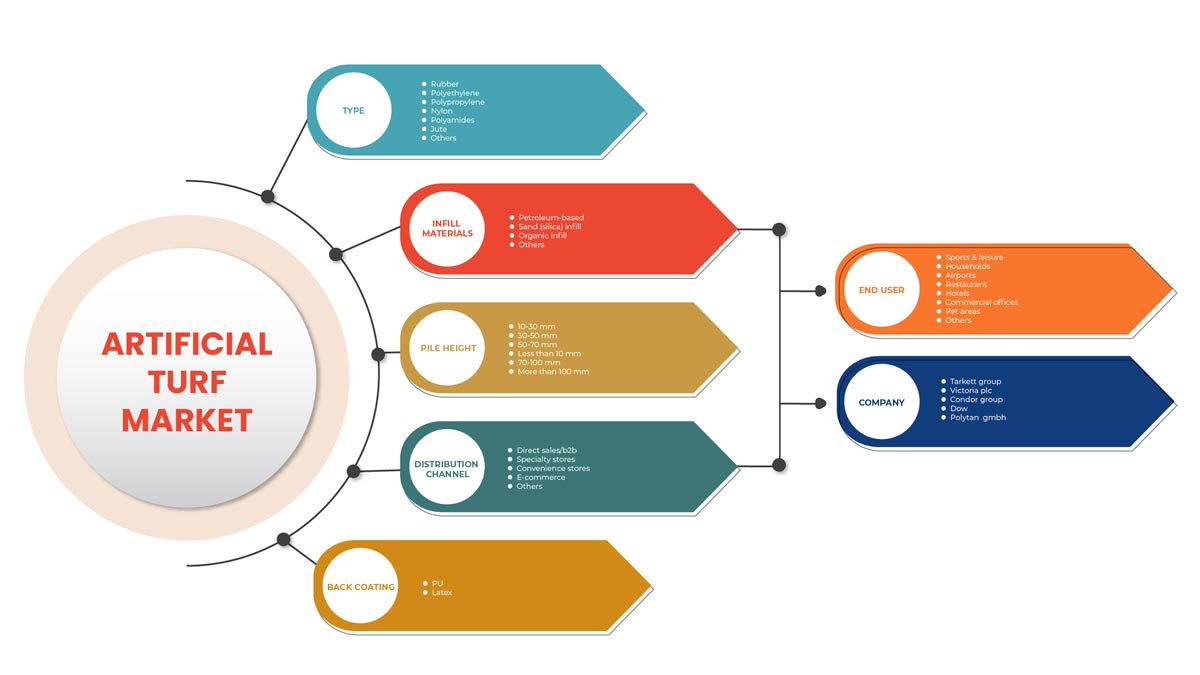

Marché du gazon artificiel en France, par type (nylon, polypropylène , polyéthylène, polyamides, jute, caoutchouc, autres), matériaux de remplissage (à base de pétrole, remplissage organique, remplissage de sable (silice), autres), hauteur de pile (moins de 10 mm, 10-30 mm, 30-50 mm, 50-70 mm, 70-100 mm, plus de 100 mm), revêtement arrière (PU, latex), canal de distribution (ventes directes/B2B, commerce électronique, magasins spécialisés, magasins de proximité, autres), utilisateur final (ménages, sports et loisirs, restaurants, hôtels, aéroports, bureaux commerciaux, zones pour animaux de compagnie, autres) Tendances de l'industrie et prévisions jusqu'en 2029

Analyse et taille du marché

Le gazon artificiel est un tapis conçu pour ressembler étroitement à l'herbe naturelle. Il s'agit d'une surface en fibres synthétiques conçue pour ressembler à de l'herbe naturelle et souvent utilisée dans les arènes pour les sports qui étaient ou sont normalement pratiqués sur de l'herbe. Il comprend divers matériaux synthétiques, semblables à des tapis, conçus pour ressembler à du gazon et utilisés comme surface de jeu pour les terrains de football et de baseball, pour couvrir les patios, etc. En particulier, le gazon artificiel nécessite peu d'entretien, est durable, respectueux des animaux, durable, rentable, offre des options de conception flexibles et offrira un espace vert et dynamique dont vous pourrez profiter toute l'année.

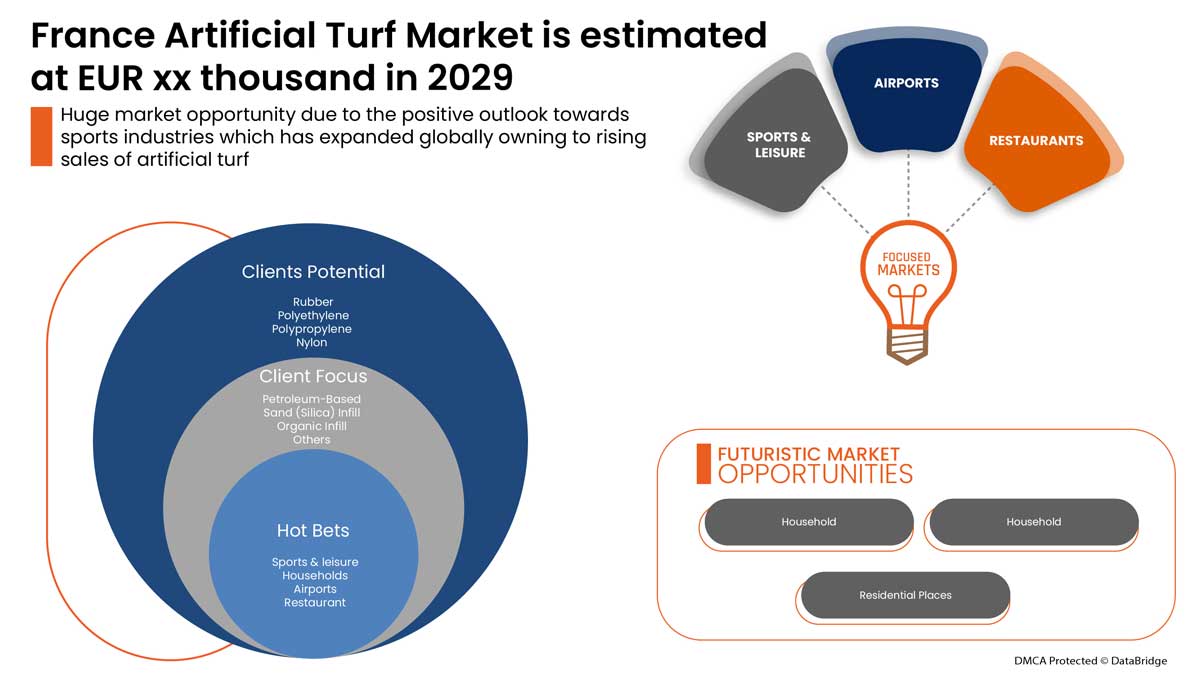

La demande croissante de gazon artificiel de la part des clubs sportifs et des différents sites devrait stimuler la croissance du marché. Une installation facile, un environnement convivial et de faibles besoins d'entretien devraient stimuler la croissance du marché. Data Bridge Market Research analyse que le marché du gazon artificiel devrait atteindre la valeur de 224 464,28 milliers d'euros d'ici 2029. « Sports & Loisirs » représente le segment d'utilisateurs finaux le plus important sur le marché respectif en raison de l'augmentation de la demande de gazon artificiel de divers domaines sportifs. Le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de la chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers d'euros, prix en euros |

|

Segments couverts |

Par type (nylon, polypropylène, polyéthylène , polyamides, jute, caoutchouc, autres), matériaux de remplissage (à base de pétrole, remplissage organique, remplissage de sable (silice), autres), hauteur de pile (moins de 10 mm, 10-30 mm, 30-50 mm, 50-70 mm, 70-100 mm, plus de 100 mm), revêtement arrière (PU, latex), canal de distribution (ventes directes/B2B, commerce électronique, magasins spécialisés, magasins de proximité, autres), utilisateur final (ménages, sports et loisirs, restaurants, hôtels, aéroports, bureaux commerciaux, zones pour animaux de compagnie, autres) |

|

Pays couverts |

France |

|

Acteurs du marché couverts |

Tarkett Group (Paris, France), Victoria PLC (Kidderminster, Royaume-Uni), POLYTAN (Burgheim, Allemagne), Dow (Michigan, États-Unis), Royal Grass (Uden, Pays-Bas), CCGrass (Nanjing, Chine), Condor Group (Hasselt, Pays-Bas), Act Global (Texas, États-Unis), entre autres. |

Définition du marché

Le gazon artificiel est un composite composé de fibres végétales organiques fabriquées par l'homme. Les brins sont verts et peuvent être utilisés dans différentes hauteurs de pile. Il est conçu de la même manière qu'un tapis, il a un dos solide et les brins sont cousus à la machine. La majorité des nouveaux gazons développés aujourd'hui se tissent souvent en une tige brune qui ressemble à l'apparence de l'herbe morte que l'on voit dans un vrai bassin herbeux. Le gazon artificiel est largement utilisé à des fins récréatives. Dans certaines régions du monde, le gazon artificiel est plus populaire que le gazon naturel sur les terrains de football des écoles secondaires. Il est utilisé pour de nombreuses installations sportives, telles que les cadres des terrains de bowling, de football et de baseball. Il est également utilisé pour l'aménagement paysager des particuliers et des entreprises.

Cadre réglementaire

Selon le STC (Synthetic Turf Council), avec l'utilisation croissante de coussinets amortisseurs dans les systèmes de gazon synthétique pour le sport dans le monde entier, le Synthetic Turf Council (STC), la plus grande organisation au monde exclusivement dédiée à l'industrie du gazon synthétique, a publié de nouvelles directives STC sur les performances et la qualité des coussinets amortisseurs. Ces directives fournissent aux gestionnaires de stade, aux désignateurs de terrains et aux propriétaires d'installations des mesures objectives lors de la spécification des coussinets amortisseurs et de la comparaison des performances et de la durabilité minimales des coussinets amortisseurs. Ce guide compare les performances de différents amortisseurs de manière objective et appropriée pour aider à la sélection d'un amortisseur pour une application particulière.

Dynamique du marché du gazon artificiel en France

Facteurs moteurs/opportunités du marché français du gazon synthétique

- Construction croissante de villas et d'appartements de luxe

Ces dernières années, la tendance vers des options de logement durables est devenue très populaire dans les pays européens. Un choix en plein essor pour les nouveaux acquéreurs de maisons, les maisons individuelles ou les villas offrent la possibilité de personnaliser la maison selon leurs goûts personnels ainsi qu'un espace polyvalent plus grand. De plus, malgré les prix élevés et la pénurie de logements à Paris, la France est depuis de nombreuses années le plus grand promoteur immobilier d'Europe, construisant plus de nouveaux logements que tout autre pays européen.

- Changement de préférence des consommateurs en faveur de produits de décoration intérieure nécessitant peu d'entretien

Les consommateurs recherchent de plus en plus des objets uniques qui personnalisent leur maison tout en préservant l'atmosphère durable de leur foyer. Par conséquent, les dépenses de consommation en produits décoratifs à faible entretien devraient augmenter au fil des ans, les consommateurs modifiant le style de leur maison en ajoutant des pièces décoratives flexibles et minuscules. De plus, l'intérêt croissant du public pour la décoration intérieure a explosé dans diverses parties du monde, mené par une vague de décoration intérieure qui comprend divers matériaux de gazon artificiel pour la décoration intérieure. Aujourd'hui, 80 % des ventes et des applications de gazon synthétique pour l'aménagement paysager en France sont destinées aux particuliers. De plus, les municipalités commencent à s'intéresser au gazon synthétique pour les espaces verts tels que les parcs et les aires de jeux.

- Popularité croissante du gazon artificiel auprès des clubs et associations sportives

Avec l'augmentation rapide des activités sportives dans divers pays européens, la tendance à passer des terrains en gazon naturel aux terrains en gazon artificiel est devenue très populaire ces dernières années. Les terrains de football en gazon artificiel apparaissent partout dans la région. Les gouvernements locaux de divers pays, dont la France, soutiennent également l'installation de ces terrains, principalement parce que les terrains de sport en gazon artificiel coûtent moins cher que l'entretien du gazon naturel. En particulier, la FIFA approuve même le gazon artificiel de haute qualité pour la pratique du football.

- Perspectives positives du gazon artificiel pour le secteur de l'hôtellerie

Le tourisme a stimulé l'activité du secteur de l'hôtellerie et de la restauration dans le monde entier et offre de grandes perspectives à l'industrie hôtelière. Le secteur a prospéré principalement grâce au tourisme en raison de la diversité des paysages, des croyances et des sociétés dans différents pays, tout en offrant une grande attraction aux touristes de différentes régions. Les secteurs de l'hôtellerie et de la restauration de nombreux pays se sont progressivement développés au cours des deux dernières décennies, et un développement est prévu dans les années à venir, associé à une augmentation de la demande de divers types de matériaux de gazon artificiel.

Contraintes/défis rencontrés par le marché français du gazon synthétique

- Disponibilité de produits alternatifs

Le gazon artificiel est souvent constitué d'un tapis de gazon synthétique auquel on ajoute de petits granulés de caoutchouc pour que le gazon se tienne droit, offrant ainsi amortissement et adhérence. Bien que le gazon artificiel présente divers avantages, il existe encore quelques substituts tels que le paillis organique, la mousse et le thym rampant, entre autres, qui peuvent remplacer le gazon artificiel pour diverses applications. Les produits de substitution sont tous des matériaux peu exigeants en entretien, pratiques et fonctionnels qui peuvent être utilisés à la place du gazon artificiel.

- Difficultés dans la gestion des déchets

Les déchets générés par les produits usagés en plastique et en caoutchouc sont potentiellement nocifs pour l'environnement dans une large mesure. Les plastiques sont constitués de polymères organiques synthétiques qui sont largement utilisés dans différentes applications allant des gazons artificiels à divers matériaux industriels. Ces derniers temps, les plastiques et le caoutchouc sont devenus un produit indispensable et polyvalent avec une large gamme de propriétés, de compositions chimiques et d'applications, ce qui crée par conséquent un problème au moment de l'élimination.

Le COVID-19 a eu un impact minime sur le marché français du gazon artificiel

La COVID-19 a eu un impact sur diverses industries de fabrication et de services au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, le déséquilibre entre l'offre et la demande et son impact sur les prix sont considérés comme à court terme et devraient se rétablir à la fin de cette pandémie. En raison de l'épidémie de covid19 dans le monde entier, la demande de gazon artificiel a diminué. Ainsi, l'industrie du sport et des loisirs, de l'hôtellerie et de la restauration a beaucoup souffert pendant l'épidémie de covid19, l'industrie du gazon artificiel devrait, espérons-le, croître avec la levée des restrictions en France.

Développements récents

- En mai 2020, Dow a annoncé la mise au point et la commercialisation de la nouvelle résine plastique PCR conçue pour les applications de collage de films rétractables en Asie-Pacifique. Cette dernière résine est conçue pour obtenir un rendement de film équivalent à celui des résines traditionnelles avec 40 % de matériau PCR. Le médicament, XUS 60921.01, est produit à partir de plastiques recyclés obtenus localement par l'intermédiaire du partenaire de recyclage stratégique Dow's à Nanjing, en Chine. Cette dernière résine conduit à un système de plastique circulaire, mais sans perte d'efficacité pour les propriétaires de marques et les clients. Ce développement a aidé l'entreprise à attirer des clients qui préfèrent les produits avancés.

- En janvier 2019, Royal Grass a lancé Lush, le dernier modèle de la collection Royal Grass. Avec ce gazon artificiel, les brins d'herbe sont plus nombreux au mètre carré et la pelouse paraît particulièrement luxuriante. De nombreux brins d'herbe ont une teinte jaunâtre et naturelle qui apporte une légère sensation de chute au gazon artificiel. Tout comme pour les autres produits récents de Royal Grass, la technologie ReaDY a introduit cette forme de plante artificielle, qui a permis aux fibres de se développer naturellement. Ce développement a aidé l'entreprise à attirer une nouvelle clientèle.

Portée du marché du gazon artificiel en France

Le marché du gazon artificiel est segmenté en fonction de la matière première, des matériaux de remplissage, de la hauteur des poils, du canal de distribution et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Caoutchouc

- Polyéthylène

- Polypropylène

- Nylon

- Polyamides

- Jute

- Autres

Sur la base de la matière première, le marché français du gazon artificiel est segmenté en nylon, polypropylène, polyéthylène, polyamides, jute, caoutchouc et autres.

Matériaux de remplissage

- À base de pétrole

- Remplissage de sable (silice)

- Remplissage organique

- Autres

Sur la base des matériaux de remplissage, le marché français du gazon artificiel est segmenté en remplissage à base de pétrole, remplissage organique, remplissage de sable (silice) et autres.

Hauteur des poils

- 10-30 mm

- 30-50 mm

- 50-70 mm

- Moins de 10 mm

- 70-100 mm

- Plus de 100 mm

Sur la base de la hauteur des poils, le marché français du gazon artificiel est segmenté en moins de 10 mm, 10-30 mm, 30-50 mm, 50-70 mm, 70-100 mm et plus de 100 mm.

Revêtement arrière

- PU

- Latex

Sur la base du revêtement arrière, le marché français du gazon artificiel est segmenté en PU et latex.

Canal de distribution

- Vente directe/B2B

- Magasins spécialisés

- Dépanneurs

- Commerce électronique

- Autres

Sur la base du canal de distribution, le marché français du gazon artificiel est segmenté en ventes directes/B2B, commerce électronique, magasins spécialisés, magasins de proximité et autres.

Utilisateur final

- Sports et loisirs

- Ménages

- Aéroports

- Restaurant

- Hôtels

- Bureaux commerciaux

- Espaces réservés aux animaux

- Autres

Sur la base de l'utilisateur final, le marché français du gazon artificiel est segmenté en ménages, sports et loisirs, restaurants, hôtels, aéroports, bureaux commerciaux, zones pour animaux de compagnie et autres.

Analyse du paysage concurrentiel et des parts de marché du gazon artificiel

Le paysage concurrentiel du marché du gazon artificiel fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en France, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché du gazon artificiel.

Certains des principaux acteurs du marché engagés sur le marché du gazon artificiel en France sont Tarkett Group, Victoria PLC, POLYTAN, Dow, Royal Grass, CCGrass, Condor Group, Act Global, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF FRANCE ARTIFICIAL TURF MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES:

4.1.1 THE THREAT OF NEW ENTRANTS:

4.1.2 THE THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 CONSUMER BUYING BEHAVIOR

4.2.1 OVERVIEW

4.2.2 PROMOTIONAL FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 CONCLUSION

4.3 FACTORS AFFECTING BUYING DECISION OF THE CONSUMERS

4.3.1 OVERVIEW

4.3.2 PURCHASING POWER

4.3.3 MARKETING

4.3.4 SOCIAL FACTORS

4.3.5 PSYCHOLOGICAL FACTORS

4.3.6 ECONOMIC CONDITIONS

4.3.7 CONSUMER’S EXPERIENCE

4.3.8 PURCHASE DECISION AND WILLINGNESS TO PAY

4.3.9 CONCLUSION

4.4 REGULATION COVERAGE

4.5 PRODUCT ADOPTION CRITERIA

4.5.1 OVERVIEW

4.5.2 PERSONAL INFLUENCE

4.5.3 PRODUCT INNOVATION CHARACTERISTICS

4.5.4 WILLINGNESS TO EMBRACE NEW PRODUCTS

4.5.5 CONCLUSION

4.6 VENDOR SELECTION CRITERIA

4.7 LIST OF POTENTIAL BUYERS

4.8 COUNTRY ANALYSIS (2022)

5 SUPPLY CHAIN ANALYSIS

5.1.1 LOGISTIC COST SCENARIO

5.1.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSTRUCTION OF VILLAS AND LUXURY APARTMENTS

6.1.2 SHIFT IN CONSUMER’S PREFERENCE TOWARD LOW-MAINTENANCE HOME DECORATION PRODUCTS

6.1.3 GAINING POPULARITY OF ARTIFICIAL TURF FROM SPORTS CLUBS AND ASSOCIATIONS

6.1.4 POSITIVE OUTLOOK OF ARTIFICIAL TURF TOWARD HOSPITALITY INDUSTRY

6.2 RESTRAINTS

6.2.1 AVAILABILITY OF ALTERNATIVE PRODUCTS

6.2.2 DIFFICULTIES IN WASTE MANAGEMENT

6.3 OPPORTUNITIES

6.3.1 FAVOURABLE GOVERNMENT INITIATIVES TOWARD RAPID URBANIZATION

6.3.2 INCREASING TECHNOLOGICAL ADVANCEMENT FOR INSTALLING ARTIFICIAL TURF

6.4 CHALLENGES

6.4.1 FLUCTUATION IN THE RAW MATERIALS PRICES

6.4.2 DIFFICULTIES IN MAINTAINING THE FIELD TEMPERATURE

7 FRANCE ARTIFICIAL TURF MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 RUBBER

7.3 POLYETHYLENE

7.4 POLYPROPYLENE

7.5 NYLON

7.6 POLYAMIDES

7.7 JUTE

7.8 OTHERS

8 FRANCE ARTIFICIAL TURF MARKET, BY INFILL MATERIALS

8.1 OVERVIEW

8.2 PETROLEUM-BASED

8.2.1 PETROLEUM-BASED, BY TYPE

8.2.2 CRUMB RUBBER

8.2.3 COATED RUBBER INFILL

8.2.4 EPDM (ETHYLENE PROPYLENE DIENE INFILL)

8.2.5 TPE (THERMO PLASTIC ELASTOMER)

8.2.6 COATED SILICA SAND INFILL

8.3 SAND (SILICA) INFILL

8.4 ORGANIC INFILL

8.5 OTHERS

9 FRANCE ARTIFICIAL TURF MARKET, BY PILE HEIGHT

9.1 OVERVIEW

9.2 10-30 MM

9.3 30-50 MM

9.4 50-70 MM

9.5 LESS THAN 10 MM

9.6 70-100 MM

9.7 MORE THAN 100 MM

10 FRANCE ARTIFICIAL TURF MARKET, BY BACK COATING

10.1 OVERVIEW

10.2 PU

10.3 LATEX

11 FRANCE ARTIFICIAL TURF MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT SALES/B2B

11.3 SPECIALTY STORES

11.4 CONVENIENCE STORES

11.5 E-COMMERCE

11.6 OTHERS

12 FRANCE ARTIFICIAL TURF MARKET, BY END-USER

12.1 OVERVIEW

12.2 SPORTS & LEISURE

12.2.1 SPORTS & LEISURE, BY END-USER

12.2.2 SPORTS GROUNDS

12.2.3 SPORTS GROUNDS, BY TYPE

12.2.3.1 FOOTBALL

12.2.3.2 GOLF

12.2.3.3 HOCKEY

12.2.3.4 RUGBY

12.2.3.5 TENNIS

12.2.3.6 OTHERS

12.2.4 PLAYGROUNDS & PLAY ARENA

12.2.5 OTHERS

12.3 HOUSEHOLDS

12.3.1 HOUSEHOLDS, BY END-USER

12.3.2 BALCONY

12.3.3 LANDSCAPE

12.3.4 ROOFS

12.3.5 OTHERS

12.4 AIRPORTS

12.5 RESTAURANT

12.6 HOTELS

12.7 COMMERCIAL OFFICES

12.8 PET AREAS

12.9 OTHERS

13 FRANCE ARTIFICIAL TURF MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: FRANCE

13.2 MERGER & ACQUISITION

13.3 COLLABORATIONS AND PARTNERSHIPS

13.4 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 TARKETT GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 VICTORIA PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATE

15.3 CONDOR GROUP

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT UPDATE

15.4 DOW

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATE

15.5 ACT GLOBAL

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT UPDATES

15.6 CCGRASS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATE

15.7 POLYTAN

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATE

15.8 ROYAL GRASS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF ARTICLES AND EQUIPMENT FOR SPORT AND OUTDOOR GAMES N.E.S; SWIMMING AND PADDLING POOLS; HS CODE - 950699 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES AND EQUIPMENT FOR SPORT AND OUTDOOR GAMES N.E.S; SWIMMING AND PADDLING POOLS; HS CODE - 950699 (USD THOUSAND)

TABLE 3 FRANCE ARTIFICIAL TURF MARKET, BY RAW MATERIAL, 2020-2029 (EUR THOUSAND)

TABLE 4 FRANCE ARTIFICIAL TURF MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND METER SQUARE)

TABLE 5 FRANCE ARTIFICIAL TURF MARKET, BY INFILL MATERIALS, 2020-2029 (EUR THOUSAND)

TABLE 6 FRANCE PETROLEUM-BASED IN ARTIFICIAL TURF MARKET, BY TYPE, 2020-2029 (EUR THOUSAND)

TABLE 7 FRANCE ARTIFICIAL TURF MARKET, BY PILE HEIGHT, 2020-2029 (EUR THOUSAND)

TABLE 8 FRANCE ARTIFICIAL TURF MARKET, BY BACK COATING, 2020-2029 (EUR THOUSAND)

TABLE 9 FRANCE ARTIFICIAL TURF MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (EUR THOUSAND)

TABLE 10 FRANCE ARTIFICIAL TURF MARKET, BY END-USER, 2020-2029 (EUR THOUSAND)

TABLE 11 FRANCE SPORTS & LEISURE IN ARTIFICIAL TURF MARKET, BY END-USER, 2020-2029 (EUR THOUSAND)

TABLE 12 FRANCE SPORTS GROUNDS IN ARTIFICIAL TURF MARKET, BY TYPE, 2020-2029 (EUR THOUSAND)

TABLE 13 FRANCE HOUSEHOLDS IN ARTIFICIAL TURF MARKET, BY END-USER, 2020-2029 (EUR THOUSAND)

Liste des figures

FIGURE 1 FRANCE ARTIFICIAL TURF MARKET: SEGMENTATION

FIGURE 2 FRANCE ARTIFICIAL TURF MARKET: DATA TRIANGULATION

FIGURE 3 FRANCE ARTIFICIAL TURF MARKET: DROC ANALYSIS

FIGURE 4 FRANCE ARTIFICIAL TURF MARKET: FRANCE VS REGIONAL MARKET ANALYSIS

FIGURE 5 FRANCE ARTIFICIAL TURF MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 FRANCE ARTIFICIAL TURF MARKET: THE RAW MATERIAL LIFE LINE CURVE

FIGURE 7 FRANCE ARTIFICIAL TURF MARKET: MULTIVARIATE MODELLING

FIGURE 8 FRANCE ARTIFICIAL TURF MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 FRANCE ARTIFICIAL TURF MARKET: DBMR MARKET POSITION GRID

FIGURE 10 FRANCE ARTIFICIAL TURF MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 FRANCE ARTIFICIAL TURF MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 FRANCE ARTIFICIAL TURF MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 FRANCE ARTIFICIAL TURF MARKET: SEGMENTATION

FIGURE 14 GROWING CONSTRUCTION OF VILLAS AND LUXURY APARTMENTS IS EXPECTED TO DRIVE FRANCE ARTIFICIAL TURF MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RUBBER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF FRANCE ARTIFICIAL TURF MARKET IN 2022 & 2029

FIGURE 16 FRANCE ARTIFICIAL TURF MARKET: CONSUMER BUYING BEHAVIOUR

FIGURE 17 FRANCE ARTIFICIAL TURF MARKET: FACTORS AFFECTING BUYING DYNAMICS OF THE CONSUMERS

FIGURE 18 FRANCE ARTIFICIAL TURF MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 19 FRANCE ARTIFICIAL TURF MARKET - SUPPLY CHAIN ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF FRANCE ARTIFICIAL TURF MARKET

FIGURE 21 TOP 6 IMPORTING COUNTRIES OF HOME DECORATION & HOME TEXTILES (HDHT) PRODUCTS IN EUROPE, 2019

FIGURE 22 TOURISM IN FRANCE

FIGURE 23 FRANCE ARTIFICIAL TURF MARKET: BY RAW MATERIAL, 2021

FIGURE 24 FRANCE ARTIFICIAL TURF MARKET: BY INFILL MATERIALS, 2021

FIGURE 25 FRANCE ARTIFICIAL TURF MARKET: BY PILE HEIGHT, 2021

FIGURE 26 FRANCE ARTIFICIAL TURF MARKET: BY BACK COATING, 2021

FIGURE 27 FRANCE ARTIFICIAL TURF MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 FRANCE ARTIFICIAL TURF MARKET: BY END-USER, 2021

FIGURE 29 FRANCE ARTIFICIAL TURF MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.