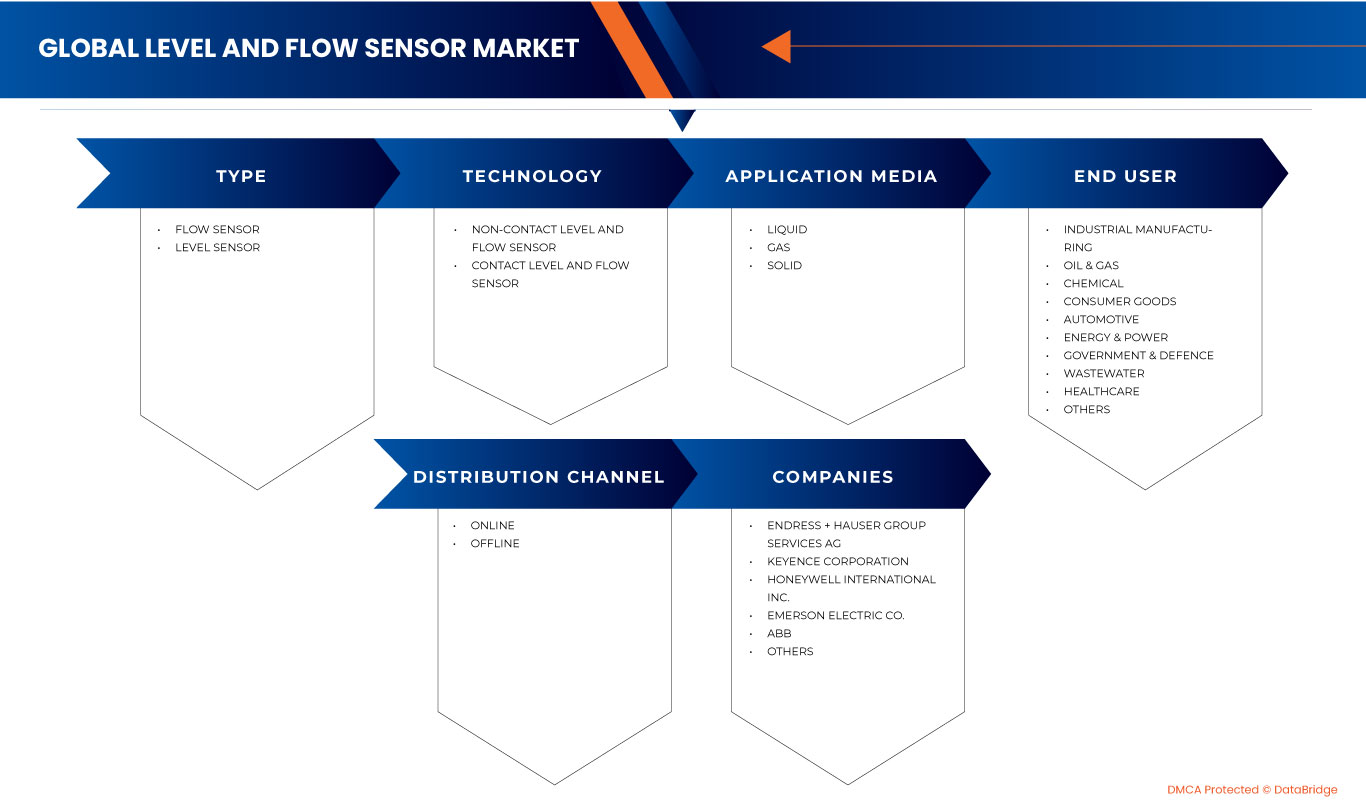

Marché mondial des capteurs de niveau et de débit, par type (capteur de débit et capteur de niveau), technologie (capteur de niveau et de débit sans contact et capteur de niveau et de débit avec contact), supports d'application (solides, liquides et gaz), utilisateur final (fabrication industrielle, pétrole et gaz, produits chimiques , biens de consommation, automobile, énergie et électricité, gouvernement et défense, eaux usées, soins de santé et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse du marché et des tailles des capteurs de niveau et de débit

Le marché mondial des capteurs de niveau et de débit fait référence au secteur de l'économie qui s'occupe de la fourniture de solutions d'alimentation électrique adaptées aux installations et aux opérations industrielles. Ce marché englobe une large gamme de produits et de services axés sur la production, la distribution et le contrôle d'énergie pour répondre aux demandes spécifiques des usines de fabrication, des usines, des entrepôts et d'autres sites industriels. Les principaux composants du marché comprennent les équipements de production d'énergie tels que les turbines à gaz , les générateurs diesel et les sources d'énergie renouvelables, les systèmes de distribution d'énergie tels que les transformateurs et les appareillages de commutation, les équipements de contrôle et de surveillance de l'énergie, les centres de contrôle des moteurs et les contrôleurs logiques programmables, et les solutions de stockage d'énergie comme les batteries. En outre, le marché comprend des services d'installation, de maintenance et de gestion de projet liés aux systèmes mondiaux de capteurs de niveau et de débit. Les facteurs qui influencent ce marché comprennent la croissance industrielle, les politiques énergétiques, les avancées technologiques et les préoccupations en matière de durabilité environnementale.

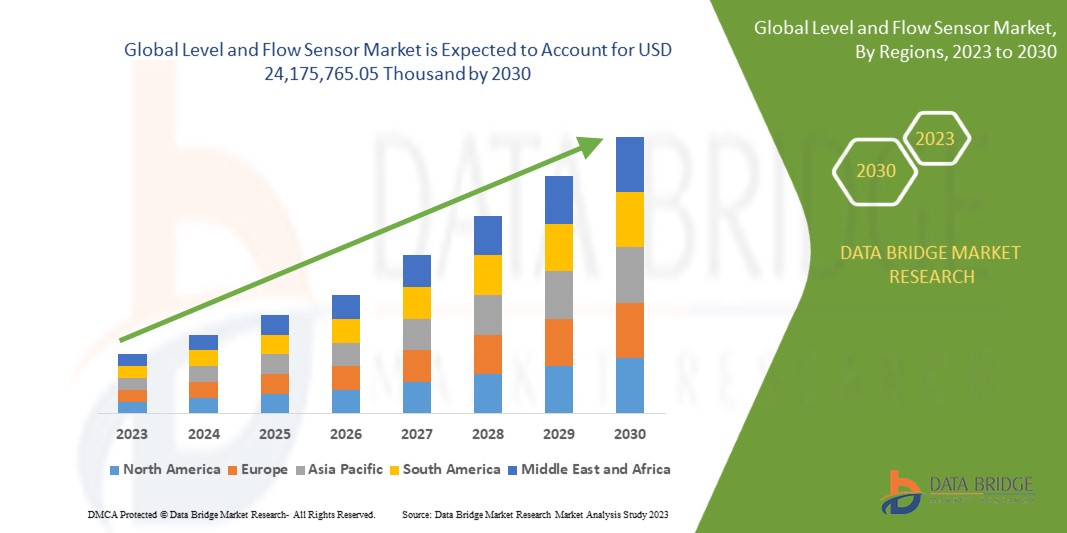

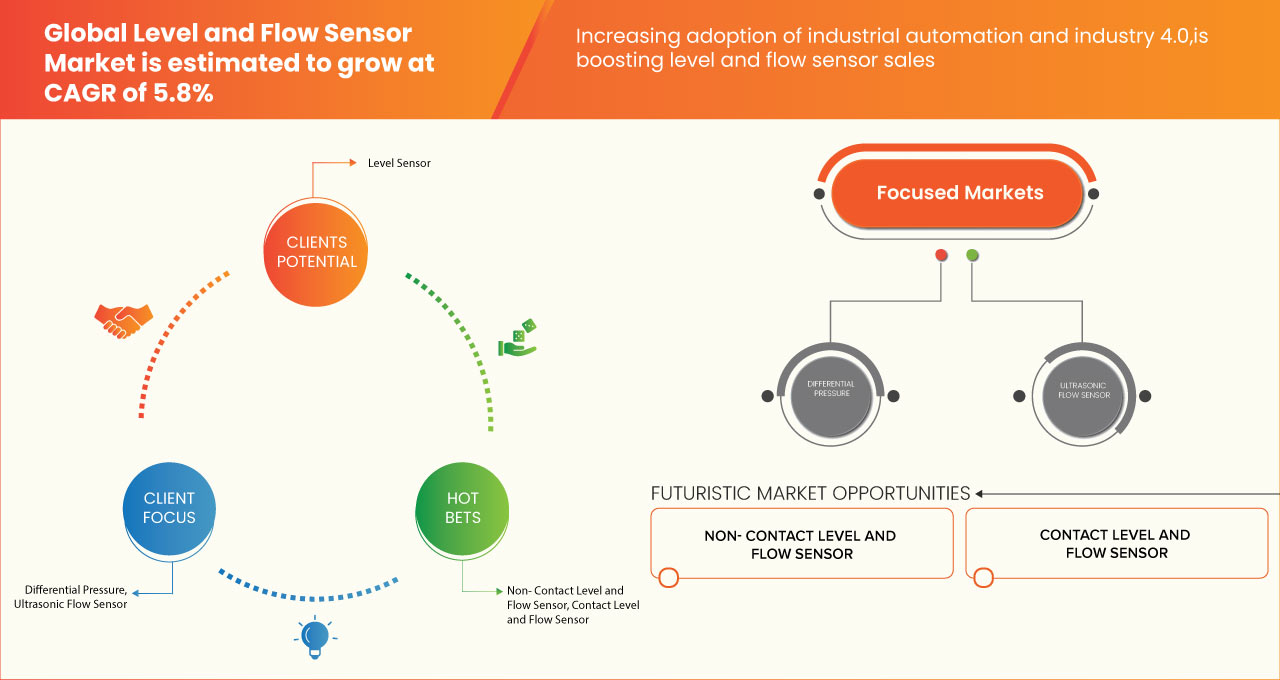

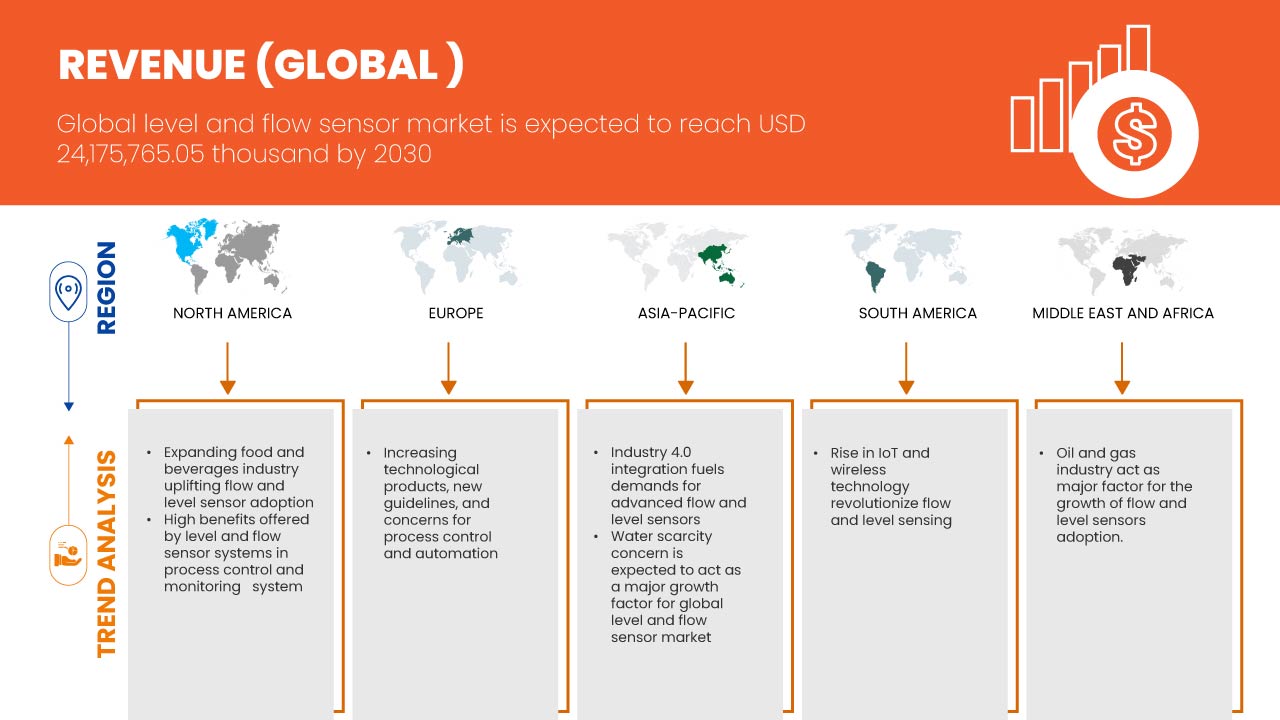

Data Bridge Market Research analyse que le marché mondial des capteurs de niveau et de débit devrait croître à un TCAC de 5,8 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 24 175 765,05 milliers USD d'ici 2030. Le rapport sur le marché des capteurs de niveau et de débit couvre également l'analyse des prix, l'analyse des brevets et les avancées technologiques en profondeur.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Type (capteur de débit et capteur de niveau), technologie (capteur de niveau et de débit sans contact et capteur de niveau et de débit avec contact), milieu d'application (solides, liquides et gaz), utilisateur final (fabrication industrielle, pétrole et gaz, produits chimiques, biens de consommation, automobile, énergie et électricité, gouvernement et défense, eaux usées, soins de santé et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Pologne, Pays-Bas, Belgique, Suisse, Danemark, Finlande, Suède, Norvège, Turquie, Reste de l'Europe, Chine, Japon, Corée du Sud, Inde, Taïwan, Australie, Thaïlande, Indonésie, Malaisie, Singapour, Nouvelle-Zélande, Philippines, Vietnam, Reste de l'Asie-Pacifique, Brésil, Argentine et reste de l'Amérique du Sud, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Koweït, Qatar, Égypte, Israël, Oman, Bahreïn et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

TE Connectivity, Temposonics (une filiale d'Amphenol Corporation), AMETEK Inc., Emerson Electric Co., KEYENCE CORPORATION, ABB, Fortive, SICK AG, OMRON Corporation, Azbil Corporation, Honeywell International Inc., Endress+Hauser Group Services AG, SSI Technologies, LLC, Balluff Automation India Pvt. Ltd, KROHNE, Siemens, Schneider Electric, Omega Engineering inc., Yokogawa Electric Corporation, ifm electronic GmbH, Baumer, Nanjing AH Electronic Science & Technology Co., Ltd., UWT GmbH, NOHKEN INC., FAFNIR GmbH, Sapcon Instruments Pvt Ltd, Anderson-Negele, Senix Ultrasonic Distance and Ultrasonic Level Sensors, GF Piping Systems, Fuelics PC, Aplus Finetek Sensor, Inc (une filiale de Finetek CO, LTD.), Pulsar Measurement et Flowline, entre autres |

Définition du marché

Le marché mondial des capteurs de niveau et de débit représente la demande, l'offre et le commerce collectifs d'appareils conçus pour mesurer et surveiller les niveaux et les débits de fluides dans diverses applications industrielles, commerciales et résidentielles. Ces capteurs jouent un rôle crucial pour assurer une gestion efficace et précise des liquides et des gaz au sein des systèmes, des processus et des équipements. Le marché englobe une large gamme de types de capteurs, de technologies et d'applications, destinés à des secteurs tels que la fabrication, le traitement chimique, la gestion de l'eau et des eaux usées et l'énergie, entre autres.

Dynamique du marché mondial des capteurs de niveau et de débit

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Adoption croissante de l'automatisation industrielle et de l'industrie 4.0

L'adoption croissante de l'automatisation industrielle dans des secteurs tels que la fabrication, la chimie et la pharmacie a entraîné une demande accrue de capteurs précis et fiables. Les capteurs de niveau et de débit fournissent des données en temps réel, aidant les industries à optimiser leurs processus, à réduire les interventions manuelles et à améliorer la productivité globale.

- Nombreuses applications des capteurs de niveau et de débit dans l'industrie pétrolière et gazière

Les capteurs de débit sont utilisés dans la fabrication pour mesurer le débit des liquides et des gaz. Ces informations sont utilisées pour contrôler le processus de production et garantir que les produits sont fabriqués conformément aux spécifications. L'automatisation est de plus en plus utilisée dans de nombreux secteurs, tels que la fabrication, l'énergie et les transports. Les capteurs de débit sont utilisés dans les systèmes d'automatisation pour mesurer le débit des fluides et contrôler le fonctionnement des machines et des équipements.

Opportunité

- Besoin croissant de précision dans diverses industries

Le besoin croissant de précision dans diverses industries crée des opportunités pour le marché mondial des capteurs de niveau et de débit. Les fabricants de capteurs de débit développent des technologies nouvelles et innovantes pour répondre aux exigences exigeantes de ces industries. En conséquence, le marché mondial des capteurs de niveau et de débit devrait connaître une croissance significative dans les années à venir.

Retenue/Défi

- Coût initial élevé des capteurs de niveau et de débit

De nombreuses industries et applications qui s'appuient sur des capteurs de niveau et de débit, comme la fabrication, le traitement de l'eau et le pétrole et le gaz, sont souvent sensibles aux coûts. Des dépenses initiales élevées peuvent dissuader les clients potentiels d'adopter ces capteurs, en particulier dans les cas où un grand nombre de capteurs est nécessaire.

Développements récents

- En mai 2023, Murata Manufacturing Co., Ltd a présenté la série EVA de condensateurs céramiques multicouches (MLCC) dotés de capacités de moulage de résine avancées, conçus pour les applications de véhicules électriques (VE) telles que les chargeurs embarqués, les onduleurs, les systèmes de gestion de batterie et le transfert d'énergie sans fil. Ces MLCC de classe Y2 certifiés en matière de sécurité présentent des tensions nominales de 305 VCA/1 500 VCC, des lignes de fuite de 10 mm et des valeurs de capacité allant de 0,1 nF à 4,7 nF, répondant aux exigences de la migration vers les groupes motopropulseurs de 800 V tout en maintenant la miniaturisation dans les systèmes automobiles modernes. L'utilisation du moulage en résine permet à ces composants compacts d'atteindre à la fois une ligne de fuite étendue et une compacité, garantissant une fiabilité à long terme dans les groupes motopropulseurs de véhicules électriques avec des tensions plus élevées.

- En mars 2023, Delta Electronics, Inc. a présenté ses alimentations industrielles et ses solutions de charge sans fil pour les robots mobiles autonomes (AMR) au Forum sur la fabrication du futur du salon international des machines-outils de Taipei (TIMTOS). Ils ont présenté l'alimentation à montage sur panneau à profil bas de la série PMT2 et la série LYTE II de type rail DIN ultra-mince pour les besoins en énergie industrielle. En outre, Delta a présenté le système de charge sans fil M∞Vair 1 kW pour les AMR et les AGV, soulignant ainsi son engagement envers des opérations d'usine intelligentes et des solutions efficaces.

- En août 2022, UWT Gmbh a reçu le prestigieux « Supplier Performance Award » de Siemens en reconnaissance de sa collaboration exceptionnelle et de ses performances exceptionnelles tout au long de l'année précédente, reflétant le solide partenariat entre les deux entreprises.

- En avril 2021, Temposonics est officiellement devenue une filiale de la prestigieuse Amphenol Corporation. Amphenol, reconnu comme l'un des plus grands fabricants mondiaux de produits d'interconnexion, est spécialisé dans les connecteurs électriques, électroniques et à fibre optique de pointe, les systèmes d'interconnexion, etc.

- En juillet 2020, Yokogawa Electric Corporation a annoncé l'extension de sa solution IoT industrielle sans fil (IIoT) Sushi Sensor avec l'introduction de nouveaux capteurs de pression et de température.

Portée du marché mondial des capteurs de niveau et de débit

Le marché mondial des capteurs de niveau et de débit est segmenté en fonction du type, de la technologie, du support d'application, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Capteur de débit

- Capteur de niveau

Sur la base du type, le marché mondial des capteurs de niveau et de débit est segmenté en capteur de débit et capteur de niveau.

Technologie

- Capteur de niveau et de débit sans contact

- Capteur de niveau et de débit à contact

Sur la base de la technologie, le marché mondial des capteurs de niveau et de débit est segmenté en capteurs de niveau et de débit sans contact et en capteurs de niveau et de débit avec contact.

Supports d'application

- Solide

- Liquide

- Gaz

Sur la base des supports d’application, le marché mondial des capteurs de niveau et de débit est segmenté en solide, liquide et gaz.

Utilisateur final

- Fabrication industrielle

- Pétrole et gaz

- Chimique

- Biens de consommation

- Automobile

- Énergie et électricité

- Gouvernement et défense

- Eaux usées

- Soins de santé

- Autres

Sur la base de l'utilisateur final, le marché mondial des capteurs de niveau et de débit est segmenté en fabrication industrielle, pétrole et gaz, produits chimiques, biens de consommation, automobile, énergie et électricité, gouvernement et défense, eaux usées, soins de santé et autres.

Canal de distribution

- Hors ligne

- En ligne

Sur la base du canal de distribution, le marché mondial des capteurs de niveau et de débit est segmenté en hors ligne et en ligne.

Analyse/perspectives régionales du marché mondial des capteurs de niveau et de débit

Le marché mondial des capteurs de niveau et de débit est analysé et des informations et tendances sur la taille du marché sont fournies par région, type, technologie, support d’application, utilisateur final et canal de distribution comme référencé ci-dessus.

Français Les pays couverts dans le rapport sur le marché mondial des capteurs de niveau et de débit sont les États-Unis, le Canada, le Mexique, l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, la Russie, la Pologne, les Pays-Bas, la Belgique, la Suisse, le Danemark, la Finlande, la Suède, la Norvège, la Turquie, le reste de l'Europe, la Chine, le Japon, la Corée du Sud, l'Inde, Taïwan, l'Australie, la Thaïlande, l'Indonésie, la Malaisie, Singapour, la Nouvelle-Zélande, les Philippines, le Vietnam, le reste de l'Asie-Pacifique, le Brésil, l'Argentine et le reste de l'Amérique du Sud, l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, le Koweït, le Qatar, l'Égypte, Israël, Oman, Bahreïn et le reste du Moyen-Orient et de l'Afrique.

L'Asie-Pacifique devrait dominer le marché mondial des capteurs de niveau et de débit en raison des nombreux lancements de produits sur les principaux marchés de la région et de la sensibilisation croissante des consommateurs. Dans la région Asie-Pacifique, la Chine devrait dominer la région, car elle est rapidement devenue un pôle mondial de fabrication et de technologie. En Amérique du Nord, les États-Unis devraient dominer, car ils possèdent l'une des économies les plus grandes et les plus développées au monde. En Europe, l'Allemagne devrait dominer, car elle est connue pour sa forte tradition d'ingénierie et sa main-d'œuvre qualifiée.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché mondiales des capteurs de niveau et de débit

Le paysage concurrentiel du marché mondial des capteurs de niveau et de débit fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Français Certains des principaux acteurs opérant sur le marché mondial des capteurs de niveau et de débit sont TE Connectivity, Temposonics (une filiale d'Amphenol Corporation), AMETEK Inc., Emerson Electric Co., KEYENCE CORPORATION, ABB, Fortive, SICK AG, OMRON Corporation, Azbil Corporation, Honeywell International Inc., Endress+Hauser Group Services AG, SSI Technologies, LLC, Balluff Automation India Pvt. Ltd, KROHNE, Siemens, Schneider Electric, Omega Engineering inc., Yokogawa Electric Corporation, ifm electronic GmbH, Baumer, Nanjing AH Electronic Science & Technology Co., Ltd., UWT GmbH, NOHKEN INC., FAFNIR GmbH, Sapcon Instruments Pvt Ltd, Anderson-Negele, Senix Ultrasonic Distance and Ultrasonic Level Sensors, GF Piping Systems, Fuelics PC, Aplus Finetek Sensor, Inc (une filiale de Finetek CO, LTD.), et Pulsar Measurement and Flowline, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL LEVEL AND FLOW SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 UPCOMING PROJECTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF INDUSTRIAL AUTOMATION AND INDUSTRY 4.0

5.1.2 CONTINUOUS ADVANCEMENTS IN SENSOR TECHNOLOGY

5.1.3 RISING AWARENESS OF SAFETY IN PROCESS CONTROL

5.1.4 WIDE APPLICATIONS OF LEVEL AND FLOW SENSORS IN THE OIL AND GAS INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH INITIAL COST OF LEVEL AND FLOW SENSORS

5.2.2 STRICT REGULATORY COMPLIANCES RELATED TO SENSOR TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 INCREASING COLLABORATION AND PARTNERSHIPS AMONG MARKET PLAYERS

5.3.2 GROWING NEED FOR ACCURACY IN VARIOUS INDUSTRIES

5.3.3 EMERGING TECHNOLOGIES, SUCH AS IIOT, ASSET MANAGEMENT, AND ADVANCED DIAGNOSTICS

5.4 CHALLENGES

5.4.1 REQUIREMENT OF TIMELY CALIBRATION AND MAINTENANCE

5.4.2 LESS AVAILABILITY OF SKILLED LABOR

5.4.3 TECHNICAL LIMITATIONS RELATED TO LEVEL AND FLOW SENSORS

6 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TYPE

6.1 OVERVIEW

6.2 FLOW SENSOR

6.2.1 DIFFERENTIAL PRESSURE

6.2.2 ULTRASONIC FLOW SENSOR

6.2.3 MAGNETIC INDUCTION FLOW SENSOR

6.2.4 VORTEX FLOW SENSOR

6.2.5 THERMAL FLOW SENSOR

6.2.6 TURBINE FLOW SENSOR

6.2.7 CURIOUS SENSOR

6.2.8 POSITIVE DISPLACEMENT FLOW SENSOR

6.2.9 OTHERS

6.3 LEVEL SENSOR

6.3.1 ULTRASONIC LEVEL SENSOR

6.3.2 CAPACITANCE LEVEL SENSOR

6.3.3 OPTICAL LEVEL SENSOR

6.3.4 CONDUCTIVITY OR RESISTANCE LEVEL SENSOR

6.3.5 VIBRATING OR TUNING FORK LEVEL SENSOR

6.3.6 FLOAT LEVEL SENSOR

6.3.7 OTHERS

7 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 NON- CONTACT LEVEL AND FLOW SENSOR

7.3 CONTACT LEVEL AND FLOW SENSOR

8 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY APPLICATION MEDIA

8.1 OVERVIEW

8.2 LIQUID

8.3 GAS

8.4 SOLID

9 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY END USER

9.1 OVERVIEW

9.2 INDUSTRIAL MANUFACTURING

9.2.1 FLOW SENSOR

9.2.2 LEVEL SENSOR

9.3 OIL & GAS

9.3.1 FLOW SENSOR

9.3.2 LEVEL SENSOR

9.4 CHEMICAL

9.4.1 FLOW SENSOR

9.4.2 LEVEL SENSOR

9.5 CONSUMER GOODS

9.5.1 FLOW SENSOR

9.5.2 LEVEL SENSOR

9.6 AUTOMOTIVE

9.6.1 FLOW SENSOR

9.6.2 LEVEL SENSOR

9.7 ENERGY & POWER

9.7.1 FLOW SENSOR

9.7.2 LEVEL SENSOR

9.8 GOVERNMENT & DEFENSE

9.8.1 FLOW SENSOR

9.8.2 LEVEL SENSOR

9.9 WASTEWATER

9.9.1 FLOW SENSOR

9.9.2 LEVEL SENSOR

9.1 HEALTHCARE

9.10.1 FLOW SENSOR

9.10.2 LEVEL SENSOR

9.11 OTHERS

9.11.1 FLOW SENSOR

9.11.2 LEVEL SENSOR

10 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 SPECIALITY STORES

10.2.2 RETAIL STORES

10.2.3 OTHERS

10.3 ONLINE

10.3.1 COMPANY WEBSITE

10.3.2 THIRD PARTY E-COMMERCE WEBSITE

11 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY REGION

11.1 OVERVIEW

11.2 NORTH AMERICA

11.2.1 U.S.

11.2.2 CANADA

11.2.3 MEXICO

11.3 EUROPE

11.3.1 GERMANY

11.3.2 U.K.

11.3.3 FRANCE

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 RUSSIA

11.3.7 POLAND

11.3.8 NETHERLANDS

11.3.9 BELGIUM

11.3.10 SWITZERLAND

11.3.11 DENMARK

11.3.12 FINLAND

11.3.13 SWEDEN

11.3.14 NORWAY

11.3.15 TURKEY

11.3.16 REST OF EUROPE

11.4 ASIA-PACIFIC

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 SOUTH KOREA

11.4.4 INDIA

11.4.5 TAIWAN

11.4.6 AUSTRALIA

11.4.7 THAILAND

11.4.8 INDONESIA

11.4.9 MALAYSIA

11.4.10 SINGAPORE

11.4.11 NEWZEALAND

11.4.12 PHILIPPINES

11.4.13 VIETNAM

11.4.14 REST OF ASIA-PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.2 U.A.E.

11.5.3 SOUTH AFRICA

11.5.4 KUWAIT

11.5.5 QATAR

11.5.6 EGYPT

11.5.7 ISRAEL

11.5.8 OMAN

11.5.9 BAHRAIN

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL LEVEL AND FLOW SENSOR MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL FLOW SENSOR MARKET

12.2 COMPANY SHARE ANALYSIS: GLOBAL LEVEL SENSOR MARKET

12.3 COMPANY SHARE ANALYSIS: NORTH AMERICA FLOW SENSOR MARKET

12.4 COMPANY SHARE ANALYSIS: NORTH AMERICA LEVEL SENSOR MARKET

12.5 COMPANY SHARE ANALYSIS: EUROPE FLOW SENSOR MARKET

12.6 COMPANY SHARE ANALYSIS: EUROPE LEVEL SENSOR MARKET

12.7 COMPANY SHARE ANALYSIS: ASIA-PACIFIC FLOW SENSOR MARKET

12.8 COMPANY SHARE ANALYSIS: ASIA-PACIFIC LEVEL SENSOR MARKET

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ENDRESS + HAUSER GROUP SERVICES AG

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 KEYENCE CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 HONEYWELL INTERNATIONAL INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 EMERSON ELECTRIC CO.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ABB

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 AMETEK INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ANDERSON-NEGELE

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 APLUS FINETEK SENSOR, INC

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 AZBIL CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BALLUFF AUTOMATION INDIA PVT. LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BAUMER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 FAFNIR GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 FLOWLINE

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 FORTIVE

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 FUELICS PC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 GF PIPING SYSTEMS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 IFM ELECTRONIC GMBH

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 KROHNE

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 NANJING AH ELECTRONIC SCIENCE & TECHNOLOGY CO., LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 NOHKEN INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 OMEGA ENGINEERING, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 OMRON CORPORATION

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 PULSAR MEASUREMENT

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 SAPCON INSTRUMENTS PVT LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 SCHNEIDER ELECTRIC

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENTS

14.26 SENIX ULTRASONIC DISTANCE AND ULTRASONIC LEVEL SENSORS

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS

14.27 SICK AG

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

14.28 SIEMENS (2022)

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 RECENT DEVELOPMENTS

14.29 SSI TECHNOLOGIESM, LLC

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

14.3 TE CONNECTIVITY

14.30.1 COMPANY SNAPSHOT

14.30.2 REVENUE ANALYSIS

14.30.3 PRODUCT PORTFOLIO

14.30.4 RECENT DEVELOPMENTS

14.31 TEMPOSONICS (A SUBSIDIARITY OF AMPHENOL CORPORATION)

14.31.1 COMPANY SNAPSHOT

14.31.2 PRODUCT PORTFOLIO

14.31.3 RECENT DEVELOPMENTS

14.32 UWT GMBH

14.32.1 COMPANY SNAPSHOT

14.32.2 PRODUCT PORTFOLIO

14.32.3 RECENT DEVELOPMENTS

14.33 YOKOGAWA ELECTRIC CORPORATION

14.33.1 COMPANY SNAPSHOT

14.33.2 REVENUE ANALYSIS

14.33.3 PRODUCT PORTFOLIO

14.33.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 OPTICAL MEASUREMENT SYSTEMS AND COST ASSOCIATED (USD)

TABLE 2 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL LEVEL SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL LEVEL SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL NON-CONTACT LEVEL AND FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL CONTACT LEVEL AND FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY APPLICATION MEDIA, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL LIQUID IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL GAS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL SOLID IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL INDUSTRIAL MANUFACTURING IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL INDUSTRIAL MANUFACTURING IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL OIL & GAS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL OIL & GAS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL CHEMICAL IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL CHEMICAL IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL CONSUMER GOODS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL CONSUMER GOODS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL AUTOMOTIVE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL AUTOMOTIVE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL ENERGY & POWER IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL ENERGY & POWER IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL GOVERNMENT & DEFENSE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL GOVERNMENT & DEFENSE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL WASTEWATER IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL WASTEWATER IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL HEALTHCARE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL HEALTHCARE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL OTHERS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL OTHERS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 36 GLOBAL OFFLINE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 GLOBAL OFFLINE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 GLOBAL ONLINE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 GLOBAL ONLINE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 MARKET SHARE OF TOP 15 COMPANIES IN GLOBAL FLOW AND LEVEL SENSOR MARKET

TABLE 41 MARKET SHARE OF TOP 15 COMPANIES IN NORTH AMERICA FLOW AND LEVEL SENSOR MARKET

TABLE 42 MARKET SHARE OF TOP 15 COMPANIES IN EUROPE FLOW AND LEVEL SENSOR MARKET

TABLE 43 MARKET SHARE OF TOP 15 COMPANIES IN ASIA-PACIFIC FLOW AND LEVEL SENSORS MARKET

Liste des figures

FIGURE 1 GLOBAL LEVEL AND FLOW SENSOR MARKET: SEGMENTATION

FIGURE 2 GLOBAL LEVEL AND FLOW SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL LEVEL AND FLOW SENSOR MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL LEVEL AND FLOW SENSOR MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL LEVEL AND FLOW SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL LEVEL AND FLOW SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL LEVEL AND FLOW SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL LEVEL SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL FLOW SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL LEVEL AND FLOW SENSOR MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 GLOBAL LEVEL AND FLOW SENSOR MARKET: MULTIVARIATE MODELLING

FIGURE 12 GLOBAL LEVEL AND FLOW SENSOR MARKET: TYPE TIMELINE CURVE

FIGURE 13 GLOBAL LEVEL AND FLOW SENSOR MARKET: SEGMENTATION

FIGURE 14 THE INCREASING ADOPTION OF INDUSTRIAL AUTOMATION AND INDUSTRY 4.0 IS EXPECTED TO BE KEY DRIVERS FOR THE GLOBAL LEVEL AND FLOW SENSOR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 FLOW SENSOR IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL LEVEL AND FLOW SENSOR MARKET IN 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL LEVEL AND FLOW SENSOR MARKET

FIGURE 17 INCREASING AUTOMATION IN INDIA (IN %)

FIGURE 18 ADVANCEMENTS IN SENSOR TECHNOLOGY

FIGURE 19 VARIOUS STRATEGIC INITIATIVES

FIGURE 20 GROWING NEED FOR ACCURACY IN VARIOUS INDUSTRIES

FIGURE 21 TOP IOT CATEGORIES BASED ON 2020 MARKET SHARE

FIGURE 22 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY TYPE, 2022

FIGURE 23 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY TECHNOLOGY, 2022

FIGURE 24 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY APPLICATION MEDIA, 2022

FIGURE 25 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY END USER, 2022

FIGURE 26 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 GOBAL LEVEL AND FLOW SENSOR MARKET: SNAPSHOT (2022)

FIGURE 28 GLOBAL FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 29 GLOBAL LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 30 NORTH AMERICA FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 31 NORTH AMERICA LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 EUROPE FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 33 EUROPE LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 34 ASIA-PACIFIC FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 35 ASIA-PACIFIC LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.