Global Ultra High Purity Anhydrous Hydrogen Chloride Hcl Gas Market

Taille du marché en milliards USD

TCAC :

%

USD

4.14 Billion

USD

6.17 Billion

2024

2032

USD

4.14 Billion

USD

6.17 Billion

2024

2032

| 2025 –2032 | |

| USD 4.14 Billion | |

| USD 6.17 Billion | |

|

|

|

|

Segmentation du marché mondial du gaz chlorhydrique anhydre (HCL) ultra-pur, par produit (électronique et chimie), application (électronique et électricité, produits pharmaceutiques, produits chimiques et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché du gaz chlorhydrique anhydre (HCL) de très haute pureté

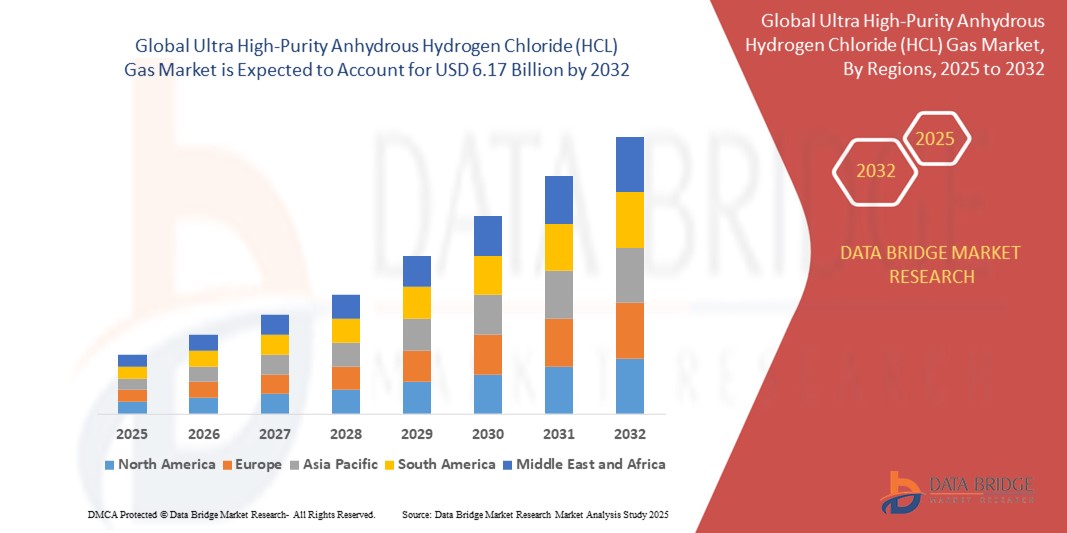

- La taille du marché mondial du gaz chlorhydrique anhydre (HCL) de très haute pureté était évaluée à 4,14 milliards USD en 2024 et devrait atteindre 6,17 milliards USD d'ici 2032 , à un TCAC de 5,12 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de l'industrie des semi-conducteurs pour des gaz de haute pureté utilisés dans la fabrication de puces et les processus de gravure, ainsi que par une adoption accrue dans la synthèse pharmaceutique et la production de produits chimiques spécialisés.

- Les investissements croissants dans la fabrication de produits électroniques en Asie-Pacifique et en Amérique du Nord stimulent la consommation de gaz chlorhydrique anhydre de très haute pureté, en particulier dans la production de circuits intégrés et de panneaux d'affichage.

Analyse du marché du gaz chlorhydrique anhydre (HCL) de très haute pureté

- Le marché connaît une demande accrue de la part de l'industrie électronique où le gaz de haute pureté est essentiel pour la gravure et le nettoyage dans la fabrication de semi-conducteurs.

- Les fabricants se concentrent sur l'amélioration de la qualité du gaz et sur la garantie de cohérence pour répondre aux spécifications strictes de l'industrie

- L'Amérique du Nord a dominé le marché du gaz chlorhydrique anhydre de très haute pureté en 2024, portée par une forte demande des secteurs de l'électronique et des semi-conducteurs, notamment aux États-Unis et au Canada.

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché mondial du gaz chlorhydrique anhydre (HCL) de très haute pureté, grâce à une industrialisation rapide, à l'expansion de la fabrication de semi-conducteurs et à la hausse des investissements dans les secteurs électronique et pharmaceutique dans des pays comme la Chine, le Japon et la Corée du Sud.

- Le segment de qualité électronique a dominé le marché, enregistrant la plus grande part de chiffre d'affaires en 2024, en raison de son rôle essentiel dans la fabrication des semi-conducteurs, notamment dans les processus de gravure et de nettoyage. La grande pureté de ce segment garantit une contamination minimale lors de la production de composants microélectroniques. Avec la complexité et la miniaturisation croissantes des puces, la demande de gaz HCL ultra-pur pour garantir la constance des performances et le rendement lors du traitement des plaquettes augmente.

Portée du rapport et segmentation du marché du gaz chlorhydrique anhydre (HCL) de très haute pureté

|

Attributs |

Informations clés sur le marché du gaz chlorhydrique anhydre (HCL) de très haute pureté |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

• Gas Innovations (États-Unis) |

|

Opportunités de marché |

• Demande croissante des industries de fabrication de semi-conducteurs et d'électronique • Utilisation croissante dans la synthèse pharmaceutique avancée et le traitement chimique |

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché du gaz chlorhydrique anhydre (HCL) de très haute pureté

« Adoption croissante dans la fabrication de semi-conducteurs »

- Le chlorure d'hydrogène de haute pureté est essentiel dans les processus de semi-conducteurs tels que le nettoyage et la gravure des plaquettes, où le contrôle de la contamination est essentiel pour l'intégrité des puces.

- La miniaturisation croissante des puces entraîne une demande de gaz ultra-purs pour répondre aux tolérances strictes de la microélectronique de nouvelle génération.

- Des entreprises telles que Samsung s'associent à des fournisseurs de gaz régionaux pour créer des solutions de pureté personnalisées pour les nœuds semi-conducteurs avancés

- L'essor de la construction d'usines de semi-conducteurs à Taïwan et en Corée du Sud stimule l'approvisionnement en gros de chlorure d'hydrogène de haute pureté.

- Les fabricants de gaz renforcent leurs infrastructures de purification pour répondre aux exigences de qualité et de volume des clients de haute technologie du secteur électronique.

Dynamique du marché du gaz chlorhydrique anhydre (HCL) de très haute pureté

Conducteur

« Expansion de l'industrie des semi-conducteurs »

- L'expansion rapide de l'industrie des semi-conducteurs est un moteur majeur pour le marché du gaz chlorhydrique anhydre de très haute pureté, avec une demande accrue de micropuces hautes performances pour des appareils tels que les smartphones, les ordinateurs portables et les appareils intelligents.

- Ce gaz est essentiel pour les étapes critiques de fabrication des semi-conducteurs telles que la gravure et le dopage des plaquettes de silicium, où la pureté est cruciale pour éviter les défauts et garantir la fiabilité des puces.

- L'adoption croissante de technologies avancées telles que la 5G, l'IA et l'IoT pousse les fabricants de puces à produire des circuits intégrés plus complexes, augmentant ainsi le besoin de gaz ultra-purs.

- De nouvelles installations de fabrication de semi-conducteurs dans des pays comme Taïwan, la Corée du Sud et les États-Unis ont considérablement augmenté la demande de chlorure d'hydrogène ultra-pur ; par exemple, l'expansion de TSMC en Arizona alimente la demande des fournisseurs de gaz régionaux.

- Pour répondre à la demande croissante, les producteurs de gaz investissent dans des technologies de purification avancées et des systèmes d'assurance qualité stricts pour répondre aux besoins croissants de la chaîne d'approvisionnement mondiale en semi-conducteurs.

Retenue/Défi

« Exigences strictes en matière de manutention et de stockage »

- Les exigences strictes en matière de manipulation et de stockage représentent un défi majeur sur le marché du gaz chlorhydrique anhydre de très haute pureté en raison de la nature corrosive et toxique du gaz.

- Une infrastructure spécialisée, comprenant des réservoirs de stockage et des canalisations résistants à la corrosion, est nécessaire pour maintenir la pureté du gaz et assurer la sécurité des travailleurs pendant le transport et l'application.

- Même une contamination mineure peut compromettre l'adéquation du gaz à la fabrication de semi-conducteurs, entraînant des défauts de production ou des dommages à l'équipement.

- Les petits fabricants n’ont souvent pas la capacité financière d’investir dans les systèmes de confinement avancés et les protocoles de conformité nécessaires pour répondre aux réglementations internationales en matière de sécurité.

- Par exemple, les retards dans les expéditions à l'exportation dus à des contrôles stricts des matières dangereuses ou à l'absence de partenaires logistiques conformes peuvent interrompre les chaînes d'approvisionnement des fabricants de puces électroniques qui dépendent d'une disponibilité ininterrompue du gaz.

Portée du marché du gaz chlorhydrique anhydre (HCL) de très haute pureté

Le marché du gaz chlorure d'hydrogène anhydre (HCL) de très haute pureté est segmenté en fonction du produit et de l'application.

• Par produit

En fonction du produit, le marché du gaz chlorhydrique anhydre (HCL) ultra-pur est segmenté en deux catégories : électronique et chimique. En 2024, le segment électronique a dominé le marché, affichant la plus grande part de chiffre d'affaires, en raison de son rôle essentiel dans la fabrication des semi-conducteurs, notamment dans les processus de gravure et de nettoyage. La grande pureté de ce gaz garantit une contamination minimale lors de la production de composants microélectroniques. Avec la complexité et la miniaturisation croissantes des puces, la demande en gaz HCL ultra-pur pour garantir la constance des performances et le rendement lors du traitement des plaquettes est en hausse.

Le segment des grades chimiques devrait connaître sa croissance la plus rapide entre 2025 et 2032, grâce à son utilisation croissante dans la synthèse chimique de haute précision et les formulations chimiques de spécialité. Ce grade est particulièrement utile dans les applications exigeant une réactivité constante sans risque d'impuretés métalliques ou organiques, notamment dans les produits chimiques industriels et de laboratoire.

• Sur demande

En fonction des applications, le marché est segmenté en électronique et électricité, produits pharmaceutiques, produits chimiques, etc. Ce segment a représenté la plus grande part de chiffre d'affaires en 2024, grâce à la croissance rapide de la fabrication de semi-conducteurs et de l'électronique grand public. Le gaz HCL anhydre de très haute pureté est largement utilisé pour le nettoyage des plaquettes de silicium et comme agent réactif dans la production de circuits intégrés, ce qui le rend indispensable dans ce secteur.

Le secteur pharmaceutique devrait connaître sa croissance la plus rapide entre 2025 et 2032, grâce à l'adoption croissante de la synthèse d'ingrédients pharmaceutiques actifs (API) et de produits de chimie fine. Son niveau de pureté le rend idéal pour les formulations pharmaceutiques sensibles, notamment pour la production de médicaments anti-infectieux et oncologiques.

Analyse régionale du marché du gaz chlorhydrique anhydre (HCL) de très haute pureté

• L'Amérique du Nord a dominé le marché du gaz chlorhydrique anhydre de très haute pureté en 2024, grâce à une forte demande des secteurs de l'électronique et des semi-conducteurs, notamment aux États-Unis et au Canada.

• L'industrie chimique bien établie de la région, les normes de pureté élevées et les investissements croissants dans la fabrication de produits électroniques sont des facteurs clés contribuant au leadership du marché

• Une infrastructure avancée, des activités de recherche et développement robustes et la présence d'importantes industries d'utilisation finale soutiennent davantage l'utilisation généralisée du gaz de haute pureté en Amérique du Nord

Aperçu du marché américain du gaz chlorhydrique anhydre de très haute pureté

En 2024, le marché américain a conquis la plus grande part de marché en Amérique du Nord, grâce à l'utilisation croissante de gaz de haute pureté dans la fabrication électronique et la synthèse pharmaceutique. L'accent mis par le pays sur la fabrication de semi-conducteurs, conjugué à la demande croissante de procédés chimiques de précision, favorise l'adoption du gaz chlorhydrique anhydre de très haute pureté. La présence de fabricants de premier plan et des politiques industrielles favorables continuent de soutenir l'expansion du marché.

Aperçu du marché européen du gaz chlorhydrique anhydre de très haute pureté

Le marché européen devrait connaître sa plus forte croissance entre 2025 et 2032, soutenu par le renforcement des réglementations environnementales et la demande croissante de produits chimiques de haute pureté dans les secteurs électronique et pharmaceutique. Des pays comme l'Allemagne et la France investissent dans des technologies plus propres, et l'évolution vers des pratiques industrielles durables favorise l'utilisation de gaz de haute pureté. De plus, l'engagement de la région en faveur de l'innovation et de la qualité des produits encourage leur adoption dans des applications chimiques spécialisées.

Aperçu du marché britannique du gaz chlorhydrique anhydre de très haute pureté

Le marché britannique devrait connaître sa croissance la plus rapide entre 2025 et 2032, grâce aux avancées technologiques et à une industrie pharmaceutique dynamique. L'accent mis par le pays sur la production d'ingrédients pharmaceutiques actifs (API) de haute qualité et sa participation aux chaînes de valeur européennes de l'électronique créent une demande de gaz ultra-pur. Les efforts continus visant à renforcer la production nationale améliorent également les perspectives de croissance du marché.

Aperçu du marché allemand du gaz chlorhydrique anhydre de très haute pureté

Le marché allemand devrait connaître sa plus forte croissance entre 2025 et 2032, grâce au rôle clé du pays en tant que pôle clé de la fabrication de précision et du traitement chimique de haute pureté. Les industries allemandes privilégient des normes de pureté et de sécurité strictes, conformes aux caractéristiques de performance du gaz chlorhydrique anhydre ultra-pur. Le développement continu de la fabrication intelligente et des applications électroniques alimente la croissance de ce marché.

Aperçu du marché du chlorure d'hydrogène anhydre de très haute pureté en Asie-Pacifique

La région Asie-Pacifique devrait connaître sa croissance la plus rapide entre 2025 et 2032, soutenue par une industrialisation rapide, notamment en Chine, au Japon, en Corée du Sud et en Inde. L'essor du secteur des semi-conducteurs et les investissements importants dans la production électronique en sont les principaux moteurs. Le soutien des pouvoirs publics à la production locale et la demande croissante de procédés chimiques propres et efficaces encouragent l'utilisation généralisée de gaz ultra-purs dans diverses applications.

Aperçu du marché japonais du gaz chlorhydrique anhydre de très haute pureté

Le marché japonais devrait connaître sa plus forte croissance entre 2025 et 2032, grâce à l'industrie électronique de pointe du pays et à l'importance accordée à la précision de fabrication. La demande de gaz ultra-pur augmente dans la production de semi-conducteurs, où la pureté chimique est essentielle. L'approche innovante du Japon et son adhésion aux normes internationales de qualité soutiennent l'expansion continue du marché dans les applications techniques et pharmaceutiques.

Aperçu du marché chinois du gaz chlorhydrique anhydre de très haute pureté

En 2024, la Chine détenait la plus grande part de marché en Asie-Pacifique, portée par la croissance rapide de ses secteurs électronique, chimique et pharmaceutique. Pôle majeur de la production de semi-conducteurs, le pays a investi massivement dans la modernisation de ses capacités de production. La disponibilité de fournisseurs locaux et la demande croissante de procédés chimiques à haute efficacité soutiennent la croissance du marché dans divers secteurs.

Part de marché du gaz chlorhydrique anhydre (HCL) de très haute pureté

L'industrie du gaz de chlorure d'hydrogène anhydre (HCL) de très haute pureté est principalement dirigée par des entreprises bien établies, notamment :

• Gas Innovations (États-Unis)

• Air Liquide (France)

• Matheson Tri-Gas, Inc. (Japon)

• WEITAI CHEM (Chine)

• Linde plc (Royaume-Uni)

Derniers développements sur le marché mondial du gaz chlorhydrique anhydre (HCL) de très haute pureté

- En septembre 2023, le programme de traitement des bouteilles d'Air Liquide, présenté lors du récent salon Laborama, souligne l'importance de garantir la stabilité et la durée de conservation des gaz d'étalonnage utilisés dans les équipements de mesure des émissions. Conscient de la réactivité de composés tels que le chlorure d'hydrogène (HCL), Air Liquide utilise diverses techniques telles que la mise sous vide, le traitement thermique, le polissage interne, la gravure et le revêtement pour modifier la surface interne des bouteilles. Commercialisés sous les marques Aculife et AlphaTech, ces traitements s'appuient sur des données scientifiques et offrent une durée de conservation constante de trois ans dans le monde entier.

- En novembre 2021, Linde India (filiale de Linde) a finalisé un accord de transfert d'activité avec HPS Gases Ltd., basée à Vadodara, prenant effet le 1er novembre 2021. Cet accord porte sur l'acquisition de l'ensemble de son activité de gaz conditionnés et de ses actifs de distribution spécifiques, pour un montant total en numéraire de 3,3 millions de dollars américains. Cette opération stratégique comprend des accords supplémentaires tels qu'un contrat d'achat d'actifs, une clause de non-concurrence et un contrat d'approvisionnement et d'achat de produits.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRICING ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL COVERAGE

4.6 SUPPLY CHAIN ANALYSIS

5 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: REGULATION COVERAGE

6 PRODUCTION CAPACITY OVERVIEW

6.1 ESTIMATED PRODUCTION CAPACITY

7 PRODUCTION CONSUMPTION ANALYSIS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING DEMAND IN SEMICONDUCTOR INDUSTRY

8.1.2 THE INCREASING UTILIZATION OF ANHYDROUS HYDROGEN CHLORIDE GAS AS A REAGENT IN SPECIALTY CHEMICALS SYNTHESIS

8.2 RESTRAINTS

8.2.1 SIGNIFICANT HEALTH RISKS ASSOCIATED WITH HANDLING ULTRA-HIGH PURITY ANHYDROUS HYDROGEN CHLORIDE

8.2.2 REGULATORY REQUIREMENTS ASSOCIATED WITH ULTRA-HIGH PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS.

8.3 OPPORTUNITIES

8.3.1 ADOPTION OF ULTRA-HIGH PURITY ANHYDROUS HCL GAS IN SPECIALIZED RESEARCH AND DEVELOPMENT ACTIVITIES

8.3.2 INTEGRATION OF CUTTING-EDGE PURIFICATION TECHNOLOGIES FOR ULTRA-HIGH PURITY HCL GAS PRODUCTION

8.4 CHALLENGES

8.4.1 DIFFICULTY IN HANDLING AND TRANSPORTATION COST OF ULTRA HIGH PURITY ANHYDROUS HYDROGEN CHLORIDE GAS

9 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 ELECTRONICS GRADE

9.3 CHEMICAL GRADE

10 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ELECTRONICS AND ELECTRICALS

10.3 PHARMACEUTICALS

10.4 CHEMICALS

10.5 OTHERS

11 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA PACIFIC

11.2.1 TAIWAN

11.2.2 CHINA

11.2.3 SOUTH KOREA

11.2.4 JAPAN

11.2.5 SINGAPORE

11.2.6 INDIA

11.2.7 MALAYSIA

11.2.8 THAILAND

11.2.9 INDONESIA

11.2.10 AUSTRALIA

11.2.11 NEW ZEALAND

11.2.12 PHILIPPINES

11.2.13 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 EUROPE

11.4.1 GERMANY

11.4.2 FRANCE

11.4.3 U.K.

11.4.4 NETHERLANDS

11.4.5 SWITZERLAND

11.4.6 ITALY

11.4.7 BELGIUM

11.4.8 SPAIN

11.4.9 PORTUGAL

11.4.10 RUSSIA

11.4.11 TURKEY

11.4.12 DENMARK

11.4.13 NORWAY

11.4.14 FINLAND

11.4.15 SWEDEN

11.4.16 REST OF EUROPE

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.2 U.A.E.

11.5.3 SOUTH AFRICA

11.5.4 EGYPT

11.5.5 ISRAEL

11.5.6 QATAR

11.5.7 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.4 COMPANY SHARE ANALYSIS: EUROPE

12.5 NEW PRODUCTION PLANT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 AIR LIQUIDE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 LINDE PLC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 MATHESON TRI-GAS, INC. ((A SUBSIDIARY OF NIPPON HOLDINGS GROUP)

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 GAS INNOVATIONS

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 WEITAI CHEM

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 ESTIMATED PRODUCTION OVERVIEW

TABLE 3 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 4 GLOBAL ELECTRONICS GRADE IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 GLOBAL CHEMICAL GRADE IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 6 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL ELECTRONICS AND ELECTRICALS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL PHARMACEUTICALS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL CHEMICALS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL OTHERS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 14 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 16 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 17 TAIWAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 18 TAIWAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 19 TAIWAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 20 CHINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 21 CHINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 22 CHINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 23 SOUTH KOREA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 24 SOUTH KOREA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 25 SOUTH KOREA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 26 JAPAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 27 JAPAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 28 JAPAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 29 SINGAPORE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 30 SINGAPORE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 31 SINGAPORE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 32 INDIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 33 INDIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 34 INDIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 35 MALAYSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 36 MALAYSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 37 MALAYSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 38 THAILAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 39 THAILAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 40 THAILAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 41 INDONESIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 42 INDONESIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 43 INDONESIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 44 AUSTRALIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 45 AUSTRALIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 46 AUSTRALIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 47 NEW ZEALAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 48 NEW ZEALAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 49 NEW ZEALAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 50 PHILIPPINES ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 51 PHILIPPINES ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 52 PHILIPPINES ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 53 REST OF ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 54 REST OF ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 55 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 56 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 57 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 58 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 59 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 60 U.S. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 61 U.S. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 62 U.S. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 63 CANADA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 64 CANADA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 65 CANADA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 66 MEXICO ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 67 MEXICO ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 68 MEXICO ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 69 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 70 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 71 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 72 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 73 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 75 GERMANY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 76 GERMANY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 77 FRANCE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 78 FRANCE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 79 FRANCE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 80 U.K. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 81 U.K. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 82 U.K. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 NETHERLANDS ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 84 NETHERLANDS ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 85 NETHERLANDS ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 86 SWITZERLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 87 SWITZERLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 88 SWITZERLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 89 ITALY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 90 ITALY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 91 ITALY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 92 BELGIUM ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 93 BELGIUM ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 94 BELGIUM ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 95 SPAIN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 96 SPAIN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 97 SPAIN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 98 PORTUGAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 99 PORTUGAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 100 PORTUGAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 101 RUSSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 102 RUSSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 103 RUSSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 104 TURKEY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 105 TURKEY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 106 TURKEY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 107 DENMARK ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 108 DENMARK ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 109 DENMARK ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 110 NORWAY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 111 NORWAY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 112 NORWAY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 113 FINLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 114 FINLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 115 FINLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 116 SWEDEN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 117 SWEDEN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 118 SWEDEN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 119 REST OF EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 120 REST OF EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 121 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 123 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 125 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 126 SAUDI ARABIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 127 SAUDI ARABIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 128 SAUDI ARABIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 129 U.A.E. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 130 U.A.E. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 131 U.A.E. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 132 SOUTH AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 133 SOUTH AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 134 SOUTH AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 135 EGYPT ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 136 EGYPT ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 137 EGYPT ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 138 ISRAEL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 139 ISRAEL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 140 ISRAEL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 141 QATAR ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 142 QATAR ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 143 QATAR ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 144 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 145 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 146 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 147 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 148 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 149 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 150 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 151 BRAZIL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 152 BRAZIL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 153 BRAZIL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 154 ARGENTINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 155 ARGENTINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 156 ARGENTINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 157 REST OF SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 158 REST OF SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

Liste des figures

FIGURE 1 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET

FIGURE 2 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET, AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 13 RISING DEMAND IN SEMICONDUCTOR INDUSTRY IS DRIVING THE GROWTH OF THE GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET IN THE FORECAST PERIOD 2024 TO 2031

FIGURE 14 ELECTRONICS GRADE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET IN 2024 AND 2031

FIGURE 15 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS IN THE FORECAST PERIOD

FIGURE 16 PRICING ANALYSIS FOR GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (USD/KG)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MARKET

FIGURE 20 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET: BY PRODUCT, 2023

FIGURE 21 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET: BY APPLICATION, 2023

FIGURE 22 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: SNAPSHOT (2023)

FIGURE 23 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: SNAPSHOT (2023)

FIGURE 24 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (2023)

FIGURE 25 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (2023)

FIGURE 26 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: SNAPSHOT (2023)

FIGURE 27 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (2023)

FIGURE 28 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET COMPANY SHARE 2023 (%)

FIGURE 29 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY SHARE 2023 (%)

FIGURE 30 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY SHARE 2023 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.