Marché mondial des échangeurs de chaleur automobiles, par application (refroidisseur intermédiaire, radiateur, climatisation, refroidisseur d'huile et autres), type de conception (ailette de tube, barre de plaque et autres), matériau (aluminium, cuivre et autres), type de propulsion ( moteur à combustion interne (ICE) et véhicule électrique (EV)), type de véhicule (voiture de tourisme, véhicule utilitaire léger et véhicule utilitaire lourd) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des échangeurs de chaleur pour automobiles

Lors de l'analyse des échangeurs de chaleur, il est souvent pratique de travailler avec un coefficient de transfert de chaleur global, appelé facteur U. Les échangeurs de chaleur sont généralement classés en fonction de la disposition des flux et du type de construction. Les différents types d'échangeurs de chaleur sont les dispositions à flux parallèles et les dispositions à contre-courant.

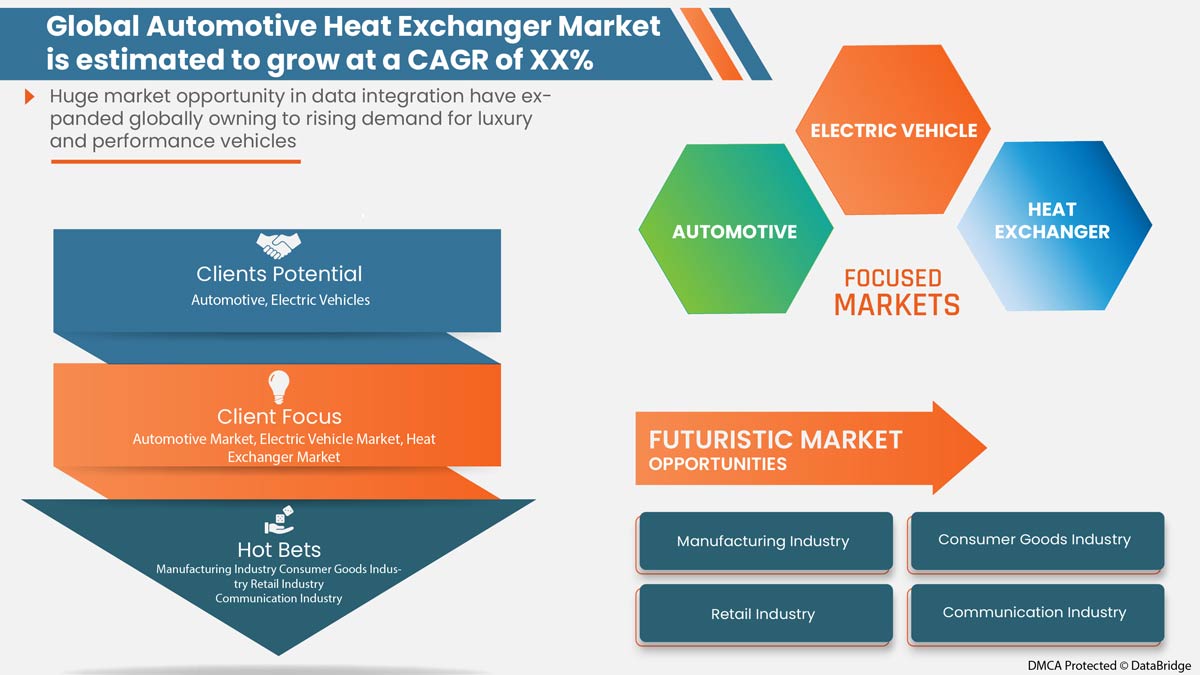

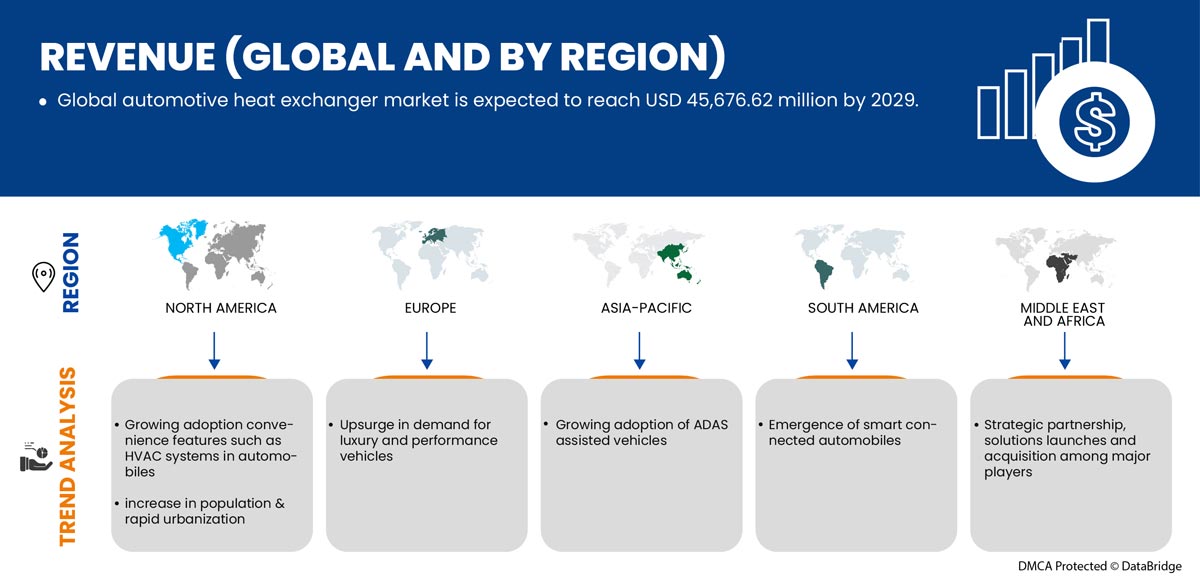

L'augmentation de la population, l'urbanisation rapide et l'industrialisation ont un impact propositionnel sur la croissance et l'adoption de l'échangeur de chaleur automobile, car les systèmes d'échangeurs de chaleur automobiles actuels sont largement utilisés pour améliorer la dynamique et les caractéristiques de sécurité des véhicules. Data Bridge Market Research analyse que le marché mondial des échangeurs de chaleur automobiles connaîtra un TCAC de 6,3 % entre 2022 et 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par application (échangeur thermique, radiateur, climatisation, refroidisseur d'huile et autres), type de conception (ailette tubulaire, barre de plaque et autres), matériau (aluminium, cuivre et autres), type de propulsion (moteur à combustion interne (ICE) et véhicule électrique (VE)), type de véhicule (voiture de tourisme, véhicule utilitaire léger et véhicule utilitaire lourd). |

|

Pays couverts |

États-Unis, Canada, Mexique, Royaume-Uni, Allemagne, France, Espagne, Italie, Pays-Bas, Suisse, Russie, Belgique, Turquie, reste de l'Europe, Chine, Corée du Sud, Japon, Inde, Australie, Singapour, Malaisie, Indonésie, Thaïlande, Philippines, reste de l'Asie-Pacifique, Afrique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Égypte, reste du Moyen-Orient et de l'Afrique, Brésil, Argentine et reste de l'Amérique du Sud. |

|

Acteurs du marché couverts |

Français La société Nippon Light Metal Company, Ltée, T.RAD Co., Ltée, Marelli Holdings Co., Ltée, Nissens Automotive A/S, Griffin Thermal Products, Valeo, Dana Limited., Hanon Systems, TYC Brother Industrial Co., Ltée, Clizen Inc., MODINE MANUFACTURING COMPANY, DENSO Corporation, MAHLE GmbH, Constellium, SANDEN CORPORATION., G&M Radiator, Mishimoto Automotive, Groupe AKG, Banco Products (I) Ltd., PWR Corporate. |

Définition du marché

Un échangeur de chaleur est un dispositif de transfert de chaleur qui échange de la chaleur entre deux ou plusieurs fluides de traitement. Les échangeurs de chaleur ont de nombreuses applications industrielles et domestiques. De nombreux échangeurs de chaleur ont été développés dans les centrales à vapeur, les usines de traitement chimique, les systèmes de chauffage et de climatisation des bâtiments, les systèmes d'alimentation électrique des transports et les unités de réfrigération. Le transfert de chaleur dans un échangeur de chaleur implique généralement une convection dans chaque fluide et une conduction thermique à travers la paroi séparant les deux fluides.

Dynamique du marché mondial des échangeurs de chaleur pour automobiles

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

AUGMENTATION DE LA POPULATION, URBANISATION RAPIDE ET INDUSTRIALISATION

Depuis plus d’une décennie, l’industrialisation et l’urbanisation ont joué un rôle important dans l’émergence et la croissance de l’industrie automobile. Avec une population croissante à travers le monde et la majorité de la population se déplaçant vers les zones urbaines pour de meilleures opportunités et un meilleur niveau de vie, elle joue un rôle essentiel dans le façonnement du secteur de l’industrie automobile.

-

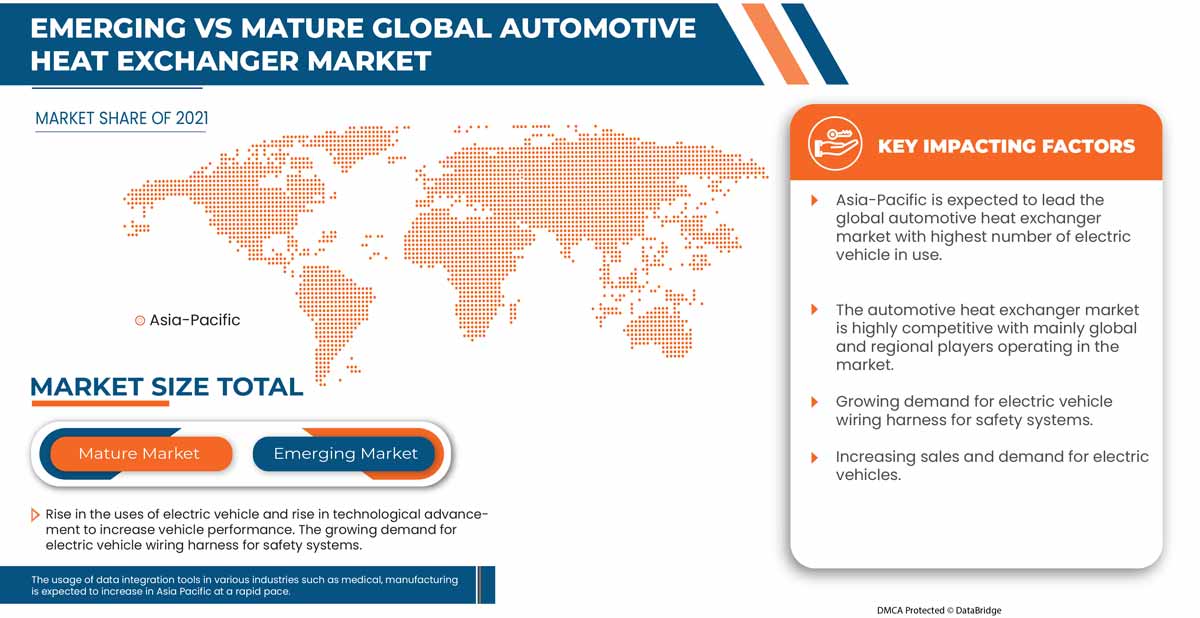

ÉMERGENCE DES VÉHICULES ÉLECTRIQUES (VE)

L'industrie automobile a connu une croissance considérable en raison de la demande croissante de véhicules électriques de luxe. Les véhicules entièrement électriques (VE) sont appelés véhicules électriques à batterie, qui utilisent une batterie pour stocker l'énergie électrique qui alimente les véhicules. Certains des facteurs qui stimulent les ventes de véhicules électriques comprennent les réglementations gouvernementales strictes concernant les émissions des véhicules et la demande croissante de véhicules économes en carburant, à hautes performances et à faibles émissions. Cela s'ajoute à l'adoption de véhicules entièrement électriques comme véhicules à zéro émission, minimisant ainsi efficacement les émissions de carbone.

-

CROISSANCE DE LA DEMANDE DE VÉHICULES ADAS ET DE SON MODÈLE D'ABONNEMENT

Les systèmes avancés d'aide à la conduite (ADAS) sont des systèmes électroniques implantés dans les automobiles pour assister la conduite des véhicules ou des voitures autonomes. Ce système utilise des capteurs tels que des radars et des caméras pour l'analyse et prend des mesures automatiques en fonction de l'environnement du véhicule. Ce système mis en œuvre dans les automobiles permet d'améliorer les systèmes de sécurité en termes de conduite en évitant les collisions, en adoptant le régulateur de vitesse, l'antiblocage des freins, l'automatisation de l'éclairage, l'atténuation de l'évitement des collisions avec les piétons (PCAM) et bien d'autres.

-

HAUSSE DE LA DEMANDE DE VÉHICULES DE LUXE ET DE PERFORMANCE

Un véhicule de luxe est un véhicule doté de caractéristiques de luxe avancées telles que des matériaux intérieurs de meilleure qualité, des moteurs, des transmissions, des systèmes audio, des systèmes télématiques et des dispositifs de sécurité efficaces. Ces véhicules ont des caractéristiques qui ne sont pas disponibles sur les modèles de véhicules moins chers.

Opportunité

-

ÉMERGENCE DE L'AUTOMOBILE CONNECTÉ ET INTELLIGENT

Un véhicule connecté est capable de connecter des réseaux sans fil à des appareils à proximité. Le concept de véhicule connecté est possible grâce aux avancées technologiques telles que l'IA, le Big Data, la connectivité réseau avancée et l'IoT. Le véhicule connecté devient populaire auprès des consommateurs pour diverses applications et cas d'utilisation. L'un de ces cas d'utilisation peut être celui des systèmes de divertissement connectés, qui permettent aux téléphones mobiles des consommateurs de se connecter à Internet avec des véhicules grâce à une communication bidirectionnelle avec divers autres véhicules et appareils mobiles.

Retenue/Défi

-

EMPREINTE CARBONE ÉLEVÉE DU SECTEUR AUTOMOBILE, COMPLEXITÉS DE CONCEPTION ET COÛTS INITIAUX ÉLEVÉS

Cependant, l’empreinte carbone élevée du secteur automobile obligera les organismes gouvernementaux à prendre des mesures et des réglementations strictes pour contrôler les niveaux d’émissions, ce qui pourrait réduire l’adoption de solutions d’échangeurs de chaleur pour l’automobile. De plus, les complexités de conception et les coûts initiaux élevés sont directement liés aux ventes et à la disponibilité de nouveaux systèmes d’échangeurs de chaleur pour l’automobile.

Impact du Covid-19 sur le marché mondial des échangeurs de chaleur pour automobiles

Le COVID-19 a eu un impact négatif sur le marché. Les systèmes d'échangeurs de chaleur automobiles mondiaux étant très demandés, des entreprises telles que Marelli Holdings Co., Ltd., Hanon Systems, Nissens, Griffin Thermal Products, TYC Brother Industrial Co., Ltd., Dana Limited et d'autres entreprises mondiales ont du mal à fournir des systèmes avancés pour les véhicules neufs et anciens en raison de la pénurie de puces de contrôle et de contrôleurs à semi-conducteurs, en raison des réglementations strictes imposées par le gouvernement. Une offre limitée de puces et de gadgets à semi-conducteurs a considérablement affecté l'offre de véhicules sur le marché.

Développement récent

- En mars 2022, T.RAD Co., Ltd. a lancé des équipements de refroidissement et de ventilation non domestiques (NACE2 2825) en Amérique du Nord. La principale caractéristique de ces produits dans la région était de lancer ses multiples produits, par exemple, radiateur, refroidisseur d'huile, refroidisseur intermédiaire, refroidisseur EGR, évaporateur, condenseur, serpentins à eau et récupérateur. Grâce à cela, la société a augmenté ses revenus et ses ventes dans la région.

Portée du marché mondial des échangeurs de chaleur pour automobiles

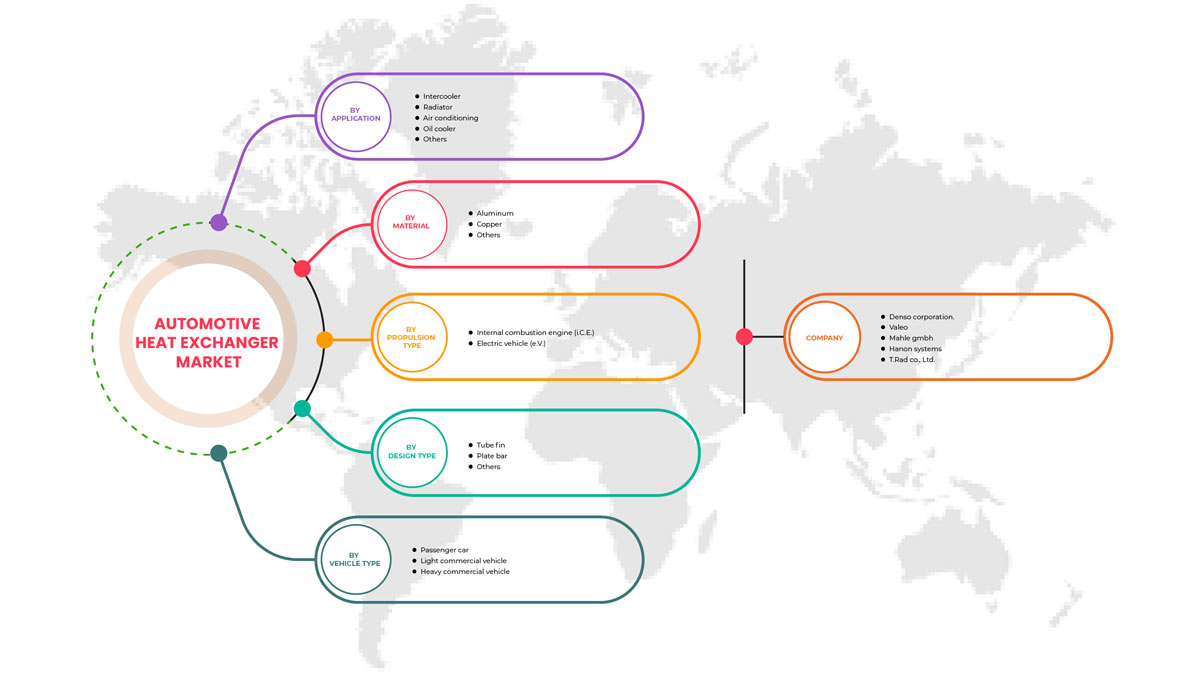

Le marché mondial des échangeurs de chaleur pour automobiles est segmenté en fonction de l'application, du type de conception, du type de véhicule et du type de propulsion. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Application

- Refroidisseur intermédiaire

- Radiateur

- Climatisation

- Refroidisseur d'huile

- Autres

Sur la base de l'application, le marché mondial des échangeurs de chaleur automobiles est segmenté en refroidisseur intermédiaire, radiateur, climatisation, refroidisseur d'huile et autres.

Type de conception

- Aileron tubulaire

- Barre de plaque

- Autres

Sur la base du type de conception, le marché mondial des échangeurs de chaleur automobiles est segmenté en tubes à ailettes, barres à plaques et autres.

Matériel

- Aluminium

- Cuivre

- Autres

Sur la base du matériau, le marché mondial des échangeurs de chaleur automobiles est segmenté en aluminium, cuivre et autres.

Type de propulsion

- Moteur à combustion interne (ICE)

- Véhicule électrique (VE)

Sur la base du type de propulsion, le marché mondial des échangeurs de chaleur automobiles est segmenté en moteur à combustion interne (ICE) et véhicule électrique (VE).

Type de véhicule

- Voiture de tourisme

- Véhicule utilitaire léger

- Véhicule utilitaire lourd

Sur la base du type de véhicule, le marché mondial des échangeurs de chaleur automobiles est segmenté en voiture particulière, véhicule utilitaire léger et véhicule utilitaire lourd.

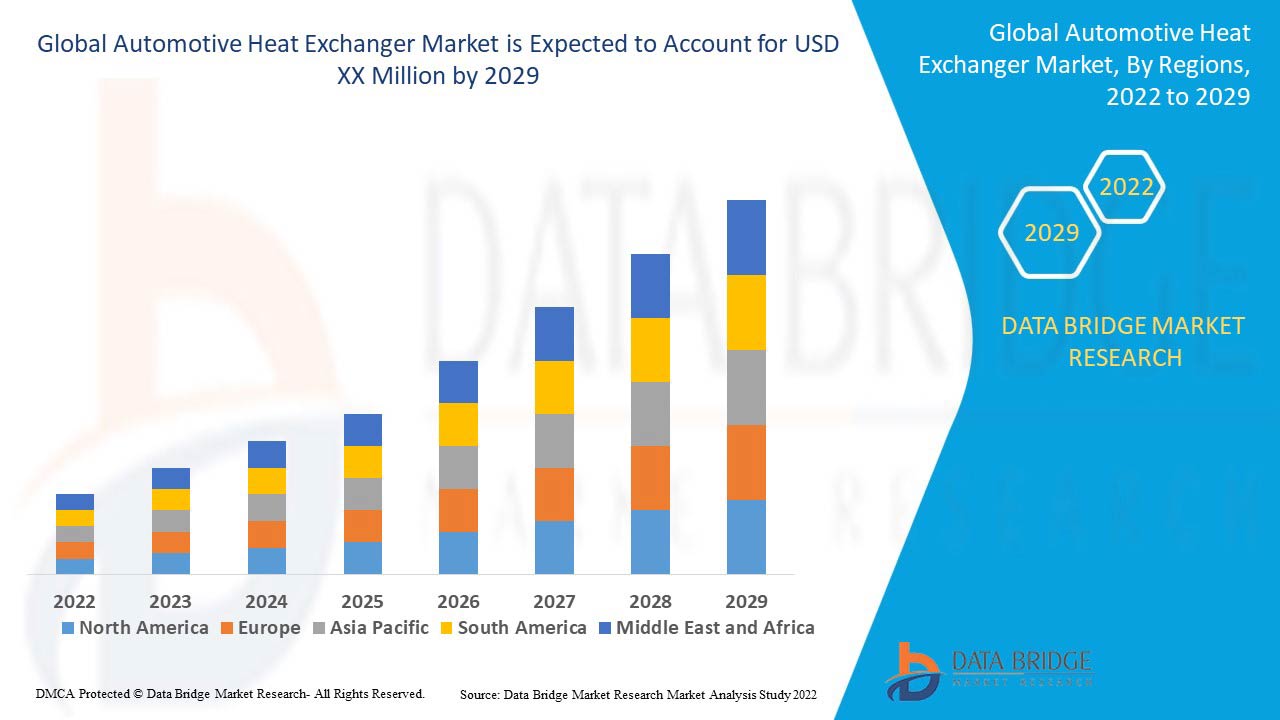

Analyse/perspectives régionales du marché mondial des échangeurs de chaleur pour automobiles

Le marché mondial des échangeurs de chaleur automobiles est analysé et des informations sur la taille du marché et les tendances sont fournies par région, application, type de conception, matériau, type de propulsion et type de véhicule, comme référencé ci-dessus.

Français Les régions couvertes par le rapport sur le marché mondial des échangeurs de chaleur automobiles sont l'Asie-Pacifique, l'Europe, l'Amérique du Nord, le Moyen-Orient et l'Afrique et l'Amérique du Sud. Le marché des échangeurs de chaleur automobiles en Amérique du Nord est sous-segmenté en États-Unis, Canada et Mexique. Le marché européen des échangeurs de chaleur automobiles est sous-segmenté en Royaume-Uni, Allemagne, France, Espagne, Italie, Pays-Bas, Suisse, Russie, Belgique, Turquie et reste de l'Europe. Le marché des échangeurs de chaleur automobiles en Asie-Pacifique est sous-segmenté en Chine, Corée du Sud, Japon, Inde, Australie, Singapour, Malaisie, Indonésie, Thaïlande, Philippines et reste de l'Asie-Pacifique. Le marché des échangeurs de chaleur automobiles au Moyen-Orient et en Afrique est sous-segmenté en Afrique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Égypte et reste du Moyen-Orient et de l'Afrique. Le marché des échangeurs de chaleur automobiles en Amérique du Sud est sous-segmenté en Brésil, Argentine et reste de l'Amérique du Sud.

En 2022, la région Asie-Pacifique dominera le marché mondial des échangeurs de chaleur automobiles car il s'agit d'une région technologiquement avancée avec un grand nombre d'acteurs majeurs du marché, ce qui augmente par la suite l'adoption des produits d'échangeurs de chaleur automobiles et de leurs services.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché mondiales des échangeurs de chaleur pour automobiles

Le paysage concurrentiel du marché mondial des échangeurs de chaleur pour automobiles fournit des détails sur un concurrent. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise vers le marché mondial des échangeurs de chaleur pour automobiles.

Parmi les principaux acteurs mondiaux du marché des échangeurs de chaleur automobiles figurent DENSO CORPORATION, MAHLE GmbH, VALEO, Hanon Systems et T.RAD Co., Ltd., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 APPLICATION TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN POPULATION & RAPID URBANIZATION

5.1.2 EMERGENCE OF ELECTRIC VEHICLES (EVS)

5.1.3 GROWING ADOPTION OF ADAS ASSISTED VEHICLES

5.1.4 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.2 RESTRAINTS

5.2.1 HIGH CARBON FOOTPRINT OF AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 STRATEGIC PARTNERSHIP, SOLUTIONS LAUNCHES, AND ACQUISITIONS AMONG MAJOR PLAYERS

5.3.2 EMERGENCE OF SMART CONNECTED AUTOMOTIVE

5.3.3 GROWING ADOPTION OF CONVENIENCE FEATURES SUCH AS HVAC SYSTEMS IN AUTOMOTIVES

5.4 CHALLENGES

5.4.1 UPCOMING EMISSION NORMS COULD POSE A CHALLENGE FOR AUTOMOTIVE HEAT EXCHANGERS

5.4.2 DESIGN COMPLEXITIES AND HIGH UPFRONT COST

6 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 INTERCOOLER

6.3 RADIATOR

6.4 AIR CONDITIONING

6.5 OIL COOLER

6.6 OTHERS

7 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE

7.1 OVERVIEW

7.2 TUBE FIN

7.3 PLATE BAR

7.4 OTHERS

8 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 ALUMINUM

8.3 COPPER

8.4 OTHERS

9 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE

9.1 OVERVIEW

9.2 INTERNAL COMBUSTION ENGINE (ICE)

9.3 ELECTRIC VEHICLE (EV)

10 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CAR

10.3 LIGHT COMMERCIAL VEHICLE

10.4 HEAVY COMMERCIAL VEHICLE

10.4.1 ON-HIGHWAY VEHICLE

10.4.2 OFF-HIGHWAY VEHICLE

10.4.2.1 CONSTRUCTION

10.4.2.2 AGRICULTURE

10.4.2.3 OTHERS

11 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 JAPAN

11.2.3 SOUTH KOREA

11.2.4 INDIA

11.2.5 AUSTRALIA

11.2.6 THAILAND

11.2.7 INDONESIA

11.2.8 MALAYSIA

11.2.9 PHILIPPINES

11.2.10 SINGAPORE

11.2.11 REST OF ASIA-PACIFIC

11.3 EUROPE

11.3.1 GERMANY

11.3.2 U.K.

11.3.3 FRANCE

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 RUSSIA

11.3.7 SWITZERLAND

11.3.8 NETHERLANDS

11.3.9 BELGIUM

11.3.10 TURKEY

11.3.11 REST OF EUROPE

11.4 NORTH AMERICA

11.4.1 U.S.

11.4.2 CANADA

11.4.3 MEXICO

11.5 MIDDLE EAST AND AFRICA

11.5.1 U.A.E.

11.5.2 SAUDI ARABIA

11.5.3 ISRAEL

11.5.4 SOUTH AFRICA

11.5.5 EGYPT

11.5.6 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 DENSO CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 VALEO

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 BUSINESS PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 MAHLE GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HANON SYSTEMS

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 BUSINESS PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 T.RAD CO., LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCTS PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AKG GROUP

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT0

14.7 BANCO PRODUCTS (I) LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CLIZEN INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 CONSTELLIUM

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 DANA LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 BUSINESS PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 G&M RADIATOR

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 GRIFFIN THERMAL PRODUCTS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCTS PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MARELLI HOLDINGS CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCTS PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 MISHIMOTO AUTOMOTIVE

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MODINE MANUFACTURING COMPANY

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 NISSENS AUTOMOTIVE A/S

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCTS PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 PWR CORPORATE

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SANDEN CORPORATION.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 TYC BROTHER INDUSTRIAL CO., LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 BUSINESS PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS, SUVS &TRUCK

TABLE 2 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL INTERCOOLER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL RADIATOR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL AIR CONDITIONING IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL OIL COOLER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL TUBE FIN IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL PLATE BAR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL ALUMINUM IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL COPPER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL INTERNAL COMBUSTION ENGINE (ICE) IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL ELECTRIC VEHICLE (EV) IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL PASSENGER CAR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 36 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 37 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 39 CHINA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 43 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 44 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 45 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 46 JAPAN HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 JAPAN OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 53 SOUTH KOREA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SOUTH KOREA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 57 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 58 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 59 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 60 INDIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 64 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 71 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 72 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 73 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 74 THAILAND HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 THAILAND OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 78 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 80 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDONESIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 INDONESIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 85 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 86 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 87 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 88 MALAYSIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 MALAYSIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 92 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 93 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 94 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 95 PHILIPPINES HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 PHILIPPINES OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 REST OF ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 106 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 108 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 109 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 110 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 111 EUROPE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 EUROPE OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 115 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 116 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 117 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 118 GERMANY HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 GERMANY OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 123 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 124 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 125 U.K. HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 U.K. OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 129 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 130 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 131 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 132 FRANCE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 FRANCE OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 136 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 137 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 138 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 139 ITALY HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 ITALY OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 144 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 146 SPAIN HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SPAIN OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 150 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 157 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 159 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 160 SWITZERLAND HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 SWITZERLAND OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 162 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 164 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 165 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 167 NETHERLANDS HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 NETHERLANDS OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 171 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 172 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 173 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 174 BELGIUM HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 BELGIUM OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 177 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 178 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 179 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 180 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 181 TURKEY HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 TURKEY OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 REST OF EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 184 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 185 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 187 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 188 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 189 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 190 NORTH AMERICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 NORTH AMERICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 193 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 194 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 195 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 196 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 197 U.S. HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 U.S. OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 201 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 202 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 203 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 204 CANADA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 CANADA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 206 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 207 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 208 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 209 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 210 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 211 MEXICO HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 MEXICO OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 213 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 214 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 215 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 216 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 217 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 218 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 219 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 221 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 222 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 223 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 224 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 225 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 226 U.A.E. HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 U.A.E. OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 228 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 229 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 230 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 231 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 232 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 233 SAUDI ARABIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 SAUDI ARABIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 235 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 237 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 238 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 239 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 240 ISRAEL HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 ISRAEL OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 243 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 244 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 245 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 246 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 247 SOUTH AFRICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 SOUTH AFRICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 249 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 250 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 251 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 252 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 253 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 254 EGYPT HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 EGYPT OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 256 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 257 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 258 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 259 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 260 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 261 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 262 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 263 SOUTH AMERICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 264 SOUTH AMERICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 265 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 266 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 267 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 268 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 269 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 270 BRAZIL HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 BRAZIL OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 272 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 273 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 274 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 275 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 276 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 277 ARGENTINA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 ARGENTINA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 279 REST OF SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: SEGMENTATION

FIGURE 2 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: SEGMENTATION

FIGURE 10 GROWING ADOPTION OF ADAS ASSISTED VEHICLES IS EXPECTED TO DRIVE GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INTERCOOLER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET FROM 2022 TO 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IT IS THE FASTEST GROWING REGION IN THE GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR AUTOMOTIVE HEAT EXCHANGER MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET

FIGURE 15 URBANIZED REGIONS IN THE GLOBE

FIGURE 16 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 17 ROAD TRANSPORT EMISSIONS

FIGURE 18 BENEFITS OF SMART TELEMATICS FOR FLEET MANAGEMENT

FIGURE 19 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION, 2021

FIGURE 20 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY DESIGN TYPE, 2021

FIGURE 21 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY MATERIAL, 2021

FIGURE 22 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY PROPULSION TYPE, 2021

FIGURE 23 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY VEHICLE TYPE, 2021

FIGURE 24 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 25 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY REGION (2021)

FIGURE 26 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY REGION (2022 & 2029)

FIGURE 27 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY REGION (2021 & 2029)

FIGURE 28 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 29 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 30 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 31 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 34 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 35 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 36 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 39 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 40 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 41 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 44 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 46 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 49 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 50 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 51 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 52 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 53 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 54 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.