Marché mondial de l'indium, par produit (primaire, secondaire et type III), application ( écrans plats , matériaux semi-conducteurs, photovoltaïque, soudures, alliages, matériaux d'interface thermique et batteries) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de l'indium

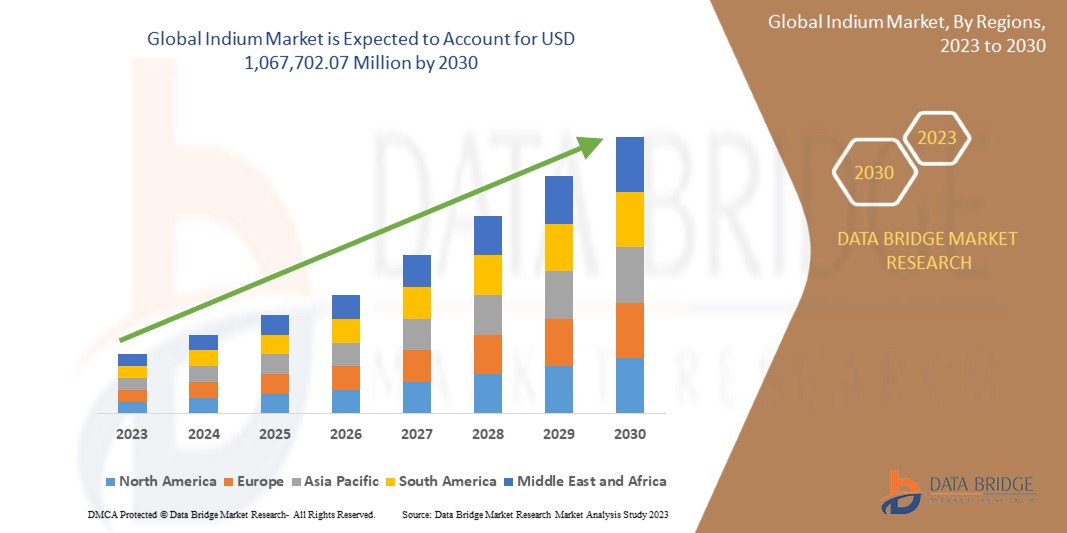

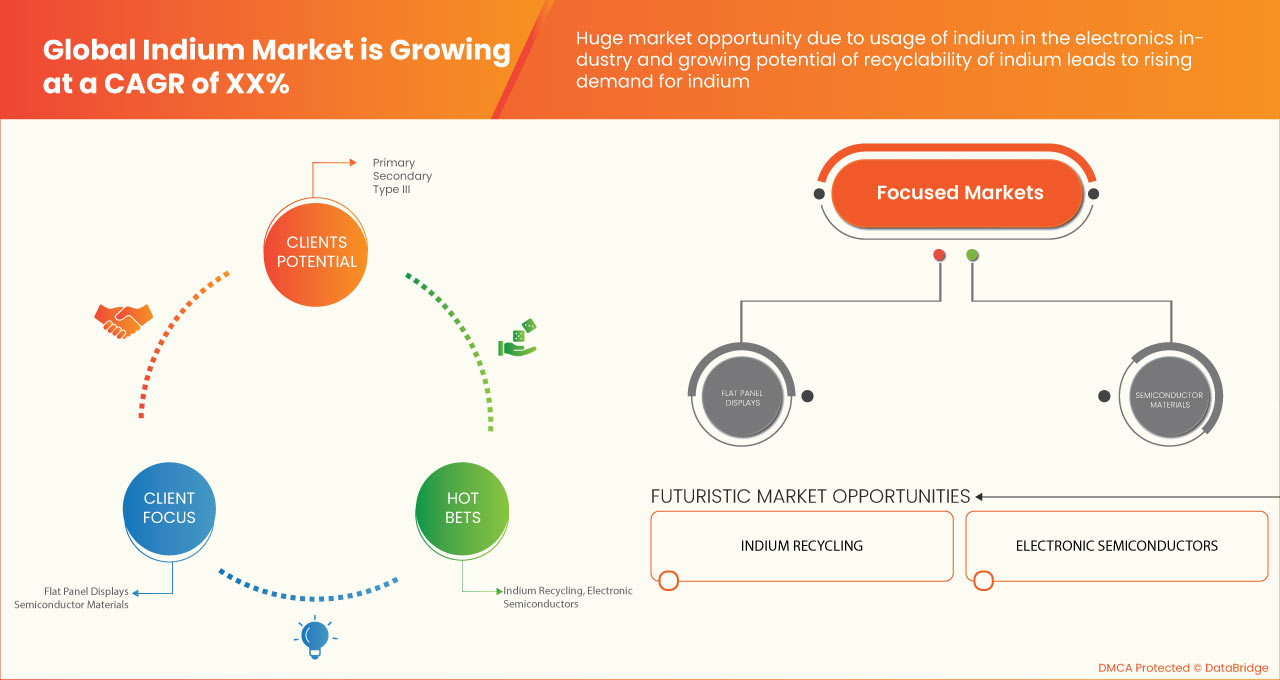

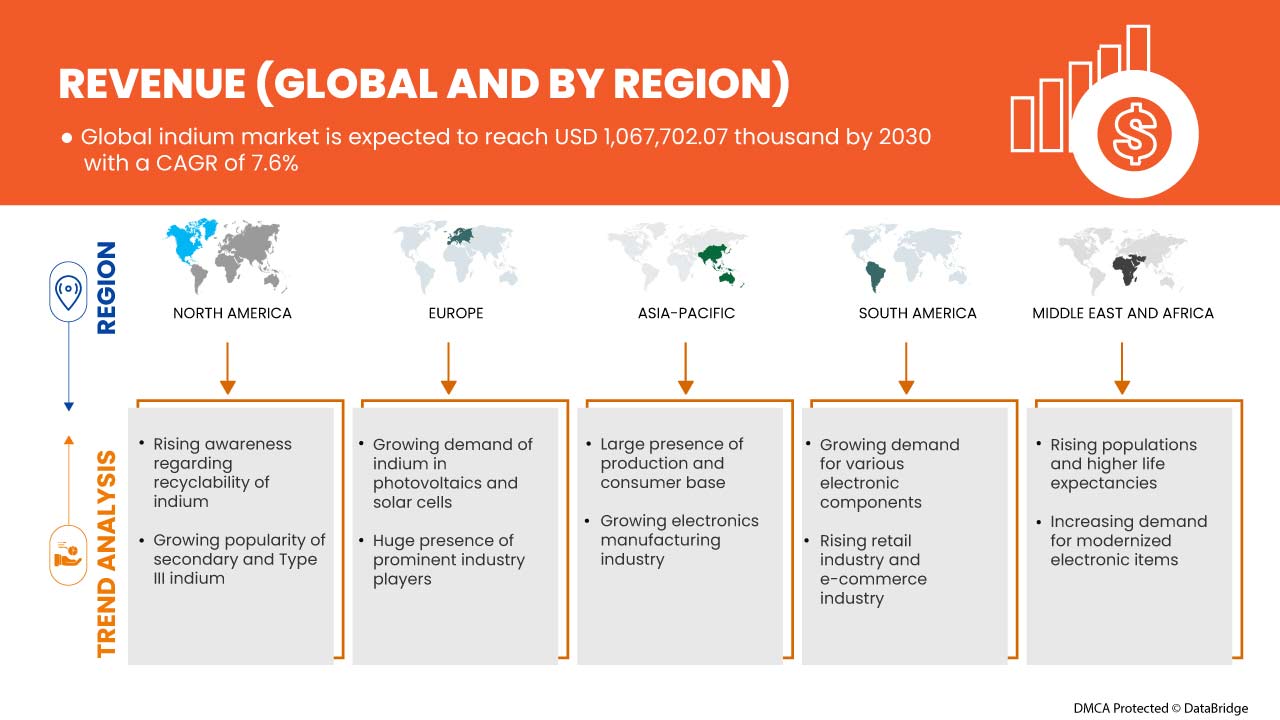

Le marché mondial de l'indium devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,6 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 067 702,07 millions USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché de l'indium est la demande croissante d'articles électroniques. La popularité croissante des panneaux solaires et leur utilisation dans les alliages dentaires devraient propulser la croissance du marché mondial de l'indium.

La croissance de l'industrie des semi-conducteurs et la capacité de recyclage de l'indium métallique devraient offrir des opportunités sur le marché mondial de l'indium. Cependant, les fluctuations des prix des matières premières et les écarts importants entre l'offre et la demande devraient remettre en cause la croissance du marché. Les principales contraintes susceptibles d'avoir un impact négatif sur le marché mondial de l'indium sont la menace crédible des substituts et les problèmes environnementaux et sanitaires associés à l'indium.

Le rapport sur le marché mondial de l'indium fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Contactez-nous pour un briefing d'analyste afin de comprendre l'analyse et le scénario du marché. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par produit (primaire, secondaire et type III), application (écrans plats, matériaux semi-conducteurs, photovoltaïque , soudures, alliages, matériaux d'interface thermique et batteries) |

|

Pays couverts |

États-Unis, Canada, Mexique, Royaume-Uni, Russie, France, Espagne, Italie, Allemagne, Turquie, Pays-Bas, Suisse, Belgique, reste de l'Europe, Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, et le reste de l'Asie-Pacifique, Brésil, Argentine, reste de l'Amérique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Français Nippon Rare Metal Inc, Umicore, Teck Resources Limited, Nyrstar, Avalon Advanced Materials Inc., Ahpmat.com., Indium Corporation, Lipmann Walton & Co. Ltd, Zhuzhou Keneng New Material Co., Ltd. Inc., ESPI Metals, AIM Metals & Alloys LP, DOWA Electronics Materials Co. Ltd. et Xinlian Environmental Protection Technology Co., Ltd. entre autres. |

Définition du marché

L'indium est un métal aux propriétés diverses et distinctes. Il s'agit d'un métal blanc argenté mou présent naturellement et combiné avec du zinc et d'autres métaux. Il possède des propriétés uniques telles qu'une liaison exclusive par soudage à froid, un taux de transfert thermique élevé, des substances non métalliques, des propriétés fiables à des températures cryogéniques et une douceur.

Dynamique du marché mondial de l'indium

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Hausse de la demande d'articles électroniques

La demande d'articles électroniques tels que les smartphones , les tablettes , les écrans plats, les ordinateurs portables et les moniteurs a augmenté dans le monde entier. La demande pour ces produits électroniques est attribuée à diverses raisons, telles que le développement de nouvelles technologies, l'augmentation du revenu disponible et l'amélioration du niveau de vie qui ont encouragé les clients à les acheter. La récente pandémie de COVID-19 a fait prospérer les ventes de ces produits, car la plupart des employés et des étudiants travaillaient et étudiaient respectivement à domicile. Les avancées technologiques ont trouvé leur utilisation dans de nombreux domaines, notamment le développement d'applications, les logiciels, l'intelligence artificielle, les soins de santé personnalisés et la robotique, ce qui a encore accru la demande pour ces équipements. En outre, plusieurs pays en développement connaissent une transformation numérique, ce qui stimule encore davantage les ventes de ces produits électroniques.

- Augmentation de la popularité des panneaux solaires

La lumière du soleil est une source d'énergie renouvelable. La production et la fourniture d'énergie solaire sont illimitées. Comparée à d'autres sources d'énergie, comme les combustibles fossiles, qui ne sont pas renouvelables, la production d'énergie solaire est plus facile et moins coûteuse. L'utilisation de l'énergie solaire ne contribue même pas au réchauffement climatique. L'architecture solaire, l'énergie solaire concentrée, les cellules et panneaux photovoltaïques sont quelques exemples de technologies de l'énergie solaire.

L'indium est un métal utilisé dans la production de panneaux solaires. Même si la demande en indium a récemment été faible, il est nécessaire pour les systèmes photovoltaïques à hétérojonction. En raison de leur transparence optique, de leurs propriétés de conductivité électrique et de leur résistance chimique à l'humidité, les oxydes d'étain et d'indium sont des matériaux largement utilisés dans les panneaux solaires.

- Utilisation dans les alliages dentaires

Les alliages utilisés pour fabriquer des prothèses dentaires contiennent principalement de l'or, de l'argent et du palladium comme métaux principaux, avec 0,5 à 10 % d'indium ajouté. La résistance à la corrosion et la dureté des implants dentaires peuvent être considérablement augmentées en utilisant une quantité minimale d'indium métallique. De plus, les amalgames dentaires contiennent souvent de l'indium. Pour éviter que l'amalgame ne devienne dangereux, l'indium aide à retenir le mercure. Ainsi, l'indium aide à protéger les personnes des effets secondaires toxiques du mercure dans les amalgames dentaires.

Opportunités

- Croissance de l'industrie des semi-conducteurs

Le point d'ébullition élevé, la résistance à la corrosion et la faible résistance sont quelques-unes des propriétés de l'indium, en raison desquelles il est largement utilisé dans l'industrie des semi-conducteurs. Les composés à base d'indium tels que le trichlorure d'indium sont bien connus pour la construction de couches semi-conductrices telles que les circuits électroniques, les lasers et les LED. De plus, l'indium a des applications dans les transistors à haute et basse température. L'indium est également utilisé dans l'assemblage solaire en tant que semi-conducteur cuivre-indium-gallium-séléniure. Une telle application haut de gamme de l'indium dans les industries créera davantage d'opportunités d'augmentation des ventes pour les produits dans lesquels l'indium est utilisé.

- Capacité de recyclage de l'indium métallique

En raison de ses performances dans les semi-conducteurs et l'optoélectronique, l'indium suscite de plus en plus d'intérêt. Il s'agit d'une ressource stratégique cruciale, classée parmi les ressources clés par la Commission européenne. Il n'existe pas de minerai d'indium propre ; il est principalement produit à partir de sous-produits de plomb et de zinc.

L'indium étant largement utilisé dans les écrans LCD, le recyclage de l'indium à partir de ces panneaux LCD est effectué. Les écrans LCD endommagés sont récupérés et démontés manuellement ou automatiquement.

Restrictions

- Problèmes environnementaux et sanitaires liés à l’indium

L'indium a pollué et eu un impact négatif sur l'environnement et notre santé en raison de son utilisation intensive dans diverses applications. La quantité d'indium dans la croûte terrestre est d'environ 0,052 ppm, et il est normalement récupéré comme sous-produit de la fabrication du zinc et du cuivre car il ne forme pas facilement ses minéraux. Les impacts négatifs de l'exploitation minière sont la déforestation, les habitats de la pêche et de la faune, les précipitations irrégulières et les perturbations écologiques. En plus des mines proprement dites, les infrastructures construites pour aider les opérations minières, telles que les routes, les lignes électriques et les voies ferrées, influencent les voies de migration des animaux et aggravent la diversité des habitats. De tels impacts environnementaux négatifs freinent la croissance du marché mondial de l'indium.

- Faible concentration dans la croûte terrestre et problèmes liés à l'extraction

L'indium est un métal largement accepté et utilisé dans divers domaines, tels que les écrans plats électroniques, les dispositifs photovoltaïques et les dispositifs semi-conducteurs. En raison de ces applications aussi larges, l'indium est l'un des métaux les plus demandés. À l'intérieur de la croûte terrestre, l'indium est très faible en quantité, environ 160 ppb en poids. La production mondiale d'indium ne représente que 800 tonnes par an. De plus, une si faible quantité d'indium a fait augmenter le prix de l'indium pur à 900 dollars américains par kilogramme. Une production aussi faible, une concentration moindre dans la croûte terrestre et une forte demande d'indium de la part des industries ont résisté à la croissance du marché mondial de l'indium.

Défis

- Fluctuation des prix des matières premières

L'indium est utilisé quotidiennement dans des produits tels que les LED, les écrans plats, les soudures, les panneaux solaires et bien d'autres. Cependant, l'indium est un sous-produit obtenu à partir de minerais de cuivre et de zinc. Il ne possède donc pas ses propres minéraux. Ainsi, le prix de production de l'indium dépend de la demande et des prix des métaux obtenus à partir de ces minerais. En outre, il s'agit de l'un des éléments les plus rares de la croûte terrestre. Les prix de l'indium varient également en fonction de la concurrence des utilisateurs finaux pour l'obtenir.

Toute nouvelle utilisation populaire pourrait modifier considérablement la demande globale, qui pourrait augmenter plus rapidement que les capacités disponibles. Cette situation pourrait perdurer pendant une décennie ou plus, en fonction du temps nécessaire pour augmenter considérablement les capacités de production.

- Un écart important entre l'offre et la demande

L'écart entre l'offre et la demande d'un produit est appelé « écart entre l'offre et la demande ». En tant que métal des terres rares, l'indium est l'un des métaux les plus rares de la croûte terrestre. Dans le cas de l'indium, 95 % de la production est réalisée à partir du traitement des minerais de zinc. La production d'indium est désavantagée car elle ne se produit pas à l'état natif. L'indium se trouve dans des minerais métalliques tels que le zinc et l'étain. Par conséquent, l'offre et la demande d'indium dépendent également d'autres métaux comme le zinc. Cet écart entraîne en outre une volatilité des prix des matières premières de l'indium. Une telle volatilité peut également influencer les prix des produits finis et les faire fluctuer.

La Chine produit plus de 50 % de l'indium raffiné mondial. Au cours des trois dernières années, la Chine a produit environ 1 000 tonnes d'indium par an et a également stocké plus de 3 000 tonnes .

Développement récent

- En décembre 2022, Umicore et PowerCo, une entreprise de batteries de Volkswagen, ont étendu leur collaboration dans le domaine des matériaux pour batteries. Ils étudient un accord d'approvisionnement stratégique à long terme pour alimenter la future Gigafactory de batteries de PowerCo pour véhicules électriques (VE) en Amérique du Nord. Ce développement contribuera à renforcer les opérations de l'entreprise

Portée du marché mondial de l'indium

Le marché mondial de l'indium est classé en fonction du produit et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Primaire

- Secondary

- Type III

Based on product, the global indium market is classified into three segments primary, secondary, and type III.

Application

- Flat Panel Displays

- Semiconductor Materials

- Photovoltaics

- Solders

- Alloys

- Thermal Interface Materials

- Batteries

Based on the application, the global indium market is classified into seven segments flat panel displays, semiconductor materials, photovoltaics, solders, alloys, thermal interface materials, and batteries.

Global Indium Market Regional Analysis/Insights

The global indium market is segmented based on product and application.

The countries in the global indium market are the U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa.

The U.S. dominates in the North American region due to the increased demand for electronic items. Germany dominated expected to dominate the Europe indium market due to the growing demand for indium in the region. South Africa dominated the indium market in the Middle East and Africa, increasing the use of indium in the region.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Indium Market Share Analysis

The global indium market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the global indium market.

Français Certains des principaux acteurs opérant sur le marché mondial de l'indium sont Nippon Rare Metal, Inc, Umicore, Teck Resources Limited, Nyrstar, Avalon Advanced Materials Inc. Ahpmat.com. Indium Corporation, Lipmann Walton & Co. Ltd, Zhuzhou Keneng New Material Co., Ltd. Inc., ESPI Metals, AIM Metals & Alloys LP, DOWA Electronics Materials Co., Ltd. et Xinlian Environmental Protection Technology Co., Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INDIUM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PURITY LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT-EXPORT SCENARIO

4.2 PRICING ANALYSIS

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 SUBSTITUTE COMPETITIVE ANALYSIS

4.5 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR ELECTRONIC ITEMS

5.1.2 INCREASE IN THE POPULARITY OF SOLAR PANELS

5.1.3 USAGE IN DENTAL ALLOYS

5.1.4 APPLICATION IN BALL BEARINGS MANUFACTURING AND FIRE SPRINKLER SYSTEM

5.2 RESTRAINTS

5.2.1 CREDIBLE THREAT OF SUBSTITUTES

5.2.2 ENVIRONMENTAL AND HEALTH ISSUES ASSOCIATED WITH INDIUM

5.2.3 LOW CONCENTRATION IN EARTH'S CRUST AND EXTRACTION-RELATED ISSUES

5.3 OPPORTUNITIES

5.3.1 GROWTH IN THE SEMICONDUCTOR INDUSTRY

5.3.2 ABILITY TO RECYCLE INDIUM METAL

5.4 CHALLENGES

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 SIGNIFICANT DEMAND AND SUPPLY GAP

6 GLOBAL INDIUM MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 PRIMARY

6.3 SECONDARY

6.4 TYPE III

7 GLOBAL INDIUM MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 FLAT PANEL DISPLAYS

7.2.1 TELEVISION & DIGITAL SIGNAGE

7.2.2 PC & LAPTOP

7.2.3 SMARTPHONE & TABLETS

7.2.4 VEHICLE DISPLAY

7.2.5 SMART WEARABLES

7.2.6 OTHERS

7.3 SEMICONDUCTOR MATERIALS

7.3.1 ALUMINIUM GALLIUM INDIUM PHOSPHIDE

7.3.2 INDIUM GALLIUM ARSENIDE

7.4 PHOTOVOLTAICS

7.4.1 GROUND MOUNTED

7.4.2 ROOFTOP

7.4.3 OTHERS

7.5 SOLDERS

7.5.1 WIRES

7.5.2 PASTE

7.5.3 PERFORMS

7.5.4 BARS

7.5.5 OTHERS

7.6 ALLOYS

7.6.1 INDIUM-TIN ALLOY

7.6.2 INDIUM-LEAD ALLOY

7.6.3 INDIUM-LEAD ALLOY

7.7 THERMAL INTERFACE MATERIALS

7.8 BATTERIES

7.8.1 AUTOMOTIVE

7.8.2 PORTABLE

7.8.3 INDUSTRIAL

8 GLOBAL INDIUM MARKET, BY REGION

8.1 OVERVIEW

8.2 ASIA-PACIFIC

8.2.1 CHINA

8.2.2 JAPAN

8.2.3 SOUTH KOREA

8.2.4 INDIA

8.2.5 AUSTRALIA & NEW ZEALAND

8.2.6 SINGAPORE

8.2.7 THAILAND

8.2.8 INDONESIA

8.2.9 MALAYSIA

8.2.10 PHILIPPINES

8.2.11 REST OF ASIA-PACIFIC

8.3 NORTH AMERICA

8.3.1 U.S.

8.3.2 CANADA

8.3.3 MEXICO

8.4 EUROPE

8.4.1 GERMANY

8.4.2 U.K.

8.4.3 FRANCE

8.4.4 ITALY

8.4.5 SPAIN

8.4.6 RUSSIA

8.4.7 TURKEY

8.4.8 NETHERLANDS

8.4.9 BELGIUM

8.4.10 SWITZERLAND

8.4.11 REST OF EUROPE

8.5 SOUTH AMERICA

8.5.1 BRAZIL

8.5.2 ARGENTINA

8.5.3 REST OF SOUTH AMERICA

8.6 MIDDLE EAST AND AFRICA

8.6.1 SOUTH AFRICA

8.6.2 ISRAEL

8.6.3 SAUDI ARABIA

8.6.4 UNITED ARAB EMIRATES

8.6.5 EGYPT

8.6.6 REST OF MIDDLE EAST AND AFRICA

9 GLOBAL INDIUM MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: GLOBAL

9.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

9.3 COMPANY SHARE ANALYSIS: EUROPE

9.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

9.5 EXPANSION

9.6 COLLABORATION

9.7 AWARD

9.8 EVENTS

9.9 RECOGNITION

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 UMICORE

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATES

11.2 TECK RESOURCES LIMITED

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATE

11.3 NYRSTAR

11.3.1 COMPANY SNAPSHOT

11.3.2 COMPANY SHARE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT UPDATES

11.4 AIM METALS & ALLOYS LP

11.4.1 COMPANY SNAPSHOT

11.4.2 COMPANY SHARE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT UPDATE

11.5 INDIUM CORPORATION

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT UPDATE

11.6 AHPMAT.COM

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT UPDATES

11.7 AVALON ADVANCED MATERIALS INC.

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT UPDATE

11.8 DOWA ELECTRONICS MATERIALS CO., LTD.

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 ESPI METALS, INC.

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT UPDATES

11.1 LIPMANN WALTON & CO. LTD

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT UPDATES

11.11 NIPPON RARE METALS, INC.

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT UPDATE

11.12 XINLIAN ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT UPDATES

11.13 ZHUZHOU KENENG NEW MATERIALS CO., LTD.

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT UPDATE

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF ARTICLES OF NIOBIUM "COLUMBIUM", GALLIUM, INDIUM, VANADIUM, AND GERMANIUM, N.E.S.; HS CODE – 811299 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF NIOBIUM "COLUMBIUM", GALLIUM, INDIUM, VANADIUM, AND GERMANIUM, N.E.S.; HS CODE – 811299 (USD THOUSAND)

TABLE 3 SUBSTITUTE MATERIALS FOR INDIUM ALONG WITH THEIR CHARACTERISTICS, APPLICATIONS, AND MANUFACTURING COMPANIES

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 GLOBAL INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 7 GLOBAL PRIMARY IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL PRIMARY IN INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 GLOBAL SECONDARY IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL SECONDARY IN INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 11 GLOBAL TYPE III IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL TYPE III IN INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 13 GLOBAL INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL FLAT PANEL DISPLAYS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL PHOTOVOLTAICS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL SOLDERS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL ALLOYS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL THERMAL INTERFACE MATERIALS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL BATTERIES IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 29 ASIA-PACIFIC INDIUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC INDIUM MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 31 ASIA-PACIFIC INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 33 ASIA-PACIFIC INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 CHINA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 41 CHINA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 42 CHINA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 CHINA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 CHINA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CHINA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 CHINA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 CHINA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CHINA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 JAPAN INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 50 JAPAN INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 51 JAPAN INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 JAPAN FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 JAPAN SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 JAPAN PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 JAPAN SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 JAPAN ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 JAPAN BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 SOUTH KOREA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH KOREA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 60 SOUTH KOREA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH KOREA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH KOREA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH KOREA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH KOREA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH KOREA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 SOUTH KOREA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 INDIA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 68 INDIA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 69 INDIA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 70 INDIA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 INDIA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 INDIA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 INDIA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 INDIA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 INDIA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 AUSTRALIA & NEW ZEALAND INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 77 AUSTRALIA & NEW ZEALAND INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 78 AUSTRALIA & NEW ZEALAND INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 79 AUSTRALIA & NEW ZEALAND FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 AUSTRALIA & NEW ZEALAND SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 AUSTRALIA & NEW ZEALAND PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 AUSTRALIA & NEW ZEALAND SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 AUSTRALIA & NEW ZEALAND ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 AUSTRALIA & NEW ZEALAND BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SINGAPORE INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 86 SINGAPORE INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 87 SINGAPORE INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 88 SINGAPORE FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 SINGAPORE SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 SINGAPORE PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 SINGAPORE SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 SINGAPORE ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 SINGAPORE BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 THAILAND INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 95 THAILAND INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 96 THAILAND INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 97 THAILAND FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 THAILAND SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 THAILAND PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 THAILAND SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 THAILAND ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 THAILAND BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 INDONESIA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 104 INDONESIA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 105 INDONESIA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 106 INDONESIA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 INDONESIA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 INDONESIA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 INDONESIA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 INDONESIA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 INDONESIA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 MALAYSIA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 113 MALAYSIA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 114 MALAYSIA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 115 MALAYSIA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 MALAYSIA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 MALAYSIA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 MALAYSIA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 MALAYSIA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 MALAYSIA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 PHILIPPINES INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 122 PHILIPPINES INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 123 PHILIPPINES INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 124 PHILIPPINES FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 PHILIPPINES SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 PHILIPPINES PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 PHILIPPINES SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 PHILIPPINES ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 PHILIPPINES BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 REST OF ASIA-PACIFIC INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 131 REST OF ASIA-PACIFIC INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 132 NORTH AMERICA INDIUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 133 NORTH AMERICA INDIUM MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 134 NORTH AMERICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 135 NORTH AMERICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 136 NORTH AMERICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 137 NORTH AMERICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 NORTH AMERICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 NORTH AMERICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 NORTH AMERICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 141 NORTH AMERICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 NORTH AMERICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 U.S. INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 144 U.S. INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 145 U.S. INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 146 U.S. FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 U.S. SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 U.S. PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 U.S. SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 U.S. ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 U.S. BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 CANADA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 153 CANADA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 154 CANADA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 155 CANADA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 CANADA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 CANADA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 CANADA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 CANADA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 160 CANADA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 MEXICO INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 162 MEXICO INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 163 MEXICO INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 164 MEXICO FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 165 MEXICO SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 MEXICO PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 MEXICO SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 MEXICO ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 MEXICO BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 170 EUROPE INDIUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 171 EUROPE INDIUM MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 172 EUROPE INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 173 EUROPE INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 174 EUROPE INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 175 EUROPE FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 EUROPE SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 EUROPE PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 EUROPE SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 EUROPE ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 EUROPE BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 GERMANY INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 182 GERMANY INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 183 GERMANY INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 184 GERMANY FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 GERMANY SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 GERMANY PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 GERMANY SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 GERMANY ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 189 GERMANY BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 U.K. INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 191 U.K. INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 192 U.K. INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 193 U.K. FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 U.K. SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 U.K. PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 196 U.K. SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 U.K. ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 198 U.K. BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 FRANCE INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 200 FRANCE INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 201 FRANCE INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 202 FRANCE FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 FRANCE SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 204 FRANCE PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 205 FRANCE SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 FRANCE ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 FRANCE BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 ITALY INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 209 ITALY INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 210 ITALY INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 211 ITALY FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 ITALY SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 213 ITALY PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 214 ITALY SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 ITALY ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 216 ITALY BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 217 SPAIN INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 218 SPAIN INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 219 SPAIN INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 220 SPAIN FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 SPAIN SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 SPAIN PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 223 SPAIN SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 SPAIN ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 225 SPAIN BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 226 RUSSIA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 227 RUSSIA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 228 RUSSIA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 229 RUSSIA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 230 RUSSIA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 RUSSIA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 232 RUSSIA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 RUSSIA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 234 RUSSIA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 235 TURKEY INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 236 TURKEY INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 237 TURKEY INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 238 TURKEY FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 239 TURKEY SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 TURKEY PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 241 TURKEY SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 242 TURKEY ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 243 TURKEY BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 244 NETHERLANDS INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 245 NETHERLANDS INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 246 NETHERLANDS INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 247 NETHERLANDS FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 NETHERLANDS SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 NETHERLANDS PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 250 NETHERLANDS SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 251 NETHERLANDS ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 252 NETHERLANDS BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 BELGIUM INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 254 BELGIUM INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 255 BELGIUM INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 256 BELGIUM FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 257 BELGIUM SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 258 BELGIUM PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 BELGIUM SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 260 BELGIUM ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 261 BELGIUM BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 262 SWITZERLAND INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 263 SWITZERLAND INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 264 SWITZERLAND INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 265 SWITZERLAND FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 266 SWITZERLAND SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 SWITZERLAND PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 SWITZERLAND SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 SWITZERLAND ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 270 SWITZERLAND BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 271 REST OF EUROPE INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 272 REST OF EUROPE INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 273 SOUTH AMERICA INDIUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 274 SOUTH AMERICA INDIUM MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 275 SOUTH AMERICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 276 SOUTH AMERICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 277 SOUTH AMERICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 278 SOUTH AMERICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 279 SOUTH AMERICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 280 SOUTH AMERICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 281 SOUTH AMERICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 282 SOUTH AMERICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 283 SOUTH AMERICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 BRAZIL INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 285 BRAZIL INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 286 BRAZIL INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 287 BRAZIL FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 288 BRAZIL SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 289 BRAZIL PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 290 BRAZIL SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 291 BRAZIL ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 292 BRAZIL BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 ARGENTINA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 294 ARGENTINA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 295 ARGENTINA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 296 ARGENTINA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 297 ARGENTINA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 ARGENTINA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 299 ARGENTINA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 300 ARGENTINA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 301 ARGENTINA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 REST OF SOUTH AMERICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 303 REST OF SOUTH AMERICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 304 MIDDLE EAST AND AFRICA INDIUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 305 MIDDLE EAST AND AFRICA INDIUM MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 306 MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 307 MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 308 MIDDLE EAST AND AFRICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 309 MIDDLE EAST AND AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 310 MIDDLE EAST AND AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 MIDDLE EAST AND AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 312 MIDDLE EAST AND AFRICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 313 MIDDLE EAST AND AFRICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 MIDDLE EAST AND AFRICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 315 SOUTH AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 316 SOUTH AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 317 SOUTH AFRICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 318 SOUTH AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 319 SOUTH AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 320 SOUTH AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 321 SOUTH AFRICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 322 SOUTH AFRICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 323 SOUTH AFRICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 324 ISRAEL INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 325 ISRAEL INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 326 ISRAEL INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 327 ISRAEL FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 328 ISRAEL SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 329 ISRAEL PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 330 ISRAEL SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 331 ISRAEL ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 332 ISRAEL BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 333 SAUDI ARABIA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 334 SAUDI ARABIA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 335 SAUDI ARABIA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 336 SAUDI ARABIA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 337 SAUDI ARABIA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 338 SAUDI ARABIA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 339 SAUDI ARABIA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 340 SAUDI ARABIA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 341 SAUDI ARABIA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 342 UNITED ARAB EMIRATES INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 343 UNITED ARAB EMIRATES INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 344 UNITED ARAB EMIRATES INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 345 UNITED ARAB EMIRATES FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 346 UNITED ARAB EMIRATES SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 347 UNITED ARAB EMIRATES PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 348 UNITED ARAB EMIRATES SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 349 UNITED ARAB EMIRATES ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 350 UNITED ARAB EMIRATES BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 351 EGYPT INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 352 EGYPT INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 353 EGYPT INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 354 EGYPT FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 355 EGYPT SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 356 EGYPT PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 357 EGYPT SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 358 EGYPT ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 359 EGYPT BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 360 REST OF MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 361 REST OF MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

Liste des figures

FIGURE 1 GLOBAL INDIUM MARKET

FIGURE 2 GLOBAL INDIUM MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL INDIUM MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL INDIUM MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL INDIUM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL INDIUM MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 GLOBAL INDIUM MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL INDIUM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL INDIUM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL INDIUM MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 GLOBAL INDIUM MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL INDIUM MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL INDIUM MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL INDIUM MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 RISING DEMAND FOR ELECTRONIC ITEMS IS EXPECTED TO DRIVE THE GLOBAL INDIUM MARKET IN THE FORECAST PERIOD

FIGURE 16 PRIMARY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL INDIUM MARKET IN 2022 & 2029

FIGURE 17 ASIA PACIFIC IS THE FASTEST-GROWING MARKET FOR INDIUM MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 PRICE ANALYSIS FOR THE GLOBAL INDIUM MARKET (USD/KG)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL INDIUM MARKET

FIGURE 21 GLOBAL INDIUM MARKET: BY PRODUCT, 2022

FIGURE 22 GLOBAL INDIUM MARKET: BY APPLICATION, 2022

FIGURE 23 GLOBAL INDIUM MARKET: SNAPSHOT (2022)

FIGURE 24 GLOBAL INDIUM MARKET: BY REGION (2022)

FIGURE 25 GLOBAL INDIUM MARKET: BY REGION (2023 & 2030)

FIGURE 26 GLOBAL INDIUM MARKET: BY REGION (2022 & 2030)

FIGURE 27 GLOBAL INDIUM MARKET: BY PRODUCT (2023-2030)

FIGURE 28 ASIA-PACIFIC INDIUM MARKET: SNAPSHOT (2022)

FIGURE 29 ASIA-PACIFIC INDIUM MARKET: BY COUNTRY (2022)

FIGURE 30 ASIA-PACIFIC INDIUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 31 ASIA-PACIFIC INDIUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 32 ASIA-PACIFIC INDIUM MARKET: BY PRODUCT (2023 - 2030)

FIGURE 33 NORTH AMERICA INDIUM MARKET: SNAPSHOT (2022)

FIGURE 34 NORTH AMERICA INDIUM MARKET: BY COUNTRY (2022)

FIGURE 35 NORTH AMERICA INDIUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 36 NORTH AMERICA INDIUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 37 NORTH AMERICA INDIUM MARKET: BY PRODUCT (2023 - 2030)

FIGURE 38 EUROPE INDIUM MARKET: SNAPSHOT (2022)

FIGURE 39 EUROPE INDIUM MARKET: BY COUNTRY (2022)

FIGURE 40 EUROPE INDIUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 41 EUROPE INDIUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 EUROPE INDIUM MARKET: BY PRODUCT (2023 - 2030)

FIGURE 43 SOUTH AMERICA INDIUM MARKET: SNAPSHOT (2022)

FIGURE 44 SOUTH AMERICA INDIUM MARKET: BY COUNTRY (2022)

FIGURE 45 SOUTH AMERICA INDIUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 46 SOUTH AMERICA INDIUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 47 SOUTH AMERICA INDIUM MARKET: BY PRODUCT (2023 - 2030)

FIGURE 48 MIDDLE EAST AND AFRICA INDIUM MARKET: SNAPSHOT (2022)

FIGURE 49 MIDDLE EAST AND AFRICA INDIUM MARKET: BY COUNTRY (2022)

FIGURE 50 MIDDLE EAST AND AFRICA INDIUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 51 MIDDLE EAST AND AFRICA INDIUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 52 MIDDLE EAST AND AFRICA INDIUM MARKET: BY PRODUCT (2023 - 2030)

FIGURE 53 GLOBAL INDIUM MARKET: COMPANY SHARE 2022 (%)

FIGURE 54 NORTH AMERICA INDIUM MARKET: COMPANY SHARE 2022 (%)

FIGURE 55 EUROPE INDIUM MARKET: COMPANY SHARE 2022 (%)

FIGURE 56 ASIA-PACIFIC INDIUM MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.