Global Thin And Ultra Thin Films Market

Taille du marché en milliards USD

TCAC :

%

USD

5,313.17 Million

USD

22,812.53 Million

2021

2029

USD

5,313.17 Million

USD

22,812.53 Million

2021

2029

| 2022 –2029 | |

| USD 5,313.17 Million | |

| USD 22,812.53 Million | |

|

|

|

|

Marché mondial des films minces et ultra-minces, par méthodes de revêtement (état gazeux, état de solution, état fondu ou semi-fondu), type (mince, ultra-mince), techniques de dépôt (dépôt physique, dépôt chimique), application (électronique et semi-conducteurs, énergies renouvelables, applications de santé et biomédicales, automobile, aérospatiale et défense, autres) – Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

Les films minces et ultra-minces sont très utilisés en raison de leur légèreté et peuvent être utilisés pour revêtir d'autres matériaux, notamment le métal ou le plastique. Ces films sont largement déployés dans divers domaines tels que le photovoltaïque (PV), la protection contre la corrosion, les batteries, les piles à combustible, les peintures et les revêtements , entre autres.

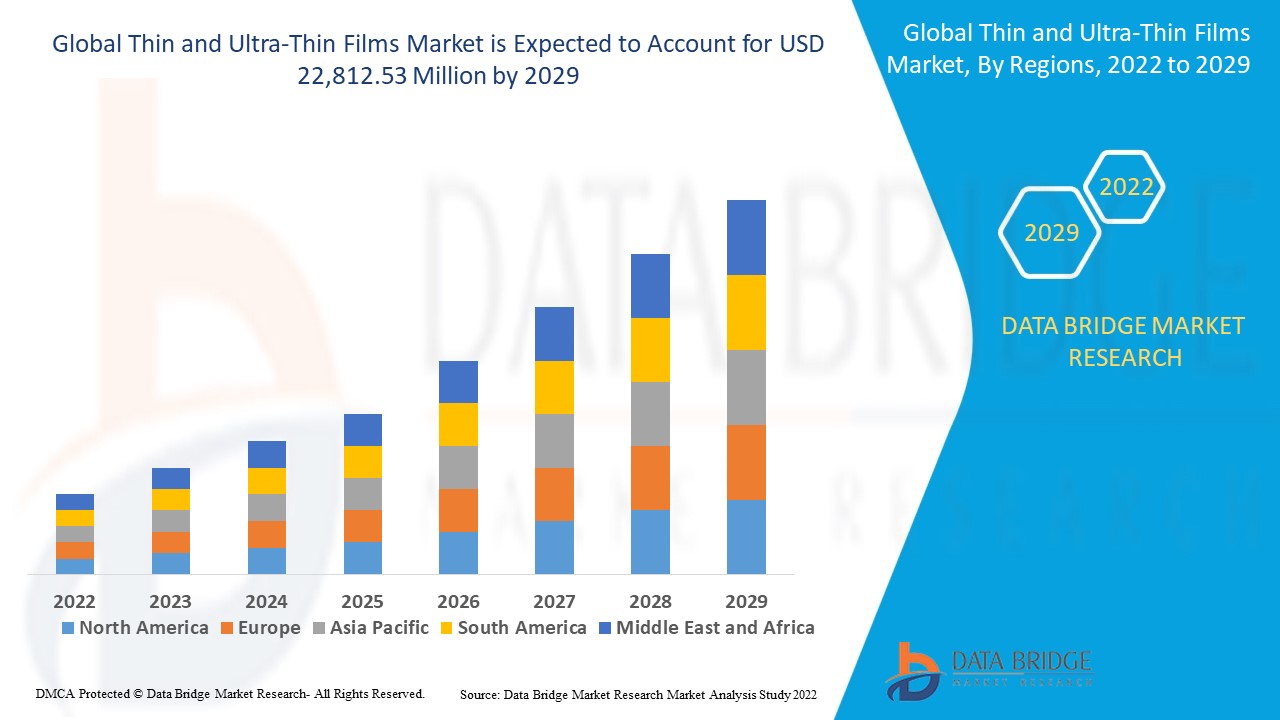

Le marché mondial des films minces et ultra-minces était évalué à 5 313,17 millions USD en 2021 et devrait atteindre 22 812,53 millions USD d'ici 2029, enregistrant un TCAC de 15,40 % au cours de la période de prévision 2022-2029. L'électronique et les semi-conducteurs représentent le segment d'application sur le marché respectif en raison de leur utilisation élevée pour l'emballage et le revêtement de matériaux semi-conducteurs. Le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse des pilon.

Définition du marché

Les films minces désignent les films dont l'épaisseur est inférieure à 1 μm. Ces films sont essentiellement des couches de matériau déposées sur n'importe quelle surface. Les films ultra-minces sont définis comme des films déposés à l'aide de techniques de dépôt chimique et physique complexes, notamment des précurseurs en phase gazeuse et un procédé plasma.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Méthodes de revêtement (état gazeux, état de solution, état fondu ou semi-fondu), type (mince, ultra-mince), techniques de dépôt (dépôt physique, dépôt chimique), application (électronique et semi-conducteurs, énergies renouvelables, soins de santé et applications biomédicales, automobile, aérospatiale et défense, autres) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Arabie saoudite, Émirats arabes unis, Israël, Égypte, Afrique du Sud, Reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), Brésil, Argentine et Reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud |

|

Acteurs du marché couverts |

American Elements (États-Unis), LEW TECHNIQUES LTD (Royaume-Uni), Denton Vacuum (États-Unis), KANEKA CORPORATION (Japon), Umicore (Belgique), Materion Corporation (États-Unis), AIXTRON (Allemagne), Kurt J. Lesker Company (États-Unis), Vital Materials Co., Limited (Chine), AJA INTERNATIONAL, Inc. (États-Unis), Praxair ST Technology, Inc. (États-Unis), PVD Products, Inc. (États-Unis), GEOMATEC Co., Ltd. (Japon), INTEVAC, INC. (États-Unis), Plasma-Therm (Royaume-Uni), Arrow Thin Films, Inc. (États-Unis), Super Conductor Materials, Inc. (États-Unis), Angstrom Engineering Inc. (Canada), ThinFilms Inc. (États-Unis), Orange Thin Films (Pays-Bas), entre autres |

|

Opportunités de marché |

|

Dynamique du marché des films minces et ultra-minces

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- L'essor de la miniaturisation

L'augmentation de la miniaturisation des semi-conducteurs est l'un des principaux facteurs de croissance du marché des films minces et ultra-minces. De plus, l'expansion de la nanotechnologie dans différents domaines de la science des matériaux a un impact positif sur le marché.

- Demande de divers secteurs

L'augmentation de la demande de films minces et ultra-minces dans de nombreux secteurs, tels que les semi-conducteurs, le secteur médical et l'emballage, entre autres, accélère la croissance du marché. Diverses techniques de dépôt de films minces contribuent à l'expansion du marché.

- Les progrès dans le cinéma

L'augmentation de l'innovation et des progrès des entreprises leaders dans le domaine du dépôt de brevets pour leurs produits influence encore davantage le marché. L'augmentation de la demande pour ces films en raison de leur haut degré de flexibilité stimule le marché.

De plus, l’urbanisation rapide, le changement de mode de vie, l’augmentation des investissements et l’augmentation des dépenses de consommation ont un impact positif sur le marché des films minces et ultra-minces.

Opportunités

En outre, la croissance révolutionnaire de la nanotechnologie étend les opportunités rentables aux acteurs du marché au cours de la période de prévision de 2022 à 2029. En outre, l'augmentation des investissements élargira encore le marché.

Contraintes/Défis

D'autre part, le manque d'efficacité de conversion des cellules au silicium devrait entraver la croissance du marché. En outre, le manque de sensibilisation devrait mettre à mal le marché des films minces et ultra-minces au cours de la période de prévision 2022-2029.

Ce rapport sur le marché des films minces et ultra-minces fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des films minces et ultra-minces, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des films minces et ultra-minces

Le COVID-19 a eu un impact sur le marché des films minces et ultra-minces. Les coûts d'investissement limités et le manque d'employés ont entravé les ventes et la production de la technologie d'affichage sur papier électronique (e-paper). Cependant, le gouvernement et les principaux acteurs du marché ont adopté de nouvelles mesures de sécurité pour développer les pratiques. Les progrès de la technologie ont fait grimper le taux de vente des films minces et ultra-minces car ils ciblaient le bon public. L'augmentation des ventes d'électronique grand public à travers le monde devrait stimuler davantage la croissance du marché dans le scénario post-pandémique.

Portée et taille du marché mondial des films minces et ultra-minces

Le marché des films minces et ultra-minces est segmenté en fonction des méthodes de revêtement, du type, des techniques de dépôt et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Méthodes de revêtement

- État gazeux

- État des solutions

- État fondu ou semi-fondu

Taper

- Mince

- Ultra-mince

Techniques de dépôt

- Dépôt physique

- Dépôt chimique

Application

- Électronique et semi-conducteurs

- Energie renouvelable

- Applications médicales et biomédicales

- Automobile

- Aérospatiale et Défense

- Autres

Analyse/perspectives régionales du marché des films minces et ultra-minces

Le marché des films minces et ultra-minces est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, méthodes de revêtement, type, techniques de dépôt et application comme référencé ci-dessus.

Français Les pays couverts dans le rapport sur le marché des films minces et ultra-minces sont les États-Unis, le Canada et le Mexique en Amérique du Nord, l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, le reste de l'Europe en Europe, la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), l'Arabie saoudite, les Émirats arabes unis, Israël, l'Égypte, l'Afrique du Sud, le reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), le Brésil, l'Argentine et le reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud.

L’Asie-Pacifique (APAC) domine le marché des films minces et ultra-minces en raison de l’acceptation croissante de la technologie dans la région.

L’Amérique du Nord devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029 en raison de l’adoption de la technologie et de la pression croissante pour réduire les émissions de carbone dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Paysage concurrentiel et marché des films minces et ultra-minces

Le paysage concurrentiel du marché des films minces et ultra-minces fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des films minces et ultra-minces.

Certains des principaux acteurs opérant sur le marché des films minces et ultra-minces sont

- Éléments américains (États-Unis)

- LEW TECHNIQUES LTD (Royaume-Uni)

- Aspirateur Denton (États-Unis)

- KANEKA CORPORATION (Japon)

- Umicore (Belgique)

- Materion Corporation (États-Unis)

- AIXTRON (Allemagne)

- Société Kurt J. Lesker (États-Unis)

- Vital Materials Co., Limited (Chine)

- AJA INTERNATIONAL, Inc. (États-Unis)

- Praxair ST Technology, Inc. (États-Unis)

- PVD Products, Inc. (États-Unis)

- GEOMATEC Co., Ltd. (Japon)

- INTEVAC, INC. (États-Unis)

- Plasma-Therm (Royaume-Uni)

- Arrow Thin Films, Inc. (États-Unis)

- Matériaux supraconducteurs, Inc. (États-Unis)

- Angstrom Engineering Inc. (Canada)

- ThinFilms Inc. (États-Unis)

- Films minces orange (Pays-Bas)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL THIN AND ULTRA-THIN FILMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COATING METHODS TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 IMPACT ANALYSIS OF COVID-19

5.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

5.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.3 IMPACT ON DEMAND

5.4 IMPACT ON SUPPLY CHAIN

5.5 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN WIND ENERGY

6.1.2 GROWING DEMAND FOR CONSUMERS ELECTRONIC

6.1.3 INCREASING USE OF THIN FILM FOR MEDICAL DEVICES

6.1.4 INCREASING ADOPTION OF SOLAR ENERGY

6.2 RESTRAINT

6.2.1 LACK OF STANDARDIZATION

6.3 OPPORTUNITIES

6.3.1 GROWING ADVANCEMENT IN NANOTECHNOLOGY

6.3.2 INCREASING DEMAND FROM THE AEROSPACE AND DEFENSE INDUSTRY FOR THIN FILM APPLICATIONS

6.3.3 GOVERNMENT INITIATIVES TO REDUCE CARBON EMISSION

6.4 CHALLENGE

6.4.1 POOR CONVERSION EFFICIENCY OF THIN FILM SOLAR CELLS

7 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS

7.1 OVERVIEW

7.2 GASEOUS STATE

7.3 SOLUTIONS STATE

7.4 MOLTEN OR SEMI-MOLTEN STATE

8 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE

8.1 OVERVIEW

8.2 THIN

8.3 ULTRA-THIN

9 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES

9.1 OVERVIEW

9.2 PHYSICAL DEPOSITION

9.2.1 TYPE

9.2.1.1 Evaporation Techniques

9.2.1.2 Sputtering Deposition

9.2.1.3 Pulsed Laser Deposition (PLD)

9.2.1.4 Others

9.2.2 MATERIAL

9.2.2.1 Sputtering Targets

9.2.2.2 Pellets

9.2.2.3 Others

9.3 CHEMICAL DEPOSITION

9.3.1 TYPE

9.3.1.1 Chemical Vapor Deposition (CVD)

9.3.1.2 Sol-Gel Deposition

9.3.1.3 Plating

9.3.1.4 Others

9.3.2 MATERIAL

9.3.2.1 Metal Halides

9.3.2.2 Metal Hydrides

9.3.2.3 Reactive Gases

9.3.2.4 Organometallic Compounds

9.3.2.5 Metal Salts

9.3.2.6 Others

10 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ELECTRONICS & SEMICONDUCTOR

10.2.1 FULLY TRANSPARENT ELECTRICAL CONDUCTORS

10.2.2 INTEGRATED CIRCUIT FABRICATION

10.2.3 THIN FILM BATTERIES

10.2.4 OTHERS

10.3 RENEWABLE ENERGY

10.3.1 SOLAR

10.3.2 WIND

10.4 HEALTHCARE AND BIOMEDICAL APPLICATIONS

10.5 AUTOMOTIVE

10.6 AEROSPACE & DEFENSE

10.7 OTHERS

11 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY GEOGRAPHY

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 INDIA

11.2.3 SOUTH KOREA

11.2.4 JAPAN

11.2.5 AUSTRALIA

11.2.6 SINGAPORE

11.2.7 THAILAND

11.2.8 MALAYSIA

11.2.9 INDONESIA

11.2.10 PHILIPPINES

11.2.11 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 EUROPE

11.4.1 GERMANY

11.4.2 FRANCE

11.4.3 RUSSIA

11.4.4 U.K.

11.4.5 ITALY

11.4.6 SPAIN

11.4.7 NETHERLANDS

11.4.8 BELGIUM

11.4.9 SWITZERLAND

11.4.10 TURKEY

11.4.11 REST OF EUROPE

11.5 MIDDLE EAST & AFRICA

11.5.1 ISRAEL

11.5.2 SAUDI ARABIA

11.5.3 SOUTH AFRICA

11.5.4 U.A.E.

11.5.5 EGYPT

11.5.6 REST OF MIDDLE EAST & AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 KANEKA CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 UMICORE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 MATERION CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 PRAXAIR S.T. TECHNOLOGY, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 INTEVAC, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AIXTRON

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 AJA INTERNATIONAL, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 AMERICAN ELEMENTS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANGSTROM ENGINEERING INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 ARROW THIN FILMS, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 DENTON VACUUM

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 GEOMATEC CO., LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KURT J. LESKER COMPANY

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 LEW TECHNIQUES LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ORANGE THIN FILMS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 PLASMA-THERM

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 PVD PRODUCTS, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 SUPER CONDUCTOR MATERIALS, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 THINFILMS INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 VITAL MATERIALS CO., LIMITED

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, MARKET FORECAST 2020-2027 (USD MILLION) 65

TABLE 2 GLOBAL GASEOUS STATE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 65

TABLE 3 GLOBAL SOLUTIONS STATE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 66

TABLE 4 GLOBAL MOLTEN OR SEMI-MOLTEN STATE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 67

TABLE 5 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, MARKET FORECAST 2020-2027 (USD MILLION) 70

TABLE 6 GLOBAL THIN IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 70

TABLE 7 GLOBAL ULTRA-THIN IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 71

TABLE 8 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, MARKET FORECAST 2020-2027 (USD MILLION) 74

TABLE 9 GLOBAL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 74

TABLE 10 GLOBAL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE,2018-2027, (USD MILLION) 74

TABLE 11 GLOBAL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL,2018-2027, (USD MILLION) 75

TABLE 12 GLOBAL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 76

TABLE 13 GLOBAL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE,2018-2027, (USD MILLION) 76

TABLE 14 GLOBAL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL,2018-2027, (USD MILLION) 78

TABLE 15 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, MARKET FORECAST 2020-2027 (USD MILLION) 82

TABLE 16 GLOBAL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 82

TABLE 17 GLOBAL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION,2018-2027, (USD MILLION) 83

TABLE 18 GLOBAL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 84

TABLE 19 GLOBAL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION,2018-2027, (USD MILLION) 84

TABLE 20 GLOBAL HEALTHCARE AND BIOMEDICAL APPLICATIONS IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 85

TABLE 21 GLOBAL AUTOMOTIVE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 85

TABLE 22 GLOBAL AEROSPACE & DEFENSE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 86

TABLE 23 GLOBAL OTHERS IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 86

TABLE 24 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY REGION, 2018-2027 (USD MILLION) 92

TABLE 25 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 96

TABLE 26 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 96

TABLE 27 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 96

TABLE 28 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 97

TABLE 29 ASIA-PACIFIC PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 97

TABLE 30 ASIA-PACIFIC PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 97

TABLE 31 ASIA-PACIFIC CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 97

TABLE 32 ASIA-PACIFIC CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 98

TABLE 33 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 98

TABLE 34 ASIA-PACIFIC ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 98

TABLE 35 ASIA-PACIFIC RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 99

TABLE 36 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 100

TABLE 37 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 100

TABLE 38 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 100

TABLE 39 CHINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 101

TABLE 40 CHINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 101

TABLE 41 CHINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 101

TABLE 42 CHINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 102

TABLE 43 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 102

TABLE 44 CHINA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 102

TABLE 45 CHINA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 102

TABLE 46 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 104

TABLE 47 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 104

TABLE 48 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 104

TABLE 49 INDIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 105

TABLE 50 INDIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 105

TABLE 51 INDIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 105

TABLE 52 INDIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 106

TABLE 53 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 106

TABLE 54 INDIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 106

TABLE 55 INDIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 106

TABLE 56 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 108

TABLE 57 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 108

TABLE 58 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 108

TABLE 59 SOUTH KOREA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 109

TABLE 60 SOUTH KOREA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 109

TABLE 61 SOUTH KOREA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 109

TABLE 62 SOUTH KOREA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 110

TABLE 63 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 110

TABLE 64 SOUTH KOREA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 110

TABLE 65 SOUTH KOREA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 111

TABLE 66 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 112

TABLE 67 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 112

TABLE 68 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 112

TABLE 69 JAPAN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 113

TABLE 70 JAPAN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 113

TABLE 71 JAPAN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 113

TABLE 72 JAPAN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 114

TABLE 73 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 114

TABLE 74 JAPAN ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 114

TABLE 75 JAPAN RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 114

TABLE 76 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 116

TABLE 77 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 116

TABLE 78 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 116

TABLE 79 AUSTRALIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 117

TABLE 80 AUSTRALIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 117

TABLE 81 AUSTRALIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 117

TABLE 82 AUSTRALIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 118

TABLE 83 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 118

TABLE 84 AUSTRALIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 118

TABLE 85 AUSTRALIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 119

TABLE 86 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 120

TABLE 87 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 120

TABLE 88 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 120

TABLE 89 SINGAPORE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 121

TABLE 90 SINGAPORE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 121

TABLE 91 SINGAPORE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 121

TABLE 92 SINGAPORE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 122

TABLE 93 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 122

TABLE 94 SINGAPORE ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 122

TABLE 95 SINGAPORE RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 123

TABLE 96 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 124

TABLE 97 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 124

TABLE 98 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 124

TABLE 99 THAILAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 125

TABLE 100 THAILAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 125

TABLE 101 THAILAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 125

TABLE 102 THAILAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 126

TABLE 103 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 126

TABLE 104 THAILAND ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 126

TABLE 105 THAILAND RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 127

TABLE 106 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 128

TABLE 107 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 128

TABLE 108 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 128

TABLE 109 MALAYSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 129

TABLE 110 MALAYSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 129

TABLE 111 MALAYSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 129

TABLE 112 MALAYSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 130

TABLE 113 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 130

TABLE 114 MALAYSIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 130

TABLE 115 MALAYSIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 131

TABLE 116 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 132

TABLE 117 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 132

TABLE 118 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 132

TABLE 119 INDONESIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 133

TABLE 120 INDONESIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 133

TABLE 121 INDONESIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 133

TABLE 122 INDONESIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 134

TABLE 123 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 134

TABLE 124 INDONESIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 134

TABLE 125 INDONESIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 135

TABLE 126 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 136

TABLE 127 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 136

TABLE 128 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 136

TABLE 129 PHILIPPINES PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 137

TABLE 130 PHILIPPINES PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 137

TABLE 131 PHILIPPINES CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 137

TABLE 132 PHILIPPINES CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 138

TABLE 133 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 138

TABLE 134 PHILIPPINES ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 138

TABLE 135 PHILIPPINES RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 139

TABLE 136 REST OF ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 140

TABLE 137 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 144

TABLE 138 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 144

TABLE 139 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 144

TABLE 140 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 144

TABLE 141 NORTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 145

TABLE 142 NORTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 145

TABLE 143 NORTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 145

TABLE 144 NORTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 146

TABLE 145 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 146

TABLE 146 NORTH AMERICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 146

TABLE 147 NORTH AMERICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 147

TABLE 148 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 148

TABLE 149 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 148

TABLE 150 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 148

TABLE 151 U.S. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 149

TABLE 152 U.S. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 149

TABLE 153 U.S. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 149

TABLE 154 U.S. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 150

TABLE 155 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 150

TABLE 156 U.S. ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 150

TABLE 157 U.S. RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 151

TABLE 158 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 152

TABLE 159 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 152

TABLE 160 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 152

TABLE 161 CANADA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 153

TABLE 162 CANADA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 153

TABLE 163 CANADA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 153

TABLE 164 CANADA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 154

TABLE 165 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 154

TABLE 166 CANADA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 154

TABLE 167 CANADA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 154

TABLE 168 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 156

TABLE 169 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 156

TABLE 170 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 156

TABLE 171 MEXICO PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 157

TABLE 172 MEXICO PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 157

TABLE 173 MEXICO CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 157

TABLE 174 MEXICO CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 158

TABLE 175 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 158

TABLE 176 MEXICO ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 158

TABLE 177 MEXICO RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 158

TABLE 178 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 163

TABLE 179 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 163

TABLE 180 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 163

TABLE 181 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 164

TABLE 182 EUROPE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 164

TABLE 183 EUROPE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 164

TABLE 184 EUROPE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 165

TABLE 185 EUROPE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 165

TABLE 186 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 165

TABLE 187 EUROPE ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 165

TABLE 188 EUROPE RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 166

TABLE 189 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 167

TABLE 190 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 167

TABLE 191 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 167

TABLE 192 GERMANY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 168

TABLE 193 GERMANY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 168

TABLE 194 GERMANY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 168

TABLE 195 GERMANY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 169

TABLE 196 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 169

TABLE 197 GERMANY ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 169

TABLE 198 GERMANY RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 170

TABLE 199 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 171

TABLE 200 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 171

TABLE 201 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 171

TABLE 202 FRANCE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 172

TABLE 203 FRANCE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 172

TABLE 204 FRANCE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 172

TABLE 205 FRANCE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 173

TABLE 206 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 173

TABLE 207 FRANCE ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 173

TABLE 208 FRANCE RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 173

TABLE 209 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 175

TABLE 210 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 175

TABLE 211 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 175

TABLE 212 RUSSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 176

TABLE 213 RUSSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 176

TABLE 214 RUSSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 176

TABLE 215 RUSSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 177

TABLE 216 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 177

TABLE 217 RUSSIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 177

TABLE 218 RUSSIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 177

TABLE 219 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 179

TABLE 220 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 179

TABLE 221 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 179

TABLE 222 U.K. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 180

TABLE 223 U.K. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 180

TABLE 224 U.K. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 180

TABLE 225 U.K. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 181

TABLE 226 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 181

TABLE 227 U.K. ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 181

TABLE 228 U.K. RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 182

TABLE 229 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 183

TABLE 230 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 183

TABLE 231 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 183

TABLE 232 ITALY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 184

TABLE 233 ITALY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 184

TABLE 234 ITALY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 184

TABLE 235 ITALY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 185

TABLE 236 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 185

TABLE 237 ITALY ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 185

TABLE 238 ITALY RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 185

TABLE 239 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 187

TABLE 240 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 187

TABLE 241 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 187

TABLE 242 SPAIN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 188

TABLE 243 SPAIN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 188

TABLE 244 SPAIN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 188

TABLE 245 SPAIN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 189

TABLE 246 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 189

TABLE 247 SPAIN ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 189

TABLE 248 SPAIN RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 189

TABLE 249 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 191

TABLE 250 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 191

TABLE 251 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 191

TABLE 252 NETHERLANDS PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 192

TABLE 253 NETHERLANDS PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 192

TABLE 254 NETHERLANDS CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 192

TABLE 255 NETHERLANDS CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 193

TABLE 256 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 193

TABLE 257 NETHERLANDS ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 193

TABLE 258 NETHERLANDS RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 194

TABLE 259 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 195

TABLE 260 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 195

TABLE 261 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 195

TABLE 262 BELGIUM PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 196

TABLE 263 BELGIUM PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 196

TABLE 264 BELGIUM CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 196

TABLE 265 BELGIUM CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 197

TABLE 266 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 197

TABLE 267 BELGIUM ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 197

TABLE 268 BELGIUM RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 198

TABLE 269 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 199

TABLE 270 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 199

TABLE 271 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 199

TABLE 272 SWITZERLAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 200

TABLE 273 SWITZERLAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 200

TABLE 274 SWITZERLAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 200

TABLE 275 SWITZERLAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 201

TABLE 276 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 201

TABLE 277 SWITZERLAND ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 201

TABLE 278 SWITZERLAND RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 202

TABLE 279 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 203

TABLE 280 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 203

TABLE 281 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 203

TABLE 282 TURKEY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 204

TABLE 283 204

TABLE 284 TURKEY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 204

TABLE 285 TURKEY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 204

TABLE 286 TURKEY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 205

TABLE 287 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 205

TABLE 288 TURKEY ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 205

TABLE 289 TURKEY RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 205

TABLE 290 REST OF EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 207

TABLE 291 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 211

TABLE 292 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 211

TABLE 293 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 211

TABLE 294 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 211

TABLE 295 MIDDLE EAST & AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 212

TABLE 296 MIDDLE EAST & AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 212

TABLE 297 MIDDLE EAST & AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 212

TABLE 298 MIDDLE EAST & AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 213

TABLE 299 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 213

TABLE 300 MIDDLE EAST & AFRICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 213

TABLE 301 MIDDLE EAST & AFRICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 214

TABLE 302 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 215

TABLE 303 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 215

TABLE 304 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 215

TABLE 305 ISRAEL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 216

TABLE 306 ISRAEL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 216

TABLE 307 ISRAEL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 216

TABLE 308 ISRAEL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 217

TABLE 309 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 217

TABLE 310 ISRAEL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 217

TABLE 311 ISRAEL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 217

TABLE 312 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 219

TABLE 313 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 219

TABLE 314 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 219

TABLE 315 SAUDI ARABIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 220

TABLE 316 SAUDI ARABIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 220

TABLE 317 SAUDI ARABIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 220

TABLE 318 SAUDI ARABIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 221

TABLE 319 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 221

TABLE 320 SAUDI ARABIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 221

TABLE 321 SAUDI ARABIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 222

TABLE 322 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 223

TABLE 323 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 223

TABLE 324 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 223

TABLE 325 SOUTH AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 224

TABLE 326 SOUTH AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 224

TABLE 327 SOUTH AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 224

TABLE 328 SOUTH AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 225

TABLE 329 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 225

TABLE 330 SOUTH AFRICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 225

TABLE 331 SOUTH AFRICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 226

TABLE 332 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 227

TABLE 333 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 227

TABLE 334 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 227

TABLE 335 U.A.E. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 228

TABLE 336 U.A.E. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 228

TABLE 337 U.A.E. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 228

TABLE 338 U.A.E. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 229

TABLE 339 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 229

TABLE 340 U.A.E. ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 229

TABLE 341 U.A.E. RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 229

TABLE 342 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 231

TABLE 343 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 231

TABLE 344 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 231

TABLE 345 EGYPT PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 232

TABLE 346 EGYPT PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 232

TABLE 347 EGYPT CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 232

TABLE 348 EGYPT CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 233

TABLE 349 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 233

TABLE 350 EGYPT ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 233

TABLE 351 EGYPT RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 233

TABLE 352 REST OF MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 235

TABLE 353 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 239

TABLE 354 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 239

TABLE 355 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 239

TABLE 356 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 239

TABLE 357 SOUTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 240

TABLE 358 SOUTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 240

TABLE 359 SOUTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 240

TABLE 360 SOUTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 241

TABLE 361 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 241

TABLE 362 SOUTH AMERICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 241

TABLE 363 SOUTH AMERICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 242

TABLE 364 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 243

TABLE 365 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 243

TABLE 366 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 243

TABLE 367 BRAZIL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 244

TABLE 368 BRAZIL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 244

TABLE 369 BRAZIL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 244

TABLE 370 BRAZIL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 245

TABLE 371 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 245

TABLE 372 BRAZIL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 245

TABLE 373 BRAZIL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 245

TABLE 374 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 247

TABLE 375 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 247

TABLE 376 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 247

TABLE 377 ARGENTINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 248

TABLE 378 ARGENTINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 248

TABLE 379 ARGENTINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 248

TABLE 380 ARGENTINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 249

TABLE 381 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 249

TABLE 382 ARGENTINA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 249

TABLE 383 ARGENTINA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 250

TABLE 384 REST OF SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 251

Liste des figures

LIST OF FIGURES

FIGURE 1 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: SEGMENTATION 38

FIGURE 2 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: DATA TRIANGULATION 41

FIGURE 3 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: DROC ANALYSIS 42

FIGURE 4 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS 43

FIGURE 5 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: COMPANY RESEARCH ANALYSIS 43

FIGURE 6 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: INTERVIEW DEMOGRAPHICS 44

FIGURE 7 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: DBMR MARKET POSITION GRID 45

FIGURE 8 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: VENDOR SHARE ANALYSIS 46

FIGURE 9 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: MARKET APPLICATION COVERAGE GRID 48

FIGURE 10 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: SEGMENTATION 51

FIGURE 11 GROWING DEMAND FOR CONSUMERS ELECTRONIC IS EXPECTED TO DRIVE THE GLOBAL THIN AND ULTRA-THIN FILMS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027 52

FIGURE 12 GASEOUS STATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL THIN AND ULTRA-THIN FILMS MARKET IN 2020 & 2027 52

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE GLOBAL THIN AND ULTRA-THIN FILMS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027 53

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR THIN AND ULTRA-THIN FILMS MANUFACTURERS IN THE FORECAST PERIOD OF 2020 TO 2027 54

FIGURE 15 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGE OF GLOBAL THIN AND ULTRA-THIN FILMS MARKET 58

FIGURE 16 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS, 2019 64

FIGURE 17 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY TYPE, 2019 69

FIGURE 18 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY DEPOSITION TECHNIQUES, 2019 73

FIGURE 19 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY APPLICATION, 2019 81

FIGURE 20 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 89

FIGURE 21 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY GEOGRAPHY (2019) 90

FIGURE 22 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY GEOGRAPHY (2020 & 2027) 90

FIGURE 23 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY GEOGRAPHY (2019 & 2027) 91

FIGURE 24 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 91

FIGURE 25 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 93

FIGURE 26 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 94

FIGURE 27 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 94

FIGURE 28 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 95

FIGURE 29 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 95

FIGURE 30 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 141

FIGURE 31 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 142

FIGURE 32 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 142

FIGURE 33 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 143

FIGURE 34 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 143

FIGURE 35 EUROPE THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 160

FIGURE 36 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 161

FIGURE 37 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 161

FIGURE 38 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 162

FIGURE 39 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 162

FIGURE 40 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 208

FIGURE 41 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 209

FIGURE 42 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 209

FIGURE 43 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 210

FIGURE 44 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 210

FIGURE 45 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 236

FIGURE 46 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 237

FIGURE 47 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 237

FIGURE 48 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 238

FIGURE 49 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 238

FIGURE 50 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 252

FIGURE 51 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 253

FIGURE 52 EUROPE THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 254

FIGURE 53 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 255

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.