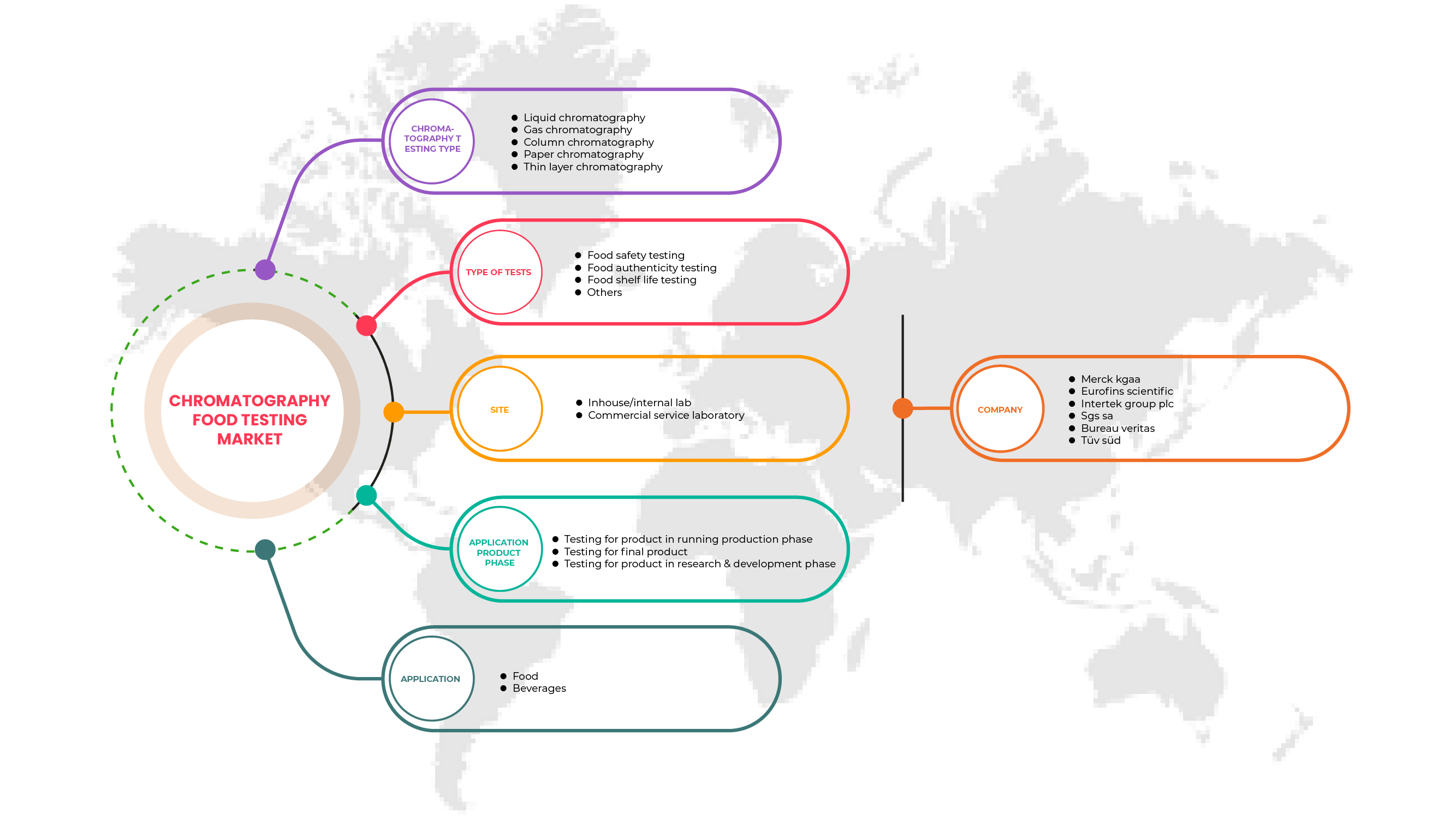

Marché mondial des tests alimentaires par chromatographie, par type de test chromatographique (chromatographie liquide, chromatographie en phase gazeuse, chromatographie sur colonne, chromatographie sur papier et chromatographie sur couche mince), type de tests (tests de sécurité alimentaire, tests d'authenticité des aliments, tests de durée de conservation des aliments et autres), site (laboratoire interne/interne et laboratoire de service commercial), phase du produit d'application (tests pour le produit en phase de production en cours, tests pour le produit final et tests pour le produit en phase de recherche et développement), tendances et prévisions de l'industrie des applications (aliments et boissons) jusqu'en 2029.

Analyse et perspectives du marché des tests alimentaires par chromatographie

Les tests alimentaires par chromatographie peuvent être utilisés à différentes étapes de la chaîne alimentaire, de la détermination de la qualité des aliments à la détection d'additifs, de pesticides, d'agents pathogènes et d'autres contaminants nocifs pouvant affecter la santé humaine. L'augmentation des pandémies telles que la COVID-19 dans les régions a stimulé la croissance des tests alimentaires, y compris les tests alimentaires par chromatographie.

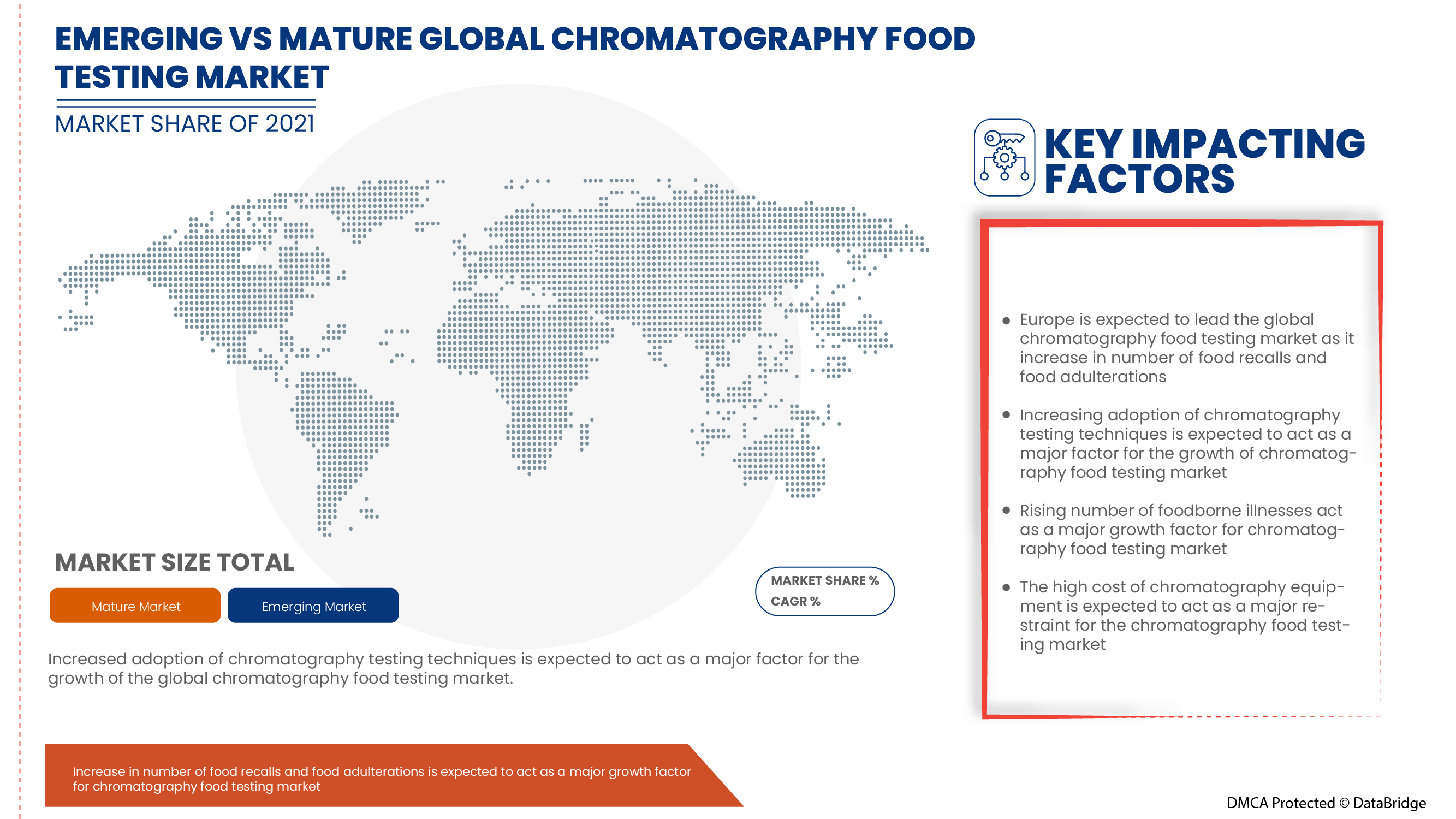

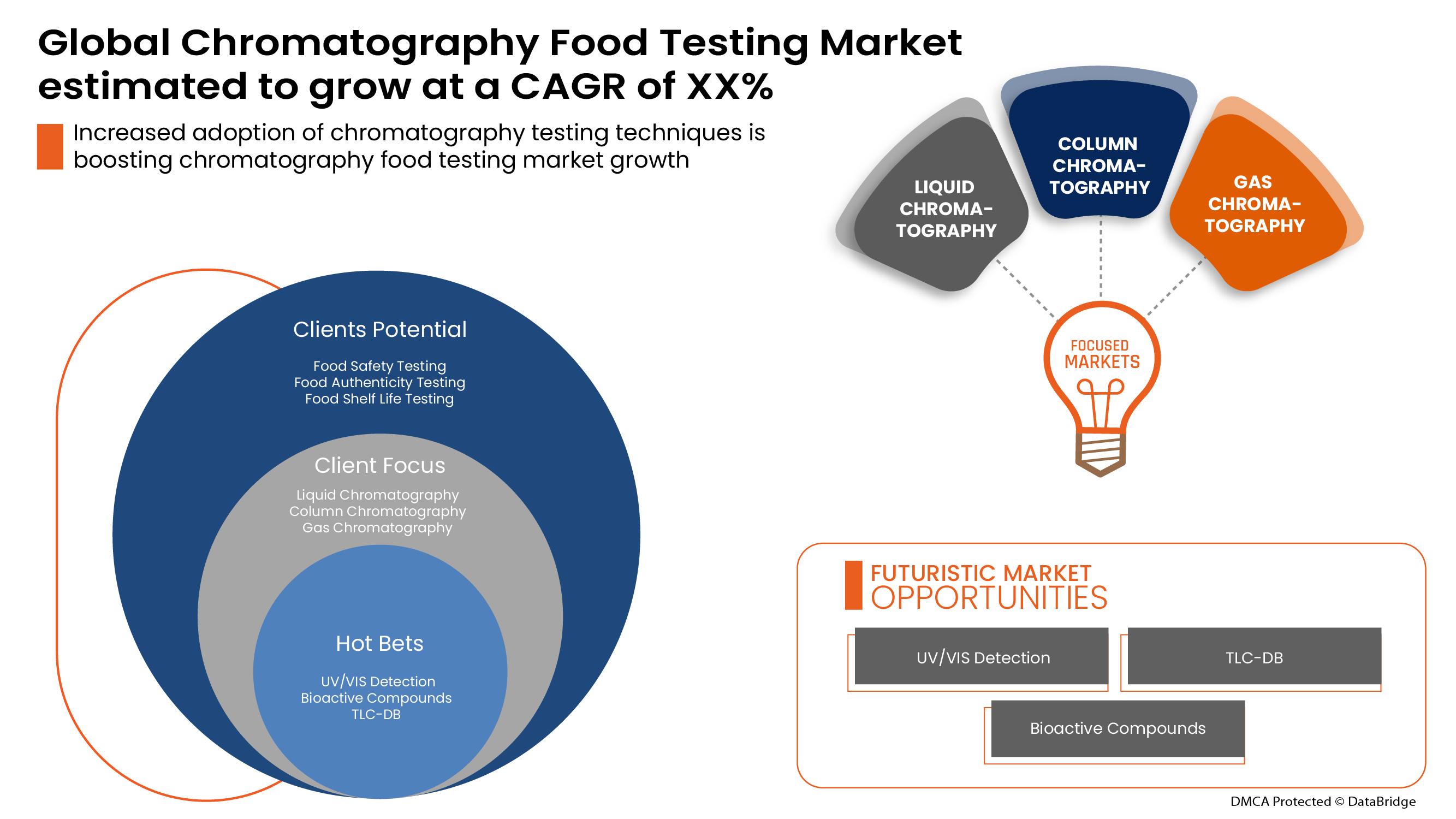

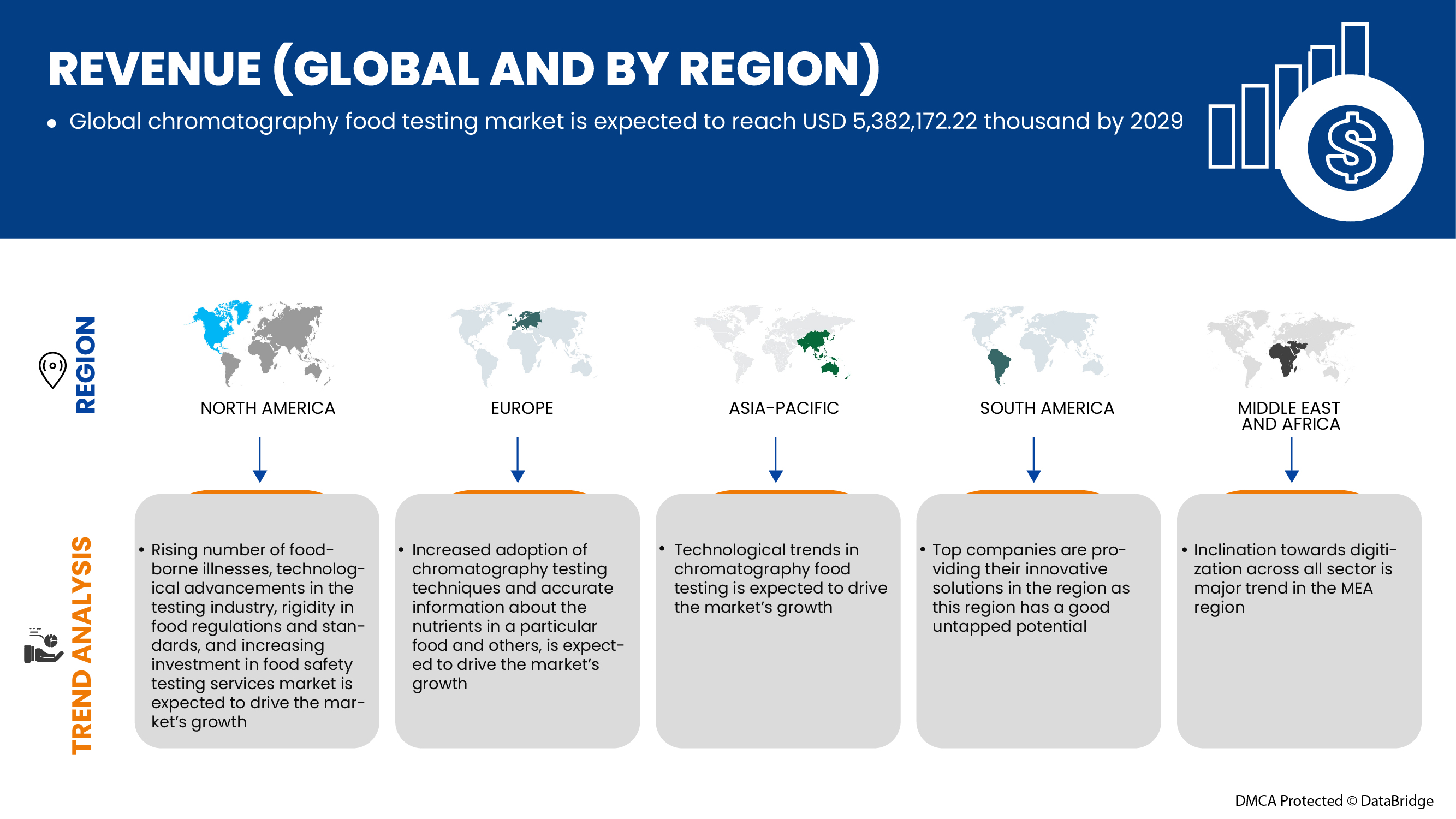

Le nombre croissant de maladies d'origine alimentaire, les progrès technologiques dans le secteur des tests, la rigidité de la réglementation et des normes alimentaires et l'augmentation des investissements dans les services de test de sécurité alimentaire sont quelques-uns des facteurs qui stimulent le marché. Cependant, le coût élevé des équipements de chromatographie et la présence de technologies alternatives de test des aliments peuvent entraver la croissance du marché. Data Bridge Market Research analyse que le marché mondial des tests alimentaires par chromatographie devrait croître à un TCAC de 6,3 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en unités, prix en dollars américains |

|

Segments couverts |

Par type de test chromatographique (chromatographie liquide, chromatographie gazeuse, chromatographie sur colonne, chromatographie sur papier et chromatographie sur couche mince), type de test ( test de sécurité alimentaire , test d'authenticité alimentaire, test de durée de conservation alimentaire et autres), site (laboratoire interne et laboratoire de service commercial), phase du produit d'application (test du produit en phase de production en cours, test du produit final et test du produit en phase de recherche et développement), application (aliments et boissons) |

|

Pays couverts |

Chine, Japon, Australie, Inde, Corée du Sud, Malaisie, Singapour, Vietnam, Indonésie, Thaïlande, Philippines, Nouvelle-Zélande, Reste de l'Asie-Pacifique, États-Unis, Canada, Mexique, France, Allemagne, Italie, Royaume-Uni, Espagne, Pays-Bas, Pologne, Suisse, Russie, Belgique, Danemark, Suède, Turquie, Reste de l'Europe, Brésil, Argentine et Reste de l'Amérique du Sud, Afrique du Sud, Arabie saoudite, Émirats arabes unis, Oman, Qatar, Koweït, Reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS, Intertek Group plc, Symbio Laboratories, BVAQ, QIMA, Pacific Lab, Merck KGaA, Cotecna, Mérieux NutriSciences, Food Safety Net Services, AsureQuality, ADPEN Laboratories, Inc., Element Materials Technology, Spectro Analytical Labs, NSF, RJ Hill Laboratories Limited, ifp Institut für Produktqualität GmbH, Neogen Corporation, Waters Corporation, Thermo Fisher Scientific Inc. et Shimadzu Corporation, entre autres |

Définition du marché

Les maladies d'origine alimentaire sont causées par la consommation d'aliments avariés ou contaminés par des additifs, des pesticides, des bactéries pathogènes, des virus, des parasites et autres, entraînant une infection. Les maladies d'origine alimentaire peuvent se propager par divers facteurs tels qu'une mauvaise manipulation des aliments, un manque de sensibilisation et bien d'autres. Ces facteurs pathogènes doivent être testés avant la consommation des aliments. La chromatographie peut être utilisée à différentes étapes de la chaîne alimentaire, de la détermination de la qualité des aliments à la détection des additifs, des pesticides et d'autres contaminants nocifs.

Dynamique du marché mondial des tests alimentaires par chromatographie

Conducteurs

- Augmentation du nombre de maladies d'origine alimentaire

Les maladies d’origine alimentaire sont causées par la consommation d’aliments ou de boissons contaminés. Il existe plus de 250 maladies d’origine alimentaire connues. La majorité des infections sont causées par des bactéries, des virus et des parasites, et certaines sont causées par des produits chimiques et des toxines. Escherichia coli est la principale espèce de bactéries qui vit dans les intestins humains.

- Adoption croissante des techniques de test chromatographiques

La chromatographie est une technique biophysique importante qui permet de séparer, d'identifier et de purifier les composants d'un mélange pour des analyses qualitatives et quantitatives. Aujourd'hui, la chromatographie permet à l'industrie alimentaire de fournir des informations précises sur les nutriments contenus dans des aliments particuliers et bien plus encore.

- Une augmentation du nombre de rappels d’aliments et de falsifications alimentaires

Un rappel alimentaire est une mesure prise pour retirer de la vente, de la distribution et de la consommation un aliment particulier qui peut présenter un risque pour la sécurité des consommateurs. Un rappel alimentaire peut être lancé à la suite d'un rapport ou d'une plainte provenant de diverses sources, telles que les fabricants, les grossistes, les détaillants, les organismes gouvernementaux et les consommateurs.

Opportunités

-

Progrès technologiques dans le secteur des tests

Les tendances technologiques dans les tests alimentaires par chromatographie qui stimulent la croissance du marché ces derniers temps sont l'intelligence artificielle (IA), la numérisation, les technologies de connectivité et les technologies automatisées intelligentes alimentées par les données et l'apprentissage automatique. Avant la pandémie, l'intérêt pour les avantages des technologies intelligentes et automatisées était élevé.

Contraintes/Défis

- Coût élevé associé aux tests de chromatographie et présence de technologies alternatives de test des aliments

Cependant, il existe actuellement différents types de tests chromatographiques, tels que la chromatographie sur papier, la chromatographie sur couche mince, la chromatographie gazeuse, la chromatographie sur membrane et la chromatographie colorant-ligand. Ces tests chromatographiques sont largement utilisés dans les industries alimentaire, biopharmaceutique, nutraceutique et de biotransformation, entre autres. Les tests chromatographiques sont utilisés dans diverses industries pour obtenir des résultats précis après les tests, mais les tests chromatographiques sont coûteux et prennent beaucoup de temps. L'autre facteur qui peut entraver les tests chromatographiques utilisés dans l'industrie alimentaire est le coût qui y est associé.

Impact du COVID-19 sur le marché mondial des tests alimentaires par chromatographie

La COVID-19 a eu un effet positif sur le marché, car les services de test alimentaire ont connu un essor considérable. Les systèmes et services de test alimentaire par chromatographie étant très demandés par les consommateurs en raison de la COVID-19, la nécessité de détecter la contamination et les agents pathogènes était une obligation pour l'industrie alimentaire. Cela a stimulé la croissance de divers types de services de test alimentaire, notamment les tests alimentaires par chromatographie.

Développement récent

- En juin 2022, PerkinElmer, Inc. a lancé une solution de plateforme de chromatographie en phase gazeuse automatisée de nouvelle génération. Les principales caractéristiques de cette solution étaient sa chromatographie en phase gazeuse (GC) automatisée, son échantillonneur d'espace de tête et sa solution GC/spectrométrie de masse (GC/MS)

Portée du marché mondial des tests alimentaires par chromatographie

Le marché des tests de chromatographie alimentaire est segmenté en fonction du type de test de chromatographie, du type de tests, du site, de la phase du produit d'application et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de test chromatographique

- Chromatographie liquide

- Chromatographie en phase gazeuse

- Chromatographie sur colonne

- Chromatographie sur papier

- Chromatographie sur couche mince

Sur la base du type de test de chromatographie, le marché des tests alimentaires par chromatographie est segmenté en chromatographie liquide, chromatographie en phase gazeuse, chromatographie sur colonne, chromatographie sur papier et chromatographie sur couche mince.

Type de tests

- Tests de sécurité alimentaire

- Test d'authenticité des aliments

- Test de durée de conservation des aliments

- Autres

Sur la base du type de tests, le marché des tests alimentaires par chromatographie est segmenté en tests de sécurité alimentaire, tests d'authenticité alimentaire, tests de durée de conservation des aliments et autres.

Site

- Laboratoire interne

- Laboratoire de services commerciaux

Sur la base du site, le marché des tests alimentaires par chromatographie est segmenté en laboratoire interne/interne et en laboratoire de services commerciaux.

Phase de produit d'application

- Tests pour produits en phase de production

- Test pour le produit final

- Tests de produits en phase de recherche et développement

Sur la base de la phase du produit d'application, le marché des tests alimentaires par chromatographie est segmenté en tests pour les produits en phase de production en cours, tests pour le produit final et tests pour les produits en phase de recherche et développement.

Application

- Nourriture

- Boissons

Sur la base de l’application, le marché des tests alimentaires par chromatographie est segmenté en aliments et boissons.

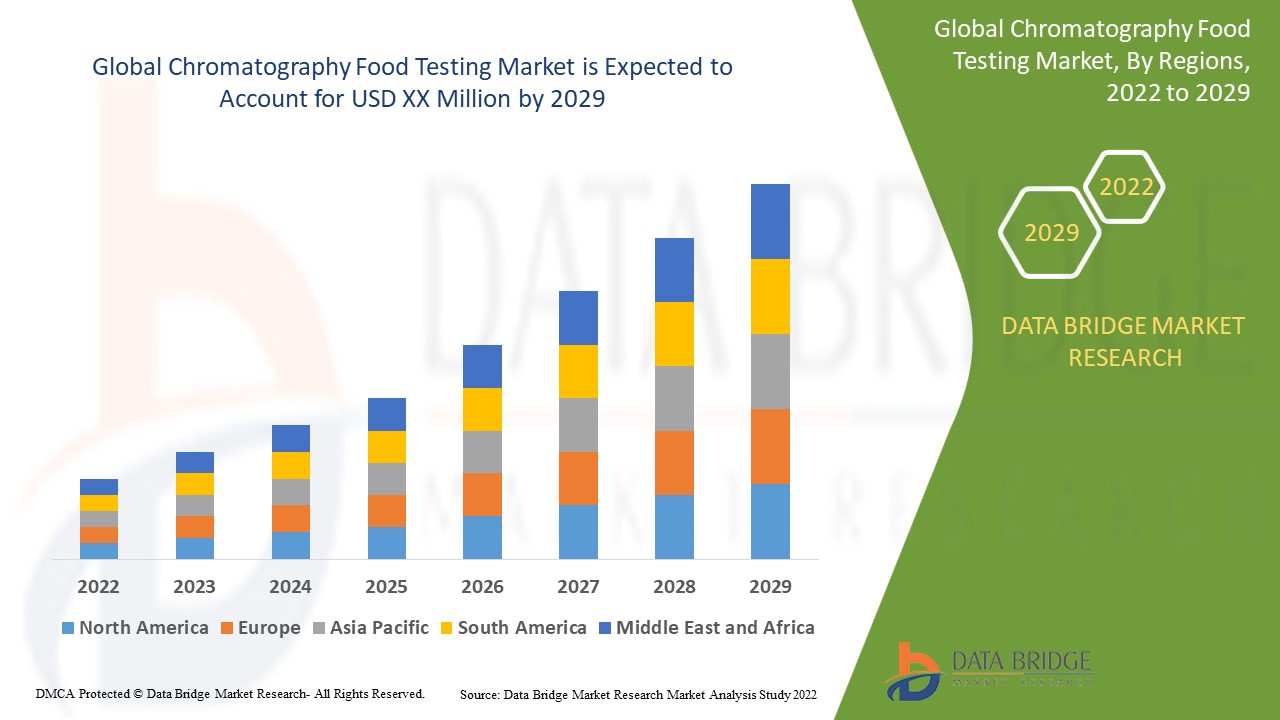

Analyse/perspectives régionales du marché mondial des tests alimentaires par chromatographie

Le marché mondial des tests alimentaires par chromatographie est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de test de chromatographie, type de tests, site, phase du produit d'application et application, comme référencé ci-dessus.

En 2022, l’Europe devrait dominer le marché mondial des tests alimentaires par chromatographie en raison de la plus grande production alimentaire et des normes de qualité alimentaire élevées.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché mondiales des tests alimentaires par chromatographie

Le paysage concurrentiel du marché des tests alimentaires par chromatographie fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des tests alimentaires par chromatographie.

Français Certains des principaux acteurs opérant sur le marché mondial des tests alimentaires par chromatographie sont SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS, Intertek Group plc, Symbio Laboratories, BVAQ, QIMA, Pacific Lab, Merck KGaA, Cotecna, Mérieux NutriSciences, Food Safety Net Services, AsureQuality, ADPEN Laboratories, Inc., Element Materials Technology, Spectro Analytical Labs, NSF, RJ Hill Laboratories Limited, ifp Institut für Produktqualität GmbH, Neogen Corporation, Waters Corporation, Thermo Fisher Scientific Inc. et Shimadzu Corporation, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 LIQUID CHROMATOGRAPHY TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.2 GROWING FOOD ADULTERATION CASES

4.3 INDUSTRY TRENDS & FUTURE PERSPECTIVE

4.4 SUPPLY CHAIN ANALYSIS

4.5 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF CHROMATOGRAPHY FOOD TESTING TECHNOLOGIES

4.6 OVERVIEW OF TECHNOLOGICAL ADVANCEMENT IN THE FIELD

4.7 TECHNOLOGICAL TRENDS IN CHROMATOGRAPHY FOOD TESTING

4.8 EMERGING TREND ANALYSIS

4.8.1 ETHYLENE OXIDE AND 2-CHLOROETHANOL ANALYSIS

4.8.2 NEW TECHNOLOGIES WITH HIGH ACCURACY AND PRECISION

5 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, REGULATORY FRAMEWORK AND GUIDELINES

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOOD SAFETY & STANDARDS PACKAGING & LABELLING REGULATIONS 2011

5.3 ANALYSIS OF LAWSUITS RELATED TO CHROMATOGRAPHY FOOD TESTING

5.4 FOODBORNE ILLNESS OUTBREAKS AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.5 RECENTLY FORMED LAWS FOR CHROMATOGRAPHY FOOD TESTING BY GOVERNMENT BODIES CHANGES IN GLOBAL FOOD SAFETY REGULATIONS

5.6 CHANGES IN GLOBAL FOOD SAFETY REGULATIONS

5.7 FOOD PRODUCTS RECALLS

5.8 FOOD PRODUCTS WITHDRAWALS

6 REGIONAL SUMMARY

6.1 SUMMARY WRITE-UP (NORTH AMERICA)

6.1.1 OVERVIEW

6.2 SUMMARY WRITE-UP (EUROPE)

6.2.1 OVERVIEW

6.3 SUMMARY WRITE-UP (ASIA-PACIFIC)

6.3.1 OVERVIEW

6.4 SUMMARY WRITE-UP (SOUTH AMERICA)

6.4.1 OVERVIEW

6.5 SUMMARY WRITE-UP (MIDDLE EAST AND AFRICA)

6.5.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN NUMBER OF FOODBORNE ILLNESSES

7.1.2 AN INCREASE IN THE AMOUNT OF FOOD RECALLS AND FOOD ADULTERATIONS

7.1.3 INCREASING ADOPTION OF CHROMATOGRAPHY TESTING TECHNIQUES

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH CHROMATOGRAPHY TESTING

7.2.2 PRESENCE OF ALTERNATIVE FOOD TESTING TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 TECHNOLOGICAL ADVANCEMENTS IN THE TESTING INDUSTRY

7.3.2 GROWING APPLICATIONS OF CHROMATOGRAPHY IN VARIOUS FIELDS

7.3.3 INCREASING NUMBER OF FOOD SAFETY TESTING SERVICE PROVIDERS

7.3.4 RIGIDITY IN FOOD REGULATION AND STANDARDS

7.3.5 INCREASING ACQUISITIONS AND PARTNERSHIPS AMONG MARKET PLAYERS

7.4 CHALLENGES

7.4.1 LACK OF HARMONIZATION IN FOOD SAFETY STANDARDS

7.4.2 LACK OF INFRASTRUCTURE AND SKILLED PROFESSIONALS

8 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE

8.1 OVERVIEW

8.2 LIQUID CHROMATOGRAPHY

8.3 GAS CHROMATOGRAPHY

8.4 COLUMN CHROMATOGRAPHY

8.5 PAPER CHROMATOGRAPHY

8.6 THIN LAYER CHROMATOGRAPHY

9 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE OF TESTS

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 MILK

9.2.1.2 EGG

9.2.1.3 SEAFOOD

9.2.1.4 PEANUT & SOY

9.2.1.5 GLUTEN

9.2.1.6 TREE NUTS

9.2.1.7 OTHERS

9.2.2 PATHOGENS TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 LISTERIA

9.2.2.5 CAMPYLOBACTER

9.2.2.6 VIBRIO SPP

9.2.2.7 OTHERS

9.2.3 HEAVY METALS TESTING

9.2.3.1 LEAD

9.2.3.2 ARSENIC

9.2.3.3 CADMIUM

9.2.3.4 MERCURY

9.2.3.5 OTHERS

9.2.4 NUTRITIONAL LABELLING

9.2.5 GMO TESTING

9.2.5.1 STACKED

9.2.5.2 HERBICIDE TOLERANCE

9.2.5.3 INSECT RESISTANCE

9.2.6 ORGANIC CONTAMINANTS TESTING

9.2.7 MYCOTOXINS TESTING

9.2.7.1 AFLATOXINS

9.2.7.2 OCHRATOXINS

9.2.7.3 PATULIN

9.2.7.4 FUMONISINS

9.2.7.5 TRICHOTHECENES

9.2.7.6 DEOXYNIVALENOL

9.2.7.7 ZEARALENONE

9.2.8 PESTICIDES TESTING

9.2.8.1 INSECTICIDES

9.2.8.2 HERBICIDES

9.2.8.3 FUNGICIDES

9.2.8.4 OTHERS

9.3 FOOD AUTHENTICITY TESTING

9.3.1 ADULTERATION TESTS

9.3.2 ORGANIC

9.3.3 ALLERGEN TESTING

9.3.4 MEAT SPECIATION

9.3.5 GMO TESTING

9.3.6 HALAL VERIFICATION

9.3.7 KOSHER VERIFICATION

9.3.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.3.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.3.10 FALSE LABELLING

9.4 FOOD SHELF LIFE TESTING

9.4.1 ORGANOLEPTIC AND APPEARANCE

9.4.1.1 COLOR

9.4.1.2 TEXTURE

9.4.1.3 PACKAGING

9.4.1.4 AROMA

9.4.1.5 TASTE

9.4.1.6 SEPARATION

9.4.1.7 STRATIFICATION

9.4.2 RANCIDITY

9.4.2.1 PEROXIDE VALUE (PV)

9.4.2.2 P-ANISIDINE (P-AV)

9.4.2.3 FREE FATTY ACIDS (FFA)

9.4.3 INGREDIENT ACTIVITY

9.4.4 NUTRIENT STABILITY

9.4.5 CHEMICAL TESTS

9.4.6 ACIDITY LEVELS

9.4.7 BROWNING

9.4.7.1 ENZYMATIC BROWNING

9.4.7.2 CHEMICAL BROWNING

9.4.8 REAL-TIME SHELF TESTING

9.4.9 ACCELERATED SHELF-LIFE TESTING

9.4.10 ACCELERATED (40C/75%RH)

9.4.11 INTERMEDIATE (30C/65%RH)

9.4.12 AMBIENT (25C/60%RH)

9.4.13 TROPICAL (30C/75%RH)

9.4.14 REFRIGERATED (2C TO 8C)

9.4.15 FROZEN (-15C TO -20C)

9.4.16 OTHERS

9.5 OTHERS

10 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET , BY SITE

10.1 OVERVIEW

10.2 INHOUSE/INTERNAL LAB

10.3 COMMERCIAL SERVICE LABORATORY

11 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION PRODUCT PHASE

11.1 OVERVIEW

11.2 TESTING FOR PRODUCT IN RUNNING PRODUCTION PHASE

11.3 TESTING FOR FINAL PRODUCT

11.4 TESTING FOR PRODUCT IN RESEARCH & DEVELOPMENT PHASE

12 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 PROCESSED FOOD

12.2.1.1 PROCESSED FOOD, BY TYPE

12.2.1.1.1 CANNED FRUITS & VEGETABLES

12.2.1.1.2 JAMS, PRESERVES & MARMALADES

12.2.1.1.3 FRUIT & VEGETABLE PUREE

12.2.1.1.4 SAUCES, DRESSINGS & CONDIMENTS

12.2.1.1.5 READY MEALS

12.2.1.1.6 SOUPS

12.2.1.1.7 PICKLES

12.2.1.1.8 OTHERS

12.2.1.2 PROCESSED FOOD, BY CHROMATOGRAPHY TESTING TYPE

12.2.1.2.1 LIQUID CHROMATOGRAPHY

12.2.1.2.2 GAS CHROMATOGRAPHY

12.2.1.2.3 COLUMN CHROMATOGRAPHY

12.2.1.2.4 THIN LAYER CHROMATOGRAPHY

12.2.1.2.5 PAPER CHROMATOGRAPHY

12.2.2 DAIRY PRODUCTS

12.2.2.1 DAIRY PRODUCTS, BY TYPE

12.2.2.1.1 ICE CREAM

12.2.2.1.2 CHEESE

12.2.2.1.3 MILK DESSERT

12.2.2.1.3.1 MILK DESSERT, BY TYPE

12.2.2.1.3.2 PUDDING

12.2.2.1.3.3 CUSTARD

12.2.2.1.3.4 OTHERS

12.2.2.1.4 YOGURT

12.2.2.1.5 CHEESE BASED DESERTS

12.2.2.1.5.1 CHEESE BASED DESERTS, BY TYPE

12.2.2.1.5.2 CHEESE CAKE

12.2.2.1.5.3 CHEESE PUDDING

12.2.2.1.5.4 CHEESE CAKE

12.2.2.1.5.5 OTHERS

12.2.2.1.6 OTHERS

12.2.2.2 DAIRY PRODUCTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.2.2.1 LIQUID CHROMATOGRAPHY

12.2.2.2.2 GAS CHROMATOGRAPHY

12.2.2.2.3 COLUMN CHROMATOGRAPHY

12.2.2.2.4 THIN LAYER CHROMATOGRAPHY

12.2.2.2.5 PAPER CHROMATOGRAPHY

12.2.3 MEAT & POULTRY PRODUCTS

12.2.3.1 MEAT & POULTRY PRODUCTS, BY TYPE

12.2.3.1.1 CHICKEN & EGGS

12.2.3.1.2 SEAFOOD

12.2.3.1.3 BEEF

12.2.3.1.4 LAMB & GOAT

12.2.3.1.5 PORK

12.2.3.1.6 OTHERS

12.2.3.2 MEAT & POULTRY PRODUCTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.3.2.1 LIQUID CHROMATOGRAPHY

12.2.3.2.2 GAS CHROMATOGRAPHY

12.2.3.2.3 COLUMN CHROMATOGRAPHY

12.2.3.2.4 THIN LAYER CHROMATOGRAPHY

12.2.3.2.5 PAPER CHROMATOGRAPHY

12.2.4 VEGETABLES

12.2.4.1 VEGETABLES, BY TYPE

12.2.4.1.1 LEAFY GREENS

12.2.4.1.2 CRUCIFEROUS VEGETABLES

12.2.4.1.3 MARROW VEGETABLES

12.2.4.1.4 ROOT VEGETABLES

12.2.4.1.5 ONION

12.2.4.1.6 GARLIC

12.2.4.1.7 OTHERS

12.2.4.2 VEGETABLES, BY CHROMATOGRAPHY TESTING TYPE

12.2.4.2.1 LIQUID CHROMATOGRAPHY

12.2.4.2.2 GAS CHROMATOGRAPHY

12.2.4.2.3 COLUMN CHROMATOGRAPHY

12.2.4.2.4 THIN LAYER CHROMATOGRAPHY

12.2.4.2.5 PAPER CHROMATOGRAPHY

12.2.5 FRUITS

12.2.5.1 FRUITS, BY TYPE

12.2.5.1.1 APPLE & PEARS

12.2.5.1.2 CITRUS FRUITS

12.2.5.1.3 TROPICAL FRUITS

12.2.5.1.4 BERRIES

12.2.5.1.5 MELONS

12.2.5.1.6 OTHERS

12.2.5.2 FRUITS, BY CHROMATOGRAPHY TESTING TYPE

12.2.5.2.1 LIQUID CHROMATOGRAPHY

12.2.5.2.2 GAS CHROMATOGRAPHY

12.2.5.2.3 COLUMN CHROMATOGRAPHY

12.2.5.2.4 THIN LAYER CHROMATOGRAPHY

12.2.5.2.5 PAPER CHROMATOGRAPHY

12.2.6 CEREALS & GRAINS

12.2.6.1 CEREALS & GRAINS, BY TYPE

12.2.6.1.1 RICE

12.2.6.1.2 WHEAT

12.2.6.1.3 BARLEY

12.2.6.1.4 MAIZE

12.2.6.1.5 OAT

12.2.6.1.6 SORGHUM

12.2.6.1.7 OTHERS

12.2.6.2 CEREALS & GRAINS, BY CHROMATOGRAPHY TESTING TYPE

12.2.6.2.1 LIQUID CHROMATOGRAPHY

12.2.6.2.2 GAS CHROMATOGRAPHY

12.2.6.2.3 COLUMN CHROMATOGRAPHY

12.2.6.2.4 THIN LAYER CHROMATOGRAPHY

12.2.6.2.5 PAPER CHROMATOGRAPHY

12.2.7 EDIBLE OILS

12.2.7.1 EDIBLE OILS, BY TYPE

12.2.7.1.1 SOYBEAN OIL

12.2.7.1.2 SUNFLOWER OIL

12.2.7.1.3 GROUNDNUT OIL

12.2.7.1.4 COCONUT OIL

12.2.7.1.5 OLIVE OIL

12.2.7.1.6 OTHERS

12.2.7.2 EDIBLE OILS, BY CHROMATOGRAPHY TESTING TYPE

12.2.7.2.1 LIQUID CHROMATOGRAPHY

12.2.7.2.2 GAS CHROMATOGRAPHY

12.2.7.2.3 COLUMN CHROMATOGRAPHY

12.2.7.2.4 THIN LAYER CHROMATOGRAPHY

12.2.7.2.5 PAPER CHROMATOGRAPHY

12.2.8 OILSEEDS & PULSES

12.2.8.1 OILSEEDS & PULSES, BY TYPE

12.2.8.1.1 GRAM

12.2.8.1.2 PEA

12.2.8.1.3 SUNFLOWERS

12.2.8.1.4 LENTILS

12.2.8.1.5 SOYBEANS

12.2.8.1.6 GROUNDNUT

12.2.8.1.7 SESAME

12.2.8.1.8 PALM

12.2.8.1.9 COTTON SEED

12.2.8.1.10 OTHERS

12.2.8.2 OILSEEDS & PULSES, BY CHROMATOGRAPHY TESTING TYPE

12.2.8.2.1 LIQUID CHROMATOGRAPHY

12.2.8.2.2 GAS CHROMATOGRAPHY

12.2.8.2.3 COLUMN CHROMATOGRAPHY

12.2.8.2.4 THIN LAYER CHROMATOGRAPHY

12.2.8.2.5 PAPER CHROMATOGRAPHY

12.2.9 CONFECTIONERY

12.2.9.1 CONFECTIONERY, BY TYPE

12.2.9.1.1 CHOCOLATES

12.2.9.1.2 CANDY BARS

12.2.9.1.3 JELLIES

12.2.9.1.4 MERINGUES

12.2.9.1.5 MARMALADES

12.2.9.1.6 OTHERS

12.2.9.2 CONFECTIONERY, BY CHROMATOGRAPHY TESTING TYPE

12.2.9.2.1 LIQUID CHROMATOGRAPHY

12.2.9.2.2 GAS CHROMATOGRAPHY

12.2.9.2.3 COLUMN CHROMATOGRAPHY

12.2.9.2.4 THIN LAYER CHROMATOGRAPHY

12.2.9.2.5 PAPER CHROMATOGRAPHY

12.2.10 SPICES

12.2.11 NUTS

12.2.11.1 NUTS, BY TYPE

12.2.11.1.1 ALMOND

12.2.11.1.2 WALNUT

12.2.11.1.3 CASHEWNUT

12.2.11.1.4 BRAZIL NUT

12.2.11.1.5 MACADAMIA NUTS

12.2.11.1.6 OTHERS

12.2.11.2 NUTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.11.2.1 LIQUID CHROMATOGRAPHY

12.2.11.2.2 GAS CHROMATOGRAPHY

12.2.11.2.3 COLUMN CHROMATOGRAPHY

12.2.11.2.4 THIN LAYER CHROMATOGRAPHY

12.2.11.2.5 PAPER CHROMATOGRAPHY

12.2.12 HERBAL EXTRACTS AND HERBS

12.2.13 HONEY

12.2.14 BABY FOOD

12.2.15 PLANT-BASED MEAT AND MEAT ALTERNATIVES

12.2.15.1 PLANT-BASED MEAT AND MEAT ALTERNATIVES, BY TYPE

12.2.15.1.1 TOFU

12.2.15.1.2 BURGER AND PATTIES

12.2.15.1.3 SAUSAGES

12.2.15.1.4 SEITEN

12.2.15.1.5 STRIPS AND NUGGETS

12.2.15.1.6 MEATBALLS

12.2.15.1.7 TEMPEH

12.2.15.1.8 OTHERS

12.2.15.2 PLANT-BASED MEAT AND MEAT ALTERNATIVES, BY CHROMATOGRAPHY TESTING TYPE

12.2.15.2.1 LIQUID CHROMATOGRAPHY

12.2.15.2.2 GAS CHROMATOGRAPHY

12.2.15.2.3 COLUMN CHROMATOGRAPHY

12.2.15.2.4 THIN LAYER CHROMATOGRAPHY

12.2.15.2.5 PAPER CHROMATOGRAPHY

12.2.16 OTHERS

12.3 BEVERAGES

12.3.1 BEVERAGES, BY TYPE

12.3.1.1 NON-ALCOHOLIC

12.3.1.1.1 CARBONATED DRINKS

12.3.1.1.2 JUICES

12.3.1.1.3 SPORT DRINKS

12.3.1.1.4 COFFEE

12.3.1.1.5 NUTRITIONAL DRINKS

12.3.1.1.6 PLANT-BASED MILK

12.3.1.1.6.1 SOY MILK

12.3.1.1.6.2 ALMOND MILK

12.3.1.1.6.3 OAT MILK

12.3.1.1.6.4 CASHEW MILK

12.3.1.1.6.5 RICE

12.3.1.1.6.6 OTHERS

12.3.1.1.7 SMOOTHIES

12.3.1.1.8 TEA

12.3.1.1.9 MINERAL WATER

12.3.1.1.10 OTHERS

12.3.1.2 ALCOHOLIC

12.3.1.2.1 BEER

12.3.1.2.2 WINE

12.3.1.2.3 VODKA

12.3.1.2.4 WHISKEY

12.3.1.2.5 BRANDY

12.3.1.2.6 GIN

12.3.1.2.7 TEQUILA

12.3.1.2.8 OTHERS

12.3.2 BEVERAGES, BY CHROMATOGRAPHY TESTING TYPE

12.3.2.1 LIQUID CHROMATOGRAPHY

12.3.2.2 GAS CHROMATOGRAPHY

12.3.2.3 COLUMN CHROMATOGRAPHY

12.3.2.4 THIN LAYER CHROMATOGRAPHY

12.3.2.5 PAPER CHROMATOGRAPHY

13 GLOBAL CHROMATOGRAPHY FOOD TESTINGMARKET, BY GEOGRAPHY

13.1 OVERVIEW

13.2 EUROPE

13.2.1 FRANCE

13.2.2 GERMANY

13.2.3 ITALY

13.2.4 U.K.

13.2.5 SPAIN

13.2.6 NETHERLANDS

13.2.7 POLAND

13.2.8 SWITZERLAND

13.2.9 RUSSIA

13.2.10 BELGIUM

13.2.11 DENMARK

13.2.12 SWEDEN

13.2.13 TURKEY

13.2.14 REST OF EUROPE

13.3 NORTH AMERICA

13.3.1 U.S.

13.3.2 CANADA

13.3.3 MEXICO

13.4 ASIA-PACIFIC

13.4.1 CHINA

13.4.2 JAPAN

13.4.3 AUSTRALIA

13.4.4 INDIA

13.4.5 SOUTH KOREA

13.4.6 MALAYSIA

13.4.7 SINGAPORE

13.4.8 VIETNAM

13.4.9 INDONESIA

13.4.10 THAILAND

13.4.11 PHILIPPINES

13.4.12 NEW ZEALAND

13.4.13 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 SAUDI ARABIA

13.6.3 U.A.E

13.6.4 OMAN

13.6.5 QATAR

13.6.6 KUWAIT

13.6.7 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL CHROMATOGRAPHY FOOD TETING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: EUROPE

14.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MERCK KGAA

16.1.1 COMPANY SNAPSHOT

16.1.2 RECENT FINANCIAL

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 EUROFINS SCIENTIFIC

16.2.1 COMPANY SNAPSHOT

16.2.2 RECENT FINANCIAL

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 INTERTEK GROUP PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 RECENT FINANCIAL

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 INDUSTRIES AND SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SGS SA

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 BUREAU VERITAS

16.5.1 COMPANY PROFILE

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICES PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADPEN LABORATORIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ALS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICE PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ASUREQUALITY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BVAQ

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 COTECNA

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICES PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELEMENT MATERIALS TECHNOLOGY (FORMERLY AVOMEEN)

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FOOD SAFETY NET SERVICES

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 SOLUTION PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MÉRIEUX NUTRISCIENCES CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NEOGEN CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 NSF.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PACIFIC LABS

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICES PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 QIMA

16.18.1 COMPANY SNAPSHOT

16.18.2 SOLUTION PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 R J HILL LABORATORIES LIMITED

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHIMADZU CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 SPECTRO ANALYTICAL LABS PVT. LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SYMBIO LABORATORIES

16.22.1 COMPANY SNAPSHOT

16.22.2 SOLUTION PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 THERMO FISHER SCIENTIFIC INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 TÜV SÜD

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 WATERS CORPORATION

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPARATIVE ANALYSIS

TABLE 2 FREQUENCY OF SIGNS AND SYMPTOMS AMONG CASES OF FOODBORNE ILLNESS.

TABLE 3 CHOLERA ATTACK RATE BY AGE GROUP, MANKHOWKWE CAMP, MALAWI, MARCH–MAY 1988, SHOWS THE HIGHEST DISEASE RATES AMONG PERSONS AGED 15 YEARS AND ABOVE.

TABLE 4 THE PRICE IS ASSOCIATED WITH THE SPACE PARTS OF HPLC AND GC INSTRUMENTS

TABLE 5 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 GLOBAL LIQUID CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 GLOBAL GAS CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 GLOBAL COLUMN CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 GLOBAL PAPER CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 GLOBAL THIN LAYER CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD THOUSAND)

TABLE 12 GLOBAL FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 GLOBAL FOOD SAFETY TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 GLOBAL ALLERGEN TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 GLOBAL PATHOGENS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 GLOBAL HEAVY METALS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 GLOBAL GMO TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 GLOBAL MYCOTOXINS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 GLOBAL PESTICIDES TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 GLOBAL COMMUNICATIONS SATELLITES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 GLOBAL FOOD AUTHENTICITY TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 GLOBAL FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 GLOBAL FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 GLOBAL ORGANOLEPTIC AND APPEARANCE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 GLOBAL RANCIDITY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 GLOBAL BROWNING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 GLOBAL FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD THOUSAND)

TABLE 28 GLOBAL FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY PACKAGED FOOD CONDITION, 2020-2029 (USD THOUSAND)

TABLE 29 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, BY SITE, 2020-2029 (USD THOUSAND)

TABLE 30 GLOBAL INHOUSE/INTERNAL LAB IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 GLOBAL COMMERCIAL SERVICE LABORATORY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION PRODUCT PHASE, 2020-2029 (USD THOUSAND)

TABLE 33 GLOBAL TESTING FOR PRODUCT IN RUNNING PRODUCTION PHASE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 GLOBAL TESTING FOR FINAL PRODUCT IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 GLOBAL TESTING FOR PRODUCT IN RESEARCH & DEVELOPMENT PHASE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 GLOBAL FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 GLOBAL FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 GLOBAL PROCESSED FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 GLOBAL PROCESSED FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 GLOBAL DAIRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 GLOBAL MILK DESSERT IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 GLOBAL CHEESE BASED DESERTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 GLOBAL DAIRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 GLOBAL MEAT & POULTRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 GLOBAL MEAT & POULTRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 GLOBAL VEGETABLES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 GLOBAL VEGETABLES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 GLOBAL FRUITS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 GLOBAL FRUITS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 GLOBAL CEREALS & GRAINS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 GLOBAL CEREALS & GRAINS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 GLOBAL EDIBLE OILS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 GLOBAL EDIBLE OILS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 GLOBAL OILSEEDS & PULSES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 GLOBAL OILSEEDS & PULSES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 GLOBAL CONFECTIONERY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 GLOBAL CONFECTIONERY IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 GLOBAL NUTS IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 GLOBAL NUTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 GLOBAL PLANT-BASED MEAT AND MEAT ALTERNATIVES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 GLOBAL PLANT-BASED MEAT AND MEAT ALTERNATIVES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 GLOBAL BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 64 GLOBAL BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 GLOBAL NON-ALCOHOLIC IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 GLOBAL PLANT-BASED MILK IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 GLOBAL ALCOHOLIC IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 GLOBAL BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 GLOBAL CHROMATOGRAPHY FOOD TESTINGMARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 70 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 71 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC CHROMATOGRAPHY FOOD TESTING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA CHROMATOGRAPHY FOOD TESTING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: SEGMENTATION

FIGURE 2 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: SEGMENTATION

FIGURE 11 RISING NUMBER OF FOODBORNE ILLNESSES IS EXPECTED TO DRIVE GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 LIQUID CHROMATOGRAPHY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET IN 2022 & 2029

FIGURE 13 EUROPE IS EXPECTED TO DOMINATE, AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR CHROMATOGRAPHY FOOD TESTING MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SUPPLY CHAIN OF CHROMATOGRAPHY FOOD TESTING MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET

FIGURE 17 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET : BY CHROMATOGRAPHY TESTING TYPE, 2021

FIGURE 18 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: BY TYPE OF TESTS, 2021

FIGURE 19 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET : BY SITE, 2021

FIGURE 20 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: BY APPLICATION PRODUCT PHASE, 2021

FIGURE 21 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: BY APPLICATION,2021

FIGURE 22 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: SNAPSHOT (2021)

FIGURE 23 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: BY REGION (2021)

FIGURE 24 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: BY REGION (2022 & 2029)

FIGURE 25 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: BY REGION (2021 & 2029)

FIGURE 26 GLOBAL CHROMATOGRAPHY FOOD TESTING MARKET: BY CHROMATOGRAPHY TESTING TYPE (2022-2029)

FIGURE 27 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: SNAPSHOT (2021)

FIGURE 28 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021)

FIGURE 29 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY CHROMATOGRAPHY TESTING TYPE (2022-2029)

FIGURE 32 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: SNAPSHOT (2021)

FIGURE 33 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021)

FIGURE 34 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 35 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 36 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY CHROMATOGRAPHY TESTING TYPE (2022-2029)

FIGURE 37 ASIA-PACIFIC CHROMATOGRAPHY FOOD TESTING MARKET: SNAPSHOT (2021)

FIGURE 38 ASIA-PACIFIC CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021)

FIGURE 39 ASIA-PACIFIC CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 40 ASIA-PACIFIC CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 41 ASIA-PACIFIC CHROMATOGRAPHY FOOD TESTING MARKET: BY CHROMATOGRAPHY TESTING TYPE (2022-2029)

FIGURE 42 SOUTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: SNAPSHOT (2021)

FIGURE 43 SOUTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021)

FIGURE 44 SOUTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 SOUTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 SOUTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY CHROMATOGRAPHY TESTING TYPE (2022-2029)

FIGURE 47 MIDDLE EAST AND AFRICA CHROMATOGRAPHY FOOD TESTING MARKET: SNAPSHOT (2021)

FIGURE 48 MIDDLE EAST AND AFRICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021)

FIGURE 49 MIDDLE EAST AND AFRICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 50 MIDDLE EAST AND AFRICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 51 MIDDLE EAST AND AFRICA CHROMATOGRAPHY FOOD TESTING MARKET: BY CHROMATOGRAPHY TESTING TYPE (2022-2029)

FIGURE 52 GLOBAL CHROMATOGRAPHY FOOD TETING MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 EUROPE CHROMATOGRAPHY FOOD TETING MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 NORTH AMERICA CHROMATOGRAPHY FOOD TETING MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 ASIA-PACIFIC CHROMATOGRAPHY FOOD TETING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.