Global Food Processing Equipment Market

Taille du marché en milliards USD

TCAC :

%

USD

61.90 Billion

USD

81.51 Billion

2024

2032

USD

61.90 Billion

USD

81.51 Billion

2024

2032

| 2025 –2032 | |

| USD 61.90 Billion | |

| USD 81.51 Billion | |

|

|

|

|

Segmentation du marché mondial des équipements de transformation des aliments, par type d'équipement (équipements de refroidissement et de congélation, équipements de cuisson et de chauffage, remplisseuses, scelleuses, mélangeurs, broyeurs et moulins, coupeuses et trancheuses, équipements de séchage et de déshydratation, éplucheuses, séparateurs et autres), type d'automatisation (automatique, semi-automatique et manuelle), secteur d'activité (viande, volaille et fruits de mer, produits laitiers, boulangerie, fruits et légumes transformés, confiserie, produits de minoterie et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des équipements de transformation des aliments

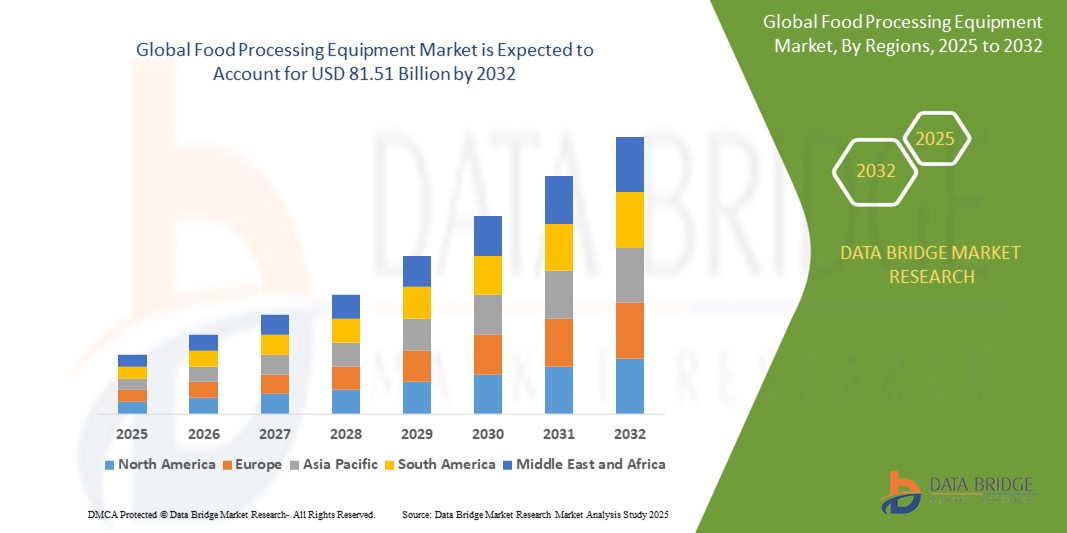

- La taille du marché mondial des équipements de transformation des aliments était évaluée à 61,90 milliards USD en 2024 et devrait atteindre 81,51 milliards USD d'ici 2032 , à un TCAC de 3,50 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante des consommateurs en aliments transformés et pratiques en raison de l’évolution des modes de vie et de l’augmentation des revenus disponibles, du besoin croissant de méthodes de transformation des aliments efficaces et hygiéniques, de l’adoption de technologies avancées telles que l’automatisation et l’IA dans la transformation des aliments, et de l’expansion du commerce mondial des aliments transformés.

- De plus, les réglementations strictes en matière de sécurité et de qualité des aliments dans le monde entier obligent les fabricants de produits alimentaires à investir dans des équipements de transformation modernes pour garantir la conformité et maintenir l’intégrité des produits.

Analyse du marché des équipements de transformation des aliments

- Le marché des équipements de transformation des aliments connaît actuellement une phase de progrès technologique continu avec un fort accent sur l'automatisation pour améliorer l'efficacité et réduire les coûts de main-d'œuvre.

- Les fabricants se concentrent de plus en plus sur le développement d'équipements répondant à des normes strictes de sécurité et d'hygiène alimentaire, ainsi que sur des solutions offrant une plus grande flexibilité et une plus grande personnalisation pour répondre aux divers besoins de production alimentaire.

- L'Amérique du Nord a dominé le marché des équipements de transformation des aliments avec la plus grande part de revenus de 38,6 % en 2024, grâce à une forte présence d'entreprises de fabrication de produits alimentaires et à une demande croissante d'aliments transformés et emballés.

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé du marché mondial des équipements de transformation des aliments, stimulé par une industrialisation rapide, une population urbaine croissante, des revenus disponibles en hausse et une demande croissante d'aliments emballés et prêts à consommer dans les économies émergentes telles que la Chine, l'Inde et les pays d'Asie du Sud-Est.

- Le segment de la viande, de la volaille et des fruits de mer a représenté la plus grande part de revenus du marché en 2024, grâce à la consommation mondiale croissante de régimes alimentaires riches en protéines et à la nécessité de systèmes de transformation hygiéniques et efficaces.

Portée du rapport et segmentation du marché des équipements de transformation des aliments

|

Attributs |

Informations clés sur le marché des équipements de transformation des aliments |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des équipements de transformation des aliments

« Adoption accrue de l'automatisation et de la robotique »

- Le secteur de la transformation alimentaire intègre de plus en plus de bras robotisés pour des tâches telles que le tri et l'emballage afin d'augmenter le rendement et de maintenir les normes d'hygiène

- Les véhicules à guidage automatique (AGV) et les robots mobiles autonomes (AMR) deviennent monnaie courante dans les installations de transformation des aliments pour la manutention et le transport des matériaux.

- La mise en œuvre de systèmes automatisés de nettoyage et d'assainissement gagne du terrain pour garantir la sécurité alimentaire et le respect de réglementations strictes

- L'analyse des données et l'IoT (Internet des objets) sont intégrés aux équipements automatisés de transformation des aliments pour permettre une surveillance en temps réel et une maintenance prédictive.

- Des robots collaboratifs (cobots) sont déployés dans les environnements de transformation des aliments pour travailler aux côtés des employés humains sur des tâches nécessitant à la fois précision et flexibilité.

Dynamique du marché des équipements de transformation des aliments

Conducteur

« Demande de produits alimentaires transformés et emballés »

- L'augmentation de la population mondiale nécessite une production alimentaire à grande échelle pour répondre aux besoins nutritionnels d'un nombre croissant de consommateurs.

- Par exemple, dans les pays dont la population croît rapidement, il existe une demande accrue d’équipements de transformation des céréales de grande capacité pour garantir un approvisionnement alimentaire suffisant.

- La demande d’aliments transformés et emballés augmente en raison de l’évolution des modes de vie et de l’augmentation des revenus disponibles, en particulier dans les régions urbaines et en développement.

- L'urbanisation et l'évolution des modes de vie ont conduit à une plus grande dépendance aux options alimentaires pratiques, ce qui accroît encore le besoin d'équipements de transformation des aliments de pointe.

- Les fabricants de produits alimentaires sont obligés d'investir dans des machines sophistiquées capables de traiter de grands volumes de matières premières tout en garantissant une qualité constante des produits et en respectant des normes d'hygiène et de sécurité strictes.

- La mondialisation du commerce alimentaire nécessite des technologies de transformation et d’emballage avancées pour faciliter la distribution sûre et efficace des produits alimentaires au-delà des frontières géographiques.

Retenue/Défi

« Coût d'investissement initial substantiel associé à l'acquisition et à la mise en œuvre de technologies de traitement avancées »

- Le coût d’investissement initial substantiel des équipements de transformation alimentaire avancés, en particulier des machines intégrant l’automatisation et la robotique, constitue un obstacle financier important.

- Par exemple, une petite entreprise de transformation de viande pourrait trouver le coût initial des systèmes automatisés de découpe et d'emballage trop élevé.

- Les équipements modernes de transformation des aliments dotés de systèmes de contrôle sophistiqués nécessitent souvent des dépenses d'investissement importantes, créant ainsi une barrière à l'entrée pour de nombreux

- Ce coût élevé constitue un défi considérable pour les petites et moyennes entreprises (PME) du secteur de la transformation alimentaire disposant de ressources financières limitées.

- La mise en œuvre de machines complexes nécessite des investissements supplémentaires dans des domaines tels que la modernisation des infrastructures, la formation spécialisée du personnel, ainsi que la maintenance et le support technique continus.

- Le risque perçu et les incertitudes entourant la demande du marché et le retour sur investissement peuvent dissuader davantage les entreprises d'adopter des technologies de transformation des aliments de pointe, mais coûteuses.

Portée du marché des équipements de transformation des aliments

Le marché est segmenté en fonction du type d’équipement, du type d’automatisation et de l’industrie.

- Par type d'équipement

En fonction du type d'équipement, le marché des équipements de transformation alimentaire est segmenté en équipements de refroidissement et de congélation, équipements de cuisson et de chauffage, remplisseuses, scelleuses, mélangeurs, broyeurs et moulins, découpeuses et trancheuses, équipements de séchage et de déshydratation, éplucheurs et séparateurs, etc. Le segment des équipements de refroidissement et de congélation a dominé le marché avec la plus grande part de chiffre d'affaires en 2024, stimulé par la demande croissante de produits surgelés et la nécessité de conserver les produits périssables tout au long des chaînes d'approvisionnement étendues. Ces équipements garantissent la sécurité et la qualité des aliments, ce qui les rend essentiels dans les installations de production et de stockage à grande échelle.

Le segment des mélangeurs devrait connaître la croissance la plus rapide entre 2025 et 2032, en raison de son rôle essentiel dans le mélange d'ingrédients pour diverses catégories d'aliments. Les mélangeurs garantissent la régularité et l'efficacité des lots, et les progrès en matière de conception hygiénique et d'automatisation favorisent leur adoption dans les installations de transformation alimentaire modernes.

- Par type d'automatisation

Selon le type d'automatisation, le marché des équipements de transformation alimentaire est segmenté en automatique, semi-automatique et manuel. Le segment automatique a représenté la plus grande part de chiffre d'affaires en 2024, porté par la demande croissante d'équipements performants et économes en main-d'œuvre, garantissant une qualité constante des produits. L'automatisation minimise les erreurs humaines, améliore la productivité et réduit les coûts d'exploitation, ce qui la rend de plus en plus populaire auprès des grands fabricants de produits alimentaires.

Le segment semi-automatique devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à sa flexibilité au sein des petites et moyennes entreprises (PME). Il offre un équilibre entre rentabilité et contrôle manuel, particulièrement précieux pour les besoins de transformation sur mesure ou les produits alimentaires de niche.

- Par industrie

Par secteur d'activité, le marché des équipements de transformation alimentaire est segmenté en viande, volaille et fruits de mer, produits laitiers, boulangerie, fruits et légumes transformés, confiserie, produits de minoterie, etc. En 2024, ce segment représentait la plus grande part de chiffre d'affaires, stimulée par la consommation mondiale croissante d'aliments riches en protéines et la nécessité de systèmes de transformation hygiéniques et efficaces. La complexité de la transformation de la viande exige également des équipements spécialisés pour la découpe, le hachage, la cuisson et le conditionnement.

Le segment des fruits et légumes transformés devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la demande croissante de plats préparés et une prise de conscience croissante des enjeux de santé. Les consommateurs recherchent de plus en plus des produits transformés prêts à consommer et riches en nutriments, ce qui stimule l'innovation et les investissements dans des équipements de transformation de pointe pour ce segment.

Analyse régionale du marché des équipements de transformation des aliments

- L'Amérique du Nord a dominé le marché des équipements de transformation des aliments avec la plus grande part de revenus de 38,6 % en 2024, grâce à une forte présence d'entreprises de fabrication de produits alimentaires et à une demande croissante d'aliments transformés et emballés.

- La région bénéficie d'infrastructures de fabrication avancées, de dépenses de consommation élevées en aliments prêts à consommer et de l'adoption d'équipements d'automatisation et conformes aux normes d'hygiène dans les installations alimentaires.

- Les progrès technologiques continus et les réglementations strictes en matière de sécurité alimentaire soutiennent la croissance du marché, les fabricants investissant dans des solutions efficaces et automatisées pour améliorer la productivité et la qualité des produits.

Aperçu du marché américain des équipements de transformation des aliments

Le marché américain des équipements de transformation alimentaire a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, avec 80,4 %, grâce à la production alimentaire à grande échelle, à l'innovation technologique et à la demande croissante de produits alimentaires clean label et prêts à consommer. Le besoin d'équipements de pointe garantissant la sécurité alimentaire, l'efficacité énergétique et l'automatisation est un facteur clé. De plus, la tendance croissante à la transformation des aliments d'origine végétale et biologique favorise l'adoption d'équipements polyvalents et performants sur le marché américain.

Aperçu du marché européen des équipements de transformation des aliments

Le marché européen des équipements de transformation alimentaire devrait connaître sa plus forte croissance entre 2025 et 2032, porté par une industrie agroalimentaire mature et des réglementations européennes strictes en matière de sécurité et d'hygiène alimentaires. L'évolution vers des systèmes de transformation durables et économes en énergie est un facteur majeur d'adoption d'équipements modernes. La demande croissante de produits laitiers, de boulangerie et de confiserie transformés soutient également l'expansion du marché régional, en particulier dans les pays à fort potentiel d'exportation.

Aperçu du marché britannique des équipements de transformation des aliments

Le marché britannique des équipements de transformation alimentaire devrait connaître sa plus forte croissance entre 2025 et 2032, grâce à l'augmentation des investissements dans l'innovation alimentaire, l'automatisation et la modernisation des installations. La demande d'aliments plus sains, notamment d'alternatives à faible teneur en sucre et à base de plantes, pousse les producteurs à adopter des équipements plus adaptables et plus précis. De plus, les ajustements réglementaires post-Brexit incitent les entreprises à moderniser leurs systèmes de transformation afin de répondre aux normes de qualité nationales et internationales.

Aperçu du marché allemand des équipements de transformation des aliments

Le marché allemand des équipements de transformation alimentaire devrait connaître sa plus forte croissance entre 2025 et 2032, porté par la solide base technique du pays, l'accent mis sur la qualité des aliments et la demande croissante de technologies de transformation durables. Les fabricants allemands sont à l'avant-garde de l'intégration des technologies de l'Industrie 4.0, telles que l'IA, la robotique et l'IoT, dans les systèmes de transformation alimentaire. L'accent mis sur la réduction du gaspillage alimentaire et de la consommation d'énergie contribue également à l'adoption d'équipements de pointe et respectueux de l'environnement.

Aperçu du marché des équipements de transformation des aliments en Asie-Pacifique

Le marché des équipements de transformation alimentaire en Asie-Pacifique devrait connaître sa plus forte croissance entre 2025 et 2032, porté par l'urbanisation rapide, la hausse des revenus disponibles et l'essor de la classe moyenne dans des pays comme la Chine, l'Inde et les pays d'Asie du Sud-Est. Les initiatives gouvernementales visant à améliorer la sécurité alimentaire, le développement des infrastructures et l'émergence de pôles de production alimentaire stimulent considérablement la croissance du marché. L'appétit croissant de la région pour les aliments transformés, emballés et prêts à consommer accélère encore la demande d'équipements.

Aperçu du marché japonais des équipements de transformation des aliments

Le marché japonais des équipements de transformation alimentaire devrait connaître sa plus forte croissance entre 2025 et 2032, porté par la préférence du pays pour l'automatisation, les machines compactes et les normes d'hygiène. Le vieillissement de la population et la diminution de la main-d'œuvre incitent les fabricants à investir dans des technologies économes en main-d'œuvre et des équipements à haut rendement. La forte tradition japonaise de consommation d'aliments emballés et prêts à consommer, combinée à sa réputation de qualité et d'innovation, soutient la croissance continue du secteur des équipements de transformation alimentaire.

Aperçu du marché chinois des équipements de transformation des aliments

Le marché chinois des équipements de transformation alimentaire devrait connaître sa plus forte croissance entre 2025 et 2032, porté par l'essor du secteur agroalimentaire et la demande croissante des consommateurs en aliments transformés et emballés. L'urbanisation rapide, la hausse des revenus disponibles et l'évolution des préférences alimentaires contribuent à l'essor de la demande de solutions modernes de transformation alimentaire. De plus, les politiques gouvernementales encourageant la sécurité alimentaire, l'innovation technologique et l'automatisation favorisent l'adoption d'équipements de pointe. Les fabricants nationaux et internationaux investissent massivement sur le marché chinois pour répondre au besoin croissant de systèmes de transformation efficaces, performants et conformes dans des secteurs tels que la viande, les produits laitiers, la boulangerie et les boissons.

Part de marché des équipements de transformation des aliments

L'industrie des équipements de transformation des aliments est principalement dirigée par des entreprises bien établies, notamment :

- JBT (États-Unis)

- ALFA LAVAL (Suède)

- Marel (Islande)

- La Middleby Corporation (États-Unis)

- Bühler AG (Suisse)

- Groupe GEA Aktiengesellschaft (Allemagne)

- SPX FLOW (États-Unis)

- Groupe Tetra Pak (Suisse)

- Bigtem Makine AS (Turquie)

- TNA Australia Pty Limited (Australie)

- Schaaf Technologie GmbH (Allemagne)

- ANKO FOOD MACHINE CO., LTD. (Taïwan)

- Bettcher Industries, Inc. (États-Unis)

- Baker Perkins (Royaume-Uni)

- Heat and Control, Inc. (États-Unis)

- Technologie clé (États-Unis)

- Provisur Technologies, Inc. (États-Unis)

- PROXES GMBH (Allemagne)

- FME Food Machinery Europe Sp. z oo (Pologne)

- Alto-Shaam, Inc. (États-Unis)

Derniers développements sur le marché mondial des équipements de transformation des aliments

- En mai 2024, le groupe Tetra Pak a dévoilé son offre « Solutions durables pour l'usine », une nouvelle approche globale d'optimisation des usines. Cette initiative vise à améliorer les processus de gestion de l'énergie, de l'eau et du nettoyage en place (NEP) dans les sites de production agroalimentaire. Elle offre aux producteurs une combinaison personnalisée de technologies de pointe et de capacités d'intégration supérieures, les aidant à atteindre leurs objectifs de développement durable en améliorant l'efficacité énergétique et des ressources, et en réduisant ainsi les coûts d'exploitation. Cela renforce le portefeuille global de Tetra Pak en matière de développement durable.

- En janvier 2024, le groupe Tetra Pak a annoncé une collaboration stratégique avec Absolicon, une entreprise suédoise spécialisée dans le solaire thermique. Ce partenariat vise à fournir une solution standardisée pour les équipements industriels alimentés par l'énergie thermique renouvelable (chaleur). Ils intégreront des modules solaires thermiques évolutifs aux lignes UHT existantes et nouvelles, offrant ainsi diverses options de décarbonation, notamment des réductions significatives des émissions de gaz à effet de serre adaptées aux besoins des clients. Cette collaboration permet à Tetra Pak d'atteindre ses objectifs de développement durable, d'améliorer son efficacité opérationnelle et de conserver un avantage concurrentiel sur le marché.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.