Global Oil Field Specialty Chemicals Market

Taille du marché en milliards USD

TCAC :

%

USD

2.87 Billion

USD

4.14 Billion

2025

2033

USD

2.87 Billion

USD

4.14 Billion

2025

2033

| 2026 –2033 | |

| USD 2.87 Billion | |

| USD 4.14 Billion | |

|

|

|

|

Global Oil Field Specialty Chemicals Market Segmentation, By Type (Surfactants, Demulsifiers, Inhibitors, Biocides, Additives, Acids, Deformers, Polymers, Friction Reducers, Emulsifiers, Iron Control Agents, Dispersants, Viscosifiers, Wetting Agents, Retarders, and Others), Location (Onshore and Offshore), Application (Drilling, Stimulation, Production, Enhanced Oil Recovery (EOR), Cementing, Workover & Completion, and Others) - Industry Trends and Forecast to 2033

What is the Global Oil Field Specialty Chemicals Market Size and Growth Rate?

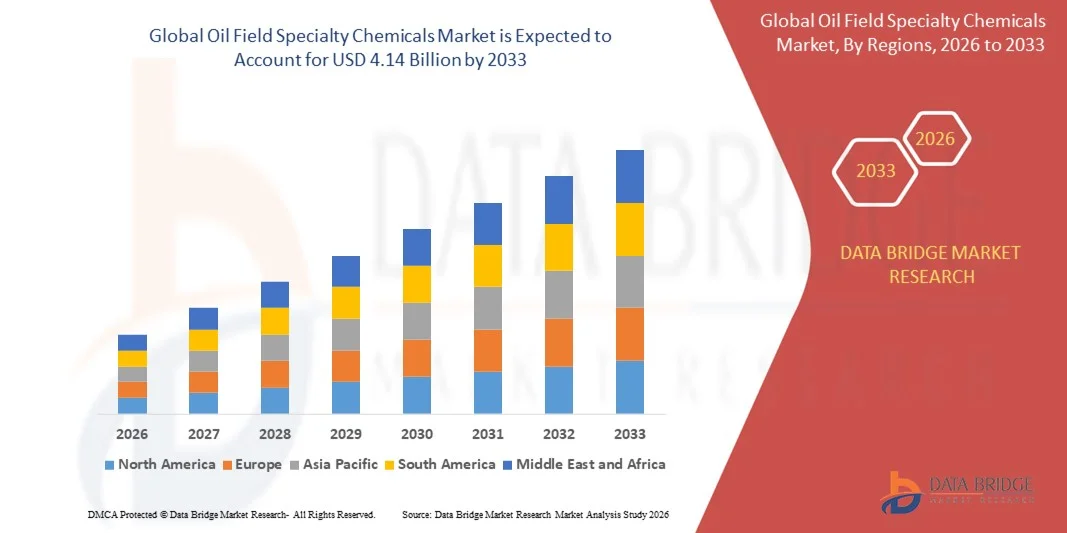

- The global oil field specialty chemicals market size was valued at USD 2.87 billion in 2025 and is expected to reach USD 4.14 billion by 2033, at a CAGR of 4.70% during the forecast period

- Rising oil and gas exploration and production activities, increasing demand for enhanced oil recovery (EOR) techniques, growing deepwater and ultra-deepwater drilling operations, higher usage of corrosion inhibitors and demulsifiers, expanding shale gas development, and rising focus on improving well efficiency and flow assurance are some of the major factors expected to drive the growth of the Oil Field Specialty Chemicals market

What are the Major Takeaways of Oil Field Specialty Chemicals Market?

- Growing investments in upstream oil & gas projects across developing economies, along with increasing adoption of advanced drilling fluids and production chemicals, are expected to create significant growth opportunities for the oil field specialty chemicals market

- Volatility in crude oil prices, stringent environmental regulations, high operational costs, and concerns related to chemical disposal and toxicity are expected to act as key restraining factors for the growth of the oil field specialty chemicals market

- North America dominated the oil field specialty chemicals market with a 41.8% revenue share in 2025, driven by extensive oil & gas exploration and production activities, high shale gas output, and strong adoption of advanced drilling, production, and enhanced oil recovery (EOR) technologies across the U.S. and Canada

- Europe is expected to register the fastest CAGR of 8.74% from 2026 to 2033, driven by increasing offshore exploration in the North Sea, rising investment in mature field optimization, and growing adoption of advanced chemical EOR techniques

- The Surfactants segment dominated the market with a 28.6% share in 2025, owing to their extensive use in drilling fluids, enhanced oil recovery (EOR), and production operations. Surfactants play a critical role in reducing interfacial tension, improving oil displacement efficiency, and enhancing fluid performance across both conventional and unconventional reservoirs

Report Scope and Oil Field Specialty Chemicals Market Segmentation

|

Attributes |

Oil Field Specialty Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oil Field Specialty Chemicals Market?

Increasing Shift Toward High-Performance, Eco-Friendly, and Application-Specific Oil Field Specialty Chemicals

- The oil field specialty chemicals market is witnessing growing adoption of high-performance and application-specific chemicals designed to enhance drilling efficiency, production optimization, and reservoir performance across complex oilfield environments

- Manufacturers are increasingly developing advanced surfactants, inhibitors, polymers, and friction reducers that offer improved thermal stability, corrosion resistance, and compatibility with high-pressure and high-temperature (HPHT) wells

- Rising focus on environmentally friendly and biodegradable chemical formulations is driving innovation to comply with stringent environmental regulations, especially in offshore and sensitive regions

- For instance, companies such as BASF SE, Halliburton, Baker Hughes, and Clariant have introduced low-toxicity, water-based, and high-efficiency oilfield chemical solutions to improve operational sustainability

- Increasing demand for enhanced oil recovery (EOR), shale gas development, and deepwater exploration is accelerating the shift toward specialized, high-value chemical formulations

- As oil and gas operations become more complex and efficiency-driven, oil field specialty chemicals will remain critical for maximizing recovery, reducing downtime, and improving overall well economics

What are the Key Drivers of Oil Field Specialty Chemicals Market?

- Rising demand for efficient drilling, stimulation, and production chemicals to improve well productivity, flow assurance, and reservoir longevity is driving market growth

- For instance, during 2024–2025, major oilfield service providers such as Schlumberger, Halliburton, and Baker Hughes expanded their specialty chemical portfolios to support unconventional and deepwater projects

- Growing investments in upstream oil & gas exploration, including shale, tight oil, and offshore fields, are boosting demand for surfactants, demulsifiers, corrosion inhibitors, and biocides across the U.S., Middle East, and Asia-Pacific

- Advancements in chemical formulation technologies, including nano-enabled additives and high-performance polymers, are enhancing efficiency while reducing chemical consumption

- Increasing adoption of enhanced oil recovery (EOR) techniques such as chemical flooding and polymer injection is creating sustained demand for specialty oilfield chemicals

- Supported by expanding energy demand, improved drilling technologies, and recovery optimization initiatives, the Oil Field Specialty Chemicals market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Oil Field Specialty Chemicals Market?

- Volatility in crude oil prices significantly impacts exploration and production spending, thereby affecting demand for oilfield specialty chemicals

- For instance, during 2024–2025, fluctuating oil prices and project delays led to reduced chemical procurement across several upstream projects globally

- Stringent environmental regulations related to chemical toxicity, disposal, and offshore discharge increase compliance costs and limit the use of certain formulations

- High operational and formulation costs associated with advanced, HPHT-compatible, and environmentally compliant chemicals restrict adoption among smaller operators

- Supply chain disruptions and raw material price fluctuations create cost pressures for manufacturers and reduce profit margins

- To overcome these challenges, companies are focusing on sustainable formulations, cost-efficient production methods, and region-specific chemical solutions to strengthen market adoption of oil field specialty chemicals

How is the Oil Field Specialty Chemicals Market Segmented?

The market is segmented on the basis of type, location, and application.

- By Type

On the basis of type, the oil field specialty chemicals market is segmented into Surfactants, Demulsifiers, Inhibitors, Biocides, Additives, Acids, Deformers, Polymers, Friction Reducers, Emulsifiers, Iron Control Agents, Dispersants, Viscosifiers, Wetting Agents, Retarders, and Others. The Surfactants segment dominated the market with a 28.6% share in 2025, owing to their extensive use in drilling fluids, enhanced oil recovery (EOR), and production operations. Surfactants play a critical role in reducing interfacial tension, improving oil displacement efficiency, and enhancing fluid performance across both conventional and unconventional reservoirs. Their wide applicability, cost-effectiveness, and continuous formulation improvements support strong demand across global oilfields.

The Polymers segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of polymer flooding in EOR, rising shale gas exploration, and growing demand for viscosity control and fluid loss reduction. Advancements in high-temperature and high-salinity-resistant polymers are further accelerating growth.

- By Location

On the basis of location, the oil field specialty chemicals market is segmented into Onshore and Offshore. The Onshore segment dominated the market with a 64.2% share in 2025, supported by extensive onshore oil and gas exploration activities, particularly in shale formations, tight oil reservoirs, and mature fields across the U.S., China, and the Middle East. Onshore operations require large volumes of drilling fluids, production chemicals, corrosion inhibitors, and biocides, driving sustained demand for specialty chemicals. Lower operational costs and easier logistics compared to offshore projects further strengthen onshore dominance.

The Offshore segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising deepwater and ultra-deepwater exploration activities in regions such as the Gulf of Mexico, Brazil, and West Africa. Increasing investment in offshore developments and stringent flow assurance requirements are boosting demand for high-performance, environmentally compliant specialty chemicals.

- By Application

On the basis of application, the oil field specialty chemicals market is segmented into Drilling, Stimulation, Production, Enhanced Oil Recovery (EOR), Cementing, Workover & Completion, and Others. The Production segment dominated the market with a 31.4% share in 2025, as production operations require continuous use of corrosion inhibitors, demulsifiers, scale inhibitors, and biocides to maintain flow assurance, equipment integrity, and operational efficiency throughout the life of a well. Increasing focus on maximizing output from mature fields has further strengthened demand for production chemicals globally.

The Enhanced Oil Recovery (EOR) segment is expected to register the fastest CAGR from 2026 to 2033, driven by declining conventional reserves and growing adoption of chemical EOR techniques such as polymer flooding and surfactant injection. Rising emphasis on improving recovery rates and extending reservoir life is significantly accelerating demand for specialty chemicals in EOR applications.

Which Region Holds the Largest Share of the Oil Field Specialty Chemicals Market?

- North America dominated the oil field specialty chemicals market with a 41.8% revenue share in 2025, driven by extensive oil & gas exploration and production activities, high shale gas output, and strong adoption of advanced drilling, production, and enhanced oil recovery (EOR) technologies across the U.S. and Canada. Continuous demand for drilling fluids, corrosion inhibitors, demulsifiers, and production chemicals supports sustained market growth across onshore and offshore fields

- Major oilfield service providers and chemical manufacturers in North America are actively introducing high-performance, environmentally compliant specialty chemicals to improve well productivity, flow assurance, and asset integrity, reinforcing the region’s leadership position

- Strong upstream investments, advanced infrastructure, technological innovation, and availability of skilled workforce further strengthen North America’s dominance in the global Oil Field Specialty Chemicals market

U.S. Oil Field Specialty Chemicals Market Insight

The U.S. is the largest contributor within North America, supported by large-scale shale oil and gas production, extensive onshore drilling activity, and widespread use of advanced production and EOR chemicals. Increasing focus on maximizing recovery from mature wells, along with rising deployment of corrosion inhibitors, biocides, and friction reducers, continues to drive market growth. Presence of major oilfield service companies, strong R&D capabilities, and ongoing investments in unconventional resources further support sustained demand.

Canada Oil Field Specialty Chemicals Market Insight

Canada contributes significantly to regional growth due to active oil sands development, offshore exploration, and rising application of specialty chemicals in production and EOR operations. Increasing focus on improving operational efficiency, managing flow assurance challenges, and complying with environmental regulations supports adoption of advanced oilfield chemical solutions across the country.

Europe Oil Field Specialty Chemicals Market

Europe is expected to register the fastest CAGR of 8.74% from 2026 to 2033, driven by increasing offshore exploration in the North Sea, rising investment in mature field optimization, and growing adoption of advanced chemical EOR techniques. Stringent environmental regulations are accelerating demand for biodegradable and low-toxicity specialty chemicals across offshore and onshore projects.

U.K. Oil Field Specialty Chemicals Market Insight

The U.K. remains a key contributor in Europe, supported by ongoing North Sea operations, enhanced recovery initiatives, and strong focus on extending the life of aging oilfields. Increasing deployment of production and flow assurance chemicals is strengthening market growth.

Norway Oil Field Specialty Chemicals Market Insight

Norway shows strong growth due to advanced offshore infrastructure, high investment in deepwater fields, and emphasis on environmentally sustainable oilfield operations. Adoption of high-performance and eco-friendly specialty chemicals continues to rise.

Germany Oil Field Specialty Chemicals Market Insight

Germany contributes through strong chemical manufacturing capabilities, technology development, and supply of advanced oilfield specialty formulations to European oil & gas operators. Innovation in sustainable chemical solutions further supports regional market expansion.

Which are the Top Companies in Oil Field Specialty Chemicals Market?

The oil field specialty chemicals industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Solvay (Belgium)

- Dow (U.S.)

- Baker Hughes Company (U.S.)

- Clariant (Switzerland)

- Evonik Industries AG (Germany)

- Kemira (Finland)

- Thermax Limited (India)

- Huntsman International LLC. (U.S.)

- Colonial Chemical Inc. (U.S.)

- Zirax (Russia)

- Innospec (U.S.)

- CES Energy Solutions Corp. (Canada)

- Stepan Company (U.S.)

- EMEC (Italy)

- Chevron Phillips Chemical Company LLC (U.S.)

- KRATON CORPORATION. (U.S.)

- Jiaxing Midas Oilfield Chemical Mfg Co., Ltd (China)

- Versalis S.p.A. (Italy)

- Halliburton (U.S.)

- Albemarle Corporation (U.S.)

What are the Recent Developments in Global Oil Field Specialty Chemicals Market?

- In May 2024, the industry witnessed rising adoption of digitalization and automation technologies, with specialty oilfield chemical suppliers developing remotely monitored and controlled solutions to optimize treatment processes and improve operational efficiency, highlighting the sector’s shift toward smarter and more efficient oilfield operations

- In March 2024, consolidation activity continued within the specialty oilfield chemicals market as leading players engaged in mergers and acquisitions to expand product portfolios and strengthen geographic presence, indicating an industry-wide focus on scale, competitiveness, and long-term growth

- In October 2023, The Lubrizol Corporation announced a new distribution agreement with IMCD Group, a leading global distributor and developer of specialty chemicals and ingredients, reinforcing Lubrizol’s market reach and supply chain capabilities

- In July 2022, Solvay SA stated that it would seek advisory support from Bank of America to evaluate the potential sale of its oilfield chemicals business as part of a strategic review, reflecting efforts to streamline operations and refocus on core growth areas

- In March 2022, Halliburton inaugurated its first oilfield specialty chemical manufacturing plant in Saudi Arabia to support next-generation chemical solutions and strengthen regional production capabilities, marking a significant expansion of the company’s footprint in the eastern hemisphere

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.