Global Treasury Software Market

Taille du marché en milliards USD

TCAC :

%

USD

3.67 Billion

USD

4.68 Billion

2024

2032

USD

3.67 Billion

USD

4.68 Billion

2024

2032

| 2025 –2032 | |

| USD 3.67 Billion | |

| USD 4.68 Billion | |

|

|

|

|

Segmentation du marché mondial des logiciels de trésorerie, par système d'exploitation (Windows, Linux, iOS, Android et Mac), application (gestion des liquidités et de la trésorerie, gestion des investissements, gestion de la dette, gestion des risques financiers, gestion de la conformité, planification fiscale, etc.), mode de déploiement (sur site et dans le cloud), taille de l'organisation (grandes et moyennes entreprises), secteur d'activité (banque, services financiers et assurances, administration publique, industrie manufacturière, santé, biens de consommation, produits chimiques, énergie, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des logiciels de trésorerie

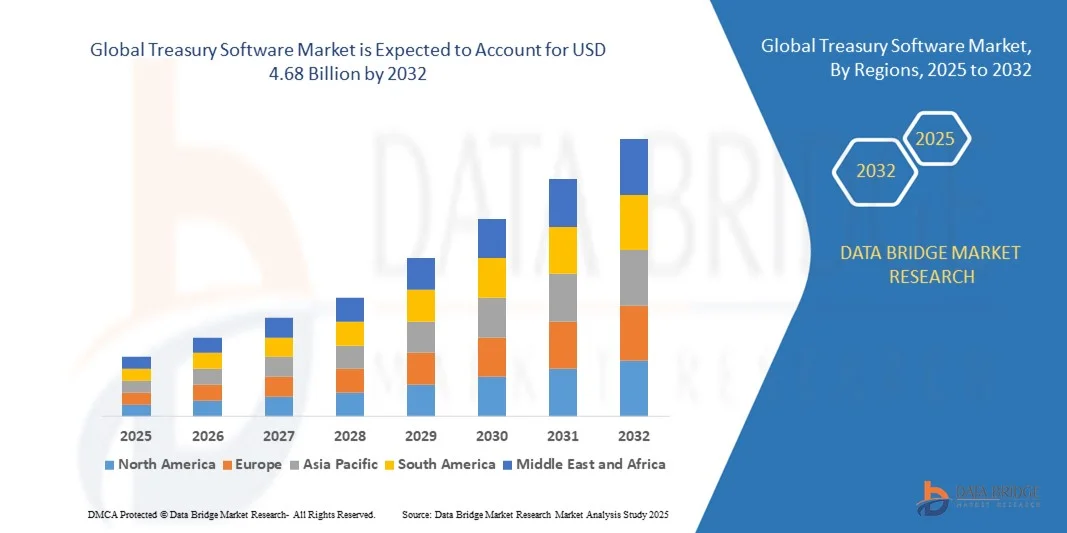

- La taille du marché mondial des logiciels de trésorerie était évaluée à 3,67 milliards USD en 2024 et devrait atteindre 4,68 milliards USD d'ici 2032 , à un TCAC de 3,1 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante de solutions de gestion financière numériques et les avancées technologiques continues dans les opérations de trésorerie, conduisant à une automatisation améliorée, à des rapports en temps réel et à une meilleure visibilité des flux de trésorerie pour les entreprises.

- Par ailleurs, la demande croissante des organisations pour des plateformes sécurisées, intégrées et conviviales pour gérer les liquidités, les investissements, les risques et la conformité fait des logiciels de trésorerie un outil essentiel de la gestion financière moderne. Ces facteurs convergents accélèrent l'adoption des solutions de trésorerie, stimulant ainsi considérablement la croissance du marché.

Analyse du marché des logiciels de trésorerie

- Les logiciels de trésorerie désignent des plateformes numériques permettant aux organisations de gérer efficacement leur trésorerie, leurs liquidités, leurs investissements, leurs dettes, leurs risques financiers et leur conformité réglementaire. Ces systèmes s'intègrent aux progiciels de gestion intégrés (ERP) et aux plateformes bancaires pour offrir un contrôle centralisé, des informations en temps réel et l'automatisation des processus courants.

- La demande croissante de logiciels de trésorerie est principalement alimentée par le besoin d'efficacité opérationnelle, de transparence financière accrue, de conformité réglementaire et la préférence croissante pour les solutions basées sur le cloud et accessibles sur mobile qui permettent aux trésoriers de surveiller et de gérer les finances de l'entreprise à distance.

- L'Amérique du Nord a dominé le marché des logiciels de trésorerie avec une part de 41,55 % en 2024, en raison d'une demande croissante de gestion financière numérique et d'automatisation dans les entreprises.

- L'Asie-Pacifique devrait être la région connaissant la croissance la plus rapide sur le marché des logiciels de trésorerie au cours de la période de prévision en raison de l'urbanisation croissante, de l'adoption croissante du numérique et des avancées technologiques dans des pays comme la Chine, le Japon et l'Inde.

- Le segment sur site a dominé le marché avec une part de marché de 52,8 % en 2024, en raison de la préférence des entreprises pour un contrôle total des données financières sensibles, la conformité aux normes de sécurité et des options de personnalisation. De nombreuses grandes entreprises continuent d'investir dans des solutions sur site pour maintenir leur gouvernance interne et s'intégrer parfaitement à leur infrastructure informatique existante. La fiabilité et la stabilité des déploiements sur site en font un choix privilégié pour les opérations de trésorerie critiques.

Portée du rapport et segmentation du marché des logiciels de trésorerie

|

Attributs |

Informations clés sur le marché des logiciels de trésorerie |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché des logiciels de trésorerie

Adoption croissante des solutions de trésorerie basées sur le cloud et mobiles

- Le marché des logiciels de trésorerie est de plus en plus influencé par l'intégration de solutions cloud et mobiles, offrant une accessibilité, une évolutivité et une sécurité accrues aux équipes financières des entreprises. La technologie cloud permet aux organisations de centraliser leurs opérations de trésorerie sur différentes zones géographiques, réduisant ainsi les coûts d'infrastructure et améliorant l'agilité opérationnelle.

- Par exemple, Kyriba s'est imposée comme une référence dans le domaine des plateformes cloud de gestion de trésorerie et de gestion des risques, offrant à ses clients des outils cloud natifs sécurisés pour la gestion des liquidités, la visibilité de la trésorerie et l'accès mobile. Les partenariats de l'entreprise avec des institutions financières illustrent la manière dont les fournisseurs proposent des innovations cloud pour répondre à l'évolution des besoins en trésorerie.

- L'adoption de solutions de trésorerie mobiles permet aux dirigeants et aux responsables financiers d'accéder 24h/24 et 7j/7 aux données financières critiques via leurs smartphones et tablettes. Ainsi, les opérations de trésorerie, telles que l'autorisation des paiements, la vérification des positions de liquidité et la surveillance des risques de marché, peuvent être réalisées en temps réel, où que vous soyez.

- Les plateformes de trésorerie cloud natives offrent également des analyses et un apprentissage automatique intégrés pour des prévisions de trésorerie prédictives et des analyses de scénarios, améliorant ainsi la rapidité et la précision des prises de décision. Ces avancées permettent aux entreprises d'identifier proactivement leurs expositions aux devises, de gérer les risques de taux d'intérêt et d'adapter leurs stratégies de liquidité aux fluctuations du marché.

- L'intégration de la trésorerie cloud aux infrastructures de paiement numérique et à la blockchain améliore la transparence des transactions et l'efficacité des paiements transfrontaliers. Des fournisseurs comme FIS Global intègrent des solutions blockchain pour accélérer le règlement des paiements et sécuriser les processus de rapprochement, stimulant ainsi l'innovation dans les processus financiers.

- Le recours croissant aux solutions de trésorerie cloud et mobiles reflète une transition plus large vers la transformation numérique de la finance d'entreprise. Cette tendance favorise la résilience et la flexibilité des opérations de trésorerie et soutient également des objectifs stratégiques tels que l'amélioration de la conformité et la maîtrise des risques au sein de réseaux financiers diversifiés.

Dynamique du marché des logiciels de trésorerie

Conducteur

Demande de flux de trésorerie et de gestion des risques en temps réel

- Le besoin d'informations en temps réel sur la liquidité et la gestion des risques des entreprises est devenu un moteur majeur de l'adoption de logiciels de trésorerie. Les entreprises sont confrontées à une complexité croissante de leurs opérations financières, exigeant des équipes de trésorerie qu'elles gèrent avec précision et rapidité les fluctuations de change, la volatilité des taux d'intérêt et les défis liés aux paiements internationaux.

- Par exemple, les modules de gestion de trésorerie et de gestion des risques de SAP permettent aux entreprises d'intégrer leurs positions de trésorerie, de prévoir leurs besoins de liquidités et d'automatiser leurs processus de comptabilité de couverture. En offrant visibilité et contrôle en temps réel, ces outils aident les organisations à minimiser les risques financiers tout en maintenant leur conformité avec les réglementations en constante évolution.

- Le logiciel de trésorerie offre une visibilité centralisée sur les positions de trésorerie multi-entités et multi-devises, offrant aux directeurs financiers et aux trésoriers un accès instantané aux soldes de trésorerie et aux besoins de financement. Ce niveau de transparence permet aux organisations d'optimiser l'allocation des liquidités, de réduire les soldes inutilisés et d'améliorer leurs stratégies d'investissement pour les fonds excédentaires.

- La mondialisation croissante des entreprises et la complexité des transactions financières transfrontalières ont accru le besoin d'outils de gestion des risques performants. Les plateformes de trésorerie soutiennent les entreprises en leur fournissant des analyses avancées pour la mesure de l'exposition, la gestion de la conformité réglementaire et le reporting en temps réel aux parties prenantes.

- La demande croissante de surveillance continue des liquidités et d'évaluation proactive des risques rend les solutions de trésorerie indispensables. À mesure que les entreprises étendent leurs opérations à l'international, les pratiques de trésorerie en temps réel deviennent un facteur essentiel de stabilité et d'efficacité financière dans tous les secteurs.

Retenue/Défi

Intégration avec les systèmes ERP et bancaires existants

- L'un des principaux défis de l'adoption de logiciels de trésorerie réside dans la difficulté d'intégrer des solutions numériques avancées aux progiciels de gestion intégrés (ERP) existants et aux diverses plateformes bancaires. De nombreuses multinationales utilisent des environnements informatiques hérités qui compliquent la migration fluide des données et l'interopérabilité.

- Par exemple, les entreprises qui s'appuient sur des systèmes ERP traditionnels comme Oracle E-Business Suite ou d'anciennes interfaces bancaires sont souvent confrontées à des retards et à des coûts accrus lors de l'intégration d'applications de trésorerie modernes. Cela limite l'efficacité de la visibilité de la trésorerie en temps réel et du rapprochement des transactions.

- Les dépendances des systèmes existants engendrent des silos de données fragmentés qui entravent l'accès à des informations financières complètes. Sans connexions simplifiées entre les logiciels de trésorerie, les modules ERP et les réseaux bancaires, les entreprises peinent à gérer les rapprochements manuels, les processus redondants et les inefficacités du reporting.

- Les défis d'interopérabilité se traduisent par des limitations dans l'automatisation des flux de paiement et la standardisation des formats entre les différentes banques internationales. Les équipes de trésorerie constatent souvent des incohérences dans les échanges de données et les messages de règlement, ce qui peut accroître les taux d'erreur et les risques de non-conformité.

- Résoudre ces problèmes d'intégration nécessite des investissements dans les technologies middleware, les API bancaires ouvertes et la modernisation progressive des infrastructures ERP. Lever ces obstacles sera essentiel pour garantir le fonctionnement optimal des plateformes de trésorerie avancées au sein d'écosystèmes financiers interconnectés.

Portée du marché des logiciels de trésorerie

Le marché est segmenté en fonction du système d’exploitation, de l’application, du mode de déploiement, de la taille de l’organisation et du secteur vertical.

- Par système d'exploitation

En fonction du système d'exploitation, le marché des logiciels de trésorerie est segmenté entre Windows, Linux, iOS, Android et MAC. En 2024, Windows a dominé le marché en termes de chiffre d'affaires, grâce à son adoption généralisée dans les environnements informatiques des entreprises et à sa compatibilité avec les systèmes financiers existants. Les entreprises privilégient souvent les solutions de trésorerie Windows en raison de leur écosystème de support robuste, de leur interface conviviale et de leurs capacités d'intégration avec les progiciels de gestion intégrés (ERP) et les logiciels financiers. La familiarité des équipes informatiques avec les environnements Windows encourage son déploiement continu dans les opérations de trésorerie, permettant des flux de travail fluides et une gestion système efficace.

Le segment Android devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par l'utilisation croissante des applications de trésorerie mobiles et le besoin d'accès en temps réel aux données financières. Les solutions de trésorerie compatibles Android permettent aux professionnels de gérer leurs liquidités, leurs paiements et leurs investissements à distance, améliorant ainsi leur efficacité opérationnelle. L'évolutivité de la plateforme, sa large compatibilité avec les appareils et ses coûts de développement inférieurs à ceux d'iOS contribuent à son adoption accélérée dans les entreprises de toutes tailles.

- Par application

En fonction des applications, le marché est segmenté en gestion de liquidités et de trésorerie, gestion des investissements, gestion de la dette, gestion des risques financiers, gestion de la conformité et planification fiscale, entre autres. Ce segment a représenté la plus grande part de chiffre d'affaires en 2024, les organisations privilégiant le suivi en temps réel de leur trésorerie et l'optimisation de leur fonds de roulement. Ces solutions aident les trésoriers à maintenir des liquidités adéquates, à gérer les investissements à court terme et à rationaliser les flux de trésorerie internes, garantissant ainsi la continuité opérationnelle. La complexité croissante des transactions financières et le besoin d'automatisation des prévisions de trésorerie favorisent l'adoption de logiciels de trésorerie axés sur la liquidité.

Le secteur de la gestion des risques financiers devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par une exposition croissante aux risques de marché, de crédit et opérationnels. Les organisations utilisent de plus en plus des solutions de trésorerie pour modéliser, surveiller et atténuer les risques liés aux fluctuations des devises, des taux d'intérêt et des contreparties. L'intégration d'outils d'analyse, de planification de scénarios et de conformité réglementaire améliorés à ces systèmes renforce la confiance dans la prise de décision stratégique, favorisant ainsi une adoption rapide dans tous les secteurs.

- Par mode de déploiement

En fonction du mode de déploiement, le marché des logiciels de trésorerie est segmenté entre les solutions sur site et les solutions cloud. Le segment sur site a dominé le marché avec une part de 52,8 % en 2024, soutenu par la préférence des organisations pour un contrôle total des données financières sensibles, la conformité en matière de sécurité et les options de personnalisation. De nombreuses grandes entreprises continuent d'investir dans des solutions sur site pour maintenir leur gouvernance interne et s'intégrer parfaitement à leur infrastructure informatique existante. La fiabilité et la stabilité des déploiements sur site en font un choix privilégié pour les opérations de trésorerie critiques.

Le segment du cloud devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par la demande croissante de solutions de trésorerie évolutives, accessibles et rentables. Les systèmes cloud offrent un accès à distance, des rapports en temps réel et des mises à jour fluides, permettant aux organisations de s'adapter rapidement aux environnements financiers dynamiques. Les PME, en particulier, adoptent de plus en plus le cloud pour réduire leurs coûts informatiques tout en bénéficiant de fonctionnalités professionnelles.

- Par taille d'organisation

Selon la taille des organisations, le marché est segmenté en grandes entreprises et en petites et moyennes entreprises (PME). En 2024, ces dernières ont dominé le marché en termes de chiffre d'affaires, gérant des opérations de trésorerie complexes dans plusieurs zones géographiques et devises. Les grandes entreprises bénéficient de solutions de trésorerie avancées pour consolider leur gestion de trésorerie, automatiser les paiements, atténuer les risques et garantir la conformité aux réglementations financières internationales. Leur importante capacité d'investissement permet la personnalisation et l'intégration de logiciels de trésorerie à d'autres systèmes d'entreprise, favorisant ainsi leur adoption.

Le segment des PME devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par la prise de conscience croissante des outils de trésorerie numériques et la nécessité d'une gestion efficace de la trésorerie et des risques. Les PME adoptent des solutions évolutives et rentables pour améliorer leur efficacité opérationnelle, bénéficier d'une visibilité en temps réel sur leurs flux de trésorerie et optimiser leur prise de décision. Les offres cloud et les formules d'abonnement facilitent l'adoption de ces solutions par les petites entreprises disposant de ressources informatiques limitées.

- Par Vertical

Sur le plan vertical, le marché des logiciels de trésorerie est segmenté entre les secteurs de la banque, des services financiers et de l'assurance (BFSI), des administrations publiques, de l'industrie manufacturière, de la santé, des biens de consommation, de la chimie, de l'énergie, etc. En 2024, le segment BFSI a dominé le marché, en raison de la nécessité pour le secteur de gérer d'importants volumes de transactions financières, de respecter les exigences de liquidité et de conformité. Les banques et les institutions financières s'appuient fortement sur des solutions de trésorerie pour optimiser la gestion de leur trésorerie, leurs opérations d'investissement et la surveillance des risques, garantissant ainsi le respect de la réglementation et l'efficacité opérationnelle. Leurs capacités d'analyse avancées et de surveillance en temps réel rendent ces solutions indispensables pour le secteur BFSI.

Le secteur manufacturier devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par la complexité croissante des chaînes d'approvisionnement, des transactions internationales et des exigences de gestion de trésorerie. Les fabricants adoptent des logiciels de trésorerie pour optimiser leur fonds de roulement, gérer leur exposition aux devises et améliorer leur planification financière globale. L'intégration aux systèmes ERP et l'automatisation des paiements renforcent encore l'efficacité, favorisant ainsi une adoption rapide dans l'ensemble du secteur.

Analyse régionale du marché des logiciels de trésorerie

- L'Amérique du Nord a dominé le marché des logiciels de trésorerie avec la plus grande part de revenus de 41,55 % en 2024, tirée par une demande croissante de gestion financière numérique et d'automatisation dans les entreprises.

- Les organisations de la région accordent une grande importance à la surveillance des flux de trésorerie en temps réel, à la gestion des risques et à la conformité simplifiée offertes par les solutions de trésorerie.

- L'adoption généralisée est en outre soutenue par une infrastructure technologiquement avancée, des dépenses informatiques élevées et la présence d'institutions financières majeures, établissant les logiciels de trésorerie comme un outil clé pour des opérations financières d'entreprise efficaces.

Aperçu du marché des logiciels du Trésor américain

Le marché américain des logiciels de trésorerie a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, grâce à la transformation numérique rapide et à l'adoption de solutions de trésorerie automatisées. Les entreprises accordent de plus en plus d'importance à l'optimisation des liquidités, à la supervision des investissements et à la réduction des risques grâce à des plateformes logicielles intégrées. La demande croissante de solutions cloud, d'accès mobile et d'analyses avancées pour une prise de décision en temps réel stimule la croissance du marché. De plus, la présence de fournisseurs de logiciels de premier plan et l'importance accordée par le pays à l'innovation fintech contribuent significativement à l'expansion du marché.

Aperçu du marché européen des logiciels de trésorerie

Le marché européen des logiciels de trésorerie devrait connaître une croissance annuelle moyenne (TCAC) substantielle tout au long de la période de prévision, principalement portée par les exigences de conformité réglementaire et le besoin croissant de transparence financière des entreprises. Les organisations adoptent des solutions de trésorerie pour optimiser la gestion de leur trésorerie, gérer les risques financiers et améliorer la surveillance de leurs investissements. L'augmentation des transactions transfrontalières, conjuguée à l'adoption croissante du numérique dans le secteur des entreprises, favorise le déploiement de logiciels de trésorerie. Les entreprises européennes intègrent également leurs systèmes de trésorerie à leurs progiciels de gestion intégrés (ERP) et à leurs plateformes de reporting financier afin de garantir efficacité et conformité.

Aperçu du marché des logiciels du Trésor britannique

Le marché britannique des logiciels de trésorerie devrait connaître une croissance annuelle moyenne (TCAC) remarquable au cours de la période de prévision, portée par la demande de solutions robustes de gestion des risques financiers et d'automatisation des liquidités. Les entreprises privilégient la visibilité de leur trésorerie en temps réel, le respect des réglementations et une allocation efficace des fonds, ce qui favorise l'adoption des logiciels de trésorerie. Le solide écosystème fintech du Royaume-Uni, son infrastructure bancaire numérique et l'utilisation généralisée des solutions cloud soutiennent la croissance du marché auprès des grandes entreprises et des PME.

Aperçu du marché allemand des logiciels du Trésor

Le marché allemand des logiciels de trésorerie devrait connaître une croissance annuelle moyenne (TCAC) considérable au cours de la période de prévision, stimulé par l'adoption de solutions financières numériques avancées et l'accent mis sur la gestion des risques et la conformité. Les entreprises déploient de plus en plus de logiciels de trésorerie pour optimiser leurs liquidités, suivre leurs portefeuilles d'investissement et automatiser leurs processus de reporting. La forte base industrielle allemande, l'importance accordée à la numérisation et la rigueur de la réglementation financière encouragent le déploiement de solutions de trésorerie tant dans les entreprises que dans les administrations publiques.

Aperçu du marché des logiciels de trésorerie en Asie-Pacifique

Le marché des logiciels de trésorerie en Asie-Pacifique devrait connaître son taux de croissance annuel composé (TCAC) le plus élevé au cours de la période de prévision 2025-2032, porté par l'urbanisation croissante, l'adoption croissante du numérique et les avancées technologiques dans des pays comme la Chine, le Japon et l'Inde. Les entreprises de la région adoptent de plus en plus des solutions de trésorerie cloud et mobiles pour améliorer la gestion de leurs liquidités et le contrôle des risques financiers. Les initiatives gouvernementales en faveur de la finance numérique, conjuguées à l'émergence de fournisseurs de logiciels régionaux, stimulent l'adoption de logiciels de trésorerie dans tous les secteurs.

Aperçu du marché japonais des logiciels du Trésor

Le marché japonais des logiciels de trésorerie connaît un essor considérable grâce à l'infrastructure technologique avancée du pays et à l'adoption croissante de l'automatisation des opérations financières. Les entreprises exploitent ces solutions pour optimiser leurs flux de trésorerie, suivre leurs investissements et se conformer aux réglementations. L'intégration des logiciels de trésorerie aux progiciels de gestion intégrés (ERP) et aux systèmes de reporting financier alimente la croissance, tandis que la demande de solutions conviviales et sécurisées, tant dans les grandes entreprises que dans les PME, ne cesse de croître.

Aperçu du marché des logiciels du Trésor chinois

En 2024, le marché chinois des logiciels de trésorerie représentait la plus grande part de chiffre d'affaires de la région Asie-Pacifique, grâce à l'urbanisation rapide, à l'adoption des nouvelles technologies et à la croissance des opérations financières des entreprises. Les organisations déploient des logiciels de trésorerie pour optimiser la gestion de leurs liquidités, la supervision de leurs investissements et la maîtrise des risques. La forte progression de la finance numérique, conjuguée à la disponibilité de solutions rentables proposées par des fournisseurs nationaux et internationaux, stimule la croissance du marché dans de nombreux secteurs, notamment l'industrie manufacturière, les services financiers et les biens de consommation.

Part de marché des logiciels de trésorerie

L’industrie des logiciels de trésorerie est principalement dirigée par des entreprises bien établies, notamment :

- Finastra (Royaume-Uni)

- ZenTreasury Ltd (Finlande)

- Emphasys Software (États-Unis)

- SS&C Technologies, Inc. (États-Unis)

- CAPIX (Australie)

- Adenza (Royaume-Uni et États-Unis)

- Coupa Software Inc. (États-Unis)

- DataLog Finance (France & Singapour)

- FIS (États-Unis)

- Access Systems (UK) Limited (Royaume-Uni)

- Treasury Software Corp. (États-Unis)

- MUREX SAS (France)

- EdgeVerve Systems Limited (Inde)

- Financial Sciences Corp. (États-Unis)

- Broadridge Financial Solutions, Inc. (États-Unis)

- CashAnalytics (Irlande)

- Oracle (États-Unis)

- Fiserv, Inc. (États-Unis)

- ION (Royaume-Uni)

- SAP (Allemagne)

- Solomon Software (États-Unis)

- ABM CLOUD (Géorgie)

Derniers développements sur le marché mondial des logiciels de trésorerie

- En juin 2023, ZenTreasury a apporté des améliorations significatives à son logiciel de comptabilité des contrats de location IFRS 16, simplifiant ainsi les processus de conformité des entreprises. Ce logiciel mis à jour intègre des fonctionnalités d'automatisation avancées, permettant le suivi et le reporting en temps réel des obligations locatives. Cette amélioration réduit la saisie manuelle des données et minimise les risques d'erreurs, garantissant ainsi un reporting financier précis. Grâce à son intégration transparente aux progiciels de gestion intégrés (ERP) existants, le logiciel facilite les audits et améliore l'efficacité opérationnelle globale. Cette mise à niveau positionne ZenTreasury comme un leader des solutions complètes de comptabilité des contrats de location, répondant aux exigences réglementaires en constante évolution.

- En mai 2023, Treasury Intelligence Solutions (TIS) et Delega ont renforcé leur collaboration afin d'optimiser les fonctionnalités de gestion électronique des comptes bancaires (eBAM). L'intégration offre désormais des fonctionnalités avancées pour la gestion des droits de signature sur plusieurs relations bancaires. Cette évolution permet aux trésoriers d'entreprise d'automatiser la création, la modification et la suppression des enregistrements de signature, réduisant ainsi considérablement les interventions manuelles et les risques associés. Les fonctionnalités eBAM étendues garantissent la conformité aux réglementations bancaires mondiales et améliorent l'efficacité des opérations de trésorerie. Cette amélioration stratégique souligne l'engagement de TIS et Delega à fournir des solutions de pointe pour une gestion de trésorerie moderne.

- En avril 2023, ZenTreasury a lancé un module multidevise au sein de son logiciel de comptabilité des contrats de location IFRS 16, répondant ainsi aux complexités rencontrées par les multinationales. Cette nouvelle fonctionnalité permet aux entreprises de gérer leurs obligations locatives dans différentes devises au sein d'une plateforme unique. Le module automatise les conversions de devises et garantit un reporting financier précis, conforme aux normes comptables internationales. En centralisant les données des contrats de location et en fournissant des informations en temps réel, le module multidevise optimise les processus décisionnels et soutient les efforts de consolidation financière à l'échelle mondiale. Cet ajout renforce l'engagement de ZenTreasury à proposer des solutions évolutives aux entreprises opérant dans des environnements financiers diversifiés.

- En mars 2022, ZenTreasury et son partenaire local MCA ont fourni à Redington Gulf un logiciel de comptabilité des contrats de location conforme à la norme IFRS-16. Les clients n'ont plus besoin d'importer des données de plusieurs sources et de les stocker sur plusieurs plateformes. Tout est géré par un seul logiciel. Cette intégration simplifie les flux de travail, réduit la redondance des données et améliore leur précision, ce qui optimise les processus de comptabilité des contrats de location. L'approche globale de la solution simplifie les tâches de conformité et de reporting, permettant aux entreprises de se concentrer davantage sur la gestion financière stratégique.

- En septembre 2022, TIS et Delega ont collaboré pour offrir à leurs clients une gestion automatisée des droits de signature multi-bancaire de nouvelle génération. Grâce à cet accord, les clients de TIS et Delega peuvent bénéficier de la gestion électronique des comptes bancaires (eBAM) de nouvelle génération. Cette collaboration permet aux organisations d'automatiser et de centraliser la gestion des signataires de comptes bancaires, améliorant ainsi leur efficacité et réduisant les risques d'erreur. En simplifiant le processus, les entreprises peuvent garantir une meilleure conformité avec la réglementation bancaire et renforcer la sécurité de leurs opérations financières.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.