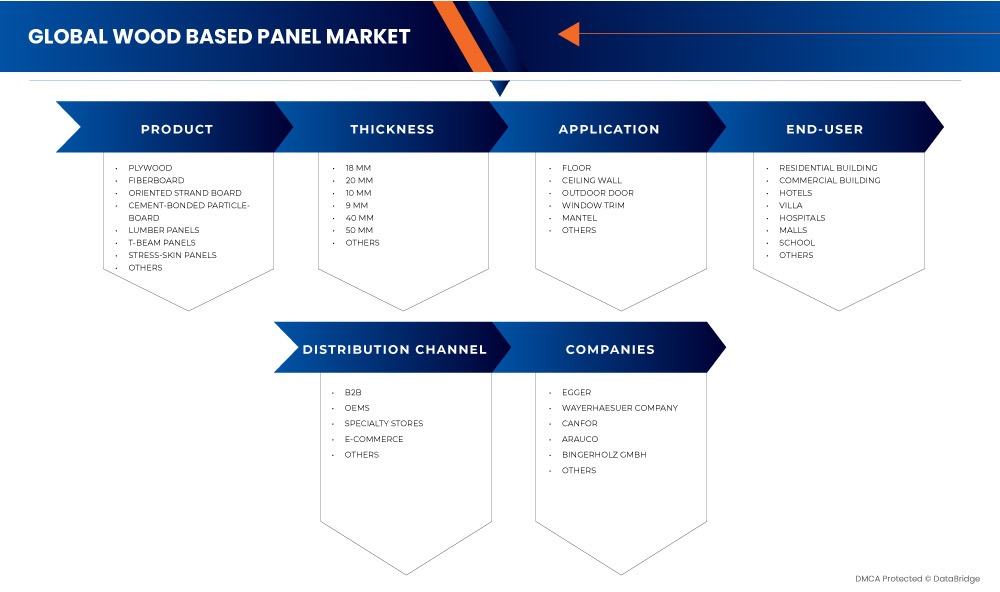

Marché européen des panneaux à base de bois par produit (contreplaqué, panneaux de fibres, panneaux à copeaux orientés, panneaux de particules liés au ciment, panneaux de bois d'œuvre, panneaux à poutres en T, panneaux à peau tendue et autres), épaisseur (9 mm, 10 mm, 18 mm, 20 mm, 40 mm, 50 mm et autres), canal de distribution (B2B, OEM, magasins spécialisés, commerce électronique et autres), application (porte extérieure, garniture de fenêtre, mur de plafond, manteau, sol et autres), utilisateur final (bâtiment résidentiel, bâtiment commercial, hôtels, villa, hôpitaux, écoles, centres commerciaux et autres) – Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché des panneaux à base de bois en Europe

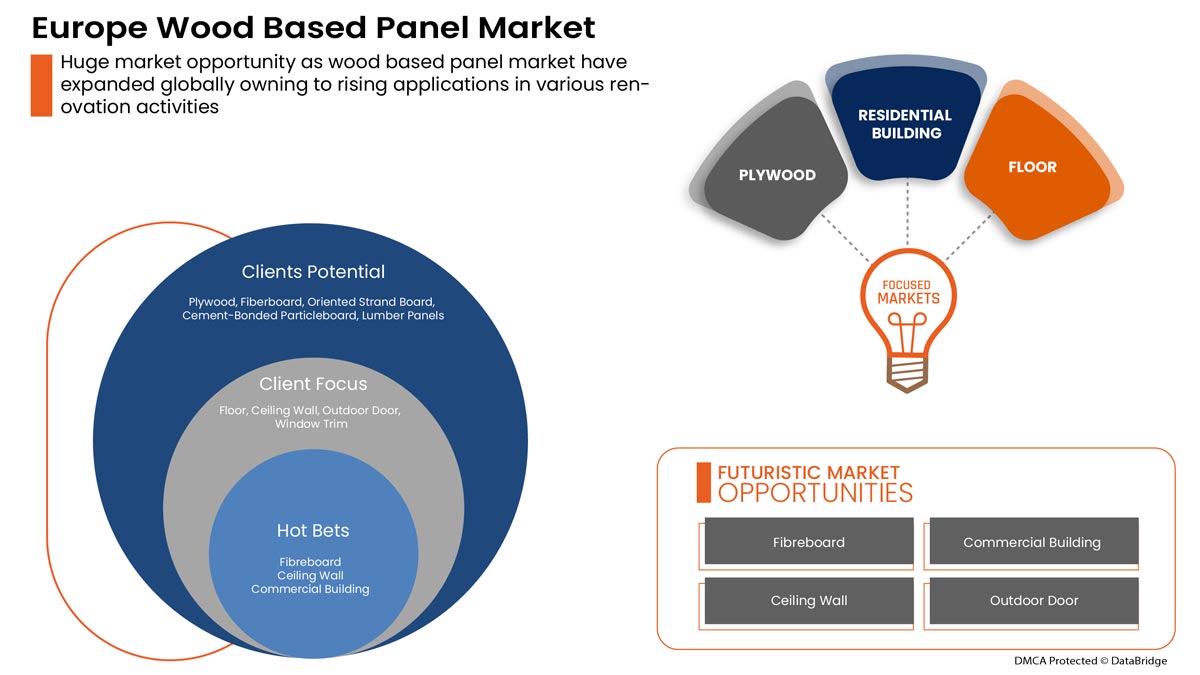

Les panneaux à base de bois sont largement utilisés pour les plafonds, les bardages, les toitures , les revêtements de sol et les meubles en raison de leur résistance et de leur durabilité. La demande croissante de produits à base de bois de la part des industries d'utilisation finale accélère la croissance du marché à travers le monde. L'adaptation de ces technologies à l'industrie des panneaux à base de bois a été stimulée par la nécessité d'améliorer simultanément la qualité des produits et de réduire les coûts de fabrication, ou plutôt de garantir la compétitivité des producteurs de panneaux à base de bois. Par conséquent, la demande croissante de panneaux à base de bois devrait stimuler la croissance du marché au cours de la période projetée.

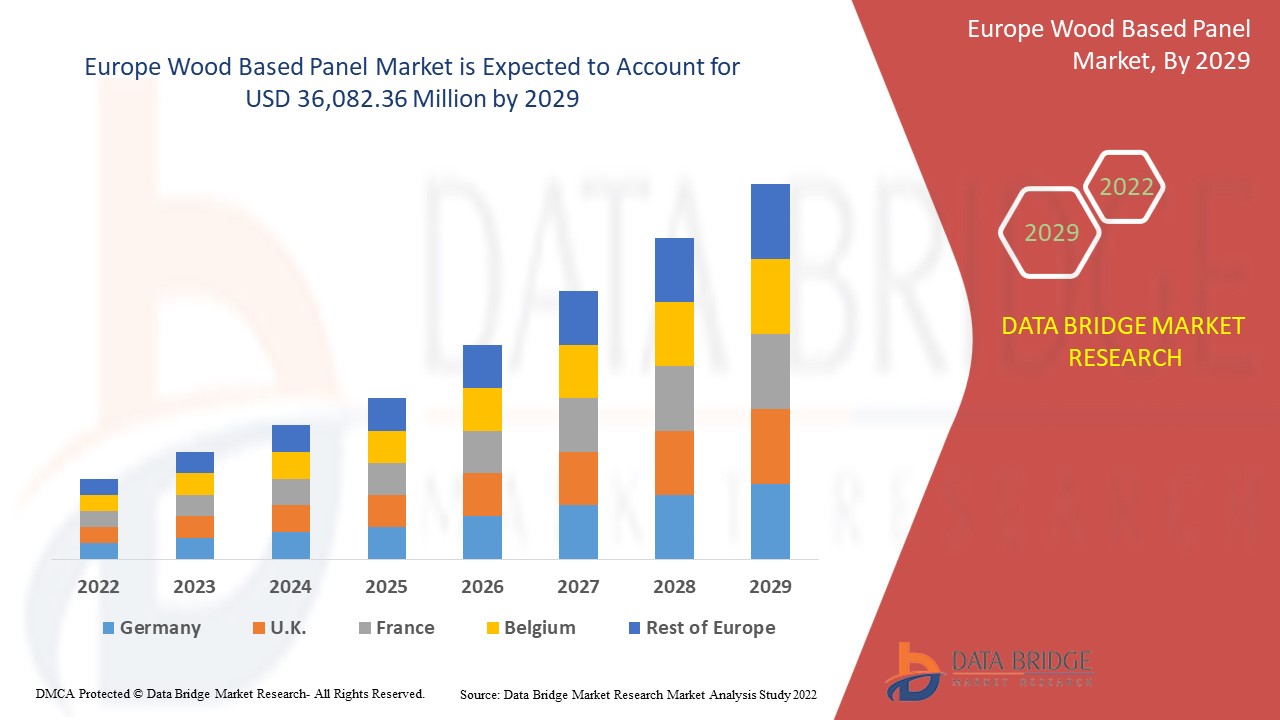

Data Bridge Market Research estime que le marché des panneaux à base de bois devrait atteindre la valeur de 36 082,36 millions USD d'ici 2029, à un TCAC de 3,2 % au cours de la période de prévision. Le « plancher » représente le segment d'application le plus important sur le marché concerné en raison de l'augmentation des panneaux à base de bois. Le rapport de marché élaboré par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par produit (contreplaqué, panneau de fibres, panneau de particules orientées, panneau de particules liées au ciment, panneaux de bois d'œuvre, panneaux à poutres en T, panneaux à revêtement sous contrainte et autres), épaisseur (9 mm, 10 mm, 18 mm, 20 mm, 40 mm, 50 mm et autres), canal de distribution (B2B, OEM, magasins spécialisés, commerce électronique et autres), application (porte extérieure, garniture de fenêtre, mur de plafond, manteau de cheminée, sol et autres), utilisateur final (bâtiment résidentiel, bâtiment commercial, hôtels, vila, hôpitaux, école, centres commerciaux et autres). |

|

Pays couverts |

Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Turquie, Suisse, Belgique, Pays-Bas et reste de l'Europe. |

|

Acteurs du marché couverts |

Groupe EGGER, West Fraser, Starbank Panel Products Ltd, Groupe Dongwha, Kronoplus Limited, BinderHolz GmbH, DARE panel group co., ltd., Canfor, Sonae Industria, EVERGREEN FIBREBOARD BERHAD, Mieco Chipboard Berhad, Kastamonu Entegre et PFEIFER GROUP, entre autres. |

Définition du marché

Les panneaux à base de bois sont un terme courant pour désigner un ensemble de produits différents, qui présentent une large gamme de propriétés techniques. Si certains types de panneaux sont relativement nouveaux sur le marché, d'autres ont été développés et introduits avec succès il y a plus de cent ans. Cependant, les types de panneaux ont une longue histoire d'optimisation continue qui est encore loin d'être pleinement développée, et ils peuvent toujours avoir une chance d'être améliorés. Les développements technologiques, d'une part, et les nouvelles exigences du marché et de la réglementation, ainsi qu'une situation des matières premières en constante évolution, entraînent des améliorations continues des panneaux à base de bois et de leurs processus de fabrication

Dynamique du marché des panneaux à base de bois en Europe

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Facteurs moteurs/opportunités pour le marché européen des panneaux à base de bois

- Hausse des dépenses de consommation en panneaux à base de bois dans la rénovation des maisons et des meubles

L'industrie des panneaux de bois comprend les feuilles de contreplaqué, les panneaux de bois d'ingénierie, les panneaux MDF (panneaux de fibres à densité moyenne), les panneaux de meubles, les panneaux de particules et les produits de surface décoratifs tels que les stratifiés. L'augmentation des dépenses de consommation en panneaux à base de bois dans la rénovation des maisons et des meubles devrait stimuler la demande de panneaux à base de bois dans les bâtiments commerciaux et résidentiels. L'amélioration et l'augmentation des activités de rénovation des bâtiments avec l'adoption de panneaux à base de bois pour une augmentation de l'esthétique sont un autre facteur qui stimule la croissance du marché. De plus, la construction accrue de bâtiments publics, de grands hôtels et de complexes hôteliers avec des panneaux de bois décoratifs a conduit à la croissance du marché.

- Procédures d'importation et d'exportation équilibrées de panneaux de bois entre les pays

Le commerce mondial des produits du bois est fortement régionalisé, avec l'Europe, l'Amérique du Nord et l'Asie. Ces dernières années, le commerce mondial des produits du bois a considérablement changé avec l'augmentation de la demande de panneaux de bois et l'augmentation des marchés émergents de panneaux de bois. Ces dernières années, la production et le commerce de produits à base de bois tels que le contreplaqué, les panneaux de particules, les panneaux de fibres, les panneaux à copeaux orientés et les panneaux de bois d'œuvre ont augmenté en raison de la hausse de la demande du marché du logement et de l'augmentation de la population mondiale.

- Faible coût du produit associé aux propriétés supérieures des panneaux de bois, notamment la résistance et la durabilité

Les panneaux à base de bois sont des produits spécialisés qui offrent des performances avancées, une performance à long terme et une durabilité accrue, tout en étant moins coûteux à produire et à utiliser. Les panneaux à base de bois offrent un éventail incroyable de possibilités en termes d'applications structurelles et esthétiques. En raison de leur prix abordable, de leurs performances supérieures et de leur flexibilité en matière de conception, de construction et de rénovation, l'utilisation des panneaux à base de bois augmente dans les constructions résidentielles. La construction à ossature bois s'est considérablement améliorée avec une construction plus rapide, une meilleure utilisation des fibres, moins de déchets et un meilleur contrôle de la qualité. Les nouvelles avancées technologiques dans les EWP et les connexions permettent à l'industrie des produits du bois de rivaliser avec succès dans la construction de structures beaucoup plus grandes et plus complexes.

- Augmentation des investissements et des initiatives en faveur des activités de construction tant commerciales que résidentielles

Le secteur de la construction est devenu un secteur manufacturier robuste et efficace dans le monde entier. Dans tous les pays, la croissance de la demande de projets de construction et d'immobilier est tirée par des mégatendances macroéconomiques et disruptives, telles que l'urbanisation croissante, l'expansion du commerce, les tendances démographiques telles que l'augmentation des niveaux de revenus, la technologie et les environnements durables. Dans ce contexte, divers projets ont été lancés pour créer des communautés socialement inclusives et durables, car la croissance économique de tout pays dépend principalement du développement de ses infrastructures.

Contraintes/défis rencontrés par le marché européen des panneaux à base de bois

- Augmentation des inquiétudes concernant la poussière liée à l'utilisation de panneaux de bois

Les panneaux à base de bois couvrent la production d'une gamme variée de produits, et bien que le flux de production diffère d'un produit à l'autre, il existe certaines caractéristiques communes en termes de problèmes environnementaux clés. Les émissions de poussières, de composés organiques et de formaldéhyde sont les principales préoccupations croissantes lors de la fabrication de produits à base de panneaux de bois. Les émissions de particules fines contribuent aux émissions de poussières provenant de la production de panneaux à base de bois, où les particules inférieures à 3 µm peuvent constituer jusqu'à 50 % de la poussière totale mesurée en raison des émissions de poussières provenant de la fabrication de panneaux à base de bois, provoquant des problèmes de santé et d'environnement, qui figurent en tête de l'agenda de la politique environnementale.

- Fluctuation des prix de la pâte de bois

La fluctuation du prix des matières premières aura une incidence sur le coût de production des produits à base de bois. Le changement du coût de production modifiera les revenus des fabricants. La pâte de bois est extraite des arbres, mais en raison de la demande accrue dans les différentes régions, l'importation et l'exportation de pâte de bois se font dans la quantité spécifiée. La matière première est disponible en différentes qualités et à différents tarifs, ce qui rend la production de produits à base de bois très difficile pour les fabricants. Des coûts de matières premières très fluctuants et une gestion des prix inefficace peuvent mettre en danger un fabricant sur le marché. En raison de la fluctuation du prix des matières premières, les fabricants peuvent désormais fixer le coût du produit, ce qui entraîne une perte pour les fabricants.

- Fluctuation des prix des matières premières et incohérence de la chaîne d'approvisionnement

L'écosystème de la chaîne d'approvisionnement est devenu de plus en plus volatil en raison d'une pénurie de différents facteurs, tels que les coûts élevés des produits, les coûts de transport et autres. Les fabricants de produits en bois sont confrontés à de nombreux défis en raison de la grande variabilité des matières premières. Chaque étape de transformation de la fabrication a un impact sur l'utilisation des matériaux et la rentabilité, ce qui explique le coût plus élevé des matériaux. Le défi le plus courant pour le fabricant de produits en bois est de réaliser un profit et d'exécuter le processus de fabrication à faible coût mais avec des matières premières variables à coût élevé.

Impact de la pandémie de COVID-19 sur le marché européen des panneaux à base de bois

La COVID-19 a eu un impact sur plusieurs secteurs de la fabrication au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. En raison du confinement, le marché a connu une baisse des ventes en raison de la fermeture des points de vente au détail et des restrictions d'accès des clients au cours des dernières années.

Cependant, la croissance du marché après la pandémie est due au nombre croissant de personnes travaillant à domicile et à l’augmentation du revenu disponible. Cela a entraîné une augmentation de la demande de mobilier. Les principaux acteurs du marché prennent diverses décisions stratégiques pour rebondir après la COVID-19. Ils mènent de nombreuses activités de R&D pour améliorer leurs offres. Ils renforcent leur part de marché en explorant différents canaux de vente au détail et en s’étendant dans de nouvelles régions.

Ce rapport sur le marché européen des panneaux à base de bois fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l’analyse des importations et des exportations, l’analyse de la production, l’optimisation de la chaîne de valeur, la part de marché, l’impact des acteurs du marché national et localisé, les opportunités d’analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l’analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d’application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d’informations sur le marché des panneaux à base de bois, contactez Data Bridge Market Research pour un briefing d’analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développements récents

- En novembre 2020, West Fraser a acquis Norbord, créant ainsi un leader européen diversifié des produits du bois. Cette acquisition a accru la crédibilité de l'entreprise sur le marché et l'aidera ainsi à diversifier ses activités.

- En mars 2021, Binderholz GmbH et Hilti ont travaillé ensemble pour combler les lacunes dans les bâtiments de protection incendie structurelle. Celles-ci représentent des contraintes pour les experts en sécurité et les propriétaires de bâtiments. Le partenariat garantit l'approbation de davantage d'unités de protection incendie structurelle et de critères de documentation pour la planification et le développement de bâtiments protégés contre l'incendie.

Portée du marché européen des panneaux à base de bois

Le marché européen des panneaux à base de bois est segmenté en fonction du produit, du canal de distribution, de l'épaisseur, de l'application et des utilisateurs finaux. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Contre-plaqué

- Panneau de fibres

- Panneau de particules lié au ciment

- Panneau à copeaux orientés

- Panneaux de bois

- Panneaux à poutres en T

- Panneaux à revêtement anti-stress

- Autres

Sur la base du produit, le marché européen des panneaux à base de bois est segmenté en contreplaqué, panneaux de fibres, panneaux à copeaux orientés, panneaux de particules liées au ciment, panneaux de bois, panneaux à poutres en T, panneaux à peau tendue et autres.

Canal de distribution

- Commerce électronique

- OEM

- B2B

- Magasins spécialisés

- Autres

Sur la base du canal de distribution, le marché européen des panneaux à base de bois est segmenté en B2B, OEM, magasins spécialisés, commerce électronique et autres.

Épaisseur

- 9 MM

- 10 MM

- 18 MM

- 20 MM

- 40 MM

- 50 MM

- Autres

Sur la base de l'épaisseur, le marché européen des panneaux à base de bois est segmenté en 9 MM, 10 MM, 18 MM, 20 MM, 40 MM, 50 MM et autres.

Application

- Porte extérieure

- Garniture de fenêtre

- Plafond Mur

- Manteau

- Sol

- Autres

Sur la base des applications, le marché européen des panneaux à base de bois est segmenté en portes extérieures, garnitures de fenêtres, murs de plafond, manteaux, sols et autres.

Utilisateur final

- Bâtiment résidentiel

- Bâtiment commercial

- Hôtels

- Villa

- Hôpitaux

- École

- Centres commerciaux

- Autres

Sur la base des utilisateurs finaux, le marché européen des panneaux à base de bois est segmenté en bâtiments résidentiels, bâtiments commerciaux, hôtels, villas, hôpitaux, écoles, centres commerciaux et autres.

Analyse/perspectives régionales du marché des panneaux à base de bois en Europe

Le marché européen des panneaux à base de bois est analysé et des informations sur la taille du marché et les tendances sont fournies par produit, canal de distribution, épaisseur, application et utilisateurs finaux, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché européen des panneaux à base de bois sont l’Allemagne, le Royaume-Uni, l’Italie, la France, l’Espagne, la Russie, la Turquie, la Suisse, la Belgique, les Pays-Bas et le reste de l’Europe.

L'Allemagne domine le marché en raison d'une augmentation des dépenses de consommation en panneaux à base de bois pour la rénovation des maisons et des meubles dans la région. L'augmentation des investissements et des initiatives en faveur des activités de construction à la fois commerciales et résidentielles stimule la demande de la région pour les panneaux à base de bois.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des panneaux à base de bois en Europe

Le paysage concurrentiel du marché européen des panneaux à base de bois fournit des détails par concurrent. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises sur le marché européen des panneaux à base de bois.

Certains des principaux acteurs opérant sur le marché des panneaux à base de bois sont Egger Group, West Fraser, Starbank Panel Products Ltd, Dongwha Group, Kronoplus Limited, BinderHolz GmbH, Dare panel group co., ltd., Canfor, Sonae Industria, Evergreen Fibreboard Berhad, Mieco Chipboard Berhad, Kastamonu Entegre, Pfeifer Group entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE WOOD BASED PANELS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DISTRIBUTION CHANNEL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 IMPORT EXPORT SCENARIO

4.3 PORTER’S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 PRICING TREND SCENARIO

4.5 PRODUCTION & CONSUMPTION ANALYSIS

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

4.9 REGULATORY FRAMWORK

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATION

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE

7.1.2 BALANCED IMPORT AND EXPORT PROCEDURES OF WOOD PANELS AMONG THE COUNTRIES

7.1.3 LOW PRODUCT COST COUPLED WITH SUPERIOR PROPERTIES OF WOOD PANELS, INCLUDING STRENGTH AND DURABILITY

7.2 RESTRAINTS

7.2.1 STRINGENT RULES AND NORMS BY THE GOVERNMENT REGARDING DEFORESTATION

7.2.2 RISE IN CONCERNS OF DUST BY WOOD PANEL USAGE

7.2.3 FLUCTUATION IN THE PRICES OF WOOD PULP

7.3 OPPORTUNITIES

7.3.1 RISE IN INVESTMENTS AND INITIATIVES TOWARDS CONSTRUCTION ACTIVITIES FOR BOTH COMMERCIAL AND RESIDENTIAL

7.3.2 INCREASE IN PARTNERSHIPS FOR THE GROWTH OF CONSTRUCTION SECTOR IN EMERGING COUNTRIES

7.3.3 INCORPORATION OF APA STANDARDS FOR MANUFACTURERS AIDS THE PRODUCT ENTRY INTO THE MARKET

7.4 CHALLENGES

7.4.1 SHORTAGE OF TIMBER AND CLIMATE CHANGE

7.4.2 FLUCTUATION OF RAW MATERIAL PRICES AND SUPPLY CHAIN INCONSISTENCY

7.4.3 SHORTAGE IN LABOR AND FINANCIAL LOSSES

8 IMPACT OF COVID-19 ON THE EUROPE WOOD BASED PANEL MARKET

8.1 ANALYSIS ON IMPACT OF COVID-19 ON EUROPE WOOD BASED PANEL MARKET

8.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

8.3 STRATEGIC DECISION FOR MANUFACTURES AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.4 IMPACT ON PRICE

8.5 IMPACT ON DEMAND

8.6 IMPACT ON SUPPLY CHAIN

8.7 CONCLUSION

9 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 PLYWOOD

9.2.1 SOFTWOOD PLYWOOD

9.2.2 HARDWOOD PLYWOOD

9.2.3 OTHERS

9.3 FIBERBOARD

9.3.1 MDF

9.3.2 HDF

9.3.3 PARTICLEBOARD

9.3.4 HARDBOARD

9.3.5 OTHERS

9.4 ORIENTED STRAND BOARD

9.5 CEMENT-BONDED PARTICLEBOARD

9.6 LUMBER PANELS

9.7 T-BEAM PANELS

9.8 STRESS-SKIN PANELS

9.9 OTHERS

10 EUROPE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 B2B

10.3 OEMS

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 EUROPE WOOD BASED PANEL MARKET, BY THICKNESS

11.1 OVERVIEW

11.2 18 MM

11.3 20 MM

11.4 10 MM

11.5 9 MM

11.6 40 MM

11.7 50 MM

11.8 OTHERS

12 EUROPE WOOD BASED PANEL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FLOOR

12.3 CEILING WALL

12.4 OUTDOOR DOOR

12.5 WINDOW TRIM

12.6 MANTEL

12.7 OTHERS

13 EUROPE WOOD BASED PANEL MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESIDENTIAL BUILDING

13.2.1 PLYWOOD

13.2.2 FIBERBOARD

13.2.3 ORIENTED STRAND BOARD

13.2.4 CEMENT-BONDED PARTICLEBOARD

13.2.5 LUMBER PANELS

13.2.6 T-BEAM PANELS

13.2.7 STRESS-SKIN PANELS

13.2.8 OTHERS

13.3 COMMERCIAL BUILDING

13.3.1 PLYWOOD

13.3.2 FIBERBOARD

13.3.3 ORIENTED STRAND BOARD

13.3.4 CEMENT-BONDED PARTICLEBOARD

13.3.5 LUMBER PANELS

13.3.6 T-BEAM PANELS

13.3.7 STRESS-SKIN PANELS

13.3.8 OTHERS

13.4 HOTELS

13.4.1 PLYWOOD

13.4.2 FIBERBOARD

13.4.3 ORIENTED STRAND BOARD

13.4.4 CEMENT-BONDED PARTICLEBOARD

13.4.5 LUMBER PANELS

13.4.6 T-BEAM PANELS

13.4.7 STRESS-SKIN PANELS

13.4.8 OTHERS

13.5 VILLA

13.5.1 PLYWOOD

13.5.2 FIBERBOARD

13.5.3 ORIENTED STRAND BOARD

13.5.4 CEMENT-BONDED PARTICLEBOARD

13.5.5 LUMBER PANELS

13.5.6 T-BEAM PANELS

13.5.7 STRESS-SKIN PANELS

13.5.8 OTHERS

13.6 HOSPITALS

13.6.1 PLYWOOD

13.6.2 FIBERBOARD

13.6.3 ORIENTED STRAND BOARD

13.6.4 CEMENT-BONDED PARTICLEBOARD

13.6.5 LUMBER PANELS

13.6.6 T-BEAM PANELS

13.6.7 STRESS-SKIN PANELS

13.6.8 OTHERS

13.7 MALLS

13.7.1 PLYWOOD

13.7.2 FIBERBOARD

13.7.3 ORIENTED STRAND BOARD

13.7.4 CEMENT-BONDED PARTICLEBOARD

13.7.5 LUMBER PANELS

13.7.6 T-BEAM PANELS

13.7.7 STRESS-SKIN PANELS

13.7.8 OTHERS

13.8 SCHOOL

13.8.1 PLYWOOD

13.8.2 FIBERBOARD

13.8.3 ORIENTED STRAND BOARD

13.8.4 CEMENT-BONDED PARTICLEBOARD

13.8.5 LUMBER PANELS

13.8.6 T-BEAM PANELS

13.8.7 STRESS-SKIN PANELS

13.8.8 OTHERS

13.9 OTHERS

13.9.1 PLYWOOD

13.9.2 FIBERBOARD

13.9.3 ORIENTED STRAND BOARD

13.9.4 CEMENT-BONDED PARTICLEBOARD

13.9.5 LUMBER PANELS

13.9.6 T-BEAM PANELS

13.9.7 STRESS-SKIN PANELS

13.9.8 OTHERS

14 EUROPE WOOD BASED PANEL MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 ITALY

14.1.4 TURKEY

14.1.5 RUSSIA

14.1.6 FRANCE

14.1.7 SPAIN

14.1.8 NETHERLANDS

14.1.9 BELGIUM

14.1.10 SWITZERLAND

14.1.11 REST OF EUROPE

15 EUROPE WOOD BASED PANEL MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGER & ACQUISITION

15.3 PRODUCT LAUNCH

15.4 PARTNERSHIP

15.5 EXPANSIONS

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 WEST FRASER

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 WEYERHAEUSER COMPANY

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CANFOR

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 EGGER GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ARAUCO

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BINDERHOLZ GMBH

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BOISE CASCADE

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DARE PANEL GROUP CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 DONGWHA GROUP

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 EVERGREEN FIBREBOARD BERHAD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 GEORGIA-PACIFIC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 GREEN RIVER HOLDING CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KASTAMONU ENTEGRE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 KRONOPLUS LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 MIECO CHIPBOARD BERHAD

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 PFEIFER GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 SONAE INDUSTRIA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 STARBANK PANEL PRODUCTS LTD

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 TIMBER PRODUCTS COMPANY

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 2 EXPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 3 EXPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 4 IMPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 5 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 7 EUROPE PLYWOOD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 EUROPE FIBERBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ORIENTED STRAND BOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE CEMENT-BONDED PARTICLEBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE LUMBER PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE T-BEAM PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE STRESS-SKIN PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 18 EUROPE B2B IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OEMS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE SPECIALTY STORES IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE E-COMMERCE IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 24 EUROPE 18 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE 20 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE 10 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE 9 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE 40 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE 50 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE FLOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE CEILING WALL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE OUTDOOR DOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE WINDOW TRIM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE MANTEL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 EUROPE RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 EUROPE COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HOTELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 EUROPE VILLA IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 EUROPE HOSPITALS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 EUROPE MALLS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 EUROPE SCHOOL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 EUROPE WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 56 EUROPE WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (MILLION CUBIC METERS)

TABLE 57 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 59 EUROPE PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 EUROPE FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 EUROPE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 EUROPE WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 63 EUROPE WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 EUROPE WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 65 EUROPE RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 EUROPE COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 EUROPE HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 EUROPE VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 EUROPE HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 70 EUROPE MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 EUROPE SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 GERMANY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 GERMANY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 75 GERMANY PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 GERMANY FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 GERMANY WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 GERMANY WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 79 GERMANY WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 GERMANY WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 81 GERMANY RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 GERMANY COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 GERMANY HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 GERMANY VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 GERMANY HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 GERMANY MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 GERMANY SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 GERMANY OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 U.K. WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 U.K. WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 91 U.K. PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 U.K. FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.K. WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 U.K. WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 95 U.K. WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.K. WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 U.K. RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 U.K. COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 U.K. HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 U.K. VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 U.K. HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 U.K. MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 103 U.K. SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 104 U.K. OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 105 ITALY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 106 ITALY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 107 ITALY PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 108 ITALY FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 109 ITALY WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 110 ITALY WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 111 ITALY WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 ITALY WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 ITALY RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 ITALY COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 ITALY HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 ITALY VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 ITALY HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 ITALY MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 ITALY SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 ITALY OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 TURKEY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 TURKEY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 123 TURKEY PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 124 TURKEY FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 TURKEY WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 TURKEY WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 127 TURKEY WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 TURKEY WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 129 TURKEY RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 TURKEY COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 131 TURKEY HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 132 TURKEY VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 133 TURKEY HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 134 TURKEY MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 135 TURKEY SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 136 TURKEY OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 137 RUSSIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 138 RUSSIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 139 RUSSIA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 143 RUSSIA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 RUSSIA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 150 RUSSIA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 153 FRANCE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 154 FRANCE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 155 FRANCE PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 156 FRANCE FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 157 FRANCE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 158 FRANCE WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 159 FRANCE WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 FRANCE WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 161 FRANCE RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 162 FRANCE COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 163 FRANCE HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 164 FRANCE VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 165 FRANCE HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 166 FRANCE MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 167 FRANCE SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 168 FRANCE OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 169 SPAIN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 170 SPAIN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 171 SPAIN PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 172 SPAIN FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 173 SPAIN WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 174 SPAIN WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 175 SPAIN WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 SPAIN WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 177 SPAIN RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 178 SPAIN COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 179 SPAIN HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 180 SPAIN VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 181 SPAIN HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 182 SPAIN MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 183 SPAIN SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 184 SPAIN OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 186 NETHERLANDS WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 187 NETHERLANDS PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 188 NETHERLANDS FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 190 NETHERLANDS WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 NETHERLANDS WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 193 NETHERLANDS RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 194 NETHERLANDS COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 195 NETHERLANDS HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 196 NETHERLANDS VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 197 NETHERLANDS HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 198 NETHERLANDS MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 199 NETHERLANDS SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 200 NETHERLANDS OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 201 BELGIUM WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 202 BELGIUM WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 203 BELGIUM PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 204 BELGIUM FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 205 BELGIUM WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 BELGIUM WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 208 BELGIUM WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 216 BELGIUM OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 217 SWITZERLAND WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 218 SWITZERLAND WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 219 SWITZERLAND PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 220 SWITZERLAND FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 221 SWITZERLAND WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 222 SWITZERLAND WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 223 SWITZERLAND WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 SWITZERLAND WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 225 SWITZERLAND RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 226 SWITZERLAND COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 227 SWITZERLAND HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 228 SWITZERLAND VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 229 SWITZERLAND HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 230 SWITZERLAND MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 231 SWITZERLAND SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 232 SWITZERLAND OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 233 REST OF EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 234 REST OF EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

Liste des figures

FIGURE 1 EUROPE WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 2 EUROPE WOOD BASED PANEL MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE WOOD BASED PANELS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE WOOD BASED PANELS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE WOOD BASED PANELS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE WOOD BASED PANELS MARKET: THE DISTRIBUTION CHANNEL LIFE LINE CURVE

FIGURE 7 EUROPE WOOD BASED PANELS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE WOOD BASED PANELS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE WOOD BASED PANELS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE WOOD BASED PANELS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 EUROPE WOOD BASED PANELS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 EUROPE WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 13 RISING CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE EXPECTED TO DRIVE THE EUROPE WOOD BASED PANELS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 PLYWOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE WOOD BASED PANELS MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 PRICE ANALYSIS FOR EUROPE WOOD BASED PANEL MARKET, 2018-2022

FIGURE 17 EUROPE, EECCA, NORTH AMERICA WOOD BASED PANELS PRODUCTION, AND NET APPARENT CONSUMPTION, 2018-2020 FROM 2018-2020 (1,000 M3)

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 SUPPLY CHAIN ANALYSIS- EUROPE WOOD BASED PANEL MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE WOOD BASED PANEL MARKET

FIGURE 21 EUROPE WOOD BASED PANEL PRODUCTION, IN 2018

FIGURE 22 EXPENDITURE ON FURNISHINGS, EQUIPMENT AND ROUTINE MAINTENANCE

FIGURE 23 WOOD PULP PRICE IN 2020 (USD DOLLAR)

FIGURE 24 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2021

FIGURE 25 EUROPE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 EUROPE WOOD BASED PANEL MARKET, BY THICKNESS, 2021

FIGURE 27 EUROPE WOOD BASED PANEL MARKET, BY APPLICATION, 2021

FIGURE 28 EUROPE WOOD BASED PANEL MARKET, BY END-USER, 2021

FIGURE 29 EUROPE WOOD BASED PANEL MARKET: SNAPSHOT (2021)

FIGURE 30 EUROPE WOOD BASED PANEL MARKET: BY COUNTRY (2021)

FIGURE 31 EUROPE WOOD BASED PANEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 EUROPE WOOD BASED PANEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 EUROPE WOOD BASED PANEL MARKET: BY PRODUCT (2022-2029)

FIGURE 34 EUROPE WOOD BASED PANEL MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.