Global Fluorobenzene Market

Taille du marché en milliards USD

TCAC :

%

USD

266.63 Million

USD

370.55 Million

2024

2032

USD

266.63 Million

USD

370.55 Million

2024

2032

| 2025 –2032 | |

| USD 266.63 Million | |

| USD 370.55 Million | |

|

|

|

|

Segmentation du marché mondial du fluorobenzène, par pureté (99 % à 99,9 % et supérieure à 99,9 %), application (intermédiaires pharmaceutiques, produits agrochimiques, solvants, production de polymères, produits chimiques industriels, réactifs, colorants et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché du fluorobenzène

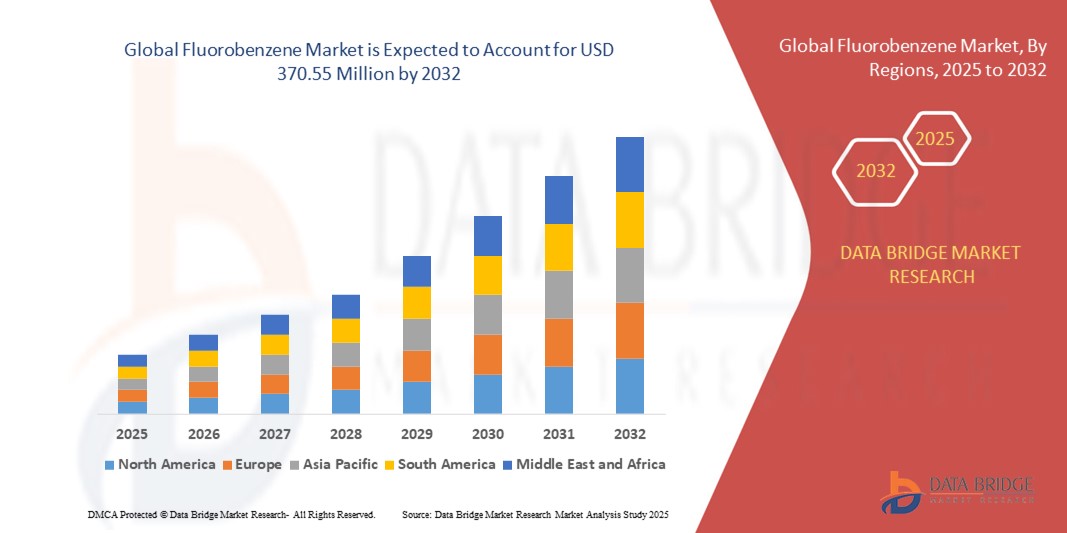

- La taille du marché mondial du fluorobenzène était évaluée à 266,63 millions USD en 2024 et devrait atteindre 370,55 millions USD d'ici 2032 , à un TCAC de 4,2 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante d'intermédiaires fluorés dans la synthèse pharmaceutique et agrochimique, motivée par l'augmentation des besoins mondiaux en matière de soins de santé et l'expansion de la production agricole.

- De plus, la transition vers des produits chimiques de haute pureté et de spécialité, combinée à une forte demande des fabricants de médicaments et de produits agrochimiques, renforce l'importance du fluorobenzène comme composant essentiel. Ces facteurs convergents accélèrent l'utilisation de ce composé dans tous les secteurs, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché du fluorobenzène

- Le fluorobenzène est un composé aromatique largement utilisé comme intermédiaire dans la production de produits pharmaceutiques, de produits agrochimiques, de colorants et de polymères spéciaux. Sa structure chimique permet l'introduction d'atomes de fluor dans des molécules plus grosses, améliorant ainsi leur stabilité, leur biodisponibilité et leur efficacité.

- L'utilisation croissante du fluorobenzène est principalement due à la demande croissante de médicaments fluorés et d'agents phytosanitaires, à l'expansion rapide de la fabrication de médicaments génériques et à l'augmentation des investissements dans la production de produits chimiques spécialisés dans les économies émergentes.

- L'Asie-Pacifique a dominé le marché du fluorobenzène avec une part de 35,5 % en 2024, en raison de l'expansion de la fabrication pharmaceutique, de la demande croissante de produits agrochimiques fluorés et d'une forte présence de pôles de production chimique.

- L'Amérique du Nord devrait être la région connaissant la croissance la plus rapide sur le marché du fluorobenzène au cours de la période de prévision en raison de la forte demande de produits chimiques fluorés dans les produits pharmaceutiques, agrochimiques et les polymères.

- Le segment de pureté 99 % à 99,9 % dominait le marché avec une part de marché de 61,9 % en 2024, grâce à sa large application dans la synthèse chimique standard et les procédés industriels. Ce niveau de pureté est largement utilisé dans la fabrication à grande échelle où une précision ultra-élevée n'est pas essentielle, comme dans les colorants, les réactifs industriels et certaines formulations agrochimiques. Sa rentabilité et sa facilité de production renforcent sa préférence auprès des fabricants ciblant des applications à volume élevé.

Portée du rapport et segmentation du marché du fluorobenzène

|

Attributs |

Informations clés sur le marché du fluorobenzène |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché du fluorobenzène

Demande croissante de fluorobenzène de haute pureté dans la synthèse pharmaceutique

- Le marché du fluorobenzène connaît une expansion rapide en raison des applications croissantes dans la synthèse pharmaceutique où le fluorobenzène de haute pureté sert d'intermédiaire clé dans le développement d'ingrédients pharmaceutiques actifs (API) et de composés médicamenteux avancés.

- Par exemple, des entreprises telles que SDFuer, LIANCHANG et XLH Chemical fournissent du fluorobenzène de haute qualité adapté à la fabrication de médicaments oncologiques et cardiovasculaires, contribuant ainsi à améliorer l'efficacité, la stabilité et la biodisponibilité des médicaments.

- Les progrès des technologies de synthèse, notamment des procédés catalytiques plus écologiques et des méthodes de purification améliorées, permettent la production de fluorobenzène ultra-pur qui répond aux spécifications strictes de qualité pharmaceutique avec un impact environnemental réduit.

- La demande de fluorobenzène dans la synthèse agrochimique augmente également, soutenant la production d'herbicides et d'insecticides à haute performance qui améliorent les rendements des cultures et la durabilité agricole.

- Les industries de l'électronique et des semi-conducteurs adoptent le fluorobenzène pour la fabrication de produits chimiques spécialisés utilisés dans les écrans à cristaux liquides (LCD), les semi-conducteurs et les matériaux de batterie, reflétant la diversification des secteurs d'utilisation finale.

- L'accent réglementaire mis sur la fabrication de produits chimiques durables et l'utilisation croissante de solvants respectueux de l'environnement orientent le marché vers l'innovation dans les procédés de production de fluorobenzène qui minimisent les émissions et les déchets dangereux.

Dynamique du marché du fluorobenzène

Conducteur

Croissance de l'industrie de l'électronique et des semi-conducteurs

- L'essor de l'électronique de pointe et de la fabrication de semi-conducteurs alimente la demande de fluorobenzène en tant qu'intermédiaire essentiel dans la production de matériaux tels que les polymères, les circuits imprimés et les revêtements spéciaux essentiels aux performances des appareils.

- Par exemple, les principaux fournisseurs de produits chimiques tels que Mitsui Chemicals et HAL Advanced Chemicals fournissent du fluorobenzène purifié pour répondre aux normes de qualité rigoureuses requises pour les applications électroniques, notamment les écrans LCD et la microélectronique.

- L'expansion de l'électronique grand public, de l'infrastructure 5G, des véhicules électriques et des technologies d'énergie renouvelable à l'échelle mondiale amplifie les besoins en fluorobenzène de haute pureté et en produits chimiques spécialisés connexes.

- La croissance des pays d'Asie-Pacifique en tant que pôles mondiaux de fabrication de produits électroniques et de semi-conducteurs stimule davantage la demande régionale de fluorobenzène et les développements associés de la chaîne d'approvisionnement.

- La R&D collaborative entre les fabricants de produits chimiques et les entreprises d'électronique permet la formulation de dérivés de fluorobenzène personnalisés qui améliorent les propriétés thermiques et électriques des composants semi-conducteurs.

Retenue/Défi

Concurrence d'autres produits chimiques et solvants

- Le fluorobenzène fait face à une concurrence intense de la part des solvants aromatiques et fluorés alternatifs, alors que les industries recherchent des options rentables, évolutives et parfois moins rigoureuses sur le plan environnemental pour les processus de synthèse et de fabrication.

- Par exemple, les solvants tels que le chlorobenzène, le bromobenzène et les éthers fluorés peuvent remplacer le fluorobenzène dans certaines applications en raison de leur coût inférieur ou de chaînes d'approvisionnement établies, ce qui remet en cause la croissance des parts de marché des fournisseurs de fluorobenzène.

- Les exigences de pureté élevées et les méthodes de fabrication complexes du fluorobenzène entraînent des coûts de production élevés, limitant la compétitivité des prix sur des marchés chimiques plus larges.

- Les réglementations environnementales strictes concernant la production et la manipulation de composés fluorés ajoutent des coûts de conformité et des complexités opérationnelles pour les producteurs comme pour les utilisateurs.

- La pénétration du marché dans les secteurs émergents peut être ralentie par des barrières techniques lorsque des solvants alternatifs démontrent des performances comparables, ce qui nécessite une innovation continue et une éducation des clients.

Portée du marché du fluorobenzène

Le marché est segmenté en fonction de la pureté et de l’application.

- Par pureté

En termes de pureté, le marché du fluorobenzène est segmenté en deux catégories : 99 % à 99,9 % et plus de 99,9 %. Le segment 99 % à 99,9 % a dominé la plus grande part de chiffre d'affaires du marché, avec 61,9 % en 2024, principalement en raison de sa large applicabilité dans la synthèse chimique standard et les procédés industriels. Ce niveau de pureté est largement utilisé dans la fabrication à grande échelle où une précision ultra-élevée n'est pas essentielle, comme dans les colorants, les réactifs industriels et certaines formulations agrochimiques. Sa rentabilité et sa facilité de production renforcent encore sa préférence auprès des fabricants ciblant des applications en volume.

Le segment des produits à plus de 99,9 % devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par la demande croissante d'applications de haute pureté dans les secteurs pharmaceutique et des polymères spéciaux. Ce niveau de pureté est crucial pour le développement de médicaments et la synthèse chimique fine, où la moindre impureté peut compromettre l'efficacité ou la sécurité du produit final. La rigueur réglementaire croissante et le besoin croissant de matériaux fiables et performants stimulent la demande de fluorobenzène ultra-pur dans les secteurs de pointe.

- Par application

En fonction de ses applications, le marché du fluorobenzène est segmenté en intermédiaires pharmaceutiques, produits agrochimiques, solvants, production de polymères, produits chimiques industriels, réactifs, colorants, etc. En 2024, le segment des intermédiaires pharmaceutiques détenait la plus grande part de chiffre d'affaires du marché, en raison de son utilisation intensive dans la synthèse de principes actifs pharmaceutiques et d'autres intermédiaires clés. Sa capacité à servir de source de fluor dans les molécules médicamenteuses améliore la biodisponibilité et la stabilité métabolique, ce qui le rend indispensable en chimie pharmaceutique moderne.

Le secteur de la production de polymères devrait connaître le TCAC le plus élevé entre 2025 et 2032, porté par l'utilisation croissante de polymères fluorés dans les applications automobiles, électroniques et aérospatiales. Le fluorobenzène joue un rôle essentiel dans l'introduction de la fonctionnalité fluorée lors de la synthèse des polymères, améliorant ainsi la résistance chimique, la stabilité thermique et les propriétés diélectriques. Alors que les industries se tournent de plus en plus vers des matériaux avancés et hautes performances, la demande de fluorobenzène dans les applications polymères est sur le point de connaître une forte accélération.

Analyse régionale du marché du fluorobenzène

- L'Asie-Pacifique a dominé le marché du fluorobenzène avec la plus grande part de revenus de 35,5 % en 2024, grâce à l'expansion de la fabrication pharmaceutique, à la demande croissante de produits agrochimiques fluorés et à une forte présence de pôles de production chimique.

- Le paysage manufacturier rentable de la région, les investissements croissants dans la production de produits chimiques spécialisés et les exportations croissantes d'intermédiaires fluorés accélèrent l'expansion du marché.

- La disponibilité d'une main-d'œuvre qualifiée, les politiques gouvernementales favorables et l'industrialisation rapide dans les économies en développement contribuent à une consommation accrue de fluorobenzène dans les secteurs pharmaceutique et industriel.

Aperçu du marché chinois du fluorobenzène

En 2024, la Chine détenait la plus grande part du marché du fluorobenzène en Asie-Pacifique, grâce à son statut de leader mondial de la fabrication de produits chimiques et de la production d'ingrédients pharmaceutiques actifs (IPA). La solidité de son tissu industriel, les politiques gouvernementales favorables à l'expansion du secteur chimique et ses importantes capacités d'exportation de composés fluorés constituent des moteurs de croissance majeurs. La demande est également soutenue par les investissements continus dans les produits chimiques de spécialité et de chimie fine, tant pour les marchés nationaux qu'internationaux.

Aperçu du marché indien du fluorobenzène

L'Inde connaît la croissance la plus rapide de la région Asie-Pacifique, portée par un secteur pharmaceutique en plein essor, une production croissante de médicaments génériques et des investissements croissants dans les infrastructures de chimie de spécialité. L'initiative « Make in India », conjuguée à une évolution vers l'autonomie en intermédiaires pharmaceutiques, renforce la demande de fluorobenzène. De plus, l'essor des exportations de produits agrochimiques et le développement des capacités de R&D en chimie fine contribuent à une forte expansion du marché.

Aperçu du marché européen du fluorobenzène

Le marché européen du fluorobenzène connaît une croissance constante, soutenu par des cadres réglementaires stricts, une forte demande en intermédiaires fluorés de haute pureté et des investissements croissants dans la production chimique durable et spécialisée. La région accorde une grande importance à la qualité, au respect de l'environnement et aux formulations avancées, notamment dans les produits pharmaceutiques et les matériaux haute performance. L'utilisation croissante de composés fluorés dans la synthèse à façon renforce encore la croissance du marché.

Aperçu du marché allemand du fluorobenzène

Le marché allemand du fluorobenzène repose sur son leadership dans la fabrication pharmaceutique de haute précision, son solide héritage dans l'industrie chimique et son modèle de production orienté vers l'exportation. Le pays dispose de réseaux de R&D bien établis et de partenariats entre les établissements universitaires et les fabricants de produits chimiques, favorisant ainsi l'innovation continue dans le domaine des intermédiaires fluorés. La demande est particulièrement forte pour les applications en chimie fine, polymères et ingrédients pharmaceutiques.

Aperçu du marché britannique du fluorobenzène

Le marché britannique s'appuie sur une industrie des sciences de la vie mature, des efforts croissants pour localiser les chaînes d'approvisionnement pharmaceutiques et chimiques après le Brexit, et une demande accrue de réactifs et d'intermédiaires spécialisés. Grâce à l'accent croissant mis sur la R&D, la collaboration entre le monde universitaire et l'industrie, et aux investissements dans la synthèse et la production en laboratoire de composés fluorés de niche, le Royaume-Uni continue de jouer un rôle important sur les marchés chimiques à forte valeur ajoutée.

Aperçu du marché du fluorobenzène en Amérique du Nord

L'Amérique du Nord devrait connaître le TCAC le plus élevé entre 2025 et 2032, porté par une forte demande de produits chimiques fluorés dans les secteurs pharmaceutique, agrochimique et des polymères. L'accent mis sur la découverte de médicaments, les avancées en science des matériaux et le recours croissant aux intermédiaires de haute pureté stimulent la demande. De plus, la relocalisation croissante de la fabrication de produits chimiques et la collaboration croissante entre les entreprises pharmaceutiques et les entreprises de chimie de spécialité soutiennent l'expansion du marché.

Aperçu du marché américain du fluorobenzène

En 2024, les États-Unis détenaient la plus grande part du marché nord-américain, grâce à leur industrie pharmaceutique en pleine expansion, à leur solide infrastructure de R&D et à leurs investissements importants dans la production de produits chimiques de spécialité. L'accent mis par le pays sur l'innovation, la conformité réglementaire et le développement durable encourage l'utilisation de composés fluorés de haute pureté dans la synthèse de médicaments et le développement de matériaux avancés. La présence d'acteurs clés et un réseau de distribution mature renforcent encore la position de leader des États-Unis dans la région.

Part de marché du fluorobenzène

L’industrie du fluorobenzène est principalement dirigée par des entreprises bien établies, notamment :

- Groupe Azelis (Belgique)

- Kishida Chemical Co., Ltd. (Japon)

- KANTO KAGAKU (Japon)

- CHEMOS GmbH & Co. KG (Allemagne)

- Xiangshui Xinlianhe Chemical Co., Ltd. (Chine)

- Shandong Fore Co., Ltd. (Chine)

- Nacalai Tesque Inc. (Japon)

- Fuxin Hongchang Chemical Co., Ltd. (Chine)

- Hridaan Pharma Chem (Inde)

- Regal Remedies Limited (Inde)

- Tokyo Chemical Industry Co., Ltd. (Japon)

- Muby Chemicals (Inde)

- Haihang Industry (Chine)

- Groupe Molekula (Royaume-Uni)

- AB ENTERPRISES (Inde)

Derniers développements sur le marché mondial du fluorobenzène

- En mars 2023, AGC a annoncé l'augmentation de sa capacité de production de composés fluorés dans son usine de Chiba, au Japon, reflétant la demande mondiale croissante en composés fluorés haute performance. Cette décision stratégique souligne la volonté de l'entreprise de renforcer sa position sur le marché du fluorobenzène et, plus largement, sur celui des composés fluorés, en améliorant ses capacités d'approvisionnement et en répondant aux besoins croissants des secteurs de l'électronique, de la pharmacie et de la chimie.

- En 2022, Tata Steel a finalisé l'acquisition de Neelachal Ispat Nigam Ltd. (NINL), accédant ainsi à une capacité de production annuelle d'acier long de 1,1 million de tonnes et à des réserves d'environ 100 millions de tonnes de minerai de fer. Cette acquisition renforce considérablement la sécurité de l'approvisionnement en matières premières et les capacités de production de Tata Steel, consolidant ainsi sa position sur le marché de l'acier long et améliorant sa capacité à répondre aux besoins des secteurs des infrastructures et de la construction en Inde.

- En 2022, FMC Inde a lancé Corprima, un nouvel insecticide formulé pour les cultures de tomates et de gombos. Ce lancement élargit la gamme de produits agrochimiques de FMC et soutient le secteur agricole indien en offrant une durée de lutte antiparasitaire prolongée, en améliorant le rendement des cultures et en offrant une meilleure rentabilité aux agriculteurs. Ce lancement renforce la présence de FMC sur le marché indien, un segment en pleine croissance de la protection des cultures.

- En 2022, Novo Nordisk a lancé sur le marché indien le sémaglutide oral, un antidiabétique oral révolutionnaire conçu pour le traitement du diabète de type 2. Ce lancement représente une avancée majeure dans la prise en charge du diabète en offrant une alternative orale efficace aux injectables, améliorant ainsi l'observance du traitement et l'accessibilité. Il renforce également la présence de Novo Nordisk sur le marché indien en pleine expansion des produits pharmaceutiques et du traitement du diabète.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.