Marché allemand des kits de test à domicile, par type de test (beauté et bien-être, santé, nutrition, test de grossesse, test MST, kit de test de prédiction d'ovulation, kit de test de toxicomanie et autres types de tests), type (cassette, bandelette, test intermédiaire, panneau de test, carte à immersion et autres), âge (pédiatrique, adulte et gériatrique), type d'échantillon (urine, sang, salive et autres types d'échantillons), revenu (faible revenu, revenu moyen et revenu élevé), utilisation (jetable et réutilisable), canaux de distribution (pharmacies de détail, pharmacies, supermarchés/hypermarchés et pharmacies en ligne) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des kits de test à domicile en Allemagne

Le marché allemand des kits de test à domicile devrait croître en raison de la sensibilisation croissante à plusieurs produits. Les kits de test à domicile ou d'auto-test sont facilement disponibles dans les pharmacies et leur achat est devenu extrêmement facile. Diverses sociétés médicales se lancent dans ce domaine en fabriquant rapidement des kits d'auto-test.

Cette disponibilité généralisée peut également être attribuée aux start-ups médicales des pharmacies en ligne, qui facilitent l'accès au médicament en un clic. De plus, ces kits d'auto-test sont disponibles sans ordonnance, ce qui peut stimuler le marché des kits de test à domicile. Les kits de test à domicile permettent aux utilisateurs finaux de prélever leur échantillon à domicile et de l'effectuer à domicile ou de l'envoyer au laboratoire pour analyse. Les kits de test à domicile ont sans aucun doute facilité le processus de confirmation de l'inquiétude de la personne, qu'il s'agisse d'un test de grossesse à domicile ou d'un test de dépistage du VIH ou de toute autre maladie infectieuse.

Ces tests à domicile sont faciles à utiliser et abordables. Cependant, il existe toujours des doutes sur l'exactitude des résultats, ce qui devrait freiner la croissance du marché. Cependant, un résultat de test faussement positif peut provoquer de l'anxiété et du stress chez la personne, même si elle ne l'a pas. Il est très bouleversant et dérangeant pour la personne de recevoir des résultats faussement positifs ou négatifs. Aujourd'hui, de nombreuses entreprises produisent des kits de test de diagnostic rapide pour le COVID-19, qui peuvent être effectués à domicile. Mais il existe divers problèmes liés à la précision, de sorte que la distribution de ces kits de test à domicile a été suspendue pour vérifier leur fiabilité.

Data Bridge Market Research analyse que le marché allemand des kits de test à domicile devrait croître à un TCAC de 10,5 % entre 2023 et 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions et prix en USD |

|

Segments couverts |

Type de test (beauté et bien-être, santé, nutrition, test de grossesse, test MST, kit de test de prédiction d'ovulation, kit de test de toxicomanie et autres types de tests), type (cassette, bandelette, test intermédiaire, panel de test, carte à immersion et autres), âge (pédiatrique, adulte et gériatrique), type d'échantillon (urine, sang, salive et autres types d'échantillons), revenu (faible revenu, revenu moyen et revenu élevé), utilisation (jetable et réutilisable), canaux de distribution (pharmacies de détail, parapharmacies, supermarchés/hypermarchés et pharmacies en ligne) |

|

Pays couvert |

Allemagne |

|

Acteurs du marché couverts |

Abbott, Siemens Healthcare GmbH, F. Hoffman-La Roche Ltd, Quidel Corporation, Cardinal Health, bioLytical Laboratories Inc., kiweno GmbH, Nova Biomedical, Johnson & Johnson Services, Inc. et B. Braun SE, entre autres |

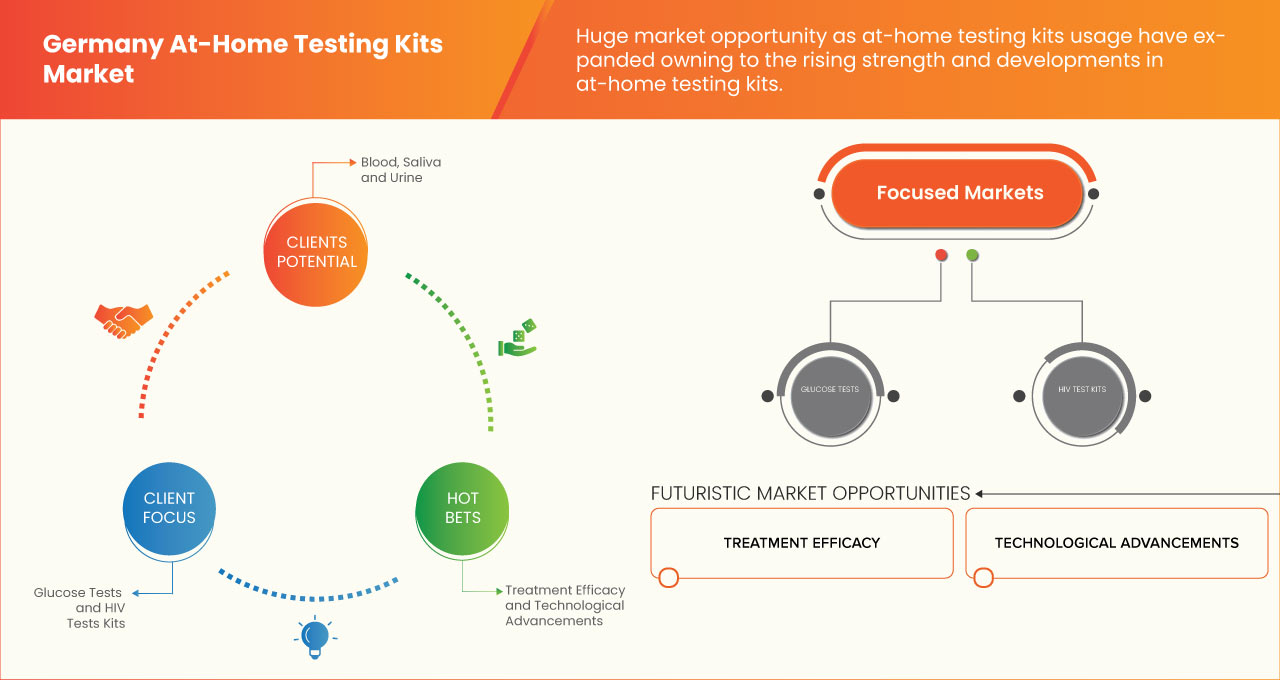

Définition du marché

Les kits de test à domicile permettent à la personne d'effectuer des tests à domicile et de leur donner des résultats rapides en une minute. Ils comprennent également un équipement de surveillance pour vérifier et contrôler en permanence la santé des patients diabétiques. Les tests à domicile sont pratiques à réaliser confortablement et sont disponibles à un prix très abordable. Les autotests sont généralement les versions avancées des kits de tests rapides au point de service conçus à l'origine pour les professionnels de la santé et peuvent être effectués par le commun des mortels. Leurs processus, leur emballage et leurs instructions ont été simplifiés pour guider une personne à travers les étapes de la réalisation d'un test. Divers kits de test à domicile sont disponibles, notamment des kits de test de beauté, des tests du VIH, des tests de grossesse, du diabète, des tests d'ovulation et des maladies infectieuses telles que le paludisme, la grippe et d'autres. Le sang, l'urine et le liquide buccal peuvent être prélevés comme échantillons pour effectuer ces tests rapides à domicile.

Dynamique du marché des kits de test à domicile en Allemagne

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l'adoption des kits de dépistage à domicile en raison de l'augmentation de la prévalence des troubles de santé

Avec la croissance économique croissante, les gens s'intéressent davantage à la santé et au bien-être à long terme. Les patients diabétiques ont besoin d'appareils pour surveiller leur taux de sucre ; le contrôle de la grossesse augmente la demande de bandelettes de grossesse ; la surveillance de la tension artérielle entraîne une demande d'appareils tels que des tensiomètres et des sphygmomanomètres ; le stress et l'anxiété augmentent la demande de kits de test de stress et autres. En plus de gérer le trouble, il permet également de vérifier la peau et d'autres problèmes liés au corps tels que les allergies.

Auparavant, les gens se rendaient souvent dans les hôpitaux/cliniques/centres de diagnostic pour des problèmes de base. Cependant, à mesure que la sensibilisation à plusieurs produits, tels que les kits de test à domicile pour la beauté et le bien-être, la santé, la nutrition et autres, s'est accrue, ce comportement a changé et a inversé la tendance. De nos jours, les gens préfèrent faire leurs tests de base à l'aide de kits de test à domicile avant de consulter un médecin ou un technicien.

Cette situation est devenue encore plus évidente en raison de cette pandémie, car les gens adoptent davantage de kits de test en libre-service en raison de plusieurs restrictions en vigueur. C'est devenu une aubaine déguisée pour les hôpitaux/cliniques/centres de diagnostic et les patients, car les hôpitaux/cliniques/centres de diagnostic sont déjà à court de ressources et peuvent se concentrer entièrement sur les patients atteints de COVID-19. Les patients peuvent économiser des frais importants de visites chez le médecin et de médicaments. C'est devenu très pratique pour les consommateurs car ils peuvent rapidement connaître les résultats de leurs tests à portée de main.

Ainsi, l’adoption croissante des kits de test à domicile en raison de leur commodité et de la rapidité des résultats devrait stimuler la croissance du marché.

- Disponibilité facile des kits d'auto-test dans les pharmacies et les boutiques en ligne

Les kits d'auto-test ou à domicile sont facilement disponibles dans les pharmacies et les boutiques en ligne, et il est devenu facile de s'en procurer. Diverses sociétés médicales se lancent dans ce domaine en fabriquant rapidement des kits d'auto-test.

Cette large disponibilité peut également être attribuée aux start-ups médicales des pharmacies en ligne, qui facilitent l'accès aux médicaments en un clic. De plus, ces kits d'auto-test sont disponibles sans ordonnance.

Les boutiques en ligne spécialisées, les marchés numériques émergents, le commerce électronique et la publicité sur Internet attirent également le marché. Les boutiques en ligne offrent des options de confidentialité indispensables avec livraison à domicile, élargissant ainsi leur portée commerciale.

Ainsi, les kits d’auto-test sont devenus largement disponibles pour diverses maladies en raison de la fabrication rapide par les sociétés de tests médicaux et devraient stimuler la croissance du marché.

Opportunité

- Développer l'activité grâce à des filiales

Les entreprises exercent leurs activités par l’intermédiaire de filiales réparties dans le monde entier. Cela permettrait à l’entreprise de générer davantage de revenus en servant une large clientèle par l’intermédiaire de ses filiales, ce qui créerait pour l’entreprise l’opportunité d’étendre ses activités et de générer davantage de revenus. Les acteurs détenant une part de marché importante développent en permanence leur activité de bien-être et de santé par l’intermédiaire de leurs filiales ; ils sont présents presque partout dans le monde. Cela les aide à attirer davantage de clients et à créer une base de données de clients dans diverses régions, ce qui les aide finalement à identifier la région et les pays qui nécessitent davantage d’attention et de plans pour aider les clients du secteur de la santé à prendre des décisions structurelles.

Ce syndicat indique que l'entreprise exerce ses activités par l'intermédiaire de ses nombreuses filiales dans différentes régions du monde. Cela a permis à l'entreprise de générer davantage de revenus et de créer une opportunité de croissance du marché.

Retenue/Défi

- Inexactitude des résultats des kits d'auto-test

Les kits de dépistage à domicile permettent aux utilisateurs finaux de prélever leur échantillon à domicile et de l'effectuer à domicile ou de l'envoyer au laboratoire pour analyse. Les kits de dépistage à domicile ont sans aucun doute facilité le processus de confirmation de l'inquiétude de la personne, qu'il s'agisse d'un test de grossesse à domicile ou d'un test de dépistage du VIH ou de toute autre maladie infectieuse.

Ces tests à domicile sont faciles à utiliser et abordables. Cependant, il existe toujours un doute quant à la précision des résultats. Le dépistage à domicile des MST peut être plus confortable qu'une visite à l'hôpital ou au cabinet du médecin. Il contribuera également à réduire le risque de propagation ou d'acquisition de la MST lors du dépistage.

Cependant, un résultat de test faussement positif peut provoquer de l'anxiété et du stress chez la personne, même si elle n'en est pas atteinte. Il est très bouleversant et perturbant pour la personne de recevoir des résultats faussement positifs ou négatifs. Aujourd'hui, de nombreuses entreprises produisent des kits de diagnostic rapide pour les MST, le diabète et autres, qui peuvent être effectués à domicile. Mais il existe divers problèmes liés à la précision, de sorte que la distribution de ces kits de test à domicile a été suspendue pour vérifier leur fiabilité.

Différents facteurs peuvent entraîner des résultats erronés, tels que des défauts de fabrication, une faible faisabilité, des instructions incorrectes ou une mauvaise interprétation des résultats.

Ainsi, les utilisateurs finaux doutent de la fiabilité des kits de test rapide à domicile, ce qui devrait freiner la croissance du marché.

Développement récent

- En avril 2023, Abbott a annoncé que la Food and Drug Administration (FDA) des États-Unis avait autorisé un lecteur pour son système intégré de surveillance continue du glucose (iCGM) FreeStyle Libre 3, qui est doté du capteur de glucose le plus petit, le plus fin et le plus discret au monde5. Avec l'autorisation de la FDA pour un lecteur autonome, l'entreprise espère générer davantage de revenus.

Portée du marché des kits de test à domicile en Allemagne

Le marché allemand des kits de test à domicile est classé en sept segments notables en fonction du type de test, du type, du revenu, de l'âge, du type d'échantillon, de l'utilisation et des canaux de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance du marché dans les industries et fournira aux utilisateurs un aperçu et des informations précieuses sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de test

- Beauté et bien-être

- Santé

- Nutrition

- Test de grossesse

- Kit de test MST

- Kit de test de prédiction de l'ovulation

- Kit de test de toxicomanie

- Autres types de tests

Sur la base du type de test, le marché est segmenté en beauté et bien-être, santé, nutrition, test de grossesse, kit de test MST, kit de test de prédiction d'ovulation, kit de test de toxicomanie et autres types de tests.

Taper

- Cassette

- Bande

- Au milieu du cours d'eau

- Panneau de test

- Carte à tremper

- Autres

Sur la base du type, le marché est segmenté en cassette, bande, flux intermédiaire, panneau de test, carte à immersion et autres.

Revenu

- Faible revenu

- Revenu moyen

- Revenu élevé

Sur la base des revenus, le marché est segmenté en revenus faibles, revenus moyens et revenus élevés.

Âge

- Pédiatrique

- Adulte

- Gériatrie

En fonction de l’âge, le marché est segmenté en pédiatrique, adulte et gériatrique.

Type d'échantillon

- Urine

- Sang

- Salive

- Autres types d'échantillons

Sur la base du type d’échantillon, le marché est segmenté en échantillons d’urine, de sang, de salive et d’autres types d’échantillons.

Usage

- Jetable

- Réutilisable

En fonction de l’utilisation, le marché est segmenté en jetables et réutilisables.

Canaux de distribution

- Pharmacies de détail

- Pharmacie

- Supermarché/Hypermarché

- Pharmacies en ligne

Sur la base des canaux de distribution, le marché est segmenté en pharmacies de détail, parapharmacies, supermarchés/hypermarchés et pharmacies en ligne.

Analyse du paysage concurrentiel et des parts de marché des kits de test à domicile en Allemagne

Le paysage concurrentiel du marché allemand des kits de test à domicile fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence dans le pays, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs du marché opérant sur le marché allemand des kits de test à domicile sont Abbott, Siemens Healthcare GmbH, F. Hoffman-La Roche Ltd, Quidel Corporation, Cardinal Health, bioLytical Laboratories Inc., kiweno GmbH, Nova Biomedical, Johnson & Johnson Services, Inc. et B. Braun SE, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GERMANY AT-HOME TESTING KITS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 GERMANY AT-HOME TESTING KITS MARKET, BY TEST TYPE

2.8 MARKET POSITION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

4.3 STRATEGIC INITIATIVES

4.4 BRAND ANALYSIS

4.5 PRICING ANALYSIS

5 GERMANY AT-HOME TESTING KITS MARKET: REGULATIONS

5.1 REGULATION IN EUROPE

5.2 GUIDELINES FOR TESTING KITS

6 GERMANY AT-HOME TESTING KITS MARKET, MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE ADOPTION OF AT-HOME TESTING KITS DUE TO THE INCREASE IN THE PREVALENCE OF HEALTH DISORDERS

6.1.2 EASY AVAILABILITY OF SELF-TESTING KITS AT PHARMACIES AND ONLINE STORES

6.1.3 INCREASE IN AWARENESS ABOUT THE IMPORTANCE OF STD DIAGNOSIS

6.1.4 LOW COST AND EASE TO USE AT-HOME TEST KITS

6.2 RESTRAINTS

6.2.1 PRODUCT RECALL OF AT-HOME TESTING KITS

6.2.2 INACCURACY OF RESULTS BY SELF-TESTING KITS

6.2.3 STRINGENT GOVERNMENT REGULATIONS FOR THE MANUFACTURING AND DISTRIBUTION OF TESTING KITS

6.3 OPPORTUNITIES

6.3.1 EXPANDING BUSINESS THROUGH SUBSIDIARIES

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.4 CHALLENGES

6.4.1 LOW AWARENESS IN SOCIETY

6.4.2 REDUCTION IN THE R&D BUDGET

7 GERMANY AT-HOME TESTING KITS MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 HEALTH

7.2.1 DIABETES KITS

7.2.2 KIDNEY FUNCTION TEST KITS

7.2.3 LIVER FUNCTION TEST KITS

7.2.4 PROTEIN KITS

7.2.5 IRON STATUS KITS

7.2.6 HEART DISEASE RISK TEST KITS

7.2.7 THYROID FUNCTION

7.2.8 RED BLOOD CELLS

7.2.9 WHITE BLOOD CELLS

7.2.10 CLOTTING STATUS

7.2.11 HORMONE

7.2.12 PSA

7.2.13 MENOPAUSE TEST

7.2.14 ANXIETY

7.2.15 ASTHMA

7.2.16 ATRIAL FIBRILLATION

7.2.17 GOUT

7.2.18 HDL AND LDL CHOLESTROL TEST KITS

7.2.19 HIGH BLOOD PRESSURE

7.2.20 OTHERS

7.3 BEAUTY AND WELLNESS

7.3.1 SKIN MICROBIME TEST

7.3.2 GENETIC BASED TEST KITS

7.3.3 FOOD SENSITIVITY TEST KITS

7.3.4 SEX HORMONE

7.3.4.1 FEMALE HORMONE TEST

7.3.4.2 MALE HORMONE TEST

7.3.5 HAIR, NAILS AND SKIN TEST KITS

7.3.6 STRESS TEST KITS

7.3.7 ALCOHOL FLUSH REACTION

7.3.8 CAFFEINE CONSUMPTION

7.3.9 DEEP SLEEP

7.3.10 MUSCLE COMPOSITION

7.3.11 SATURATED FAT

7.3.12 SLEEP MOVEMENT

7.3.13 ALLERGY TESTING

7.3.14 INTOLERANCE TESTING

7.3.14.1 LACTOSE INTOLERANCE

7.3.14.2 VEGAN INTOLERANCE TESTING

7.3.14.3 OTHER TEST

7.3.15 GUT MICROBIOME TEST

7.3.16 SKIN DNA TEST

7.4 STD TEST

7.4.1 HIV TEST

7.4.2 GONORRHEA TEST

7.4.3 SYPHILIS TEST

7.4.4 HERPES TEST

7.4.5 TRICHOMONIASIS

7.4.6 HEPATITIS B

7.4.7 HEPATITIS C

7.4.8 MEASLES

7.4.9 RUBELLA

7.4.10 VARICELLA

7.4.11 CHLAMYDIA TEST

7.4.12 OTHERS

7.5 NUTRITION

7.5.1 VITAMINS

7.5.1.1 D3

7.5.1.2 B12

7.5.1.3 ACTIVE B12

7.5.2 VITALITY

7.5.2.1 HEALTH MARKERS

7.5.2.2 IRON STATUS

7.5.2.3 MINERALS

7.5.3 OMEGA 3 TEST

7.5.4 IODINE DEFICIENCY TEST

7.5.5 ZINC TEST

7.5.6 SELENIUM TEST

7.5.7 MAGNESIUM BLOOD TEST

7.5.8 FERRITIN TEST

7.5.9 AMINO ACID TEST

7.6 PREGNANCY TEST

7.6.1 STRIP TESTS

7.6.2 MIDSTREAM TEST

7.6.3 CASSETTE TEST

7.6.4 DIGITAL TEST

7.6.5 HCG URINE TEST

7.6.6 HCG BLOOD TEST

7.6.7 LH URINE TEST

7.6.8 FSH URINE TEST

7.7 DRUG ABUSE TEST KITS

7.7.1 MARUUANA KITS

7.7.2 OPIATES KITS

7.7.3 ALCOHOL KITS

7.7.4 OTHERS

7.8 OVULATION PREDICTOR TEST KIT

7.9 OTHERS TEST TYPES

7.9.1 MALE INFERTILITY TEST TYPE

7.9.2 URINARY TRACT INFECTIONS TEST

7.9.3 MENOPAUSE TEST KITS

7.9.4 FECAL OCCULT BLOOD TEST

7.9.5 OTHERS

8 GERMANY AT-HOME TESTING KITS MARKET, BY TYPE

8.1 OVERVIEW

8.2 STRIP

8.2.1 RETAIL PHARMACIES

8.2.2 ONLINE PHARMACIES

8.2.3 DRUG STORE

8.2.4 SUPERMARKET/HYPERMARKET

8.2.5 CASSETTES

8.2.6 RETAIL PHARMACIES

8.2.7 ONLINE PHARMACIES

8.2.8 DRUG STORE

8.2.9 SUPERMARKET/HYPERMARKET

8.2.10 MIDSTREAM

8.2.11 RETAIL PHARMACIES

8.2.12 ONLINE PHARMACIES

8.2.13 DRUG STORE

8.2.14 SUPERMARKET/HYPERMARKET

8.2.15 DIP CARD

8.2.16 RETAIL PHARMACIES

8.2.17 ONLINE PHARMACIES

8.2.18 DRUG STORE

8.2.19 SUPERMARKET/HYPERMARKET

8.2.20 TEST PANEL

8.2.21 RETAIL PHARMACIES

8.2.22 ONLINE PHARMACIES

8.2.23 DRUG STORE

8.2.24 SUPERMARKET/HYPERMARKET

8.3 OTHERS

9 GERMANY AT-HOME TESTING KITS MARKET, BY AGE

9.1 OVERVIEW

9.2 ADULT

9.3 GERIATRIC

9.4 PEDIATRIC

10 GERMANY AT-HOME TESTING KITS MARKET, BY USAGE

10.1 OVERVIEW

10.2 DISPOSABLE

10.3 REUSABLE

11 GERMANY AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE

11.1 OVERVIEW

11.2 BLOOD

11.3 SALIVA

11.4 URINE

11.5 OTHER SAMPLE TYPES

12 GERMANY AT-HOME TESTING KITS MARKET, BY INCOME

12.1 OVERVIEW

12.2 MIDDLE INCOME

12.3 LOW INCOME

12.4 HIGH INCOME

13 GERMANY AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 RETAIL PHARMACIES

13.3 ONLINE PHARMACIES

13.4 DRUG STORE

13.5 SUPERMARKET/HYPERMARKET

14 GERMANY AT-HOME TESTING KITS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ABBOTT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUS ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 F. HOFFMANN- LA ROCHE LTD

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 SIEMENS HEALTHCARE GMBH

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 QUIDEL CORPORATION.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 CARDINAL HEALTH.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 ASCENSIA DIABETES CARE HOLDINGS AG.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 B. BRAUN SE MELSUNGEN AG

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BIOLYTICAL LABORATORIES INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BTNX INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CARE DIAGNOSTICA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 DEXCOM, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 DRÄGERWERK AG & CO. KGAA

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 JOHNSON & JOHNSON SERVICES, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 KIWENO GMBH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 MP BIOMEDICALS.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NOVA BIOMEDICAL

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PIRAMAL ENTERPRISES LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 PRIMA LAB SA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SELFDIAGNOSTICS OU

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 SA SCIENTIFIC LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 PRICES OF PRODUCTS OFFERED BY SOME OF THE COMPANIES:

TABLE 2 GERMANY AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 3 GERMANY HEALTH IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 4 GERMANY BEAUTY AND WELLNESS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 5 GERMANY SEX HORMONE IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 6 GERMANY INTOLERANCE TESTING IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 7 GERMANY STD TEST IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 8 GERMANY NUTRITION IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 9 GERMANY VITAMINS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 10 GERMANY VITALITY IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 11 GERMANY PREGNANCY TEST IN AT-HOME TESTING KITS MARKET, BY PRODUCT, 2021-2030 (USD MILLION), 2021-2030 (USD MILLION)

TABLE 12 GERMANY PREGNANCY TEST IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 13 GERMANY DRUG ABUSE TEST KITS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 14 GERMANY OTHER TEST TYPE IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 15 GERMANY AT-HOME TESTING KITS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 GERMANY STRIP IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 17 GERMANY CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 18 GERMANY MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 19 GERMANY MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 20 GERMANY MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 21 GERMANY AT-HOME TESTING KITS MARKET, BY AGE, 2021-2030 (USD MILLION)

TABLE 22 GERMANY AT-HOME TESTING KITS MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 23 GERMANY AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 24 GERMANY AT-HOME TESTING KITS MARKET, BY INCOME, 2021-2030 (USD MILLION)

TABLE 25 GERMANY AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 GERMANY AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 2 GERMANY AT-HOME TESTING KITS MARKET: DATA TRIANGULATION

FIGURE 3 GERMANY AT-HOME TESTING KITS MARKET: DROC ANALYSIS

FIGURE 4 GERMANY AT-HOME TESTING KITS MARKET: GERMANY VS REGIONAL MARKET ANALYSIS

FIGURE 5 GERMANY AT-HOME TESTING KITS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GERMANY AT-HOME TESTING KITS MARKET: MARKET POSITION COVERAGE GRID

FIGURE 7 GERMANY AT-HOME TESTING KITS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GERMANY AT-HOME TESTING KITS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GERMANY AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 10 EASY AVAILABILITY OF SELF-TESTING KITS AT PHARMACIES AND ONLINE STORES IS EXPECTED TO DRIVE GERMANY AT-HOME TESTING KITS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 HEALTH SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GERMANY AT-HOME TESTING KITS MARKET, BY TEST TYPE IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GERMANY AT HOME TESTING KITS MARKET

FIGURE 13 GERMANY AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2022

FIGURE 14 GERMANY AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 15 GERMANY AT-HOME TESTING KITS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 16 GERMANY AT-HOME TESTING KITS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 17 GERMANY AT-HOME TESTING KITS MARKET: BY TYPE, 2022

FIGURE 18 GERMANY AT-HOME TESTING KITS MARKET: BY TYPE, 2021-2030 (USD MILLION)

FIGURE 19 GERMANY AT-HOME TESTING KITS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 20 GERMANY AT-HOME TESTING KITS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 GERMANY AT-HOME TESTING KITS MARKET: BY AGE, 2022

FIGURE 22 GERMANY AT-HOME TESTING KITS MARKET: BY AGE, 2023-2030 (USD MILLION)

FIGURE 23 GERMANY AT-HOME TESTING KITS MARKET: BY AGE, CAGR (2023-2030)

FIGURE 24 GERMANY AT-HOME TESTING KITS MARKET: BY AGE, LIFELINE CURVE

FIGURE 25 GERMANY AT-HOME TESTING KITS MARKET: BY USAGE, 2022

FIGURE 26 GERMANY AT-HOME TESTING KITS MARKET: BY USAGE, 2023-2030 (USD MILLION)

FIGURE 27 GERMANY AT-HOME TESTING KITS MARKET: BY USAGE, CAGR (2023-2030)

FIGURE 28 GERMANY AT-HOME TESTING KITS MARKET: BY USAGE, LIFELINE CURVE

FIGURE 29 GERMANY AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2022

FIGURE 30 GERMANY AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2021-2030 (USD MILLION)

FIGURE 31 GERMANY AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, CAGR (2023-2030)

FIGURE 32 GERMANY AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 33 GERMANY AT-HOME TESTING KITS MARKET: BY INCOME, 2022

FIGURE 34 GERMANY AT-HOME TESTING KITS MARKET: BY INCOME, 2021-2030 (USD MILLION)

FIGURE 35 GERMANY AT-HOME TESTING KITS MARKET: BY INCOME, CAGR (2023-2030)

FIGURE 36 GERMANY AT-HOME TESTING KITS MARKET: BY INCOME, LIFELINE CURVE

FIGURE 37 GERMANY AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 38 GERMANY AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 39 GERMANY AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 40 GERMANY AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 GERMANY AT-HOME TESTING KITS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.