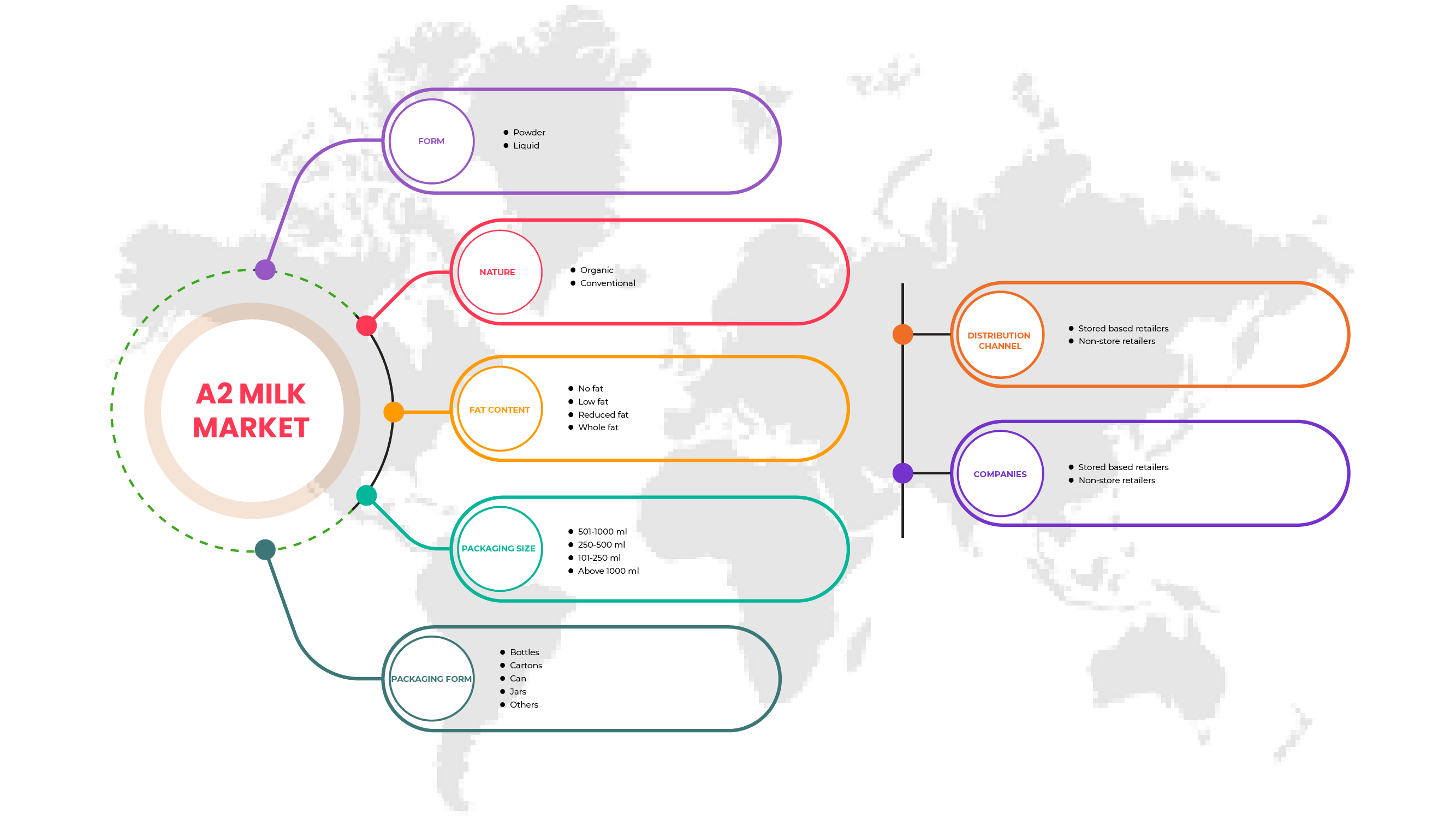

Marché mondial du lait A2, par forme (poudre et liquide), nature (biologique et conventionnel), teneur en matières grasses (sans matière grasse, faible en matière grasse, à teneur réduite en matières grasses et matière grasse entière), taille de l'emballage (101-250 ml/g, 250-500 ml/g, 501-1000 ml/g et plus de 1000 ml/g), forme de l'emballage (bouteilles, cartons, canettes, pots et autres), canal de distribution (détaillants en magasin et détaillants hors magasin) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché du lait A2

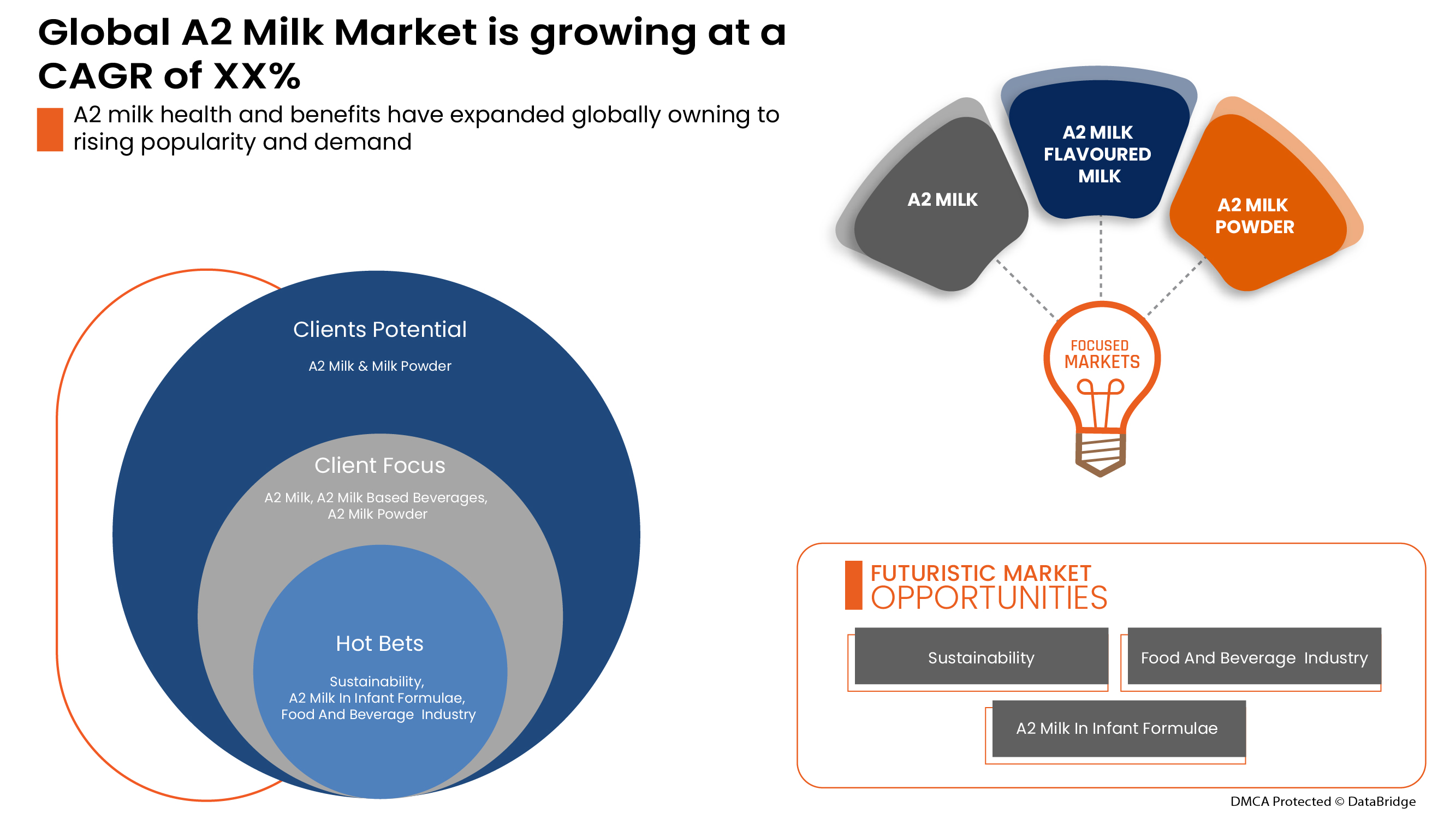

Le lait A2 favorise le développement de l'immunité, stimule le métabolisme et fournit des acides gras oméga 3. Le lait A2 connaît une croissance significative en raison de la sensibilisation croissante des consommateurs à leur santé et à la teneur nutritionnelle élevée du lait A2 par rapport au lait ordinaire. Il est disponible sous diverses formes et est facilement disponible sur le marché. Cependant, les prix élevés du lait A2 et de ses produits devraient freiner la croissance du marché du lait A2 au cours de la période de prévision.

La croissance du marché est notamment due à l'essor de la technologie du lait A2, à l'utilisation croissante du lait A2 dans les préparations pour nourrissons et à la sensibilisation croissante des consommateurs à la santé. Cependant, les limitations des prix élevés du lait A2 devraient freiner la croissance du marché.

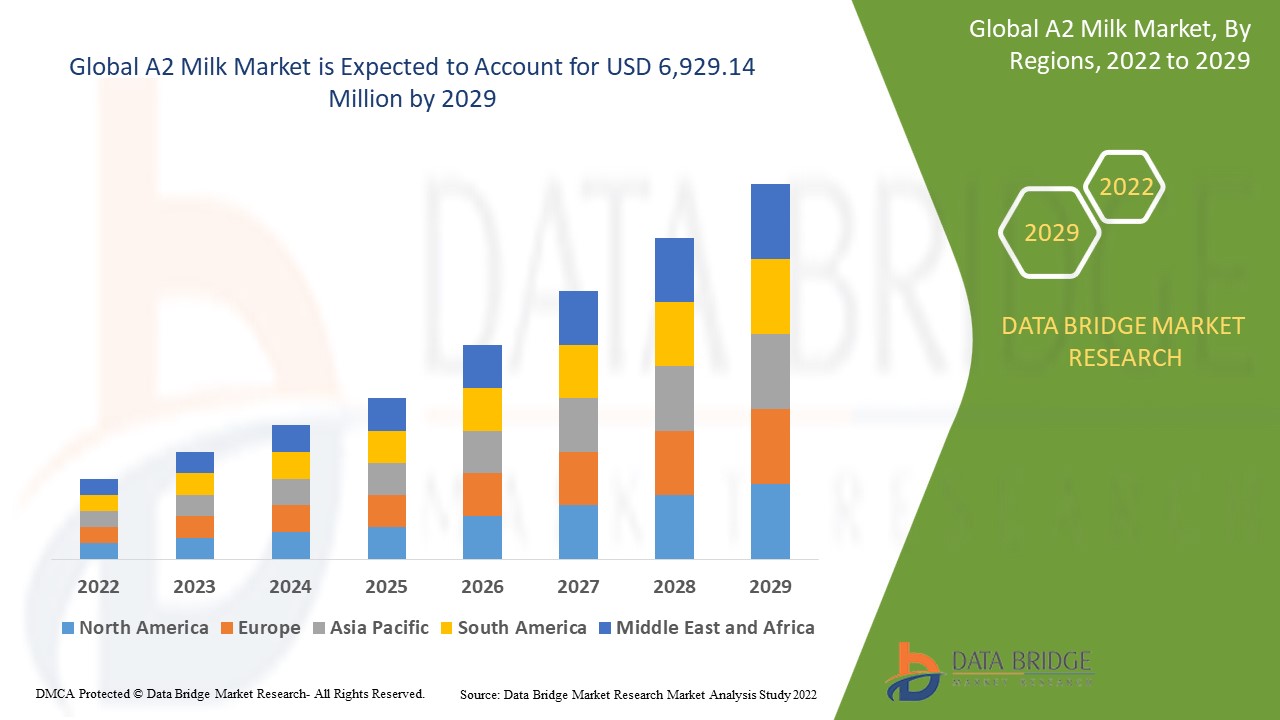

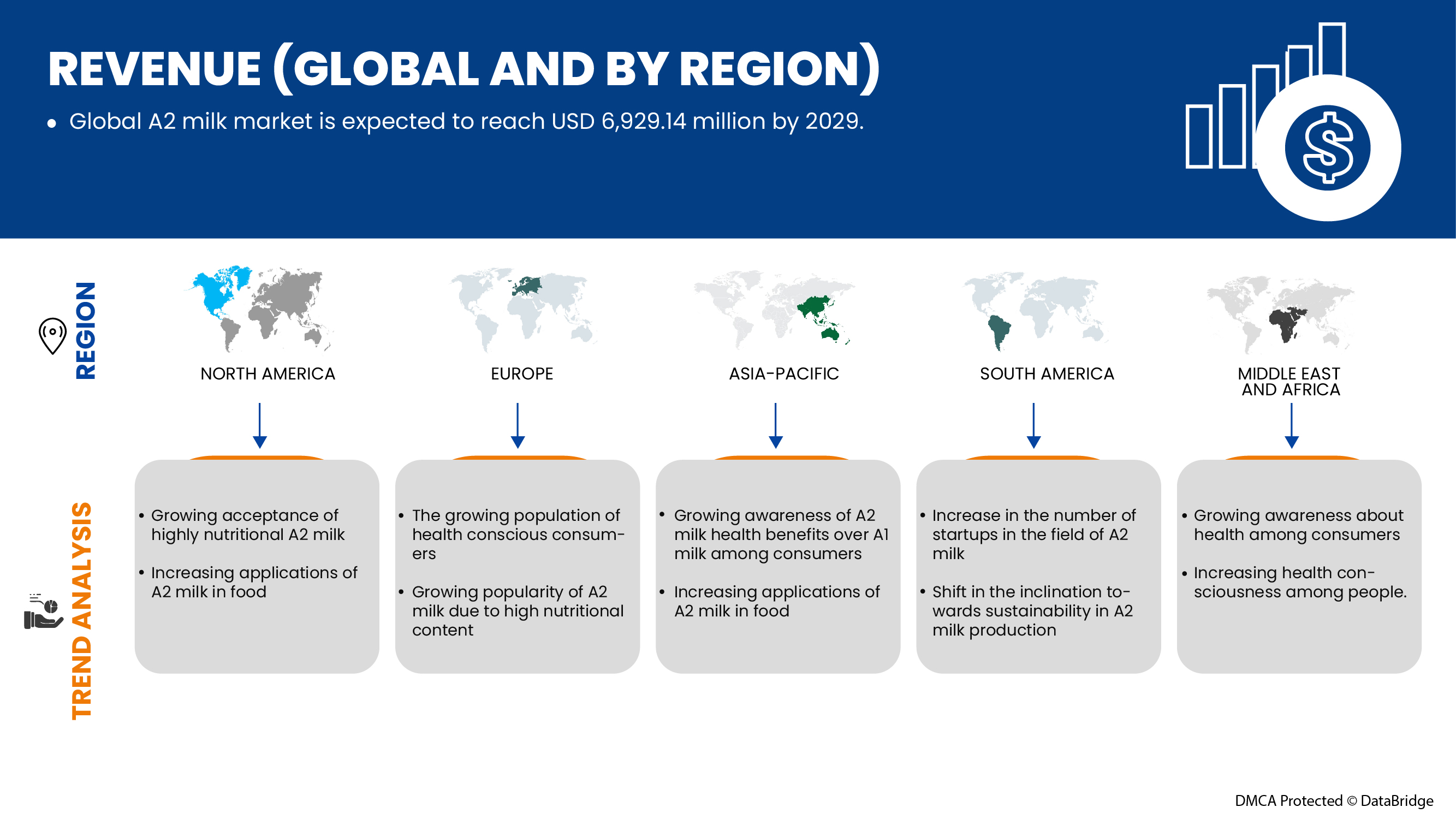

Data Bridge Market Research analyse que le marché du lait A2 devrait atteindre 6 929,14 millions USD d'ici 2029, à un TCAC de 21,7 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par forme (poudre et liquide), nature (biologique et conventionnelle), teneur en matières grasses (sans matières grasses, faible en matières grasses, à teneur réduite en matières grasses et matières grasses entières), taille de l'emballage (101-250 ml/g, 250-500 ml/g, 501-1000 ml/g et plus de 1000 ml/g), forme de l'emballage (bouteilles, cartons, canettes, pots et autres) et canal de distribution (détaillants en magasin et détaillants hors magasin) |

|

Pays couverts |

États-Unis, Canada et Mexique, Allemagne, Royaume-Uni, Italie, France, Espagne, Suisse, Pays-Bas, Belgique, Russie, Turquie, reste de l'Europe, Chine, Nouvelle-Zélande, Australie, Inde, Malaisie, Singapour, Corée du Sud, Indonésie, Japon, Philippines, Thaïlande et reste de l'Asie-Pacifique, Afrique du Sud, Émirats arabes unis, Arabie saoudite, Koweït et reste du Moyen-Orient et de l'Afrique, Brésil, Argentine et reste de l'Amérique du Sud. |

|

Acteurs du marché couverts |

GCMMF, Erden Creamery Pvt Ltd, PROVILAC, Ripley Farms LLC., Taw River Dairy, The a2 Milk Company Limited, Urban Farms Milk., Vedaaz Organics Pvt. Ltd., AVTARAN MILK, DOFE, Captain's Farm., Ksheerdham., Ayuda Organics, Veco Zuivel BV et Australia's Own. |

Définition du marché

Le lait A2 est un type de lait de vache qui ne contient pas la forme A1 des protéines de caséine et contient principalement la forme A2. La protéine bêta-caséine A2 du lait A2 se décompose rapidement en acides aminés pour une digestion rapide, améliorant ainsi notre santé globale et augmentant la valeur nutritionnelle du lait de vache. Le lait de vache A2 contient des minéraux tels que le calcium, le potassium et le phosphore, qui sont nécessaires à la solidité des os et des dents, à une meilleure fonction musculaire, à la régulation de la pression artérielle, à la croissance des tissus et des cellules, à l'amélioration du bon cholestérol (HDL), ainsi qu'au maintien de la nutrition et du bien-être général du corps.

A2 Dynamique du marché du lait

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs :

- Sensibilisation accrue des consommateurs à la santé

La prise de conscience croissante des consommateurs en matière de santé, d'apport alimentaire et de régime alimentaire est le principal moteur du marché mondial du lait A2. Au fil du temps, les consommateurs connaissent les avantages et les inconvénients des aliments qu'ils consomment quotidiennement. Le lait A2 est très nutritif et a un impact positif sur le corps d'une personne en raison de la présence de la protéine bêta-caséine A2. Cette protéine A2 prévient diverses maladies cardiaques, le diabète et l'autisme. Grâce à cela, les gens consomment du lait A2 et le préfèrent pour une consommation régulière. Ce changement de préférence et le développement de la sensibilisation à la santé devraient stimuler la croissance du marché mondial du lait A2.

Ainsi, la prise de conscience croissante des problèmes de santé et l'évolution des habitudes alimentaires des consommateurs finaux entraînent une demande accrue de lait A2. Cette demande croissante de lait A2 devrait stimuler le marché mondial du lait A2.

- Valeurs nutritionnelles élevées en a2 par rapport au lait ordinaire

Le lait A2 diffère du lait A1 en termes de type de protéines et de structure. Le lait A2 est le meilleur choix pour renforcer l'immunité et rester en bonne santé. Remplacer le lait ordinaire par du lait A2 est bénéfique pour l'esprit et le corps en améliorant la fonction cognitive et en nourrissant la peau et les cheveux. De plus, le lait A2 prévient les problèmes tels que les maladies cardiaques, l'intolérance au lactose, le diabète et l'autisme. Avec une nutrition abondante et de nombreux avantages pour la santé, la demande des consommateurs pour le lait A2 augmente rapidement. Les utilisateurs finaux préfèrent le lait A2 au lait ordinaire dans différents produits laitiers pour rester en bonne santé. Par conséquent, le lait A2 s'avère plus nutritif que le lait ordinaire.

Ainsi, la haute valeur nutritionnelle et la teneur plus élevée en minéraux du lait A2 entraînent une demande et des ventes plus élevées de lait A2 sur le marché. Avec cette demande croissante, le marché mondial du lait A2 devrait connaître une croissance significative.

Retenue

- Prix élevés du lait A2

Les prix élevés du lait A2 par rapport au lait ordinaire constituent un frein majeur à la croissance du marché. Le lait A2 et les produits laitiers ont une gamme de prix deux fois supérieure à celle du lait ordinaire sur le marché. La production de lait A2 est encore limitée car les races de vaches laitières A2 produisent moins de lait par jour et, de ce fait, les entreprises facturent des coûts élevés pour le lait A2 afin de générer des revenus plus élevés. Les utilisateurs finaux des produits laitiers A2 sont les hommes ordinaires et la présence de lait A2 sur le marché avec une gamme plus élevée n'est pas abordable pour beaucoup de gens. En raison des degrés plus élevés, les gens préfèrent le lait ordinaire au lait A2 et à ses produits. Ces prix élevés du lait constituent un facteur de restriction majeur de la croissance du marché.

Ainsi, les prix élevés du lait et des produits laitiers de catégorie A2 incitent les consommateurs à consommer du lait ordinaire, ce qui devrait à son tour freiner la croissance du marché mondial du lait de catégorie A2.

Opportunité

- Inclination des consommateurs pour une production durable de lait a2

La durabilité protège la santé et la capacité biologique de l'environnement. Le bien-être individuel et communautaire est favorisé par la durabilité. La durabilité favorise une meilleure économie avec moins de pollution et de déchets, moins d'émissions, plus d'emplois et une répartition équitable des richesses. Une approche durable de la production de lait A2 réduit l'impact environnemental de l'élevage laitier tout en augmentant le bien-être animal et l'approbation sociale du secteur laitier. Les consommateurs ayant des normes morales plus élevées sont plus susceptibles d'être intéressés par l'achat de produits laitiers à base de lait A2 qui utilisent des innovations durables. Les consommateurs biologiques réguliers ont une attitude plus favorable à l'égard des produits laitiers qui utilisent des innovations durables. En conséquence, de nombreuses entreprises à base de lait A2 se concentrent sur la durabilité dans leur production, leur transformation, leur emballage et d'autres processus.

Ainsi, la mise en œuvre d’approches durables à presque toutes les étapes de la production de lait A2 et de produits à base de lait A2 a offert diverses opportunités de croissance du marché, même au cours de la période prévue, car les consommateurs préfèrent principalement les produits durables et biologiques.

Défi

- Croissance de la tendance au véganisme parmi la population

Le véganisme est un mode de vie qui préconise l'élimination des produits d'origine animale de l'alimentation, en particulier les produits laitiers, la viande et la volaille. Le véganisme a évolué vers une tendance vers un mode de vie plus sain à mesure que de plus en plus de personnes prennent conscience des dommages qu'il cause à l'environnement et aux espèces animales. La raison d'être du véganisme est de cesser de stresser, d'exploiter et de tuer les animaux pour mettre fin à leur espèce. Cette tendance au véganisme apporte des alternatives au lait plus naturelles, de sorte que la plupart des personnes adoptées par le véganisme évitent les produits à base de lait A2, même si le lait A2 présente un avantage nutritionnel plus élevé que les autres. Le lait A2 étant un produit d'origine animale, la tendance au véganisme posera un défi important à la croissance du marché du lait A2.

Ainsi, la tendance au véganisme conduit les consommateurs à opter de manière minimale pour les produits à base de produits laitiers. Cette tendance au véganisme parmi la population devrait donc constituer un défi majeur pour la croissance du marché mondial du lait A2.

Impact post-COVID-19 sur le marché mondial du lait A2

Après la pandémie, la demande de lait A2 a augmenté car il n'y aura plus de restrictions de mouvement ; par conséquent, l'approvisionnement en produits serait facile. La persistance du COVID-19 pendant une période plus longue a affecté la chaîne d'approvisionnement car elle a été perturbée, et il est devenu difficile de fournir les produits alimentaires aux consommateurs, ce qui a initialement augmenté la demande de produits. Cependant, après le COVID, le besoin de lait A2 a considérablement augmenté en raison de la bonne teneur en protéines et d'autres nutriments disponibles.

Développements récents

- En août 2022, la société a2 Milk Company (a2MC) s'associe à KidsCan, la principale organisation de Nouvelle-Zélande qui soutient les enfants défavorisés. En tant que partenaire majeur, a2MC fera un don annuel de 130 000 $ pendant les trois premières années pour aider à financer les programmes de KidsCan et organisera le bénévolat du personnel et des amis pour aider KidsCan à mener à bien sa mission d'une importance cruciale

- En mai 2022, la société a2 Milk et l'université de Lincoln collaborent pour lancer un nouveau programme visant à soutenir les initiatives d'élevage laitier durable en Nouvelle-Zélande. La société a2 Milk et l'université de Lincoln, la seule université spécialisée dans l'élevage laitier terrestre en Nouvelle-Zélande, ont uni leurs forces pour lancer aujourd'hui le Farm Sustainability Fund

Portée du marché mondial du lait A2

Le marché mondial du lait A2 est segmenté en fonction de la forme, de la nature, de la teneur en matières grasses, de la taille de l'emballage, de la forme de l'emballage et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Formulaire

- Poudre

- Liquide

Sur la base de la forme, le marché mondial du lait A2 est segmenté en poudre et liquide.

Nature

- Organique

- Conventionnel

Sur la base de la nature, le marché mondial du lait A2 est segmenté en biologique et conventionnel.

Teneur en matières grasses

- Sans gras

- Faible en gras

- Teneur réduite en matières grasses

- Graisse entière

Sur la base de la teneur en matières grasses, le marché mondial du lait A2 est segmenté en sans matière grasse, à faible teneur en matières grasses, à teneur réduite en matières grasses et à teneur en matières grasses entières.

Taille de l'emballage

- 101-250 ml/g

- 250-500 ml/g

- 501-1000 ml/g

- Au-dessus de 1000 ml/g

Sur la base de la taille de l'emballage, le marché mondial du lait A2 est segmenté en 101-250 ml/g, 250-500 ml/g, 501-1000 ml/g et plus de 1000 ml/g.

Forme d'emballage

- Bouteilles

- Cartons

- Peut

- Pots

- Autres

Sur la base de la forme de l'emballage, le marché mondial du lait A2 est segmenté en bouteilles, cartons, canettes, pots et autres.

Canal de distribution

- Détaillants en magasin

- Détaillants hors magasin

Sur la base du canal de distribution, le marché mondial du lait A2 est segmenté en détaillants en magasin et en détaillants hors magasin.

Analyse/perspectives régionales du marché du lait A2

Le marché du lait A2 est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, forme, nature, teneur en matières grasses, taille de l’emballage, forme de l’emballage et canal de distribution, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché mondial du lait A2 sont les États-Unis, le Canada et le Mexique, l'Allemagne, le Royaume-Uni, l'Italie, la France, l'Espagne, la Suisse, les Pays-Bas, la Belgique, la Russie, la Turquie, le reste de l'Europe, la Chine, la Nouvelle-Zélande, l'Australie, l'Inde, la Malaisie, Singapour, la Corée du Sud, l'Indonésie, le Japon, les Philippines, la Thaïlande et le reste de l'Asie-Pacifique, l'Afrique du Sud, les Émirats arabes unis, l'Arabie saoudite, le Koweït et le reste du Moyen-Orient et de l'Afrique, le Brésil, l'Argentine et le reste de l'Amérique du Sud.

L'Asie-Pacifique est le plus grand marché du lait A2. La prise de conscience croissante des bienfaits du lait A2 sur la santé par rapport au lait A1 parmi les consommateurs est la principale raison de la croissance du marché du lait A2 en Asie-Pacifique. De plus, le marché des aliments à base de plantes connaît une croissance progressive dans la région Asie-Pacifique. La croissance de ce marché aura un impact direct sur le développement du marché du lait A2. Cependant, les prix élevés du lait A2 sont susceptibles de limiter la croissance du marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui affectent les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du lait A2

Le paysage concurrentiel du marché du lait A2 fournit des détails sur le concurrent. Les composants inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus ne concernent que les entreprises se concentrant sur le marché du lait A2.

Certains des principaux acteurs opérant sur le marché du lait A2 sont GCMMF, Erden Creamery Pvt Ltd, PROVILAC, Ripley Farms LLC., Taw River Dairy, The a2 Milk Company Limited, Urban Farms Milk., Vedaaz Organics Pvt. Ltd., AVTARAN MILK, DOFE, Captain's Farm., Ksheerdham., Ayuda Organics, Veco Zuivel BV et Australia's Own., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL A2 MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 PRODUCT NUTRITIONAL QUALITY

4.1.2 PRODUCT PRICING

4.1.3 AUTHENTICITY OF PRODUCT

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 TRADE ANALYSIS

4.3.1 IMPORTS-EXPORTS OF THE GLOBAL A2 MILK MARKET

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF GLOBAL A2 MILK MARKET

4.4.1 INDUSTRY TRENDS

4.4.2 FUTURE PERSPECTIVE

4.5 RAW MATERIAL SOURCING ANALYSIS: GLOBAL A2 MILK MARKET

4.6 SUPPLY CHAIN OF THE GLOBAL A2 MILK MARKET

4.6.1 RAW A2 MILK PRODUCTION

4.6.2 PROCESSING AND PACKAGING

4.6.3 TRANSPORTATION AND DISTRIBUTION

4.6.4 END USERS

4.7 TECHNOLOGICAL ADVANCEMENTS

4.8 VALUE CHAIN ANALYSIS: GLOBAL A2 MILK MARKET

4.9 PORTER'S FIVE

4.9.1 PORTER'S FIVE FORCES ANALYSIS FOR GLOBAL A2 MILK MARKET

4.9.2 BARGAINING POWER OF SUPPLIERS

4.9.3 BARGAINING POWER OF BUYERS/CONSUMERS

4.9.4 THREAT OF NEW ENTRANTS

4.9.5 THREAT OF SUBSTITUTE PRODUCTS

4.9.6 INTENSITY OF COMPETITIVE RIVALRY

5 REGULATORY FRAMEWORK AND LABELLING FOR THE GLOBAL A2 MILK MARKET

6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –GLOBAL A2 MILK MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

7 PRICING INDEX

7.1 FOB & B2B PRICES - GLOBAL A2 MILK MARKET

7.2 B2B PRICES - GLOBAL A2 MILK MARKET

8 PRODUCTION CAPACITY OF KEY MANUFACTURERS

9 BRAND OUTLOOK

9.1 PRODUCT VS BRAND OVERVIEW

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING AWARENESS ABOUT HEALTH AMONG CONSUMERS

10.1.2 INCREASING APPLICATIONS OF A2 MILK IN INFANT FORMULAE

10.1.3 HIGH NUTRITIONAL VALUES IN A2 COMPARED TO REGULAR MILK

10.1.4 CONSUMERS EXPERIENCING HEALTH ISSUES DUE TO CONSUMPTION OF REGULAR MILK

10.2 RESTRAINT

10.2.1 HIGH PRICES OF A2 MILK

10.3 OPPORTUNITY

10.3.1 INCLINATION OF CONSUMERS OVER SUSTAINABLE PRODUCTION OF A2 MILK

10.4 CHALLENGES

10.4.1 GROWING TREND OF VEGANISM AMONG PEOPLE

10.4.2 HIGH INVESTMENT IN R&D FOR A2 MILK PRODUCTS

11 GLOBAL A2 MILK MARKET, BY FORM

11.1 OVERVIEW

11.2 LIQUID

11.3 POWDER

12 GLOBAL A2 MILK MARKET, BY NATURE

12.1 OVERVIEW

12.2 CONVENTIONAL

12.3 ORGANIC

13 GLOBAL A2 MILK MARKET, BY FAT CONTENT

13.1 OVERVIEW

13.2 WHOLE FAT

13.3 LOW FAT

13.4 REDUCED FAT

13.5 NO FAT

14 GLOBAL A2 MILK MARKET, BY PACKAGIING SIZE

14.1 OVERVIEW

14.2 501-1000 ML

14.3 250-500 ML

14.4 101-250 ML

14.5 ABOVE 1000 ML

15 GLOBAL A2 MILK MARKET, BY PACKAGING FORM

15.1 OVERVIEW

15.2 BOTTLES

15.2.1 PLASTIC

15.2.2 GLASS

15.3 CARTONS

15.4 CAN

15.5 JARS

15.6 OTHERS

16 GLOBAL A2 MILK MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 NON-STORE RETAILERS

16.2.1 ONLINE

16.2.2 VENDING MACHINE

16.3 STORE BASED RETAILERS

16.3.1 SUPERMARKETS/HYPERMARKETS

16.3.2 CONVENIENCE STORES

16.3.3 GROCERY STORES

16.3.4 SPECIALTY STORES

17 GLOBAL A2 MILK MARKET, BY REGION

17.1 OVERVIEW

17.2 ASIA-PACIFIC

17.2.1 CHINA

17.2.2 NEW ZEALAND

17.2.3 AUSTRALIA

17.2.4 INDIA

17.2.5 MALAYSIA

17.2.6 SINGAPORE

17.2.7 SOUTH KOREA

17.2.8 INDONESIA

17.2.9 JAPAN

17.2.10 PHILIPPINES

17.2.11 THAILAND

17.2.12 REST OF ASIA-PACIFIC

17.3 EUROPE

17.3.1 GERMANY

17.3.2 NETHERLANDS

17.3.3 SWITZERLAND

17.3.4 RUSSIA

17.3.5 U.K.

17.3.6 FRANCE

17.3.7 SPAIN

17.3.8 REST OF EUROPE

17.4 NORTH AMERICA

17.4.1 U.S.

17.4.2 CANADA

17.5 SOUTH AMERICA

17.5.1 BRAZIL

17.5.2 ARGENTINA

17.5.3 REST OF SOUTH AMERICA

17.6 MIDDLE EAST AND AFRICA

17.6.1 SOUTH AFRICA

17.6.2 UAE

17.6.3 REST OF MIDDLE EAST AND AFRICA

18 COMPANY LANDSCAPE: GLOBAL A2 MILK MARKET

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 THE A2 MILK COMPANY LIMITED

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 GCMMF

20.2.1 COMPANY SNAPSHOT

20.2.2 COMPANY SHARE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 CAPTAIN’S FARM

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 VEDAAZ ORGANICS PVT. LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 URBAN FARMS MILK

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 AUSTRALIA'S OWN

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 AVTARAN MILK

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AYUDA ORGANICS

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 DOFE

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 ERDEN CREAMERY PRIVATE LIMITED

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 KSHEERDHAM

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 PROVILAC DAIRY FARMS PVT. LTD

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 RIPLEY FARMS LLC

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 TAW RIVER DAIRY

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 VECO ZUIVEL B.V.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 FREE ON BOARD (FOB) OF A2 MILK

TABLE 2 BRAND COMPARATIVE ANALYSIS OF THE GLOBAL A2 MILK MARKET

TABLE 3 GLOBAL A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL LIQUID IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL POWDER IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL CONVENTIONAL IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL ORGANIC IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL WHOLE FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL LOW FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL REDUCED FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL NO FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL 501-1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL 250-500 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL 101-250 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL ABOVE 1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL BOTTLES IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL CARTONS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL CAN IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL JARS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL OTHERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL NON-STORE RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL STORE BASED RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 CHINA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 44 CHINA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 45 CHINA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 46 CHINA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 47 CHINA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 CHINA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 CHINA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 CHINA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NEW ZEALAND A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 52 NEW ZEALAND A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 53 NEW ZEALAND A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 54 NEW ZEALAND A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 55 NEW ZEALAND A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 56 NEW ZEALAND BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NEW ZEALAND A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 NEW ZEALAND STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NEW ZEALAND NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 AUSTRALIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 61 AUSTRALIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 AUSTRALIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 63 AUSTRALIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 64 AUSTRALIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 INDIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 INDIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 71 INDIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 72 INDIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 73 INDIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 74 INDIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 INDIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MALAYSIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 MALAYSIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 80 MALAYSIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 81 MALAYSIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 82 MALAYSIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 83 MALAYSIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 MALAYSIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 MALAYSIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MALAYSIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SINGAPORE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 88 SINGAPORE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 89 SINGAPORE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 90 SINGAPORE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 91 SINGAPORE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 92 SINGAPORE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SINGAPORE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SINGAPORE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 TABLE 41 SOUTH KOREA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 INDONESIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 106 INDONESIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 107 INDONESIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 108 INDONESIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 109 INDONESIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 110 INDONESIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDONESIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 INDONESIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDONESIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 JAPAN A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 115 JAPAN A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 116 JAPAN A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 117 JAPAN A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 118 JAPAN A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 119 JAPAN BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 JAPAN A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 JAPAN STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 JAPAN NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 PHILIPPINES A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 124 PHILIPPINES A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 125 PHILIPPINES A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 126 PHILIPPINES A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 127 PHILIPPINES A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 128 PHILIPPINES BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 PHILIPPINES A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 PHILIPPINES STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 PHILIPPINES NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 133 THAILAND A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 135 THAILAND A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 137 THAILAND BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 THAILAND A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 THAILAND STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 REST OF ASIA-PACIFIC A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 142 EUROPE A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 143 EUROPE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 144 EUROPE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 145 EUROPE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 146 EUROPE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 147 EUROPE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 148 EUROPE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 EUROPE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 150 EUROPE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 EUROPE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 GERMANY A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 153 GERMANY A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 154 GERMANY A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 155 GERMANY A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 156 GERMANY A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 157 GERMANY BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 GERMANY A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 159 GERMANY STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 GERMANY NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 NETHERLANDS A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 163 NETHERLANDS A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 164 NETHERLANDS A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 165 NETHERLANDS A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 NETHERLANDS A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 NETHERLANDS STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 NETHERLANDS NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 SWITZERLAND A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 171 SWITZERLAND A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 172 SWITZERLAND A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 173 SWITZERLAND A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 174 SWITZERLAND A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 175 SWITZERLAND BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 SWITZERLAND A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 177 SWITZERLAND STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 SWITZERLAND NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 RUSSIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 180 RUSSIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 181 RUSSIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 182 RUSSIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 183 RUSSIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 184 RUSSIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 RUSSIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 186 RUSSIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 RUSSIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 U.K. A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 189 U.K. A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 190 U.K. A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 191 U.K. A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 192 U.K. A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 193 U.K. BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 U.K. A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 195 U.K. STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 U.K. NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 FRANCE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 198 FRANCE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 199 FRANCE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 200 FRANCE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 201 FRANCE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 202 FRANCE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 FRANCE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 204 FRANCE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 FRANCE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 SPAIN A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 207 SPAIN A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 208 SPAIN A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 209 SPAIN A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 210 SPAIN A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 211 SPAIN BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 SPAIN A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 213 SPAIN STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 SPAIN NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 REST OF EUROPE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 216 NORTH AMERICA A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 217 NORTH AMERICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 218 NORTH AMERICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 219 NORTH AMERICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 220 NORTH AMERICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 221 NORTH AMERICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 222 NORTH AMERICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 NORTH AMERICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 224 NORTH AMERICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 NORTH AMERICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 U.S. A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 227 U.S. A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 228 U.S. A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 229 U.S. A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 230 U.S. A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 231 U.S. BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 U.S. A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 233 U.S. STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 U.S. NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 CANADA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 236 CANADA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 237 CANADA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 238 CANADA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 239 CANADA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 240 CANADA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 CANADA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 242 CANADA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 CANADA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 SOUTH AMERICA A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 245 SOUTH AMERICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 246 SOUTH AMERICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 247 SOUTH AMERICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 248 SOUTH AMERICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 249 SOUTH AMERICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 250 SOUTH AMERICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 SOUTH AMERICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 252 SOUTH AMERICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 SOUTH AMERICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 BRAZIL A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 255 BRAZIL A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 256 BRAZIL A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 257 BRAZIL A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 258 BRAZIL A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 259 BRAZIL BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 BRAZIL A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 261 BRAZIL STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 BRAZIL NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 ARGENTINA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 264 ARGENTINA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 265 ARGENTINA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 266 ARGENTINA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 267 ARGENTINA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 268 ARGENTINA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 ARGENTINA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 270 ARGENTINA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 ARGENTINA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 273 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 274 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 275 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 276 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 277 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 278 MIDDLE-EAST AND AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 280 MIDDLE-EAST AND AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 MIDDLE-EAST AND AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 SOUTH AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 283 SOUTH AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 284 SOUTH AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 285 SOUTH AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 286 SOUTH AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 287 SOUTH AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 SOUTH AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 SOUTH AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 SOUTH AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 UAE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 292 UAE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 293 UAE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 294 UAE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 295 UAE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 296 UAE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 UAE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 298 UAE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 UAE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 REST OF MIDDLE EAST AND AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL A2 MILK MARKET: SEGMENTATION

FIGURE 2 GLOBAL A2 MILK MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL A2 MILK MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL A2 MILK MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL A2 MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL A2 MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL A2 MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL A2 MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL A2 MILK MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE GLOBAL A2 MILK MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 INCREASING APPLICATION OF A2 MILK IN THE FOOD INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL A2 MILK MARKET IN THE FORECAST PERIOD

FIGURE 12 LIQUID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL A2 MILK MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR A2 MILK MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 14 SUPPLY CHAIN OF THE GLOBAL A2 MILK MARKET

FIGURE 15 VALUE CHAIN OF A2 MILK

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL A2 MILK MARKET

FIGURE 17 GLOBAL A2 MILK MARKET: BY FORM, 2021

FIGURE 18 GLOBAL A2 MILK MARKET: BY NATURE, 2021

FIGURE 19 GLOBAL A2 MILK MARKET: BY FAT CONTENT, 2021

FIGURE 20 GLOBAL A2 MILK MARKET: BY PACKAGING SIZE, 2021

FIGURE 21 GLOBAL A2 MILK MARKET: BY PACKAGING FORM, 2021

FIGURE 22 GLOBAL A2 MILK MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 GLOBAL A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 24 GLOBAL A2 MILK MARKET: BY REGION (2021)

FIGURE 25 GLOBAL A2 MILK MARKET: BY REGION (2022 & 2029)

FIGURE 26 GLOBAL A2 MILK MARKET: BY REGION (2021 & 2029)

FIGURE 27 GLOBAL A2 MILK MARKET: BY FORM (2022-2029)

FIGURE 28 ASIA-PACIFIC A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 29 ASIA-PACIFIC A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 30 ASIA-PACIFIC A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 ASIA-PACIFIC A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 ASIA-PACIFIC A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 33 EUROPE A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 38 NORTH AMERICA A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 43 SOUTH AMERICA A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 44 SOUTH AMERICA A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 45 SOUTH AMERICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 SOUTH AMERICA A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 SOUTH AMERICA A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 48 MIDDLE EAST AND AFRICA A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 49 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 50 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 53 GLOBAL A2 MILK MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 NORTH AMERICA A2 MILK MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 EUROPE A2 MILK MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 ASIA-PACIFIC A2 MILK MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.