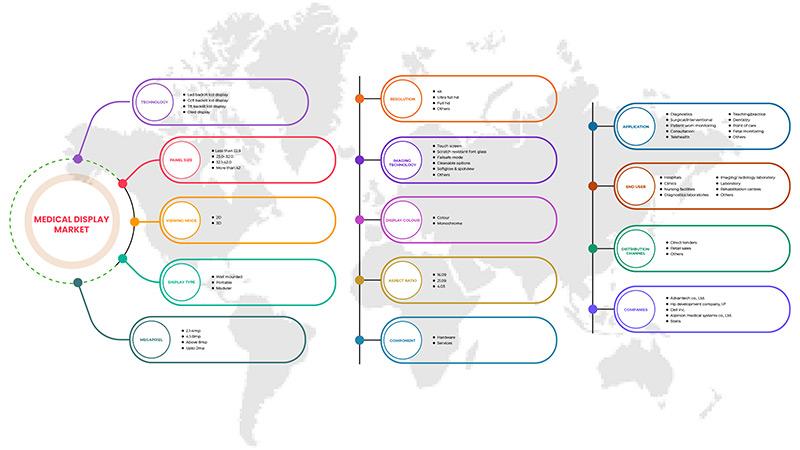

Marché mondial des écrans médicaux, par technologie (écran LCD rétroéclairé par LED, écran LCD rétroéclairé par CCFL, écran LCD TFT et écran OLED), taille du panneau (panneaux inférieurs à 22,9 pouces, panneaux de 23,0 à 32,0 pouces, panneaux de 27,0 à 41,9 pouces et panneaux supérieurs à 42 pouces), mode de visualisation (2D et 3D), mégapixels (jusqu'à 2 MP, 2,1 à 4 MP, 4,1 à 8 MP et plus de 8 MP), résolution (4K, Ultra Full HD, Full HD et autres), type d'affichage (montage mural, portable, modulaire), technologie d'imagerie (écran tactile, verre de police résistant aux rayures, mode de sécurité intégrée, options de nettoyage, Softglow et Spotview et autres), couleur d'affichage (couleur, monochrome), rapport hauteur/largeur (16,09, 21,09, 4,03), composant (matériel et services), application (consultation, diagnostic, chirurgie/intervention, télésanté, enseignement/pratique, Surveillance fœtale, dentisterie, point de service, surveillance portée par le patient et autres) Utilisateur final (hôpitaux, cliniques, établissements de soins infirmiers, laboratoires de diagnostic, laboratoire d'imagerie/radiologie, laboratoire, centres de réadaptation et autres), canal de distribution (appel d'offres direct, vente au détail et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché de l'affichage médical

Les principales raisons de la croissance du marché de l'affichage médical sont la demande croissante de traitements mini-invasifs (MIT) en raison de multiples avantages tels que moins de douleurs postopératoires, moins de complications opératoires et postopératoires majeures, une durée d'hospitalisation raccourcie, des temps de récupération plus rapides, moins de cicatrices, moins de stress sur le système immunitaire, une incision plus petite et, pour certaines procédures, une réduction du temps opératoire et des coûts également.

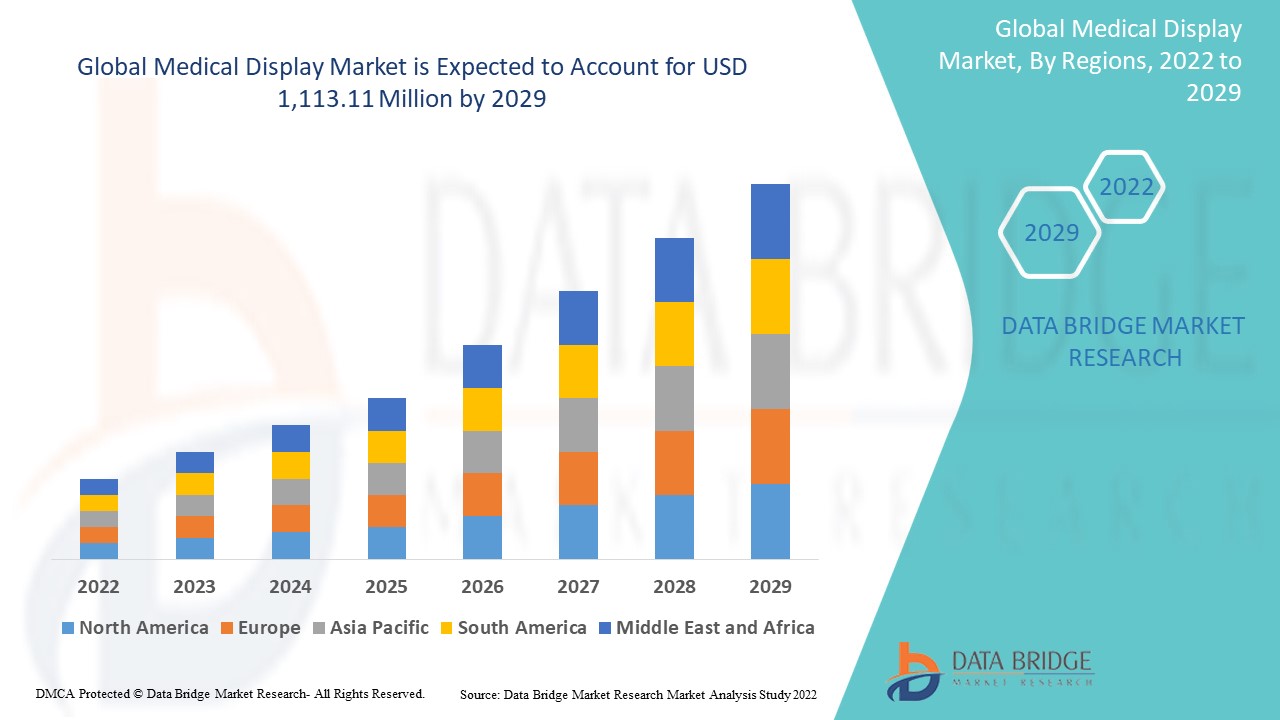

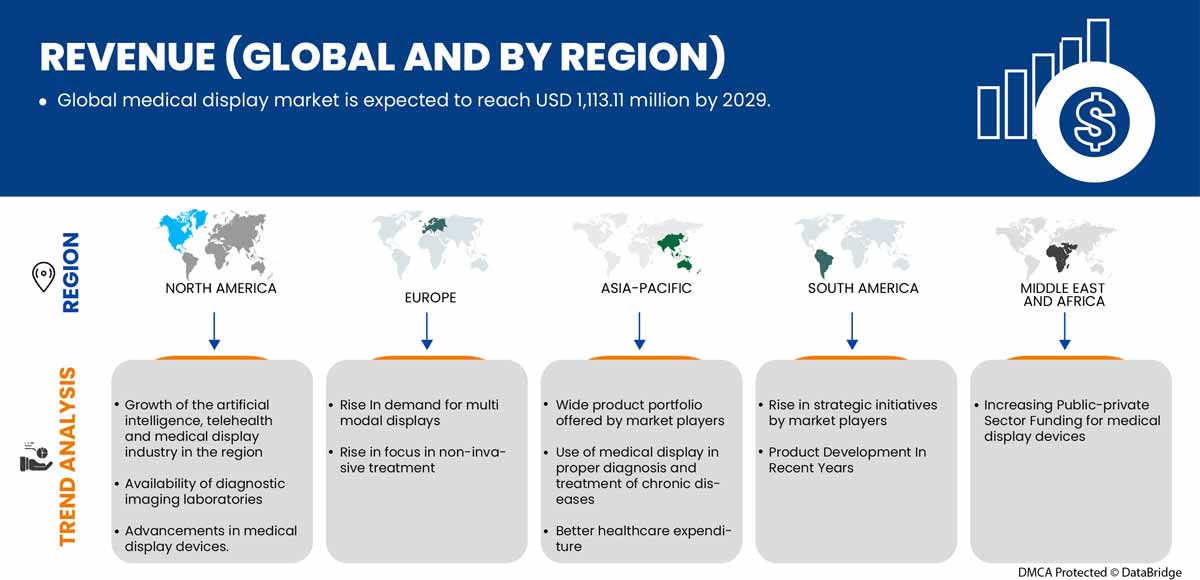

Data Bridge Market Research estime que le marché des écrans médicaux devrait atteindre la valeur de 1 113,11 millions USD d'ici 2029, à un TCAC de 6,2 % au cours de la période de prévision. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par technologie (écran LCD rétroéclairé par LED, écran LCD rétroéclairé par CCFL, écran LCD TFT et écran OLED), taille du panneau (panneaux de moins de 22,9 pouces, panneaux de 23,0 à 32,0 pouces, panneaux de 27,0 à 41,9 pouces et panneaux supérieurs à 42 pouces), mode de visualisation (2D et 3D), mégapixels (jusqu'à 2 MP, 2,1 à 4 MP, 4,1 à 8 MP et plus de 8 MP), résolution (4K, Ultra Full HD, Full HD et autres), type d'affichage (montage mural, portable, modulaire), technologie d'imagerie (écran tactile, verre de police résistant aux rayures, mode de sécurité intégrée, options de nettoyage, Softglow et Spotview et autres), couleur d'affichage (couleur, monochrome), rapport hauteur/largeur (16,09, 21,09, 4,03), composant (matériel et services), application (consultation, diagnostic, chirurgie/intervention, télésanté, enseignement/pratique, Surveillance fœtale, dentisterie, point de service, surveillance portée par le patient et autres) Utilisateur final (hôpitaux, cliniques, établissements de soins infirmiers, laboratoires de diagnostic, laboratoire d'imagerie/radiologie, laboratoire, centres de rééducation et autres), canal de distribution (appel d'offres direct, vente au détail et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Suisse, Pays-Bas, Turquie, Belgique, Reste de l'Europe, Chine, Japon, Inde, Australie, Corée du Sud, Singapour, Thaïlande, Malaisie, Indonésie, Philippines, Reste de l'Asie-Pacifique, Brésil, Argentine, Reste de l'Amérique du Sud, Afrique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Égypte, Reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Français : BenQ, ALPINION MEDICAL SYSTEMS Co., Ltd, Nanjing Jusha Commercial & Trading Co., Ltd, COJE CO., LTD., Axiomtek Co., Ltd., Dell Inc., HP Development Company, LP, Reshin, Onyx Healthcare Inc., Teguar Computers., Shenzhen Beacon Display Technology Co., Ltd., Rein Medical, STERIS., Barco., Hisense., Sony Corporation, Advantech Co., Ltd., LG Electronics., Sharp NEC Display Solutions, Koninklijke Philips NV, EIZO INC., Novanta Inc., FSN Medical Technologies., Quest, Ampronix., Siemens Healthcare GmbH, Panasonic Corporation, entre autres. |

Définition du marché de l'affichage médical

Un écran médical est un moniteur qui répond aux exigences élevées de l'imagerie médicale . Il est généralement doté de technologies spéciales d'amélioration de l'image pour garantir une luminosité constante tout au long de la durée de vie de l'écran, des images sans bruit, une lecture ergonomique et une conformité automatisée avec l'imagerie numérique et les communications en médecine (DICOM) et d'autres normes médicales.

Le développement des technologies d'imagerie médicale a fait progresser les soins de santé, en fournissant des outils de diagnostic puissants, en favorisant l'évaluation non invasive des blessures et des problèmes internes et en permettant de détecter les maladies bien plus tôt que jamais auparavant. Les écrans médicaux sont préférés aux écrans grand public lorsqu'ils sont utilisés pour l'imagerie médicale. La raison est simple : les écrans médicaux répondent à des exigences définies en matière de qualité d'image, de réglementation médicale et d'assurance qualité.

L’avenir des dispositifs d’affichage médicaux repose sur les progrès de l’intelligence artificielle (IA) et de l’analyse de données. Les dispositifs médicaux font progresser la gestion des maladies en permettant aux cliniciens de personnaliser la médecine comme jamais auparavant. Ces technologies fournissent des informations révélatrices sur les patients individuels en temps réel.

Dynamique du marché de l'affichage médical

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- La tendance croissante vers un traitement minimalement invasif

Les principales raisons de la croissance du marché mondial de l'affichage médical sont la demande croissante de traitements mini-invasifs (MIT) en raison de multiples avantages tels que moins de douleurs postopératoires, moins de complications opératoires et postopératoires majeures, une durée d'hospitalisation raccourcie, des temps de récupération plus rapides, moins de cicatrices, moins de stress sur le système immunitaire, une incision plus petite et, pour certaines procédures, une réduction du temps opératoire et des coûts également.

La chirurgie mini-invasive est une excellente approche pour diagnostiquer et traiter un large éventail de troubles thoraciques qui nécessitaient auparavant une sternotomie ou une thoracotomie ouverte. La prévalence des maladies chroniques nécessitant une intervention chirurgicale a augmenté dans le monde entier. En raison des nombreux avantages du traitement mini-invasif, de nombreux patients le préfèrent. De plus, les chirurgies vasculaires et endovasculaires, les chirurgies neurologiques et rachidiennes, les soins orthopédiques en traumatologie et les chirurgies cardiaques sont pratiqués dans des salles d'opération hybrides. Cette caractéristique permet aux hôpitaux d'effectuer des opérations chirurgicales avancées, ce qui augmente la demande d'écrans médicaux. En outre, l'augmentation des coûts des soins de santé et le nombre de laboratoires de pathologie et de radiologie stimulent la demande d'écrans médicaux.

La chirurgie mini-invasive permet aux chirurgiens d'utiliser des technologies modernes et des techniques chirurgicales avancées pour opérer le corps humain de manière moins nocive. Cela devrait stimuler la demande de chirurgies mini-invasives.

- Infrastructures de santé en pleine croissance

Les gouvernements et les organisations à but non lucratif de plusieurs pays se concentrent principalement sur le développement des infrastructures de santé pour minimiser la charge de morbidité et fournir de meilleurs services de santé. En outre, l'adoption d'appareils médicaux, d'écrans, de moniteurs et de divers autres appareils de pointe a augmenté. Tous ces facteurs sont susceptibles de créer des opportunités favorables à la croissance du marché au cours de la période de prévision. En outre, les investissements importants des principaux acteurs dans le lancement de produits innovants et la mise à jour des fonctionnalités au cours des prochaines années peuvent également stimuler le marché.

En outre, la demande croissante de services de santé rentables, la demande croissante de solutions techniques, la mobilité croissante des informations, l'augmentation des initiatives et des incitations gouvernementales et l'augmentation du financement des écrans médicaux de haute qualité dans les hôpitaux et les centres de recherche devraient stimuler ces établissements de santé sur le marché. L'infrastructure logicielle médicale a constitué la base des avancées récentes dans les écrans médicaux, les bibliothèques médicales numériques et les systèmes d'information de gestion. Ces facteurs devraient stimuler la croissance du marché mondial des écrans médicaux.

Opportunité

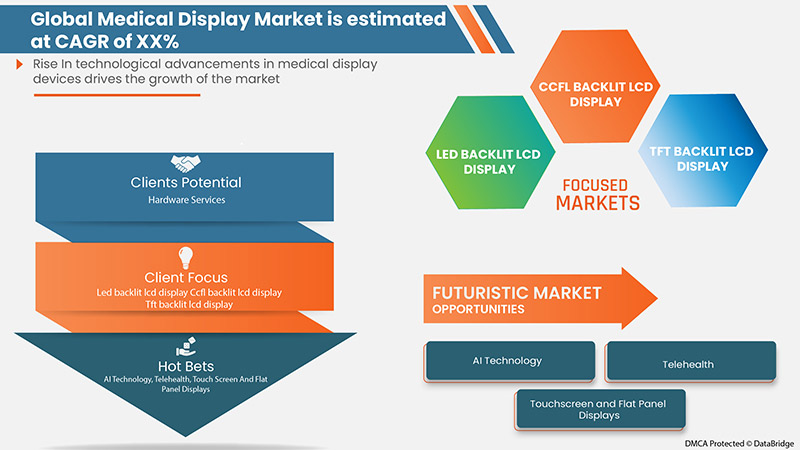

- Progrès technologiques dans les instruments d'affichage médical

Alors que le marché se concentre sur la production de formes galéniques à administration orale, il existe une lutte constante pour développer des formulations appropriées de nouvelles molécules qui permettent l'administration orale et, simultanément, garantissent au médicament une biodisponibilité optimale chez les patients. Pour surmonter ce problème, les fabricants d'excipients pharmaceutiques développent des produits plus simples et réduisent le temps et les coûts de développement. Le développement des technologies d'affichage médical a changé le secteur de la santé, en fournissant des outils de diagnostic, la télésanté, en fournissant un soutien pour les traitements non invasifs, en permettant l'évaluation des maladies et en permettant leur détection plus précoce.

Le lancement de développements technologiques dans les dispositifs d'affichage médical améliore l'efficacité de l'affichage médical et augmente la facilité d'utilisation des dispositifs d'affichage médical. L'essor des applications technologiques dans les dispositifs d'affichage médical entraînerait une réduction de la main-d'œuvre et un diagnostic et une guérison rapides des maladies. À l'avenir, la technologie de l'intelligence artificielle remplacera le marché de l'affichage médical. Ce facteur devrait constituer une opportunité pour la croissance du marché mondial de l'affichage médical au cours de la période de prévision.

Retenue/Défis

- Coûts élevés des dispositifs d'affichage médicaux

Le coût élevé des dispositifs d'affichage et leur mise en œuvre sont les principaux facteurs qui freinent la croissance du marché, en particulier dans les pays où le scénario de remboursement est médiocre. La plupart des établissements de santé des pays en développement, tels que les hôpitaux et les centres de diagnostic, ne peuvent pas se permettre ces appareils en raison des coûts d'installation et de maintenance élevés. En raison du coût élevé de ces équipements médicaux et des faibles ressources financières, les établissements de santé des pays émergents sont réticents à investir dans de nouveaux systèmes technologiquement avancés. Ces facteurs peuvent entraver la numérisation des établissements de santé et avoir un impact sur l'adoption de technologies avancées pour le diagnostic et l'analyse.

Les progrès technologiques conduisant au développement de dispositifs d'affichage avancés et innovants font grimper le coût de ces dispositifs. Ainsi, le coût élevé des dispositifs d'affichage devrait freiner la croissance du marché.

Développements récents

- En juin 2022, EIZO Corporation a lancé le RadiForce MX243W, un moniteur de 24,1 pouces et 2,3 mégapixels (1920 x 1200 pixels). Le moniteur de 24,1 pouces et 2,3 mégapixels (1920 x 1200 pixels) a été conçu pour une surveillance et un diagnostic minutieux de la physiologie complète du système du patient dans les cliniques et les hôpitaux. Le lancement a permis l'ajout d'un nouveau dispositif médical au portefeuille et a offert une pureté de marché exceptionnelle

- En mai 2021, Barco a lancé l'écran médical Nio Fusion 12MP. Le lancement du produit a donné lieu à un portefeuille de produits amélioré et à une augmentation des ventes et à l'expansion de la gamme de produits d'affichage médical en Amérique du Nord et en Europe

Portée du marché mondial des écrans médicaux

Le marché mondial des écrans médicaux est divisé en treize segments notables qui sont basés sur la technologie, la taille du panneau, le mode d'affichage, le mégapixel, la résolution, le type d'affichage, la technologie d'imagerie, la couleur d'affichage, le rapport hauteur/largeur, le composant, l'application, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR TECHNOLOGIE

- ÉCRAN LCD RÉTROÉCLAIRÉ PAR LED

- ÉCRAN LCD RÉTROÉCLAIRÉ CCFL

- ÉCRAN LCD TFT

- ÉCRAN OLED

Sur la base de la technologie, le marché de l'affichage médical est segmenté en écran LCD rétroéclairé par LED, écran LCD rétroéclairé par CCFL, écran LCD TFT et écran OLED.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR TAILLE DE PANNEAU

- PANNEAUX DE MOINS DE 22,9 POUCES

- PANNEAUX DE 23,0 À 26,9 POUCES

- PANNEAUX DE 27,0 À 41,9 POUCES

- PANNEAUX DE PLUS DE 42 POUCES

Sur la base de la taille du panneau, le marché de l'affichage médical est segmenté en panneaux de moins de 22,9 pouces, panneaux de 23,0 à 32,0 pouces, panneaux de 27,0 à 41,9 pouces et panneaux de plus de 42 pouces.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR MODE DE VISUALISATION

- 2D

- 3D

Sur la base du mode de visualisation, le marché de l’affichage médical est segmenté en 2D et 3D.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR MÉGAPIXEL

- JUSQU'À 2MP

- 2,1 à 4 MP

- 4,1 à 8 MP

- AU-DESSUS DE 8MP

Sur la base des mégapixels, le marché des écrans médicaux est segmenté en JUSQU'À 2 MP, 2,1-4 MP, 4,1-8 MP et plus de 8 MP.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR RÉSOLUTION

- Full HD

- Ultra Full HD

- 4K

- AUTRES

Sur la base de la résolution, le marché de l'affichage médical est segmenté en Full HD, ultra-full HD, 4K et autres.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR TYPE D'AFFICHAGE

- MONTAGE MURAL

- PORTABLE

- MODULAIRE

Sur la base du type d'affichage, le marché des écrans médicaux est segmenté en écrans muraux, portables et modulaires.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR TECHNOLOGIE D'IMAGERIE

- ÉCRAN TACTILE

- VERRE DE POLICE RÉSISTANT AUX RAYURES

- MODE DE SÉCURITÉ INTÉGRÉE

- OPTIONS DE NETTOYAGE

- SOFTGLOW ET SPOTVIEW

- AUTRES

Sur la base de la technologie d'imagerie, le marché de l'affichage médical est segmenté en écran tactile, verre de police résistant aux rayures, mode de sécurité intégrée, options de nettoyage, softglow et spotview et autres.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR COULEUR D'AFFICHAGE

- COULEUR

- MONOCHROME

Sur la base de la couleur d'affichage, le marché de l'affichage médical est segmenté en couleur et monochrome.

MARCHÉ MONDIAL DES ÉCRANS MÉDICAUX, PAR RAPPORT D'ASPECT

- 16:09

- 21:09

- 4:03

Sur la base du rapport hauteur/largeur, le marché de l'affichage médical est segmenté en 16:09, 21:09 et 4:03.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR COMPOSANT

- MATÉRIEL

- SERVICES

Sur la base des composants, le marché de l'affichage médical est segmenté en matériel et services.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR APPLICATION

- DIAGNOSTIC

- CHIRURGICAL/INTERVENTIONNEL

- SURVEILLANCE PORTÉE PAR LE PATIENT

- CONSULTATION

- TÉLÉSANTÉ

- ENSEIGNEMENT/PRATIQUE

- DENTISTERIE

- POINT DE SOINS

- SURVEILLANCE FŒTALE

- AUTRES

Sur la base des applications, le marché de l'affichage médical est segmenté en consultation, diagnostic, chirurgie/intervention, télésanté, enseignement/pratique, surveillance fœtale, dentisterie, point de service, surveillance portée par le patient et autres.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR UTILISATEUR FINAL

- HÔPITAUX

- PAR TECHNOLOGIE

- CLINIQUES

- ÉTABLISSEMENTS DE SOINS INFIRMIERS

- LABORATOIRES DE DIAGNOSTIC

- LABO D'IMAGERIE/RADIOLOGIE

- LABORATOIRE

- CENTRES DE RÉADAPTATION

- AUTRES

Sur la base de l'utilisateur final, le marché de l'affichage médical est segmenté en hôpitaux, cliniques, établissements de soins infirmiers, laboratoires de diagnostic, laboratoires d'imagerie/radiologie, laboratoires, centres de rééducation et autres.

MARCHÉ MONDIAL DE L'AFFICHAGE MÉDICAL, PAR CANAL DE DISTRIBUTION

- APPEL D'OFFRES DIRECT

- VENTES AU DÉTAIL

- AUTRES

Sur la base du canal de distribution, le marché de l'affichage médical est segmenté en appels d'offres directs, ventes au détail et autres.

Analyse/perspectives régionales du marché de l'affichage médical

Le marché de l'affichage médical est analysé et des informations sur la taille du marché sont fournies sur la technologie, la taille du panneau, le mode de visualisation, les mégapixels, la résolution, le type d'affichage, la technologie d'imagerie, la couleur d'affichage, le rapport hauteur/largeur, le composant, l'application, l'utilisateur final et le canal de distribution.

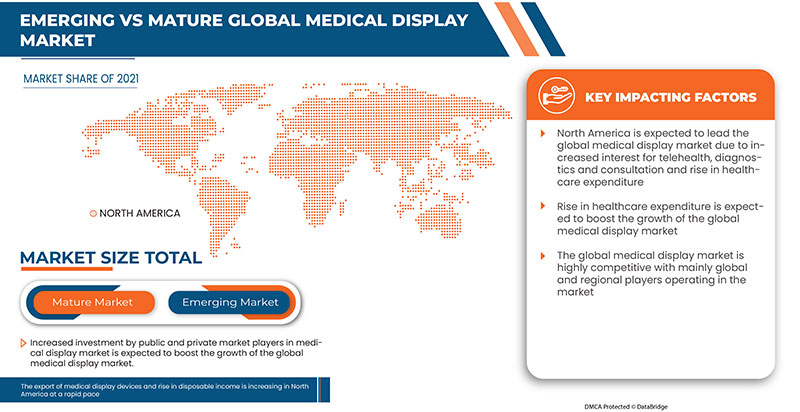

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada, le Mexique, l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, la Russie, la Suisse, les Pays-Bas, la Turquie, la Belgique, le reste de l'Europe, la Chine, le Japon, l'Inde, l'Australie, la Corée du Sud, Singapour, la Thaïlande, la Malaisie, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique, le Brésil, l'Argentine, le reste de l'Amérique du Sud, l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, Israël, l'Égypte et le reste du Moyen-Orient et de l'Afrique.

L'Asie-Pacifique devrait dominer le marché, car il s'agit du plus grand marché mondial des dispositifs médicaux. La Chine domine la région Asie-Pacifique en raison de la croissance rapide du marché des soins de santé et de l'augmentation de la production d'écrans médicaux.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des écrans médicaux

Le paysage concurrentiel du marché de l'affichage médical fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché de l'affichage médical.

Français Certains des principaux acteurs opérant sur le marché sont BenQ, ALPINION MEDICAL SYSTEMS Co., Ltd, Nanjing Jusha Commercial & Trading Co, Ltd, COJE CO., LTD., Axiomtek Co., Ltd., Dell Inc., HP Development Company, LP, Reshin, Onyx Healthcare Inc., Teguar Computers., Shenzhen Beacon Display Technology Co., Ltd., Rein Medical, STERIS., Barco., Hisense., Sony Corporation, Advantech Co., Ltd., LG Electronics., Sharp NEC Display Solutions, Koninklijke Philips NV, EIZO INC., Novanta Inc. , FSN Medical Technologies., Quest, Ampronix., Siemens Healthcare GmbH, Panasonic Corporation, entre autres.

Méthodologie de recherche : Marché de l'affichage médical

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché de l'entreprise, les normes de mesure, l'analyse mondiale et régionale et l'analyse des parts des fournisseurs. Veuillez demander un appel à l'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MEDICAL DISPLAY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TECHNOLOGYLIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 TECHNOLOGICAL LANDSCAPE IN THE GLOBAL MEDICAL DISPLAY MARKET

3.3.1 ORGANIC LIGHT EMITTING DIODE (OLED)

3.3.2 LIGHT EMITTING DIODE (LED), TECHNOLOGY

3.3.3 LIQUID CRYSTAL DISPLAY (LCD)

4 VALUE CHAIN ANALYSIS: GLOBAL MEDICAL DISPLAY MARKET

5 GLOBAL MEDICAL DISPLAY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING TREND TOWARDS MINIMALLY INVASIVE TREATMENT

6.1.2 GROWING HEALTHCARE INFRASTRUCTURE

6.1.3 SURGE IN THE NUMBER OF DIAGNOSTIC IMAGING CENTERS

6.2 RESTRAINTS

6.2.1 INCREASE IN USE OF REFURBISHED MEDICAL DISPLAYS

6.2.2 MEDICAL COMMUNITY HAS ATTEMPTED TO TAKE ADVANTAGE

6.2.3 HIGH COSTS OF MEDICAL DISPLAY DEVICES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DISPLAY INSTRUMENTS

6.3.3 RISING DISPOSABLE INCOME

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 STRINGENT REGULATIONS

7 GLOBAL MEDICAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LED BACKLIT LCD DISPLAY

7.3 CCFL BACKLIT LCD DISPLAY

7.4 TFT BACKLIT LCD DISPLAY

7.5 OLED DISPLAY

7.5.1 AMOLED

7.5.2 PMOLED

8 GLOBAL MEDICAL DISPLAY MARKET, BY PANEL SIZE

8.1 OVERVIEW

8.2 LESS THAN 22.9

8.2.1 LED BACKLIT LCD DISPLAY

8.2.2 CCFL BACKLIT LCD DISPLAY

8.2.3 TFT BACKLIT LCD DISPLAY

8.2.4 OLED DISPLAY

8.3 23.0- 32.0

8.3.1 LED BACKLIT LCD DISPLAY

8.3.2 CCFL BACKLIT LCD DISPLAY

8.3.3 TFT BACKLIT LCD DISPLAY

8.3.4 OLED DISPLAY

8.4 32.1-42.0

8.4.1 LED BACKLIT LCD DISPLAY

8.4.2 CCFL BACKLIT LCD DISPLAY

8.4.3 TFT BACKLIT LCD DISPLAY

8.4.4 OLED DISPLAY

8.5 MORE THAN 42

8.5.1 LED BACKLIT LCD DISPLAY

8.5.2 CCFL BACKLIT LCD DISPLAY

8.5.3 TFT BACKLIT LCD DISPLAY

8.5.4 OLED DISPLAY

9 GLOBAL MEDICAL DISPLAY MARKET, BY VIEWING MODE

9.1 OVERVIEW

9.2 2D

9.3 3D

10 GLOBAL MEDICAL DISPLAY MARKET, BY MEGAPIXEL

10.1 OVERVIEW

10.2 2.1-4MP

10.3 4.1-8MP

10.4 ABOVE 8MP

10.5 UPTO 2MP

11 GLOBAL MEDICAL DISPLAY MARKET, BY RESOLUTION

11.1 OVERVIEW

11.2 4K

11.3 ULTRA FULL HD

11.4 FULL HD

11.5 OTHERS

12 GLOBAL MEDICAL DISPLAY MARKET, BY DISPLAY TYPE

12.1 OVERVIEW

12.2 WALL MOUNTED

12.3 PORTABLE

12.4 MODULAR

13 GLOBAL MEDICAL DISPLAY MARKET, BY DISPLAY COLOR

13.1 OVERVIEW

13.2 COLOR

13.2.1 LED BACKLIT LCD DISPLAY

13.2.2 CCFL BACKLIT LCD DISPLAY

13.2.3 TFT BACKLIT LCD DISPLAY

13.2.4 OLED DISPLAY

13.3 MONOCHROME

13.3.1 LED BACKLIT LCD DISPLAY

13.3.2 CCFL BACKLIT LCD DISPLAY

13.3.3 TFT BACKLIT LCD DISPLAY

13.3.4 OLED DISPLAY

14 GLOBAL MEDICAL DISPLAY MARKET, BY COMPONENT

14.1 OVERVIEW

14.2 HARDWARE

14.2.1 ACCESSORIES

14.2.2 SENSORS

14.2.3 PANELS

14.2.4 OTHERS

14.3 SERVICES

14.3.1 CONSULTING

14.3.2 INSTALLATION

14.3.3 AFTER-SALE SERVICES

15 GLOBAL MEDICAL DISPLAY MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 DIAGNOSTICS

15.2.1 BY TYPE

15.2.1.1 GENERAL RADIOLOGY

15.2.1.2 MAMMOGRAPHY

15.2.1.3 DIGITAL PATHOLOGY

15.2.1.4 MULTI-MODALITY

15.2.2 BY PANEL SIZE

15.2.2.1 LESS THAN 22.9

15.2.2.2 23.0- 32.0

15.2.2.3 32.1-42.0

15.2.2.4 MORE THAN 42

15.3 SURGICAL/INTERVENTIONAL

15.3.1 BY TYPE

15.3.1.1 CARDIOVASCULAR

15.3.1.2 ONCOLOGY

15.3.1.3 NEUROLOGY

15.3.1.4 OPHTHALMOLOGY

15.3.1.5 OTHERS

15.3.2 BY PANEL SIZE

15.3.2.1 LESS THAN 22.9

15.3.2.2 23.0- 32.0

15.3.2.3 32.1-42.0

15.3.2.4 MORE THAN 42

15.4 PATIENT WORN MONITORING

15.5 CONSULTATION

15.6 TELEHEALTH

15.6.1 BY PANEL SIZE

15.6.1.1 LESS THAN 22.9

15.6.1.2 23.0- 32.0

15.6.1.3 32.1-42.0

15.6.1.4 MORE THAN 42

15.7 TEACHING/PRACTICE

15.7.1 BY PANEL SIZE

15.7.1.1 LESS THAN 22.9

15.7.1.2 23.0- 32.0

15.7.1.3 32.1-42.0

15.7.1.4 MORE THAN 42

15.8 DENTISTRY

15.8.1 BY PANEL SIZE

15.8.1.1 LESS THAN 22.9

15.8.1.2 23.0- 32.0

15.8.1.3 32.1-42.0

15.8.1.4 MORE THAN 42

15.9 POINT OF CARE

15.9.1 BY PANEL SIZE

15.9.1.1 LESS THAN 22.9

15.9.1.2 23.0- 32.0

15.9.1.3 32.1-42.0

15.9.1.4 MORE THAN 42

15.1 FETAL MONITORING

15.10.1 BY PANEL SIZE

15.10.1.1 LESS THAN 22.9

15.10.1.2 23.0- 32.0

15.10.1.3 32.1-42.0

15.10.1.4 MORE THAN 42

15.11 OTHERS

16 GLOBAL MEDICAL DISPLAY MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 BY AREA

16.2.1.1 OPERATING ROOM

16.2.1.2 SURGERY UNIT

16.2.1.3 OTHERS

16.2.2 BY TECHNOLOGY

16.2.2.1 LED BACKLIT LCD DISPLAY

16.2.2.2 CCFL BACKLIT LCD DISPLAY

16.2.2.3 TFT BACKLIT LCD DISPLAY

16.2.2.4 OLED DISPLAY

16.2.3 CLINICS

16.2.3.1 LED BACKLIT LCD DISPLAY

16.2.3.2 CCFL BACKLIT LCD DISPLAY

16.2.3.3 TFT BACKLIT LCD DISPLAY

16.2.3.4 OLED DISPLAY

16.2.4 NURSING FACILITIES

16.2.4.1 LED BACKLIT LCD DISPLAY

16.2.4.2 CCFL BACKLIT LCD DISPLAY

16.2.4.3 TFT BACKLIT LCD DISPLAY

16.2.4.4 OLED DISPLAY

16.2.5 DIAGNOSTIC LABORATORIES

16.2.5.1 LED BACKLIT LCD DISPLAY

16.2.5.2 CCFL BACKLIT LCD DISPLAY

16.2.5.3 TFT BACKLIT LCD DISPLAY

16.2.5.4 OLED DISPLAY

16.3 IMAGING/ RADIOLOGY LABORATORY

16.3.1 LABORATORY

16.3.1.1 LED BACKLIT LCD DISPLAY

16.3.1.2 CCFL BACKLIT LCD DISPLAY

16.3.1.3 TFT BACKLIT LCD DISPLAY

16.3.1.4 OLED DISPLAY

16.3.2 REHABILITATION CENTERS

16.3.2.1 LED BACKLIT LCD DISPLAY

16.3.2.2 CCFL BACKLIT LCD DISPLAY

16.3.2.3 TFT BACKLIT LCD DISPLAY

16.3.2.4 OLED DISPLAY

16.4 OTHERS

17 GLOBAL MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY

17.1 OVERVIEW

17.2 TOUCH SCREEN

17.3 SCRATCH RESISTANT FONT GLASS

17.4 FAILSAFE MODE

17.5 CLEANABLE OPTIONS

17.6 SOFTGLOW & SPOTVIEW

17.7 OTHERS

18 GLOBAL MEDICAL DISPLAY MARKET, BY ASPECT RATIO

18.1 OVERVIEW

18.2 12/30/1899 4:09:00 PM

18.3 12/30/1899 9:09:00 PM

18.4 12/30/1899 4:03:00 AM

19 GLOBAL MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 DIRECT TENDERS

19.3 RETAIL SALES

19.4 OTHERS

20 GLOBAL MEDICAL DISPLAY MARKET, BY GEOGRAPHY

20.1 OVERVIEW

20.2 NORTH AMERICA

20.2.1 U.S.

20.2.2 CANADA

20.2.3 MEXICO

20.3 ASIA-PACIFIC

20.3.1 CHINA

20.3.2 JAPAN

20.3.3 SOUTH KOREA

20.3.4 INDIA

20.3.5 AUSTRALIA

20.3.6 SINGAPORE

20.3.7 THAILAND

20.3.8 MALAYSIA

20.3.9 INDONESIA

20.3.10 PHILIPPINES

20.3.11 REST OF ASIA-PACIFIC

20.4 EUROPE

20.4.1 GERMANY

20.4.2 FRANCE

20.4.3 U.K.

20.4.4 ITALY

20.4.5 RUSSIA

20.4.6 SPAIN

20.4.7 TURKEY

20.4.8 NETHERLANDS

20.4.9 SWITZERLAND

20.4.10 BELGIUM

20.4.11 REST OF EUROPE

20.5 SOUTH AMERICA

20.5.1 BRAZIL

20.5.2 ARGENTINA

20.5.3 REST OF SOUTH AMERICA

20.6 MIDDLE EAST AND AFRICA

20.6.1 SOUTH AFRICA

20.6.2 SAUDI ARABIA

20.6.3 U.A.E

20.6.4 EGYPT

20.6.5 ISRAEL

20.6.6 REST OF MIDDLE EAST AND AFRICA

21 GLOBAL MEDICAL DISPLAY MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 ADVANTECH CO., LTD

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 COMPANY SHARE ANALYSIS

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 HP DEVELOPMENT COMPANY, L.P

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 COMPANY SHARE ANALYSIS

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENT

23.3 DELL INC.

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 COMPANY SHARE ANALYSIS

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 ALPINION MEDICAL SYSTEMS CO., LTD

23.4.1 COMPANY SNAPSHOT

23.4.2 COMPANY SHARE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 STERIS

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 COMPANY SHARE ANALYSIS

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENT

23.6 AMPRONIX

23.6.1 COMPANY SNAPSHOT

23.6.2 PRODUCT PORTFOLIO

23.6.3 RECENT DEVELOPMENT

23.7 AXIOMTEK CO., LTD.

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 BARCO

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 BENQ

23.9.1 COMPANY SNAPSHOT

23.9.2 PRODUCT PORTFOLIO

23.9.3 RECENT DEVELOPMENTS

23.1 COJE CO., LTD.

23.10.1 COMPANY SNAPSHOT

23.10.2 PRODUCT PORTFOLIO

23.10.3 RECENT DEVELOPMENTS

23.11 EIZO INC (2021)

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENT

23.12 FSN MEDICAL TECHNOLOGIES.

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 HISENSE MEDICAL EQUIPMENT CO, LTD (A SUBSIDIARY OF HISENSE GROUP)

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENT

23.14 KONINKLIJKE PHILIPS N.V.( 2021)

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENT

23.15 LG DISPLAY CO., LTD.

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENT

23.16 NANJING JUSHA COMMERCIAL &TRADING CO,LTD

23.16.1 COMPANY SNAPSHOT

23.16.2 PRODUCT PORTFOLIO

23.16.3 RECENT DEVELOPMENTS

23.17 NOVANTA INC. (2021)

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 ONYX HEALTHCARE INC. (SUBSIDIARY OF AAEON TECHNOLOGY INC.)

23.18.1 COMPANY SNAPSHOT

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 PANASONIC HOLDINGS CORPORATION

23.19.1 COMPANY SNAPSHOT

23.19.2 REVENUE ANALYSIS

23.19.3 RECENT DEVELOPMENT

23.2 QUEST MEDICAL, INC. (A SUBSIDIARY OF ATRION CORPORATION)

23.20.1 COMPANY SNAPSHOT

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 REIN MEDICAL GMBH

23.21.1 COMPANY SNAPSHOT

23.21.2 PRODUCT PORTFOLIO

23.21.3 RECENT DEVELOPMENTS

23.22 SHARP NEC DISPLAY SOLUTIONS ( 2021)

23.22.1 COMPANY SNAPSHOT

23.22.2 PRODUCT PORTFOLIO

23.22.3 RECENT DEVELOPMENTS

23.23 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.

23.23.1 COMPANY SNAPSHOT

23.23.2 PRODUCT PORTFOLIO

23.23.3 RECENT DEVELOPMENT

23.24 SHENZHEN JLD DISPLAY EXPERT CO., LTD

23.24.1 COMPANY SNAPSHOT

23.24.2 PRODUCT PORTFOLIO

23.24.3 RECENT DEVELOPMENTS

23.25 SIEMENS HEALTHCARE GMBH

23.25.1 COMPANY SNAPSHOT

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT DEVELOPMENT

23.26 SONY GROUP CORPORATION

23.26.1 COMPANY SNAPSHOT

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT DEVELOPMENT

23.27 TEGUAR COMPUTERS

23.27.1 COMPANY SNAPSHOT

23.27.2 PRODUCT PORTFOLIO

23.27.3 RECENT DEVELOPMENTS

24 QUESTIONNAIRE

25 RELATED REPORTS

Liste des tableaux

TABLE 1 GLOBAL MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL LED BACKLIT LCD DISPLAY MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL CCFL BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL TFT BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL OLED DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL OLED DISPLAY TYPE IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL 32.1-42.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL 32.1-40.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL MEDICAL DISPLAY MARKET, BY VIEWING MODE, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL 2D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL 3D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL MEDICAL DISPLAY MARKET, BY MEGAPIXEL, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL 2.1-4MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL 4.1-8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL ABOVE 8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL UPTO 2MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL MEDICAL DISPLAY MARKET, BY RESOLUTION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL 4K IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL ULTRA FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL MEDICAL DISPLAY MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL WALL MOUNTED IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL PORTABLE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL MODULAR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL MEDICAL DISPLAY MARKET, BY DISPLAY COLOR, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL COLOR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL COLOR IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL MONOCHROME IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 GLOBAL MONOCHROME IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 GLOBAL MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 39 GLOBAL HARDWARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL HARDWARE IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 41 GLOBAL SERVICES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL SERVICES IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 GLOBAL MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 GLOBAL DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 GLOBAL DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 GLOBAL BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 GLOBAL BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 GLOBAL SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 GLOBAL SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 GLOBAL BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 GLOBAL BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 GLOBAL PATIENT WORN MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 GLOBAL CONSULTATION IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 GLOBAL TELEHEALTH IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 GLOBAL TELEHEALTH IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 56 GLOBAL TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 GLOBAL TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 58 GLOBAL DENTISTRY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 GLOBAL DENTISTRY IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 60 GLOBAL POINT OF CARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 GLOBAL POINT OF CARE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 62 GLOBAL FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 GLOBAL FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 64 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 GLOBAL MEDICAL DISPLAY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 GLOBAL HOSPITALS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 GLOBAL HOSPITALS IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 68 GLOBAL BY AREA IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 69 GLOBAL BY TECHNOLOGY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 GLOBAL CLINICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 GLOBAL CLINICS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 GLOBAL NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 GLOBAL NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 GLOBAL DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 75 GLOBAL DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 GLOBAL IMAGING/ RADIOLOGY LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 GLOBAL LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 GLOBAL LABORATORY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 GLOBAL REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 GLOBAL REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 GLOBAL MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 GLOBAL TOUCH SCREEN IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 GLOBAL SCRATCH RESISTANT FONT GLASS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 GLOBAL FAILSAFE MODE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 GLOBAL CLEANABLE OPTIONS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 GLOBAL SOFTGLOW & SPOTVIEW IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 89 GLOBAL MEDICAL DISPLAY MARKET, BY ASPECT RATIO, 2020-2029 (USD MILLION)

TABLE 90 GLOBAL 16:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 91 GLOBAL 21:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 GLOBAL 4:03 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 93 GLOBAL MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 GLOBAL DIRECT TENDERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 95 GLOBAL RETAIL SALES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL MEDICAL DISPLAYMARKET: SEGMENTATION

FIGURE 2 GLOBAL MEDICAL DISPLAYMARKET : DATA TRIANGULATION

FIGURE 3 GLOBAL MEDICAL DISPLAYMARKET: DROC ANALYSIS

FIGURE 4 GLOBAL MEDICAL DISPLAYMARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL MEDICAL DISPLAYMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL MEDICAL DISPLAYMARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL MEDICAL DISPLAYMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL MEDICAL DISPLAYMARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL MEDICAL DISPLAYMARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL MEDICAL DISPLAYMARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL MEDICAL DISPLAY MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL MEDICAL DISPLAY MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS IN MEDICAL DISPLAYIS DRIVING THE GLOBAL MEDICAL DISPLAYMARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 TECHNOLOGYSEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL MEDICAL DISPLAYMARKET IN 2022 & 2029

FIGURE 15 NORTH AMERICA IS THE FASTEST GROWING MARKET FOR MEDICAL DISPLAY AND ASIA-PACIFIC IS ESTIMATED TO BE INCREASING WITH A STRONG CAGR IN THE FORECAST PERIOD FROM 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MEDICAL DISPLAY MARKET

FIGURE 17 GLOBAL MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2021

FIGURE 18 GLOBAL MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 19 GLOBAL MEDICAL DISPLAY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 20 GLOBAL MEDICAL DISPLAY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 21 GLOBAL MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2021

FIGURE 22 GLOBAL MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2022-2029 (USD MILLION)

FIGURE 23 GLOBAL MEDICAL DISPLAY MARKET : BY PANEL SIZE, CAGR (2022-2029)

FIGURE 24 GLOBAL MEDICAL DISPLAY MARKET : BY PANEL SIZE, LIFELINE CURVE

FIGURE 25 GLOBAL MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2021

FIGURE 26 GLOBAL MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2022-2029 (USD MILLION)

FIGURE 27 GLOBAL MEDICAL DISPLAY MARKET : BY VIEWING MODE, CAGR (2022-2029)

FIGURE 28 GLOBAL MEDICAL DISPLAY MARKET : BY VIEWING MODE, LIFELINE CURVE

FIGURE 29 GLOBAL MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2021

FIGURE 30 GLOBAL MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2022-2029 (USD MILLION)

FIGURE 31 GLOBAL MEDICAL DISPLAY MARKET : BY MEGAPIXEL, CAGR (2022-2029)

FIGURE 32 GLOBAL MEDICAL DISPLAY MARKET : BY MEGAPIXEL, LIFELINE CURVE

FIGURE 33 GLOBAL MEDICAL DISPLAY MARKET : BY RESOLUTION, 2021

FIGURE 34 GLOBAL MEDICAL DISPLAY MARKET : BY RESOLUTION, 2022-2029 (USD MILLION)

FIGURE 35 GLOBAL MEDICAL DISPLAY MARKET : BY RESOLUTION, CAGR (2022-2029)

FIGURE 36 GLOBAL MEDICAL DISPLAY MARKET : BY RESOLUTION, LIFELINE CURVE

FIGURE 37 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2021

FIGURE 38 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2022-2029 (USD MILLION)

FIGURE 39 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, CAGR (2022-2029)

FIGURE 40 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, LIFELINE CURVE

FIGURE 41 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2021

FIGURE 42 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2022-2029 (USD MILLION)

FIGURE 43 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, CAGR (2022-2029)

FIGURE 44 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, LIFELINE CURVE

FIGURE 45 GLOBAL MEDICAL DISPLAY MARKET : BY COMPONENT, 2021

FIGURE 46 GLOBAL MEDICAL DISPLAY MARKET : BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 47 GLOBAL MEDICAL DISPLAY MARKET : BY COMPONENT, CAGR (2022-2029)

FIGURE 48 GLOBAL MEDICAL DISPLAY MARKET : BY COMPONENT, LIFELINE CURVE

FIGURE 49 GLOBAL MEDICAL DISPLAY MARKET: BY APPLICATION, 2021

FIGURE 50 GLOBAL MEDICAL DISPLAY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 51 GLOBAL MEDICAL DISPLAY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 52 GLOBAL MEDICAL DISPLAY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 53 GLOBAL MEDICAL DISPLAY MARKET: BY END USER, 2021

FIGURE 54 GLOBAL MEDICAL DISPLAY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 55 GLOBAL MEDICAL DISPLAY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 56 GLOBAL MEDICAL DISPLAY MARKET: BY END USER, LIFELINE CURVE

FIGURE 57 GLOBAL MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2021

FIGURE 58 GLOBAL MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 59 GLOBAL MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, CAGR (2022-2029)

FIGURE 60 GLOBAL MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, LIFELINE CURVE

FIGURE 61 GLOBAL MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2021

FIGURE 62 GLOBAL MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2022-2029 (USD MILLION)

FIGURE 63 GLOBAL MEDICAL DISPLAY MARKET: BY ASPECT RATIO, CAGR (2022-2029)

FIGURE 64 GLOBAL MEDICAL DISPLAY MARKET: BY ASPECT RATIO, LIFELINE CURVE

FIGURE 65 GLOBAL MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 66 GLOBAL MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 67 GLOBAL MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 68 GLOBAL MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 69 GLOBAL MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 70 GLOBAL MEDICAL DISPLAY MARKET: BY REGION (2021)

FIGURE 71 GLOBAL MEDICAL DISPLAY MARKET: BY REGION (2022 & 2029)

FIGURE 72 GLOBAL MEDICAL DISPLAY MARKET: BY REGION (2021 & 2029)

FIGURE 73 GLOBAL MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 74 NORTH AMERICA MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 75 NORTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 76 NORTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 77 NORTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 78 NORTH AMERICA MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 79 ASIA-PACIFIC MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 80 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 81 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 82 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 83 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 84 EUROPE MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 85 EUROPE MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 86 EUROPE MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 87 EUROPE MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 88 EUROPE MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 89 SOUTH AMERICA MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 90 SOUTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 91 SOUTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 92 SOUTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 93 SOUTH AMERICA MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 94 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 95 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 96 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 97 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 98 GLOBAL MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

FIGURE 99 NORTH AMERICA MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

FIGURE 100 EUROPE MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

FIGURE 101 ASIA-PACIFIC MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.