Global Anti Aging Skincare Ingredients Market

Taille du marché en milliards USD

TCAC :

%

USD

1.87 Billion

USD

2.70 Billion

2024

2032

USD

1.87 Billion

USD

2.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.87 Billion | |

| USD 2.70 Billion | |

|

|

|

|

Segmentation du marché mondial des ingrédients de soins anti-âge, par produit (rétinoïde, acide hyaluronique, antioxydants, peptides, niacinamide (vitamine B3), acides alpha-hydroxylés (AHAS), céramides, oxyde de zinc et dioxyde de titane, acide bêta-hydroxylé (BHA), coenzyme Q10 (ubiquinone), extrait de thé vert, acide alpha-lipoïque, caféine, bakuchiol, squalane, acide kojique, alpha-arbutine, isoflavones de soja, etc.), forme (poudre, liquide et granulé), fonction (hydratant, stimulant du collagène, protection solaire, exfoliant, éclaircissant, anti-inflammatoire, réparateur cutané, etc.), application (antirides, antipigmentant, anti-oxydation, produits de comblement cutané, etc.), utilisation finale (sérum, hydratant, nettoyant, crème contour des yeux, huile visage, masque, tonique, etc.) Tendances et prévisions de l'industrie jusqu'en 2032

Taille du marché des ingrédients de soins anti-âge

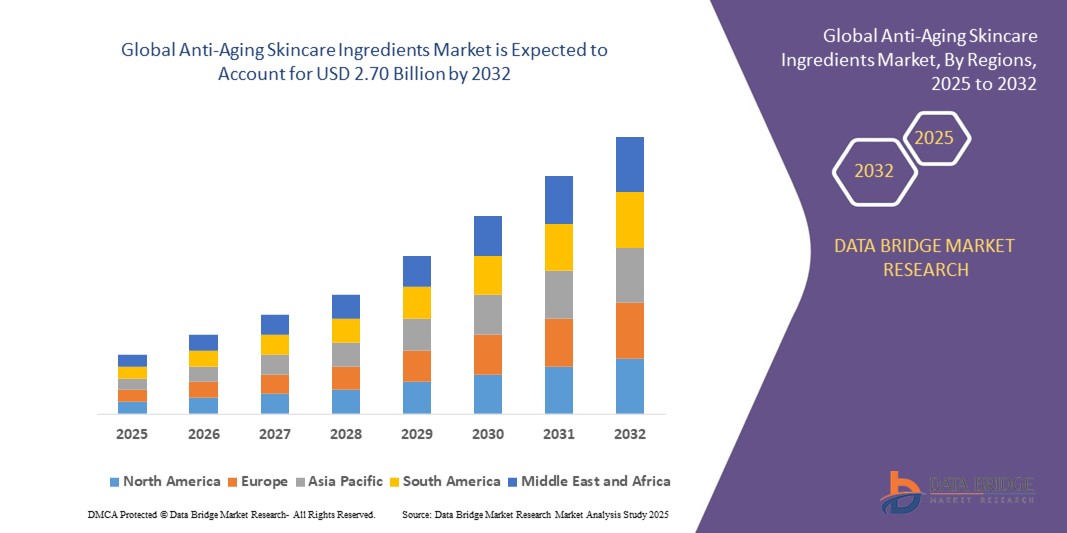

- La taille du marché mondial des ingrédients de soins anti-âge était évaluée à 1,87 milliard USD en 2024 et devrait atteindre 2,70 milliards USD d'ici 2032 , à un TCAC de 4,71 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la sensibilisation croissante des consommateurs aux soins de la peau, la demande croissante de solutions préventives et anti-âge et les innovations technologiques dans les ingrédients bioactifs et multifonctionnels, qui permettent des formulations plus efficaces pour la réduction des rides, l'éclaircissement de la peau et l'hydratation.

- De plus, la préférence croissante pour les ingrédients naturels, issus de sources durables et produits de manière éthique favorise l'adoption de formules anti-âge haut de gamme. Ces facteurs convergents accélèrent l'adoption d'ingrédients de soins de la peau de pointe, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des ingrédients de soins anti-âge

- Les ingrédients des soins anti-âge comprennent des composés bioactifs tels que les rétinoïdes, les peptides, l'acide hyaluronique, les antioxydants et les céramides, qui contribuent à réduire les signes visibles du vieillissement, à améliorer l'élasticité de la peau et à favoriser sa santé globale. Ces ingrédients sont largement utilisés dans les sérums, crèmes, masques et crèmes solaires, tant pour des applications préventives que correctives.

- La demande croissante d'ingrédients de soins anti-âge est principalement alimentée par le vieillissement de la population, l'augmentation des revenus disponibles, l'intérêt croissant des consommateurs pour les soins personnels et la pénétration croissante des produits de soins haut de gamme sur les marchés développés et émergents. L'engagement numérique croissant et l'adoption du e-commerce améliorent encore l'accessibilité des produits et la croissance du marché.

- Le marché des ingrédients de soins anti-âge pour la peau a dominé l'Asie-Pacifique avec une part de 36,70 % en 2024, en raison de la sensibilisation croissante des consommateurs aux soins de la peau, de l'augmentation des revenus disponibles et de l'influence des tendances K-beauty et J-beauty.

- L'Amérique du Nord devrait être la région connaissant la croissance la plus rapide sur le marché des ingrédients de soins anti-âge au cours de la période de prévision en raison de la préférence croissante des consommateurs pour les soins de la peau de luxe et naturels, de la sensibilisation croissante aux routines anti-âge préventives et de la forte présence des principales marques de cosmétiques.

- Le segment des antioxydants a dominé le marché avec une part de marché de 34,2 % en 2024, grâce à leur capacité avérée à neutraliser les radicaux libres, à protéger contre le stress oxydatif et à ralentir les signes visibles du vieillissement tels que les rides et les ridules. Les antioxydants tels que la vitamine C, la vitamine E, l'extrait de thé vert et la coenzyme Q10 sont largement utilisés dans les sérums, les crèmes et les écrans solaires, ce qui leur confère une grande polyvalence dans les formulations de produits. Leur rôle multifonctionnel : éclaircissement de la peau, amélioration de la stabilité du collagène et protection contre les agressions environnementales telles que les rayons UV et la pollution, a consolidé leur position de référence dans les soins anti-âge.

Portée du rapport et segmentation du marché des ingrédients de soins anti-âge

|

Attributs |

Informations clés sur le marché des ingrédients anti-âge pour les soins de la peau |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des ingrédients de soins anti-âge

Évolution des préférences vers les produits naturels et biologiques

- Le marché des ingrédients anti-âge pour les soins de la peau est en pleine mutation : les consommateurs privilégient les composés naturels et biologiques, recherchant des alternatives plus sûres aux produits chimiques de synthèse. Cette préférence ouvre de nouvelles perspectives de croissance et stimule l'innovation produit, tant sur les segments grand public que haut de gamme.

- Par exemple, des marques comme Shiseido et Lady Green ont lancé des sérums et des crèmes visage anti-âge bio contenant des extraits de plantes et des actifs végétaux bio-fermentés. Ces lancements gagnent en popularité auprès des millennials et des consommateurs soucieux de leur santé, en quête de soins éthiques et durables.

- Les avancées technologiques dans les systèmes d'administration d'ingrédients améliorent l'efficacité et la confiance des consommateurs. Les entreprises utilisent l'encapsulation, la microfluidique et la biotechnologie pour optimiser la biodisponibilité et l'efficacité des actifs anti-âge naturels, tels que l'acide hyaluronique et les peptides, en applications topiques.

- La demande de transparence sur les ingrédients et de formulations sûres augmente, les consommateurs se tournant vers des produits clean label et certifiés véganes. Les revendications en matière de durabilité et d'approvisionnement éthique sont des facteurs d'achat importants, influençant le positionnement des marques en matière d'ingrédients anti-âge à l'international.

- Les routines beauté personnalisées utilisant des ingrédients anti-âge naturels se généralisent. Les consommateurs recherchent des solutions ciblées pour des problèmes spécifiques tels que les rides, la pigmentation ou la perte d'élasticité, ce qui oblige les marques à proposer des formules sur mesure et des kits de soins holistiques.

- Les produits anti-âge multifonctionnels et minimalistes, composés d'ingrédients naturels de haute qualité, connaissent un succès croissant. Les marques les présentent comme des solutions efficaces pour un mode de vie actif et une exposition réduite aux additifs inutiles, reflétant ainsi les tendances en matière de bien-être et de soins personnels.

Dynamique du marché des ingrédients de soins anti-âge

Conducteur

Activités de marque et de publicité de produits innovants

- Des actions de branding et de publicité efficaces amplifient la croissance du marché en rendant les ingrédients des soins anti-âge rapidement reconnaissables, en renforçant l'engagement des consommateurs et en renforçant leur fidélité dans un environnement concurrentiel. Les marques s'appuient sur le design, les réseaux sociaux et les expériences immersives pour différencier leurs offres.

- Par exemple, DSM et les principaux acteurs de la beauté ont mis en place des partenariats avec des influenceurs et des campagnes en ligne ciblées pour mettre en avant les bienfaits anti-âge cliniquement prouvés d'ingrédients naturels tels que les peptides et les antioxydants. Leurs approches de marque basées sur les données élargissent la portée et accélèrent la conversion des ventes sur les marchés clés.

- Les technologies numériques avancées permettent aux marques d'interagir directement avec les consommateurs, renforçant ainsi la notoriété et l'essai de soins innovants. Les essais virtuels, la personnalisation générée par l'IA et la publicité omnicanale intégrée façonnent les préférences pour le lancement de nouveaux ingrédients sur un marché mondial dynamique.

- L'innovation produit continue de susciter l'enthousiasme des consommateurs, les marques proposant des ingrédients anti-âge axés sur l'efficacité, la science et le bien-être. Des campagnes stratégiques positionnent ces produits comme des incontournables des routines de soins multi-étapes et des régimes de santé holistiques pour tous les âges.

- L'engagement sur les réseaux sociaux et les retours clients aident les marques à adapter rapidement leurs offres. Les entreprises optimisent leur image de marque et leurs messages pour répondre à l'évolution des priorités des consommateurs, créant ainsi un environnement de marché réactif qui stimule une demande soutenue et une expansion du marché.

Retenue/Défi

Augmentation des effets secondaires de certains ingrédients de soins de la peau

- Les effets secondaires liés à certains ingrédients anti-âge constituent un défi persistant, impactant la confiance des consommateurs et la surveillance réglementaire. Les signalements de réactions allergiques, d'éruptions cutanées et de sensibilité cutanée dues à des additifs synthétiques ou à des produits contrefaits minent la confiance dans les solutions anti-âge conventionnelles.

- Par exemple, la sensibilisation croissante aux parabènes, aux sulfates et aux parfums artificiels a entraîné des rappels de produits et des restrictions dans plusieurs pays. Cette surveillance oblige les fabricants à repenser leurs formulations et à se conformer à des réglementations de sécurité en constante évolution, complexifiant ainsi les opérations commerciales.

- La longueur des processus d'approbation des produits et la rigueur des tests ralentissent l'introduction de nouveaux ingrédients. Les cadres réglementaires, notamment en Europe et en Amérique du Nord, exigent des essais exhaustifs pour vérifier l'innocuité et l'efficacité, ce qui retarde les lancements et augmente les coûts de développement pour les fournisseurs.

- Les produits contrefaits et de mauvaise qualité exacerbent les difficultés du marché, car leur disponibilité généralisée et leurs prix compétitifs incitent les consommateurs à se tourner vers des alternatives dangereuses. Ces problèmes incitent l'industrie à investir davantage dans l'authenticité, le suivi et les campagnes de sensibilisation des consommateurs.

- La demande croissante de solutions biologiques et naturelles, alimentée par les inquiétudes liées aux effets secondaires, accroît la pression sur les chaînes d'approvisionnement en ingrédients. Les marques doivent garantir la cohérence, la traçabilité et la sécurité, tout en gérant les fluctuations de coûts et les problèmes d'évolutivité des extraits botaniques et des actifs naturels.

Marché des ingrédients anti-âge pour les soins de la peau

Le marché est segmenté sur la base du produit, de la forme, de la fonction, de l’application et de l’utilisation finale.

- Par produit

En fonction des produits, le marché des ingrédients de soins anti-âge est segmenté comme suit : rétinoïdes, acide hyaluronique, antioxydants, peptides, niacinamide (vitamine B3), acides alpha-hydroxylés (AHA), céramides, oxyde de zinc et dioxyde de titane, acide bêta-hydroxylé (BHA), coenzyme Q10 (ubiquinone), extrait de thé vert, acide alpha-lipoïque, caféine, bakuchiol, squalane, acide kojique, alpha-arbutine, isoflavones de soja, etc. En 2024, le segment des antioxydants a dominé la plus grande part de marché, avec 34,2 % de chiffre d'affaires, grâce à leur capacité avérée à neutraliser les radicaux libres, à protéger contre le stress oxydatif et à ralentir les signes visibles du vieillissement tels que les rides et ridules. Les antioxydants tels que la vitamine C, la vitamine E, l'extrait de thé vert et la coenzyme Q10 sont largement utilisés dans les sérums, les crèmes et les écrans solaires, ce qui leur confère une grande polyvalence dans les formulations de produits. Leur rôle multifonctionnel dans l’éclaircissement de la peau, l’amélioration de la stabilité du collagène et la protection contre les agresseurs environnementaux tels que les rayons UV et la pollution a consolidé leur position de pierre angulaire des soins anti-âge de la peau.

Le segment de l'acide hyaluronique devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par la demande croissante des consommateurs pour des solutions anti-âge hydratantes. L'acide hyaluronique est largement apprécié pour ses propriétés hydratantes, qui améliorent l'élasticité de la peau et réduisent l'apparence des rides. Son utilisation dans les sérums, les masques en tissu et les crèmes hydratantes s'inscrit dans la tendance du clean label, car il est naturellement présent dans l'organisme et bien toléré par tous les types de peau. L'attrait croissant des traitements hydratants non invasifs et son utilisation croissante dans les formulations de comblement dermique renforcent encore son adoption rapide.

- Par formulaire

En termes de forme, le marché est segmenté en poudre, liquide et granulé. Le segment liquide a dominé la plus grande part de marché en 2024, principalement grâce à sa grande applicabilité dans les sérums, les crèmes et les hydratants. Les liquides offrent une meilleure solubilité des ingrédients, une absorption cutanée plus rapide et une formulation facile pour des produits anti-âge multifonctionnels. Ils constituent donc le choix privilégié des fabricants souhaitant combiner plusieurs ingrédients actifs, tels que des antioxydants, des peptides et des rétinoïdes, dans une seule formule.

Le segment des poudres devrait connaître le TCAC le plus rapide entre 2025 et 2032, les marques se tournant de plus en plus vers les ingrédients en poudre pour leur stabilité et leur durée de conservation prolongée. Les poudres permettent aux utilisateurs finaux de mélanger les produits avant application, préservant ainsi leur efficacité et réduisant le recours aux conservateurs. Ce format gagne également en popularité dans les soins DIY, les routines beauté minimalistes et les emballages durables, s'inscrivant parfaitement dans les tendances de consommation éco-responsables.

- Par fonction

En fonction de leur fonction, le marché est segmenté en hydratants, stimulants du collagène, protection solaire, exfoliants, éclaircissants, anti-inflammatoires, réparateurs cutanés, etc. Le segment hydratant détenait la plus grande part de marché en 2024, l'hydratation restant le bénéfice le plus recherché dans les soins anti-âge. Les ingrédients hydratants tels que l'acide hyaluronique, les céramides et le squalane renforcent la fonction barrière cutanée, ce qui en fait des incontournables de la quasi-totalité des formules anti-âge. Ce segment bénéficie de son application universelle à tous les âges, types de peau et climats, renforçant ainsi sa domination à long terme.

Le segment des boosters de collagène devrait connaître sa plus forte croissance entre 2025 et 2032, soutenu par la demande croissante pour une peau plus ferme et plus jeune. Des ingrédients tels que les peptides, les rétinoïdes et la vitamine C sont de plus en plus utilisés dans les formules anti-âge pour leur capacité à stimuler la synthèse du collagène et à atténuer les signes visibles du vieillissement. L'intérêt croissant pour les soins préventifs de la peau dès le plus jeune âge, combiné aux innovations scientifiques dans la technologie des peptides, favorise une adoption accélérée.

- Par application

En fonction de l'application, le marché est segmenté en produits antirides, antipigmentaires, anti-oxydants, produits de comblement dermique, etc. En 2024, le segment antirides a dominé la plus grande part de chiffre d'affaires du marché, en raison de sa position de principal moteur de la demande des consommateurs dans le secteur anti-âge. Grâce à des ingrédients tels que les rétinoïdes, les peptides et l'acide hyaluronique agissant directement sur la réduction des rides, cette catégorie bénéficie d'investissements importants dans le développement de produits et les revendications cliniques. Le vieillissement de la population sur les marchés développés renforce encore sa domination.

Le segment des soins anti-pigmentation devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la sensibilisation croissante des consommateurs à l'hyperpigmentation, aux irrégularités du teint et aux taches solaires. Des ingrédients tels que la niacinamide, l'acide kojique et l'alpha-arbutine connaissent un fort succès dans les formules éclaircissantes et anti-taches. Cette tendance est renforcée par la demande croissante sur les marchés d'Asie-Pacifique, où l'uniformité du teint est une priorité beauté majeure, et sur les marchés occidentaux, où la correction des dommages causés par le soleil est de plus en plus mise en avant.

- Par utilisation finale

En fonction de l'utilisation finale, le marché est segmenté en sérums, crèmes hydratantes, nettoyants, crèmes contour des yeux, huiles visage, masques, toniques, etc. Le segment des sérums a représenté la plus grande part de chiffre d'affaires en 2024, car ils offrent une diffusion concentrée d'ingrédients actifs anti-âge. Leur formule légère et leur pénétration profonde dans la peau les rendent très efficaces pour réduire les rides, éclaircir et hydrater, ce qui séduit fortement les consommateurs haut de gamme et grand public. La préférence croissante des consommateurs pour les sérums multifonctionnels contenant des mélanges d'antioxydants, de peptides et de boosters d'hydratation renforce encore la position de leader de ce segment.

Le segment des crèmes contour des yeux devrait connaître la croissance la plus rapide entre 2025 et 2032, reflétant la prise de conscience croissante des premiers signes de vieillissement qui apparaissent souvent sur la zone délicate du contour de l'œil. Les crèmes contour des yeux sont formulées avec des ingrédients ciblés tels que la caféine, les peptides et l'acide hyaluronique pour atténuer les poches, les ridules et les cernes. La demande croissante des jeunes pour des solutions préventives et les innovations croissantes dans les formules adaptées aux peaux sensibles propulsent sa croissance.

Analyse régionale du marché des ingrédients de soins anti-âge

- L'Asie-Pacifique a dominé le marché des ingrédients de soins anti-âge avec la plus grande part de revenus de 36,70 % en 2024, grâce à la sensibilisation croissante des consommateurs aux soins de la peau, à l'augmentation des revenus disponibles et à l'influence des tendances K-beauty et J-beauty.

- La solide base manufacturière de la région, les lancements de produits innovants et la pénétration croissante du commerce électronique alimentent l'expansion du marché

- L'urbanisation rapide, l'influence croissante des médias sociaux et la demande de formules haut de gamme et naturelles accélèrent encore l'adoption d'ingrédients de soins anti-âge dans la région Asie-Pacifique.

Aperçu du marché chinois des ingrédients anti-âge pour les soins de la peau

En 2024, la Chine détenait la plus grande part du marché des ingrédients de soins anti-âge en Asie-Pacifique, grâce à sa position de leader mondial dans la fabrication et la production de cosmétiques. Sa solide base industrielle, sa réglementation favorable aux produits de soins personnels et son vaste réseau d'exportation d'ingrédients de soins constituent des moteurs de croissance majeurs. La demande est également soutenue par l'adoption croissante des tendances de la K-beauty, l'augmentation du revenu disponible et la préférence croissante des consommateurs pour les formules anti-âge avancées et multifonctionnelles.

Aperçu du marché indien des ingrédients anti-âge pour les soins de la peau

L'Inde connaît la croissance la plus rapide de la région Asie-Pacifique, portée par l'augmentation des revenus disponibles, l'urbanisation galopante et l'adoption croissante de soins de la peau haut de gamme et naturels. La sensibilisation croissante aux routines de soins préventives, l'influence du marketing digital et la préférence pour les produits véganes et issus de sources éthiques renforcent cette adoption. Une population jeune et experte en numérique et la croissance rapide des plateformes de e-commerce stimulent encore l'expansion du marché indien.

Aperçu du marché européen des ingrédients de soins anti-âge

Le marché européen des ingrédients anti-âge pour la peau connaît une croissance constante, porté par une forte demande des consommateurs pour des formules naturelles et biologiques, une réglementation cosmétique stricte et une adoption croissante des soins haut de gamme. L'Europe occidentale privilégie la sécurité, l'efficacité et la durabilité, favorisant ainsi les ingrédients « clean label ». L'intérêt croissant pour les produits anti-âge multifonctionnels et écologiques contribue également à la croissance du marché.

Aperçu du marché allemand des ingrédients anti-âge pour les soins de la peau

Le marché allemand est porté par une préférence pour des formules de haute qualité, testées dermatologiquement, un secteur des soins naturels et biologiques performant, et des investissements constants en R&D. La solide présence des réseaux de distribution et l'intérêt des consommateurs pour la beauté propre accélèrent l'innovation dans les formules anti-âge. La demande est particulièrement forte chez les consommateurs soucieux de leur santé et de l'environnement.

Aperçu du marché britannique des ingrédients anti-âge pour les soins de la peau

Le marché britannique bénéficie d'une adoption croissante des soins haut de gamme, d'une préférence croissante pour les formules non testées sur les animaux et durables, et d'une forte demande pour les produits multifonctionnels. Les consommateurs privilégient l'approvisionnement éthique et les emballages écologiques, tandis que la pénétration du e-commerce améliore l'accessibilité. Les collaborations entre marques de cosmétiques et dermatologues renforcent la confiance des consommateurs et l'adoption par le marché.

Aperçu du marché nord-américain des ingrédients anti-âge pour la peau

L'Amérique du Nord devrait connaître le TCAC le plus rapide entre 2025 et 2032, porté par la préférence croissante des consommateurs pour les soins de la peau luxueux et naturels, la sensibilisation croissante aux routines anti-âge préventives et la forte présence des grandes marques de cosmétiques. La demande de soins personnalisés, de formules propres et de textures innovantes alimente l'expansion régionale.

Aperçu du marché américain des ingrédients anti-âge pour les soins de la peau

En 2024, les États-Unis détenaient la plus grande part du marché nord-américain, grâce à la maturité de leur industrie des soins de la peau, à leurs dépenses de consommation élevées en soins personnels et à leurs capacités de R&D avancées. La préférence croissante pour les ingrédients clean label, naturels et cruelty-free, combinée à une forte adoption du e-commerce, favorise une utilisation généralisée. La présence de grandes marques mondiales de beauté et des stratégies marketing agressives consolident encore le leadership des États-Unis dans la région.

Part de marché des ingrédients de soins anti-âge

L'industrie des ingrédients de soins anti-âge est principalement dirigée par des entreprises bien établies, notamment :

- ADEKA CORPORATION (Japon)

- Beiersdorf AG (Allemagne)

- Croda International Plc (Royaume-Uni)

- BASF SE (Allemagne)

- Wacker Chemie AG (Allemagne)

- Lonza (Suisse)

- CLARIANT (Suisse)

- Evonik Industries AG (Allemagne)

- DSM (Pays-Bas)

- Kao Corporation (Japon)

- BioThrive Sciences (États-Unis)

- Contipro as (République tchèque)

Dernières évolutions du marché mondial des ingrédients anti-âge pour la peau

- En février 2025, Estée Lauder Companies (ELC) a collaboré avec Serpin Pharma pour développer des ingrédients anti-âge innovants, axés sur la longévité. Ce partenariat s'appuie sur l'expertise de Serpin Pharma en recherche anti-inflammatoire, notamment sur les inhibiteurs de sérine protéase, qui aident l'organisme à réparer les cellules enflammées. Cette collaboration devrait renforcer le portefeuille d'ELC en matière de solutions de soins de la peau avancées, en améliorant l'efficacité des produits et en attirant les consommateurs en quête de bienfaits anti-âge durables et scientifiquement prouvés.

- En février 2025, NIVEA MEN a lancé la gamme de soins Age Defense, ciblant les signes courants du vieillissement tels que les rides, la sécheresse, la rugosité, le teint terne et la perte de fermeté. Cette gamme intègre des ingrédients clés comme le thiamidol et l'acide hyaluronique pour des résultats visibles tout en conservant une routine simple. Ce lancement, qui comprend des sérums avancés, des crèmes contour des yeux et une crème hydratante quotidienne avec SPF 30, devrait accroître la part de marché de la marque en s'adressant aux hommes à la recherche de solutions anti-âge complètes et pratiques.

- En janvier 2025, Croda International a annoncé le lancement de LongevityActive, un ingrédient bioactif conçu pour lutter contre le vieillissement cellulaire et le stress oxydatif. Cet ingrédient favorise la réparation cutanée et renforce les défenses antioxydantes naturelles, contribuant ainsi à la formulation de sérums et de soins hydratants de pointe. Ce lancement devrait favoriser la différenciation et l'adoption de produits par les marques de soins haut de gamme axées sur l'efficacité des solutions anti-âge.

- En septembre 2023, BASF a étendu sa production en Asie-Pacifique avec Uvinul A Plus, l'un des rares filtres UVA photostables disponibles, qui protège contre les rayons UVA nocifs, les radicaux libres et les dommages cutanés. Sa forme granulaire liposoluble offre une flexibilité de formulation, une efficacité élevée à faible concentration et l'absence de conservateurs, favorisant ainsi la création de soins solaires et anti-âge longue durée. Cette expansion devrait renforcer la position de BASF sur le marché des soins de la peau en pleine expansion en Asie-Pacifique.

- En mars 2023, DSM a élargi sa gamme PARSOL avec le lancement de PARSOL® DHHB, un filtre UVA polyvalent adapté aux soins multifonctionnels. Son excellente solubilité et sa large compatibilité avec les formulations permettent de créer des crèmes solaires, des soins du visage et des cosmétiques de maquillage offrant une protection UVA adéquate et des notes écologiques élevées. Cette innovation offre aux formulateurs la flexibilité nécessaire pour répondre à la demande croissante des consommateurs pour des soins anti-âge durables, multifonctionnels et performants.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.