Global Programmatic Display Market

Taille du marché en milliards USD

TCAC :

%

USD

101.56 Billion

USD

1,133.82 Billion

2025

2033

USD

101.56 Billion

USD

1,133.82 Billion

2025

2033

| 2026 –2033 | |

| USD 101.56 Billion | |

| USD 1,133.82 Billion | |

|

|

|

|

Global Programmatic Display Market Segmentation, By Ad Format (Online Display, Online Video, Mobile Display, and Mobile Video), Sales Channel (Real Time Bidding (RTB), Private Marketplaces (PMP), and Automated Guaranteed (AG)) - Industry Trends and Forecast to 2033

Programmatic Display Market Size

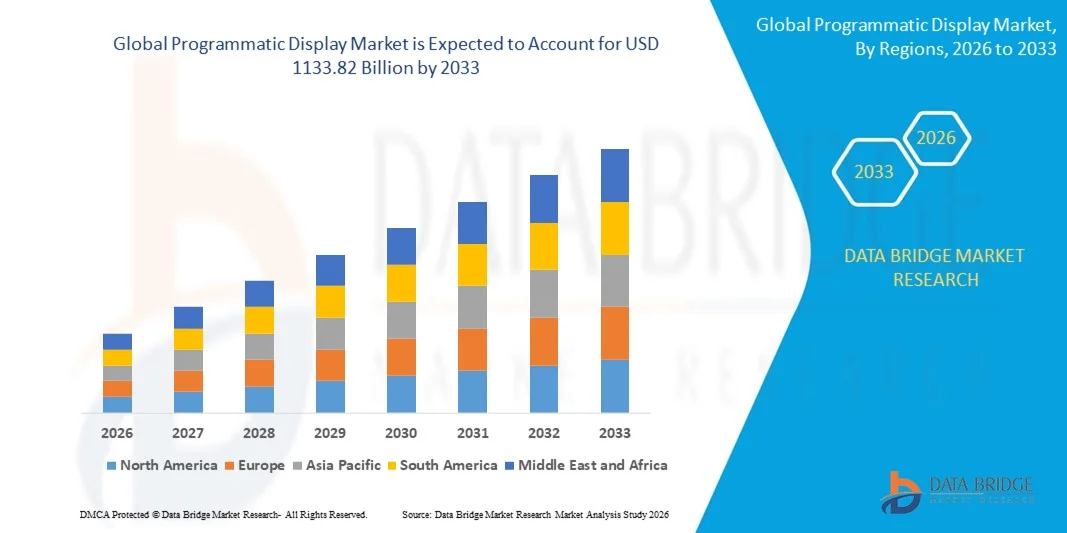

- The global programmatic display market size was valued at USD 101.56 billion in 2025 and is expected to reach USD 1133.82 billion by 2033, at a CAGR of 35.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital advertising and advancements in programmatic technologies, enabling automated, data-driven ad buying across display, video, and mobile channels

- Furthermore, rising demand from brands and advertisers for precise audience targeting, real-time optimization, and measurable ROI is establishing programmatic display as the preferred solution for digital marketing campaigns. These converging factors are accelerating the adoption of programmatic platforms, thereby significantly boosting the industry's growth

Programmatic Display Market Analysis

- Programmatic display advertising leverages automated platforms to buy and deliver digital ads across web, mobile, and connected TV inventories in real time. These systems integrate with demand-side platforms (DSPs), supply-side platforms (SSPs), and data management platforms (DMPs) to enhance targeting precision, efficiency, and campaign performance for advertisers

- The escalating demand for programmatic display is primarily fueled by widespread digitalization, growing consumption of online content, increasing e-commerce activity, and a rising preference for personalized, measurable, and scalable advertising campaigns

- Asia-Pacific dominated the programmatic display market with a share of 34.5% in 2025, due to rapid digitalization, growing e-commerce penetration, and increasing adoption of online advertising across both urban and semi-urban regions

- North America is expected to be the fastest growing region in the programmatic display market during the forecast period due to advanced programmatic infrastructure, high digital ad spend, and widespread adoption of automated marketing solutions

- Online display segment dominated the market with a market share of 39% in 2025, due to its established reach and versatility in targeting audiences across desktop and mobile platforms. Advertisers often prioritize online display for its effectiveness in brand awareness campaigns and measurable performance metrics such as impressions and click-through rates. The segment also benefits from broad programmatic integration with demand-side platforms (DSPs) and advanced audience targeting capabilities, making it a preferred choice for both large and medium-sized advertisers

Report Scope and Programmatic Display Market Segmentation

|

Attributes |

Programmatic Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Programmatic Display Market Trends

Growing Adoption of AI-Driven Programmatic Advertising

- A significant trend in the programmatic display market is the increasing incorporation of artificial intelligence and machine learning into programmatic platforms, enabling automated decision-making, real-time optimization, and predictive audience targeting. This trend is elevating the role of programmatic advertising as a key tool for marketers seeking precise and scalable campaign execution across digital channels

- For instance, The Trade Desk leverages AI-powered bidding algorithms to optimize ad placement across display, video, and mobile inventory, improving campaign efficiency and ROI for brands

- Advertisers are increasingly using AI-driven programmatic solutions to personalize ad content and dynamically adjust targeting based on user behavior and contextual insights, enhancing engagement and conversion rates

- The adoption of AI in programmatic display is expanding across industries such as e-commerce, media, and BFSI, where data-driven campaign management supports measurable outcomes and improved advertising spend efficiency

- Companies are integrating machine learning to enhance fraud detection and viewability tracking, which strengthens brand safety and maintains high-quality inventory standards

- The growth of connected devices, OTT platforms, and digital video consumption is further driving the need for AI-enabled programmatic solutions that can manage complex, cross-channel campaigns with minimal manual intervention

Programmatic Display Market Dynamics

Driver

Rising Demand for Data-Driven Targeting and Measurable ROI

- The growing reliance on data analytics and audience segmentation is driving demand for programmatic display solutions that deliver measurable performance and precise targeting. These solutions enable marketers to optimize ad spend, track conversions, and refine campaigns based on real-time insights

- For instance, Google Ads and Xandr provide advanced data management and targeting capabilities that allow advertisers to segment audiences by demographics, behavior, and intent, improving the efficiency of display and video campaigns

- The rise of omnichannel marketing strategies has expanded the need for programmatic solutions capable of integrating first-party and third-party data for cohesive campaign execution

- Retailers and e-commerce companies are leveraging programmatic platforms to drive personalized product recommendations and retargeting campaigns, enhancing user engagement and sales performance

- The adoption of real-time bidding and dynamic creative optimization supports the delivery of relevant ads at scale, reinforcing programmatic display as a critical component of modern digital marketing strategies

Restraint/Challenge

Increasing Regulatory Scrutiny and Data Privacy Compliance

- The programmatic display market faces challenges from tightening data privacy regulations and the need to comply with laws such as GDPR, CCPA, and emerging privacy frameworks globally. These regulations restrict the use of cookies and third-party data, affecting audience targeting and ad personalization

- For instance, Adobe and Verizon Media have had to adapt their programmatic platforms to comply with privacy mandates, implementing consent management and anonymization techniques to continue delivering targeted campaigns

- Advertisers and publishers must navigate complex regulatory landscapes while maintaining campaign performance, which increases operational complexity and compliance costs

- Restrictions on third-party data usage and cookie deprecation are prompting investments in alternative tracking technologies, such as first-party data strategies and contextual advertising

- The challenge of balancing privacy compliance with effective targeting is influencing platform development, pushing programmatic providers to innovate in areas such as AI-driven contextual targeting and privacy-safe measurement solutions

Programmatic Display Market Scope

The market is segmented on the basis of ad format and sales channel.

- By Ad Format

On the basis of ad format, the programmatic display market is segmented into online display, online video, mobile display, and mobile video. The online display segment dominated the largest market revenue share of 39% in 2025, driven by its established reach and versatility in targeting audiences across desktop and mobile platforms. Advertisers often prioritize online display for its effectiveness in brand awareness campaigns and measurable performance metrics such as impressions and click-through rates. The segment also benefits from broad programmatic integration with demand-side platforms (DSPs) and advanced audience targeting capabilities, making it a preferred choice for both large and medium-sized advertisers.

The online video segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising consumption of video content across social media, OTT platforms, and streaming services. For instance, The Trade Desk and Google DV360 have reported strong adoption of programmatic video solutions by brands aiming to increase engagement and storytelling impact. Online video offers higher engagement rates and interactive ad formats, enabling advertisers to deliver immersive experiences and measurable outcomes. The increasing bandwidth availability and advancements in programmatic targeting technology also contribute to the accelerated adoption of online video advertising.

- By Sales Channel

On the basis of sales channel, the programmatic display market is segmented into real-time bidding (RTB), private marketplaces (PMP), and automated guaranteed (AG). The RTB segment dominated the largest market revenue share in 2025, driven by its ability to deliver cost-efficient, scalable, and automated ad buying across multiple inventory sources. Advertisers often prefer RTB due to its dynamic pricing model and access to a vast pool of impressions, enabling precise audience targeting and optimization in real time. The segment also benefits from integrations with major DSPs and analytics platforms, allowing for efficient campaign management and performance tracking.

The private marketplaces segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for premium, brand-safe inventory and controlled buying environments. For instance, PubMatic and Magnite have expanded their PMP offerings to cater to advertisers seeking guaranteed visibility and reduced ad fraud risks. PMPs provide greater transparency and quality assurance compared with open auctions, making them appealing to brands focused on high-impact campaigns. The rising emphasis on brand safety, data privacy compliance, and direct publisher relationships further drives the adoption of private marketplaces in programmatic advertising.

Programmatic Display Market Regional Analysis

- Asia-Pacific dominated the programmatic display market with the largest revenue share of 34.5% in 2025, driven by rapid digitalization, growing e-commerce penetration, and increasing adoption of online advertising across both urban and semi-urban regions

- The region’s cost-effective digital infrastructure, rising internet penetration, and strong mobile user base are accelerating market expansion

- The availability of skilled digital marketing professionals, supportive government policies, and investments in programmatic advertising technologies are contributing to increased adoption across industries such as retail, BFSI, and e-commerce

China Programmatic Display Market Insight

China held the largest share in the Asia-Pacific programmatic display market in 2025, owing to its massive digital consumer base and strong e-commerce ecosystem. The country’s high internet penetration, advanced mobile payment infrastructure, and investments in AI-driven advertising platforms are major growth drivers. Demand is also bolstered by the proliferation of online video and mobile display advertising across social media and e-commerce platforms.

India Programmatic Display Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid smartphone adoption, expanding internet connectivity in rural and semi-urban areas, and growing digital marketing spend. Government initiatives to support digital economy growth, combined with increasing e-commerce penetration, are strengthening programmatic display adoption. In addition, rising interest from SMEs and startups in targeted advertising and performance-based marketing is contributing to robust market expansion.

Europe Programmatic Display Market Insight

The Europe programmatic display market is expanding steadily, supported by strict data privacy regulations, increasing adoption of GDPR-compliant programmatic platforms, and high demand for personalized advertising solutions. The region places strong emphasis on brand safety, transparency, and high-quality inventory, particularly in retail, media, and automotive sectors. The growing use of programmatic solutions for online video and mobile display campaigns is further enhancing market growth.

Germany Programmatic Display Market Insight

Germany’s programmatic display market is driven by its leadership in digital marketing adoption, advanced advertising technology infrastructure, and strong e-commerce sector. The country has well-established networks of DSPs, ad exchanges, and agencies, fostering innovation in automated ad buying. Demand is particularly strong for programmatic solutions targeting automotive, retail, and financial services.

U.K. Programmatic Display Market Insight

The U.K. market is supported by a mature digital advertising ecosystem, high social media engagement, and increasing adoption of programmatic video and mobile display campaigns. With growing focus on programmatic analytics, audience targeting, and data-driven advertising strategies, the U.K. continues to play a significant role in high-value online advertising markets. Investments in AI-based ad optimization and cross-platform campaign management further support growth.

North America Programmatic Display Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by advanced programmatic infrastructure, high digital ad spend, and widespread adoption of automated marketing solutions. Increasing use of AI and machine learning for real-time bidding, audience segmentation, and cross-channel campaign optimization is boosting adoption. In addition, investments in OTT platforms, mobile advertising, and data-driven marketing strategies are supporting market expansion.

U.S. Programmatic Display Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its mature digital advertising ecosystem, high internet penetration, and strong investments in programmatic technologies. The country’s focus on advanced analytics, targeted advertising, and cross-channel integration is encouraging the adoption of online display, video, and mobile programmatic campaigns. Presence of key players such as The Trade Desk, Google DV360, and MediaMath further solidify the U.S.’s leading position in the region.

Programmatic Display Market Share

The programmatic display industry is primarily led by well-established companies, including:

- Google (U.S.)

- DataXu, Inc. (U.S.)

- NextRoll, Inc. (U.S.)

- Xandr Inc. (U.S.)

- Verizon Media (U.S.)

- Rocket Fuel (U.S.)

- Turn Inc. (U.S.)

- RadiumOne, Inc. (U.S.)

- Yahoo! (U.S.)

- Adobe (U.S.)

- The Rubicon Project, Inc. (U.S.)

- IPONWEB Limited (U.K.)

- betweenx (Germany)

- FlucT (Japan)

- Adform (Denmark)

- The Trade Desk (U.S.)

- Beeswax (U.S.)

- CONNEXITY (U.S.)

- Centro Incorporated (U.S.)

Latest Developments in Global Programmatic Display Market

- In January 2026, PubMatic launched its AgenticOS platform to support agent‑to‑agent advertising at scale, enabling autonomous planning, execution, and optimization of programmatic campaigns across premium digital inventory. This launch aims to significantly boost campaign efficiency and speed while preserving brand safety, potentially redefining how agencies and advertisers leverage automation in programmatic workflows and reducing manual intervention in campaign management

- In December 2025, the IAB Tech Lab released version 1.0 of its Deals API for public comment, introducing a standardized method for how deal terms are communicated between supply‑side platforms (SSPs) and demand‑side platforms (DSPs). This development is poised to enhance transparency and operational efficiency in private marketplaces and curated inventory deals, reducing mismatches and under‑delivery issues that have historically hindered high‑value programmatic transactions, thereby improving buyer confidence in programmatic supply chains

- In August 2025, Magnite announced a strategic data integration with Acxiom, marking it as Acxiom’s first programmatic sell‑side data activation partner. This partnership allows advertisers to activate first‑party and third‑party data directly through Magnite’s platform, enhancing addressable advertising by improving match rates, targeting precision, and forecasting accuracy, which overall increases ad spend efficiency in streaming and display environments

- In March 2025, PubMatic’s Activate platform achieved industry‑wide adoption by all of the “Big Six” advertising agencies, reflecting its rapid ascent as a central programmatic activation tool that delivers improved supply path optimization, curated inventory access, and measurable cost efficiencies such as lower CPMs. This adoption underscores its impact as a preferred technology for large agencies seeking greater transparency and performance in programmatic buying

- In February 2025, DataXu (now part of Roku) expanded its programmatic advertising solutions with enhanced cross‑device attribution and identity resolution capabilities, enabling marketers to better track and target users across connected TV (CTV), mobile, and desktop. This expansion supports the growing shift toward omnichannel programmatic campaigns, improving cross‑platform measurement and helping advertisers gain a more unified view of performance across screens

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.