Marché mondial des adhésifs floqués, par produit (polyuréthane, acrylique, époxy et autres), source (à base de solvant et à base d'eau), substrat (textile, plastique, métal, verre, bois et autres), application (automobile, textile et vêtements techniques, impression, papier et emballage et autres), pays (États-Unis, Canada, Mexique, Allemagne, France, Italie, Royaume-Uni, Belgique, Espagne, Russie, Turquie, Pays-Bas, Suisse et reste de l'Europe, Japon, Chine, Inde, Corée du Sud, Australie, Nouvelle-Zélande, Singapour, Malaisie, Thaïlande, Indonésie, Philippines et reste de l'Asie-Pacifique, Émirats arabes unis, Arabie saoudite, Égypte, Israël, Afrique du Sud, reste du Moyen-Orient et Afrique) Tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché : marché mondial des adhésifs floqués

Analyse et perspectives du marché : marché mondial des adhésifs floqués

Le marché mondial des adhésifs floqués devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît à un TCAC de 5,5 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 4 596 087,85 milliers de dollars d'ici 2029. La tendance croissante des véhicules légers et à faibles émissions de carbone pourrait stimuler le marché mondial des adhésifs floqués.

Les adhésifs floqués sont des matériaux de liaison utilisés pour coller divers substrats , tels que le caoutchouc, le plastique et le métal. Le flocage adhésif se produit lorsque des particules de fibres sont incorporées électrostatiquement dans la couche adhésive. La plupart des flocages utilisent des fibres naturelles ou synthétiques finement hachées. L'extérieur floqué confère à la surface des propriétés décoratives et fonctionnelles.

L’adoption croissante des adhésifs floqués dans la fabrication d’isolation thermique et l’évolution des préférences des consommateurs pour le niveau de qualité de l’intérieur automobile sont quelques-uns des principaux déterminants qui pourraient favoriser la croissance du marché mondial des adhésifs floqués au cours de la période de prévision.

Cependant, la volatilité des prix des matières premières et la réaction des différentes structures de composition peuvent constituer des freins majeurs à la croissance du marché mondial des adhésifs floqués. En outre, les réglementations strictes associées au processus d'approbation de la commercialisation peuvent remettre en cause la croissance du marché au cours de la période de prévision.

L’augmentation de l’utilisation des adhésifs floqués dans les secteurs de l’impression et de l’emballage peut créer des opportunités lucratives pour le marché.

Ce rapport sur le marché mondial des adhésifs flock fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché mondial des adhésifs floqués

Portée et taille du marché mondial des adhésifs floqués

Le marché mondial des adhésifs floqués est segmenté en quatre segments notables en fonction de la source, du substrat, du produit et de l'application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base de la source, le marché mondial des adhésifs floqués est segmenté en adhésifs à base de solvants et adhésifs à base d'eau. En 2022, le segment des adhésifs à base d'eau devrait dominer le marché, car les adhésifs à base d'eau ont un pouvoir de résistance élevé, ce qui augmente sa demande à l'échelle mondiale.

- Sur la base du substrat, le marché mondial des adhésifs floqués est segmenté en textile, plastique, métal, verre, bois et autres. En 2022, le segment du plastique devrait dominer le marché car le plastique a une grande durabilité, ce qui augmente sa demande mondiale.

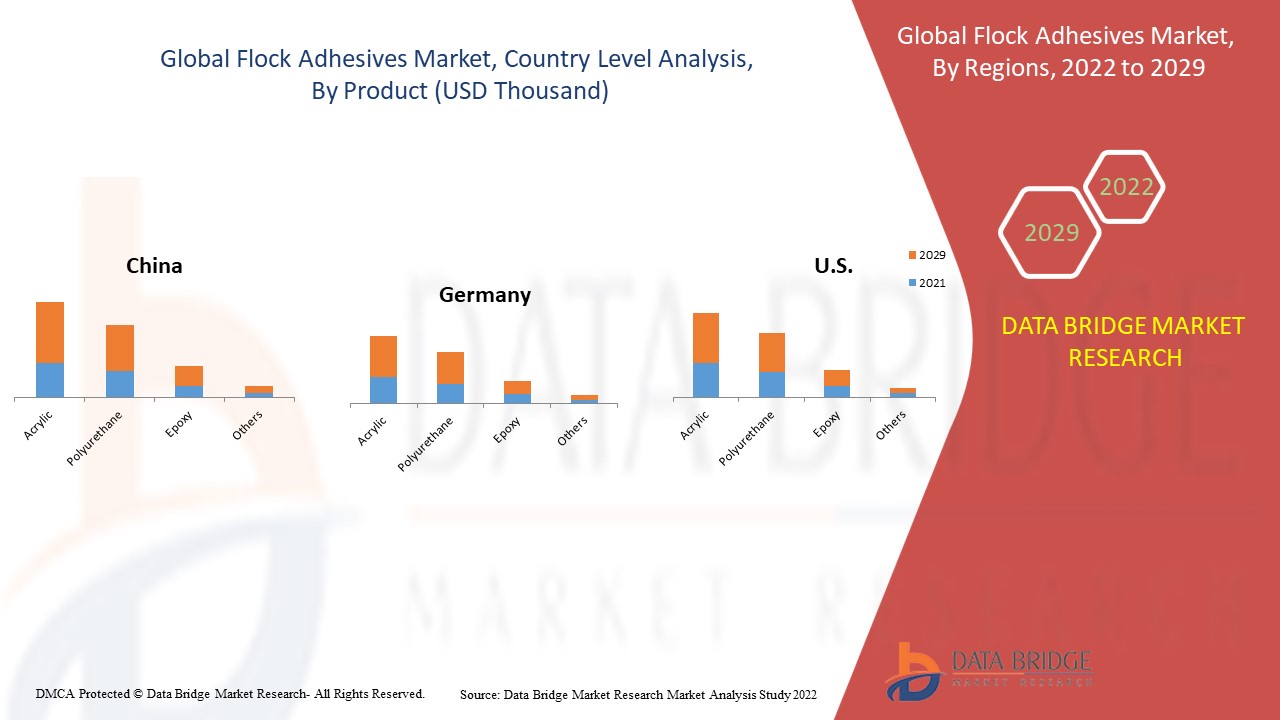

- Sur la base du produit, le marché mondial des adhésifs floqués est segmenté en polyuréthane, acrylique, époxy et autres. En 2022, le segment acrylique devrait dominer le marché car les adhésifs acryliques ont une bonne compatibilité, augmentant ainsi sa demande mondiale.

- En fonction des applications, le marché mondial des adhésifs floqués est segmenté en automobile, textile et vêtements techniques, impression, papier et emballage, etc. En 2022, le segment automobile devrait dominer le marché car les adhésifs floqués offrent un bon effet isolant pour produire des pièces automobiles, ce qui augmente sa demande à l'échelle mondiale.

Analyse du marché mondial des adhésifs floqués au niveau des pays

Analyse du marché mondial des adhésifs floqués au niveau des pays

Le marché mondial des adhésifs floqués est segmenté en quatre segments notables en fonction de la source, du substrat, du produit et de l'application.

Les pays couverts dans le rapport sur le marché mondial des adhésifs floqués sont les États-Unis, le Canada, le Mexique, l'Allemagne, la France, l'Italie, le Royaume-Uni, la Belgique, l'Espagne, la Russie, la Turquie, les Pays-Bas, la Suisse, le reste de l'Europe, le Japon, la Chine, l'Inde, la Corée du Sud, l'Australie, la Nouvelle-Zélande, Singapour, la Malaisie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique, les Émirats arabes unis, l'Arabie saoudite, l'Égypte, Israël, l'Afrique du Sud, le reste du Moyen-Orient et l'Afrique.

L'Asie-Pacifique devrait dominer le marché mondial des adhésifs floqués en raison de la demande croissante de véhicules légers et à faibles émissions de carbone. La Chine devrait être le leader de la croissance du marché de l'Asie-Pacifique en raison de la production facile et avancée des adhésifs floqués avec des matériaux de haute qualité. Les États-Unis devraient dominer le marché nord-américain en raison de l'utilisation croissante des adhésifs floqués dans le secteur automobile de la région, tandis que l'Allemagne devrait dominer le marché européen en raison de l'évolution des préférences des consommateurs pour le niveau de qualité de l'intérieur des automobiles, ce qui augmente la demande d'adhésifs floqués dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Tendance croissante des véhicules légers et à faibles émissions de carbone

Les matériaux légers utilisés dans la fabrication des automobiles offrent de grandes possibilités de réduction de poids et d'autres avantages lorsqu'ils sont utilisés dans les structures en acier et en fonte dans les applications automobiles. Les véhicules électriques ont l'impact le plus significatif sur la réduction des émissions de gaz à effet de serre dans la plupart des pays, et les véhicules à essence légers permettent des réductions significatives. Une réduction de 10 % du poids du véhicule peut améliorer la consommation de carburant de 6 % et 8 %.

Les matériaux de fabrication avancés pour véhicules électriques sont essentiels pour alimenter le marché automobile tout en maintenant la sécurité et les performances. Les matériaux légers offrent un grand potentiel pour augmenter l'efficacité des véhicules, car les objets plus légers nécessitent moins d'énergie pour accélérer que les plus lourds. Le remplacement des pièces en fonte et en acier traditionnelles par des matériaux légers tels que l'acier à haute résistance et les alliages de magnésium peut réduire le poids de la carrosserie et du châssis du véhicule jusqu'à 50 %, réduisant ainsi la consommation de carburant.

- En conclusion, les véhicules légers sont principalement fabriqués en aluminium ou en acier léger spécial et émettent moins de gaz polluants que les autres véhicules. Pour cette raison, la tendance croissante des véhicules légers et à faibles émissions de carbone devrait agir comme un moteur pour stimuler la demande du marché mondial des adhésifs floqués.

Le marché mondial des adhésifs flock vous fournit également une analyse de marché détaillée pour la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2012 à 2020.

Analyse du paysage concurrentiel et des parts de marché mondiales des adhésifs floqués

Le paysage concurrentiel du marché mondial des adhésifs flock fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché mondial des adhésifs flock.

Certains des principaux acteurs du marché engagés dans le marché mondial des adhésifs floqués sont Sika AG, CHT Group, NYATEX, SwissFlock AG, Arkema, HB Fuller Company, Dow, PARKER HANNIFIN CORP, Henkel AG & Co. KGaA, Stahl Holdings BV, Avient Corporation, Kissel + Wolf GmbH et NANPAO RESINS CHEMICAL GROUP, entre autres acteurs nationaux. Les analystes de DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Les entreprises initient également de nombreux contrats et accords, ce qui accélère le marché des adhésifs floqués en Asie-Pacifique.

Par exemple,

- En juillet 2021, HB Fuller Company s'est associée à Covestro, l'un des plus grands fournisseurs de polymères au monde, pour fournir un adhésif à impact climatique réduit pour les industries du bois, des composites, du textile et de l'automobile. Cela a permis à l'entreprise de produire des produits adhésifs respectueux de l'environnement

- En novembre 2020, NANPAO RESINS CHEMICAL GROUP a reçu le « Good Deeds Award » lors de la 18e exposition d'or organisée par le ministère du Travail à Taiwan. Cela a renforcé la position de l'entreprise dans la région Asie-Pacifique

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of GLOBAL FLOCK ADHESIVES MARKET

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- The product LIFE LINE CURVE

- MULTIVARIATE MODELING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- MARKET application COVERAGE GRID

- DBMR MARKET CHALLENGE MATRIX

- vendor share analysis

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Regional Summary

- Global

- NORTH AMERICA

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

- market overview

- drivers

- Growing trend of lightweight and low carbon-emitting vehicles

- Positive outlook towards flock adhesives in automotive and textile sectors

- Rising adoption of flock adhesives to manufacturE thermal insulation

- Shifting consumer preference towards quality level of automotive interior

- restraints

- Volatility in Raw Material Prices

- Reaction of different composition structure

- Restricted supply of raw materials for producing flock adhesives

- opportunities

- Increasing R&D activities investments for the development of new products

- Upsurge in utilization of flock adhesives in printing and packaging sectors

- Flame retarding and high washability qualities based flock adhesives products creates lucrative opportunities

- challenges

- Stringent regulations associateD with the commercialization approval process

- Lack of awareness regarding Flock Adhesives in several emerging economies

- IMPACT OF COVID 19 IMPACT ON THE Global flock adhesives market

- ANALYSIS ON IMPACT OF COVID-19 ON THE Global flock adhesives market

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE GLOBAL FLOCK ADHESIVES MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT on PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Global Flock Adhesives Market, BY PRODUCT

- overview

- acrylic

- POLYURETHANE

- EPOXY

- others

- Global Flock Adhesives Market, source

- OVERVIEW

- water-borne

- solvent-borne

- Global Flock Adhesives Market, BY substrate

- overview

- plastic

- metal

- textile

- wood

- glass

- OTHERS

- Global Flock Adhesives Market, BY application

- overview

- automotive

- acrylic

- polyurethane

- epoxy

- others

- Technical Textile & Clothing

- acrylic

- polyurethane

- epoxy

- others

- Paper & Packaging

- acrylic

- polyurethane

- epoxy

- others

- Printing

- acrylic

- polyurethane

- epoxy

- others

- others

- acrylic

- polyurethane

- epoxy

- others

- GLOBAL Flock adhesive market, BY region

- overview

- Asia-Pacific

- CHIna

- india

- japan

- south korea

- australia & new zealand

- indonesia

- thailand

- malaysia

- singapore

- philippines

- rest of asia-pacific

- Europe

- germany

- u.k

- russia

- france

- italy

- turkey

- spain

- netherlands

- belgium

- switzerland

- rest of europe

- South America

- brazil

- Argentina

- rest of south america

- Middle East & Africa

- U.A.E

- Saudi Arabia

- South africa

- israel

- egypt

- rest of Middle East & Africa

- North America

- U.S.

- Canada

- Mexico

- GLOBAL FLOCK ADHESIVES MARKET: COMPANY landscape

- company share analysis: GLOBAL

- company share analysis: north america

- company share analysis: EUROPE

- company share analysis: Asia-pacific

- MergerS, partnershipS & AcquisitionS

- EXPANSIONS

- new product developments

- swot analysis

- company profiles

- Dow

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT update

- Sika AG

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT updates

- Henkel AG & Co. KGaA

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT update

- PARKER HANNIFIN CORP

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT update

- Arkema

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT updates

- Avient Corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- H.B. Fuller Company

- COMPANY SNAPSHOT

- revenue analysis

- Product Portfolio

- RECENT updates

- CHT Group

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPdates

- Kissel + Wolf Gmbh

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- NANPAO RESINS CHEMICAL GROUP

- COMPANY SNAPSHOT

- revenue analysis

- Product Portfolio

- RECENT update

- NYATEX

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPdate

- Stahl Holdings B.V

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT Update

- SwissFlock AG

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPdate

- QUESTIONNAIRE

- related reports

Liste des tableaux

TABLE 1 export DATA of Glues, prepared, and other prepared adhesives, n.e.s., HS 350699 (USD Thousand)

TABLE 2 import DATA OF GLUES, PREPARED, AND OTHER PREPARED ADHESIVES, N.E.S., HS 350699 (USD THOUSAND)

TABLE 3 Global Flock adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 4 Global Flock adhesives Market, By product, 2020-2029 (tons)

TABLE 5 Global Acrylic in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 6 Global acrylic in FLOCK ADHESIVES market, BY region, 2020-2029 (Tons)

TABLE 7 Global Polyurethane in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 8 Global Polyurethane in FLOCK ADHESIVES market, BY region, 2020-2029 (TONS)

TABLE 9 Global Epoxy in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 10 Global Epoxy in FLOCK ADHESIVES market, BY region, 2020-2029 (tons)

TABLE 11 Global others in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 12 Global others in FLOCK ADHESIVES market, BY region, 2020-2029 (Tons)

TABLE 13 Global FLOCK ADHESIVES market, BY SOurce, 2022-2029 (USD Thousand)

TABLE 14 Global water-borne IN FLOCK ADHESIVES market, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 Global Solvent-borne IN FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 16 Global Flock adhesives Market, By Substrate, 2020-2029 (usd thousand)

TABLE 17 Global plastic in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 18 Global metal in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 19 Global textile in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 20 Global wood in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 21 Global glass in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 22 Global others in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 23 Global Flock adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 24 Global Automotive in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 25 Global Automotive in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 26 Global Technical Textile & Clothing in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 27 Global Technical Textile & Clothing in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 28 Global Paper & Packaging in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 29 Global Paper & Packaging in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 30 Global Printing in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 31 Global Printing in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 32 Global others in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 33 Global OTHERS in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 34 GLOBAL flock adhesive market, By region, 2020-2029 (USD thousand)

TABLE 35 GLOBAL flock adhesive market, By region, 2020-2029 (TONS)

TABLE 36 Asia-Pacific Flock Adhesives Market, BY COUNTRY, 2020-2029 (USD Thousand)

TABLE 37 Asia-Pacific Flock Adhesives Market, BY COUNTRY, 2020-2029 (Tons)

TABLE 38 Asia-Pacific Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 39 Asia-Pacific Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 40 Asia-Pacific Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 41 Asia-Pacific Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 42 Asia-Pacific Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 43 Asia-Pacific automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 44 Asia-Pacific technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 45 Asia-Pacific paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 46 Asia-Pacific printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 47 Asia-Pacific others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 48 china Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 49 china Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 50 china Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 51 china Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 52 china Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 53 china automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 54 china technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 55 china paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 56 china printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 57 china others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 58 india Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 59 india Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 60 india Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 61 india Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 62 india Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 63 india automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 64 india technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 65 india paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 66 india printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 67 india others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 68 japan Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 69 japan Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 70 japan Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 71 japan Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 72 japan Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 73 japan automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 74 japan technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 75 japan paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 76 japan printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 77 japan others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 78 South korea Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 79 South korea Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 80 South korea Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 81 South korea Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 82 South korea Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 83 South korea automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 84 South korea technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 85 South korea paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 86 South korea printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 87 South korea others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 88 Australia & new zealand Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 89 Australia & new zealand Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 90 Australia & new zealand Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 91 Australia & new zealand Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 92 Australia & new zealand Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 93 Australia & new zealand automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 94 Australia & new zealand technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 95 Australia & new zealand paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 96 Australia & new zealand printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 97 Australia & new zealand others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 98 indonesia Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 99 indonesia Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 100 indonesia Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 101 indonesia Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 102 indonesia Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 103 indonesia automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 104 indonesia technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 105 indonesia paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 106 indonesia printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 107 indonesia others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 108 thailand Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 109 thailand Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 110 thailand Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 111 thailand Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 112 thailand Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 113 thailand automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 114 thailand technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 115 thailand paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 116 thailand printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 117 thailand others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 118 malaysia Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 119 malaysia Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 120 malaysia Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 121 malaysia Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 122 malaysia Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 123 malaysia automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 124 malaysia technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 125 malaysia paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 126 malaysia printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 127 malaysia others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 128 singapore Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 129 singapore Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 130 singapore Flock Adhesives Market, BY source, 2020-2029 (USD Thousand

TABLE 131 singapore Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 132 singapore Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 133 singapore automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 134 singapore technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 135 singapore paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 136 singapore printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 137 singapore others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 138 philippines Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 139 philippines Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 140 philippines Flock Adhesives Market, BY source, 2020-2029 (USD Thousand

TABLE 141 philippines Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 142 philippines Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 143 philippines automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 144 philippines technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 145 philippines paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 146 philippines printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 147 philippines others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 148 rest of Asia-Pacific Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 149 rest of Asia-Pacific Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 150 Europe Flock Adhesives Market, BY COUNTRY, 2020-2029 (USD Thousand)

TABLE 151 Europe Flock Adhesives Market, BY COUNTRY, 2020-2029 (tons)

TABLE 152 Europe Flock Adhesives Market, By Product, 2020-2029 (USD THOUSAND)

TABLE 153 Europe Flock Adhesives Market, By Product, 2020-2029 (Tons)

TABLE 154 Europe flock adhesives Market, BY SOURCE, 2020-2029 (USD Thousand)

TABLE 155 Europe flock adhesives Market, By Substrate, 2020-2029 (USD Thousand)

TABLE 156 Europe Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 157 EUROPE AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 158 EUROPE Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 159 EUROPE Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 160 EUROPE printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 161 EUROPE others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 162 germany Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 163 germany Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 164 germany Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 165 germany Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 166 germany Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 167 germany AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 168 germany Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 169 germany Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 170 germany printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 171 germany others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 172 U.K. Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 173 U.K. Flock Adhesives Market, BY product, 2020-2029 (tons)

TABLE 174 U.K. Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 175 U.K. Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 176 U.K. Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 177 U.K. AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 178 U.K. Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 179 U.K. Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 180 U.K. printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 181 U.K. others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 182 Russia Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 183 Russia Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 184 Russia Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 185 Russia Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 186 Russia Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 187 Russia AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 188 Russia Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 189 Russia Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 190 Russia printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 191 Russia others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 192 France Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 193 France Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 194 France Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 195 France Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 196 France Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 197 France AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 198 France Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 199 France Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 200 France printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 201 France others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 202 Italy Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 203 Italy Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 204 Italy Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 205 Italy Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 206 Italy Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 207 Italy AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 208 Italy Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 209 Italy Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 210 Italy printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 211 Italy others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 212 Turkey Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 213 Turkey Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 214 Turkey Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 215 Turkey Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 216 Turkey Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 217 Turkey AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 218 Turkey Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 219 Turkey Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 220 Turkey printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 221 Turkey others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 222 Spain Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 223 Spain Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 224 Spain Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 225 Spain Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 226 Spain Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 227 Spain AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 228 Spain Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 229 Spain Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 230 Spain printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 231 Spain others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 232 Netherlands Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 233 Netherlands Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 234 Netherlands Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 235 Netherlands Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 236 Netherlands Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 237 Netherlands AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 238 Netherlands Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 239 Netherlands Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 240 Netherlands printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 241 Netherlands others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 242 Belgium Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 243 Belgium Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 244 Belgium Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 245 Belgium Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 246 Belgium Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 247 Belgium AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 248 Belgium Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 249 Belgium Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 250 Belgium printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 251 Belgium others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 252 Switzerland Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 253 Switzerland Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 254 Switzerland Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 255 Switzerland Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 256 Switzerland Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 257 Switzerland AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 258 Switzerland Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 259 Switzerland Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 260 Switzerland printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 261 Switzerland others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 262 Rest of Europe Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 263 Rest of Europe Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 264 South America Flock Adhesives Market, BY COUNTRY, 2020-2029 (USD Thousand)

TABLE 265 South America Flock Adhesives Market, BY COUNTRY, 2020-2029 (tons)

TABLE 266 South America Flock Adhesives Market, By Product, 2020-2029 (USD THOUSAND)

TABLE 267 South America Flock Adhesives Market, By Product, 2020-2029 (Tons)

TABLE 268 South America flock adhesives Market, BY SOURCE, 2020-2029 (USD Thousand)

TABLE 269 South America flock adhesives Market, By Substrate, 2020-2029 (USD Thousand)

TABLE 270 South America Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 271 South America AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 272 South America Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 273 South America Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 274 South America printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 275 South America others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 276 Brazil Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 277 Brazil Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 278 Brazil Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 279 Brazil Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 280 Brazil Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 281 Brazil AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 282 Brazil Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 283 Brazil Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 284 Brazil printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 285 Brazil others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 286 Argentina Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 287 Argentina Flock Adhesives Market, BY product, 2020-2029 (tons)

TABLE 288 Argentina Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 289 Argentina Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 290 Argentina Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 291 Argentina AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 292 Argentina Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 293 Argentina Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 294 Argentina printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 295 Argentina others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 296 Rest of South America Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 297 Rest of South America Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 298 Middle East & Africa Flock Adhesives Market, BY COUNTRY, 2020-2029 (USD Thousand)

TABLE 299 Middle East & Africa Flock Adhesives Market, BY COUNTRY, 2020-2029 (Tons)

TABLE 300 Middle East & Africa Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 301 Middle East & Africa Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 302 Middle East & Africa Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 303 Middle East & Africa Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 304 Middle East & Africa Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 305 Middle East & Africa automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 306 Middle East & Africa technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 307 Middle East & Africa paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 308 Middle East & Africa printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 309 Middle East & Africa others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 310 U.A.E Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 311 U.A.E Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 312 U.A.E Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 313 U.A.E Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 314 U.A.E Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 315 U.A.E automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 316 U.A.E technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 317 U.A.E paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 318 U.A.E printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 319 U.A.E others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 320 Saudi Arabia Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 321 Saudi Arabia Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 322 Saudi Arabia Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 323 Saudi Arabia Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 324 Saudi Arabia Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 325 Saudi Arabia automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 326 Saudi Arabia technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 327 Saudi Arabia paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 328 Saudi Arabia printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 329 Saudi Arabia others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 330 South Africa Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 331 South Africa Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 332 South Africa Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 333 South Africa Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 334 South Africa Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 335 South Africa automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 336 South Africa technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 337 South Africa paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 338 South Africa printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 339 South Africa others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 340 Israel Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 341 Israel Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 342 Israel Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 343 Israel Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 344 Israel Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 345 Israel automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 346 Israel technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 347 Israel paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 348 Israel printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 349 Israel others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 350 Egypt Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 351 Egypt Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 352 Egypt Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 353 Egypt Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 354 Egypt Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 355 Egypt automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 356 Egypt technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 357 Egypt paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 358 Egypt printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 359 Egypt others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 360 rest of Middle East & Africa Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 361 rest of Middle East & Africa Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 362 North America Flock Adhesives Market, BY COUNTRY, 2020-2029 (USD Thousand)

TABLE 363 North America Flock Adhesives Market, BY COUNTRY, 2020-2029 (Tons)

TABLE 364 North America Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 365 North America Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 366 North America Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 367 North America Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 368 North America Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 369 North America automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 370 North America technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 371 North America paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 372 North America printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 373 North America others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 374 U.S. Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 375 US Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 376 US Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 377 US Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 378 US Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 379 US automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 380 US technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 381 US paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 382 US printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 383 US others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 384 Canada Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 385 Canada Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 386 Canada Flock Adhesives Market, BY SOURCE, 2020-2029 (USD Thousand)

TABLE 387 Canada Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 388 Canada Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 389 Canada automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 390 Canada technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 391 Canada paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 392 Canada printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 393 Canada others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 394 Mexico Flock Adhesives Market, By product, 2020-2029 (USD THOUSAND)

TABLE 395 Mexico Flock Adhesives Market, By product, 2020-2029 (Tons)

TABLE 396 Mexico Flock Adhesives Market, BY source, 2020-2029 (USD Thousand)

TABLE 397 Mexico Flock Adhesives Market, By substrate, 2020-2029 (USD Thousand)

TABLE 398 Mexico Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 399 Mexico automotive in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 400 Mexico technical textile & clothing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 401 Mexico paper & packaging in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 402 Mexico printing in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 403 Mexico others in Flock Adhesives Market, By product, 2020-2029 (usd thousand)

Liste des figures

FIGURE 1 GLOBAL FLOCK ADHESIVES MARKET: segmentation

FIGURE 2 GLOBAL FLOCK ADHESIVES MARKET: data triangulation

FIGURE 3 GLOBAL FLOCK ADHESIVES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL FLOCK ADHESIVES MARKET: global VS regional MARKET analysis

FIGURE 5 GLOBAL FLOCK ADHESIVES MARKET: company research analysis

FIGURE 6 GLOBAL FLOCK ADHESIVES MARKET: THE product LIFE LINE CURVE

FIGURE 7 GLOBAL FLOCK ADHESIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL FLOCK ADHESIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL FLOCK ADHESIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL FLOCK ADHESIVES MARKET: MARKET application COVERAGE GRID

FIGURE 11 GLOBAL FLOCK ADHESIVES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL FLOCK ADHESIVES MARKET: vendor share analysis

FIGURE 13 GLOBAL FLOCK ADHESIVES MARKET: SEGMENTATION

FIGURE 14 Asia-PAcific is expected to DOMINATE THE GLOBAL FLOCK ADHESIVES MARKET and IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN the forecast period of 2022 to 2029

FIGURE 15 A Positive outlook towards flock adhesives in THE automotive and textile sectors is EXPECTED TO DRIVE the GLOBAL FLOCK ADHESIVES MARKET in the forecast period of 2022 to 2029

FIGURE 16 Acrylic SEGMENT is expected to account for the largest share of the GLOBAL FLOCK ADHESIVES MARKET in 2022 & 2029

FIGURE 17 Asia-Pacific is the fastest-growing market for FLOCK ADHESIVES MARKET in the forecast period of 2022 to 2029

FIGURE 18 DRIVERS, RESTRAINTs, OPPORTUNITies, AND CHALLENGEs OF global Flock Adhesives Market

FIGURE 19 Percentage of Lightweight Materials Present In Typical Vehicles (Approximate Value)

FIGURE 20 Global FLOCK ADHESIVES market, BY product, 2021

FIGURE 21 Global FLOCK ADHESIVES MARKET, BY source, 2021

FIGURE 22 Global FLOCK ADHESIVES market, BY substrate, 2021

FIGURE 23 Global FLOCK ADHESIVES market, BY application, 2021

FIGURE 24 GLOBAL flock adhesive market: SNAPSHOT (2021)

FIGURE 25 GLOBAL flock adhesive market: by REgion (2021)

FIGURE 26 GLOBAL flock adhesive market: by REgion (2022 & 2029)

FIGURE 27 GLOBAL flock adhesive market: by REgion (2021 & 2029)

FIGURE 28 GLOBAL flock adhesive market: by PRODUCT (2022-2029)

FIGURE 29 Asia-Pacific Flock Adhesives Market: SNAPSHOT (2021)

FIGURE 30 Asia-Pacific Flock Adhesives Market: by COUNTRY (2021)

FIGURE 31 Asia-Pacific Flock Adhesives Market: by COUNTRY (2022 & 2029)

FIGURE 32 Asia-Pacific Flock Adhesives Market: by COUNTRY (2021 & 2029)

FIGURE 33 Asia-Pacific Flock Adhesives Market: by PRODUCT (2022-2029)

FIGURE 34 Europe Flock Adhesives Market: SNAPSHOT (2021)

FIGURE 35 Europe Flock Adhesives Market: by COUNTRY (2021)

FIGURE 36 Europe Flock Adhesives Market: by COUNTRY (2022 & 2029)

FIGURE 37 Europe Flock Adhesives Market: by COUNTRY (2021 & 2029)

FIGURE 38 Europe Flock Adhesives Market: by PRODUCT (2022-2029)

FIGURE 39 SOUTH AMERICA FLOCK ADHESIVES MARKET: SNAPSHOT (2021)

FIGURE 40 SOUTH AMERICA FLOCK ADHESIVES MARKET: BY COUNTRY (2021)

FIGURE 41 SOUTH AMERICA FLOCK ADHESIVES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 SOUTH AMERICA FLOCK ADHESIVES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 SOUTH AMERICA FLOCK ADHESIVES MARKET: BY PRODUCT (2022-2029)

FIGURE 44 Middle East & Africa Flock Adhesives Market: SNAPSHOT (2021)

FIGURE 45 Middle East & Africa Flock Adhesives Market: by COUNTRY (2021)

FIGURE 46 Middle East & Africa Flock Adhesives Market: by COUNTRY (2022 & 2029)

FIGURE 47 Middle East & Africa Flock Adhesives Market: by COUNTRY (2021 & 2029)

FIGURE 48 Middle East & Africa Flock Adhesives Market: by PRODUCT (2022-2029)

FIGURE 49 North America Flock Adhesives Market: SNAPSHOT (2021)

FIGURE 50 North America Flock Adhesives Market: by COUNTRY (2021)

FIGURE 51 North America Flock Adhesives Market: by COUNTRY (2022 & 2029)

FIGURE 52 North America Flock Adhesives Market: by COUNTRY (2021 & 2029)

FIGURE 53 North America Flock Adhesives Market: by PRODUCT (2022-2029)

FIGURE 54 GLOBAL FLOCK ADHESIVES MARKET: company share 2021 (%)

FIGURE 55 north AMERICA FLOCK ADHESIVES MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 EUROPE FLOCK ADHESIVES MARKET: company share 2021 (%)

FIGURE 57 Asia-Pacific FLOCK ADHESIVES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.