Global Shipping Container Liner Market

Taille du marché en milliards USD

TCAC :

%

1,275.46

1,963.37

2021

2029

1,275.46

1,963.37

2021

2029

| 2022 –2029 | |

| Dollars américains 1,275.46 | |

| Dollars américains 1,963.37 | |

|

|

|

|

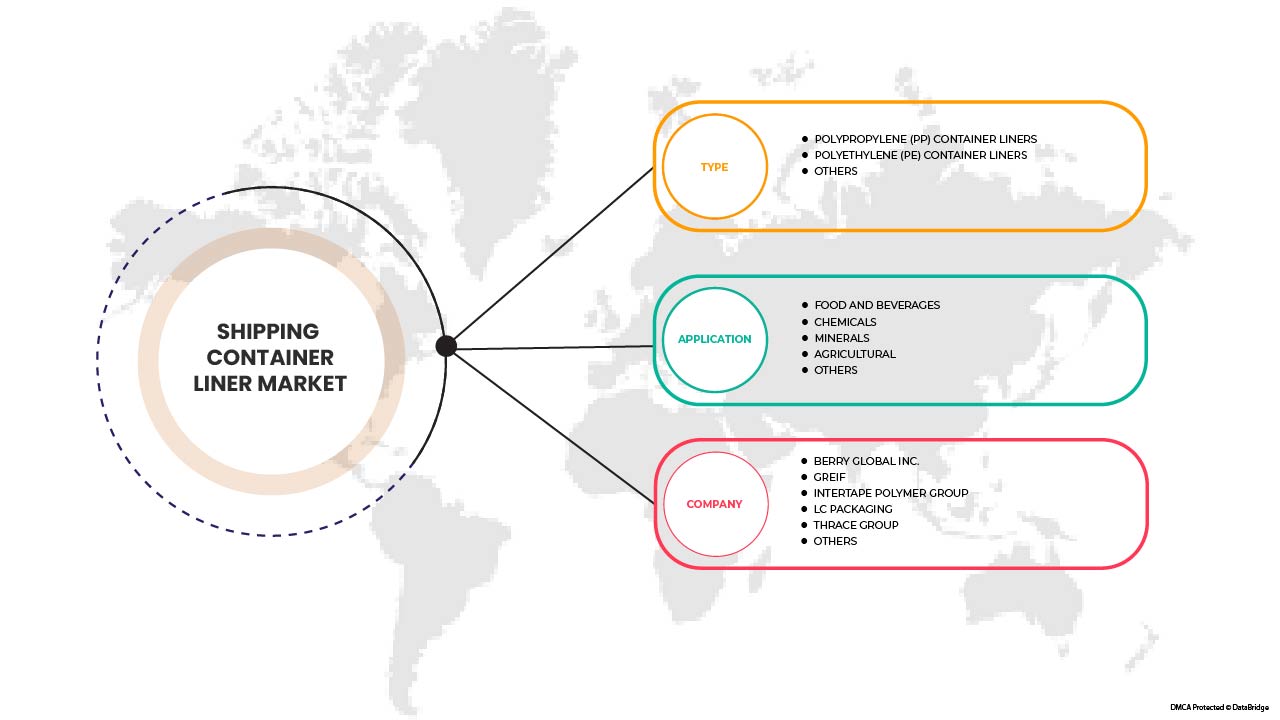

Global Shipping Container Liner Market, By Type (Polypropylene (PP) Container Liners, Polyethylene (PE) Container Liners, and Others), Application (Food and Beverages, Chemicals, Minerals, Agricultural and Others) - Industry Trends and Forecast to 2029.

Shipping Container Liner Market Analysis and Insights

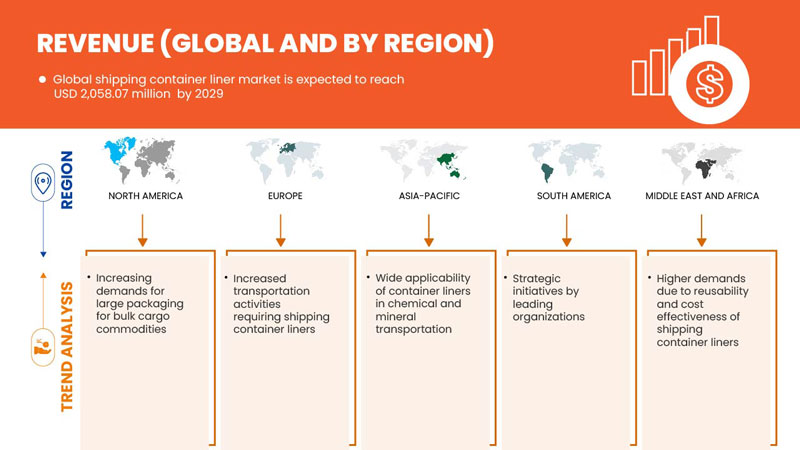

The global shipping container liner market is expected to grow significantly in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.9% in the forecast period of 2022 to 2029 and is expected to reach USD 2,058.07 million by 2029. The major factor driving the growth of the shipping container liner market is rising prevalence of container liners in food and agriculture and the increased transportation activities.

Container liners can be used to pack all kinds of dry food such as wheat, rice, coffee, legumes, sugar and other foods. For safe, contamination-free packaging, container liners offer a cost-effective, protective and valuable packaging solution. Rising prevalence of container liners in food and agriculture industry and increased transportation activities are expected to drive the global shipping container liner market Moreover, reusability and cost effectiveness of shipping container liners will propel the growth of the global shipping container liner market. However, high transportation costs and increasing freight rates may hamper the growth of the market.

The global shipping container liner market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Polypropylene (PP) Container Liners, Polyethylene (PE) Container Liners, And Others), Application (Food And Beverages, Chemicals, Minerals, Agricultural And Others) |

|

Countries Covered |

U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxemburg, Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa |

|

Market Players Covered |

UNITED BAGS, INC., Bulk Corp International, Nier Systems Inc., Rishi FIBC Solutions PVT. Ltd., Dev Ventures India Pvt. Ltd., Ven Pack, BERRY GLOBAL INC., Bulk Handling Australia, Eceplast, Greif., LC Packaging, Thrace Group, CDF Corporation, Composite Containers, LLC, INTERTAPE POLYMER GROUP, and BULK FLOW among others |

Market Definition

Container liners are the most economical means of packaging and transporting bulk dry, free-flowing products. They are of primary importance regarding packaging requirements for bulk deliveries of goods and other materials. When goods are moved from one geographical location to another, they naturally come into contact with natural elements such as oil, dust, air and soil, all of which can ruin or degrade the quality of the goods. There is a possibility that excessive contamination often renders goods unsuitable. Transported goods being rejected by the authorities, it is very important that the goods meet the quality standards set by the relevant government of the destination country. To prevent all these situations, bulk container liners are used as a protective layer. By using bulk container liners for transportation, goods are kept safe and contamination is completely avoided.

Global Shipping Container Liner Market Dynamics

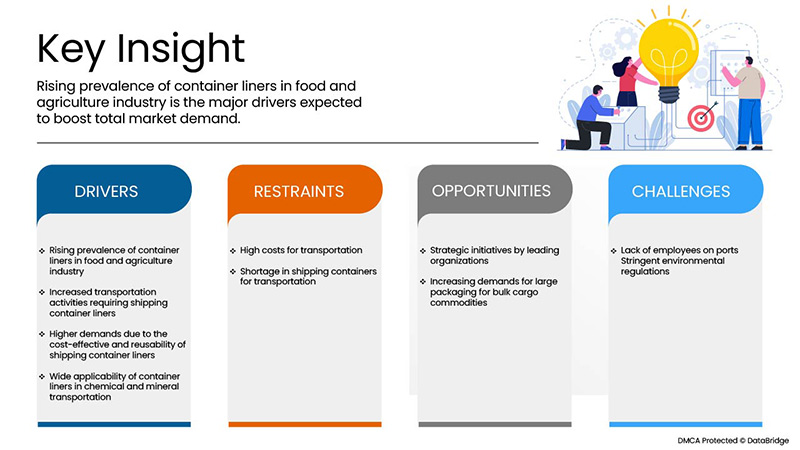

Drivers

- Rising Prevalence Of Container Liners In The Food And Agriculture Industry

Shipping container liners have become increasingly popular in the shipping industry, especially in food and agriculture. Food products and items must be transported with well-maintained chains and precautions to maintain their quality and food security. Similarly, in the agriculture industry, transportation of seeds, fertilizers, and various chemicals must be transported with proper care and handled cautiously. Container liners prevent moisture, temperature, and other contamination in the commodity. Various manufacturers are providing such container liners as per the need of end users for varying applications. The wide applicability of container liners in food and agriculture leads to higher demands and is expected to drive market growth

- Increased Transportation Activities Requiring Shipping Container Liners

The upsurge in the transportation of goods across the globe has led to the industry's higher demand for shipping container liners. The liners provide safety to the commodities and are highly efficient in loading and unloading. With this increasing transportation, the demand for container liners is also increasing and is expected to drive the market's growth.

- Higher Demands Due To The Cost-Effective And Reusability Of Shipping Container Liners

Container liners are composed of high-density polyethylene and polypropylene, enabling end users to use them again. The container liners can be used many times, resulting in cost-effectiveness. Manufacturers provide shipping container liners in various materials, which aids in their cost-effectiveness and quality. Hence, container liners are in high demand due to their cost-effectiveness and reusability, which is expected to drive market growth.

Opportunities

- Strategic Initiatives By Leading Organizations

The acceptance and high usage of shipping container liners in the market have increased the demand for the product. To fulfill such demands as per the need of end users related to various applications, it is used for; manufacturers are taking strategic decisions and provide new and innovative products in the market.

- Increasing Demands For Large Packaging For Bulk Cargo Commodities

Container liners prevent the contamination of cargo and other products transported after packaging. It shields the bulk cargo from moisture and ensures that the cargo is shipped securely and hygienically. With container liners, very little handling is required in shipping, making all the operations easy. Manufacturers provide container liners in different designs and sizes to transport bulk cargo while ensuring product safety. Hence, the increasing demand for large packaging for bulk cargo commodities might create opportunities for the global shipping container liner market.

Restraints/Challenges

- High Costs For Transportation

Due to this increased pricing in the transportation of goods, the shipping industry gets affected overall. Empirical evidence underlines that raising transport costs by 10% reduces trade volumes by more than 20%. High transportation costs impact the structure of economic activities and international trade, ultimately affecting the demand for shipping container liners

- Stringent Environmental Regulations

Due to many stringent rules and regulations, manufacturers think twice before indulging in such a business where many rules and regulations are to be followed while maintaining the proper guidelines. This serves as a major challenge for the shipping industry and ultimately affects the global shipping container liner market

Post-COVID-19 Impact on Shipping Container Liner Market

COVID-19 has affected the market to some extent. Due to the lockdown, the manufacturing and production of many small and large companies were halted as well as the demand for shipping container liner decreased as shipping and transportation activities were severely affected due to quarantine measures, which influenced the market. Due to the change in many mandates and regulations, manufacturers can design and launch new products in the market, which will help the market's growth.

Recent Development

United Bags Inc. has partnered with a recycling company which sets up baling machines, and periodically picks up the used FIBCs at no cost from the customers. Participants in this initiative receive certification stating that all their FIBCs have been recycled, causing no harm to the environment

Global Shipping Container Liner Market Scope

The global shipping container liner market is categorized based on type, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Polypropylene (PP) Container Liners

- polyethylene (PE) Container Liners

- Others

Based on type, the global shipping container liner market is classified into two segments polypropylene (PP) container liners, polyethylene (PE) container liners, and others.

Application

- Food And Beverages

- Chemicals

- Minerals

- Agricultural

- Others

Based on application, the global shipping container liner market is classified into five segments food and beverages, chemicals, minerals, agricultural and others.

Global Shipping Container Liner Market Regional Analysis/Insights

The global shipping container liner market is segmented on the basis of type, and application.

The countries in the global shipping container liner market are the U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxemburg, Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa.

Asia-Pacific is dominating the global shipping container liner market. China dominates in the Asia-Pacific region due to higher demands due to the cost-effective and reusability of shipping container liners.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Shipping Container Liner Market Share Analysis

Global shipping container liner market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies focus on the global shipping container liner market.

Some of the prominent participants operating in the global shipping container liner market are UNITED BAGS, INC., Bulk Corp International, Nier Systems Inc., Rishi FIBC Solutions PVT. Ltd., Dev Ventures India Pvt. Ltd., Ven Pack, BERRY GLOBAL INC., Bulk Handling Australia, Eceplast, Greif., LC Packaging, Thrace Group, CDF Corporation, Composite Containers, LLC, INTERTAPE POLYMER GROUP, and BULK FLOW among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Global Vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SHIPPING CONTAINER LINER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CONSUMER BUYING BEHAVIOR

4.1.1 OVERVIEW

4.1.1.1 COMPLEX BUYING BEHAVIOR

4.1.1.2 DISSONANCE-REDUCING BUYING BEHAVIOR

4.1.1.3 HABITUAL BUYING BEHAVIOR

4.1.1.4 VARIETY-SEEKING BEHAVIOR

4.1.1.5 conclusion

4.2 FACTORS INFLUENCING BUYING DECISION

4.3 PORTER'S FIVE ANALYSIS FOR THE GLOBAL SHIPPING CONTAINER LINER MARKET

4.3.1 BARGAINING POWER OF BUYERS/CONSUMERS

4.3.2 BARGAINING POWER OF SUPPLIERS

4.3.3 THE THREAT OF NEW ENTRANTS

4.3.4 THREAT OF SUBSTITUTES

4.3.5 RIVALRY AMONG EXISTING COMPETITORS

4.4 PRICING INDEX

4.4.1 FOB & B2B PRICES –GLOBAL SHIPPING CONTAINER LINER MARKET

4.4.2 B2B PRICES – GLOBAL SHIPPING CONTAINER LINER MARKET

4.5 GLOBAL SHIPPING CONTAINER LINER MARKET: RAW MATERIAL SOURCING ANALYSIS

4.5.1 POLYETHYLENE (PE)

4.5.2 POLYPROPYLENE (PP)

4.5.3 HIGH DENSITY POLYETHYLENE(HDPE) AND LOW DENSITY POLYETHYLENE (LDPE)

4.6 TRADE ANALYSIS

4.6.1 GLOBAL EXPORTERS OF SHIPPING CONTAINER LINERS, HS CODE OF PRODUCT: 392321

4.6.2 GLOBAL IMPORTERS OF SHIPPING CONTAINER LINER, HS CODE OF PRODUCT: 392321

4.6.3 IMPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.6.4 EXPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.7 PRODUCT ADOPTION SCENARIO

4.7.1 OVERVIEW

4.7.2 PRODUCT AWARENESS

4.7.3 PRODUCT INTEREST

4.7.4 PRODUCT EVALUATION

4.7.5 PRODUCT TRIAL

4.7.6 PRODUCT ADOPTION

4.7.7 CONCLUSION

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 REGULATION COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CONTAINER LINERS IN THE FOOD AND AGRICULTURE INDUSTRY

7.1.2 INCREASED TRANSPORTATION ACTIVITIES REQUIRING SHIPPING CONTAINER LINERS

7.1.3 HIGHER DEMANDS DUE TO THE COST-EFFECTIVE AND REUSABILITY OF SHIPPING CONTAINER LINERS

7.1.4 WIDE APPLICABILITY OF CONTAINER LINERS IN CHEMICAL AND MINERAL TRANSPORTATION

7.2 RESTRAINTS

7.2.1 HIGH COSTS FOR TRANSPORTATION

7.2.2 SHORTAGE IN SHIPPING CONTAINERS FOR TRANSPORTATION

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY LEADING ORGANIZATIONS

7.3.2 INCREASING DEMANDS FOR LARGE PACKAGING FOR BULK CARGO COMMODITIES

7.4 CHALLENGES

7.4.1 LACK OF EMPLOYEES ON PORTS

7.4.2 STRINGENT ENVIRONMENTAL REGULATIONS

8 GLOBAL SHIPPING CONTAINER LINER MARKET, BY TYPE

8.1 OVERVIEW

8.2 POLYETHYLENE

8.3 POLYPROPYLENE

8.4 OTHERS

9 GLOBAL SHIPPING CONTAINER LINER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FOOD AND BEVERAGE

9.2.1 POLYPROPYLENE

9.2.2 POLYETHYLENE

9.2.3 OTHERS

9.3 CHEMICAL

9.3.1 POLYPROPYLENE

9.3.2 POLYETHYLENE

9.3.3 OTHERS

9.4 AGRICULTURAL

9.4.1 POLYPROPYLENE

9.4.2 POLYETHYLENE

9.4.3 OTHERS

9.5 MINERAL

9.5.1 POLYPROPYLENE

9.5.2 POLYETHYLENE

9.5.3 OTHERS

9.6 OTHERS

9.6.1 POLYPROPYLENE

9.6.2 POLYETHYLENE

9.6.3 OTHERS

10 GLOBAL SHIPPING CONTAINER LINER MARKET, BY REGION

10.1 OVERVIEW

10.2 ASIA-PACIFIC

10.2.1 CHINA

10.2.2 INDIA

10.2.3 JAPAN

10.2.4 SOUTH KOREA

10.2.5 THAILAND

10.2.6 SINGAPORE

10.2.7 INDONESIA

10.2.8 AUSTRALIA & NEW ZEALAND

10.2.9 PHILIPPINES

10.2.10 MALAYSIA

10.2.11 REST OF ASIA-PACIFIC

10.3 NORTH AMERICA

10.3.1 U.S.

10.3.2 CANADA

10.3.3 MEXICO

10.4 EUROPE

10.4.1 GERMANY

10.4.2 U.K.

10.4.3 FRANCE

10.4.4 ITALY

10.4.5 SPAIN

10.4.6 RUSSIA

10.4.7 SWITZERLAND

10.4.8 TURKEY

10.4.9 BELGIUM

10.4.10 NETHERLANDS

10.4.11 LUXEMBURG

10.4.12 REST OF EUROPE

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 MIDDLE EAST AND AFRICA

10.6.1 SAUDI ARABIA

10.6.2 UNITED ARAB EMIRATES

10.6.3 SOUTH AFRICA

10.6.4 EGYPT

10.6.5 ISRAEL

10.6.6 REST OF MIDDLE EAST & AFRICA

11 COMPANY LANDSCAPE, GLOBAL SHIPPING CONTAINER LINER MARKET

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 COMPANY PROFILES

12.1 BERRY GLOBAL INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT UPDATES

12.2 GREIF

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATE

12.3 INTERTAPE POLYMER GROUP

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT UPDATE

12.4 LC PACKAGING

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 SWOT

12.4.5 RECENT UPDATES

12.5 BULK HANDLING AUSTRALIA

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT UPDATE

12.6 BULK CORP INTERNATIONAL

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT UPDATES

12.7 BULK FLOW

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT UPDATES

12.8 COMPOSITE CONTAINERS, LLC

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT UPDATE

12.9 CDF CORPORATION

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT UPDATE

12.1 DEV VENTURES INDIA PVT. LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 ECEPLAST

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT UPDATES

12.12 NIER SYSTEMS INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT UPDATES

12.13 RISHI FIBC SOLUTIONS PVT. LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 SWOT

12.13.4 RECENT UPDATE

12.14 THRACE GROUP

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 SWOT

12.14.4 PRODUCT PORTFOLIO

12.14.5 RECENT UPDATE

12.15 UNITED BAGS, INC

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 SWOT

12.15.4 RECENT UPDATE

12.16 VEN PACK

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 SWOT

12.16.4 RECENT UPDATES

13 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 FREE ON BOARD (FOB) OF SCREEN PRINTING MESH

TABLE 2 EXPORTERS OF SHIPPING CONTAINER LINERS UNIT: USD THOUSAND

TABLE 3 IMPORTERS OF SHIPPING CONTAINER LINER , UNIT: USD THOUSAND

TABLE 4 IMPORTS BY RUSSIAN FEDERATION , UNIT: USD THOUSAND

TABLE 5 EXPORTS BY RUSSIAN FEDERATION UNIT: USD THOUSAND

TABLE 6 GLOBAL SHIPPING CONTAINER LINER MARKET: BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL POLYETHYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL POLYPROPYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL MINERAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 CHINA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 CHINA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 CHINA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 CHINA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 CHINA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 CHINA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CHINA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 INDIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 INDIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 INDIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 INDIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 INDIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 INDIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 INDIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 JAPAN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 JAPAN SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 JAPAN FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 JAPAN CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 JAPAN AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 JAPAN MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 JAPAN OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 SOUTH KOREA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SOUTH KOREA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 SOUTH KOREA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SOUTH KOREA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 SOUTH KOREA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 THAILAND SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 THAILAND SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 THAILAND FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 HAILAND CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 THAILAND AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 THAILAND MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 THAILAND OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SINGAPORE SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SINGAPORE SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 SINGAPORE FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SINGAPORE CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SINGAPORE AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SINGAPORE MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SINGAPORE OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 INDONESIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDONESIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 INDONESIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDONESIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDONESIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDONESIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 INDONESIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 AUSTRALIA & NEW ZEALAND SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 AUSTRALIA & NEW ZEALAND SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 AUSTRALIA & NEW ZEALAND FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA & NEW ZEALAND CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 AUSTRALIA & NEW ZEALAND AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA & NEW ZEALAND MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA & NEW ZEALAND OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 PHILIPPINES SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 PHILIPPINES SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 PHILIPPINES FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 PHILIPPINES CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 PHILIPPINES AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 PHILIPPINES MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 PHILIPPINES OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 MALAYSIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 MALAYSIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 MALAYSIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MALAYSIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MALAYSIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MALAYSIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 MALAYSIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 REST OF ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 NORTH AMERICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.S. SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.S. SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 U.S. FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.S. CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.S. AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.S. OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 CANADA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 CANADA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 CANADA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 CANADA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 CANADA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 MEXICO FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 EUROPE SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 131 EUROPE SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 EUROPE SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 EUROPE FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 EUROPE CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 EUROPE AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 EUROPE MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 EUROPE OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 GERMANY SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 GERMANY SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 GERMANY FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 GERMANY CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 GERMANY AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 GERMANY MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 GERMANY OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.K. SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 U.K. SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 U.K. FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 U.K. CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 U.K. AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 U.K. MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 U.K. OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 FRANCE SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 FRANCE SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 FRANCE FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 FRANCE CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 FRANCE AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 FRANCE MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 FRANCE OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 ITALY SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 ITALY SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 161 ITALY FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 ITALY CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 ITALY AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 ITALY MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 ITALY OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 SPAIN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 SPAIN SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 SPAIN FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 SPAIN CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 SPAIN AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 SPAIN MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 SPAIN OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 RUSSIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 RUSSIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 175 RUSSIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 RUSSIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 RUSSIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 RUSSIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 RUSSIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SWITZERLAND SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 SWITZERLAND SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 SWITZERLAND FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 SWITZERLAND CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 SWITZERLAND AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 SWITZERLAND MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 SWITZERLAND OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 TURKEY SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 TURKEY SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 TURKEY FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 TURKEY CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 TURKEY AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 TURKEY MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 TURKEY OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 BELGIUM SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 BELGIUM SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 BELGIUM FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 BELGIUM CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 BELGIUM AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 BELGIUM MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 BELGIUM OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 NETHERLANDS SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 NETHERLANDS SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 203 NETHERLANDS FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 NETHERLANDS CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 NETHERLANDS AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 NETHERLANDS MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 NETHERLANDS OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 LUXEMBURG SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 LUXEMBURG SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 LUXEMBURG FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 LUXEMBURG CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 LUXEMBURG AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 LUXEMBURG MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 LUXEMBURG OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 REST OF EUROPE SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 217 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 219 SOUTH AMERICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 SOUTH AMERICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 SOUTH AMERICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 SOUTH AMERICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SOUTH AMERICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 BRAZIL SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 BRAZIL SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 226 BRAZIL FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 BRAZIL CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 BRAZIL AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 BRAZIL MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 BRAZIL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 ARGENTINA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 ARGENTINA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 233 ARGENTINA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 ARGENTINA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 ARGENTINA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 ARGENTINA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 ARGENTINA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 REST OF SOUTH AMERICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 240 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 IDDLE EAST AND AFRICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 MIDDLE EAST AND AFRICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 MIDDLE EAST AND AFRICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 MIDDLE EAST AND AFRICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 MIDDLE EAST AND AFRICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 SAUDI ARABIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 SAUDI ARABIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 249 SAUDI ARABIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 SAUDI ARABIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 SAUDI ARABIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 SAUDI ARABIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 SAUDI ARABIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 UNITED ARAB EMIRATES SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 UNITED ARAB EMIRATES SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 256 UNITED ARAB EMIRATES FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 UNITED ARAB EMIRATES CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 UNITED ARAB EMIRATES AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 UNITED ARAB EMIRATES MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 UNITED ARAB EMIRATES OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 SOUTH AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 SOUTH AFRICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 263 SOUTH AFRICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 264 SOUTH AFRICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 SOUTH AFRICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 SOUTH AFRICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 SOUTH AFRICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 EGYPT SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 EGYPT SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 270 EGYPT FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 EGYPT CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 EGYPT AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 EGYPT MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 EGYPT OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 ISRAEL SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 ISRAEL SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 277 ISRAEL FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 ISRAEL CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 ISRAEL AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 ISRAEL MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 ISRAEL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 REST OF MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 2 GLOBAL SHIPPING CONTAINER LINER MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL SHIPPING CONTAINER LINER MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL SHIPPING CONTAINER LINER MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL SHIPPING CONTAINER LINER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL SHIPPING CONTAINER LINER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL SHIPPING CONTAINER LINER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 GLOBAL SHIPPING CONTAINER LINER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 GLOBAL SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL SHIPPING CONTAINER LINER MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 RISING PREVALANCE OF SHIPPING CONTAINER LINER IN FOOD AND AGRICULTURE INSUTRY IS DRIVING THE GLOBAL SHIPPING CONTAINER LINER MARKET IN THE FORECAST PERIOD

FIGURE 12 XXX SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL SHIPPING CONTAINER LINER MARKET IN 2022 & 2029

FIGURE 13 XXX IS THE FASTEST-GROWING REGION IN GLOBAL SHIPPING CONTAINER LINER MARKET IN THE FORECAST PERIOD

FIGURE 14 GLOBAL SHIPPING CONTAINER LINER MARKET: TYPES OF CONSUMER BUYING BEHAVIOR

FIGURE 15 PORTER'S 5 ANALYSIS

FIGURE 16 GLOBAL SHIPPING CONTAINER LINER MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL SHIPPING CONTAINER LINER MARKET

FIGURE 18 GLOBAL SHIPPING CONTAINER LINER MARKET: BY TYPE, 2021

FIGURE 19 GLOBAL SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2021

FIGURE 20 GLOBAL SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 21 GLOBAL SHIPPING CONTAINER LINER MARKET: BY REGION (2021)

FIGURE 22 GLOBAL SHIPPING CONTAINER LINER MARKET: BY REGION (2022 & 2029)

FIGURE 23 GLOBAL SHIPPING CONTAINER LINER MARKET: BY REGION (2021 & 2029)

FIGURE 24 GLOBAL SHIPPING CONTAINER LINER MARKET: BY TYPE (2022-2029)

FIGURE 25 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 & 2029)

FIGURE 30 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 & 2029)

FIGURE 35 EUROPE SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 36 EUROPE SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 37 EUROPE SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 EUROPE SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 EUROPE SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 & 2029)

FIGURE 40 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 41 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 42 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 - 2029)

FIGURE 45 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 46 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 47 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 48 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 49 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 - 2029)

FIGURE 50 GLOBAL SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

FIGURE 51 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

FIGURE 52 EUROPE SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.