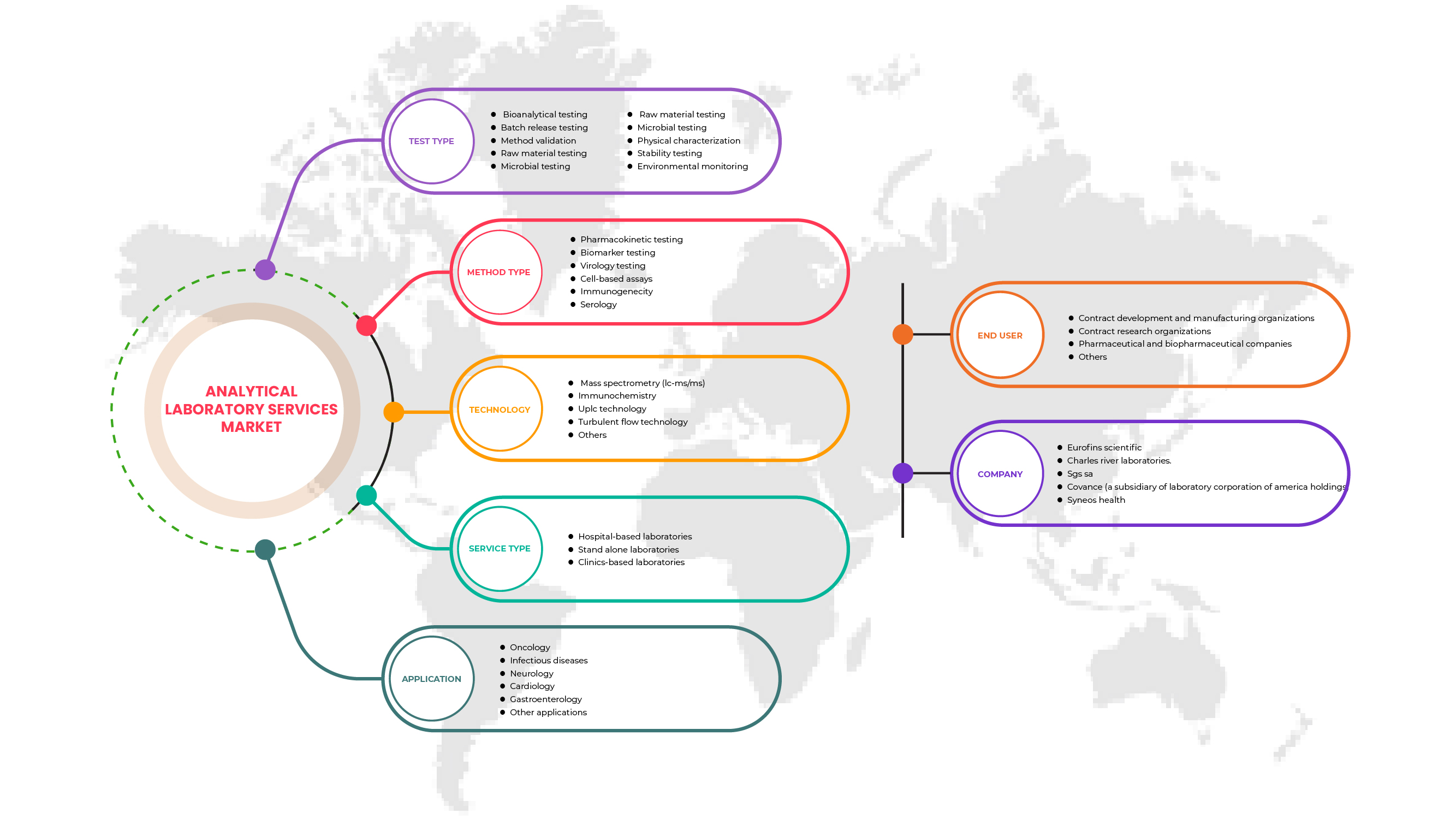

Marché mondial des services de laboratoire d'analyse, par type de test (tests bioanalytiques, tests de libération de lots, tests de stabilité, tests de matières premières, caractérisation physique, validation de méthode, tests microbiens, surveillance de l'environnement), type de service (laboratoires hospitaliers, laboratoires autonomes et laboratoires cliniques), type de méthode (dosages cellulaires, tests de virologie, tests de biomarqueurs, tests pharmacocinétiques, immunogénicité et sérologie), application (oncologie, neurologie, maladies infectieuses , gastroentérologie, cardiologie et autres applications), technologie (spectroscopie de masse (LC-MS/MS), immunochimie, technologie UPLC, technologie d'écoulement turbulent, autres), canal d'utilisateur final (sociétés pharmaceutiques et biopharmaceutiques, organisations de développement et de fabrication sous contrat, organisations de recherche sous contrat et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des services de laboratoire d'analyse

Un certain nombre de services d'analyse sont fournis sur le marché, tels que les tests bioanalytiques, les tests de matières premières, les tests de libération de lots, la validation de produits, la caractérisation physique et autres. Ces services sont largement utilisés dans le secteur de la santé, notamment dans les sociétés pharmaceutiques, les sociétés biopharmaceutiques et les sociétés de dispositifs médicaux. Ces services constituent une source fiable de précision, de qualité et d'efficacité. Ils ont des applications dans des domaines tels que l'oncologie, la neurologie, les maladies infectieuses, la cardiologie et autres. Le marché mondial des services de laboratoire d'analyse se développe avec l'augmentation des initiatives gouvernementales visant à renforcer les capacités de tests analytiques et le nombre croissant d'approbations de médicaments et d'essais cliniques. De plus, l'utilisation et le développement croissants d'un grand nombre de macromolécules et de biosimilaires pour divers domaines thérapeutiques et l'augmentation des dépenses des gouvernements pour créer de nouveaux laboratoires sont d'autres facteurs accélérant la croissance du marché des services de laboratoire.

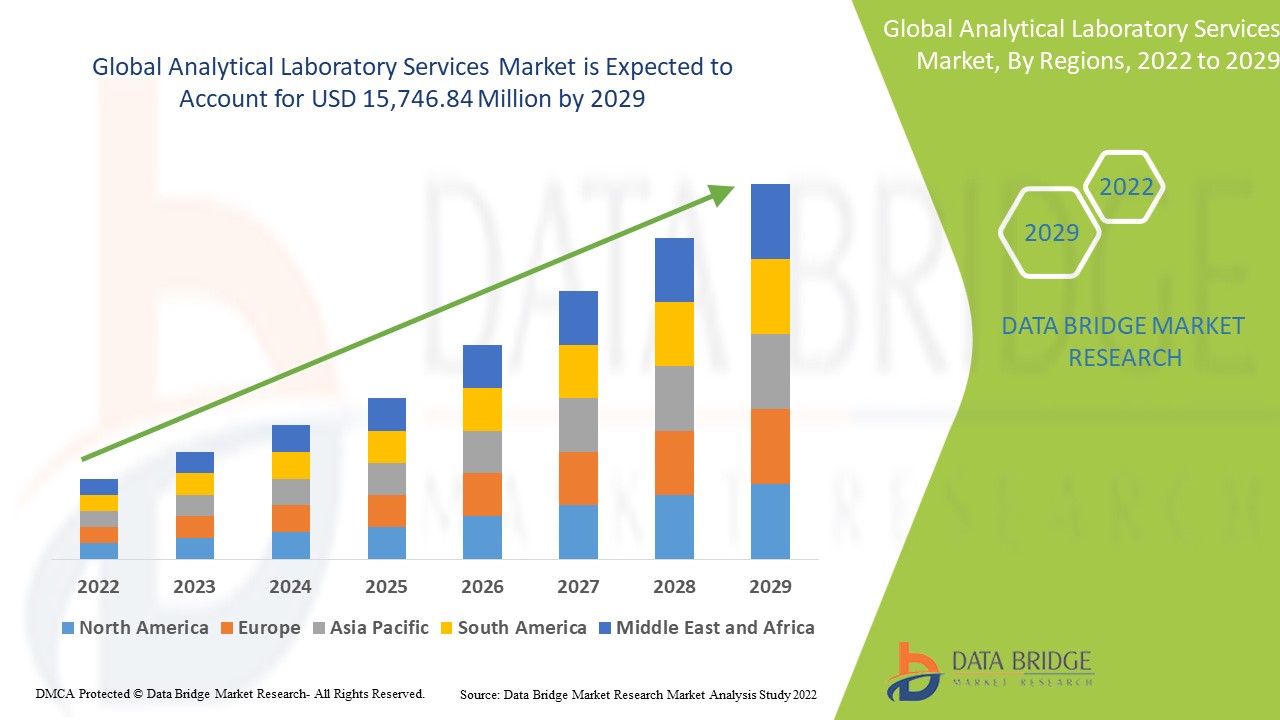

Selon les analyses de Data Bridge Market Research, le marché mondial des services de laboratoire d'analyse devrait atteindre 15 746,84 millions USD d'ici 2029, à un TCAC de 14,7 % au cours de la période de prévision. Le segment des tests bioanalytiques représente le segment d'offre le plus important sur le marché mondial des services de laboratoire d'analyse.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (Personnalisable 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de test (tests bioanalytiques, tests de libération de lots, tests de stabilité, tests de matières premières, caractérisation physique, validation de méthodes, tests microbiens, surveillance environnementale), type de service (laboratoires hospitaliers, laboratoires autonomes et laboratoires cliniques), type de méthode (dosages cellulaires, tests virologiques, tests de biomarqueurs, tests pharmacocinétiques, immunogénicité et sérologie), application (oncologie, neurologie, maladies infectieuses, gastroentérologie, cardiologie et autres applications), technologie ( spectroscopie de masse (LC-MS/MS), immunochimie, technologie UPLC, technologie de flux turbulent, autres), canal d'utilisateur final (sociétés pharmaceutiques et biopharmaceutiques, organisations de développement et de fabrication sous contrat, organisations de recherche sous contrat et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Irlande, Turquie et reste de l'Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, reste de l'Asie-Pacifique (APAC), Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, reste du Moyen-Orient et de l'Afrique, Brésil, Argentine et reste de l'Amérique du Sud |

|

Acteurs du marché couverts |

Charles River Laboratories, Medpace, Wuxi AppTec, Eurofins Scientific, Q2 Solutions (une filiale d'IQVIA), SGS SA, SOLVIAS AG, Covance (une filiale de Laboratory Corporation of America Holdings), Intertek Group plc, Pharmaceutical Research Associates Inc., Syneos Health, ICON plc, Frontage labs, Laboratory Corporation of American Holdings, TOXIKON, PRA Health Sciences, Bioscreen testing services, VxP Pharma, Inc., PPD Inc. (une filiale de Thermo Fisher Scientific Inc.), ALS Limited, Shanghai Medicilon inc., Evotec SE, BioAgilytix Labs et Pace Analytical Services, LLC, entre autres |

Définition du marché

Les services de laboratoire analytique concernent une large gamme d'analyses chimiques et microbiologiques. Les services de laboratoire analytique comprennent le développement et la validation de méthodes, l'analyse d'échantillons pour la confirmation de la concentration, les analyses de pureté, d'homogénéité et de stabilité sur les formulations préliminaires et les produits pharmaceutiques finalisés pour les soumissions IND, NDA et ANDA. Les services analytiques, également appelés « tests de matériaux », décrivent diverses techniques utilisées pour identifier la composition chimique ou les caractéristiques d'un échantillon particulier. Les fabricants de secteurs tels que les produits pharmaceutiques, alimentaires, électroniques et plastiques utilisent souvent des tests analytiques pour l'ingénierie inverse ou l'analyse des défaillances et l'identification des contaminants ou des taches sur les produits

Dynamique du marché

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Dépenses croissantes en médicaments et dispositifs médicaux

L'essor des industries pharmaceutiques et biotechnologiques va accroître le marché de ces services d'analyse, car elles dépendent des marchés des médicaments pour fournir des services tels que les tests pharmacocinétiques et autres tests par lots et tests microbiens. Par conséquent, il devrait servir de moteur à la croissance du marché mondial des services de laboratoire d'analyse au cours de la période de prévision.

- Initiatives gouvernementales visant à renforcer les capacités de tests analytiques

Le financement gouvernemental et les initiatives visant à étendre les services d’analyse aideront le marché à se développer et à accroître le nombre d’acteurs sur le marché au cours de la période de prévision. Cela devrait augmenter la taille du marché et servir de moteur à la croissance du marché mondial des services de laboratoire d’analyse au cours de la période de prévision.

- Augmentation du nombre d'approbations de médicaments et d'essais cliniques

Les acteurs du marché confient le processus de test analytique à la recherche contractuelle. En outre, l'industrie biopharmaceutique en pleine croissance, avec une production de médicaments accrue et la recherche de nouveaux produits, devrait servir de moteur à la croissance du marché mondial des services de laboratoire analytique au cours de la période de prévision.

Opportunité

-

Accroître la collaboration entre les acteurs du marché

Les collaborations sur le marché sont le principal facteur qui devrait créer des opportunités sur le marché. Des accords, des partenariats et des collaborations sont conclus pour surmonter des obstacles tels qu'une présence mondiale et une chaîne d'approvisionnement limitées et pour augmenter le portefeuille de services. Sur le marché mondial des services de laboratoire d'analyse, divers acteurs du marché ont réalisé cela, créant ainsi des opportunités sur le marché.

Contraintes/Défis

- Coût élevé d'un laboratoire d'analyse avancé

L'investissement considérable nécessaire à la mise en place d'une installation bioanalytique dotée d'un instrument limité et hautement efficace devrait limiter la croissance du marché en raison des coûts d'investissement élevés. Cela devrait constituer un frein à la croissance du marché mondial des services de laboratoire d'analyse au cours de la période de prévision.

Impact du COVID-19 sur le marché mondial des services de laboratoire d'analyse

La COVID-19 a eu un impact majeur sur diverses industries, car presque tous les pays ont opté pour la fermeture de toutes les installations, à l'exception de celles qui traitent des biens essentiels. Le gouvernement a pris des mesures strictes, telles que la fermeture des installations et la vente de biens non essentiels, le blocage du commerce international et bien d'autres, pour empêcher la propagation de la COVID-19. Les seules entreprises confrontées à cette situation de pandémie étaient les services essentiels autorisés à ouvrir et à exécuter leurs processus.

La COVID-19 a eu un impact négatif sur le marché des services de laboratoire d'analyse. En raison de l'annulation de l' essai clinique , la demande de services d'analyse a également été perturbée. La majeure partie de ces services d'analyse provient des essais cliniques et des CRO, qui sont gravement touchés. Cependant, certains acteurs du marché, tels qu'Eurofins Scientific, qui peut fournir un soutien analytique, ont réussi à minimiser les pertes pendant la COVID-19. La chaîne d'approvisionnement a été perturbée car le matériel et le solvant qui étaient obligatoires pour ces tests analytiques ont rencontré des difficultés au niveau du service des douanes et n'ont pas été autorisés à traverser les frontières internationales.

Par conséquent, le COVID-19 a eu un impact négatif sur le secteur des tests analytiques, mais l’initiative stratégique des acteurs du marché réussit en quelque sorte à minimiser la perte de revenus nets ou de revenus segmentaires.

Développements récents

- En février 2021, Eurofins Scientific a annoncé l'acquisition de Beacon Discovery, une organisation de recherche contractuelle et de découverte de médicaments de premier plan. Cela permettra à l'entreprise d'accéder plus facilement à la recherche contractuelle et d'augmenter ses revenus.

- En avril 2021, SGS SA a annoncé que la société SYNLAB Analytics & Services s'appellerait désormais SGS Analytics, suite à l'acquisition du leader européen des services de tests et de tribologie dans les domaines de l'environnement, de l'alimentation et de la santé. Cette acquisition permettra de poursuivre la croissance et l'innovation en aidant les entreprises à se conformer aux réglementations toujours plus strictes visant à garantir la sécurité alimentaire, pharmaceutique et environnementale

Portée du marché mondial des services de laboratoire d'analyse

Le marché mondial des services d'analyse en laboratoire est segmenté en fonction du type de test, du type de service, du type de méthode, de l'application, de la technologie et des utilisateurs finaux. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par type de test

- Tests bioanalytiques

- Test de libération des lots

- Validation de la méthode

- Test des matières premières

- Tests microbiens

- Caractérisation physique

- Test de stabilité

- Surveillance environnementale

Sur la base du type de test, le marché mondial des services de laboratoire d'analyse est segmenté en tests bioanalytiques, tests de libération de lots, tests de stabilité, tests de matières premières, caractérisation physique, validation de méthode, tests microbiens et surveillance environnementale.

Par type de service

- Laboratoires hospitaliers

- Laboratoires autonomes

- Laboratoires en clinique

Sur la base du type de service, le marché mondial des services de laboratoire d’analyse est segmenté en laboratoires hospitaliers, laboratoires autonomes et laboratoires cliniques.

Par type de méthode

- Tests pharmacocinétiques

- Test de biomarqueurs

- Tests virologiques

- Essais basés sur les cellules

- Immunogénicité

- Sérologie

On the basis of method type, the global analytical laboratory services market is segmented into cell-based assays, virology testing, biomarker testing, pharmacokinetic testing, immunogenicity and serology.

By Application

- Oncology

- Neurology

- Infectious disease

- Cardiology

- Gastroenterology

- Others

On the basis of application, the global analytical laboratory services market is segmented into oncology, neurology, infectious diseases, gastroenterology, cardiology and other applications.

By Technology

- Mass spectroscopy

- Immunochemistry

- UPLC technology

- Turbulent flow technology

- Others

On the basis of technology, the global analytical laboratory services market is segmented into mass spectroscopy, immunochemistry, UPLC technology, turbulent flow technology and others.

By End-User

- Pharmaceutical and biopharmaceutical companies

- Contract development and manufacturing organizations

- Contract research organizations

- Others

On the basis of end user, the global analytical laboratory services market is segmented into pharmaceutical & biopharmaceutical industries, contract development & manufacturing organizations, contract research organizations and others.

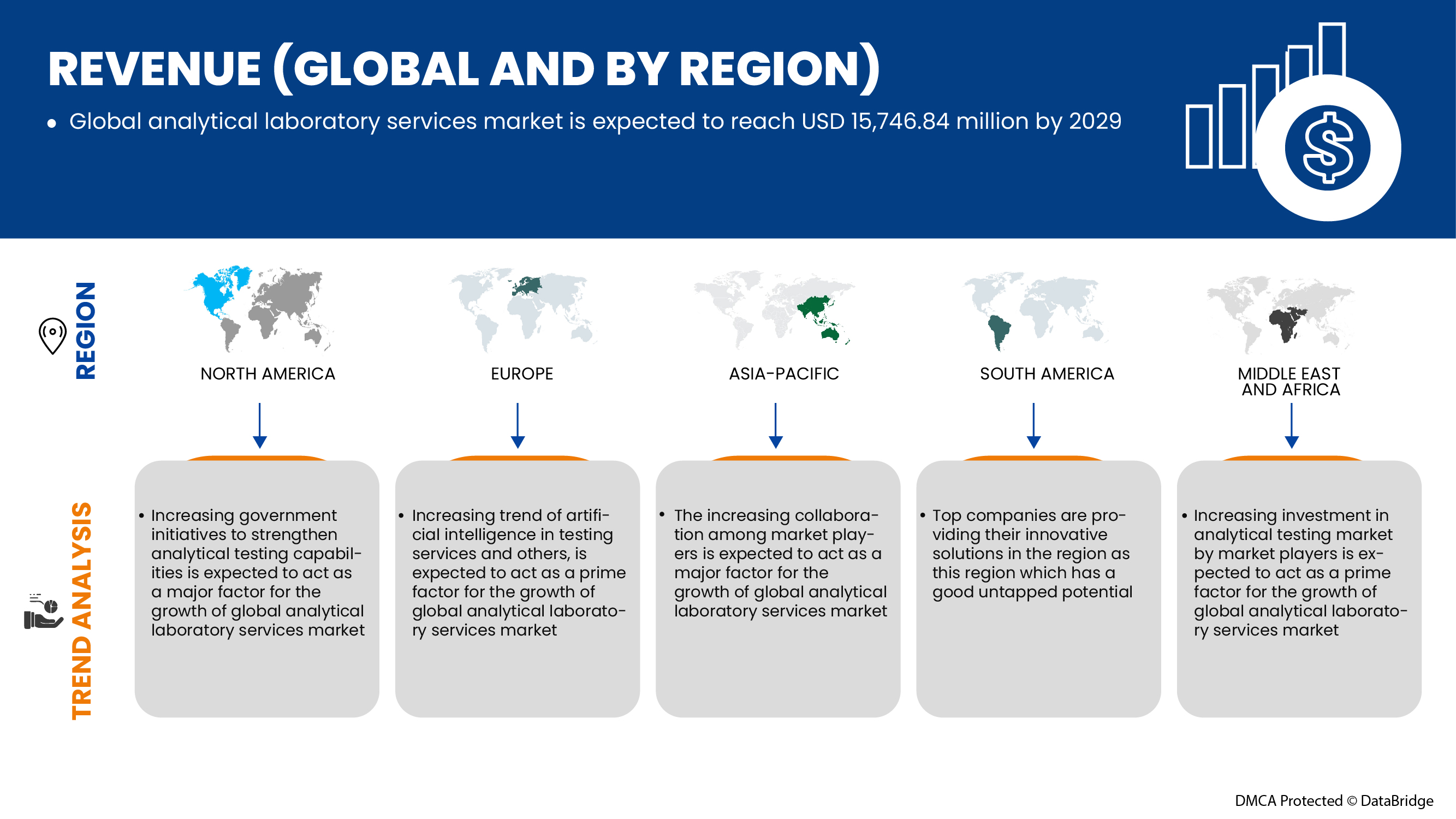

Analytical Laboratory Services Market Regional Analysis/Insights

The global analytical laboratory services market is analysed and market size insights and trends are provided by country, test type, service type, method type, application, technology and end user as referenced above.

The countries covered in the global analytical laboratory services market report are the U.S., Canada and Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Ireland, Turkey and rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa, Brazil, Argentina and rest of South America.

North America is expected to dominate the market due to high expenditure on quality testing, strong regulatory scenarios, an increasing number of clinical trials and well-established federal testing laboratories in the region. The U.S. is expected to dominate the North America analytical laboratory services market owing to the increasing development of laboratories.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Analyse du paysage concurrentiel et des parts de marché des services de laboratoire d'analyse

Le paysage concurrentiel du marché mondial des services de laboratoire d'analyse fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché mondial des services de laboratoire d'analyse.

Français Certaines des principales entreprises fournissant des services de laboratoire d'analyse sur le marché mondial des services de laboratoire d'analyse sont Charles River Laboratories, Medpace, Wuxi AppTec, Eurofins Scientific, Q2 Solutions (une filiale d'IQVIA), SGS SA, SOLVIAS AG, Covance (une filiale de Laboratory Corporation of America Holdings), Intertek Group plc, Pharmaceutical Research Associates Inc., Syneos Health, ICON plc, Frontage labs, Laboratory Corporation of American Holdings, TOXIKON, PRA Health Sciences, Bioscreen testing services, VxP Pharma, Inc., PPD Inc. (une filiale de Thermo Fisher Scientific Inc.), ALS Limited, Shanghai Medicilon inc., Evotec SE, BioAgilytix Labs et Pace Analytical Services, LLC, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of GLOBAl ANALYTICAL LABORATORY SERVICES MARKET

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- Method type LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- MARKET APPLICATION COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- PREMIUM INSIGHTS

- REGULATORY SCENARIO IN GLOBAL ANALYTICAL LABORATORY SERVICES MARKET

- Qualification of Analytical Instruments in the QC

- Validation of Analytical Procedures

- REGULATORY GUIDELINES FOR CHINA

- REGULATORY GUIDELINES FOR EMA GMP REQUIREMENT (FOR QUALITY)

- Market Overview

- drivers

- growing expenditure on drugs and medical devices

- government initiatives to strengthen analytical testing capabilities

- increasing number of drug approvals & clinical trials

- rising demand for specialized analytical testing services

- increasing investment in analytical testing by market players

- Restraints

- Limitation in analyzing novel complex products

- Cost of laboratory testing for drug development

- maintenance and updating of equipment

- High cost setting an advanced analytical lab

- opportunities

- Increasing collaboration among market players

- IncreAsing outsourcing facilities

- Increasing trend of artificial intelligence in testing services

- challenges

- Maintaining regulatory standard for testing

- development and maintenance of expertise

- IMPACT OF COVID-19 ON THE GLOBAL ANALYTICAL LABORATORY SERVICES MARKET

- IMPACT ON PRICE

- IMPACT IN DEMAND

- IMPACT ON SUPPLY

- STRATEGIC INITIATIVES

- CONCLUSION

- global analytical laboratory services MARKET, BY test type

- overview

- bioanalytical testing

- Pharmacokinetic test

- Pharmacodynamic test

- bioequivalence test

- bioavailability test

- other test

- batch release testing

- method validation

- raw material testing

- microbial testing

- physical characterization

- stability testing

- environmental monitoring

- GLOBAL ANALYTICAL LABORATORY SERVICES MARKET, BY service type

- overview

- hospital-based laboratories

- standalone laoratories

- clinics-based laboratories

- global Analytical laboratory services MARKET, BY method type

- overview

- Pharmacokinetic Testing

- Biomarker Testing

- Virology Testing

- In Vitro Virology Testing

- In Vivo Virology Testing

- Species-Specific Viral PCR Assays

- Cell-Based Assays

- Viral Cell-Based Assays

- Bacterial Cell-Based Assays

- Immunogenicity

- Serology

- global Analytical laboratory services MARKET, BY Application

- overview

- Oncology

- Infectious Diseases

- Neurology

- Cardiology

- Gastroenterology

- Other Applications

- global Analytical laboratory services MARKET, BY technology

- overview

- Mass Spectrometry (LC-MS/MS)

- Immunochemistry

- UPLC Technology

- Turbulent Flow Technology

- others

- Global analytical laboratory services Market, By end user

- overview.

- contract development and manufacturing organizations

- contract research organizations

- pharmaceutical and biopharmaceutical companies

- others

- GLOBAL ANALYTICAL LABORATORY SERVICES MARKET, by Geography

- overview

- North America

- U.S.

- Canada

- MEXICO

- Europe

- Germany

- france

- u.k.

- ITALY

- Spain

- RUSSIA

- turkey

- Ireland

- BElgium

- Netherlands

- switzerland

- rest of europe

- ASIA-PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- AUSTRALIA

- SINGAPORE

- THAILAND

- MALAYSIA

- INDONESIA

- PHILIPPINES

- REST OF ASIA-PACIFIC

- south america

- brazil

- argentina

- rest of south america

- MIDDLE EAST & AFRICA

- SOUTH AFRICA

- SAUDI ARABIA

- UAE

- EGYPT

- ISRAEL

- REST OF MIDDLE EAST & AFRICA

- Global Analytical Laboratory Services Market: COMPANY landscape

- company share analysis: Global

- company share analysis: North America

- company share analysis: Europe

- company share analysis: Asia-Pacific

- SWOT

- company profiles

- eurofins scientific

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- charles river Laboratories

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SGS SA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- covance (A subsidiary of Laboratory Corporation of America Holdings)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- wuxi apptec

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Syneos Health

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SOLUTION PORTFOLIO

- RECENT DEVELOPMENTS

- Pharmaceutical Research Associates Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- AGENZIA ITALIANA DEL FARMACO - AIFA

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- ALS Limited

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BIOAGILYTIX LABS

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- Central drugs standard control organization

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- EUROPEAN MEDICINES AGENCY

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- evotec se

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- FEDERAL INSTITUTE FOR DRUGS & MEDICAL DEVICES (BFARM)

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- FOOD SAFETY AND DRUG ADMINISTRATION DEPARTMENT

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- Frontage Labs

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE & SOLUTION PORTFOLIO

- RECENT DEVELOPMENTS

- ICON PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- INTERTEK GROUP PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- INDUSTRY & SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- MEDPACE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- National Medical Products administration

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- Pace Analytical Services, LLC

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- pharmaceuticals and medical devices agency

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- q2 solutions (a subsidiary of iqvia)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SOLUTION PORTFOLIO

- RECENT DEVELOPMENTS

- SHANGHAI MEDICILON INC.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- SPANISH AGENCY FOR MEDICINES AND HEALTH PRODUCTS

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- solvias Ag

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- toxikon

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- VxP Pharma, Inc.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

Liste des tableaux

TABLE 1 global ANALYTICAL LABORATORY SERVICES Market, By test type 2019-2028 (USD Million)

TABLE 2 Global Bioanalytical testing in Analytical Laboratory Services Market, By Region, 2019-2028 (USD Million)

TABLE 3 global BioANALYTICAL testing in analytical LABORATORY SERVICES Market, By test type 2019-2028 (USD Million)

TABLE 4 globaL batch release testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 5 globaL method validation in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 6 globaL raw material testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 7 globaL microbial testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 8 globaL physical characterization in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 9 globaL stability testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 10 globaL environmental monitoring in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 11 global ANALYTICAL LABORATORY SERVICES Market, By DIAGNOSTICS TYPE, 2019-2028 (USD Million)

TABLE 12 Global Hospital-Based Laboratories in Analytical Laboratories Services Market, By Region, 2019-2028 (USD Million)

TABLE 13 Global standalone Laboratories in Analytical Laboratories Services Market, By Region, 2019-2028 (USD Million)

TABLE 14 Global clinics-based laboratories in Analytical Laboratories Services Market, By Region, 2019-2028 (USD Million)

TABLE 15 globaL Pharmacokinetic Testing in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 16 globaL Biomarker Testing in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 17 globaL Virology Testing in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 18 Global Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 19 globaL Cell-Based Assays in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 20 Global Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 21 globaL Immunogenicity in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 22 globaL Serology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 23 globaL oncology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 24 globaL infectious diseases in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 25 globaL neurology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 26 globaL Cardiology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 27 globaL gastroenterology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 28 globaL other applications in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 29 globaL Mass Spectrometry (LC-MS/MS) in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 30 globaL immunochemistry in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 31 globaL UPLC Technology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 32 globaL turbulent flow technology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 33 globaL others in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 34 Global analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 35 Global contract development and manufacturing organizations in analytical laboratory services market, By end user, 2019-2028 (USD Million), By Region

TABLE 36 Global contract research organizations in analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 37 Global pharmaceutical and biopharmaceutical companies in analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 38 Global others in analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 39 Global Analytical laboratory servicesmarket, By Region, 2019-2028 (USD Million)

TABLE 40 North america analytical laboratory services market, By Country, 2019-2028 (USD Million)

TABLE 41 North America Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 42 North America Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 43 North America Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 44 North America Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 45 North America Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 46 North America Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 47 North America Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 48 North America Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 49 North America Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 50 U.S. Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 51 U.S. Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 52 U.S. Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 53 U.S. Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 54 U.S. Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 55 U.S. Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 56 U.S. Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 57 U.S. Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 58 U.S. Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 59 CANADA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 60 CANADA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 61 CANADA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 62 CANADA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 63 CANADA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 64 CANADA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 65 CANADA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 66 CANADA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 67 CANADA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 68 MEXICO Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 69 MEXICO Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 70 MEXICO Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 71 MEXICO Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 72 MEXICO Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 73 MEXICO Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 74 MEXICO Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 75 MEXICO Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 76 mexico Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 77 Europe analytical laboratory services market, By Country, 2019-2028 (USD Million)

TABLE 78 Europe Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 79 Europe Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 80 Europe Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 81 Europe Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 82 Europe Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 83 Europe Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 84 Europe Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 85 Europe Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 86 Europe Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 87 GERMANY Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 88 GERMANY Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 89 GERMANY Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 90 GERMANY Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 91 GERMANY Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 92 GERMANY Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 93 GERMANY Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 94 GERMANY Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 95 GERMANY Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 96 FRANCE Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 97 FRANCE Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 98 FRANCE Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 99 FRANCE Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 100 FRANCE Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 101 FRANCE Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 102 FRANCE Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 103 FRANCE Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 104 FRANCE Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 105 U.K. Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 106 U.K. Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 107 U.K. Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 108 U.K. Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 109 U.K. Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 110 U.K. Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 111 U.K. Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 112 U.K. Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 113 U.K. Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 114 ITALY Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 115 ITALY Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 116 ITALY Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 117 ITALY Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 118 ITALY Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 119 ITALY Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 120 ITALY Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 121 ITALY Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 122 italy Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 123 SPAIN Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 124 SPAIN Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 125 SPAIN Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 126 SPAIN Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 127 SPAIN Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 128 SPAIN Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 129 SPAIN Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 130 SPAIN Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 131 SPAIN Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 132 RUSSIA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 133 RUSSIA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 134 RUSSIA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 135 RUSSIA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 136 RUSSIA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 137 RUSSIA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 138 RUSSIA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 139 RUSSIA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 140 russia Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 141 TURKEY Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 142 TURKEY Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 143 TURKEY Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 144 TURKEY Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 145 TURKEY Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 146 TURKEY Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 147 TURKEY Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 148 TURKEY Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 149 turkey Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 150 IRELAND Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 151 IRELAND Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 152 IRELAND Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 153 IRELAND Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 154 IRELAND Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 155 IRELAND Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 156 IRELAND Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 157 IRELAND Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 158 ieland Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 159 BELGIUM Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 160 BELGIUM Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 161 BELGIUM Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 162 BELGIUM Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 163 BELGIUM Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 164 BELGIUM Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 165 BELGIUM Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 166 BELGIUM Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 167 belgium Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 168 NETHERLANDS Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 169 NETHERLANDS Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 170 NETHERLANDS Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 171 NETHERLANDS Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 172 NETHERLANDS Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 173 NETHERLANDS Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 174 NETHERLANDS Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 175 NETHERLANDS Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 176 Netherlands Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 177 SWITZERLAND Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 178 SWITZERLAND Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 179 SWITZERLAND Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 180 SWITZERLAND Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 181 SWITZERLAND Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 182 SWITZERLAND Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 183 SWITZERLAND Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 184 SWITZERLAND Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 185 switzerland Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 186 rest of europe Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 187 ASIA-PACIFIC analytical laboratory services market, By Country, 2019-2028 (USD Million)

TABLE 188 ASIA-PACIFIC Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 189 ASIA-PACIFIC Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 190 ASIA-PACIFIC Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 191 ASIA-PACIFIC Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 192 ASIA-PACIFIC Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 193 ASIA-PACIFIC Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 194 ASIA-PACIFIC Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 195 ASIA-PACIFIC Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 196 ASIA-PACIFIC Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 197 CHINA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 198 CHINA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 199 CHINA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 200 CHINA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 201 CHINA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 202 CHINA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 203 CHINA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 204 CHINA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 205 CHINA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 206 JAPAN Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 207 JAPAN Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 208 JAPAN Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 209 JAPAN Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 210 JAPAN Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 211 JAPAN Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 212 JAPAN Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 213 JAPAN Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 214 JAPAN Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 215 INDIA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 216 INDIA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 217 INDIA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 218 INDIA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 219 INDIA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 220 INDIA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 221 INDIA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 222 INDIA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 223 INDIA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 224 EQYPT Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 225 SOUTH KOREA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 226 SOUTH KOREA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 227 SOUTH KOREA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 228 SOUTH KOREA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 229 SOUTH KOREA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 230 SOUTH KOREA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 231 SOUTH KOREA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 232 SOUTH KOREA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 233 AUSTRALIA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 234 AUSTRALIA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 235 AUSTRALIA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 236 AUSTRALIA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 237 AUSTRALIA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 238 AUSTRALIA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 239 AUSTRALIA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 240 AUSTRALIA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 241 AUSTRALIA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 242 SINGAPORE Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 243 SINGAPORE Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 244 SINGAPORE Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 245 SINGAPORE Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 246 SINGAPORE Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 247 SINGAPORE Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 248 SINGAPORE Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 249 SINGAPORE Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 250 SINGAPORE Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 251 THAILAND Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 252 THAILAND Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 253 THAILAND Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 254 THAILAND Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 255 THAILAND Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 256 THAILAND Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 257 THAILAND Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 258 THAILAND Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 259 THAILAND Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 260 MALAYSIA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 261 MALAYSIA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 262 MALAYSIA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 263 MALAYSIA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 264 MALAYSIA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 265 MALAYSIA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 266 MALAYSIA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 267 MALAYSIA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 268 MALAYSIA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 269 INDONESIA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 270 INDONESIA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 271 INDONESIA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 272 INDONESIA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 273 INDONESIA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 274 INDONESIA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 275 INDONESIA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 276 INDONESIA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 277 INDONESIA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 278 PHILIPPINES Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 279 PHILIPPINES Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 280 PHILIPPINES Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 281 PHILIPPINES Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 282 PHILIPPINES Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 283 PHILIPPINES Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 284 PHILIPPINES Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 285 PHILIPPINES Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 286 PHILIPPINES Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 287 REST OF ASIA-PACIFIC Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 288 South America analytical laboratory services market, By Country, 2019-2028 (USD Million)

TABLE 289 South America Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 290 South America Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 291 South America Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 292 South America Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 293 South America Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 294 South America Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 295 South America Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 296 South America Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 297 South America Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 298 BRAZIL Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 299 BRAZIL Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 300 BRAZIL Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 301 BRAZIL Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 302 BRAZIL Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 303 BRAZIL Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 304 BRAZIL Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 305 BRAZIL Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 306 BRAZIL Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 307 ARGENTINA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 308 ARGENTINA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 309 Argentina Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 310 ARGENTINA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 311 Argentina Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 312 Argentina Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 313 Argentina Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 314 Argentina Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 315 Argentina Analytical Laboratory Services Market, By end User, 2019-2028 (USD Million)

TABLE 316 rest of south america Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 317 MIDDLE EAST & AFRICA analytical laboratory services market, By Country, 2019-2028 (USD Million)

TABLE 318 MIDDLE EAST & AFRICA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 319 MIDDLE EAST & AFRICA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 320 MIDDLE EAST & AFRICA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 321 MIDDLE EAST & AFRICA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 322 MIDDLE EAST & AFRICA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 323 MIDDLE EAST & AFRICA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 324 MIDDLE EAST & AFRICA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 325 MIDDLE EAST & AFRICA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 326 MIDDLE EAST & AFRICA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 327 SOUTH AFRICA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 328 SOUTH AFRICA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 329 SOUTH AFRICA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 330 SOUTH AFRICA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 331 SOUTH AFRICA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 332 SOUTH AFRICA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 333 SOUTH AFRICA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 334 SOUTH AFRICA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 335 SOUTH AFRICA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 336 SAUDI ARABIA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 337 SAUDI ARABIA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 338 SAUDI ARABIA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 339 SAUDI ARABIA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 340 SAUDI ARABIA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 341 SAUDI ARABIA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 342 SAUDI ARABIA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 343 SAUDI ARABIA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 344 SAUDI ARABIA Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 345 UAE Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 346 UAE Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 347 UAE Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 348 UAE Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 349 UAE Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 350 UAE Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 351 UAE Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 352 UAE Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 353 UAE Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 354 EQYPT Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 355 EGYPT Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 356 EGYPT Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 357 EGYPT Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 358 EGYPT Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 359 EGYPT Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 360 EGYPT Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 361 EGYPT Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 362 EGYPT Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 363 ISRAEL Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 364 ISRAEL Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 365 ISRAEL Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 366 ISRAEL Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 367 ISRAEL Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 368 ISRAEL Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 369 ISRAEL Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 370 ISRAEL Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 371 ISRAEL Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 372 REST OF MIDDLE EAST & AFRICA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

Liste des figures

FIGURE 1 Global analytical laboratory services MARKET: SEGMENTATION

FIGURE 2 GLOBAL ANALYTICAL LABORORATORY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 global ANALYTICAL LABORATORY SERVICES Market: DROC ANALYSIS

FIGURE 4 Global ANALYTICAL LABORATORY SERVICES market: Global VS REGIONAL MARKET ANALYSIS

FIGURE 5 Global ANALYTICAL LABORATORY SERVICES Market: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ANALYTICAL LABORATORY SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL ANALYTICAL LABORATORY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL ANALYTICAL LABORATORY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL ANALYTICAL LABORATORY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL ANALYTICAL LABORATORY SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 Global ANALYTICAL LABORATORY SERVICES market: SEGMENTATION

FIGURE 12 NORTH AMERICA is expected to DOMINATE THE GLOBAL ANALYTICAL LABORATORY SERVICES market, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 13 GROWING EXPENDITURE ON DRUGS and medical devices is DRIVing THE global ANALYTICAL LABORATORY SERVICES MARKET IN THE FORECAST PERIOD OF 2021 to 2028

FIGURE 14 Bioanalytical Testing SEGMENT is expected to account for the largest share of the global ANALYTICAL LABORATORY SERVICES MARKET in 2021 & 2028

FIGURE 15 north america is the fastest growing market FOR the ANALYTICAL LABORATORY SERVICES MANUFACTURERS IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 16 OVERVIEW OF DIFFERENT GUIDELINES AROUND THE GLOBE

FIGURE 17 CGMP REQUIREMENT FOR ANALYTICAL LABORATORY INCLUDES:

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGEs OF GLOBAL ANALYTICAL LABORATORY SERVICES MARKET

FIGURE 19 Increasing Prescription of Drugs

FIGURE 20 global ANALYTICAL LABORATORY SERVICES market: BY test type, 2020

FIGURE 21 global ANALYTICAL LABORATORY SERVICES market: BY test type, 2020-2028 (USD Million)

FIGURE 22 global ANALYTICAL LABORATORY SERVICES market: BY test type, CAGR (2021-2028)

FIGURE 23 global ANALYTICAL LABORATORY SERVICES market: BY test type, LIFELINE CURVE

FIGURE 24 global ANALYTICAL LABORATORY SERVICES market: BY service TYPE, 2020

FIGURE 25 global ANALYTICAL LABORATORY SERVICES market: BY service TYPE 2020-2028 (USD Million)

FIGURE 26 global ANALYTICAL LABORATORY SERVICES market: BY service TYPE, CAGR (2021-2028)

FIGURE 27 global ANALYTICAL LABORATORY SERVICES market: BY service TYPE, LIFELINE CURVE

FIGURE 28 global Analytical laboratory services market: BY method type, 2020

FIGURE 29 global Analytical laboratory services market: BY method type, 2020-2028 (USD Million)

FIGURE 30 global Analytical laboratory services market: BY method type, CAGR (2020-2028)

FIGURE 31 global Analytical laboratory services market: BY method type, LIFELINE CURVE

FIGURE 32 global Analytical laboratory services market: BY application, 2020

FIGURE 33 global Analytical laboratory services market: BY application, 2020-2028 (USD Million)

FIGURE 34 global Analytical laboratory services market: BY application, CAGR (2020-2028)

FIGURE 35 global Analytical laboratory services market: BY application, LIFELINE CURVE

FIGURE 36 global Analytical laboratory services market: BY technology, 2020

FIGURE 37 global Analytical laboratory services market: BY technology, 2020-2028 (USD Million)

FIGURE 38 global Analytical laboratory services market: BY technology, CAGR (2020-2028)

FIGURE 39 global Analytical laboratory services market: BY technology, LIFELINE CURVE

FIGURE 40 Global analytical laboratory services market: By end user, 2020

FIGURE 41 Global analytical laboratory services market: By end user, 2020-2028 (USD Million)

FIGURE 42 Global analytical laboratory services market: By end user, CAGR (2020-2028)

FIGURE 43 Global analytical laboratory services market: By end user, LIFELINE CURVE

FIGURE 44 Global analytical laboratory servicesmarket: SNAPSHOT (2020)

FIGURE 45 Global analytical laboratory servicesmarket: BY Region (2020)

FIGURE 46 Global analytical laboratory servicesmarket: BY Region (2021 & 2028)

FIGURE 47 Global analytical laboratory servicesmarket: BY Region (2020 & 2028)

FIGURE 48 Global analytical laboratory servicesmarket: BY test type (2021-2028)

FIGURE 49 North america ANALYTICAL LABORATORY SERVICES MARKET: SNAPSHOT (2020)

FIGURE 50 North america ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2020)

FIGURE 51 North america ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 52 North america ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 53 North america ANALYTICAL LABORATORY SERVICES MARKET: BY type (2021-2028)

FIGURE 54 Europe ANALYTICAL LABORATORY SERVICES MARKET: SNAPSHOT (2020)

FIGURE 55 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2020)

FIGURE 56 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 57 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 58 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY type (2021-2028)

FIGURE 59 ASIA-PACIFIC ANALYTICAL LABORATORY SERVICES MARKET: SNAPSHOT (2020)

FIGURE 60 ASIA-PACIFIC ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2020)

FIGURE 61 ASIA-PACIFIC ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 62 ASIA-PACIFIC ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 63 ASIA-PACIFIC ANALYTICAL LABORATORY SERVICES MARKET: BY type (2021-2028)

FIGURE 64 South America ANALYTICAL LABORATORY SERVICES MARKET: SNAPSHOT (2020)

FIGURE 65 South America ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2020)

FIGURE 66 South America ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 67 South America ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 68 South America ANALYTICAL LABORATORY SERVICES MARKET: BY type (2021-2028)

FIGURE 69 MIDDLE EAST & AFRICA ANALYTICAL LABORATORY SERVICES MARKET: SNAPSHOT (2020)

FIGURE 70 MIDDLE EAST & AFRICA ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2020)

FIGURE 71 MIDDLE EAST & AFRICA ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 72 MIDDLE EAST & AFRICA ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 73 MIDDLE EAST & AFRICA ANALYTICAL LABORATORY SERVICES MARKET: BY type (2021-2028)

FIGURE 74 Global Analytical Laboratory Services Market: company share 2020 (%)

FIGURE 75 North America Analytical Laboratory Services Market: company share 2020 (%)

FIGURE 76 Europe Analytical Laboratory Services Market: company share 2020 (%)

FIGURE 77 Asia-Pacific Analytical Laboratory Services Market: company share 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.