Global Architectural Coatings Market

Taille du marché en milliards USD

TCAC :

%

USD

80.30 Billion

USD

101.60 Billion

2024

2032

USD

80.30 Billion

USD

101.60 Billion

2024

2032

| 2025 –2032 | |

| USD 80.30 Billion | |

| USD 101.60 Billion | |

|

|

|

|

Segmentation du marché mondial des revêtements architecturaux, par type de résine (acrylique, acétate de vinyle-éthylène (VAE), alkydes, polyuréthane, époxy, polyesters, autres), technologie (à base de solvants, à base d'eau), fonction (peintures, apprêts, vernis, teintures, scellants, revêtements en poudre, laques, céramiques, autres), application (commerciale, résidentielle, revêtements pour bois, revêtements de toiture, revêtements de sol) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des revêtements architecturaux

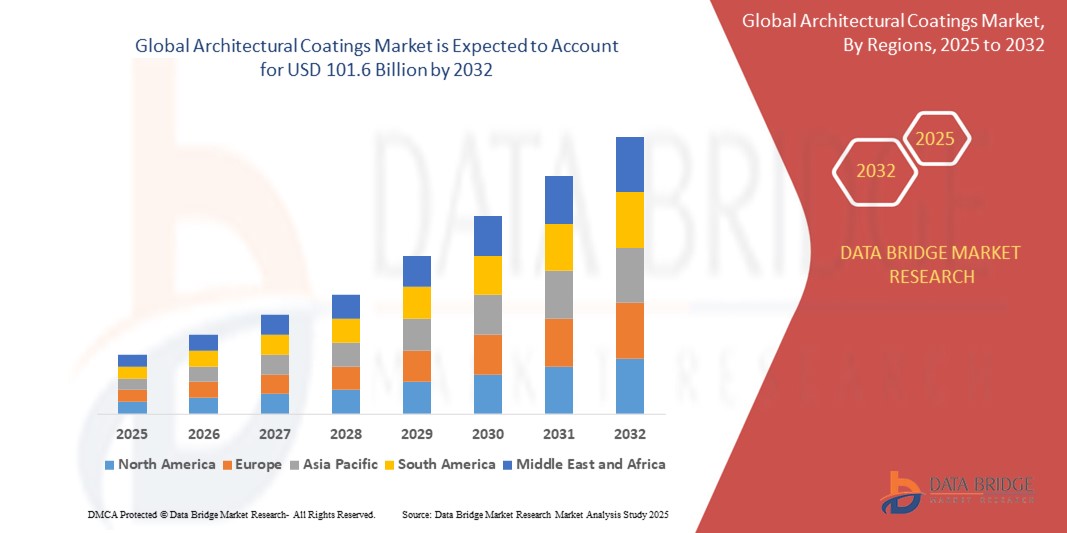

- La taille du marché mondial des revêtements architecturaux était évaluée à 80,3 milliards USD en 2024 et devrait atteindre 101,6 milliards USD d'ici 2032 , à un TCAC de 4,2 % au cours de la période de prévision.

- Cette croissance est tirée par des facteurs tels que l’augmentation de la demande du secteur de la construction

Analyse du marché des revêtements architecturaux

- Les revêtements architecturaux sont des couches protectrices et décoratives appliquées sur les bâtiments et les structures pour améliorer leur esthétique, leur durabilité et leur résistance aux facteurs environnementaux tels que l'humidité, les rayons UV et les produits chimiques. Ces revêtements comprennent les peintures, les apprêts, les produits d'étanchéité et les vernis utilisés pour les surfaces intérieures et extérieures.

- La demande de revêtements architecturaux est fortement stimulée par l'urbanisation rapide, l'augmentation des activités de construction dans les secteurs résidentiel et commercial et la préférence croissante des consommateurs pour des bâtiments esthétiques et économes en énergie.

- L'Asie-Pacifique devrait dominer le marché des revêtements architecturaux en raison de l'essor des industries de la construction dans des pays comme la Chine, l'Inde et l'Asie du Sud-Est, de la croissance démographique et des initiatives gouvernementales favorisant le développement des infrastructures et des villes intelligentes.

- L'Amérique du Nord devrait être la région connaissant la croissance la plus rapide sur le marché des revêtements architecturaux au cours de la période de prévision en raison de la croissance des projets de rénovation et de remodelage, de la demande croissante de revêtements durables et à faible teneur en COV et des avancées technologiques dans les formulations de revêtements.

- Le segment à base d'eau devrait dominer le marché avec une part de marché de 35,54 % en 2025, en raison de la réglementation environnementale croissante, de la sensibilisation accrue à la santé et à la sécurité et de la préférence pour les solutions de revêtement à faibles émissions, inodores et faciles à nettoyer.

Portée du rapport et segmentation du marché des revêtements architecturaux

|

Attributs |

Informations clés sur le marché des revêtements architecturaux |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des revêtements architecturaux

« Formulations durables et technologies de revêtement intelligentes »

- L'une des tendances marquantes du marché des revêtements architecturaux est la demande croissante de revêtements écologiques et durables, motivée par des réglementations environnementales plus strictes, une sensibilisation croissante aux émissions de COV et l'évolution mondiale vers des pratiques de construction écologiques.

- Les fabricants innovent avec des revêtements à base d'eau, à faible teneur en COV et biosourcés qui minimisent l'impact environnemental tout en maintenant la durabilité, la rétention des couleurs et la résistance aux intempéries.

- Par exemple, des résines biosourcées dérivées du soja ou de l’huile de ricin sont intégrées dans les revêtements architecturaux pour réduire la dépendance aux produits pétrochimiques et s’aligner sur les objectifs de certification LEED.

- L'émergence de revêtements intelligents, notamment les peintures autonettoyantes, antimicrobiennes et thermorégulatrices, gagne du terrain dans la construction résidentielle et commerciale. Ces revêtements améliorent la qualité de l'air intérieur, réduisent les besoins d'entretien et optimisent l'efficacité énergétique, offrant ainsi des avantages à valeur ajoutée allant au-delà de l'esthétique traditionnelle.

Dynamique du marché des revêtements architecturaux

Conducteur

« Demande croissante de matériaux de construction durables et économes en énergie »

- L'accent croissant mis sur la durabilité et l'efficacité énergétique dans la construction stimule considérablement la demande de revêtements architecturaux dans les secteurs résidentiel et commercial.

- Les réglementations en matière de construction se durcissent, privilégiant l'utilisation de matériaux écologiques. Ceci a entraîné une hausse de la demande de revêtements architecturaux à faible teneur en COV et à base d'eau. Ces revêtements offrent une durabilité et un attrait esthétique supérieurs tout en minimisant l'impact environnemental.

- De plus, la demande de revêtements aux propriétés d'économie d'énergie, tels que les revêtements réfléchissants et isolants thermiques, augmente pour contribuer à réduire la consommation d'énergie des bâtiments.

Par exemple,

- Le US Green Building Council (USGBC) a indiqué que plus de 50 % des nouveaux bâtiments commerciaux aux États-Unis sont conçus pour répondre aux normes LEED (Leadership in Energy and Environmental Design), ce qui encourage l'adoption de revêtements durables.

- En conséquence, il existe un besoin croissant de revêtements architecturaux conformes aux normes environnementales et contribuant aux certifications de bâtiments écologiques, ce qui stimule la croissance du marché à l’échelle mondiale.

Opportunité

« Progrès dans les technologies de revêtement intelligent et les solutions antimicrobiennes »

- L’une des principales opportunités du marché des revêtements architecturaux est l’essor des revêtements intelligents, utilisés pour des applications autonettoyantes, antimicrobiennes et de régulation de la température.

- Ces innovations offrent une fonctionnalité améliorée en combinant l'attrait esthétique traditionnel avec la capacité d'améliorer les performances du bâtiment, de réduire les coûts de maintenance et d'assurer une durabilité à long terme.

- Les revêtements antimicrobiens gagnent en popularité en raison de leur capacité à empêcher la croissance de bactéries, de moisissures et de mildiou sur les surfaces, ce qui est particulièrement important dans les secteurs de la santé, de la transformation des aliments et des bâtiments commerciaux à fort trafic.

Par exemple,

- En 2023, PPG Industries a lancé une gamme de revêtements architecturaux antimicrobiens conçue pour améliorer l'hygiène des bâtiments, en particulier dans des environnements tels que les hôpitaux et les écoles.

- Cette croissance des revêtements intelligents offre aux fabricants des opportunités importantes de développer des produits innovants qui répondent aux préoccupations des consommateurs concernant l’entretien des bâtiments, la sécurité et l’impact environnemental.

Retenue/Défi

« Augmentation des coûts des matières premières et perturbations de la chaîne d'approvisionnement »

- Le marché des revêtements architecturaux est confronté à des défis liés à la hausse des prix des matières premières clés telles que les résines, les pigments et les solvants, qui peuvent augmenter les coûts de production et affecter la rentabilité globale des fabricants.

- Les perturbations actuelles de la chaîne d'approvisionnement mondiale, en particulier au lendemain de la pandémie de COVID-19, ont encore exacerbé ces pressions sur les coûts et ont rendu plus difficile pour les fabricants de maintenir des prix cohérents pour les consommateurs.

- En outre, les problèmes de chaîne d’approvisionnement peuvent entraîner des retards dans les livraisons de produits, affectant les délais de construction et l’achèvement des projets.

Par exemple,

- AkzoNobel a signalé en 2023 que les prix des principales matières premières, notamment les résines et les pigments, avaient augmenté de près de 10 % en raison de pénuries d'approvisionnement, ce qui a eu un impact sur leurs marges globales.

- Ces défis pourraient limiter l’accessibilité financière des revêtements architecturaux avancés, en particulier pour les petits projets de construction ou les entreprises disposant de budgets plus serrés, ce qui entrave une adoption plus large du marché.

Portée du marché des revêtements architecturaux

Le marché est segmenté en fonction du type de résine, de la technologie, de la fonction et de l'application.

|

Segmentation |

Sous-segmentation |

|

Par type de résine |

|

|

Par technologie |

|

|

Par fonction |

|

|

Par application |

|

En 2025, le secteur résidentiel devrait dominer le marché avec une part de marché plus importante dans le segment d'application

Le segment résidentiel devrait dominer le marché des revêtements architecturaux avec la plus grande part de 56,22 % en 2025 en raison de l'accent croissant mis sur l'amélioration et la rénovation de l'habitat, entraîné par l'augmentation des revenus disponibles, la préférence des consommateurs pour l'esthétique moderne et le désir d'améliorer la valeur de la propriété, contribuant de manière significative à la demande de revêtements architecturaux dans les applications résidentielles.

Les produits à base d'eau devraient représenter la plus grande part du marché des applications au cours de la période de prévision.

En 2025, le segment à base d'eau devrait dominer le marché avec la plus grande part de marché de 51,31 % en raison de sa faible teneur en composés organiques volatils (COV), ce qui les rend plus respectueux de l'environnement par rapport aux alternatives à base de solvants.

Analyse régionale du marché des revêtements architecturaux

« L'Amérique du Nord détient la plus grande part du marché des revêtements architecturaux »

- L'Amérique du Nord domine le marché des revêtements architecturaux avec une part de marché significative de 38,15 %. Cette domination s'explique par le développement du secteur de la construction dans la région, la forte demande de matériaux de construction durables et économes en énergie, et l'importance croissante accordée aux certifications de bâtiments écologiques.

- Les États-Unis détiennent la plus grande part dans cette région en raison du secteur immobilier robuste, de la demande croissante de revêtements écoénergétiques et des investissements croissants dans les projets de développement et de rénovation des infrastructures.

- Le Canada contribue également de manière significative à la croissance régionale, grâce aux initiatives gouvernementales encourageant l’utilisation de revêtements à faible teneur en COV et respectueux de l’environnement dans les bâtiments résidentiels et commerciaux.

- L'adoption de revêtements intelligents et de solutions antimicrobiennes accélère encore la demande de revêtements architecturaux en Amérique du Nord. La présence de grands fabricants tels que PPG Industries, Sherwin-Williams et AkzoNobel soutient la croissance du marché régional et stimule l'innovation dans les technologies de revêtement.

« L'Asie-Pacifique devrait enregistrer le TCAC le plus élevé sur le marché des revêtements architecturaux »

- La région Asie-Pacifique devrait enregistrer le TCAC le plus élevé sur le marché des revêtements architecturaux, sous l'effet de l'urbanisation rapide, de la demande accrue de bâtiments économes en énergie et de la croissance des activités de construction dans les pays en développement.

- La Chine et l'Inde connaissent une forte croissance de leurs marchés grâce à l'essor des projets de construction résidentielle et commerciale, ainsi qu'à l'attention croissante des gouvernements pour les pratiques de construction durables. La demande de revêtements isolants thermiques et réfléchissants est en hausse dans ces pays, qui cherchent à réduire la consommation énergétique de leurs bâtiments.

- Le Japon et la Corée du Sud sont à la pointe de l'innovation, avec un fort intérêt des consommateurs pour les revêtements écologiques et économes en énergie. Ces marchés connaissent une adoption croissante de revêtements intelligents dotés de capacités autonettoyantes, antimicrobiennes et thermorégulatrices.

- L’Asie du Sud-Est est également en train de devenir une zone de croissance clé en raison de l’urbanisation croissante, de l’augmentation des revenus disponibles et de l’évolution vers des technologies de construction modernes, ce qui stimule encore davantage la demande de revêtements architecturaux haute performance dans des pays comme l’Indonésie, le Vietnam et la Thaïlande.

Part de marché des revêtements architecturaux

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- Société Sherwin-Williams (États-Unis)

- PPG Industries, Inc (États-Unis)

- AkzoNobel NV (Pays-Bas)

- BASF Coating GMBH (Allemagne)

- Jotun A/s (Norvège)

- Asian Paints Limited (Inde)

- Kansai Paint Co., Ltd (Japon)

- Nippon Paint Holding Co., Ltd (Japon)

- RPM International, Inc (États-Unis)

- Masco Corporation (États-Unis)

Derniers développements sur le marché mondial des revêtements architecturaux

- En janvier 2025, AkzoNobel a lancé une nouvelle gamme de revêtements architecturaux durables, à faible teneur en COV et écoénergétiques. Cette gamme de produits est conçue pour répondre à la demande croissante de solutions écologiques dans la construction commerciale et résidentielle, répondant ainsi à la demande croissante des consommateurs et des autorités réglementaires en faveur de matériaux de construction plus écologiques.

- En décembre 2024, Sherwin-Williams a lancé une technologie de revêtement intelligent pour murs extérieurs. Cette technologie améliore non seulement l'esthétique des bâtiments, mais offre également des propriétés autonettoyantes. Ce revêtement utilise la nanotechnologie pour éliminer la saleté et les polluants, réduisant ainsi les coûts d'entretien et améliorant la longévité de la structure.

- En novembre 2024, PPG Industries a lancé sa peinture extérieure Ultraclean, qui offre une résistance avancée aux taches et une prévention des moisissures. Ce revêtement innovant est conçu pour les régions à forte humidité, ce qui le rend idéal pour une utilisation en zone côtière. Ce produit est également conçu pour être à faible teneur en COV et offre une rétention de couleur longue durée, contribuant ainsi à la demande croissante de solutions durables dans le secteur de la construction.

- En octobre 2024, BASF a lancé un nouveau revêtement architectural biodégradable pour surfaces intérieures. Ce revêtement offre une finition durable tout en étant totalement exempt de produits chimiques nocifs. Ce nouveau produit de BASF s'inscrit dans la tendance des consommateurs à privilégier des matériaux de construction plus durables et plus respectueux de la santé, et vise à répondre à la demande croissante de revêtements non toxiques.

- En septembre 2024, le groupe Jotun a lancé une nouvelle gamme de revêtements haute performance destinés aux climats extrêmes. Ces revêtements sont conçus pour offrir une isolation thermique et des propriétés anticorrosion aux bâtiments situés dans les régions arctiques et désertiques, permettant ainsi des économies d'énergie et une réduction des besoins de maintenance.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.