Global Pharmaceutical Packaging Market

Taille du marché en milliards USD

TCAC :

%

USD

118.43 Billion

USD

206.52 Billion

2024

2032

USD

118.43 Billion

USD

206.52 Billion

2024

2032

| 2025 –2032 | |

| USD 118.43 Billion | |

| USD 206.52 Billion | |

|

|

|

|

Marché mondial de l'emballage pharmaceutique, par produit (emballage primaire, emballage secondaire et tertiaire), matériau (plastiques et polymères, papier et cartons, verre, métaux et autres), mode d'administration de médicaments (emballage d'administration de médicaments par voie orale, emballage d'administration de médicaments par voie parentérale, emballage d'administration de médicaments topiques, emballage d'administration de médicaments par inhalation, emballage d'administration de médicaments par voie nasale, emballage d'administration de médicaments oculaires, autres emballages d'administration de médicaments), utilisateur final (entreprises de fabrication de produits pharmaceutiques, entreprises d'emballage sous contrat, pharmacies et autres) - Tendances et prévisions de l'industrie jusqu'en 2031.

Analyse et perspectives du marché de l'emballage pharmaceutique

L’externalisation des services de conditionnement à façon est devenue cruciale pour les entreprises pharmaceutiques, leur permettant de se concentrer sur leurs compétences clés tout en respectant des normes exigeantes. Prespack propose des partenariats multidimensionnels, soulageant les fabricants de médicaments ou de dispositifs médicaux de nombreux processus. Cette tendance reflète la croissance du secteur de l’externalisation pharmaceutique, contribuant à terme à l’expansion du marché du conditionnement pharmaceutique.

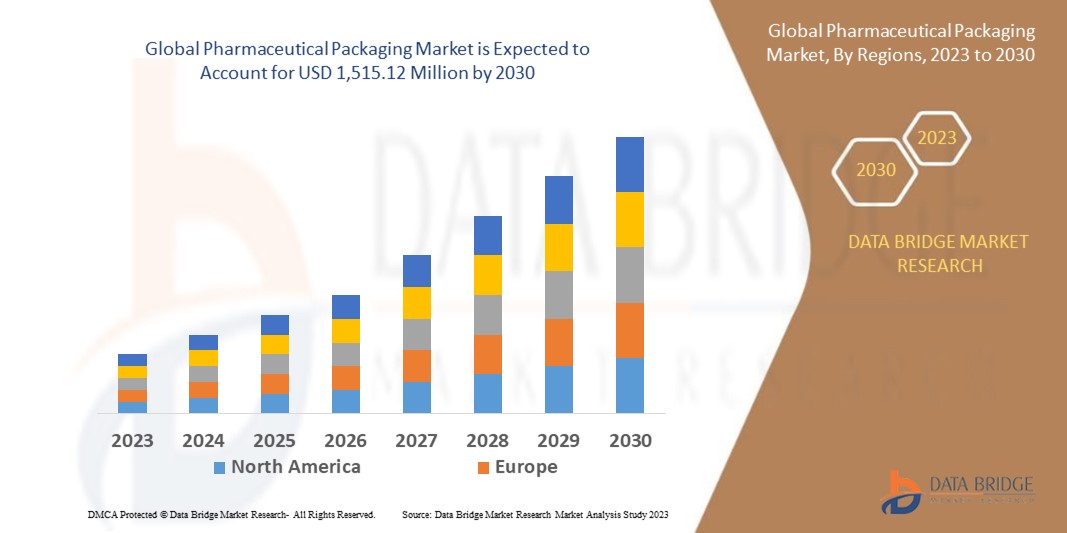

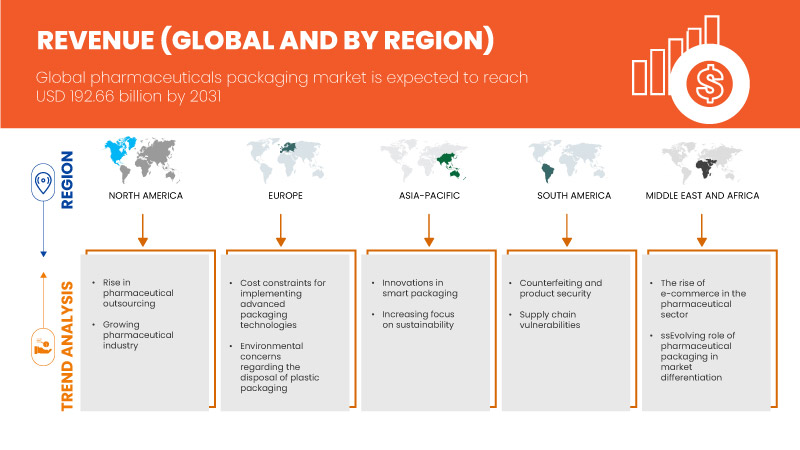

Data Bridge Market Research analyse que le marché mondial de l'emballage pharmaceutique devrait atteindre 192,66 milliards USD d'ici 2031, contre 111,52 milliards USD en 2023, avec un TCAC de 7,2 % au cours de la période de prévision de 2024 à 2031.

|

Rapport métrique |

Détails |

|

Période de prévision |

2024 à 2031 |

|

Année de base |

2023 |

|

Années historiques |

2022 (personnalisable pour 2016-2021) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD |

|

Segments couverts |

Produit (emballage primaire, emballage secondaire et tertiaire), matériau (plastiques et polymères, papier et carton, verre, métaux et autres), mode d'administration de médicaments (emballage d'administration de médicaments par voie orale, emballage d'administration de médicaments par voie parentérale, emballage d'administration de médicaments topiques, emballage d'administration de médicaments par inhalation, emballage d'administration de médicaments par voie nasale, emballage d'administration de médicaments oculaires, autres emballages d'administration de médicaments), utilisateur final (sociétés de fabrication pharmaceutique, sociétés d'emballage sous contrat, pharmacies et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Italie, Pays-Bas, Espagne, Russie, Suisse, Turquie, Belgique, Reste de l'Europe, Chine, Japon, Inde, Corée du Sud, Australie, Singapour, Indonésie, Thaïlande, Malaisie, Philippines, Reste de l'Asie-Pacifique, Brésil, Argentine, Reste de l'Amérique du Sud, Afrique du Sud, Émirats arabes unis, Arabie saoudite, Égypte, Israël, Reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

WestRock Company, Amcor plc, BD, AptarGroup, Inc., West Pharmaceutical Services, Inc., Berry Global, Inc., CCL Industries, Gerresheimer AG, Schott AG, UFlex Limited, SGD Pharma, EPL Limited, Drug Plastics Group, Comar et Daikyo Seiko Co., Ltd., entre autres |

Définition du marché

L'emballage pharmaceutique consiste à enfermer des médicaments et d'autres produits pharmaceutiques dans des matériaux d'emballage qui assurent leur protection, leur identification et la diffusion des informations. Ces matériaux comprennent le plastique, le verre, l' aluminium , le papier et le carton, chacun choisi pour ses propriétés et son application spécifiques. Ces matériaux sont soigneusement sélectionnés en fonction de leur compatibilité avec le produit pharmaceutique, de leur capacité à protéger contre les facteurs externes et des exigences réglementaires.

Dynamique du marché mondial de l'emballage pharmaceutique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

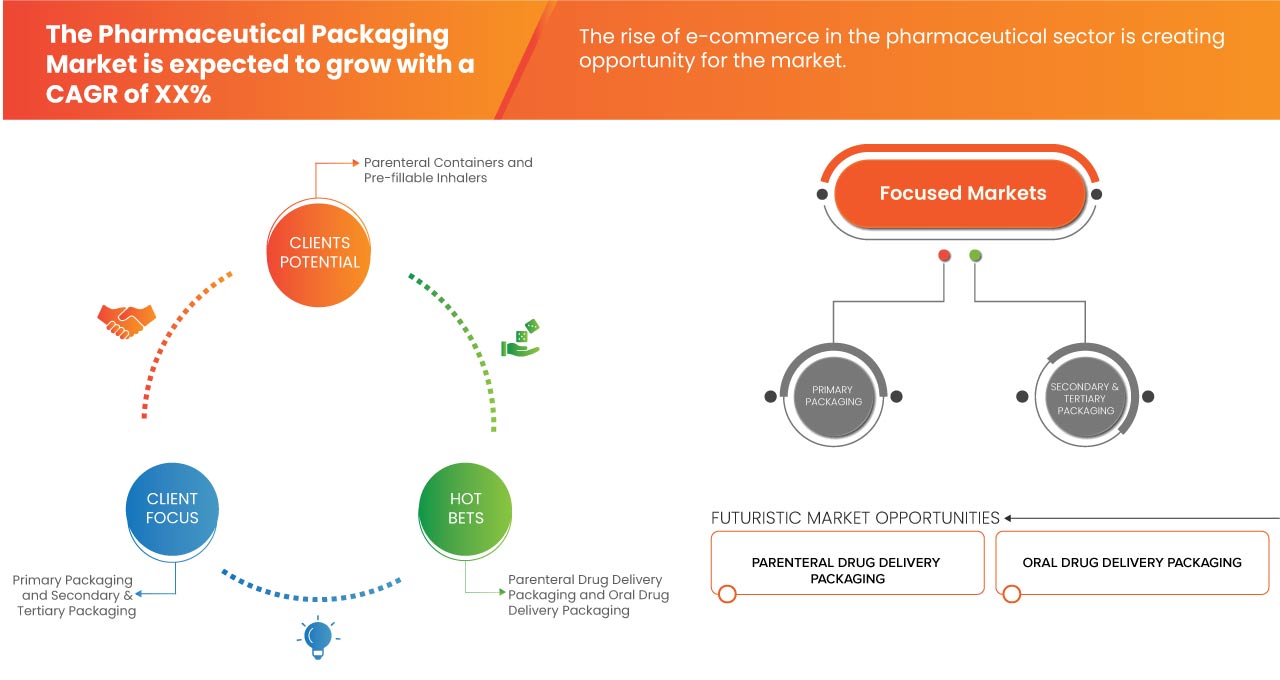

- L'externalisation croissante du secteur pharmaceutique

Les entreprises pharmaceutiques choisissent de plus en plus de confier leurs processus de fabrication à des conditionneurs sous contrat spécialisés. Ce changement stratégique permet à ces entreprises de se concentrer sur leurs compétences de base, comme la recherche, le développement et le marketing, tout en laissant les complexités du conditionnement à des experts. Les conditionneurs sous contrat offrent une gamme de services comprenant la conception des emballages, la sélection des matériaux et la garantie de la conformité aux exigences réglementaires strictes. Cela est particulièrement avantageux pour les entreprises pharmaceutiques à la recherche de solutions d'emballage innovantes et personnalisées pour leurs produits.

- Évolution du rôle de l'emballage pharmaceutique dans la différenciation du marché

L’emballage a évolué au-delà de son rôle traditionnel de simple contenant des produits pharmaceutiques ; il est désormais un élément clé pour différencier ces produits sur le marché. Cette évolution est motivée par l’intensification de la concurrence dans l’industrie pharmaceutique, où les entreprises utilisent l’emballage comme un outil pour différencier leurs produits de leurs concurrents. L’emballage sert de plate-forme visuelle et informative qui communique des détails essentiels sur le produit, notamment sa qualité, sa sécurité et son efficacité. En outre, l’emballage agit comme un support marketing, contribuant à attirer les consommateurs et à influencer leurs décisions d’achat. En réponse à cette tendance, on assiste à une augmentation des solutions d’emballage innovantes. Par exemple, les emballages intelligents intègrent des fonctionnalités numériques telles que des étiquettes RFID ou des codes QR, permettant aux consommateurs d’accéder à des informations supplémentaires sur le produit ou de suivre son authenticité.

L'utilisation de matériaux écologiques dans les emballages gagne du terrain, reflétant la conscience environnementale croissante des consommateurs. Ces approches innovantes permettent non seulement de différencier les produits, mais contribuent également à des pratiques durables, renforçant ainsi la réputation de la marque.

L’accent mis sur la différenciation des produits grâce à l’emballage entraîne des avancées significatives dans l’industrie de l’emballage pharmaceutique, favorisant un environnement de marché propice à l’innovation et à l’amélioration continues.

Opportunité

- Innovations dans le domaine des emballages intelligents

Les innovations en matière d’emballages intelligents, comme les étiquettes thermosensibles et le suivi RFID, révolutionnent le marché mondial des emballages pharmaceutiques. Ces avancées offrent une multitude d’avantages, à commencer par une visibilité accrue sur l’ensemble de la chaîne d’approvisionnement. Les étiquettes thermosensibles, par exemple, permettent une surveillance en temps réel, garantissant que les médicaments sont stockés et transportés dans des conditions optimales. Cette capacité est particulièrement cruciale pour les produits pharmaceutiques, car le maintien de la bonne température est essentiel pour préserver leur efficacité et leur sécurité. De plus, le suivi RFID permet aux entreprises de suivre les unités de produits individuelles, garantissant ainsi l’authenticité et empêchant toute falsification. Ce niveau de traçabilité contribue non seulement à la conformité aux normes réglementaires, mais renforce également la confiance des consommateurs. De plus, les emballages intelligents facilitent les processus de rappel efficaces, car les entreprises peuvent identifier et récupérer rapidement les produits concernés.

Retenue et défis

- Contrefaçon et sécurité des produits

Malgré les progrès réalisés dans les technologies de conditionnement, la contrefaçon dans le secteur pharmaceutique pose un problème à multiples facettes. La prolifération de médicaments contrefaits met non seulement en danger la santé des patients, mais érode également la confiance dans les produits pharmaceutiques et dans l’industrie. Ces activités illicites impliquent souvent des tactiques sophistiquées, notamment la duplication d’emballages et d’étiquettes pour imiter les produits authentiques. Alors que les contrefacteurs font évoluer en permanence leurs méthodes pour échapper à la détection, les sociétés pharmaceutiques doivent rester vigilantes et adapter leurs stratégies de conditionnement pour garder une longueur d’avance sur ces menaces. Cette lutte permanente contre les médicaments contrefaits souligne l’importance cruciale de solutions de conditionnement innovantes et d’efforts de collaboration au sein de l’industrie et des organismes de réglementation pour garantir la sécurité et l’intégrité des produits pharmaceutiques.

- Contraintes de coût pour la mise en œuvre de technologies d'emballage avancées

Le développement et la mise en œuvre de technologies d’emballage avancées, telles que les emballages intelligents et les mesures anti-contrefaçon, nécessitent souvent des investissements substantiels dans la recherche, le développement et l’infrastructure technologique. Pour les petites entreprises aux ressources limitées, ces coûts peuvent être prohibitifs, les empêchant d’adopter des solutions d’emballage innovantes. En conséquence, ces entreprises peuvent être désavantagées par rapport à des concurrents plus importants qui peuvent se permettre d’investir dans des technologies d’emballage avancées. Cette contrainte freine la croissance globale et le potentiel d’innovation du marché de l’emballage pharmaceutique, limitant la disponibilité de solutions d’emballage avancées et entravant potentiellement la compétitivité du marché.

Développements récents

- En septembre 2023, WestRock Company WRK et Smurfit Kappa Group Plc SMFKY ont convenu de fusionner et de créer Smurfit WestRock, qui devrait être l'une des plus grandes entreprises de papier et d'emballage au monde avec une valeur d'environ 20 milliards de dollars.

- En juillet 2023, Constantia Flexibles a annoncé sa dernière solution d'emballage pharmaceutique, le film thermoformé REGULA CIRC, une technologie de pointe qui établit une nouvelle norme en matière de durabilité dans les emballages sous blister. Conçu dans un souci de circularité, REGULA CIRC est conforme aux futures réglementations et législations, offrant une solution de barrière totale qui répond aux normes d'emballage durable les plus élevées

- En juin 2022, Berlin Packaging, l'un des plus grands fournisseurs d'emballages hybrides au monde, a annoncé l'acquisition d'Andler Packaging Group, un distributeur à valeur ajoutée de contenants et de fermetures en plastique, en verre et en métal.

- En décembre 2021, Comar, un fournisseur de premier plan de dispositifs et d'assemblages médicaux personnalisés et de solutions d'emballage spécialisées, a annoncé aujourd'hui l'acquisition d'Omega Packaging, un fabricant de produits moulés par injection et par soufflage destinés aux marchés pharmaceutiques, nutraceutiques, de la nutrition sportive et des soins de la peau.

- En avril 2022, Amcor, leader dans la conception et la production de solutions d'emballage éthiques, a récemment révélé l'ajout d'un nouveau laminé High Shield plus respectueux de l'environnement à sa gamme d'emballages pharmaceutiques

Portée du marché mondial de l'emballage pharmaceutique

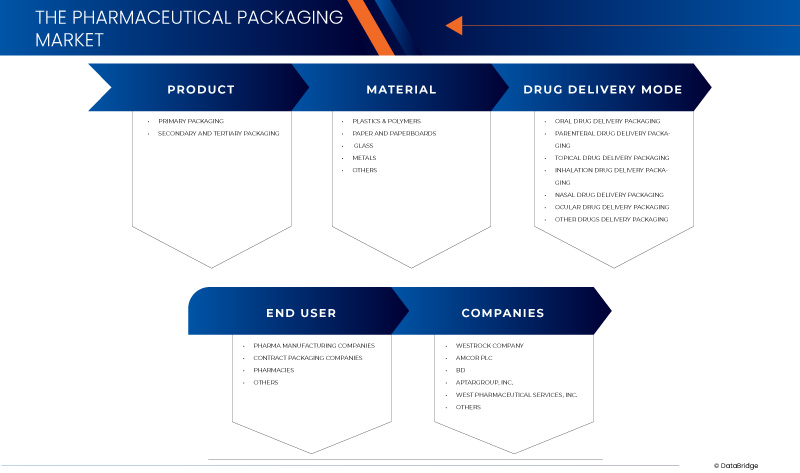

Le marché mondial de l'emballage pharmaceutique est segmenté en quatre segments notables en fonction du produit, du matériau, du mode d'administration du médicament et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et les différences entre vos marchés cibles.

Produit

- Emballage primaire

- Emballage secondaire et tertiaire

Sur la base du produit, le marché est segmenté en emballage primaire, emballage secondaire et emballage tertiaire.

Matériel

- Plastiques et polymères

- Papier et cartons

- Verre

- Métaux

- Autres

Sur la base du matériau, le marché est segmenté en plastiques et polymères, papier et cartons, verre, métaux et autres.

Mode d'administration du médicament

- Emballage pour administration orale de médicaments

- Conditionnement pour administration parentérale de médicaments

- Emballage pour administration de médicaments topiques

- Emballage pour administration de médicaments par inhalation

- Emballage pour administration nasale de médicaments

- Emballage d'administration de médicaments oculaires

- Autres emballages de livraison de médicaments

Sur la base du mode d'administration de médicaments, le marché est segmenté en emballage d'administration de médicaments par voie orale, emballage d'administration de médicaments par voie parentérale, emballage d'administration de médicaments topiques, emballage d'administration de médicaments par inhalation, emballage d'administration de médicaments par voie nasale, emballage d'administration de médicaments oculaires et autres emballages d'administration de médicaments.

Utilisateur final

- Entreprises de fabrication pharmaceutique

- Entreprises d'emballage sous contrat

- Pharmacies

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en sociétés de fabrication pharmaceutique, sociétés d'emballage sous contrat, pharmacies et autres.

Analyse/perspectives régionales du marché mondial de l'emballage pharmaceutique

Le marché mondial de l’emballage pharmaceutique est classé en quatre segments notables en fonction du produit, du matériau, du mode d’administration du médicament et de l’utilisateur final.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada, le Mexique, l'Allemagne, le Royaume-Uni, la France, l'Italie, les Pays-Bas, l'Espagne, la Russie, la Suisse, la Turquie, la Belgique, le reste de l'Europe, la Chine, le Japon, l'Inde, la Corée du Sud, l'Australie, Singapour, l'Indonésie, la Thaïlande, la Malaisie, les Philippines, le reste de l'Asie-Pacifique, le Brésil, l'Argentine, le reste de l'Amérique du Sud, l'Afrique du Sud, les Émirats arabes unis, l'Arabie saoudite, l'Égypte, Israël et le reste du Moyen-Orient et de l'Afrique.

L'Amérique du Nord devrait dominer le marché mondial de l'emballage pharmaceutique en raison de son infrastructure de soins de santé avancée, de son cadre réglementaire robuste et de ses investissements importants dans la recherche et le développement. Les États-Unis devraient dominer l'Amérique du Nord en raison de leur infrastructure de soins de santé avancée, de leur grande industrie pharmaceutique et de leur forte demande de solutions d'emballage innovantes. La Chine devrait dominer la région Asie-Pacifique en raison de son industrie pharmaceutique en pleine expansion, de sa large base de consommateurs et de ses investissements croissants dans les infrastructures de soins de santé et les technologies d'emballage. L'Allemagne devrait dominer la région Europe en raison de son secteur de fabrication pharmaceutique robuste, de son environnement réglementaire solide et de l'accent mis sur des normes d'emballage de haute qualité.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du marché mondial des emballages pharmaceutiques

Le paysage concurrentiel du marché mondial de l'emballage pharmaceutique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Certains des principaux acteurs du marché opérant sur le marché sont WestRock Company, Amcor plc, BD, AptarGroup, Inc., West Pharmaceutical Services, Inc., Berry Global, Inc., CCL Industries, Gerresheimer AG, Schott AG, UFlex Limited, SGD Pharma, EPL Limited, Drug Plastics Group, Comar et Daikyo Seiko Co., Ltd., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.