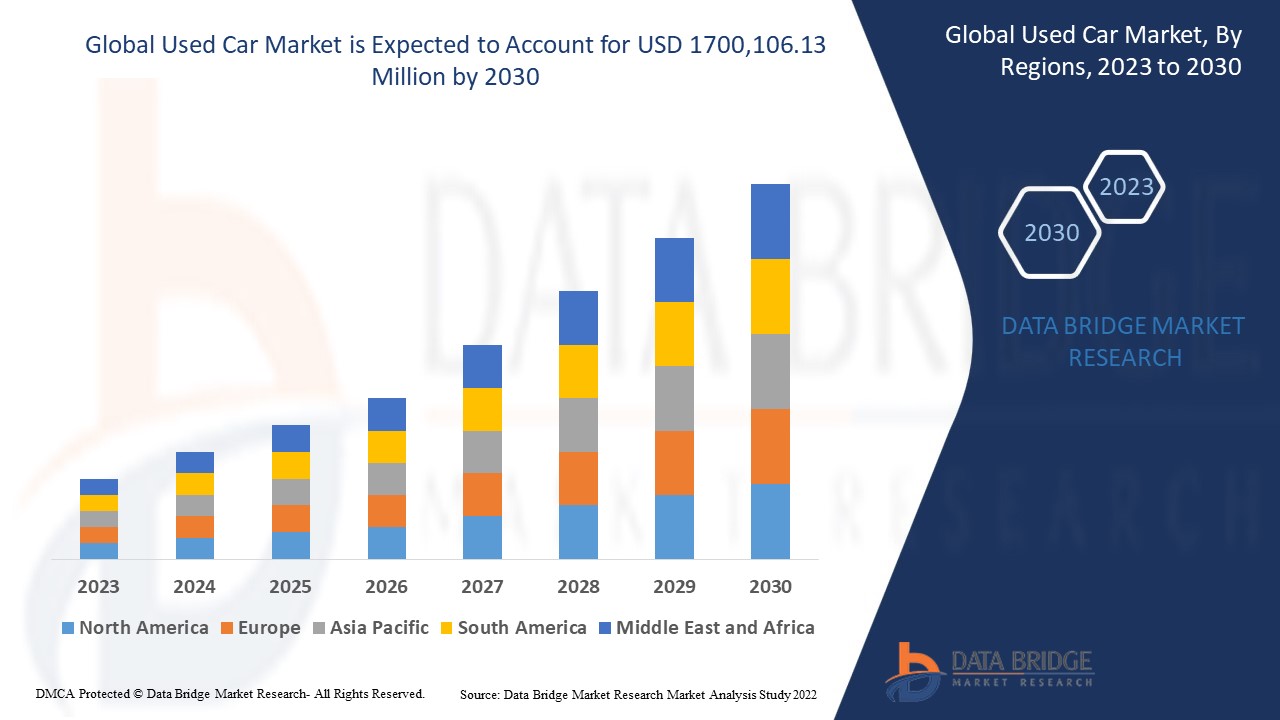

Data Bridge Market Research a analysé que le marché mondial des voitures d'occasion était évalué à 996 906,42 millions USD en 2022 et devrait atteindre la valeur de 1 700 106,13 millions USD d'ici 2030, à un TCAC de 6,90 % au cours de la période de prévision. En plus des informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse au pilon.

Portée et segmentation du marché des voitures d'occasion

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type de fournisseur (organisé, non organisé), propulsion (essence, diesel, GNC, GPL , électrique et autres), cylindrée (grande taille (plus de 2 500 CC), moyenne taille (entre 1 500 et 2 499 CC), petite taille (moins de 1 499 CC)), concessionnaire (franchisé, indépendant), canal de vente (en ligne, hors ligne), type de véhicule (voiture de tourisme, véhicule utilitaire léger, véhicule utilitaire lourd et véhicule électrique) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, Reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), Brésil, Argentine et Reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud |

|

Acteurs du marché couverts |

Group1 Automotive, Inc. (États-Unis), AutoNation, Inc. (États-Unis), HELLMAN & FRIEDMAN LLC (États-Unis), PENDRAGON (Royaume-Uni), CarMax Business Services, LLC (États-Unis), Manheim (États-Unis), THE HERTZ CORPORATION (États-Unis), Cox Automotive (États-Unis), Sun Toyota (États-Unis), eBay Inc. (États-Unis), TrueCar, Inc. (États-Unis), VROOM (États-Unis), Asbury Automotive Group (États-Unis), MARUTI SUZUKI INDIA LIMITED (Inde), Lithia Motors, Inc. (États-Unis), Hendrick Automotive Group (États-Unis) |

|

Opportunités de marché |

|

Définition du marché

Une voiture ayant déjà été vendue par un ou plusieurs propriétaires est appelée voiture d'occasion, voiture d'occasion ou voiture de seconde main. Les concessionnaires automobiles franchisés et indépendants, les agences de location de voitures, les concessionnaires qui achètent sur place, les bureaux de leasing, les ventes aux enchères et les ventes privées ne sont que quelques-uns des endroits où il est possible d'acheter des voitures d'occasion. Certains concessionnaires automobiles proposent des prix « sans marchandage », des véhicules d'occasion « certifiés » et des contrats de service ou des garanties prolongés.

Dynamique du marché mondial des voitures d'occasion

Conducteurs

- Coût élevé des voitures neuves et problèmes d'accessibilité

Le secteur automobile a observé une demande accrue de fonctionnalités avancées pour les véhicules, telles que la direction assistée, la climatisation et les systèmes de freinage antiblocage. Le coût des voitures neuves a donc augmenté. En outre, les problèmes d'accessibilité sur le marché du neuf sont illustrés par l'augmentation des prix en 2019, qui a été tirée par les segments de voitures particulières classiques. En conséquence, les ventes de voitures d'occasion ont augmenté par rapport aux ventes de voitures neuves dans l'industrie automobile. Cela devrait augmenter la demande de voitures anciennes.

- La demande de voitures à hayon polyvalentes augmente

Le marché des voitures à hayon d'occasion en Europe devrait connaître une croissance supérieure à 3,5 % d'ici 2028, en raison de la demande croissante de voitures à hayon offrant une certaine flexibilité lors de la conduite dans des espaces restreints. Le développement du marché des voitures d'occasion est favorisé par la présence importante de grands constructeurs automobiles tels qu'Audi AG, BMW AG, Mercedes-Benz et Volkswagen, car ces fabricants proposent un large choix de modèles de voitures à hayon. Les acteurs du marché proposent des voitures à hayon avec une ligne de toit haute et un design compact.

Opportunités

- Présence croissante de plusieurs constructeurs automobiles et concessionnaires de véhicules d'occasion

Grâce à la facilité d'accès au financement pour l'achat de voitures d'occasion, le marché européen des voitures d'occasion a généré un chiffre d'affaires supérieur à 500 milliards de dollars en 2021 et continuera d'augmenter régulièrement. L'industrie manufacturière est le plus grand investisseur privé en R&D en Europe, l'Europe étant le premier constructeur automobile mondial. Pour accroître la compétitivité du secteur automobile régional et conserver son hégémonie technologique à l'échelle mondiale, la Commission européenne encourage la normalisation technologique mondiale et le financement de la R&D. Les concessionnaires de véhicules d'occasion de la région proposent une gamme d'options technologiques pour suivre les performances automobiles, notamment des applications pour smartphones et des points de vente Internet virtuels.

- Croissance des technologies en ligne et du commerce électronique

Les progrès technologiques dans le secteur des télécommunications ont amélioré la connectivité Internet et l'urbanisation croissante sont quelques-uns des principaux facteurs qui permettent désormais aux gens d'accéder à l'information beaucoup plus efficacement. Ces fonctionnalités aident les propriétaires de voitures d'occasion à annoncer rapidement leurs véhicules et à partager des informations à leur sujet. Grâce à cette plateforme en ligne, davantage de personnes peuvent désormais vendre et acheter des voitures.

Restrictions

- Problèmes liés à l'expansion du marché des voitures d'occasion

L’expansion du marché des voitures d’occasion sera entravée par l’absence de lois et de réglementations strictes régissant l’achat de voitures d’occasion. Les taux de dépréciation élevés des voitures d’occasion rendront la croissance du marché plus difficile. L’épidémie de coronavirus a eu un impact négatif sur la demande mondiale de véhicules d’occasion en réduisant la demande de transports publics.

Ce rapport sur le marché des voitures d'occasion fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des voitures d'occasion, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du Covid-19 sur le marché des voitures d'occasion

La pandémie de COVID-19, qui a contraint les gouvernements à adopter des mesures de confinement strictes, des confinements régionaux, des isolements sociaux et des périodes de quarantaine, a eu un impact négatif sur la demande du marché en 2020. En raison de l'assouplissement des mesures de confinement et d'un changement de préférence des clients pour la mobilité personnelle, les propriétaires d'entreprises ont été incités à utiliser des plateformes Internet pour le marché des voitures d'occasion avec des alternatives de financement flexibles. En raison de la demande croissante des consommateurs pour les voitures d'occasion dans les zones sensibles aux prix, le secteur devrait connaître une croissance considérable dans un avenir proche.

Développement récent

- En décembre 2019, HELLMAN & FRIEDMAN LLC a conclu un contrat pour acquérir la société d'AutoScout24. Avec cette acquisition, l'entreprise souhaite fournir des solutions marketing à valeur ajoutée car elle continue de numériser ses modèles commerciaux dans l'industrie automobile.

- En décembre 2019, Group1 Automotive, Inc. a annoncé l'acquisition de deux concessionnaires Lexus pour accroître sa présence commerciale sur le marché du Nouveau-Mexique. Cela a aidé l'entreprise à s'implanter sur le marché en pleine croissance du Nouveau-Mexique.

Portée du marché mondial des voitures d'occasion

Le marché des voitures d'occasion est segmenté en fonction du type de fournisseur, de la propulsion, de la cylindrée, du concessionnaire, du canal de vente et du type de véhicule. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de fournisseur

- Organisé

- Non organisé

Propulsion

- Essence

- Diesel

- GNC

- GPL

- Électrique

- Autres

Capacité du moteur

- Taille réelle ( plus de 2500 CC)

- Taille moyenne (entre 1500 et 2499 CC)

- Petit (moins de 1499 CC)

Concession

- Franchisé

- Indépendant

Canal de vente

- En ligne

- Hors ligne

Type de véhicule

- Voiture de tourisme

- Véhicule utilitaire léger

- VHC

- Véhicule électrique

Analyse/perspectives régionales du marché des voitures d'occasion

Le marché des voitures d'occasion est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type de fournisseur, propulsion, capacité du moteur, concessionnaire, canal de vente et type de véhicule comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des voitures d'occasion sont les États-Unis, le Canada et le Mexique en Amérique du Nord, l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, le reste de l'Europe en Europe, la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, l'Égypte, Israël, le reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), le Brésil, l'Argentine et le reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud.

L'Asie-Pacifique domine le marché des voitures d'occasion en termes de croissance des revenus. Cela est principalement dû à la croissance du secteur des ventes organisées et semi-organisées. La Chine domine le marché des voitures d'occasion de l'Asie-Pacifique en raison du plus grand nombre de concessionnaires de voitures d'occasion dans cette région.

L’Europe devrait être la région qui connaîtra le développement le plus rapide au cours de la période de prévision 2023-2030 en raison de la disponibilité de matières premières abondantes et d’une main-d’œuvre bon marché. En outre, l’utilisation croissante d’Internet, les garanties offertes sur les véhicules d’occasion, les outils en ligne pour acheter ou rechercher des automobiles d’occasion et diverses alternatives d’achat sont quelques-uns des autres facteurs majeurs qui stimuleront probablement la croissance du marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des voitures d'occasion

Le paysage concurrentiel du marché des voitures d'occasion fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises vers le marché des voitures d'occasion.

Certains des principaux acteurs opérant sur le marché des voitures d'occasion sont :

- Group1 Automotive, Inc. (États-Unis)

- AutoNation, Inc. (États-Unis)

- HELLMAN & FRIEDMAN LLC (États-Unis)

- PENDRAGON (Royaume-Uni)

- CarMax Business Services, LLC (États-Unis)

- Mannheim (États-Unis)

- LA SOCIÉTÉ HERTZ (ÉTATS-UNIS)

- Cox Automotive (États-Unis)

- Sun Toyota (États-Unis)

- eBay Inc. (États-Unis)

- TrueCar, Inc. (États-Unis)

- VROOM (États-Unis)

- Groupe Asbury Automotive (États-Unis)

- Lithia Motors, Inc. (États-Unis)

- Groupe Hendrick Automotive (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF GLOBAL USED CAR MARKET

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- vendor type timeline curve

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- DRIVERS

- EMERGENCE OF DIFFERENT E-COMMERCE PLATFORM

- INCREASE IN TRANSPARENCY & SYMMETRY OF INFORMATION BETWEEN DEALERS AND CUSTOMERS

- RISE IN DEMAND FOR OFF-LEASE CARS & SUBSCRIPTION SERVICE BY THE FRANCHISE

- RISE IN DEMAND FOR THE PERSONAl TRANSPORT MOBILITY

- UPSURGE DEMAND FOR THE VEHICLE WITH GREATER VALUE AT LOWER COST

- RESTRAINTS

- EVER INCREASE IN COST OF OWNERSHIP

- STRINGENT GOVERNMENT REGULATIONS FOR CAR DEALERS

- HIGHER MAINTENANCE AND SERVICE COST

- OPPORTUNITIES

- RISE IN STRATEGIC PARTNERSHIP AND ACquisitions BETWEEN TWO COMPANIES

- Original equipment manufacturers (oems) INVOLVEMENT IN CERTIFICATION AND MARKETING PROGRAMS

- RISE IN THE INVESTMENT BY GOVERNMENT IN AUTOMOBILE SECTOR

- AVAILABILITY OF THE REIMBURSED POLICY FOR THE USED CAR

- CHALLENGES

- LACK OF POST-Sale SERVICES OF USED CAR

- INCLINATION OF OEMS (ORIGINAL EQUIPMENT MANUFACTURERS) IN SALE OF ONLY NEW CAR

- IMPACT OF COVID ON THE GLOBAL USED CAR MARKET

- IMPACT ON SUPPLY CHAIN & DEMAND ON USED CAR MARKET

- STRATEGIC DECISIONS OF MANUFACTURERS AFTER COVID 19 TO GAIN COMPETITIVE MARKET SHARE

- CONCLUSION

- GLOBAL used car MARKET, BY vendor TYPE

- overview

- ORGANIZED

- UNORGANIZED

- GLOBAL used car MARKET, BY PROPULSION TYPE

- overview

- PETROL

- Diesel

- ELECTRIC

- LPG

- CNG

- others

- GLOBAL used car MARKET, BY engine capacity

- overview

- SMALL (BELOW 1499 CC)

- MID-SIZE (BETWEEN 1500-2499 CC)

- FULL SIZE (ABOVE 2500 CC)

- GLOBAL used car MARKET, BY dealership

- overview

- franchised

- independent

- GLOBAL used car MARKET, BY sales channel

- overview

- offline

- online

- GLOBAL used car MARKET, BY vehicle type

- overview

- passenger cars

- SUV

- SEDAN

- CROSSOVER

- Coupe

- HATCHBACK

- MPV

- CONVERTIBLE

- OTHERS

- lcv

- PICKUP TRUCKS

- VANS

- CARGO VANS

- PASSENGER VANS

- MINI BUS

- COACHES

- OTHERS

- ELECTRIC VEHICLE

- BATTERY OPERATED VEHICLES

- PLUGIN VEHICLES

- HYBRID VEHICLES

- HCV

- TRUCKS

- DUMP TRUCKS

- TOW TRUCKS

- CEMENT TRUCKS

- BUSES

- Global Used Car Market, by REGION

- overview

- EUROPE

- GERMANY

- FRANCE

- U.K.

- ITALY

- SPAIN

- RUSSIA

- TURKEY

- BELGIUM

- NETHERLANDS

- SWITZERLAND

- REST OF EUROPE

- ASIA-PACIFIC

- CHINA

- JAPAN

- SOUTH KOREA

- INDIA

- AUSTRALIA

- SINGAPORE

- THAILAND

- MALAYSIA

- INDONESIA

- PHILIPPINES

- REST OF ASIA -PACIFIC

- MIDDLE EAST & AFRICA

- SOUTH AFRICA

- EGYPT

- SAUDI ARABIA

- U.A.E

- ISRAEL

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- U.S.

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- PERU

- CHILE

- VENEZUeLA

- ECUADOR

- REST OF SOUTH AMERICA

- GLOBAL Used car market: COMPANY landscape

- company share analysis: GLOBAL

- company share analysis: NORTH AMERICA

- company share analysis: EUROPE

- company share analysis: Asia-pacific

- swot

- company profile

- CARMAX BUSINESS SERVICES, LLC

- COMPANY SNAPSHOT

- REVENNUE ANALYSIS

- COMPANY SHARE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AUTONATION, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- LITHIA MOTORS, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SONIC AUTOMOTIVE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GROUP1 AUTOMOTIVE, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTTFOLIO

- RECENT DEVELOPMENTS

- ALIBABA GROUP HOLDING LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ASBURY AUTOMOTIVE GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BIG BOY TOYZ

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- CARS24

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- CHEHAODUOJIAO MOTOR VEHICLE BROKER (BEIJING) CO., LTD.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- HELLMAN & FRIEDMAN LLC

- COMPANY SNAPSHOT

- BRAND PORTFOLIO

- RECENT DEVELOPMENTS

- HENDRICK AUTOMOTIVE GROUP

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- KAIXIN AUTO HOLDINGS

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- LEITHCARS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- MAHINDRA FIRST CHOICE

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- MARUTI SUZUKI INDIA LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- OLX GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- PENDRAGON

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- TRUECAR, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- UXIN GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

Liste des tableaux

TABLE 1 Scale of Used Vehicle Exports in the Year 2017 (USD Million)

TABLE 2 Comparison of the Brand and Estimated Maintenance Cost over 10 Years (approx.)

TABLE 3 GLOBAL USED CAR MARKET, BY VENDOR TYPE, 2019-2028 (USD MILLION)

TABLE 4 Global organized in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 5 Global UNORgANIZED in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 6 GLOBAL USED CAR MARKET, BY propulsion TYPE, 2019-2028 (USD MILLION)

TABLE 7 Global petrol in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 8 Global diesel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 9 Global electric in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 10 Global lpg in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 11 Global cng in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 12 Global others in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 13 GLOBAL USED CAR MARKET, BY ENGINE CAPACITY, 2019-2028 (UsD MILLION)

TABLE 14 Global small (below 1499 CC) engine capacity in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 15 Global mid-size (between 1500-2499 cc) in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 16 Global full size (above 2500 cc) in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 17 GLOBAL USED CAR MARKET, BY dealership, 2019-2028 (USD MILLION)

TABLE 18 Global franchised in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 19 Global independent in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 20 GLOBAL USED CAR MARKET, BY sales channel, 2019-2028 (USD MILLION)

TABLE 21 Global offline sales channel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 22 Global online sales channel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 23 GLOBAL used car market, BY vehicle type, 2019-2028 (USD million)

TABLE 24 Global passenger cars in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 25 Global passenger cars in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 26 GLOBAL lcv in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 27 Global LCV in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 28 Global Vans in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 29 Global ELECTRIC VEHICLE IN used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 30 Global electric vehicle in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 31 Global HCV IN used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 32 Global HCV in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 33 Global Trucks in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 34 GLOBAL used car Market, By REGION, 2019-2028 (USD million)

TABLE 35 EUROPE Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 36 EUROPE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 37 EUROPE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 38 EUROPE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 39 EUROPE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 40 EUROPE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 41 EUROPE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 42 EUROPE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 43 EUROPE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 44 EUROPE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 45 EUROPE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 46 EUROPE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 47 EUROPE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 48 GERMANY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 49 GERMANY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 50 GERMANY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 51 GERMANY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 52 GERMANY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 53 GERMANY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 54 GERMANY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 55 GERMANY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 56 GERMANY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 57 GERMANY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 58 GERMANY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 59 GERMANY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 60 FRANCE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 61 FRANCE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 62 FRANCE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 63 FRANCE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 64 FRANCE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 65 FRANCE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 66 FRANCE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 67 FRANCE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 68 FRANCE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 69 FRANCE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 70 FRANCE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 71 FRANCE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 72 U.K. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 73 U.K. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 74 U.K. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 75 U.K. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 76 U.K. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 77 U.K. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 78 U.K. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 79 U.K. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 80 U.K. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 81 U.K. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 82 U.K. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 83 U.K. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 84 ITALY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 85 ITALY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 86 ITALY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 87 ITALY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 88 ITALY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 89 ITALY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 90 ITALY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 91 ITALY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 92 ITALY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 93 ITALY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 94 ITALY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 95 ITALY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 96 SPAIN Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 97 SPAIN Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 98 SPAIN Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 99 SPAIN Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 100 SPAIN Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 101 SPAIN Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 102 SPAIN Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 103 SPAIN LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 104 SPAIN Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 105 SPAIN HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 106 SPAIN Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 107 SPAIN Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 108 RUSSIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 109 RUSSIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 110 RUSSIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 111 RUSSIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 112 RUSSIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 113 RUSSIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 114 RUSSIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 115 RUSSIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 116 RUSSIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 117 RUSSIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 118 RUSSIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 119 RUSSIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 120 TURKEY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 121 TURKEY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 122 TURKEY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 123 TURKEY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 124 TURKEY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 125 TURKEY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 126 TURKEY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 127 TURKEY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 128 TURKEY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 129 TURKEY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 130 TURKEY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 131 TURKEY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 132 BELGIUM Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 133 BELGIUM Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 134 BELGIUM Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 135 BELGIUM Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 136 BELGIUM Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 137 BELGIUM Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 138 BELGIUM Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 139 BELGIUM LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 140 BELGIUM Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 141 BELGIUM HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 142 BELGIUM Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 143 BELGIUM Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 144 NETHERLANDS Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 145 NETHERLANDS Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 146 NETHERLANDS Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 147 NETHERLANDS Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 148 NETHERLANDS Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 149 NETHERLANDS Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 150 NETHERLANDS Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 151 NETHERLANDS LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 152 NETHERLANDS Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 153 NETHERLANDS HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 154 NETHERLANDS Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 155 NETHERLANDS Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 156 SWITZERLAND Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 157 SWITZERLAND Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 158 SWITZERLAND Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 159 SWITZERLAND Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 160 SWITZERLAND Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 161 SWITZERLAND Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 162 SWITZERLAND Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 163 SWITZERLAND LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 164 SWITZERLAND Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 165 SWITZERLAND HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 166 SWITZERLAND Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 167 SWITZERLAND Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 168 Rest of EUROPE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 169 ASIA-PACIFIC Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 170 ASIA-PACIFIC Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 171 ASIA-PACIFIC Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 172 ASIA-PACIFIC Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 173 ASIA-PACIFIC Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 174 ASIA-PACIFIC Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 175 ASIA-PACIFIC Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 176 ASIA-PACIFIC Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 177 ASIA-PACIFIC LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 178 ASIA-PACIFIC Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 179 ASIA-PACIFIC HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 180 ASIA-PACIFIC Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 181 ASIA-PACIFIC Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 182 CHINA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 183 CHINA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 184 CHINA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 185 CHINA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 186 CHINA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 187 CHINA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 188 CHINA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 189 CHINA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 190 CHINA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 191 CHINA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 192 CHINA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 193 CHINA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 194 JAPAN Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 195 JAPAN Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 196 JAPAN Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 197 JAPAN Used Car Market, By DEALERSHIP, 2019-2028 (USD Million)

TABLE 198 JAPAN Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 199 JAPAN Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 200 JAPAN Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 201 JAPAN LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 202 JAPAN Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 203 JAPAN HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 204 JAPAN Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 205 JAPAN Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 206 SOUTH KOREA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 207 SOUTH KOREA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 208 SOUTH KOREA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 209 SOUTH KOREA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 210 SOUTH KOREA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 211 SOUTH KOREA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 212 SOUTH KOREA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 213 SOUTH KOREA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 214 SOUTH KOREA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 215 SOUTH KOREA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 216 SOUTH KOREA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 217 SOUTH KOREA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 218 INDIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 219 INDIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 220 INDIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 221 INDIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 222 INDIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 223 INDIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 224 INDIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 225 INDIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 226 INDIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 227 INDIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 228 INDIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 229 INDIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 230 AUSTRALIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 231 AUSTRALIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 232 AUSTRALIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 233 AUSTRALIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 234 AUSTRALIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 235 AUSTRALIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 236 AUSTRALIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 237 AUSTRALIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 238 AUSTRALIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 239 AUSTRALIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 240 AUSTRALIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 241 AUSTRALIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 242 SINGAPORE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 243 SINGAPORE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 244 SINGAPORE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 245 SINGAPORE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 246 SINGAPORE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 247 SINGAPORE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 248 SINGAPORE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 249 SINGAPORE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 250 SINGAPORE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 251 SINGAPORE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 252 SINGAPORE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 253 SINGAPORE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 254 THAILAND Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 255 THAILAND Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 256 THAILAND Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 257 THAILAND Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 258 THAILAND Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 259 THAILAND Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 260 THAILAND Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 261 THAILAND LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 262 THAILAND Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 263 THAILAND HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 264 THAILAND Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 265 THAILAND Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 266 MALAYSIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 267 MALAYSIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 268 MALAYSIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 269 MALAYSIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 270 MALAYSIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 271 MALAYSIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 272 MALAYSIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 273 MALAYSIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 274 MALAYSIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 275 MALAYSIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 276 MALAYSIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 277 MALAYSIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 278 TABLE 86: INDONESIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 279 INDONESIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 280 INDONESIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 281 INDONESIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 282 INDONESIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 283 INDONESIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 284 INDONESIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 285 INDONESIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 286 INDONESIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 287 INDONESIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 288 INDONESIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 289 INDONESIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 290 PHILIPPINES Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 291 PHILIPPINES Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 292 PHILIPPINES Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 293 PHILIPPINES Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 294 PHILIPPINES Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 295 PHILIPPINES Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 296 PHILIPPINES Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 297 PHILIPPINES LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 298 PHILIPPINES Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 299 PHILIPPINES HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 300 PHILIPPINES Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 301 PHILIPPINES Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 302 Rest of ASIA-PACIFIC Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 303 Middle East & Africa Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 304 MIDDLE EAST AND AFRICA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 305 mIDDLE EAST AND AFRICA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 306 MIDDLE EAST AND AFRICA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 307 MIDDLE EAST AND AFRICA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 308 MIDDLE EAST AND AFRICA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 309 MIDDLE EAST AND AFRICA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 310 MIDDLE EAST AND AFRICA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 311 MIDDLE EAST AND AFRICA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 312 MIDDLE EAST AND AFRICA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 313 MIDDLE EAST AND AFRICA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 314 MIDDLE EAST AND AFRICA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 315 MIDDLE EAST AND AFRICA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 316 SOUTH AFRICA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 317 SOUTH AFRICA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 318 SOUTH AFRICA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 319 SOUTH AFRICA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 320 SOUTH AFRICA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 321 SOUTH AFRICA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 322 SOUTH AFRICA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 323 SOUTH AFRICA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 324 SOUTH AFRICA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 325 SOUTH AFRICA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 326 SOUTH AFRICA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 327 SOUTH AFRICA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 328 EGYPT Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 329 EGYPT Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 330 EGYPT Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 331 EGYPT Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 332 EGYPT Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 333 EGYPT Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 334 EGYPT Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 335 EGYPT LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 336 EGYPT Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 337 EGYPT HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 338 EGYPT Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 339 EGYPT Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 340 SAUDI ARABIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 341 SAUDI ARABIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 342 SAUDI ARABIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 343 SAUDI ARABIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 344 SAUDI ARABIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 345 SAUDI ARABIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 346 SAUDI ARABIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 347 SAUDI ARABIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 348 SAUDI ARABIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 349 SAUDI ARABIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 350 SAUDI ARABIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 351 SAUDI ARABIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 352 U.A.E. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 353 U.A.E. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 354 U.A.E. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 355 U.A.E. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 356 U.A.E. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 357 U.A.E. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 358 U.A.E. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 359 U.A.E. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 360 : U.A.E. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 361 U.A.E. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 362 U.A.E. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 363 U.A.E. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 364 ISRAEL Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 365 ISRAEL Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 366 ISRAEL Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 367 ISRAEL Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 368 ISRAEL Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 369 ISRAEL Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 370 ISRAEL Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 371 ISRAEL LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 372 ISRAEL Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 373 ISRAEL HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 374 ISRAEL Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 375 ISRAEL Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 376 Rest of MIDDLE EAST AND AFRICA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 377 North America Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 378 North America Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 379 North America Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 380 North America Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 381 North America Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 382 North America Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 383 North America Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 384 North America Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 385 North America LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 386 North America Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 387 North America HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 388 North America Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 389 North America Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 390 U.S. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 391 U.S. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 392 U.S. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 393 U.S. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 394 U.S. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 395 U.S. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 396 U.S. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 397 U.S. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 398 U.S. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 399 U.S. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 400 U.S. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 401 U.S. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 402 CANADA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 403 CANADA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 404 CANADA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 405 CANADA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 406 CANADA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 407 CANADA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 408 CANADA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 409 CANADA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 410 CANADA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 411 CANADA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 412 CANADA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 413 CANADA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 414 MEXICO Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 415 MEXICO Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 416 MEXICO Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 417 MEXICO Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 418 MEXICO Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 419 MEXICO Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 420 MEXICO Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 421 MEXICO LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 422 MEXICO Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 423 MEXICO HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 424 MEXICO Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 425 MEXICO Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 426 South America Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 427 South America Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 428 South America Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 429 South America Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 430 South America Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 431 South America Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 432 South America Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 433 South America Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 434 South America LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 435 South America Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 436 South America HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 437 South America Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 438 South America Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 439 BRAZIL Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 440 BRAZIL Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 441 BRAZIL Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 442 BRAZIL Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 443 BRAZIL Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 444 BRAZIL Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 445 BRAZIL Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 446 BRAZIL LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 447 BRAZIL Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 448 BRAZIL HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 449 BRAZIL Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 450 BRAZIL Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 451 ARGENTINA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 452 ARGENTINA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 453 ARGENTINA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 454 ARGENTINA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 455 ARGENTINA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 456 ARGENTINA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 457 ARGENTINA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 458 ARGENTINA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 459 ARGENTINA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 460 ARGENTINA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 461 ARGENTINA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 462 ARGENTINA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 463 COLOMBIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 464 COLOMBIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 465 COLOMBIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 466 COLOMBIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 467 COLOMBIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 468 COLOMBIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 469 COLOMBIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 470 COLOMBIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 471 COLOMBIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 472 COLOMBIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 473 COLOMBIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 474 COLOMBIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 475 PERU Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 476 PERU Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 477 PERU Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 478 PERU Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 479 PERU Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 480 PERU Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 481 PERU Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 482 PERU LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 483 PERU Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 484 PERU HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 485 PERU Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 486 PERU Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 487 CHILE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 488 CHILE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 489 CHILE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 490 CHILE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 491 CHILE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 492 CHILE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 493 CHILE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 494 CHILE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 495 CHILE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 496 CHILE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 497 CHILE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 498 CHILE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 499 VENEZUELA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 500 VENEZUELA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 501 VENEZUELA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 502 VENEZUELA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 503 VENEZUELA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 504 VENEZUELA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 505 VENEZUELA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 506 VENEZUELA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 507 VENEZUELA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 508 VENEZUELA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 509 VENEZUELA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 510 VENEZUELA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 511 ECUADOR Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 512 ECUADOR Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 513 ECUADOR Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 514 ECUADOR Used Car Market, By DEALERSHIP, 2019-2028 (USD Million)

TABLE 515 ECUADOR Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 516 ECUADOR Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 517 ECUADOR Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 518 ECUADOR LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 519 ECUADOR Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 520 ECUADOR HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 521 ECUADOR Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 522 ECUADOR Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 523 Rest of South America Used Car Market, By Vendor Type, 2019-2028 (USD Million)

Liste des figures

FIGURE 1 GLOBAL USED CAR MARKET segmentation

FIGURE 2 GLOBAL used car MARKET: data triangulation

FIGURE 3 GLOBAL used car MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL used car MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL used car MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL used car MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL used car MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL used car MARKET: vendor share analysis

FIGURE 9 GLOBAL used car market SEGMENTATION

FIGURE 10 THE Emergence of different ecommerce platformS is EXPECTED TO DRIVE THE GLOBAL used car market THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 ORGANIZED segment is expected to account for the largest share of THE Global used car market IN 2021 & 2028

FIGURE 12 asia-pacific is expected to DOMINATE and is the fastest-growing region in THE Global used car market IN the forecast period of 2021 to 2028

FIGURE 13 asia-pacific is the fastest growing market for used car market in the forecast period of 2021 to 2028

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GLOBAL USED CAR MARKET

FIGURE 15 Monthly Passenger Car Sales in Europe between August 2020 and June 2021 (1,000 Units)

FIGURE 16 Vehicle share per month in the year 2019 (%)

FIGURE 17 Global USEd CAR MARKET: BY VENDOR TYPE, 2020

FIGURE 18 Global USED CAR MARKET: BY PROPULSION TYPE, 2020

FIGURE 19 Global USEd CAR MARKET: BY ENGINE capacity, 2020

FIGURE 20 Global USEd CAR MARKET: BY DEALERSHIP, 2020

FIGURE 21 Global USEd CAR MARKET: BY sales channel, 2020

FIGURE 22 Global used car MARKET: BY VEHICLE type, 2020

FIGURE 23 GLOBAL USED CAR Market: SNAPSHOT (2020)

FIGURE 24 GLOBAL USED CAR Market: by Region (2020)

FIGURE 25 GLOBAL USED CAR Market: by Region (2021 & 2028)

FIGURE 26 GLOBAL Used car Market: by Region (2020 & 2028)

FIGURE 27 GLOBAL used car Market: by Vendor TYPE (2021-2028)

FIGURE 28 EUROPE USED CAR MARKET: SNAPSHOT (2020)

FIGURE 29 EUROPE USED CAR MARKET: by Country (2020)

FIGURE 30 EUROPE USED CAR MARKET: by Country (2021 & 2028)

FIGURE 31 EUROPE USED CAR MARKET: by Country (2020 & 2028)

FIGURE 32 EUROPE USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 33 ASIA-PACIFIC USED CAR MARKET: SNAPSHOT (2020

FIGURE 34 ASIA-PACIFIC USED CAR MARKET: by Country (2020)

FIGURE 35 ASIA-PACIFIC USED CAR MARKET: by Country (2021 & 2028)

FIGURE 36 ASIA-PACIFIC USED CAR MARKET: by Country (2020 & 2028)

FIGURE 37 ASIA-PACIFIC USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 38 Middle East & Africa USED CAR MARKET: SNAPSHOT (2020)

FIGURE 39 Middle East & Africa USED CAR MARKET: by Country (2020)

FIGURE 40 Middle East & Africa USED CAR MARKET: by Country (2021 & 2028)

FIGURE 41 Middle East & Africa USED CAR MARKET: by Country (2020 & 2028)

FIGURE 42 Middle East & Africa USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 43 NORTH AMERICA USED CAR MARKET: SNAPSHOT (2020)

FIGURE 44 NORTH AMERICA USED CAR MARKET: by Country (2020)

FIGURE 45 NORTH AMERICA USED CAR MARKET: by Country (2021 & 2028)

FIGURE 46 NORTH AMERICA USED CAR MARKET: by Country (2020 & 2028)

FIGURE 47 NORTH AMERICA USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 48 SOUTH AMERICA USED CAR MARKET: SNAPSHOT (2020)

FIGURE 49 SOUTH AMERICA USED CAR MARKET: by Country (2020)

FIGURE 50 SOUTH AMERICA USED CAR MARKET: by Country (2021 & 2028)

FIGURE 51 SOUTH AMERICA USED CAR MARKET: by Country (2020 & 2028)

FIGURE 52 SOUTH AMERICA USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 53 global used car Market: company share 2020 (%)

FIGURE 54 NORTH AMERICA used car Market: company share 2020 (%)

FIGURE 55 Europe used car Market: company share 2020 (%)

FIGURE 56 Asia-Pacific used car Market: company share 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.