Global Eclinical Solutions Market

Taille du marché en milliards USD

TCAC :

%

USD

9.36 Billion

USD

25.79 Billion

2024

2032

USD

9.36 Billion

USD

25.79 Billion

2024

2032

| 2025 –2032 | |

| USD 9.36 Billion | |

| USD 25.79 Billion | |

|

|

|

|

Segmentation du marché mondial des solutions e-cliniques, par produit ( systèmes de saisie électronique de données et de gestion des données d'essais cliniques, systèmes de gestion des essais cliniques, plateformes d'analyse clinique, dossiers médicaux de coordination des soins (CCMR), gestion de la randomisation et de l'approvisionnement des essais, plateformes d'intégration de données cliniques, solutions d'évaluation électronique des résultats cliniques, solutions de sécurité, systèmes de fichiers maîtres d'essais électroniques , solutions de gestion des informations réglementaires, etc.), mode de livraison (solutions hébergées sur le Web (à la demande), solutions d'entreprise sous licence (sur site) et solutions cloud (SAAS)), phase d'essai clinique (phases I, II, III et IV), taille de l'organisation (petite, moyenne et grande), appareil utilisateur (ordinateur de bureau, tablette, assistant numérique personnel, smartphone, etc.), utilisateur final (sociétés pharmaceutiques et biopharmaceutiques , organismes de recherche sous contrat, sociétés de conseil, fabricants de dispositifs médicaux, hôpitaux et instituts de recherche universitaires) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des solutions cliniques électroniques

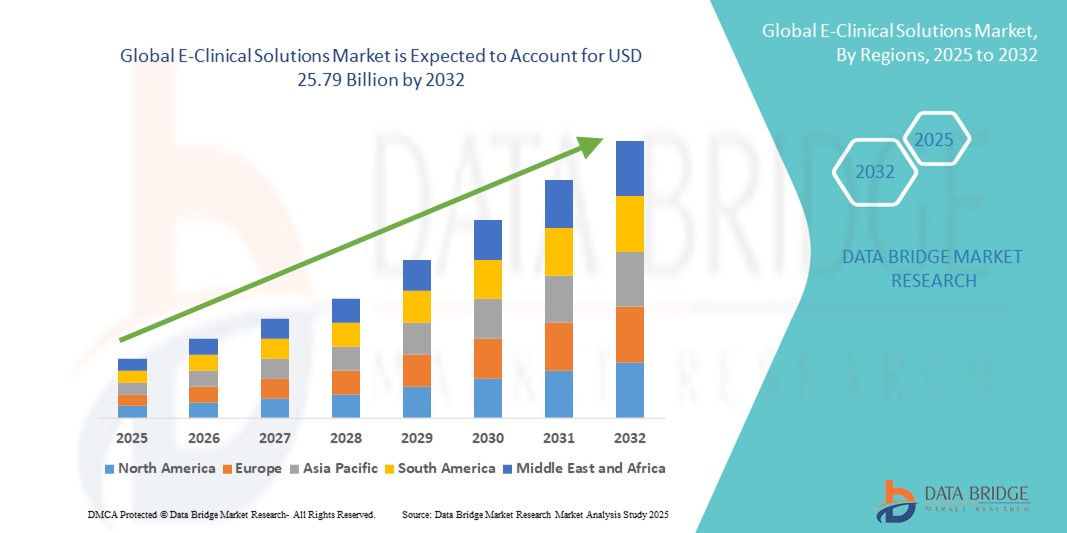

- La taille du marché mondial des solutions e-cliniques était évaluée à 9,36 milliards USD en 2024 et devrait atteindre 25,79 milliards USD d'ici 2032 , à un TCAC de 13,50 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante des technologies numériques et les progrès technologiques au sein de la recherche clinique et des systèmes de santé, conduisant à une meilleure gestion des données, à l'efficacité des essais et à la prise de décision en temps réel dans les sociétés pharmaceutiques et biotechnologiques.

- Par ailleurs, la demande croissante de plateformes sécurisées, conviviales et intégrées pour les essais cliniques fait des solutions cliniques électroniques le choix privilégié pour la collecte, le suivi et l'analyse des données. Ces facteurs convergents accélèrent l'adoption des solutions cliniques électroniques, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des solutions cliniques électroniques

- Les solutions cliniques électroniques, qui englobent des plateformes numériques telles que CTMS, EDC, eCOA et RTSM, deviennent de plus en plus essentielles dans les essais cliniques en raison de leur rôle dans la gestion des données, l'efficacité opérationnelle et la conformité réglementaire. L'expansion du marché est motivée par l'urgence de rationaliser les essais complexes et de soutenir les modèles d'essais décentralisés et virtuels.

- La demande croissante de solutions cliniques électroniques est principalement alimentée par des facteurs tels que le nombre croissant d'essais cliniques mondiaux, l'augmentation des investissements en R&D des sociétés pharmaceutiques et biotechnologiques, le passage vers des systèmes basés sur le cloud/mobiles et l'impératif d'accélérer les délais de développement des médicaments grâce à l'automatisation et à l'intégration des données.

- L'Amérique du Nord a dominé le marché des solutions e-cliniques, avec une part de chiffre d'affaires de 49,38 % en 2024, grâce à une infrastructure de santé robuste, des industries pharmaceutiques et biotechnologiques bien établies et un cadre réglementaire favorable favorisant l'adoption du numérique. Cette domination est notamment due à l'adoption avancée des États-Unis, qui détenaient environ 41,4 % du marché mondial en 2024.

- L'Asie-Pacifique devrait enregistrer une forte croissance sur le marché des solutions e-cliniques, avec un TCAC prévu de 11,8 %, en raison de l'externalisation croissante des essais cliniques, de l'expansion des infrastructures de soins de santé et de R&D et de l'augmentation de l'activité des essais dans des pays comme la Chine, l'Inde, le Japon et la Corée du Sud.

- Le segment des grandes entreprises a dominé le marché des solutions e-cliniques avec 63,4 % de parts de marché en 2024, reflétant leurs investissements importants dans la recherche et le développement, les opérations d'essais cliniques mondiaux et le besoin critique de plates-formes entièrement intégrées pour gérer la conformité réglementaire, les flux de travail complexes et la coordination des études multi-pays.

Portée du rapport et segmentation du marché des solutions cliniques électroniques

|

Attributs |

Informations clés sur le marché des solutions cliniques électroniques |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des solutions cliniques électroniques

Confort amélioré grâce aux plateformes cliniques électroniques intégrées

- Une tendance significative et croissante sur le marché mondial des solutions e-cliniques est l'intégration croissante des systèmes de gestion des essais cliniques, de saisie électronique des données (SED) et de gestion des essais cliniques (GET) au sein de plateformes numériques unifiées. Cette convergence améliore considérablement l'efficacité opérationnelle, la qualité des données et la prise de décision dans l'ensemble de l'écosystème de la recherche clinique.

- Par exemple, les plateformes e-cliniques modernes intègrent parfaitement la gestion des essais cliniques (EDC) aux fonctionnalités de gestion des essais cliniques, permettant ainsi aux promoteurs et aux organismes de recherche sous contrat (CRO) de suivre l'avancement des essais en temps réel, de gérer le recrutement des patients et de garantir la conformité réglementaire via une interface unique. De même, des solutions avancées intègrent désormais la randomisation et la gestion des stocks d'essais (RTSM), réduisant ainsi les délais et améliorant la coordination globale des essais.

- L'intégration des solutions e-cliniques permet d'automatiser la saisie des données, de les valider de manière avancée et de générer des rapports en temps réel. Par exemple, les plateformes intègrent de plus en plus de fonctionnalités de conception d'essais adaptative et de systèmes automatisés de résolution des requêtes, minimisant ainsi les interventions manuelles et améliorant la précision du traitement des données des patients. De plus, des capacités avancées d'analyse et de modélisation prédictive permettent aux responsables d'essais de prévoir les taux de recrutement des patients et d'identifier les goulots d'étranglement potentiels à l'avance.

- L'intégration transparente des plateformes e-cliniques avec les dossiers médicaux électroniques (DME), les systèmes d'information de laboratoire (SIL) et autres écosystèmes de santé numérique facilite l'accès centralisé à diverses sources de données cliniques. Grâce à une plateforme unique et unifiée, les chercheurs peuvent gérer les dossiers patients, les rapports d'événements indésirables, la documentation des essais et les soumissions réglementaires, créant ainsi un processus d'essai clinique simplifié et conforme.

- Cette tendance vers des écosystèmes e-cliniques plus intelligents, interconnectés et conviviaux transforme profondément les attentes en matière de gestion des essais cliniques. Par conséquent, des entreprises comme Medidata, Oracle Health Sciences et Veeva Systems développent des solutions e-cliniques de nouvelle génération offrant une interopérabilité améliorée, des modèles de déploiement cloud et une accessibilité mobile pour soutenir les essais cliniques mondiaux et décentralisés.

- La demande de solutions e-cliniques offrant des fonctionnalités intégrées augmente rapidement dans les secteurs pharmaceutique, biotechnologique et des dispositifs médicaux, car les parties prenantes accordent de plus en plus la priorité à l'efficacité opérationnelle, à la conformité réglementaire et à la mise sur le marché accélérée de nouvelles thérapies.

Dynamique du marché des solutions cliniques électroniques

Conducteur

Besoin croissant d'une gestion efficace des essais cliniques et adoption croissante de solutions numériques

- La complexité et le coût croissants des essais cliniques, conjugués à l'augmentation du nombre de médicaments et de candidats biologiques en développement, stimulent une forte demande de solutions cliniques électroniques avancées. Ces plateformes permettent une gestion efficace des données, un engagement fluide des patients et une conformité réglementaire sur des sites d'essai géographiquement diversifiés.

- Par exemple, en juin 2024, Medidata (Dassault Systèmes) a apporté des améliorations à sa plateforme d'essais cliniques décentralisés (DCT) pilotée par l'IA, visant à optimiser le recrutement des patients et le suivi des essais en temps réel. Ces avancées technologiques accélèrent l'adoption des plateformes cliniques électroniques dans les secteurs pharmaceutique et biotechnologique.

- Alors que les promoteurs et les CRO s'efforcent de réduire les délais des essais cliniques et d'améliorer la prise de décision, des solutions telles que la saisie électronique des données (SED), les systèmes de gestion des essais cliniques (SGC), l'eCOA et les outils de surveillance à distance deviennent indispensables. Ces systèmes offrent automatisation, précision des données et aperçu en temps réel, garantissant ainsi l'efficacité opérationnelle.

- En outre, l’évolution croissante vers des essais centrés sur le patient et l’expansion des modèles d’essais hybrides et décentralisés font des plateformes e-cliniques une partie intégrante de l’écosystème de la recherche clinique, permettant d’améliorer la rétention et la conformité des patients.

- L'intégration d'analyses avancées, de cloud computing et d'interfaces mobiles améliore encore la proposition de valeur des solutions e-cliniques, les rendant essentielles pour répondre à la demande croissante de processus de développement de médicaments plus rapides, plus sûrs et plus efficaces.

Retenue/Défi

Préoccupations concernant la sécurité des données, les complexités d'intégration et les coûts de mise en œuvre élevés

- Les préoccupations concernant la confidentialité des données et les vulnérabilités en matière de sécurité constituent un frein majeur pour le marché des solutions cliniques électroniques. Ces systèmes, manipulant des données sensibles sur les patients et les essais cliniques, restent vulnérables aux cyberattaques, aux accès non autorisés et aux failles potentielles, suscitant des inquiétudes chez les promoteurs, les CRO et les autorités réglementaires.

- Par exemple, les incidents très médiatisés de cyberattaques contre des organismes de soins de santé et de recherche clinique ont accru la sensibilisation aux risques liés à l’adoption de plateformes numériques basées sur le cloud sans mesures de protection solides.

- Répondre à ces préoccupations grâce au chiffrement avancé, à l'authentification multifacteur, à la conformité RGPD/HIPAA et à des audits système réguliers est essentiel pour préserver la confiance des utilisateurs. Des fournisseurs comme Oracle Health Sciences et Veeva Systems mettent en avant leurs capacités de protection des données pour rassurer les parties prenantes.

- En outre, les défis d’intégration liés à l’alignement des solutions e-cliniques avec les systèmes existants et les divers flux de travail de gestion des essais retardent souvent l’adoption, en particulier parmi les CRO de taille moyenne et petite.

- Les coûts initiaux élevés de mise en œuvre, incluant les licences, la personnalisation et la formation du personnel, demeurent un frein à l'adoption, notamment dans les régions en développement ou pour les promoteurs d'essais soucieux de leur budget. Si les modèles d'abonnement SaaS réduisent les dépenses initiales, les plateformes avancées intégrant l'IA, l'analyse et l'interopérabilité exigent toujours un prix élevé.

- Surmonter ces obstacles grâce à des solutions modulaires abordables, de meilleures normes d’interopérabilité et des cadres de cybersécurité plus solides sera essentiel pour parvenir à une adoption mondiale durable des solutions e-cliniques.

Portée du marché des solutions cliniques électroniques

Le marché est segmenté sur la base du produit, du mode de livraison, de la phase d’essai clinique, de la taille de l’organisation, de l’appareil utilisateur et de l’utilisateur final.

- Par produit

En fonction des produits, le marché des solutions e-cliniques est segmenté en systèmes de saisie électronique de données et de gestion des données d'essais cliniques, systèmes de gestion des essais cliniques, plateformes d'analyse clinique, dossiers médicaux de coordination des soins (DMC), gestion de la randomisation et de l'approvisionnement des essais, plateformes d'intégration de données cliniques, solutions électroniques d'évaluation des résultats cliniques, solutions de sécurité, systèmes de fichiers maîtres d'essais électroniques, solutions de gestion des informations réglementaires, etc. Le segment des systèmes de gestion de données a dominé le marché avec la plus grande part de chiffre d'affaires (28,6 %) en 2024, grâce à son rôle central dans la collecte, le nettoyage et la gestion efficaces des données d'essais cliniques. Ces systèmes sont essentiels au maintien de l'intégrité des données, à la conformité réglementaire et à la précision des rapports, ce qui les rend indispensables pour les essais cliniques, qu'ils soient de petite ou de grande envergure. L'augmentation du volume de données d'essais dans les études multicentriques et mondiales accroît la demande pour une gestion robuste des données. L'intégration aux dossiers médicaux électroniques (DME) et autres plateformes d'essais renforce encore leur adoption. Des capacités d'analyse avancées et de surveillance en temps réel font également des systèmes de gestion de données un pilier de l'efficacité des opérations cliniques.

Le segment des plateformes d'analyse clinique devrait connaître le TCAC le plus rapide, soit 22,1 % entre 2025 et 2032, grâce à l'adoption croissante de l'analyse basée sur l'IA, de l'apprentissage automatique et de la modélisation prédictive en recherche clinique. Ces plateformes permettent aux parties prenantes d'extraire des informations exploitables à partir d'ensembles de données d'essais complexes, d'optimiser le recrutement des patients et d'améliorer les résultats des essais en temps réel. Les solutions d'analyse prennent également en charge la surveillance basée sur les risques, l'identification des écarts de protocole et le renforcement de la conformité réglementaire. La capacité d'intégrer diverses sources de données, notamment les certificats d'autorisation de mise sur le marché électroniques (eCOA), les dispositifs portables et les systèmes de laboratoire, alimente leur croissance. Des outils de visualisation et des tableaux de bord avancés aident les responsables d'essais à prendre rapidement des décisions éclairées. L'accent croissant mis sur les essais de médecine adaptative et de précision accélère encore l'adoption des plateformes d'analyse clinique.

- Par mode de livraison

En fonction du mode de livraison, le marché des solutions e-cliniques est segmenté en solutions hébergées sur le web (à la demande), solutions d'entreprise sous licence (sur site) et solutions cloud (logiciel en tant que service/SAAS). Le segment des solutions hébergées sur le web (à la demande) détenait la plus grande part de marché, avec 41,3 % en 2024, grâce à son évolutivité, sa rentabilité et sa facilité de déploiement. Ces solutions permettent aux utilisateurs d'accéder aux données des essais et aux outils de gestion à distance, sans infrastructure informatique complexe, ce qui est particulièrement avantageux pour les organismes de recherche de petite et moyenne taille. La facilité d'intégration aux systèmes informatiques existants et les exigences minimales de maintenance renforcent encore leur adoption. La flexibilité d'adaptation des ressources aux besoins des essais justifie également la préférence pour ce segment. L'accès centralisé aux données et les capacités de surveillance en temps réel améliorent l'efficacité opérationnelle.

Le segment des solutions cloud (SaaS) devrait connaître une croissance annuelle composée (TCAC) record de 21,4 % entre 2025 et 2032, portée par la prévalence croissante des modèles d'essais cliniques décentralisés et hybrides. Les plateformes cloud offrent un accès sécurisé et en temps réel aux données des essais sur plusieurs sites et pays, favorisant ainsi une meilleure collaboration entre promoteurs, CRO et sites cliniques. L'automatisation des flux de travail, la standardisation des données et les fonctionnalités de conformité réglementaire contribuent à l'efficacité des opérations d'essai. L'adoption du cloud réduit également les coûts d'infrastructure informatique et accélère les délais de déploiement. L'intégration d'analyses avancées et de l'accès mobile au sein des plateformes cloud renforce la supervision opérationnelle. L'encouragement réglementaire croissant des solutions de gestion numérique des essais accélère encore la croissance du marché.

- Par phase d'essai clinique

Le marché des solutions e-cliniques est segmenté en phases I, II, III et IV selon la phase des essais cliniques. En 2024, le segment de la phase III a représenté la plus grande part de chiffre d'affaires, avec 46,7 %, en raison de protocoles d'essai complexes, de larges populations de patients et des exigences réglementaires strictes des études de stade avancé. Les essais de phase III génèrent des données importantes, nécessitant des solutions e-cliniques avancées pour une gestion efficace des données, le suivi des patients et la conformité réglementaire. L'intégration de systèmes de gestion des essais, de plateformes d'analyse et d'outils eCOA améliore la précision opérationnelle. Les promoteurs s'appuient fortement sur les systèmes de phase III pour garantir la réalisation rapide des études et minimiser les retards. L'importance croissante accordée aux essais multicentriques mondiaux renforce la domination de ce segment.

Le segment de la phase II devrait connaître sa plus forte croissance, soit un TCAC de 19,6 % entre 2025 et 2032, soutenu par la multiplication des essais cliniques intermédiaires en oncologie, en thérapies ciblées et en médecine de précision. Les études de phase II nécessitent des conceptions adaptatives, un suivi détaillé des patients et une intégration transparente des données provenant de sources multiples. Les solutions e-cliniques rationalisent ces processus, fournissant des informations en temps réel et améliorant l'efficacité des essais. L'amélioration des outils d'engagement des patients et l'intégration avec les appareils portables accélèrent l'adoption. L'accent mis par les autorités réglementaires sur la sécurité des patients et l'exactitude des données contribue également à cette croissance. La nécessité d'une prise de décision rapide dans les essais cliniques intermédiaires alimente la demande de plateformes e-cliniques sophistiquées.

- Par taille d'organisation

Selon la taille des organisations, le marché des solutions e-cliniques est segmenté entre les petites et moyennes entreprises (PME) et les grandes entreprises. Le segment des grandes entreprises dominait avec une part de marché de 63,4 % en 2024, reflétant leurs importants investissements en R&D, leurs opérations d'essais cliniques à l'échelle mondiale et leur besoin de plateformes entièrement intégrées pour gérer la conformité réglementaire, les études multinationales et les flux de travail complexes. Les grandes entreprises exploitent les solutions e-cliniques pour réduire les erreurs opérationnelles, rationaliser la collecte de données et garantir des processus standardisés pour tous les essais. La surveillance et l'analyse centralisées soutiennent la prise de décision à grande échelle. L'intégration avec les dossiers médicaux électroniques et autres systèmes hospitaliers améliore l'efficacité. L'adoption massive de solutions cloud et hébergées sur le web consolide encore leur domination.

Le segment des PME devrait enregistrer le TCAC le plus rapide, soit 20,2 % entre 2025 et 2032, grâce à l'adoption croissante de solutions cliniques électroniques évolutives, abordables et basées sur le cloud. Les PME bénéficient de flux de travail automatisés, d'un accès à distance et de coûts d'infrastructure réduits, leur permettant de mener des essais efficaces avec des ressources limitées. Le déploiement rapide de plateformes SaaS accélère l'adoption. Ces solutions permettent la conformité réglementaire sans investissements informatiques lourds. La nécessité de concurrencer les grandes entreprises en matière de délais de développement de médicaments stimule également la croissance du marché. L'intégration avec les outils mobiles et d'analyse améliore l'efficacité opérationnelle des petites organisations.

- Par appareil utilisateur

En fonction de l'appareil utilisé, le marché des solutions e-cliniques est segmenté en ordinateurs de bureau, tablettes, assistants numériques personnels (PDA), smartphones et autres. Le segment des ordinateurs de bureau détenait la plus grande part de marché (37,9 %) en 2024, car ils restent l'outil principal des gestionnaires d'essais, des analystes de données et des coordinateurs cliniques pour la saisie de données complexes, l'analyse et la création de rapports réglementaires. Leur puissance de calcul robuste, leurs interfaces à grand écran et leur environnement sécurisé en font des solutions idéales pour la gestion des données d'essais sensibles. Les ordinateurs de bureau permettent également l'intégration avec de multiples plateformes d'essais et systèmes de DMP. La fiabilité et la stabilité sont essentielles pour la gestion d'essais multicentriques à grande échelle.

Le segment des smartphones devrait connaître une croissance annuelle composée (TCAC) record de 23,5 % entre 2025 et 2032, portée par l'adoption de solutions eCOA compatibles avec les appareils mobiles, d'applications d'engagement des patients et d'outils de télésurveillance. Les smartphones fournissent des mises à jour des essais en temps réel, améliorent l'observance des patients et permettent aux cliniciens, aux moniteurs et aux promoteurs d'accéder aux données à tout moment et en tout lieu. L'accessibilité mobile optimise les modèles d'essais décentralisés et hybrides. L'intégration aux plateformes cloud et aux appareils portables permet une collecte continue des données. Le besoin croissant d'une gestion des essais flexible et centrée sur le patient accélère l'adoption des solutions sur smartphone. Les smartphones réduisent également les délais de reporting et de suivi des données, améliorant ainsi l'efficacité opérationnelle.

- Par utilisateur final

En fonction de l'utilisateur final, le marché des solutions e-cliniques est segmenté en entreprises pharmaceutiques et biopharmaceutiques, organisations de recherche sous contrat (CRO), sociétés de conseil, fabricants de dispositifs médicaux, hôpitaux et instituts de recherche universitaires. Le segment des entreprises pharmaceutiques et biopharmaceutiques dominait avec une part de marché de 51,8 % en 2024, grâce à l'adoption de plateformes e-cliniques permettant de gérer des essais complexes multicentriques, de garantir la conformité réglementaire et d'accélérer le développement des médicaments. Les grandes entreprises pharmaceutiques s'appuient sur ces solutions pour une gestion intégrée des essais, un accès aux données en temps réel et des flux de travail standardisés afin de réduire les erreurs et d'améliorer l'efficacité.

Le segment des CRO devrait connaître le TCAC le plus rapide, soit 21,9 % entre 2025 et 2032, grâce à la tendance croissante à l'externalisation des opérations d'essais cliniques et au besoin d'une gestion des essais rentable et efficace. Les CRO utilisent des plateformes e-cliniques pour gérer les essais de plusieurs clients, rationaliser les flux de travail, optimiser les ressources et garantir un reporting précis des études mondiales. L'accès en temps réel aux données, la surveillance centralisée et une meilleure collaboration entre les parties prenantes améliorent l'efficacité des essais. L'adoption croissante d'essais décentralisés et de modèles hybrides accélère la croissance. Ce segment bénéficie également d'innovations technologiques telles que l'analyse basée sur l'IA et les solutions de surveillance mobile.

Analyse régionale du marché des solutions cliniques électroniques

- L'Amérique du Nord a dominé le marché des solutions cliniques électroniques avec la plus grande part de revenus de 49,38 % en 2024, soutenue par une infrastructure de soins de santé robuste, des industries pharmaceutiques et biotechnologiques bien établies et des cadres réglementaires favorables encourageant l'adoption du numérique.

- Cette domination est particulièrement motivée par l’adoption avancée aux États-Unis , alimentée par la mise en œuvre croissante de systèmes de capture de données électroniques, de plateformes de gestion des essais cliniques et de solutions axées sur l’analyse.

- L'accent mis par la région sur la conformité réglementaire, la sécurité des patients et l'efficacité opérationnelle continue de favoriser l'adoption généralisée des plateformes cliniques électroniques dans les hôpitaux, les CRO et les instituts de recherche.

Aperçu du marché américain des solutions cliniques électroniques

Le marché américain des solutions e-cliniques a capté la plus grande part de chiffre d'affaires en Amérique du Nord, grâce à l'adoption massive de solutions numériques pour les essais cliniques, à l'externalisation croissante des opérations d'essais et à des investissements importants dans les infrastructures de recherche clinique. Des technologies avancées telles que les plateformes cloud, les outils d'évaluation électronique des résultats cliniques (eCOA) et les systèmes intégrés de gestion des essais cliniques permettent un recrutement plus rapide des patients, une gestion efficace des données et une transparence accrue des essais. L'intérêt croissant pour les essais décentralisés et hybrides favorise l'adoption de solutions e-cliniques complètes par les entreprises pharmaceutiques et biotechnologiques.

Aperçu du marché européen des solutions cliniques électroniques

Le marché européen des solutions e-cliniques devrait connaître une croissance soutenue tout au long de la période de prévision, principalement portée par l'externalisation croissante des opérations d'essais cliniques, le soutien réglementaire aux technologies de santé numérique et l'adoption de systèmes avancés de gestion des essais. Des pays comme l'Allemagne, la France et le Royaume-Uni connaissent une croissance significative grâce à la solidité de leurs écosystèmes de R&D pharmaceutique, à la complexité croissante des essais et au besoin de solutions intégrées de gestion des essais en temps réel. Les acteurs européens s'appuient sur des plateformes e-cliniques cloud, analytiques et compatibles avec les appareils mobiles pour améliorer l'efficacité opérationnelle et garantir la conformité des études multicentriques.

Aperçu du marché britannique des solutions cliniques électroniques

Le marché britannique des solutions e-cliniques devrait connaître une croissance annuelle moyenne (TCAC) remarquable au cours de la période de prévision, grâce à la solide infrastructure de recherche clinique du pays et à l'adoption croissante des plateformes d'essais numériques. Les promoteurs et les CRO investissent dans des solutions e-cliniques intégrées pour rationaliser le suivi des patients, centraliser la gestion des données d'essais et accélérer le développement des médicaments. De plus, l'essor des modèles d'essais décentralisés et hybrides encourage l'adoption de systèmes cloud et mobiles, favorisant la prise de décision en temps réel et une supervision efficace des essais.

Aperçu du marché allemand des solutions cliniques électroniques

Le marché allemand des solutions e-cliniques devrait connaître une croissance annuelle moyenne (TCAC) considérable au cours de la période de prévision, porté par la croissance des essais cliniques, des normes réglementaires strictes et l'adoption croissante de plateformes numériques avancées. La vigueur des secteurs pharmaceutique et biotechnologique allemand, conjuguée à l'importance accordée à l'innovation et à l'intégrité des données, favorise l'utilisation de solutions e-cliniques complètes, incluant la saisie électronique des données, les systèmes de gestion des essais cliniques et les plateformes d'analyse intégrées. La région connaît une forte croissance des instituts de recherche universitaires, des CRO et des organisations pharmaceutiques.

Aperçu du marché des solutions cliniques électroniques en Asie-Pacifique

Le marché des solutions e-cliniques en Asie-Pacifique devrait connaître une forte croissance de 11,8 % au cours de la période de prévision, porté par l'externalisation croissante des essais cliniques, le développement des infrastructures de santé et de R&D, et l'augmentation de l'activité d'essais cliniques dans des pays comme la Chine, l'Inde, le Japon et la Corée du Sud. La région connaît une demande croissante de systèmes de gestion des essais cliniques basés sur le cloud, de plateformes d'analyse et de solutions e-cliniques compatibles avec les appareils mobiles, afin de soutenir les études décentralisées, d'optimiser le recrutement des patients et d'améliorer la collecte de données. L'augmentation des investissements des entreprises pharmaceutiques et biotechnologiques en Asie-Pacifique favorise l'adoption de technologies e-cliniques avancées.

Aperçu du marché japonais des solutions cliniques électroniques

Le marché japonais des solutions cliniques électroniques prend de l'ampleur grâce à l'infrastructure de santé avancée du pays, à ses normes de recherche clinique de haute qualité et à l'utilisation croissante de solutions d'essais cliniques technologiques. Les promoteurs et les CRO exploitent des plateformes intégrées de gestion des essais, des outils d'eCOA et des systèmes cloud pour améliorer le suivi des patients, optimiser l'efficacité des essais et garantir la conformité réglementaire. L'intérêt croissant pour la médecine de précision et les études cliniques complexes accélère encore la croissance du marché.

Aperçu du marché chinois des solutions cliniques électroniques

Le marché chinois des solutions cliniques électroniques a représenté la plus grande part de chiffre d'affaires en Asie-Pacifique en 2024, grâce à l'expansion des activités d'essais cliniques, à de solides investissements en R&D pharmaceutique et à un soutien réglementaire croissant aux technologies de santé numérique. La Chine connaît une adoption rapide des systèmes de saisie électronique des données, des solutions de gestion des essais cliniques et des plateformes d'analyse en temps réel pour soutenir les essais multicentriques, améliorer le recrutement des patients et rationaliser les opérations d'essai. Les initiatives gouvernementales favorisant la numérisation des soins de santé et des sciences de la vie renforcent encore l'expansion du marché dans la région.

Part de marché des solutions cliniques électroniques

Le secteur des solutions cliniques électroniques est principalement dirigé par des entreprises bien établies, notamment :

- Oracle (États-Unis)

- Signant Health (États-Unis)

- MaxisIT (États-Unis)

- Parexel International Corporation (États-Unis)

- Dassault Systèmes (France)

- Clario (États-Unis)

- Mednet (États-Unis)

- OpenClinica, LLC (États-Unis)

- 4G Clinical (États-Unis)

- Veeva Systems (États-Unis)

- Saama Technologies, LLC (États-Unis)

- Anju (États-Unis)

- Castor (Pays-Bas)

- Medrio, Inc. (États-Unis)

- ArisGlobal (États-Unis)

- Merative (États-Unis)

- Advarra (États-Unis)

- eClinical Solutions, LLC (États-Unis)

- Y-Prime LLC (États-Unis)

- RealTime Software Solutions LLC (États-Unis)

- Quretec (Estonie)

- Responsable de recherche (Pays-Bas)

- Datatrack Int. (Pays-Bas)

- IQVIA Inc. (États-Unis)

Derniers développements sur le marché mondial des solutions cliniques électroniques

- En décembre 2021, Oracle Corporation a annoncé l'acquisition de Cerner Corporation, fournisseur leader de systèmes de dossiers médicaux électroniques (DME), pour environ 28,3 milliards de dollars en numéraire. Cette opération stratégique visait à renforcer la présence d'Oracle dans le secteur de la santé et à accélérer la transformation numérique des milieux cliniques.

- En juillet 2025, eClinicalWorks, fournisseur majeur de DSE ambulatoires en cloud, est devenu un acteur actif de l'écosystème technologique de santé numérique des Centers for Medicare & Medicaid Services (CMS). Cette initiative, annoncée par de hauts responsables de la santé à la Maison-Blanche, vise à promouvoir un partage fluide des données de santé et à établir de nouvelles normes d'interopérabilité sectorielles.

- En août 2023, OceanMD, une plateforme infonuagique offrant des solutions d'engagement des patients et de gestion des flux de travail cliniques, a signé un contrat de 38,5 millions de dollars avec la Régie provinciale des services de santé de la Colombie-Britannique. Cet accord visait à fournir des services numériques tels que les orientations, les consultations et les ordonnances électroniques, améliorant ainsi la prestation des soins de santé dans toute la province.

- En mars 2025, le règlement (UE) 2025/327 de l'Union européenne, établissant l'Espace européen des données de santé, est entré en vigueur. Ce règlement visait à offrir aux citoyens de l'UE un meilleur contrôle de leurs données de santé personnelles et à renforcer l'interopérabilité des dossiers médicaux électroniques entre les États membres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.