Marché mondial des solvants, par catégorie (solvants oxygénés, solvants hydrocarbonés, solvants halogénés, autres), source (conventionnelle, biosourcée), application (peintures et revêtements, produits pharmaceutiques, adhésifs, encres d'impression , soins personnels, fabrication de polymères, produits chimiques agricoles, nettoyage des métaux, autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des solvants

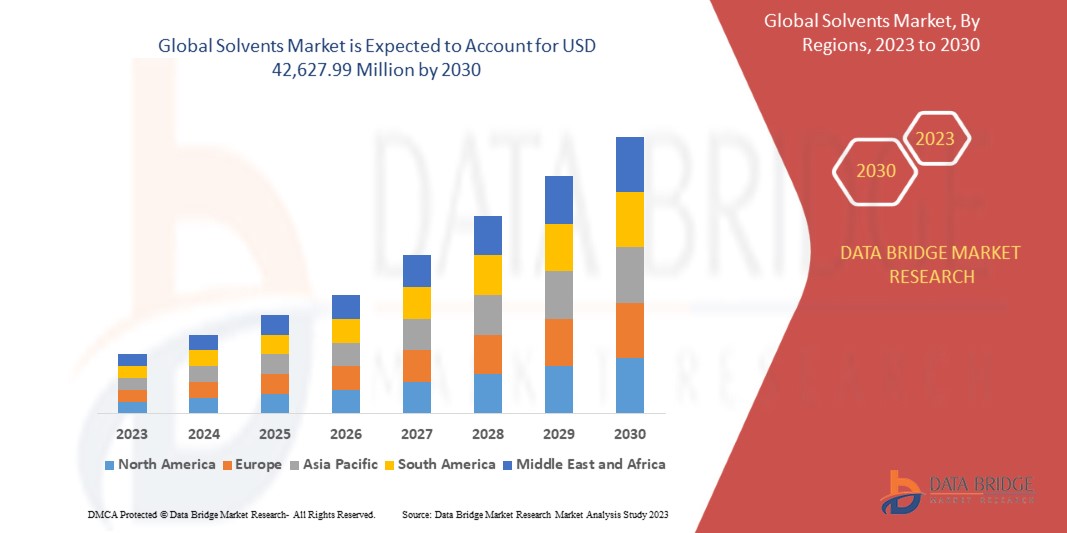

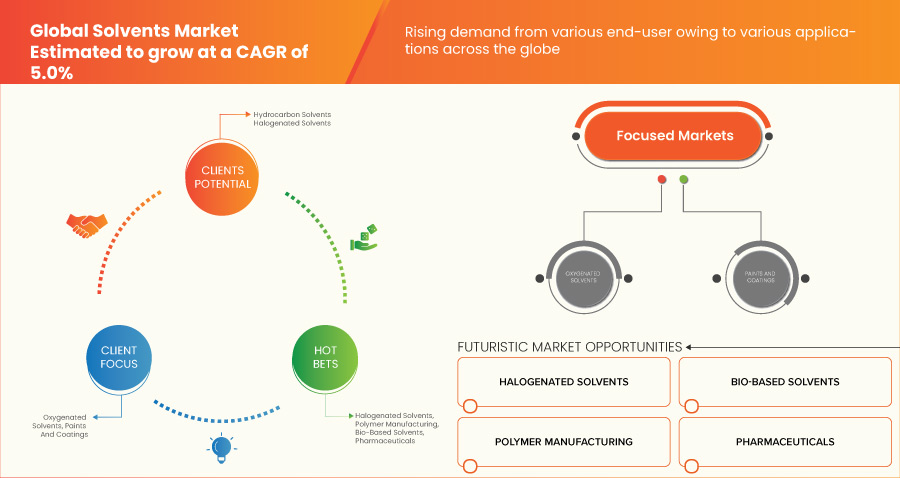

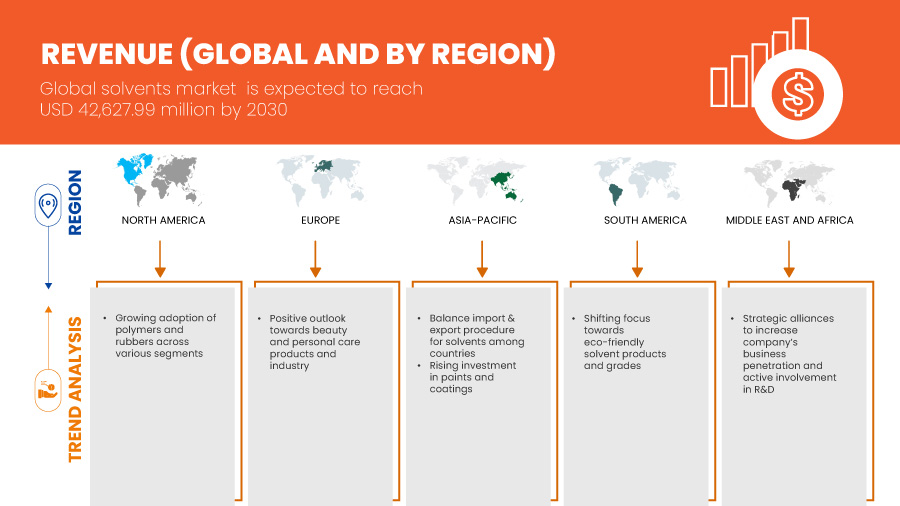

Le marché mondial des solvants devrait croître de manière significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,0 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 42 627,99 millions USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché des solvants est l'utilisation croissante d'encres d'impression pour différentes applications industrielles et les perspectives positives envers l'industrie des produits de beauté et de soins personnels.

Les solvants sont des fluides synthétiques fluorés de faible poids moléculaire. Ils sont non toxiques et ininflammables à l'état naturel. Un solvant peut être utilisé à des températures extrêmes allant de 80 °C à 200 °C. Leur structure moléculaire peut être linéaire, ramifiée ou une combinaison des deux, selon l'application. Les solvants ont diverses propriétés telles que la résistance à la température, la lubrification, la résistance à l'usure et la volatilité du fluide.

Le rapport sur le marché mondial des solvants fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en kilotonnes |

|

Segments couverts |

Catégorie (solvants oxygénés, solvants hydrocarbonés, solvants halogénés, autres), source (conventionnelle, biosourcée), application ( peintures et revêtements , produits pharmaceutiques, adhésifs, encres d'impression, soins personnels, fabrication de polymères, produits chimiques agricoles, nettoyage des métaux, autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Brésil, Argentine, Reste de l'Amérique du Sud, Allemagne, France, Italie, Pays-Bas, Royaume-Uni, Russie, Espagne, Turquie, Suisse, Belgique, Reste de l'Europe, Chine, Inde, Japon, Corée du Sud, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, Reste de l'Asie-Pacifique, Afrique du Sud, Arabie saoudite, Égypte, Émirats arabes unis, Israël, Reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Arkema (France), INVISTA (une filiale de Koch Industries, Inc.) (États-Unis), Ashland (États-Unis), Bharat Petroleum Corporation Limited (Inde), Huntsman International LLC (États-Unis), Solvay (Belgique), ADM (États-Unis), Shell Global (Pays-Bas), BP plc (Royaume-Uni), Eastman Chemical Company (États-Unis), INEOS GROUP HOLDINGS SA (Royaume-Uni), BASF SE (Allemagne), Celanese Corporation (États-Unis), Cargill, Incorporated (États-Unis), Reliance Industries Limited (Inde), Honeywell International Inc. (États-Unis), LyondellBasell Industries Holding BV (Pays-Bas), Exxon Mobil Corporation (États-Unis), Monument Chemical (États-Unis), Dow (États-Unis), Olin Corporation (États-Unis), entre autres. |

Définition du marché

Les solvants sont généralement des substances liquides capables de dissoudre ou de distribuer une large gamme de composés, notamment des substances solides, liquides et gazeuses. Ils sont largement utilisés dans de nombreuses industries, notamment les produits chimiques, les produits pharmaceutiques, les peintures et revêtements, les adhésifs, les produits de nettoyage et bien d'autres encore. Le marché des solvants comprend une variété de types de solvants, tels que les hydrocarbures , les solvants oxygénés, les solvants halogénés et d'autres solvants spécialisés.

Dynamique du marché mondial des solvants

CONDUCTEURS

- Demande croissante de solvants dans l'industrie des peintures et des revêtements

Les solvants jouent un rôle important en tant que supports pour les revêtements de surface tels que les peintures, les vernis et les adhésifs. Les produits chimiques utilisés dans les peintures et les revêtements dépendent des solvants car ils peuvent dissoudre et disperser les composants utilisés dans les formulations de revêtements. Cela garantit en outre la qualité du produit final obtenu et des performances optimales. Les solvants agissent comme des composants essentiels dans les formulations de peintures et de revêtements dans l'industrie de la construction car ils peuvent dissoudre les pigments, les additifs et les liants pour former des revêtements haute performance. Différents types de solvants sont utilisés en fonction des exigences des revêtements telles que le temps de séchage, la qualité du film et la compatibilité avec d'autres composants. Le choix des solvants tels que les solvants hydrocarbonés, les cétones , les esters, les alcools et les éthers de glycol dépend de facteurs tels que la capacité de solvatation, la polarité et la compatibilité avec d'autres composants de la formulation. Le benzène , le toluène et les xylènes sont des solvants hydrocarbonés aromatiques utilisés dans les peintures à base d'émail, tandis que les peintures à base de laque nécessitent des solvants plus puissants pour un séchage plus rapide.

Par exemple,

- Selon les données de construction de Biltrax, en avril 2022, le secteur indien de la construction devrait croître à un taux de croissance annuel composé (TCAC) de 15,7 %, pour atteindre une valeur de 738,5 milliards USD. L'expansion du secteur de la construction créera des opportunités pour les fabricants et fournisseurs solvables à l'échelle mondiale

- En mars 2022, le Groupe Berkem, acteur majeur de la chimie biosourcée, a annoncé le lancement de sa gamme de résines alkydes 100% biosourcées destinée au marché des peintures pour le bâtiment. Ce développement innovant implique la transformation de produits existants vers des solutions durables, en utilisant des huiles biosourcées, des sous-produits de la chimie organique et un solvant 100% biosourcé. Cela contribue au marché mondial des solvants en fournissant des solutions respectueuses de l'environnement dans l'industrie des peintures pour le bâtiment.

Outre les peintures et les revêtements, les solvants sont utilisés dans les adhésifs pour lier les matériaux. Les adhésifs sont de différents types tels que les adhésifs à base de polychloroprène, de polyuréthane , d'acrylate et de silicone. De plus, les solvants sont utilisés dans les agents de nettoyage et de dégraissage, les décapants pour peinture et les vernis. Le secteur de la construction et de l'automobile est en plein essor dans le monde entier en raison de l'urbanisation, du développement des infrastructures, de l'augmentation des activités de construction et de la demande croissante d'automobiles. Cette croissance de l'industrie de la construction et de l'automobile entraîne une augmentation de la demande de peintures, de revêtements et d'adhésifs et donc de la demande de solvants.

- Utilisation croissante des encres d'impression pour différentes applications industrielles

Les solvants jouent un rôle crucial dans l'industrie de l'impression car ils offrent une solvabilité aux encres pour dissoudre les pigments et les véhicules tels que les véhicules glycol solubles dans l'eau dans une solution. Cela permet de pouvoir appliquer facilement l'encre sur le papier ou tout autre substrat. Les encres d'impression ont besoin de solvants grâce auxquels une distribution appropriée de la couleur et de la consistance peut être obtenue. Les solvants qui ont un pouvoir solvant élevé peuvent produire des impressions éclatantes et durables. Les solvants ayant une plage d'ébullition étroite s'évaporent rapidement après l'application de l'encre, ce qui permet un séchage efficace et approprié de l'encre sur les substrats appliqués.

Par exemple,

- En mars 2022, selon Gardner Business Media, Inc., Sun Chemical a lancé les encres à base de solvant SunSpectro SolvaWash, conçues pour augmenter les taux de recyclage des bouteilles en PET. Ces encres lavables/désencrables pour gravure et flexographie sont spécifiquement développées pour l'impression inverse de manchons rétractables en PET cristallisables. Les encres à base de solvant SolvaWash de Sun Chemical soutiendront le marché mondial des solvants en permettant des taux de recyclage plus élevés pour les bouteilles en PET.

- En juillet 2021, selon Fint Group, Flint Group Packaging Inks a lancé une nouvelle gamme d'encres et de revêtements à base de solvants appelée ONECode, spécialement conçue pour les transformateurs européens d'emballages souples. Elle comprend six nouvelles marques, proposant des systèmes d'encre pour l'impression flexo (VertixCode), l'impression hélio (MatrixCode), des encres à double usage (HelixCode), des solutions durables (ZenCode), des vernis et apprêts de surimpression (NexisCode) et des additifs (AdmixCode). Elle bénéficiera au marché mondial des solvants en simplifiant le processus d'impression pour les transformateurs européens d'emballages souples.

L'application de solvants dans les encres d'impression est largement utilisée dans différentes applications telles que l'impression, l'emballage, l'impression de bouteilles et l'impression plastique, entre autres. L'industrie de l'emballage joue un rôle important dans la stimulation de la demande de solvants d'encre pour les applications d'impression. La demande d'emballages flexibles a augmenté en raison de leur nature personnalisable, de leur faible coût et de leurs propriétés légères. Ces emballages flexibles sont utilisés dans divers secteurs allant des biens de consommation aux soins de santé, ce qui stimule la demande de solvants au cours de la période de prévision. La croissance de l'industrie alimentaire et des boissons devrait également augmenter la demande d'emballages, ce qui stimulera davantage la demande d'encres d'impression. Les solvants d'encre aident à atteindre la qualité d'impression et la durabilité requises pour les matériaux d'emballage utilisés dans le secteur des aliments et des boissons. Dans les années à venir, la demande d'encres d'impression de haute qualité va augmenter pour différentes applications dans un large éventail d'industries telles que les solutions d'emballage pour les aliments et les boissons, les biens de consommation et les applications de soins de santé, propulsant ainsi le marché mondial des solvants vers l'avant.

- Perspectives positives pour l'industrie des produits de beauté et de soins personnels

L'industrie des produits de beauté et de soins personnels connaît une croissance rapide en raison de facteurs tels que la sensibilisation croissante aux soins personnels et la demande croissante de produits de beauté et de bien-être. De plus, l'évolution des tendances en matière de beauté et des préférences des consommateurs en raison de la présence des médias sociaux contribue à la croissance de l'industrie de la beauté et des soins personnels.

Par exemple,

- Selon l'Association des cosmétiques, des produits de toilette et de la parfumerie, le marché européen des cosmétiques a atteint une valeur de 92,66 millions USD au prix de vente au détail (PVD) en 2022. Cela donne un coup de pouce au marché mondial des solvants en indiquant l'expansion continue et la force de l'industrie cosmétique en Europe

- Selon Cosmetics Europe, l'Europe est un marché de premier plan pour les cosmétiques et les produits de soins personnels, avec une valeur de vente au détail estimée à 92,66 milliards USD en 2022. Parmi les pays européens, l'Allemagne a la plus grande taille de marché, évaluée à 15,06 milliards USD

Les solvants sont principalement utilisés pour dissoudre les ingrédients actifs hydrophobes et sont utilisés dans les formules de soins de la peau et de cosmétiques. Les solvants améliorent la stabilité, la texture et l'absorption des produits de beauté et de soins personnels. Les solvants tels que le butylène glycol, le propylène glycol , l'alcool isopropylique et l'alcool éthylique sont largement utilisés dans les produits de soins de la peau, les cosmétiques, les soins capillaires et les parfums. Les solvants agissent également comme humectants, émollients et régulateurs de viscosité. Ils aident à hydrater et à hydrater la peau, à améliorer la texture et à stabiliser les formulations. En plus de cela, les fabricants se concentrent également sur la fabrication de solvants qui ont des performances accrues, une compatibilité améliorée avec différents ingrédients et des profils de sécurité. Ainsi, la demande de solvants devrait augmenter au cours de la période de prévision à mesure que l'industrie de la beauté et des soins personnels continue de se développer, stimulant davantage le marché mondial des solvants.

OPPORTUNITÉS

- Les fabricants se tournent de plus en plus vers des solvants respectueux de l'environnement

Ces dernières années, les utilisateurs finaux ont considérablement évolué vers des solvants respectueux de l'environnement, également appelés biosolvants ou solvants verts. La plupart de ces solvants sont issus de la transformation des cultures agricoles. Comme les solvants dérivés de produits pétrochimiques contribuent aux émissions de composés organiques volatils, ils ont de graves effets secondaires sur l'environnement. Ces solvants ne sont ni cancérigènes ni corrosifs, ce qui les rend sûrs à manipuler et réduit les risques pour les travailleurs.

Par exemple,

- En novembre 2021, selon Woodcote Media Limited, Celtic Renewables, un innovateur en matière de technologies propres, a annoncé un partenariat avec Caldic pour lancer la première usine chimique durable d'Écosse à Grangemouth. La technologie brevetée à faible émission de carbone de Celtic Renewables permet la conversion de matières biologiques indésirables en produits chimiques renouvelables, en biocarburants et en d'autres produits de valeur. Ce développement soutiendra les clients de Caldic dans leur parcours vers la durabilité en leur fournissant des biosolvants de haute qualité avec une empreinte carbone nettement inférieure

- En février 2023, Clariter et TotalEnergies Fluids ont présenté les premiers solvants ultra-purs durables fabriqués à partir de déchets plastiques. Cette technologie révolutionnaire, fruit d'une collaboration de 18 mois, combine le procédé de recyclage innovant de Clariter avec la technologie d'hydro-désaromatisation de TotalEnergies Fluids. Les solvants obtenus répondent aux normes de pureté les plus élevées requises par des industries exigeantes telles que les produits pharmaceutiques et cosmétiques.

Le lactate d'éthyle est l'un des solvants verts issus de la transformation du maïs et présente des avantages tels que la biodégradabilité par rapport aux solvants conventionnels. Il est également utilisé dans des applications telles que le décapage de peinture et l'élimination des graisses, des huiles, des adhésifs et des combustibles solides de diverses surfaces métalliques. Les fabricants poursuivent actuellement leurs efforts de recherche et de développement pour améliorer les performances et la gamme de solvants respectueux de l'environnement.

- Un potentiel immense dans le secteur des énergies renouvelables

La demande en énergies propres et durables ne cesse d'augmenter, et le secteur des énergies renouvelables connaît une croissance significative ces dernières années. Les systèmes de panneaux solaires et les éoliennes, composants essentiels de la production d'énergie renouvelable, nécessitent des semi-conducteurs pour une conversion et un contrôle efficaces de l'énergie.

Par exemple,

- En avril 2023, Lowe's a récemment fait un pas en avant dans le domaine des énergies renouvelables en annonçant l'installation de panneaux solaires sur les toits de 174 de ses magasins et centres de distribution aux États-Unis. Une fois terminés, les panneaux solaires devraient fournir environ 90 % de la consommation d'énergie de chaque site. Lowe's s'est associé à DSD Renewables, Greenskies Clean Focus et Infiniti Energy pour réaliser ces installations en Californie, dans l'Illinois et dans le New Jersey.

- En décembre 2022, selon HT Digital Streams Ltd, Jindal Stainless s'est associé à ReNew Power, la plus grande entreprise d'énergie renouvelable en Inde, pour établir un projet d'énergie renouvelable de 300 MW. Ce projet utilisera une combinaison de technologies solaires et éoliennes et devrait produire 700 millions d'unités d'électricité par an.

Les solvants et les combinaisons de solvants sont largement utilisés dans l'industrie des semi-conducteurs à diverses fins telles que le nettoyage des équipements, le séchage des plaquettes et le dépôt ou le retrait des substrats. Les solvants de qualité semi-conductrice jouent un rôle important dans la fabrication des semi-conducteurs. Ils sont conçus pour l'industrie des semi-conducteurs et l'industrie électronique, qui nécessitent un faible niveau d'impuretés. L'alcool isopropylique et l'acétone font partie des solvants de nettoyage les plus populaires dans l'industrie des semi-conducteurs. Les fabricants de solvants peuvent ainsi investir dans des activités de recherche et développement pour le développement de nouveaux solvants, notamment des solvants respectueux de l'environnement qui répondent aux exigences de la fabrication de semi-conducteurs. De telles mesures contribueront à l'expansion des systèmes d'énergie renouvelable dans le monde entier, offrant ainsi un large éventail d'opportunités pour la croissance du marché mondial des solvants.

RESTRICTIONS/DÉFIS

- Problèmes de santé et de sécurité liés à l'utilisation de solvants

Les solvants sont utilisés pour diverses applications pour dissoudre ou diluer des composants. Les solvants utilisés dans les produits de construction tels que les peintures, les décapants et les diluants présentent des risques potentiels pour la santé des personnes qui y sont exposées. Les solvants tels que le dichlorométhane, le toluène et l'acétate d'éthyle influencent la santé des humains de différentes manières, notamment par contact avec la peau, ingestion, inhalation et contact avec les yeux. Lors de l'application de ces produits, la respiration se produit, ce qui entraîne des effets secondaires tels que des maux de tête, des nausées et une irritation des yeux, de la peau, des poumons et de la peau. De plus, une exposition prolongée à ces solvants entraîne des problèmes de santé tels que des dermatites et des lésions des parties du corps telles que les yeux, les reins, les poumons, le système nerveux et la peau. De fortes doses de solvants peuvent même entraîner une perte de connaissance et la mort, en particulier en cas d'exposition professionnelle.

Par exemple,

- En mai 2023, selon HealthNews, une étude publiée suggère un lien possible entre le solvant chimique tétrachloroéthylène (TCE) et la maladie de Parkinson. L'étude a examiné plusieurs études qui ont examiné les effets d'une exposition prolongée au TCE, qui était autrefois largement utilisé dans des secteurs tels que la santé, le nettoyage à sec et la fabrication. L'étude a trouvé des preuves que l'exposition au TCE peut provoquer une neuroinflammation, une perte de neurones dopaminergiques et des altérations des protéines cérébrales associées à la maladie de Parkinson.

Les préoccupations en matière de santé et de sécurité liées aux solvants entraîneront une réduction de la demande de produits à base de solvants. Les industries telles que celles des peintures, des revêtements et des adhésifs peuvent également être confrontées à des défis importants, freinant ainsi la croissance du marché mondial des solvants.

- Problèmes liés au transport et au stockage des solvants

Les solvants sont utilisés dans diverses industries telles que les produits pharmaceutiques, les peintures, les produits agrochimiques et bien d'autres. La plupart des solvants sont inflammables et nécessitent une manipulation et un stockage soigneux. S'ils ne sont pas correctement gérés, ils peuvent entraîner de graves conséquences, notamment des accidents du travail, des dommages matériels et une pollution de l'environnement. En raison de ces risques, il est nécessaire de mettre en œuvre des réglementations de sécurité lors du transport et du stockage des solvants. Les solvants dégagent également des fumées qui peuvent entraîner des problèmes de santé et des risques pour les travailleurs. Un stockage et un transport inappropriés des solvants peuvent avoir de graves effets sur l'environnement. Les solvants, s'ils se déversent, peuvent contaminer les sols et les sources d'eau, ce qui constitue une menace supplémentaire pour les écosystèmes et peut nuire à la faune.

Il existe diverses réglementations telles que l'étiquetage approprié, les conditions de stockage, la séparation, la ventilation et l'identification en ce qui concerne le stockage et le transport des solvants. Si ces réglementations sont négligées, cela peut causer beaucoup de dommages à l'endroit où le déversement de solvants a lieu. Le transport de produits chimiques tels que les solvants comporte différents risques et défis. Si les solvants sont mal étiquetés, cela peut entraîner le transport et le stockage de produits chimiques incorrects. De plus, des facteurs tels que des pratiques de stockage inadéquates, des travailleurs épuisés, des dysfonctionnements de l'équipement et des catastrophes naturelles ou d'origine humaine imprévues peuvent tous contribuer à des accidents de transport qui pourraient avoir des effets néfastes. Les défis du transport et du stockage des solvants ont un impact direct sur les fabricants de solvants. Les incidents résultant d'un transport ou d'un stockage inapproprié peuvent perturber la chaîne d'approvisionnement, entraînant des retards, une perte de confiance des clients et des pertes financières potentielles, mettant ainsi en péril la croissance du marché mondial des solvants au cours de la période de prévision.

Développement récent

- En juin 2023, Bharat Petroleum Corporation Limited (BPCL) a été récompensée lors des très prestigieux FIPI Oil & Gas Awards 2022 en obtenant cinq distinctions convoitées. Les prix ont été remis par Shri. Hardeep Singh Puri, honorable ministre du pétrole et du gaz naturel et du logement et du développement urbain du gouvernement indien, lors d'une grande cérémonie qui s'est tenue récemment

- En août 2022, Eastman a été nommé sur la liste Forbes des meilleurs employeurs de l'État 2022. Ce prix prestigieux est décerné par Forbes et Statista Inc., le premier portail de statistiques et fournisseur de classements sectoriels au monde. Cela aidera l'entreprise à se développer en tant que marque et en reconnaissance

Portée du marché mondial des solvants

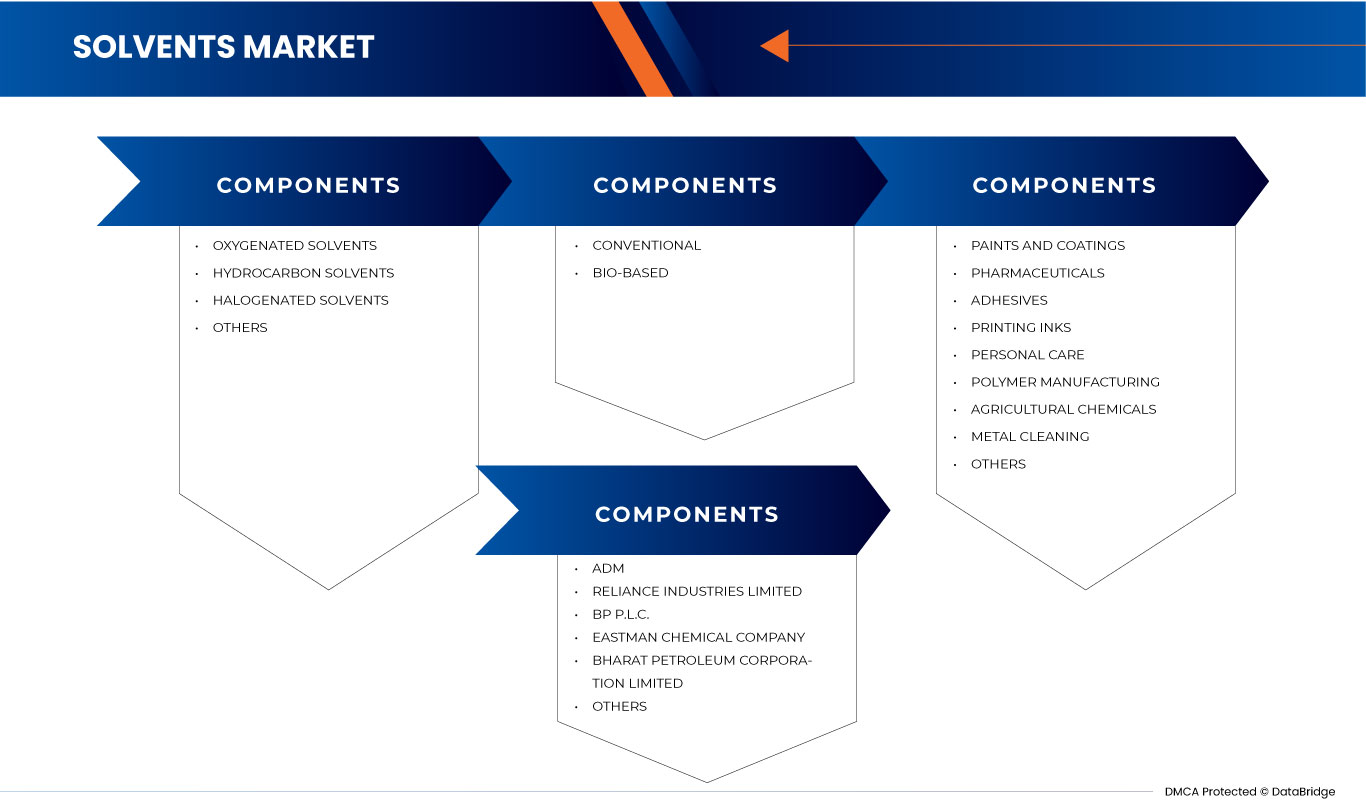

Le marché des solvants est classé en fonction de la catégorie, de la source et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Catégorie

- Solvants oxygénés

- Solvants à base d'hydrocarbures

- Solvants halogénés

- Autres

Sur la base de la catégorie, le marché est segmenté en solvants oxygénés, solvants hydrocarbonés, solvants halogénés, autres.

Source

- Conventionnel

- Biosourcé

Sur la base de la source, le marché est segmenté en conventionnel et biosourcé.

Application

- Peintures et revêtements

- Médicaments

- Adhésifs

- Encres d'impression

- Soins personnels

- Fabrication de polymères

- Produits chimiques agricoles

- Nettoyage des métaux

- Autres

Sur la base de l'application, le marché est segmenté en peintures et revêtements, produits pharmaceutiques, adhésifs, encres d'impression, soins personnels , fabrication de polymères, produits chimiques agricoles, nettoyage des métaux, autres.

Analyse/perspectives régionales du marché mondial des solvants

Le marché des solvants est segmenté en fonction de la catégorie, de la source et de l’application.

Les pays présents sur le marché des solvants sont les États-Unis, le Canada, le Mexique, le Brésil, l'Argentine, le reste de l'Amérique du Sud, l'Allemagne, la France, l'Italie, les Pays-Bas, le Royaume-Uni, la Russie, l'Espagne, la Turquie, la Suisse, la Belgique, le reste de l'Europe, la Chine, l'Inde, le Japon, la Corée du Sud, Singapour, la Thaïlande, l'Indonésie, la Malaisie, les Philippines, l'Australie et la Nouvelle-Zélande, le reste de l'Asie-Pacifique, l'Afrique du Sud, l'Arabie saoudite, l'Égypte, les Émirats arabes unis, Israël, le reste du Moyen-Orient et l'Afrique.

L'Asie-Pacifique domine le marché mondial des solvants en termes de parts de marché et de revenus. La Chine domine en raison de la demande croissante de solvants dans l'industrie des peintures et des revêtements. De plus, l'utilisation croissante des encres d'impression dans différentes applications industrielles contribue également à la croissance du marché. Les États-Unis dominent le marché en raison de l'utilisation croissante des encres d'impression dans différentes applications industrielles. L'Allemagne domine en raison de la sensibilisation croissante aux soins personnels et de la demande de produits de beauté et de bien-être. De plus, l'évolution des tendances en matière de beauté et des préférences changeantes des consommateurs contribuent également à la croissance du marché.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché mondiales des solvants

Le paysage concurrentiel du marché mondial des solvants fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché mondial des solvants.

Français Certains des principaux acteurs opérant sur le marché mondial des solvants sont Arkema (France), INVISTA (une filiale de Koch Industries, Inc.) (États-Unis), Ashland (États-Unis), Bharat Petroleum Corporation Limited (Inde), Huntsman International LLC (États-Unis), Solvay (Belgique), ADM (États-Unis), Shell Global (Pays-Bas), BP plc (Royaume-Uni), Eastman Chemical Company (États-Unis), INEOS GROUP HOLDINGS SA (Royaume-Uni), BASF SE (Allemagne), Celanese Corporation (États-Unis), Cargill, Incorporated (États-Unis), Reliance Industries Limited (Inde), Honeywell International Inc. (États-Unis), LyondellBasell Industries Holding BV (Pays-Bas), Exxon Mobil Corporation (États-Unis), Monument Chemical (États-Unis), Dow (États-Unis), Olin Corporation (États-Unis) entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 PRODUCTION ANALYSIS

4.4.1 PRODUCTION ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 VENDOR SELECTION CRITERIA

4.7 LIST OF KEY BUYERS

4.8 RAW MATERIAL COVERAGE

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR SOLVENTS IN THE PAINTS AND COATINGS INDUSTRY

6.1.2 RISING USAGE OF PRINTING INKS FOR DIFFERENT INDUSTRIAL APPLICATIONS

6.1.3 POSITIVE OUTLOOK TOWARD BEAUTY & PERSONAL CARE PRODUCTS INDUSTRY

6.1.4 GROWING ADOPTION OF POLYMERS AND RUBBERS ACROSS VARIOUS SEGMENTS

6.1.5 POSITIVE OUTLOOK TOWARD THE AGROCHEMICALS INDUSTRY

6.1.6 INCREASING SPENDING IN THE PHARMACEUTICAL SECTOR

6.2 RESTRAINTS

6.2.1 HEALTH AND SAFETY CONCERNS RELATED TO THE USAGE OF SOLVENTS

6.2.2 TECHNICAL COMPLEXITIES IN SOLVENT RECOVERY AND REUSE

6.3 OPPORTUNITIES

6.3.1 SHIFTING THE FOCUS OF MANUFACTURERS TOWARD ECO-FRIENDLY SOLVENTS

6.3.2 IMMENSE POTENTIAL IN THE RENEWABLE ENERGY SECTOR

6.4 CHALLENGES

6.4.1 ISSUES IN TRANSPORTATION AND STORAGE OF SOLVENTS

6.4.2 STRINGENT RULES AND REGULATIONS

7 GLOBAL SOLVENTS MARKET, BY REGION

7.1 OVERVIEW

7.2 ASIA-PACIFIC

7.2.1 CHINA

7.2.2 INDIA

7.2.3 JAPAN

7.2.4 SOUTH KOREA

7.2.5 SINGAPORE

7.2.6 THAILAND

7.2.7 INDONESIA

7.2.8 MALAYSIA

7.2.9 PHILIPPINES

7.2.10 AUSTRALIA & NEW ZEALAND

7.2.11 REST OF ASIA-PACIFIC

7.3 NORTH AMERICA

7.3.1 U.S.

7.3.2 CANADA

7.3.3 MEXICO

7.4 EUROPE

7.4.1 GERMANY

7.4.2 FRANCE

7.4.3 ITALY

7.4.4 NETHERLANDS

7.4.5 U.K.

7.4.6 RUSSIA

7.4.7 SPAIN

7.4.8 TURKEY

7.4.9 SWITZERLAND

7.4.10 BELGIUM

7.4.11 REST OF EUROPE

7.5 MIDDLE EAST AND AFRICA

7.5.1 SOUTH AFRICA

7.5.2 SAUDI ARABIA

7.5.3 EGYPT

7.5.4 UNITED ARAB EMIRATES

7.5.5 ISRAEL

7.5.6 REST OF MIDDLE EAST AND AFRICA

7.6 SOUTH AMERICA

7.6.1 BRAZIL

7.6.2 ARGENTINA

7.6.3 REST OF SOUTH AMERICA

8 GLOBAL SOLVENTS MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: GLOBAL

8.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

8.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8.4 COMPANY SHARE ANALYSIS: EUROPE

8.5 PRODUCT LAUNCH

8.6 AGREEMENT

8.7 ACQUISITION

8.8 AWARD

9 SWOT ANALYSIS

10 COMPANY PROFILE

10.1 ADM

10.1.1 COMPANY SNAPSHOT

10.1.2 COMPANY SHARE ANALYSIS

10.1.3 PRODUCT PORTFOLIO

10.1.4 REVENUE ANALYSIS

10.1.5 RECENT DEVELOPMENTS

10.2 RELIANCE INDUSTRIES LIMITED

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SHARE ANALYSIS

10.2.4 PRODUCT PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 BP P.L.C.

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COMPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENTS

10.4 EASTMAN CHEMICAL COMPANY (2022)

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 COMPANY SHARE ANALYSIS

10.4.4 PRODUCT PORTFOLIO

10.4.5 RECENT UPDATES

10.5 BHARAT PETROLEUM CORPORATION LIMITED (2022)

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCT PORTFOLIO

10.5.5 RECENT DEVELOPMENT

10.6 OLIN CORPORATION

10.6.1 COMPANY SNAPSHOT

10.6.2 REVENUE ANALYSIS

10.6.3 PRODUCT PORTFOLIO

10.6.4 RECENT DEVELOPMENTS

10.7 ARKEMA (2022)

10.7.1 COMPANY SNAPSHOT

10.7.2 REVENUE ANALYSIS

10.7.3 PRODUCT PORTFOLIO

10.7.4 RECENT DEVELOPMENT

10.8 ASHLAND.(2022)

10.8.1 COMPANY SNAPSHOT

10.8.2 REVENUE ANALYSIS

10.8.3 PRODUCT PORTFOLIO

10.8.4 RECENT UPDATE

10.9 BASF SE

10.9.1 COMPANY SNAPSHOT

10.9.2 REVENUE ANALYSIS

10.9.3 PRODUCT PORTFOLIO

10.9.4 RECENT UPDATE

10.1 CARGILL, INCORPORATED

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 CELANESE CORPORATON(2022)

10.11.1 COMPANY SNAPSHOT

10.11.2 REVENUE ANALYSIS

10.11.3 PRODUCT PORTFOLIO

10.11.4 RECENT UPDATE

10.12 DOW

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENTS

10.13 EXXON MOBIL CORPORATION(2022)

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 PRODUCT PORTFOLIO

10.13.4 RECENT UPDATES

10.14 HONEYWELL INTERNATIONAL INC. (2022)

10.14.1 COMPANY SNAPSHOT

10.14.2 REVENUE ANALYSIS

10.14.3 PRODUCT PORTFOLIO

10.14.4 RECENT DEVELOPMENTS

10.15 HUNTSMAN INTERNATIONAL LLC (2022)

10.15.1 COMPANY SNAPSHOT

10.15.2 REVENUE ANALYSIS

10.15.3 PRODUCT PORTFOLIO

10.15.4 RECENT DEVELOPMENT

10.16 INEOS GROUP HOLDINGS S.A. (2022)

10.16.1 COMPANY SNAPSHOT

10.16.2 REVENUE ANALYSIS

10.16.3 PRODUCT PORTFOLIO

10.16.4 RECENT DEVELOPMENT

10.17 INVISTA (A SUBSIDRIARY OF KOCH INDUSTRIES, INC.)

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 LYONDELLBASELL INDUSTRIES HOLDING B.V. (2022)

10.18.1 COMPANY SNAPSHOT

10.18.2 REVENUE ANALYSIS

10.18.3 PRODUCT PORTFOLIO

10.18.4 RECENT UPDATE

10.19 MONUMENT CHEMICAL

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCT PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

10.2 SHELL GLOBAL (2022)

10.20.1 COMPANY SNAPSHOT

10.20.2 REVENUE ANALYSIS

10.20.3 PRODUCT PORTFOLIO

10.20.4 RECENT UPDATES

10.21 SOLVAY (2022)

10.21.1 COMPANY SNAPSHOT

10.21.2 REVENUE ANALYSIS

10.21.3 PRODUCT PORTFOLIO

10.21.4 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY COVERAGE

TABLE 2 GLOBAL SOLVENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 GLOBAL SOLVENTS MARKET, BY REGION, 2021-2030 (KILO TONS)

TABLE 4 GLOBAL SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 5 GLOBAL SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 6 GLOBAL OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 7 GLOBAL ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 GLOBAL GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 GLOBAL KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 GLOBAL ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 GLOBAL GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 GLOBAL ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 GLOBAL HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 14 GLOBAL AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 GLOBAL XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 GLOBAL HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 17 GLOBAL SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 18 GLOBAL SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 19 GLOBAL SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 GLOBAL SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 21 ASIA-PACIFIC SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 22 ASIA-PACIFIC SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 23 ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 24 ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 25 ASIA-PACIFIC OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 ASIA-PACIFIC ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 ASIA-PACIFIC GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 ASIA-PACIFIC KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 ASIA-PACIFIC ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 ASIA-PACIFIC GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 38 ASIA-PACIFIC SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 40 CHINA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 41 CHINA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 42 CHINA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 43 CHINA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CHINA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CHINA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CHINA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 CHINA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CHINA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 CHINA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CHINA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CHINA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 53 CHINA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 54 CHINA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 55 CHINA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 CHINA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 57 INDIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 58 INDIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 59 INDIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 60 INDIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 INDIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 INDIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 INDIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 INDIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 INDIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 INDIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 67 INDIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 INDIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 INDIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 70 INDIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 71 INDIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 72 INDIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 INDIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 74 JAPAN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 75 JAPAN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 76 JAPAN OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 77 JAPAN ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 JAPAN GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 JAPAN KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 JAPAN ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 JAPAN GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 JAPAN ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 JAPAN HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 84 JAPAN AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 JAPAN XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 JAPAN HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 87 JAPAN SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 88 JAPAN SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 89 JAPAN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 JAPAN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 91 SOUTH KOREA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 92 SOUTH KOREA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 93 SOUTH KOREA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 94 SOUTH KOREA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 SOUTH KOREA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 SOUTH KOREA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 SOUTH KOREA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 SOUTH KOREA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SOUTH KOREA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 SOUTH KOREA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 101 SOUTH KOREA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 SOUTH KOREA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 SOUTH KOREA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 104 SOUTH KOREA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 105 SOUTH KOREA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 106 SOUTH KOREA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 SOUTH KOREA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 108 SINGAPORE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 109 SINGAPORE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 110 SINGAPORE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 111 SINGAPORE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 SINGAPORE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 SINGAPORE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 SINGAPORE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 SINGAPORE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 SINGAPORE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SINGAPORE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 118 SINGAPORE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SINGAPORE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 SINGAPORE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 121 SINGAPORE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 122 SINGAPORE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 123 SINGAPORE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 124 SINGAPORE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 125 THAILAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 126 THAILAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 127 THAILAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 128 THAILAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 THAILAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 THAILAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 THAILAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 THAILAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 THAILAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 THAILAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 135 THAILAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 THAILAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 THAILAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 138 THAILAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 139 THAILAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 140 THAILAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 THAILAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 142 INDONESIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 143 INDONESIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 144 INDONESIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 145 INDONESIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 INDONESIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 INDONESIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 INDONESIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 INDONESIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 INDONESIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 INDONESIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 152 INDONESIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 INDONESIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 INDONESIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 155 INDONESIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 156 INDONESIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 157 INDONESIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 INDONESIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 159 MALAYSIA SOLVENTS MARKET

TABLE 160 MALAYSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 161 MALAYSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 162 MALAYSIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 163 MALAYSIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 MALAYSIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 MALAYSIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 MALAYSIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 MALAYSIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 MALAYSIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 MALAYSIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 170 MALAYSIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 MALAYSIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 MALAYSIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 173 MALAYSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 174 MALAYSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 175 MALAYSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 176 MALAYSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 177 PHILIPPINES SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 178 PHILIPPINES SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 179 PHILIPPINES OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 180 PHILIPPINES ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 PHILIPPINES GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 PHILIPPINES KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 PHILIPPINES ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 PHILIPPINES GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 PHILIPPINES ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 PHILIPPINES HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 187 PHILIPPINES AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 PHILIPPINES XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 PHILIPPINES HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 190 PHILIPPINES SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 191 PHILIPPINES SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 192 PHILIPPINES SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 193 PHILIPPINES SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 194 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 195 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 196 AUSTRALIA & NEW ZEALAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 197 AUSTRALIA & NEW ZEALAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 AUSTRALIA & NEW ZEALAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 AUSTRALIA & NEW ZEALAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 AUSTRALIA & NEW ZEALAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 AUSTRALIA & NEW ZEALAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 AUSTRALIA & NEW ZEALAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 AUSTRALIA & NEW ZEALAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 204 AUSTRALIA & NEW ZEALAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 AUSTRALIA & NEW ZEALAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 AUSTRALIA & NEW ZEALAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 207 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 209 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 210 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 211 REST OF ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 212 REST OF ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 213 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 214 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 215 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 216 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 217 NORTH AMERICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 218 NORTH AMERICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 219 NORTH AMERICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 NORTH AMERICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 NORTH AMERICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 NORTH AMERICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 223 ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 NORTH AMERICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 225 NORTH AMERICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 NORTH AMERICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 NORTH AMERICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 228 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 229 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 230 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 231 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 232 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 233 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 234 U.S. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 235 U.S. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 U.S. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 237 U.S. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 U.S. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 U.S. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 U.S. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 U.S. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 242 U.S. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 U.S. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 U.S. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 245 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 246 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 247 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 248 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 249 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 250 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 251 CANADA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 252 CANADA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 CANADA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 CANADA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 CANADA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 CANADA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 CANADA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 CANADA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 259 CANADA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 CANADA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 CANADA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 262 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 263 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 264 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 265 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 266 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 267 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 268 MEXICO OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 269 MEXICO ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 276 MEXICO AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 279 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 281 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 282 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 283 EUROPE SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 284 EUROPE SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 285 EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 286 EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 287 EUROPE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 288 EUROPE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 289 EUROPE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 EUROPE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 291 EUROPE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 EUROPE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 EUROPE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 EUROPE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 295 EUROPE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 EUROPE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 EUROPE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 298 EUROPE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 299 EUROPE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 300 EUROPE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 301 EUROPE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 302 GERMANY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 303 GERMANY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 304 GERMANY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 305 GERMANY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 306 GERMANY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 307 GERMANY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 308 GERMANY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 309 GERMANY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 310 GERMANY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 311 GERMANY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 312 GERMANY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 313 GERMANY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 314 GERMANY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 315 GERMANY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 316 GERMANY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 317 GERMANY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 318 GERMANY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 319 FRANCE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 320 FRANCE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 321 FRANCE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 322 FRANCE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 323 FRANCE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 324 FRANCE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 FRANCE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 326 FRANCE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 327 FRANCE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 328 FRANCE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 329 FRANCE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 330 FRANCE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 331 FRANCE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 332 FRANCE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 333 FRANCE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 334 FRANCE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 335 FRANCE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 336 ITALY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 337 ITALY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 338 ITALY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 339 ITALY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 340 ITALY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 341 ITALY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 342 ITALY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 ITALY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 344 ITALY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 ITALY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 346 ITALY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 347 ITALY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 348 ITALY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 349 ITALY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 350 ITALY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 351 ITALY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 352 ITALY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 353 NETHERLANDS SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 354 NETHERLANDS SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 355 NETHERLANDS OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 356 NETHERLANDS ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 357 NETHERLANDS GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 358 NETHERLANDS KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 359 NETHERLANDS ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 360 NETHERLANDS GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 361 NETHERLANDS ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 362 NETHERLANDS HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 363 NETHERLANDS AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 364 NETHERLANDS XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 365 NETHERLANDS HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 366 NETHERLANDS SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 367 NETHERLANDS SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 368 NETHERLANDS SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 369 NETHERLANDS SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 370 U.K. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 371 U.K. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 372 U.K. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 373 U.K. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 374 U.K. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 375 U.K. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 376 U.K. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 377 U.K. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 378 U.K. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 379 U.K. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 380 U.K. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 381 U.K. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 382 U.K. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 383 U.K. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 384 U.K. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 385 U.K. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 386 U.K. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 387 RUSSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 388 RUSSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 389 RUSSIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 390 RUSSIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 391 RUSSIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 392 RUSSIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 393 RUSSIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 394 RUSSIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 395 RUSSIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 396 RUSSIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 397 RUSSIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 398 RUSSIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 399 RUSSIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 400 RUSSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 401 RUSSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 402 RUSSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 403 RUSSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 404 SPAIN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 405 SPAIN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 406 SPAIN OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 407 SPAIN ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 408 SPAIN GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 409 SPAIN KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 410 SPAIN ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 411 SPAIN GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 412 SPAIN ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 413 SPAIN HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 414 SPAIN AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 415 SPAIN XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 416 SPAIN HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 417 SPAIN SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 418 SPAIN SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 419 SPAIN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 420 SPAIN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 421 TURKEY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 422 TURKEY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 423 TURKEY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 424 TURKEY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 425 TURKEY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 426 TURKEY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 427 TURKEY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 428 TURKEY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 429 TURKEY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 430 TURKEY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 431 TURKEY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 432 TURKEY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 433 TURKEY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 434 TURKEY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 435 TURKEY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 436 TURKEY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 437 TURKEY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 438 SWITZERLAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 439 SWITZERLAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 440 SWITZERLAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 441 SWITZERLAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 442 SWITZERLAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 443 SWITZERLAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 444 SWITZERLAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 445 SWITZERLAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 446 SWITZERLAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 447 SWITZERLAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 448 SWITZERLAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 449 SWITZERLAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 450 SWITZERLAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 451 SWITZERLAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 452 SWITZERLAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 453 SWITZERLAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 454 SWITZERLAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 455 BELGIUM SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 456 BELGIUM SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 457 BELGIUM OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 458 BELGIUM ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 459 BELGIUM GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 460 BELGIUM KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 461 BELGIUM ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 462 BELGIUM GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 463 BELGIUM ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 464 BELGIUM HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 465 BELGIUM AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 466 BELGIUM XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 467 BELGIUM HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 468 BELGIUM SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 469 BELGIUM SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 470 BELGIUM SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 471 BELGIUM SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 472 REST OF EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 473 REST OF EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 474 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 475 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 476 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 477 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 478 MIDDLE EAST AND AFRICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 479 MIDDLE EAST AND AFRICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 480 MIDDLE EAST AND AFRICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 481 MIDDLE EAST AND AFRICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 482 MIDDLE EAST AND AFRICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 483 MIDDLE EAST AND AFRICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 484 MIDDLE EAST AND AFRICA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 485 MIDDLE EAST AND AFRICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 486 MIDDLE EAST AND AFRICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 487 MIDDLE EAST AND AFRICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 488 MIDDLE EAST AND AFRICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 489 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)