Marché mondial des tuyaux et raccords industriels, par type (tuyaux et raccords), canal de distribution (distributeurs, OEM), industrie ( automatisation industrielle , exploitation minière, construction, pétrole et gaz, automobile, pharmaceutique, alimentation et boissons, agriculture, eau et autres), type de matériau (caoutchouc, polyuréthane, polychlorure de vinyle, métal, thermoplastiques, composite, silicone et autres), milieu (pétrole, eau, gaz et autres), type de fil (fil tressé et fil spiralé), pression (basse pression (moins de 3000 PSI), moyenne pression (entre 3000 et 6000) et haute pression (plus de 6000)), pièces (pièces d'origine et pièces de rechange) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des tuyaux et raccords industriels

Les tuyaux industriels sont largement utilisés dans divers secteurs industriels en raison de leur large gamme de produits. Ces tuyaux fonctionnent dans des environnements défavorables, provoquant des dommages tels que l'abrasion, la rupture et la défaillance prématurée. Travailler dans ces conditions rend important de sélectionner correctement le type de tuyau nécessaire à l'application. Pour le transfert à haute pression, les tuyaux hydrauliques sont les plus adaptés et fonctionnent à des milliers de psi de pression. Le secteur du pétrole et du gaz utilise des tuyaux pour transférer des carburants et des gaz et nécessite des tuyaux de haute qualité pour répondre aux spécifications et à la sécurité standard. L'utilisation de tuyaux s'adresse à une large gamme d'applications, devenant ainsi un élément essentiel de divers secteurs industriels.

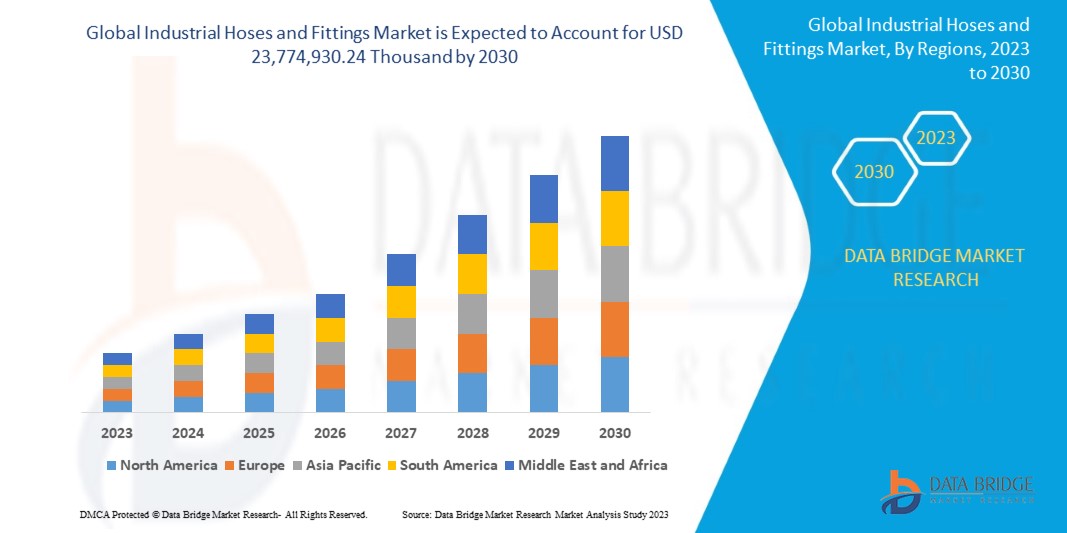

Data Bridge Market Research analyse que le marché mondial des tuyaux et raccords industriels devrait atteindre une valeur de 23 774 930,24 milliers USD d'ici 2030, à un TCAC de 6,2 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volume en unités, prix en dollars américains |

|

Segments couverts |

Par type (tuyaux et raccords), canal de distribution (distributeurs, OEM), industrie (automatisation industrielle, exploitation minière, construction, pétrole et gaz, automobile, pharmaceutique, alimentation et boissons, agriculture, eau et autres), type de matériau (caoutchouc, polyuréthane, chlorure de polyvinyle , métal, thermoplastiques, composite, silicone et autres), milieu (pétrole, eau, gaz et autres), type de fil (fil tressé et fil spiralé), pression (basse pression (moins de 3000 psi), moyenne pression (entre 3000 et 6000) et haute pression (plus de 6000)), pièces (pièces d'origine et pièces de rechange) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Espagne, Italie, Pays-Bas, Russie, Suisse, Danemark, Suède, Pologne, Belgique, Turquie, Norvège, Finlande, reste de l'Europe, Chine, Japon, Corée du Sud, Inde, Malaisie, Taïwan, Australie, Singapour, Indonésie, Thaïlande, Nouvelle-Zélande, Philippines, Vietnam, reste de l'Asie-Pacifique, Brésil, Argentine, reste de l'Amérique du Sud, Afrique du Sud, Arabie saoudite, Bahreïn, Émirats arabes unis, Koweït, Oman, Qatar, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Eaton, PIRANHA HOSE PRODUCTS, INC., PARKER HANNIFIN CORP, RYCO Hydraulics, Kurt Manufacturing, NORRES Schlauchtechnik GmbH, Transfer Oil SpA, ContiTech AG (une filiale de Continental AG), Kanaflex Corporation Co., ltd., Pacific Echo, Colex International Limited, Royaume-Uni, Gates Corporation, Semperit AG Holding, KURIYAMA OF AMERICA, INC. (une filiale de Kuriyama Holdings Corporation), Titeflex (une filiale de Smiths Group Plc), Trelleborg Group (une filiale de Trelleborg AB), Flexaust Inc., Salem-Republic Rubber Company et PIRTEK, entre autres |

Définition du marché

Les tuyaux industriels sont des tubes flexibles renforcés utilisés pour transférer les différents états de matériaux, tels que les liquides et les gaz. Le tuyau industriel fonctionne dans une large plage de pression, ce qui le rend adapté à un ensemble différent d'applications. Les tuyaux industriels sont disponibles dans différents matériaux, tels que le polyuréthane, les thermoplastiques et le chlorure de polyvinyle, entre autres. Chaque matériau offre un ensemble différent d'opérations et est utilisé pour transporter divers matériaux. Les tuyaux industriels sont disponibles sous des formes rigides et flexibles en fonction des besoins des applications industrielles.

Dynamique du marché mondial des tuyaux et raccords industriels

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteur

- Forte demande de matériaux pour tuyaux en PVC

Ces derniers jours, les tuyaux industriels en PVC sont devenus importants dans l'automobile, les produits pharmaceutiques, les infrastructures, le pétrole et le gaz, l'alimentation et les boissons, l'exploitation minière, l'eau, l'agriculture et d'autres industries pour la fabrication et l'utilisation de tubes et de tuyaux pour le transport de l'air, de l'eau, des produits chimiques et des fluides d'un bout à l'autre.

Opportunité

- Adoption croissante des tuyaux dans le secteur automobile

Les automobiles sont constituées de structures et de systèmes internes complexes dont divers composants sont intacts. L'intégration de ces systèmes et composants permet à l'automobile de fonctionner comme une machine efficace. Dans les automobiles, les tuyaux jouent un rôle important car ils sont utilisés comme système de refroidissement du moteur, dans le transport de l'huile de frein, comme transporteur de carburant, dans la climatisation et dans d'autres parties du véhicule.

Contraintes /Défis

- Limitations des tuyaux industriels dans diverses applications

Les tuyaux industriels sont largement utilisés dans diverses industries pour une efficacité opérationnelle optimale et le transfert de carburants, de produits chimiques, de matériaux en vrac, d'air, etc. Bien que les applications industrielles des tuyaux industriels continuent de se développer, les utilisateurs finaux se concentrent de plus en plus sur les niveaux d'efficacité des tuyaux industriels. Cependant, les tuyaux industriels posent divers défis dans divers environnements de système, tels que la plage de température, ce qui a pour effet de nuire aux performances et à l'efficacité globales du système.

- Faible sensibilisation des utilisateurs finaux aux tuyaux

Les tuyaux industriels sont utilisés dans diverses applications dans des conditions difficiles et doivent fonctionner de manière optimale pour soutenir le fonctionnement. Les tuyaux sont endommagés en raison de l'abrasion, des fuites, des éclatements, des ruptures de raccords, des fissures, de la corrosion des raccords, du gonflement des tubes, etc. Le marché mondial des tuyaux industriels est confronté à un grand défi pour fournir une qualité optimale et éviter les pannes opérationnelles et les défauts de fabrication, car les utilisateurs finaux ne sont pas très conscients des problèmes liés à la défaillance des tuyaux.

Développements récents

- En juillet 2021, NORRES Schlauchtechnik GmbH, fabricant, développeur et distributeur de solutions de systèmes de tuyaux flexibles, a acquis Baggerman Group (« Baggerman »), fabricant et distributeur de tuyaux, raccords et accessoires industriels. Cette acquisition aidera l'entreprise à accroître sa présence mondiale et contribuera également à développer le marché mondial des tuyaux et raccords industriels

- En septembre 2020, la société KURIYAMA OF AMERICA a développé un nouveau produit appelé Tigerflex Tiger Aquaâ" Tuyau d'aspiration et de refoulement. Ce nouvel ajout de produit améliorera non seulement le portefeuille de produits d'une entreprise, mais contribuera également à stimuler les ventes globales

Portée du marché mondial des tuyaux et raccords industriels

Le marché mondial des tuyaux et raccords industriels est segmenté en huit segments notables en fonction du type, du type de matériau, du support, du type de fil, de la pression, de l'industrie, du canal de distribution et des pièces. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Taper

- Tuyaux

- Accessoires

Sur la base du type, le marché est segmenté en tuyaux et raccords.

Type de matériau

- Caoutchouc

- Polyuréthane

- Chlorure de polyvinyle

- Métal

- Thermoplastiques

- Composite

- Silicone

- Autres

Sur la base du type de matériau, le marché est segmenté en silicone, polychlorure de vinyle, polyuréthane, caoutchouc nitrile, élastomères, thermoplastiques, métal, composite et autres.

Médias

- Huile

- Eau

- Gaz

- Autres

Sur la base des médias, le marché est segmenté en pétrole, eau, gaz et autres.

Type de fil

- Fil tressé

- Fil spiralé

Sur la base du type de fil, le marché est segmenté en fil tressé et fil en spirale.

Pression

- Basse pression (moins de 3000 psi)

- Pression moyenne (entre 3000 et 6000)

- Haute pression (plus de 6000)

Sur la base de la pression, le marché est segmenté en basse pression (moins de 3 000 psi), moyenne pression (entre 3 000 et 6 000) et haute pression (plus de 6 000).

Industry

- Mining

- Construction

- Oil and Gas

- Automotive

- Pharmaceutical

- Food & Beverages

- Agriculture

- Water

- Industrial Automation

- Others

On the basis of industry, the market is segmented into oil and gas, water, agriculture, food and beverages, pharmaceuticals, automotive, mining, and others.

Distribution Channel

- Distributors

- OEM

On the basis of distribution channel, the market has been segmented into distributors and OEM.

Parts

- Original Parts

- Replacement Parts

On the basis of parts, the market has been segmented into original parts and replacement parts.

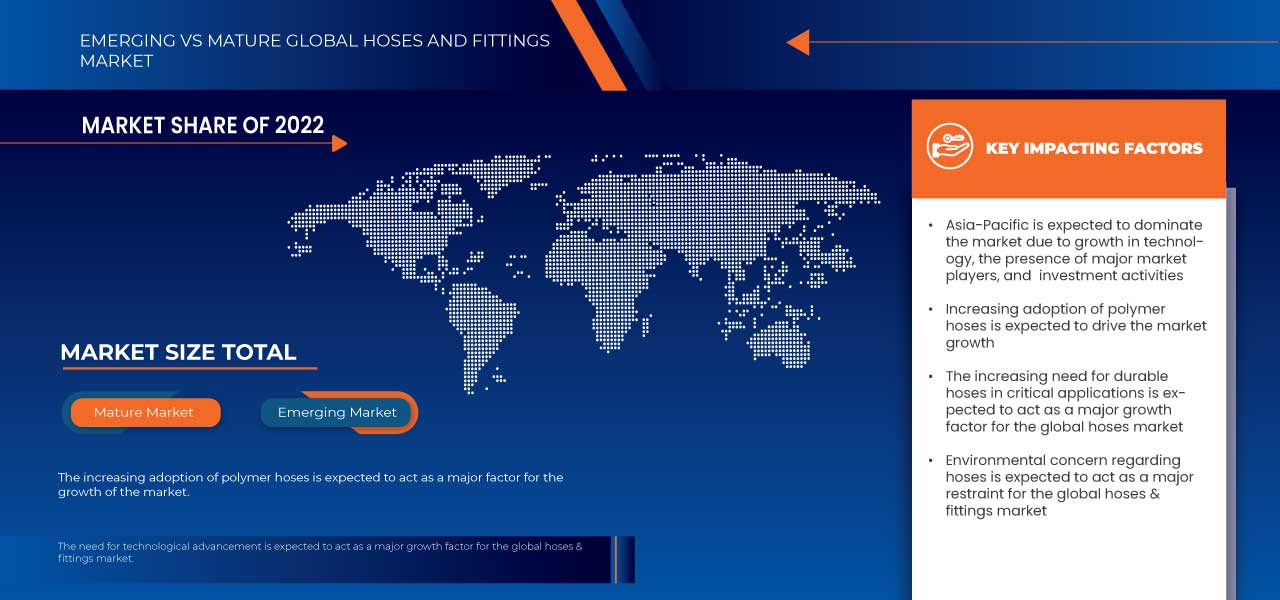

Global Industrial Hoses and Fittings Market Regional Analysis/Insights

The global industrial hoses and fittings market is segmented into eight notable segments which are on the basis of type, material type, media, wire type, pressure, industry, distribution channel, and parts.

The countries covered in this market report U.S., Canada, Mexico, Germany, U.K., France, Spain, Italy, Netherlands, Russia, Switzerland, Denmark, Sweden, Poland, Belgium, Turkey, Norway, Finland, rest of Europe, China, Japan, South Korea, India, Malaysia, Taiwan, Australia, Singapore, Indonesia, Thailand, New Zealand, Philippines, Vietnam, rest of Asia-Pacific, Brazil, Argentina, rest of South America, South Africa, Saudi Arabia, Bahrain, U.A.E., Kuwait, Oman, Qatar, Egypt, Israel, and rest of Middle East and Africa.

The U.S. is expected to dominate North America region due to the presence of key market players in the largest consumer market with high GDP to grow due to a rise in technological advancement in the market. China is expected to dominate the Asia-Pacific region due to increasing development in the manufacturing sector. India industrial hoses and fittings market is expected to dominate in the region due to increasing industrialization. The region is home to several oil and gas industries and it is the manufacturing hub of the world.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Industrial Hoses and Fittings Market Share Analysis

Le paysage concurrentiel du marché mondial des tuyaux et raccords industriels fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Français Certains des principaux acteurs du marché opérant sur le marché mondial des tuyaux et raccords industriels sont Eaton, PIRANHA HOSE PRODUCTS, INC., PARKER HANNIFIN CORP, RYCO Hydraulics, Kurt Manufacturing, NORRES Schlauchtechnik GmbH, Transfer Oil SpA, ContiTech AG (une filiale de Continental AG), Kanaflex Corporation Co., ltd., Pacific Echo, Colex International Limited, UK, Gates Corporation, Semperit AG Holding, KURIYAMA OF AMERICA, INC. (Une filiale de Kuriyama Holdings Corporation), Titeflex (Une filiale de Smiths Group Plc), Trelleborg Group (Une filiale de Trelleborg AB), Flexaust Inc., Salem-Republic Rubber Company et PIRTEK, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPACT OF UKRAINE WAR ON GLOBAL INDUSTRIAL HOSES & FITTINGS MARKET

4.1.1 ANALYSIS OF THE IMPACT OF THE UKRAINE WAR ON THE INDUSTRIAL HOSES & FITTINGS MARKET

4.1.2 STRATEGIC DECISIONS FROM COUNTRIES AND THEIR EFFECT ON MARKET

4.1.3 IMPACT ON PRICE AND SUPPLY CHAIN

4.1.4 CONCLUSION

4.2 IMPACT OF COVID-19 ON THE GLOBAL INDUSTRIAL HOSES & FITTINGS MARKET

4.2.1 ANALYSIS ON THE IMPACT OF COVID-19 ON THE INDUSTRIAL HOSES & FITTINGS MARKET

4.2.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

4.2.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

4.2.4 IMPACT ON PRICE

4.2.5 IMPACT ON DEMAND AND SUPPLY CHAIN

4.2.6 CONCLUSION

4.3 PRICING LIST

4.4 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH DEMAND FOR PVC HOSE MATERIALS

5.1.2 INCREASING NEED FOR DURABLE INDUSTRIAL HOSES IN CRITICAL APPLICATIONS

5.1.3 GROWING CONCERN ABOUT WORKPLACE SAFETY AND TESTING PROCEDURES

5.1.4 HIGH ADOPTION OF NON-METAL HOSES

5.2 RESTRAINTS

5.2.1 LIMITATIONS OF INDUSTRIAL HOSES IN VARIOUS APPLICATIONS

5.2.2 ENVIRONMENTAL CONCERNS REGARDING HOSES

5.3 OPPORTUNITIES

5.3.1 GROWING ADOPTION OF HOSES IN AUTOMOBILES SECTORS

5.3.2 GROWING USAGE AND DEMAND OF HOSES IN THE CHEMICAL INDUSTRY

5.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

5.3.4 RAPID PRODUCT DEVELOPMENT AND LAUNCHES OF INDUSTRIAL HOSES

5.4 CHALLENGE

5.4.1 LOW AWARENESS AMONG END USERS REGARDING HOSES

5.4.2 LACK OF SKILLED PROFESSIONALS FOR FITTING HOSES IN INDUSTRIES

6 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY TYPE

6.1 OVERVIEW

6.2 HOSES

6.2.1 HYDRALIC HOSES

6.2.1.1 MATERIAL TYPE

6.2.1.1.1 NITRILE RUBBER

6.2.1.1.2 ELASTOMERS

6.2.1.1.3 POLYURETHANE

6.2.1.1.4 POLYVINYL CHLORIDE

6.2.1.1.5 METAL

6.2.1.1.6 THERMOPLASTICS

6.2.1.1.7 COMPOSITE

6.2.1.1.8 SILICONE

6.2.1.1.9 OTHERS

6.2.1.2 WIRE TYPE

6.2.1.2.1 WIRE BRAIDED

6.2.1.2.2 SPIRAL WIRE

6.2.1.3 DISTRIBUTION CHANNEL

6.2.1.3.1 DISTRIBUTORS

6.2.1.3.2 OEM

6.2.1.4 INDUSTRY

6.2.1.4.1 MINING

6.2.1.4.2 CONSTRUCTION

6.2.1.4.3 AUTOMOTIVE

6.2.1.4.4 AGRICULTURE

6.2.1.4.5 OIL & GAS

6.2.1.4.6 FOOD & BEVERAGES

6.2.1.4.7 WATER

6.2.1.4.8 INDUSTRIAL AUTOMATION

6.2.1.4.9 PHARMACEUTICAL

6.2.1.4.10 OTHERS

6.2.1.5 PARTS

6.2.1.5.1 ORIGINAL PARTS

6.2.1.5.2 REPLACEMENT PARTS

6.2.2 LAYFLAT HOSE

6.2.3 SDWRAS HOSE

6.2.4 OIL RESISTANT HOSE

6.2.5 STRIPWOUND

6.2.6 THERMO-DUCT

6.2.7 OTHERS

6.3 FITTINGS

6.3.1 TYPE

6.3.1.1 BALL & SLEEVE FITTINGS

6.3.1.2 CRIMP FITTINGS

6.3.1.3 BARBED FITTINGS

6.3.1.4 CAM-LOCK FITTINGS

6.3.1.5 HYDRAULIC FITTINGS

6.3.1.6 COMPRESSION FITTINGS

6.3.1.7 FLARE FITTINGS

6.3.1.8 END FITTINGS

6.3.1.9 THREADED FITTINGS

6.3.1.10 OTHERS

6.3.2 HOSE TYPE

6.3.2.1 HYDRAULIC HOSES

6.3.2.2 LAYFLAT HOSE

6.3.2.3 SDWRAS HOSE

6.3.2.4 CORRUGATED HOSES

6.3.2.5 STRIP WOUND

6.3.2.6 THERMO-DUCT

6.3.2.7 OTHERS

6.3.3 MATERIAL TYPE

6.3.3.1 PLASTIC

6.3.3.2 STEEL

6.3.3.3 BRASS

6.3.3.4 OTHERS

7 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY INDUSTRY

7.1 OVERVIEW

7.2 MINING

7.2.1 LOW PRESSURE (LESS THAN 3000 PSI)

7.2.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

7.2.3 HIGH PRESSURE (MORE THAN 6000)

7.3 CONSTRUCTION

7.3.1 LOW PRESSURE (LESS THAN 3000 PSI)

7.3.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

7.3.3 HIGH PRESSURE (MORE THAN 6000)

7.4 OIL AND GAS

7.4.1 LOW PRESSURE (LESS THAN 3000 PSI)

7.4.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

7.4.3 HIGH PRESSURE (MORE THAN 6000)

7.5 AUTOMOTIVE

7.5.1 LOW PRESSURE (LESS THAN 3000 PSI)

7.5.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

7.5.3 HIGH PRESSURE (MORE THAN 6000)

7.6 PHARMACEUTICAL

7.6.1 LOW PRESSURE (LESS THAN 3000 PSI)

7.6.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

7.6.3 HIGH PRESSURE (MORE THAN 6000)

7.7 FOOD & BEVERAGES

7.7.1 LOW PRESSURE (LESS THAN 3000 PSI)

7.7.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

7.7.3 HIGH PRESSURE (MORE THAN 6000)

7.8 AGRICULTURE

7.8.1 LOW PRESSURE (LESS THAN 3000 PSI)

7.8.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

7.8.3 HIGH PRESSURE (MORE THAN 6000)

7.9 WATER

7.9.1 LOW PRESSURE (LESS THAN 3000 PSI)

7.9.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

7.9.3 HIGH PRESSURE (MORE THAN 6000)

7.1 INDUSTRIAL AUTOMATION

7.10.1 LOW PRESSURE (LESS THAN 3000 PSI)

7.10.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

7.10.3 HIGH PRESSURE (MORE THAN 6000)

7.11 OTHERS

8 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY WIRE TYPE

8.1 OVERVIEW

8.2 WIRE BRAIDED

8.3 SPIRAL WIRE

9 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE

9.1 OVERVIEW

9.2 LOW PRESSURE (LESS THAN 3000 PSI)

9.3 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

9.4 HIGH PRESSURE (MORE THAN 6000)

10 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DISTRIBUTORS

10.3 OEM

11 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY MATERIAL TYPE

11.1 OVERVIEW

11.2 RUBBER

11.3 POLYURETHANE

11.4 POLYVINYL CHLORIDE

11.5 METAL

11.6 THERMOPLASTICS

11.7 COMPOSITE

11.8 SILICONE

11.9 OTHERS

12 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY MEDIA

12.1 OVERVIEW

12.2 OIL

12.3 WATER

12.4 GAS

12.5 OTHERS

13 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY PARTS

13.1 OVERVIEW

13.2 ORIGINAL PARTS

13.3 REPLACEMENT PARTS

14 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION

14.1 OVERVIEW

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 U.K.

14.3.2 RUSSIA

14.3.3 ITALY

14.3.4 GERMANY

14.3.5 SPAIN

14.3.6 FRANCE

14.3.7 TURKEY

14.3.8 NETHERLANDS

14.3.9 PORTUGAL

14.3.10 BELGIUM

14.3.11 SWITZERLAND

14.3.12 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 CHINA

14.4.2 INDIA

14.4.3 SOUTH KOREA

14.4.4 JAPAN

14.4.5 SINGAPORE

14.4.6 AUSTRALIA

14.4.7 THAILAND

14.4.8 MALAYSIA

14.4.9 INDONESIA

14.4.10 PHILIPPINES

14.4.11 REST OF ASIA-PACIFIC

14.5 MIDDLE EAST AND AFRICA

14.5.1 SAUDI ARABIA

14.5.2 U.A.E

14.5.3 SOUTH AFRICA

14.5.4 ISRAEL

14.5.5 EGYPT

14.5.6 REST OF MIDDLE EAST AND AFRICA

14.6 SOUTH AMERICA

14.6.1 BRAZIL

14.6.2 ARGENTINA

14.6.3 REST OF SOUTH AMERICA

15 GLOBAL INDUSTRIAL HOSES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.4 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILING

17.1 COLEX ITERNATIONAL LIMITED, UK

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 EATON

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CONTITECH AG (A SUBSIDIARY OF CONTINENTAL AG)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 FLEXAUST INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENTS

17.5 GATES CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 KANAFLEX CORPORATION

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 KURIYAMA OF AMERICA, INC. (A SUBSIDIARY OF KURIYAMA HOLDINGS CORPORATION)

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 KURT MANUFACTURING

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 NORRES SCHLAUCHTECHNIK GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 PACIFIC ECHO

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 PARKER HANNIFIN CORP

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 COMPANY SHARE ANALYSIS

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 PIRTEK

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 RYCO HYDRAULICS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 SALEM-REPUBLIC RUBBER COMPANY

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 SEMPERIT AG HOLDING

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 COMPANY SHARE ANALYSIS

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 TITEFLEX (A SUBSIDIARY OF SMITHS GROUP PLC)

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 TRANSFER OIL S.P.A.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 TRELLEBORG GROUP (A SUBSIDIARY OF TRELLEBORG AB)

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 PIRANHA HOSE PRODUCTS, INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 2 GLOBAL HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 3 GLOBAL HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 4 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY TYPE, 2018-2030 (ASP USD)

TABLE 5 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY TYPE, 2018-2030 (THOUSAND METER)

TABLE 6 GLOBAL HYDRAULIC HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY MATERIAL TYPE, 2018-2030 (USD THOUSAND)

TABLE 7 GLOBAL HYDRAULIC HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY WIRE TYPE, 2018-2030 (USD THOUSAND)

TABLE 8 GLOBAL HYDRAULIC HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD THOUSAND)

TABLE 9 GLOBAL HYDRAULIC HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY INDUSTRY, 2018-2030 (USD THOUSAND)

TABLE 10 GLOBAL HYDRAULIC HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PARTS, 2018-2030 (USD THOUSAND)

TABLE 11 GLOBAL FITTINGS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 12 GLOBAL FITTINGS HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 13 GLOBAL FITTINGS HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY TYPE, 2018-2030 (ASP USD)

TABLE 14 GLOBAL FITTINGS HOSES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY TYPE, 2018-2030 (THOUSAND UNITS)

TABLE 15 GLOBAL FITTINGS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY HOSE TYPE, 2018-2030 (USD THOUSAND)

TABLE 16 GLOBAL FITTINGS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY MATERIAL TYPE, 2018-2030 (USD THOUSAND)

TABLE 17 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY INDUSTRY, 2018-2030 (USD THOUSAND)

TABLE 18 GLOBAL MINING IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 19 GLOBAL MINING IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030 (USD THOUSAND)

TABLE 20 GLOBAL CONSTRUCTION IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 21 GLOBAL CONSTRUCTION IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030 (USD THOUSAND)

TABLE 22 GLOBAL OIL AND GAS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 23 GLOBAL OIL AND GAS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030 (USD THOUSAND)

TABLE 24 GLOBAL AUTOMOTIVE IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 25 GLOBAL AUTOMOTIVE IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030 (USD THOUSAND)

TABLE 26 GLOBAL PHARMACEUTICAL IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 27 GLOBAL PHARMACEUTICAL IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030 (USD THOUSAND)

TABLE 28 GLOBAL FOOD & BEVERAGES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 29 GLOBAL FOOD & BEVERAGES IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030(USD THOUSAND)

TABLE 30 GLOBAL AGRICULTURE IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 31 GLOBAL AGRICULTURE IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030 (USD THOUSAND)

TABLE 32 GLOBAL WATER IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 33 GLOBAL WATER IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030 (USD THOUSAND)

TABLE 34 GLOBAL INDUSTRIAL AUTOMATION IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 35 GLOBAL INDUSTRIAL AUTOMATION IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030 (USD THOUSAND)

TABLE 36 GLOBAL OTHERS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 37 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY WIRE TYPE, 2018-2030 (USD THOUSAND)

TABLE 38 GLOBAL WIRE BRAIDED IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 39 GLOBAL SPIRAL WIRE IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 40 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY PRESSURE, 2018-2030 (USD THOUSAND)

TABLE 41 GLOBAL LOW PRESSURE (LESS THAN 3000 PSI) IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 42 GLOBAL MEDIUM PRESSURE (BETWEEN 3000 TO 6000) IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 43 GLOBAL HIGH PRESSURE (MORE THAN 6000) IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 44 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD THOUSAND)

TABLE 45 GLOBAL DISTRIBUTORS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 46 GLOBAL OEM IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 47 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY MATERIAL TYPE, 2018-2030 (USD THOUSAND)

TABLE 48 GLOBAL RUBBER IN INDUSTRIAL HOSES MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 49 GLOBAL POLYURETHANE IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 50 GLOBAL POLYVINYL CHLORIDE IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 51 GLOBAL METAL IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 52 GLOBAL THERMOPLASTICS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 53 GLOBAL COMPOSITE IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 54 GLOBAL SILICONE IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 55 GLOBAL OTHERS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 56 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY MEDIA, 2018-2030 (USD THOUSAND)

TABLE 57 GLOBAL OIL IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 58 GLOBAL WATER IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 59 GLOBAL GAS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 60 GLOBAL OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 61 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET, BY PARTS, 2018-2030 (USD THOUSAND)

TABLE 62 GLOBAL ORIGINAL PARTS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 63 GLOBAL REPLACEMENT PARTS IN INDUSTRIAL HOSES AND FITTINGS MARKET, BY REGION, 2018-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: SEGMENTATION

FIGURE 2 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: MULTIVARIATE MODELING

FIGURE 10 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: TYPE TIMELINE CURVE

FIGURE 11 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: SEGMENTATION

FIGURE 12 INCREASING NEED OF DURABLE INDUSTRIAL HOSES IN CRITICAL APPLICATIONS IS EXPECTED TO DRIVE THE GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 HOSES ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET IN 2023 AND 2030

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS FASTEST GROWING IN THE GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR INDUSTRIAL HOSES MANUFACTURERS IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL INDUSTRIAL HOSES & FITTINGS MARKET

FIGURE 17 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY TYPE, 2022

FIGURE 18 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY INDUSTRY, 2022

FIGURE 19 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY WIRE TYPE, 2022

FIGURE 20 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY PRESSURE, 2022

FIGURE 21 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 22 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY MATERIAL TYPE, 2023

FIGURE 23 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY MEDIA, 2023

FIGURE 24 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY PARTS, 2022

FIGURE 25 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: SNAPSHOT (2022)

FIGURE 26 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY REGION (2022)

FIGURE 27 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY REGION (2023 & 2030)

FIGURE 28 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY REGION (2022 & 2030)

FIGURE 29 GLOBAL INDUSTRIAL HOSES AND FITTINGS MARKET: BY TYPE (2023 - 2030)

FIGURE 30 NORTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: SNAPSHOT (2022)

FIGURE 31 NORTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022)

FIGURE 32 NORTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 NORTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 34 NORTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY TYPE (2023-2030)

FIGURE 35 EUROPE INDUSTRIAL HOSES AND FITTINGS MARKET: SNAPSHOT (2022)

FIGURE 36 EUROPE INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022)

FIGURE 37 EUROPE INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 38 EUROPE INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 39 EUROPE INDUSTRIAL HOSES AND FITTINGS MARKET: BY TYPE (2023-2030)

FIGURE 40 ASIA-PACIFIC INDUSTRIAL HOSES AND FITTINGS MARKET: SNAPSHOT (2022)

FIGURE 41 ASIA-PACIFIC INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022)

FIGURE 42 ASIA-PACIFIC INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 43 ASIA-PACIFIC INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 44 ASIA-PACIFIC INDUSTRIAL HOSES AND FITTINGS MARKET: BY TYPE (2023-2030)

FIGURE 45 MIDDLE EAST AND AFRICA INDUSTRIAL HOSES AND FITTINGS MARKET: SNAPSHOT (2022)

FIGURE 46 MIDDLE EAST AND AFRICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022)

FIGURE 47 MIDDLE EAST AND AFRICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 48 MIDDLE EAST AND AFRICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 49 MIDDLE EAST AND AFRICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY TYPE (2023-2030)

FIGURE 50 SOUTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: SNAPSHOT (2022)

FIGURE 51 SOUTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022)

FIGURE 52 SOUTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 53 SOUTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 54 SOUTH AMERICA INDUSTRIAL HOSES AND FITTINGS MARKET: BY TYPE (2023-2030)

FIGURE 55 GLOBAL INDUSTRIAL HOSES MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 ASIA-PACIFIC INDUSTRIAL HOSES MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 EUROPE INDUSTRIAL HOSES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.