Global Goat Milk Market

Taille du marché en milliards USD

TCAC :

%

USD

10.74 Billion

USD

16.11 Billion

2024

2032

USD

10.74 Billion

USD

16.11 Billion

2024

2032

| 2025 –2032 | |

| USD 10.74 Billion | |

| USD 16.11 Billion | |

|

|

|

|

Global Goat Milk market, By Product (Whole Milk, UHT Semi Skimmed & Skimmed Milk, Semi Skimmed Milk, and UHT Whole Milk), Flavour (Original/Classic, and Flavored), Fat Content (Regular, Low Fat, and Fat Free), Packaging Type (Bottle, Tetra Pack, Sachet/Pouch, Tin, and Others), Distribution Channel (Store Based Retailers, and Non-Store Retailers), End User (Household/Retail, and Food Service Industry) - Industry Trends and Forecast to 2032.

Goat Milk Market Size

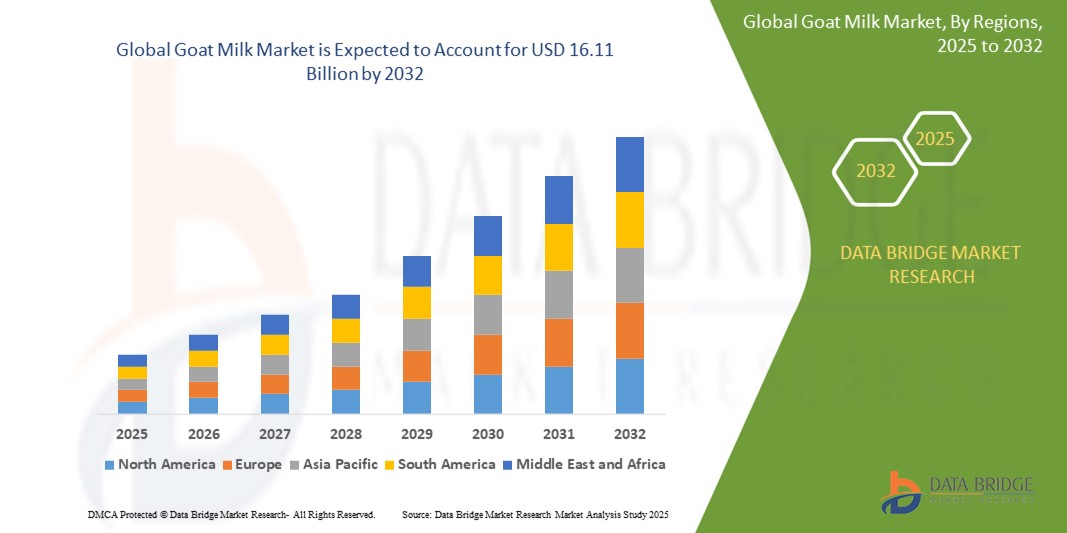

- The global goat milk market size was valued at USD 10.74 billion in 2024 and is expected to reach USD 16.11 billion by 2032, at a CAGR of 5.2% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of the health benefits associated with goat milk, such as higher digestibility and nutritional content compared to cow milk, alongside rising demand for natural and organic dairy products

- Growing preferences for lactose-free and hypoallergenic dairy alternatives, coupled with expanding applications in the food service industry, are further propelling the adoption of goat milk products, significantly boosting market expansion

Goat Milk Market Analysis

- Goat milk and its derivatives, such as cheese, yogurt, and powdered milk, are gaining popularity as nutritious and digestible alternatives to traditional dairy, particularly for lactose-intolerant consumers and those seeking sustainable food options

- The rising demand for goat milk is fueled by growing health consciousness, increasing prevalence of lactose intolerance, and a shift toward premium and specialty dairy products in both household and food service sectors

- Asia-Pacific dominated the goat milk market with the largest revenue share of 42.5% in 2024, driven by strong cultural acceptance of goat milk products, large-scale dairy farming, and growing consumer demand for healthy dairy alternatives, particularly in countries such as China and India

- North America is expected to be the fastest-growing region during the forecast period, attributed to rising health awareness, increasing adoption of organic and natural products, and growing demand for goat milk-based infant formula and specialty foods

- The whole milk segment dominated the largest market revenue share of 43.42% in 2024, driven by its high nutritional value and widespread consumer preference for unprocessed, full-fat dairy products, particularly in household consumption

Report Scope and Goat Milk Market Segmentation

|

Attributes |

Goat Milk Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Goat Milk Market Trends

“Increasing Integration of Health-Focused Innovations and Consumer Analytics”

- The global goat milk market is experiencing a notable trend toward integrating health-focused innovations and consumer analytics to meet evolving dietary preferences

- These advancements enable manufacturers to gain deeper insights into consumer purchasing patterns, nutritional demands, and product preferences, facilitating the development of tailored goat milk products

- Health-driven innovations, such as fortified goat milk with added probiotics, vitamins, or minerals, cater to the growing demand for functional foods that support digestion and immunity

- For instance, companies are leveraging consumer data analytics to create flavored goat milk variants, such as chocolate or fruit blends, targeting younger demographics and expanding market reach

- This trend enhances the appeal of goat milk products, making them more attractive to health-conscious consumers, households, and food service industries

- Analytics can evaluate consumer behaviors, such as preferences for low-fat or organic options, enabling producers to optimize product offerings and marketing strategies

Goat Milk Market Dynamics

Driver

“Rising Demand for Lactose-Friendly and Nutrient-Rich Dairy Alternatives”

- Increasing consumer demand for lactose-friendly and nutrient-rich dairy alternatives, driven by rising lactose intolerance and health awareness, is a key driver for the global goat milk market

- Goat milk products, known for their lower lactose content and easier digestibility compared to cow milk, offer features such as enhanced nutritional profiles, including high levels of calcium, protein, and vitamins

- Government initiatives in regions such as Asia-Pacific, promoting dairy diversification and nutritional health, are contributing to the widespread adoption of goat milk

- The expansion of e-commerce and advancements in packaging technology, such as tetra packs and bottles, are further enabling market growth by improving product accessibility and shelf life

- Manufacturers are increasingly offering goat milk products, such as whole milk, UHT semi-skimmed, and flavored variants, as standard or premium options to meet consumer expectations and enhance product value

Restraint/Challenge

“High Production Costs and Supply Chain Limitations”

- The high cost of goat milk production, including labor, feed, and processing, poses a significant barrier to market adoption, particularly in emerging markets where cost sensitivity is high

- Establishing efficient supply chains for goat milk, especially for UHT semi-skimmed and skimmed milk, can be complex and costly due to limited production scale compared to cow milk

- In addition, concerns over supply chain disruptions and product availability present major challenges. The limited number of large-scale goat dairy farms, particularly in regions outside Asia-Pacific, restricts consistent supply to meet growing demand

- Regulatory variations across countries regarding organic certifications, quality standards, and labeling requirements further complicate operations for global producers and distributors

- These factors can deter potential buyers and limit market expansion, especially in regions such as North America, where rapid growth is constrained by supply and cost challenges

Goat Milk market Scope

The market is segmented on the basis of product, flavour, fat content, packaging type, distribution channel, and end user.

- By Product

On the basis of product, the global goat milk market is segmented into whole milk, UHT semi skimmed & skimmed milk, semi skimmed milk, and UHT whole milk. The whole milk segment dominated the largest market revenue share of 43.42% in 2024, driven by its high nutritional value and widespread consumer preference for unprocessed, full-fat dairy products, particularly in household consumption.

The UHT semi skimmed & skimmed milk segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its extended shelf life, convenience, and alignment with health-conscious trends. Consumers seeking lower-fat dairy alternatives and the suitability of UHT processing for international trade further drive adoption.

- By Flavour

On the basis of flavour, the global goat milk market is segmented into original/classic and flavored. The original/classic segment dominated the market with a revenue share of 86.03% in 2024, owing to its authentic taste, broad consumer acceptance, and versatility in culinary applications across regions.

The flavored segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by increasing demand from younger consumers and those seeking variety. Flavors such as chocolate, vanilla, and fruit blends appeal to children and non-traditional goat milk consumers, supported by innovative marketing and ready-to-drink formats.

- By Fat Content

On the basis of fat content, the global goat milk market is segmented into regular, low fat, and fat free. The regular segment accounted for the largest market revenue share of 50.63% in 2024, attributed to its rich taste and nutritional profile, which appeals to consumers prioritizing natural and minimally processed products.

The low fat segment is expected to witness significant growth from 2025 to 2032, driven by rising health consciousness and demand for weight management-friendly dairy options. Low-fat goat milk aligns with dietary preferences for reduced calorie intake while retaining nutritional benefits.

- By Packaging Type

On the basis of packaging type, the global goat milk market is segmented into bottle, tetra pack, sachet/pouch, tin, and others. The bottle segment held the largest market revenue share of approximately 40% in 2024, due to its convenience, recyclability, and widespread use in both retail and food service sectors. Innovations in sustainable packaging further boost its dominance.

The tetra pack segment is projected to experience the fastest growth rate from 2025 to 2032, driven by its lightweight design, extended shelf life, and suitability for UHT products. Increasing demand for portable and eco-friendly packaging in urbanized regions supports its growth.

- By Distribution Channel

On the basis of distribution channel, the global goat milk market is segmented into store-based retailers and non-store retailers. The store-based retailers segment dominated the market with a revenue share of approximately 70% in 2024, driven by consumer preference for in-store shopping at supermarkets, hypermarkets, and specialty stores, which offer a wide range of goat milk products.

The non-store retailers segment is expected to witness rapid growth from 2025 to 2032, fueled by the increasing popularity of e-commerce platforms and online grocery shopping. The convenience of home delivery and the ability to reach consumers in remote areas drive adoption, particularly post-COVID-19.

- By End User

On the basis of end user, the global goat milk market is segmented into household/retail and food service industry. The household/retail segment held the largest market revenue share of 77.07% in 2024, driven by high consumer demand for goat milk as a nutritious alternative to cow milk, especially among lactose-intolerant and health-conscious individuals.

The food service industry segment is anticipated to experience robust growth from 2025 to 2032, propelled by the rising incorporation of goat milk products in cafes, restaurants, and bakeries. The demand for premium and specialty dairy products in culinary applications enhances its adoption in this sector.

Goat Milk Market Regional Analysis

- Asia-Pacific dominated the goat milk market with the largest revenue share of 42.5% in 2024, driven by strong cultural acceptance of goat milk products, large-scale dairy farming, and growing consumer demand for healthy dairy alternatives, particularly in countries such as China and India

- Consumers prioritize goat milk for its health advantages, including easier digestion, lower allergenicity compared to cow milk, and suitability for lactose-intolerant individuals, particularly in regions with diverse dietary preferences

- Growth is supported by advancements in processing technologies, such as UHT (Ultra-High Temperature) processing, and increasing adoption across household, retail, and food service industries, with a focus on flavored and low-fat variants

U.S. Goat Milk Market Insight

The U.S. goat milk market is expected to witness significant growth, fueled by growing consumer awareness of goat milk’s health benefits and rising demand for natural, organic dairy alternatives. The trend towards premium and specialty dairy products, coupled with increasing availability in mainstream retail channels, boosts market expansion. The food service industry’s adoption of goat milk in cafes and restaurants complements retail sales, creating a robust market ecosystem.

Europe Goat Milk Market Insight

The Europe goat milk market is expected to witness significant growth, supported by increasing demand for alternative dairy products and a strong focus on sustainable agriculture. Consumers seek goat milk for its nutritional profile and use in specialty products such as cheeses and yogurts. Growth is prominent in both retail and food service sectors, with countries such as France and Spain showing significant uptake due to culinary traditions and health-conscious trends.

U.K. Goat Milk Market Insight

The U.K. market for goat milk is expected to witness rapid growth, driven by rising consumer interest in health-focused dairy alternatives and sustainable food choices. Increased awareness of goat milk’s benefits for lactose intolerance and skin health encourages adoption. Evolving dietary trends and the expansion of goat milk products in supermarkets and online platforms further support market growth.

Germany Goat Milk Market Insight

Germany is expected to witness strong growth in the goat milk market, attributed to its advanced dairy industry and high consumer focus on health and wellness. German consumers prefer goat milk products with low-fat and organic certifications, which align with sustainability goals. The integration of goat milk in premium dairy products and growing availability in retail channels supports sustained market growth.

Asia-Pacific Goat Milk Market Insight

The Asia-Pacific region dominates the global goat milk market, driven by large-scale consumption and production in countries such as China, India, and Pakistan. Rising disposable incomes and growing awareness of goat milk’s health benefits, including its role in infant nutrition and digestive health, boost demand. Government initiatives promoting dairy diversification and nutritional security further encourage the use of goat milk products.

Japan Goat Milk Market Insight

Japan’s goat milk market is expected to witness significant growth due to strong consumer preference for high-quality, health-focused dairy products. The presence of major food and beverage manufacturers and the integration of goat milk in functional foods and beverages accelerate market penetration. Rising interest in premium and organic goat milk products also contributes to growth.

China Goat Milk Market Insight

China holds the largest share of the Asia-Pacific goat milk market, propelled by rapid urbanization, rising health consciousness, and increasing demand for nutritious dairy alternatives. The country’s growing middle class and focus on infant nutrition and functional foods support the adoption of goat milk. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Goat Milk Market Share

The goat milk industry is primarily led by well-established companies, including:

- Ansnutria Dairy Corporation Ltd. (China)

- Emmi Group (Switzerland)

- Dairy Goat Cooperative (New Zealand)

- Holle baby food AG (Switzerland)

- Granarolo S.p.A. (Italy)

- Bubs Australia Limited (Australia)

- CapriLac (Australia)

- Castle Dairy s.a. (Belgium)

- DEFEEM SDN. BHD. (Malaysia)

- Delamere Dairy (U.K.)

- Farm Fresh Milk Sdn. Bhd. (Malaysia)

- Hay Dairies Pte Ltd. (Singapore)

- LACTALIS (France)

- Orient EuroPharma CO. Ltd. (Taiwan)

- UK Farm SDN BHD (Malaysia)

What are the Recent Developments in Global Goat Milk Market?

- In October 2023, ICAR – Central Institute for Research on Goats (CIRG) and Heifer India formalized a strategic partnership to transform India’s goat farming landscape. Signed on October 6 at CIRG’s Makhdoom campus in Mathura, the MoU focuses on pioneering research, advanced training, and sustainable practices to uplift smallholder farmers and strengthen the goat milk value chain. The collaboration aims to boost productivity, improve breeding and healthcare practices, and ensure long-term sustainability through community empowerment and private sector linkages. This initiative supports the rising demand for goat milk derivatives both in India and globally

- In July 2023, Ausnutria Dairy Corporation Ltd. announced that its Kabrita Goat Milk-Based Infant Formula had successfully completed the U.S. FDA’s nutrition and safety review, making it the first European goat milk infant formula to receive such authorization. This milestone allows Kabrita to expand its presence in the U.S. market, offering a lactose-friendly, easy-to-digest alternative to cow milk-based formulas. Designed for infants aged 0–12 months, the formula features A2 beta-casein and a whey-to-casein ratio similar to breast milk, supporting healthy growth and digestive comfort

- In June 2023, Vilvah introduced its Goat Milk Hair Mask, a 3-in-1 deep-conditioning treatment designed to nourish, strengthen, and style hair using goat milk and plant-derived ceramides. This innovative formula helps repair the hair barrier, reduce breakage, and lock in moisture—making it ideal for dry, damaged, or curly hair. Infused with marine brown algae and xylitylglucoside, the mask enhances shine, controls frizz, and supports scalp health. It can be used as a rinse-off conditioner, leave-in mask, or heat-protective styling cream, aligning with the growing demand for natural, sustainable hair care

- In November 2022, Redwood Hill Farm & Creamery Inc. and Jackson-Mitchell Inc. merged to form Darey Brands Inc., uniting two pioneers in specialty dairy under one banner. The new entity combines Redwood Hill’s goat milk yogurts and kefirs with Jackson-Mitchell’s Meyenberg® goat milk and butter, creating a robust portfolio of goat, cow, and plant-based dairy products. Backed by parent company Emmi Group, Darey Brands is positioned for accelerated growth across multiple categories, with a focus on sustainable, better-for-you dairy that meets evolving consumer preferences

- In June 2022, Canada Royal Milk (CRM) formed a strategic partnership with the Ontario Goat Dairy Cooperative (ODGC) and Producteurs de lait de chèvre du Québec (PLCQ), securing access to goat milk from over 120 farms across Ontario and Quebec. This collaboration enables CRM to consistently source high-quality goat milk for its Kingston, Ontario facility, supporting the production of powdered goat milk products, including infant formula. The move marks a significant step in CRM’s expansion into the North American goat dairy market, offering producers greater stability and opening new avenues for innovation and export.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL GOAT MILK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PROMOTIONAL ACTIVITIES

4.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

5 REGULATION COVERAGE

5.1 REGULATORY MONITORING AND ADAPTATION

5.2 THIRD-PARTY TESTING AND CERTIFICATION

5.3 SUSTAINABILITY INITIATIVES

5.4 DOCUMENTATION AND TRANSPARENCY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF LACTOSE INTOLERANCE

6.1.2 ADVANCEMENT IN GOAT MILK-BASED INFANT FORMULA

6.1.3 SURGE IN DEMAND FOR GOAT MILK

6.1.4 ADVANTAGES OF GOAT MILK OVER COW MILK

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS OF GOAT MILK

6.2.2 STRICT REGULATORY REQUIREMENTS FOR PRODUCTION, PROCESSING, AND MARKETING

6.3 OPPORTUNITIES

6.3.1 HIGH PREVALENCE OF LIFESTYLE DISORDERS

6.3.2 INCREASING AVAILABILITY OF DIVERSIFIED GOAT MILK PRODUCTS

6.3.3 RISKS ASSOCIATED WITH THE CONSUMPTION OF COW MILK

6.4 CHALLENGES

6.4.1 LIMITED SUPPLY IN THE MARKET

6.4.2 INCREASING COMPETITION FROM PLANT BASED ALTERNATIVES

7 GLOBAL GOAT MILK MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 WHOLE MILK

7.3 UHT SEMI SKIMMED & SKIMMED MILK

7.4 SEMI SKIMMED MILK

7.5 UHT WHOLE MILK

8 GLOBAL GOAT MILK MARKET, BY PACKAGING TYPE

8.1 OVERVIEW

8.2 BOTTLE

8.2.1 PLASTIC

8.2.2 GLASS

8.3 TETRA PAK

8.4 SACHET/POUCH

8.5 TIN

8.6 OTHERS

9 GLOBAL GOAT MILK MARKET, BY FLAVOUR

9.1 OVERVIEW

9.2 ORIGINAL/CLASSIC

9.3 FLAVOURED

9.3.1 CHOCOLATE

9.3.2 OTHERS

10 GLOBAL GOAT MILK MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 REGULAR

10.3 LOW FAT

10.4 FAT FREE

11 GLOBAL GOAT MILK MARKET, BY END USER

11.1 OVERVIEW

11.2 HOUSEHOLD/RETAIL

11.3 FOOD SERVICE INDUSTRY

12 GLOBAL GOAT MILK MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 SUPERMARKETS/HYPERMARKETS

12.2.2 CONVENIENCE STORES

12.2.3 GROCERY RETAILERS

12.2.4 OTHERS

12.3 NON-STORE RETAILERS

12.3.1 ONLINE RETAILERS

12.3.2 COMPANY WEBSITES

13 GLOBAL GOAT MILK MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 MEXICO

13.1.2 U.S.

13.1.3 CANADA

13.2 EUROPE

13.2.1 FRANCE

13.2.2 SPAIN

13.2.3 NETHERLANDS

13.2.4 ITALY

13.2.5 GERMANY

13.2.6 BELGIUM

13.2.7 SWITZERLAND

13.2.8 U.K.

13.2.9 RUSSIA

13.2.10 TURKEY

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 INDIA

13.3.2 CHINA

13.3.3 INDONESIA

13.3.4 AUSTRALIA

13.3.5 MALAYSIA

13.3.6 THAILAND

13.3.7 PHILIPPINES

13.3.8 SINGAPORE

13.3.9 SOUTH KOREA

13.3.10 JAPAN

13.3.11 REST OF ASIA-PACIFIC

13.4 MIDDLE EAST AND AFRICA

13.4.1 SOUTH AFRICA

13.4.2 SAUDI ARABIA

13.4.3 U.A.E

13.4.4 KUWAIT

13.4.5 REST OF MIDDLE EAST AFRICA

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

14 GLOBAL GOAT MILK MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 AUSNUTRIA DAIRY CORPORATION LTD.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 EMMI GROUP

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 DAIRY GOAT CO-OPERATIVE (N.Z.) LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 HOLLE BABY FOOD AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 GRANAROLO S.P.A

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 BUBS AUSTRALIA LIMITED.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 CAPRILAC

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CASTLE DAIRY S.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 DEFEEM SDN. BHD.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DELAMERE DAIRY

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 FARM FRESH MILK SDN. BHD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 GOOD GOAT MILK CO.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 HAY DAIRIES PTE LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 LACTALIS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ORIENT EUROPHARMA CO., LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 UK FARM SDN BHD

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 2 GLOBAL GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 3 GLOBAL WHOLE MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 4 GLOBAL UHT SEMI SKIMMED & SKIMMED MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 GLOBAL SEMI SKIMMED MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 GLOBAL UHT WHOLE MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION

TABLE 7 GLOBAL GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 8 GLOBAL BOTTLE IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 GLOBAL BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 10 GLOBAL TETRA PAK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 GLOBAL SACHET/POUCH IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 GLOBAL TIN IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 GLOBAL OTHERS IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 GLOBAL GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 15 GLOBAL ORIGINAL/CLASSIC IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 GLOBAL FLAVOURED IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 GLOBAL FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 18 GLOBAL GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 19 GLOBAL REGULAR IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 20 GLOBAL LOW FAT IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 GLOBAL FAT FREE IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 22 GLOBAL GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 23 GLOBAL HOUSEHOLD/RETAIL IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 GLOBAL FOOD SERVICE INDUSTRY IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 25 GLOBAL GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 26 GLOBAL STORE BASED RETAILERS IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 27 GLOBAL STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 28 GLOBAL NON-STORE RETAILERS IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 29 GLOBAL NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 30 GLOBAL GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 31 NORTH AMERICA GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 32 NORTH AMERICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 33 NORTH AMERICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 34 NORTH AMERICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 35 NORTH AMERICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 36 NORTH AMERICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 37 NORTH AMERICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 38 NORTH AMERICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 39 NORTH AMERICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 40 NORTH AMERICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 41 NORTH AMERICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 42 MEXICO GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 43 MEXICO GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 44 MEXICO FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 45 MEXICO GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 46 MEXICO GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 47 MEXICO BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 48 MEXICO GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 49 MEXICO STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 50 MEXICO NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 51 MEXICO GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 52 U.S. GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 53 U.S. GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 54 U.S. FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 55 U.S. GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 56 U.S. GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 57 U.S. BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 58 U.S. GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 59 U.S. STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 60 U.S. NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 61 U.S. GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 62 CANADA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 63 CANADA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 64 CANADA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 65 CANADA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 66 CANADA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 67 CANADA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 68 CANADA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 69 CANADA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 70 CANADA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 71 CANADA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 72 EUROPE GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 73 EUROPE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 74 EUROPE GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 75 EUROPE FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 76 EUROPE GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 77 EUROPE GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 78 EUROPE BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 79 EUROPE GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 80 EUROPE STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 81 EUROPE NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 82 EUROPE GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 83 FRANCE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 84 FRANCE GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 85 FRANCE FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 86 FRANCE GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 87 FRANCE GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 88 FRANCE BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 89 FRANCE GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 90 FRANCE STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 91 FRANCE NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 92 FRANCE GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 93 SPAIN GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 94 SPAIN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 95 SPAIN FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 96 SPAIN GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 97 SPAIN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 98 SPAIN BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 99 SPAIN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 100 SPAIN STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 SPAIN NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 102 SPAIN GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 103 NETHERLANDS GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 104 NETHERLANDS GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 105 NETHERLANDS FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 106 NETHERLANDS GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 107 NETHERLANDS GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 108 NETHERLANDS BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 109 NETHERLANDS GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 110 NETHERLANDS STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 111 NETHERLANDS NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 112 NETHERLANDS GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 113 ITALY GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 114 ITALY GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 115 ITALY FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 116 ITALY GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 117 ITALY GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 118 ITALY BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 119 ITALY GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 120 ITALY STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 121 ITALY NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 122 ITALY GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 123 GERMANY GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 124 GERMANY GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 125 GERMANY FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 126 GERMANY GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 127 GERMANY GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 128 GERMANY BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 129 GERMANY GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 130 GERMANY STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 131 GERMANY NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 132 GERMANY GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 133 BELGIUM GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 134 BELGIUM GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 135 BELGIUM FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 136 BELGIUM GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 137 BELGIUM GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 138 BELGIUM BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 139 BELGIUM GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 140 BELGIUM STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 141 BELGIUM NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 142 BELGIUM GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 143 SWITZERLAND GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 144 SWITZERLAND GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 145 SWITZERLAND FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 146 SWITZERLAND GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 147 SWITZERLAND GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 148 SWITZERLAND BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 149 SWITZERLAND GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 150 SWITZERLAND STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 151 SWITZERLAND NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 152 SWITZERLAND GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 153 U.K. GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 154 U.K. GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 155 U.K. FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 156 U.K. GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 157 U.K. GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 158 U.K. BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 159 U.K. GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 160 U.K. STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 161 U.K. NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 162 U.K. GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 163 RUSSIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 164 RUSSIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 165 RUSSIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 166 RUSSIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 167 RUSSIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 168 RUSSIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 169 RUSSIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 170 RUSSIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 171 RUSSIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 172 RUSSIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 173 TURKEY GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 174 TURKEY GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 175 TURKEY FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 176 TURKEY GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 177 TURKEY GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 178 TURKEY BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 179 TURKEY GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 180 TURKEY STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 181 TURKEY NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 182 TURKEY GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 183 REST OF EUROPE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 184 ASIA-PACIFIC GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 185 ASIA-PACIFIC GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 186 ASIA-PACIFIC GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 187 ASIA-PACIFIC FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 188 ASIA-PACIFIC GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 189 ASIA-PACIFIC GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 190 ASIA-PACIFIC BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 191 ASIA-PACIFIC GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 192 ASIA-PACIFIC STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 193 ASIA-PACIFIC NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 194 ASIA-PACIFIC GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 195 INDIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 196 INDIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 197 INDIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 198 INDIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 199 INDIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 200 INDIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 201 INDIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 202 INDIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 203 INDIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 204 INDIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 205 CHINA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 206 CHINA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 207 CHINA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 208 CHINA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 209 CHINA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 210 CHINA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 211 CHINA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 212 CHINA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 213 CHINA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 214 CHINA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 215 INDONESIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 216 INDONESIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 217 INDONESIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 218 INDONESIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 219 INDONESIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 220 INDONESIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 221 INDONESIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 222 INDONESIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 223 INDONESIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 224 INDONESIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 225 AUSTRALIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 226 AUSTRALIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 227 AUSTRALIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 228 AUSTRALIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 229 AUSTRALIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 230 AUSTRALIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 231 AUSTRALIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 232 AUSTRALIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 233 AUSTRALIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 234 AUSTRALIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 235 MALAYSIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 236 MALAYSIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 237 MALAYSIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 238 MALAYSIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 239 MALAYSIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 240 MALAYSIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 241 MALAYSIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 242 MALAYSIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 243 MALAYSIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 244 MALAYSIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 245 THAILAND GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 246 THAILAND GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 247 THAILAND FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 248 THAILAND GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 249 THAILAND GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 250 THAILAND BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 251 THAILAND GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 252 THAILAND STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 253 THAILAND NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 254 THAILAND GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 255 PHILIPPINES GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 256 PHILIPPINES GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 257 PHILIPPINES FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 258 PHILIPPINES GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 259 PHILIPPINES GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 260 PHILIPPINES BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 261 PHILIPPINES GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 262 PHILIPPINES STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 263 PHILIPPINES NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 264 PHILIPPINES GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 265 SINGAPORE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 266 SINGAPORE GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 267 SINGAPORE FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 268 SINGAPORE GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 269 SINGAPORE GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 270 SINGAPORE BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 271 SINGAPORE GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 272 SINGAPORE STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 273 SINGAPORE NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 274 SINGAPORE GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 275 SOUTH KOREA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 276 SOUTH KOREA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 277 SOUTH KOREA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 278 SOUTH KOREA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 279 SOUTH KOREA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 280 SOUTH KOREA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 281 SOUTH KOREA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 282 SOUTH KOREA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 283 SOUTH KOREA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 284 SOUTH KOREA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 285 JAPAN GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 286 JAPAN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 287 JAPAN FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 288 JAPAN GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 289 JAPAN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 290 JAPAN BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 291 JAPAN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 292 JAPAN STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 293 JAPAN NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 294 JAPAN GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 295 REST OF ASIA-PACIFIC GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 296 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 297 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 298 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 299 MIDDLE EAST AND AFRICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 300 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 301 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 302 MIDDLE EAST AND AFRICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 303 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 304 MIDDLE EAST AND AFRICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 305 MIDDLE EAST AND AFRICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 306 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 307 SOUTH AFRICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 308 SOUTH AFRICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 309 SOUTH AFRICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 310 SOUTH AFRICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 311 SOUTH AFRICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 312 SOUTH AFRICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 313 SOUTH AFRICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 314 SOUTH AFRICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 315 SOUTH AFRICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 316 SOUTH AFRICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 317 SAUDI ARABIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 318 SAUDI ARABIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 319 SAUDI ARABIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 320 SAUDI ARABIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 321 SAUDI ARABIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 322 SAUDI ARABIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 323 SAUDI ARABIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 324 SAUDI ARABIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 325 SAUDI ARABIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 326 SAUDI ARABIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 327 U.A.E GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 328 U.A.E GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 329 U.A.E FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 330 U.A.E GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 331 U.A.E GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 332 U.A.E BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 333 U.A.E GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 334 U.A.E STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 335 U.A.E NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 336 U.A.E GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 337 KUWAIT GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 338 KUWAIT GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 339 KUWAIT FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 340 KUWAIT GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 341 KUWAIT GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 342 KUWAIT BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 343 KUWAIT GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 344 KUWAIT STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 345 KUWAIT NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 346 KUWAIT GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 347 REST OF MIDDLE EAST AFRICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 348 SOUTH AMERICA GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 349 SOUTH AMERICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 350 SOUTH AMERICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 351 SOUTH AMERICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 352 SOUTH AMERICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 353 SOUTH AMERICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 354 SOUTH AMERICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 355 SOUTH AMERICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 356 SOUTH AMERICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 357 SOUTH AMERICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 358 SOUTH AMERICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 359 BRAZIL GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 360 BRAZIL GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 361 BRAZIL FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 362 BRAZIL GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 363 BRAZIL GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 364 BRAZIL BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 365 BRAZIL GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 366 BRAZIL STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 367 BRAZIL NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 368 BRAZIL GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 369 ARGENTINA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 370 ARGENTINA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 371 ARGENTINA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 372 ARGENTINA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 373 ARGENTINA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 374 ARGENTINA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 375 ARGENTINA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 376 ARGENTINA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 377 ARGENTINA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 378 ARGENTINA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 379 REST OF SOUTH AMERICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL GOAT MILK MARKET: SEGMENTATION

FIGURE 2 GLOBAL GOAT MILK MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL GOAT MILK MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL GOAT MILK MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL GOAT MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL GOAT MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL GOAT MILK MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 GLOBAL GOAT MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL GOAT MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL GOAT MILK MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE GLOBAL GOAT MILK MARKET

FIGURE 12 GLOBAL GOAT MILK MARKET EXECUTIVE SUMMARY

FIGURE 13 GLOBAL GOAT MILK MARKET STRATEGIC DECISIONS

FIGURE 14 INCREASING PREVALENCE OF LACTOSE INTOLERANCE IS DRIVING THE GROWTH OF THE GLOBAL GOAT MILK MARKET FROM 2024 TO 2031

FIGURE 15 THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL GOAT MILK MARKET IN 2024 AND 2031

FIGURE 16 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL GOAT MILK MARKET AND EUROPE IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 17 EUROPE IS THE FASTEST-GROWING REGION FOR GOAT MILK MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 18 DROC ANALYSIS

FIGURE 19 GLOBAL GOAT MILK MARKET: BY PRODUCT, 2023

FIGURE 20 GLOBAL GOAT MILK MARKET: BY PACKAGING TYPE, 2023

FIGURE 21 GLOBAL GOAT MILK MARKET: BY FLAVOUR, 2023

FIGURE 22 GLOBAL GOAT MILK MARKET: BY FAT CONTENT, 2023

FIGURE 23 GLOBAL GOAT MILK MARKET: BY END USER, 2023

FIGURE 24 GLOBAL GOAT MILK MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 25 GLOBAL GOAT MILK MARKET: SNAPSHOT (2023)

FIGURE 26 GLOBAL GOAT MILK MARKET: COMPANY SHARE 2023 (%)

FIGURE 27 NORTH AMERICA GOAT MILK MARKET: COMPANY SHARE 2023 (%)

FIGURE 28 EUROPE GOAT MILK MARKET: COMPANY SHARE 2023 (%)

FIGURE 29 ASIA-PACIFIC GOAT MILK MARKET: COMPANY SHARE 2023 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.