Marché mondial des interphones, par type de système (filaire et sans fil), composant (matériel, logiciel et services), type d'appareil (systèmes d'entrée de porte, appareils portables et moniteurs vidéo pour bébé), matériau (aluminium, acier inoxydable , verre trempé, plastique et autres), alimentation (moins de 20 W et plus de 20 W), contrôle d'accès (cartes, lecteurs d'empreintes digitales, cartes de proximité , accès par mot de passe, reconnaissance faciale et autres), technologie (analogique et basée sur IP), clavier (bouton mécanique et pavé tactile), type de communication (audio/vidéo et audio uniquement)), catégorie de prix (faible (moins de 100 USD), moyen (100 USD - 500 USD) et élevé (plus de 500 USD)), communication (Push-To-Talk et mains libres ou combiné (duplex)), application (extérieure et intérieure), installation (encastrée et en surface), utilisateur final (commercial, résidentiel, industries et gouvernement), canal de distribution (Hors ligne et en ligne) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des appareils d'interphonie

Le marché mondial des interphones est l'industrie collective et mondiale englobant la production, la distribution et l'utilisation de systèmes de communication conçus pour faciliter la communication vocale bidirectionnelle et souvent la communication vidéo entre des individus situés à différents endroits dans des bâtiments, des installations ou des espaces confinés. Ce marché comprend une gamme diversifiée de solutions d'interphonie, à la fois traditionnelles et technologiquement avancées, utilisées dans les secteurs résidentiel, commercial, industriel, institutionnel et public. Le marché implique le développement de matériel, de logiciels et de systèmes intégrés qui contribuent à améliorer l'efficacité, la sécurité et la commodité des communications, répondant ainsi à une variété de besoins et d'applications dans divers secteurs et environnements mondiaux.

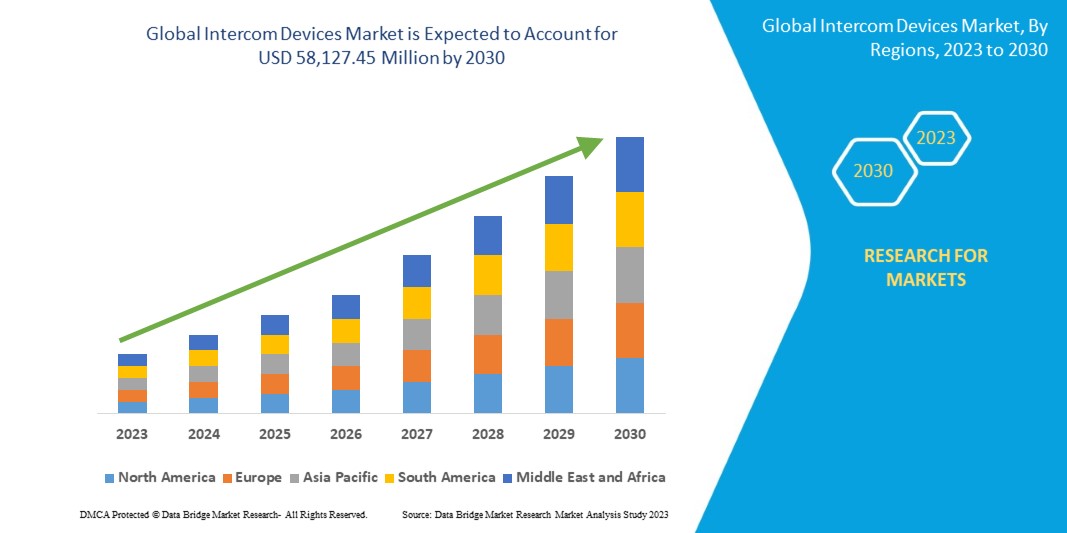

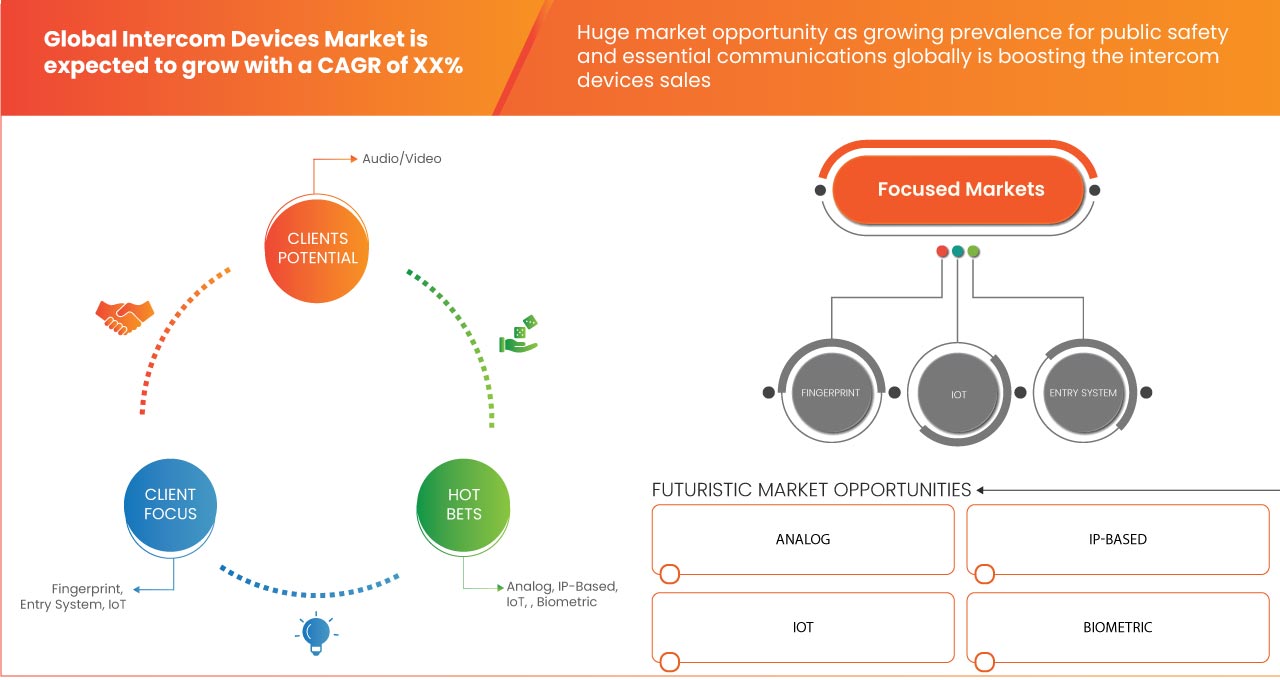

Data Bridge Market Research analyse que le marché mondial des appareils d'interphonie devrait atteindre une valeur de 58 127,45 millions USD d'ici 2030, avec un TCAC de 12,7 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type de système (filaire et sans fil), composant (matériel, logiciel et services), type d'appareil (systèmes d'entrée de porte, appareils portables et moniteurs vidéo pour bébé), matériau (aluminium, acier inoxydable, verre trempé, plastique et autres), alimentation (moins de 20 W et plus de 20 W), contrôle d'accès (cartes, lecteurs d'empreintes digitales, cartes de proximité, accès par mot de passe, reconnaissance faciale et autres), technologie (analogique et basée sur IP), clavier (bouton mécanique et pavé tactile), type de communication (audio/vidéo et audio uniquement)), catégorie de prix (faible (moins de 100 USD), moyen (100 USD à 500 USD) et élevé (plus de 500 USD)), communication (Push-To-Talk et mains libres ou combiné (duplex)), application (extérieure et intérieure), installation (encastrée et en surface), utilisateur final (commercial, résidentiel, industries et gouvernement), canal de distribution (hors ligne et en ligne) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Espagne, Italie, Pays-Bas, Russie, Suisse, Danemark, Suède, Pologne, Belgique, Turquie, Norvège, Finlande, Reste de l'Europe, Chine, Japon, Corée du Sud, Inde, Malaisie, Taïwan, Australie et Zélande, Singapour, Indonésie, Thaïlande, Philippines, Vietnam, Reste de l'Asie-Pacifique, Brésil, Argentine, Reste de l'Amérique du Sud, Afrique du Sud, Arabie saoudite, Émirats arabes unis, Koweït, Qatar, Égypte, Israël et Reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Hangzhou Hikvision Digital Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., Panasonic Holdings Corporation, Schneider Intercom GmbH (une filiale de TKH GROUP), Siedle, URMET SpA, Zicom, ABB, Aiphone Corporation, Godrej & Boyce Manufacturing Company Limited, Axis Communications AB (une filiale de Canon Group), Gira, Zenitel, The Akuvox Company, Hager Group, GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO., LTD, Schneider Electric, Alpha Communications, COMELIT SpA, FERMAX ELECTRÓNICA, SAU, TCS TürControlSysteme AG, TOA Corporation, Honeywell International Inc., Dahua Technology Co., Ltd, Legrand Group, Xiamen Leelen Technology Co., Ltd. et COMMAX, entre autres |

Définition du marché

Les interphones facilitent la communication en temps réel et sont largement adoptés dans les environnements résidentiels, commerciaux et industriels. Dans les maisons, les interphones offrent une sécurité renforcée et une communication interne pratique. Les applications industrielles impliquent des interphones pour un contrôle d'accès sécurisé. Le marché est stimulé par la demande croissante d'équipements de sécurité et d'avancées technologiques, notamment les solutions sans fil et IP, qui améliorent la portée de communication. Cependant, des défis tels que les problèmes de confidentialité et les complexités d'intégration pourraient freiner la croissance du marché. Une opportunité de marché importante réside dans l'intégration des interphones aux écosystèmes de la maison intelligente. De plus, les avancées technologiques en cours dans la qualité vidéo et audio, ainsi que l'intégration de l'IA et des services cloud, augmentent encore le potentiel du marché.

Dynamique du marché mondial des dispositifs d'interphonie

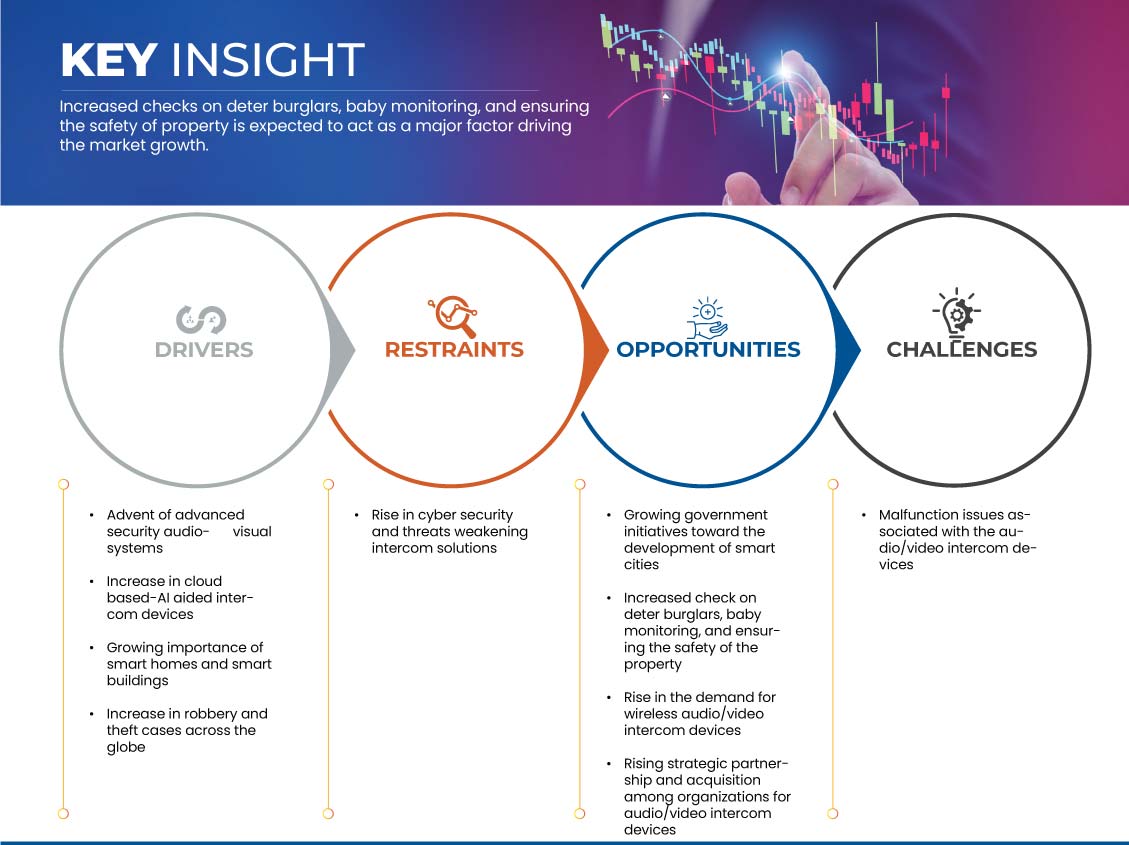

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteur

- L'avènement des systèmes audiovisuels de sécurité avancés

L’avènement des systèmes audiovisuels de sécurité avancés a considérablement transformé le paysage du marché, inaugurant une nouvelle ère de capacités améliorées en matière de communication, de surveillance et de sécurité. Cette évolution technologique a stimulé des innovations remarquables dans les dispositifs d’interphonie, augmentant leur demande dans divers secteurs et régions. Les systèmes d’interphonie traditionnels se concentraient principalement sur la communication audio. Cependant, l’intégration de systèmes audiovisuels de sécurité avancés a entraîné un changement révolutionnaire en combinant des éléments audio et vidéo. Cette convergence a permis aux utilisateurs de pouvoir non seulement entendre mais aussi voir les personnes avec lesquelles ils communiquent. Dans les contextes de sécurité, cela se traduit par des processus de vérification améliorés, car le personnel peut confirmer visuellement l’identité des visiteurs avant d’accorder l’accès. Ce niveau de vérification accru renforce les protocoles de sécurité, faisant des dispositifs d’interphonie un élément essentiel des systèmes modernes de contrôle d’accès et de surveillance, ce qui devrait stimuler la croissance du marché.

Retenue

- L'augmentation de la cybersécurité et des menaces affaiblit les solutions d'interphonie

Les problèmes de cybercriminalité/piratage informatique et de cybersécurité ont augmenté de 600 % pendant la pandémie dans tous les secteurs. Les failles de sécurité des réseaux ou des logiciels sont une faiblesse que les pirates exploitent pour effectuer des actions non autorisées au sein d'un système. Selon Purple Sec LLC, en 2018, les variantes de logiciels malveillants pour mobiles ont augmenté de 54 %, dont 98 % ciblent les appareils Android. On estime que 25 % des entreprises ont été victimes de crypto-jacking, y compris le secteur de la sécurité. Par exemple, la société Rambus a déclaré qu'environ 80 % des appareils IoT sont sujets aux cyberattaques. Le piratage peut être un vol d'identité en piratant les informations des appareils électroménagers intelligents non protégés et des appareils connectés à Internet tels que les serrures intelligentes , les serrures vidéo intelligentes, les appareils biométriques et autres. La sécurité intelligente peut également mal fonctionner s'il n'y a pas de pare-feu de protection et d'application de cybersécurité solide.

Opportunité

- Initiatives gouvernementales croissantes en faveur du développement des villes intelligentes

Les initiatives prises par le gouvernement dans les villes et communautés intelligentes sont menées par deux organes de gouvernance : un groupe de haut niveau conseillant la Commission européenne (CE) composé de hauts représentants des industries, des villes et de la société civile, et la plateforme des parties prenantes des villes intelligentes. La plateforme se concentre sur l'identification des solutions et des besoins des différents développeurs. Les villes intelligentes sont des zones urbaines qui exploitent la technologie et les solutions basées sur les données pour améliorer la qualité de vie des résidents, améliorer la durabilité et rationaliser la gestion urbaine. Les appareils d'interphonie, avec leurs capacités de communication, de sécurité et d'intégration, jouent un rôle central dans la définition de l'infrastructure de communication de ces villes intelligentes, ce qui devrait offrir des opportunités de croissance du marché.

Défi

- Problèmes de dysfonctionnement associés aux dispositifs d'interphonie

Bien que les interphones offrent de nombreux avantages en termes de communication, de sécurité et de commodité, des problèmes techniques et des dysfonctionnements peuvent nuire à leur efficacité et éroder la confiance des clients. Ces problèmes peuvent avoir un impact sur divers aspects du marché et créer des obstacles que les fabricants et les fournisseurs doivent surmonter. Les interphones sont utilisés à des fins de communication, de sécurité et de contrôle d'accès. Des dysfonctionnements tels que des appels interrompus, une mauvaise qualité audio ou un décalage vidéo peuvent susciter des inquiétudes quant à la fiabilité des appareils. Les utilisateurs peuvent hésiter à dépendre des systèmes d'interphone pour des fonctions critiques, ce qui érode la confiance et les conduit potentiellement à rechercher des solutions alternatives.

Les interphones défectueux peuvent entraîner une expérience utilisateur médiocre, frustrer les utilisateurs et diminuer la satisfaction globale. Les difficultés à initier la communication, les réponses tardives ou le son peu clair peuvent entraîner l'insatisfaction des utilisateurs et des perceptions négatives de la technologie. Les clients mécontents peuvent être moins susceptibles de recommander des interphones à d'autres, ce qui a un impact sur le bouche-à-oreille et la croissance potentielle.

Développements récents

- En septembre 2022, Hangzhou Hikvision Digital Technology Co., Ltd. a présenté son terminal de reconnaissance d'iris MinMoe, établissant de nouvelles normes en matière de sécurité du contrôle d'accès. Tirant parti des motifs d'iris uniques et stables des individus, ce terminal innovant assure une identification et une différenciation précises en une seconde seulement, même à une distance allant jusqu'à 70 cm. Son intégration de l'imagerie couleur et de la vidéo anti-contrefaçon garantit davantage de précision. L'authentification multi-méthodes du terminal, comprenant la reconnaissance de l'iris, la reconnaissance faciale, les empreintes digitales et les cartes, améliore la flexibilité et la sécurité des solutions de contrôle d'accès.

- En juin 2022, ABB a continué de faire progresser le marché mondial des interphones avec sa gamme de produits de pointe Welcome IP, redéfinissant le contrôle d'accès des maisons individuelles aux unités multi-résidentielles (MDU). Cette gamme innovante englobe un éventail de fonctionnalités, notamment la transmission audio/vidéo, l'interphone, le contrôle d'accès et l'intégration de caméras IP. L'infrastructure IP flexible facilite la planification, la grande évolutivité et la cybersécurité robuste. Notamment, la station phare Welcome IP est dotée d'un écran tactile de 5 pouces, garantissant une interaction intuitive avec l'utilisateur. L'écran tactile interne IP Touch et l'application ABB Welcome s'intègrent parfaitement à l'unité externe, offrant une conception unifiée. La gamme Welcome IP d'ABB incarne la modernité, la polyvalence et des fonctionnalités améliorées, répondant à divers besoins résidentiels et commerciaux.

Portée du marché mondial des appareils d'interphonie

Le marché mondial des appareils d'interphonie est segmenté en quinze segments notables en fonction du type de système, du composant, du type d'appareil, du matériau, de l'alimentation, du contrôle d'accès, de la technologie, du clavier, du type de communication, de la catégorie de prix, de la communication, de l'application, de l'installation, de l'utilisateur final et du canal de distribution.

Type de système

- Câblé

- Sans fil

En fonction du type de système, le marché est segmenté en filaire et sans fil .

Composant

- Matériel

- Logiciel

- Services

Sur la base des composants, le marché est segmenté en matériel, logiciels et services.

Type d'appareil

- Systèmes d'entrée de porte

- Appareils portables

- Moniteurs vidéo pour bébé

En fonction du type d'appareil, le marché est segmenté en systèmes d'entrée de porte, appareils portables et moniteurs vidéo pour bébé.

Matériel

- Aluminium

- Acier inoxydable

- Verre trempé

- Plastique

- Autres

Sur la base du matériau, le marché est segmenté en aluminium, acier inoxydable, verre trempé, plastique et autres.

Alimentation électrique

- Moins de 20 W

- Plus de 20 W

Sur la base de l'alimentation électrique, le marché est segmenté en moins de 20 W et plus de 20 W.

Contrôle d'accès

- Cartes

- Lecteurs d'empreintes digitales

- Cartes de proximité

- Accès par mot de passe

- Reconnaissance faciale

- Autres

Sur la base du contrôle d'accès, le marché est segmenté en cartes, lecteurs d'empreintes digitales, cartes de proximité, accès par mot de passe, reconnaissance faciale et autres .

Technologie

- Analogique

- Basé sur IP

Sur la base de la technologie, le marché est segmenté en analogique et IP.

Clavier

- Bouton mécanique

- Pavé tactile

Sur la base du clavier, le marché est segmenté en bouton mécanique et pavé tactile.

Type de communication

- Audio uniquement

- Audio/Vidéo

Sur la base du type de communication, le marché est segmenté en audio/vidéo et audio uniquement.

Catégorie de prix

- Faible (moins de 100 USD)

- Moyen (100-500 USD)

- Élevé (au-dessus de 500 USD)

Sur la base de la catégorie de prix, le marché est segmenté en bas (moins de 100 USD), moyen (100 à 500 USD) et élevé (plus de 500 USD).

Communication

- Appuyez pour parler

- Mains libres ou combiné (duplex)

Sur la base de la communication, le marché est segmenté en push-to-talk et mains libres ou combiné (duplex).

Application

- Intérieur

- De plein air

Sur la base des applications, le marché est segmenté en extérieur et intérieur.

Installation

- Flush

- Surface

En fonction de l'installation, le marché est segmenté en encastré et en surface.

Utilisateur final

- Commercial

- Résidentiel

- Industries

- Gouvernement

Sur la base de l'utilisateur final, le marché est segmenté en commercial, résidentiel, industriel et gouvernemental.

Canal de distribution

- Hors ligne

- En ligne

Sur la base du canal de distribution, le marché est segmenté en hors ligne et en ligne.

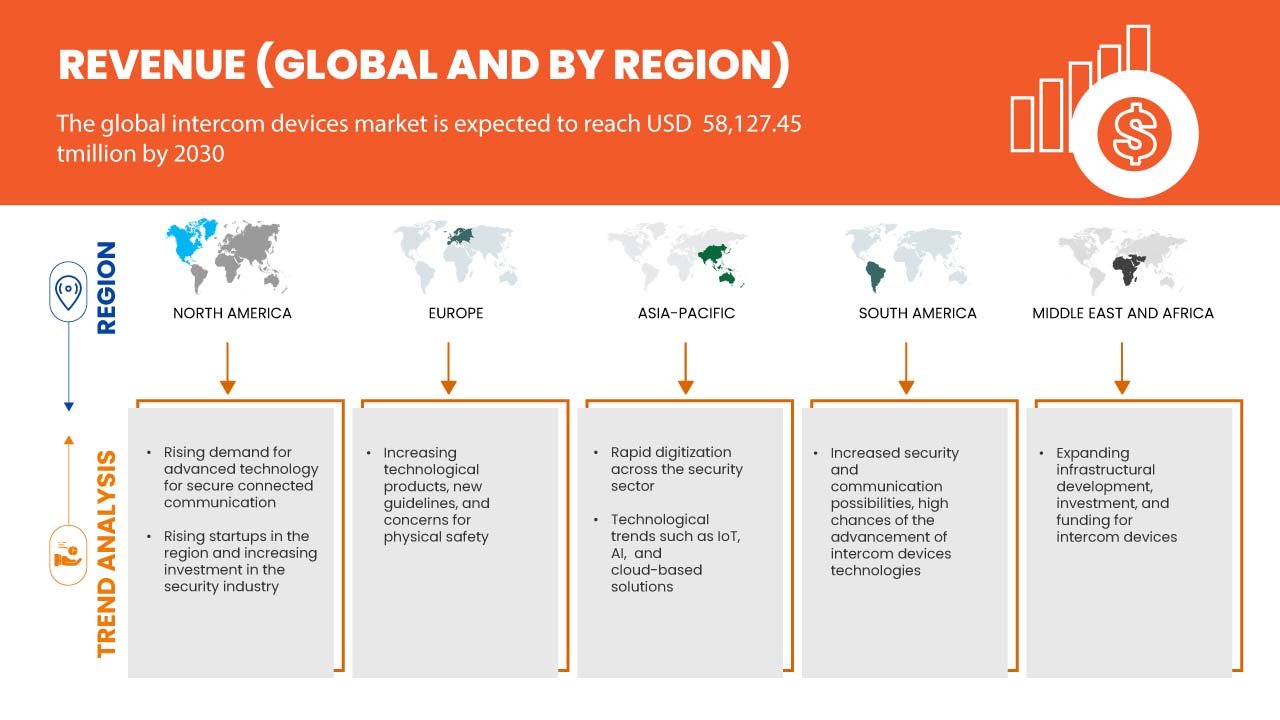

Marché mondial des appareils d'interphonieAnalyse/perspectives régionales

Le marché mondial des appareils d'interphonie est segmenté en quinze segments notables en fonction du type de système, du composant, du type d'appareil, du matériau, de l'alimentation, du contrôle d'accès, de la technologie, du clavier, du type de communication, de la catégorie de prix, de la communication, de l'application, de l'installation, de l'utilisateur final et du canal de distribution.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada, le Mexique, l'Allemagne, le Royaume-Uni, la France, l'Espagne, l'Italie, les Pays-Bas, la Russie, la Suisse, le Danemark, la Suède, la Pologne, la Belgique, la Turquie, la Norvège, la Finlande, le reste de l'Europe, la Chine, le Japon, la Corée du Sud, l'Inde, la Malaisie, Taïwan, l'Australie et la Zélande, Singapour, l'Indonésie, la Thaïlande, les Philippines, le Vietnam, le reste de l'Asie-Pacifique, le Brésil, l'Argentine, le reste de l'Amérique du Sud, l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, le Koweït, le Qatar, l'Égypte, Israël et le reste du Moyen-Orient et de l'Afrique.

L'Amérique du Nord devrait dominer le marché en raison de la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. Les États-Unis devraient dominer la région Amérique du Nord en raison de la forte présence d'acteurs clés. L'Allemagne devrait dominer la région Europe en raison de la demande croissante des marchés émergents et de l'expansion. La Chine devrait dominer la région Asie-Pacifique en raison de la tendance croissante des clients à utiliser des appareils d'enregistrement.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques mondiales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché mondiales des appareils d'interphonie

Le paysage concurrentiel du marché mondial des appareils d'interphonie fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de vie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Français Certains des principaux acteurs opérant sur le marché mondial des appareils d'interphonie sont Hangzhou Hikvision Digital Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., Panasonic Holdings Corporation, Schneider Intercom GmbH (une filiale de TKH GROUP), Siedle, URMET SpA, Zicom, ABB, Aiphone Corporation, Godrej & Boyce Manufacturing Company Limited, Axis Communications AB (une filiale du groupe Canon), Gira, Zenitel, The Akuvox Company, Hager Group, GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO., LTD, Schneider Electric, Alpha Communications, COMELIT SpA, FERMAX ELECTRÓNICA, SAU, TCS TürControlSysteme AG, TOA Corporation, Honeywell International Inc., Dahua Technology Co., Ltd, Legrand Group, Xiamen Leelen Technology Co., Ltd., et COMMAX entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL INTERCOM DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 SYSTEM TYPE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF ADVANCED SECURITY AUDIO-VISUAL SYSTEMS

5.1.2 INCREASE IN ROBBERY, BURGLARY, AND THIEF CASES ACROSS THE GLOBE

5.1.3 INCREASE IN CLOUD BASED-AI AIDED INTERCOM DEVICES

5.1.4 GROWING IMPORTANCE OF SMART HOMES AND SMART BUILDINGS

5.2 RESTRAINT

5.2.1 RISE IN CYBER SECURITY AND THREATS WEAKENING INTERCOM SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 GROWING GOVERNMENT INITIATIVES TOWARD THE DEVELOPMENT OF SMART CITIES

5.3.2 INCREASED CHECKS ON DETER BURGLARS, BABY MONITORING, AND ENSURING THE SAFETY OF PROPERTY

5.3.3 RISE IN DEMAND FOR WIRELESS INTERCOM DEVICES

5.3.4 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR INTERCOM DEVICES

5.4 CHALLENGE

5.4.1 MALFUNCTION ISSUES ASSOCIATED WITH THE INTERCOM DEVICES

6 GLOBAL INTERCOM DEVICES MARKET, BY ACCESS CONTROL

6.1 OVERVIEW

6.2 CARDS

6.3 FINGERPRINT READERS

6.4 PROXIMITY CARDS

6.5 PASSWORD ACCESS

6.6 FACE RECOGNITION

6.7 OTHERS

7 GLOBAL INTERCOM DEVICES MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ANALOG

7.3 IP-BASED

8 GLOBAL INTERCOM DEVICES MARKET, BY KEYPAD

8.1 OVERVIEW

8.2 MECHANICAL BUTTON

8.3 TOUCH PAD

9 GLOBAL INTERCOM DEVICES MARKET, BY DEVICE TYPE

9.1 OVERVIEW

9.2 DOOR ENTRY SYSTEMS

9.3 HANDHELD DEVICES

9.4 VIDEO BABY MONITORS

10 GLOBAL INTERCOM DEVICES MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 ALUMINUM

10.3 STAINLESS STEEL

10.4 TEMPERED GLASS

10.5 PLASTIC

10.6 OTHERS

11 GLOBAL INTERCOM DEVICES MARKET, BY POWER SUPPLY

11.1 OVERVIEW

11.2 LESS THAN 20 W

11.3 MORE THAN 20 W

12 GLOBAL INTERCOM DEVICES MARKET, BY PRICE CATEGORY

12.1 OVERVIEW

12.2 LOW (BELOW USD 100)

12.3 MEDIUM (USD 100- USD 500)

12.4 HIGH (ABOVE USD 500)

13 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION

13.1 OVERVIEW

13.2 PUSH-TO-TALK

13.3 HANDS-FREE OR HANDSET (DUPLEX)

14 GLOBAL INTERCOM DEVICES MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 OUTDOOR

14.3 INDOOR

15 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE

15.1 OVERVIEW

15.2 AUDIO/VIDEO

15.2.1 ON THE BASIS OF SCREEN SIZE

15.2.1.1 BELOW 3 INCHES

15.2.1.2 2-5 INCHES

15.2.1.3 5-7 INCHES

15.2.1.4 ABOVE 7 INCHES

15.3 ONLY AUDIO

16 GLOBAL INTERCOM DEVICES MARKET, BY END USER

16.1 OVERVIEW

16.2 COMMERCIAL

16.2.1 COMMERCIAL, TYPE

16.2.1.1 HOTEL

16.2.1.2 AIRPORT

16.2.1.3 BANKS AND FINANCIAL INSTITUTION

16.2.1.4 PRISONS AND POLICE STATION

16.2.1.5 OFFICES

16.2.1.6 HEALTCARE

16.2.1.7 SCHOOL AND UNIVERSITIES

16.2.1.8 PARKING GARAGE

16.2.1.9 OTHERS

16.2.2 DEVICE TYPE

16.2.2.1 DOOR ENTRY SYSTEMS

16.2.2.2 HANDHELD DEVICES

16.2.2.3 VIDEO BABY MONITORS

16.3 RESIDENTIAL

16.3.1 TYPE

16.3.1.1 APARTMENTS

16.3.1.2 SINGLE OR MULTI-FAMILY HOMES

16.3.1.3 HOSTEL

16.3.1.4 CONDOMINIUMS

16.3.1.5 OTHERS

16.3.2 DEVICE TYPE

16.3.2.1 DOOR ENTRY SYSTEMS

16.3.2.2 HANDHELD DEVICES

16.3.2.3 VIDEO BABY MONITORS

16.4 INDUSTRIES

16.4.1 DEVICE TYPE

16.4.1.1 DOOR ENTRY SYSTEMS

16.4.1.2 HANDHELD DEVICES

16.4.1.3 VIDEO BABY MONITORS

16.5 GOVERNMENT

16.5.1 DEVICE TYPE

16.5.1.1 DOOR ENTRY SYSTEMS

16.5.1.2 HANDHELD DEVICES

16.5.1.3 VIDEO BABY MONITORS

17 GLOBAL INTERCOM DEVICES MARKET, BY INSTALLATION

17.1 OVERVIEW

17.2 FLUSH

17.3 SURFACE

18 GLOBAL INTERCOM DEVICES MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 OFFLINE

18.2.1 SPECIALITY STORES

18.2.2 SUPERMARKET/HYPERMARKET

18.2.3 WHOLESALER

18.2.4 OTHERS

18.3 ONLINE

18.3.1 E-COMMERCE

18.3.2 COMPANY WEBSITE

19 GLOBAL INTERCOM DEVICES MARKET, BY SYSTEM TYPE

19.1 OVERVIEW

19.2 WIRED

19.2.1 2-WIRE SYSTEM

19.2.2 CAT-5 SYSTEM

19.2.3 4-WIRE SYSTEM

19.2.4 OTHERS

19.3 WIRELESS

19.3.1 WIFI

19.3.2 RADIO FREQUENCY

19.3.3 OTHERS

20 GLOBAL INTERCOM DEVICES MARKET, BY COMPONENT

20.1 OVERVIEW

20.2 HARDWARE

20.2.1 CAMERAS

20.2.1.1 LESS THAN 2 MM

20.2.1.2 2 MM-3 MM

20.2.1.3 MORE THAN 3 MM

20.2.2 LCD SCREEN

20.2.2.1 CAPACITIVE

20.2.2.2 RESISTIVE

20.2.3 READER

20.2.4 SENSOR

20.2.4.1 IMAGE SENSOR

20.2.4.2 PROXIMITY SENSOR

20.2.4.3 OTHERS

20.2.5 SWITCHES

20.2.6 ACCESSORIES

20.2.7 OTHERS

20.3 SOFTWARE

20.4 SERVICES

20.4.1 INSTALLATION

20.4.2 SUPPORT AND MAINTENANCE

20.4.3 TESTING

21 GLOBAL INTERCOM DEVICES MARKET, BY REGION

21.1 OVERVIEW

21.2 NORTH AMERICA

21.2.1 U.S.

21.2.2 CANADA

21.2.3 MEXICO

21.3 EUROPE

21.3.1 U.K.

21.3.2 GERMANY

21.3.3 FRANCE

21.3.4 ITALY

21.3.5 SPAIN

21.3.6 RUSSIA

21.3.7 NETHERLANDS

21.3.8 SWITZERLAND

21.3.9 TURKEY

21.3.10 BELGIUM

21.3.11 DENMARK

21.3.12 SWEDEN

21.3.13 POLAND

21.3.14 NORWAY

21.3.15 FINLAND

21.3.16 REST OF EUROPE

21.4 ASIA-PACIFIC

21.4.1 CHINA

21.4.2 JAPAN

21.4.3 SOUTH KOREA

21.4.4 INDIA

21.4.5 MALAYSIA

21.4.6 AUSTRALIA & NEW ZEALAND

21.4.7 TAIWAN

21.4.8 SINGAPORE

21.4.9 INDONESIA

21.4.10 THAILAND

21.4.11 PHILIPPINES

21.4.12 VIETNAM

21.4.13 REST OF ASIA-PACIFIC

21.5 MIDDLE EAST AND AFRICA

21.5.1 U.A.E.

21.5.2 SAUDI ARABIA

21.5.3 SOUTH AFRICA

21.5.4 EGYPT

21.5.5 ISRAEL

21.5.6 QATAR

21.5.7 KUWAIT

21.5.8 REST OF MIDDLE EAST AND AFRICA

21.6 SOUTH AMERICA

21.6.1 BRAZIL

21.6.2 ARGENTINA

21.6.3 REST OF SOUTH AMERICA

22 GLOBAL INTERCOM DEVICES MARKET: COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23 SWOT ANALYSIS

24 COMPANY PROFILINGS

24.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD

24.1.1 COMPANY SNAPSHOT

24.1.2 REVENUE ANALYSIS

24.1.3 COMPANY SHARE ANALYSIS

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 SAMSUNG ELECTRONICS CO., LTD.

24.2.1 COMPANY PROFILE

24.2.2 REVENUE ANALYSIS

24.2.3 COMPANY SHARE ANALYSIS

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 PANASONIC HOLDINGS CORPORATION

24.3.1 COMPANY SNAPSHOT

24.3.2 REVENUE ANALYSIS

24.3.3 COMPANY SHARE ANALYSIS

24.3.4 PRODUCTS PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 LEGRAND GROUP

24.4.1 COMPANY SNAPSHOT

24.4.2 REVENUE ANALYSIS

24.4.3 PRODUCTS PORTFOLIO

24.4.4 RECENT DEVELOPMENT

24.5 HONEYWELL INTERNATIONAL INC.

24.5.1 COMPANY SNAPSHOT

24.5.2 REVENUE ANALYSIS

24.5.3 PRODUCTS PORTFOLIO

24.5.4 RECENT DEVELOPMENT

24.6 ABB

24.6.1 COMPANY PROFILE

24.6.2 REVENUE ANALYSIS

24.6.3 PRODUCTS PORTFOLIO

24.6.4 RECENT DEVELOPMENTS

24.7 AIPHONE CORPORATION

24.7.1 COMPANY SNAPSHOT

24.7.2 REVENUE ANALYSIS

24.7.3 PRODUCTS PORTFOLIO

24.7.4 RECENT DEVELOPMENTS

24.8 ALPHA COMMUNICATIONS

24.8.1 COMPANY SNAPSHOT

24.8.2 PRODUCT PORTFOLIO

24.8.3 RECENT DEVELOPMENT

24.9 AXIS COMMUNICATIONS AB (A SUBSIDIARY OF CANON GROUP)

24.9.1 COMPANY SNAPSHOT

24.9.2 REVENUE ANALYSIS

24.9.3 PRODUCTS PORTFOLIO

24.9.4 RECENT DEVELOPMENTS

24.1 COMELIT GROUP S.P.A.

24.10.1 COMPANY SNAPSHOT

24.10.2 PRODUCTS PORTFOLIO

24.10.3 RECENT DEVELOPMENTS

24.11 COMMAX

24.11.1 COMPANY SNAPSHOT

24.11.2 PRODUCTS PORTFOLIO

24.11.3 RECENT DEVELOPMENT

24.12 DAHUA TECHNOLOGY CO., LTD

24.12.1 COMPANY SNAPSHOT

24.12.2 REVENUE ANALYSIS

24.12.3 PRODUCTS PORTFOLIO

24.12.4 RECENT DEVELOPMENTS

24.13 FERMAX ELECTRÓNICA, S.A.U.

24.13.1 COMPANY SNAPSHOT

24.13.2 PRODUCTS PORTFOLIO

24.13.3 RECENT DEVELOPMENTS

24.14 FUJIAN AURINE TECHNOLOGY CO., LTD.

24.14.1 COMPANY SNAPSHOT

24.14.2 PRODUCTS PORTFOLIO

24.14.3 RECENT DEVELOPMENT

24.15 GIRA

24.15.1 COMPANY SNAPSHOT

24.15.2 PRODUCTS PORTFOLIO

24.15.3 RECENT DEVELOPMENTS

24.16 GODREJ & BOYCE MANUFACTURING COMPANY LIMITED

24.16.1 COMPANY SNAPSHOT

24.16.2 REVENUE ANALYSIS

24.16.3 PRODUCT PORTFOLIO

24.16.4 RECENT DEVELOPMENT

24.17 GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO.,LTD

24.17.1 COMPANY SNAPSHOT

24.17.2 REVENUE ANALYSIS

24.17.3 PRODUCT PORTFOLIO

24.17.4 RECENT DEVELOPMENTS

24.18 HAGER GROUP

24.18.1 COMPANY SNAPSHOT

24.18.2 PRODUCTS PORTFOLIO

24.18.3 RECENT DEVELOPMENT

24.19 SCHNEIDER ELECTRIC

24.19.1 COMPANY SNAPSHOT

24.19.2 REVENUE ANALYSIS

24.19.3 PRODUCTS PORTFOLIO

24.19.4 RECENT DEVELOPMENTS

24.2 SCHNEIDER INTERCOM GMBH

24.20.1 COMPANY SNAPSHOT

24.20.2 PRODUCTS PORTFOLIO

24.20.3 RECENT DEVELOPMENTS

24.21 SIEDLE

24.21.1 COMPANY SNAPSHOT

24.21.2 PRODUCTS PORTFOLIO

24.21.3 RECENT DEVELOPMENT

24.22 TCS TÜRCONTROLSYSTEME AG

24.22.1 COMPANY SNAPSHOT

24.22.2 PRODUCTS PORTFOLIO

24.22.3 RECENT DEVELOPMENT

24.23 THE AKUVOX COMPANY

24.23.1 COMPANY SNAPSHOT

24.23.2 PRODUCTS PORTFOLIO

24.23.3 RECENT DEVELOPMENTS

24.24 TOA CORPORATION

24.24.1 COMPANY SNAPSHOT

24.24.2 REVENUE ANALYSIS

24.24.3 PRODUCT PORTFOLIO

24.24.4 RECENT DEVELOPMENTS

24.25 URMET S.P.A.

24.25.1 COMPANY SNAPSHOT

24.25.2 PRODUCTS PORTFOLIO

24.25.3 RECENT DEVELOPMENT

24.26 XIAMEN LEELEN TECHNOLOGY CO., LTD.

24.26.1 COMPANY SNAPSHOT

24.26.2 PRODUCTS PORTFOLIO

24.26.3 RECENT DEVELOPMENTS

24.27 ZENITEL

24.27.1 COMPANY SNAPSHOT

24.27.2 PRODUCTS PORTFOLIO

24.27.3 RECENT DEVELOPMENT

24.28 ZICOM

24.28.1 COMPANY SNAPSHOT

24.28.2 PRODUCT PORTFOLIO

24.28.3 RECENT DEVELOPMENTS

25 QUESTIONNAIRE

26 RELATED REPORTS

Liste des tableaux

TABLE 1 GLOBAL INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2021-2030 (USD MILLION)

TABLE 2 GLOBAL CARDS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 GLOBAL FINGERPRINT READERS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 GLOBAL PROXIMITY CARDS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 GLOBAL PASSWORD ACCESS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 GLOBAL FACE RECOGNITION IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 GLOBAL OTHERS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 GLOBAL INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 9 GLOBAL ANALOG IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 GLOBAL IP-BASED IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 GLOBAL INTERCOM DEVICES MARKET, BY KEYPAD, 2021-2030 (USD MILLION)

TABLE 12 GLOBAL MECHANICAL BUTTON IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 GLOBAL TOUCH PAD IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 GLOBAL INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 15 GLOBAL DOOR ENTRY SYSTEMS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 GLOBAL HANDHELD DEVICES IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 GLOBAL INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 GLOBAL INTERCOM DEVICES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 19 GLOBAL ALUMINUM IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 GLOBAL STAINLESS STEEL IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 GLOBAL TEMPERED GLASS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 GLOBAL INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 GLOBAL OTHERS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 GLOBAL INTERCOM DEVICES MARKET, BY POWER SUPPLY, 2021-2030 (USD MILLION)

TABLE 25 GLOBAL LESS THAN 20 W IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 GLOBAL MORE THAN 20 W IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 GLOBAL INTERCOM DEVICES MARKET, BY PRICE CATEGORY, 2021-2030 (USD MILLION)

TABLE 28 GLOBAL LOW (BELOW USD 100) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 GLOBAL MEDIUM (USD 100- USD 500) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 GLOBAL HIGH (ABOVE USD 500) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION, 2021-2030 (USD MILLION)

TABLE 32 GLOBAL PUSH-TO-TALK IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 GLOBAL HANDS-FREE OR HANDSET (DUPLEX) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 GLOBAL INTERCOM DEVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 GLOBAL OUTDOOR IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 GLOBAL INDOOR IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2021-2030 (USD MILLION)

TABLE 38 GLOBAL AUDIO/VIDEO IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 GLOBAL AUDIO/VIDEO IN INTERCOM DEVICES MARKET, BY SCREEN SIZE, 2021-2030 (USD MILLION)

TABLE 40 GLOBAL ONLY AUDIO IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 GLOBAL INTERCOM DEVICES MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 42 GLOBAL COMMERCIAL IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 GLOBAL COMMERCIAL IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 GLOBAL COMMERCIAL IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 45 GLOBAL RESIDENTIAL IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 GLOBAL RESIDENTIAL IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 GLOBAL RESIDENTIAL IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 48 GLOBAL INDUSTRIES IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 GLOBAL INDUSTRIES IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 50 GLOBAL GOVERNMENT IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 GLOBAL GOVERNMENT IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 52 GLOBAL INTERCOM DEVICES MARKET, BY INSTALLATION, 2021-2030 (USD MILLION)

TABLE 53 GLOBAL FLUSH IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 GLOBAL SURFACE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 GLOBAL INTERCOM DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 GLOBAL OFFLINE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 GLOBAL OFFLINE IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 GLOBAL ONLINE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 GLOBAL ONLINE IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 GLOBAL INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 GLOBAL WIRED IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 GLOBAL WIRED IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 GLOBAL WIRELESS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 GLOBAL WIRELESS IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 GLOBAL INTERCOM DEVICES MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 66 GLOBAL HARDWARE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 GLOBAL HARDWARE IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 GLOBAL CAMERAS IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 GLOBAL LCD SCREEN IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 GLOBAL SENSOR IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 GLOBAL SOFTWARE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 GLOBAL GROUND IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 GLOBAL SERVICES IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 2 GLOBAL INTERCOM DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL INTERCOM DEVICES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL INTERCOM DEVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL INTERCOM DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL INTERCOM DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL INTERCOM DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL INTERCOM DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL INTERCOM DEVICES MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 GLOBAL INTERCOM DEVICES MARKET: MULTIVARIATE MODELLING

FIGURE 11 GLOBAL INTERCOM DEVICES MARKET: SYSTEM TYPE

FIGURE 12 GLOBAL INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 ADVENT OF ADVANCED SECURITY AUDIO-VISUAL SYSTEMS IS EXPECTED TO BE A KEY DRIVER FOR THE GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 WIRED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD 2023 TO 2030

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL INTERCOM DEVICES MARKET

FIGURE 18 VIDEO SYSTEMS

FIGURE 19 STATS RELATED TO ROBBERY AND BURGLARY

FIGURE 20 TECHNOLOGY AMALGAMATION IN SMART HOME/ BUILDINGS

FIGURE 21 IMPACT OF CYBER SECURITY THREAT

FIGURE 22 GLOBAL INTERCOM DEVICES MARKET: BY ACCESS CONTROL, 2022

FIGURE 23 GLOBAL INTERCOM DEVICES MARKET: BY TECHNOLOGY, 2022

FIGURE 24 GLOBAL INTERCOM DEVICES MARKET: BY KEYPAD, 2022

FIGURE 25 GLOBAL INTERCOM DEVICES MARKET: BY DEVICE TYPE, 2022

FIGURE 26 GLOBAL INTERCOM DEVICES MARKET: BY MATERIAL, 2022

FIGURE 27 GLOBAL INTERCOM DEVICES MARKET: BY POWER SUPPLY, 2022

FIGURE 28 GLOBAL INTERCOM DEVICES MARKET: BY PRICE CATEGORY, 2022

FIGURE 29 GLOBAL INTERCOM DEVICES MARKET: BY COMMUNICATION, 2022

FIGURE 30 GLOBAL INTERCOM DEVICES MARKET: BY APPLICATION, 2022

FIGURE 31 GLOBAL INTERCOM DEVICES MARKET: BY COMMUNICATION TYPE, 2022

FIGURE 32 GLOBAL INTERCOM DEVICES MARKET: BY END USER, 2022

FIGURE 33 GLOBAL INTERCOM DEVICES MARKET: BY INSTALLATION, 2022

FIGURE 34 GLOBAL INTERCOM DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 GLOBAL INTERCOM DEVICES MARKET: BY SYSTEM TYPE, 2022

FIGURE 36 GLOBAL INTERCOM DEVICES MARKET: BY COMPONENT, 2022

FIGURE 37 GLOBAL INTERCOM DEVICES MARKET: SNAPSHOT (2022)

FIGURE 38 GLOBAL INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 39 NORTH AMERICA INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 40 EUROPE INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 41 ASIA-PACIFIC INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.