Europe Wheat Gluten Market

Taille du marché en milliards USD

TCAC :

%

USD

489.63 Million

USD

865.11 Million

2021

2029

USD

489.63 Million

USD

865.11 Million

2021

2029

| 2022 –2029 | |

| USD 489.63 Million | |

| USD 865.11 Million | |

|

|

|

|

Europe Wheat Gluten Market, By Category (Organic and Inorganic), Function (Emulsifier, Solidifier, Binder and Others), Form (Liquid and Dry), Application (Food & Beverages, Animal Feed and Others), Packaging (Bottle/Jar, Pouch & Bags, Boxes and Others), Distribution Channel (Store Based Retailers and Non-Store Based Retailers), End User (Household/Retail and Commercial) -Industry Trends and Forecast to 2029.

Europe Wheat Gluten Market Analysis and Insights

Europe wheat gluten market is growing in the forecast year due to the rise in market players and the availability of various plant-based meat alternatives in the market. Along with this, the number of R&D activities to find out new plant-based proteins has increased in the market which is further boosting the market growth. However, the rising cases of hereditary and chronic disorders due to gluten intolerance might hamper the market growth in the forecast period.

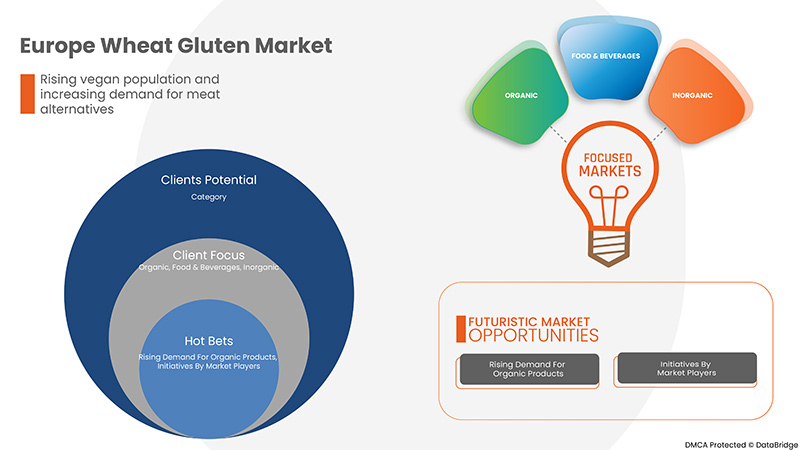

Growing awareness regarding the benefits of plant-based proteins, rising demand for organic products and initiatives by market players are giving opportunities to the market. However, the increased cost of production and manufacturing, gluten sensitivity and autoimmune reactions in people are the key challenges to market growth.

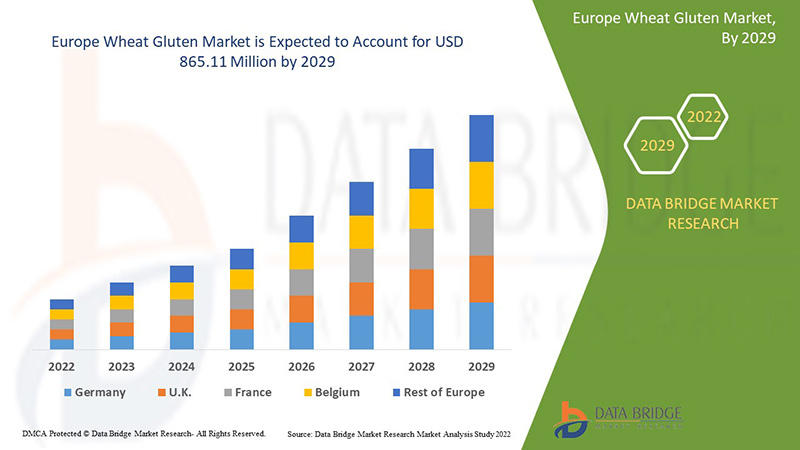

Europe wheat gluten market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 7.6% in the forecast period of 2022 to 2029 and is expected to reach USD 865.11 million by 2029 from USD 489.63 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customisable to 2014-2019) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Category (Organic and Inorganic), Function (Emulsifier, Solidifier, Binder and Others), Form (Liquid and Dry), Application (Food & Beverages, Animal Feed and Others), Packaging (Bottle/Jar, Pouch & Bags, Boxes and Others), Distribution Channel (Store Based Retailers and Non-Store Based Retailers), End User (Household/Retail and Commercial) |

|

Countries Covered |

Germany, France, U.K., Italy, Spain, Netherlands, Russia, Denmark, Sweden, Poland, Switzerland, Turkey, Sweden and rest of Europe |

|

Market Players Covered |

Cargill, Incorporated, ADM, Crespel & Deiters Group, Glico Nutrition Co., Ltd., Sedamyl, Manildra Group, MGP, Roquette Frères, CropEnergies AG, Anhui Ante Food Co., Ltd., ARDENT MILLS, Bryan W Nash and Sons, Pioneer Industries Private Limited, Henan Tianguan Group Co. Ltd, Permolex, Meelunie B.V., Mühlenchemie GmbH & Co. KG, Royal Ingredients Group, Kröner Stärke and z&f sungold corporation among others |

Market Definition

Le gluten de blé est également connu sous le nom de seitan, viande de blé, viande de gluten ou gluten. Le gluten de blé est une protéine naturellement présente dans le blé ou la farine de blé. Il est fabriqué en lavant la pâte de farine de blé dans de l'eau jusqu'à ce que tous les grains d'amidon soient éliminés. La poudre de gluten de blé est fabriquée en hydratant la farine de blé dur pour activer le gluten. Après cela, la masse hydratée est traitée pour éliminer l'amidon tout en laissant le gluten derrière. Enfin, le gluten est séché et réduit en poudre. Certaines variétés de gluten ont une texture filandreuse ou moelleuse semblable à celle de la viande.

Dynamique du marché du gluten de blé en Europe

Conducteurs

- Augmentation de la population végétalienne et demande croissante d'alternatives à la viande

Le gluten est une protéine naturellement présente dans certaines céréales comme le blé, l'orge et le seigle. Les glutens de blé sont constitués de fractions protéiques de gliadines et de gluténines. Les gliadines contiennent une chaîne polypeptidique unique associée à des liaisons hydrogène, des liaisons hydrophobes et des interactions disulfures intramoléculaires tandis que les gluténines contiennent des interactions disulfures intermoléculaires. Le gluten de blé et l'amidon de blé sont des coproduits économiquement importants produits lors du traitement humide de la farine de blé. Le gluten de blé est un ingrédient alimentaire de base et ses applications se situent principalement dans les produits de boulangerie et les produits carnés transformés. Il possède des propriétés uniques telles que, lorsqu'il est hydraté et mélangé, il forme une structure très extensible et élastique qui est responsable de la capacité de rétention de gaz de la pâte à pain. Il peut être utilisé en combinaison avec de la farine de blé et d'autres additifs pour produire un produit texturé sans soja.

La population végétalienne augmente dans le monde entier et la demande d'alternatives à la viande augmente également. Les gens sont de plus en plus conscients des bienfaits des protéines végétales pour la santé et se tournent vers un mode de vie végétalien où le gluten de blé peut servir d'alternative à la viande.

- Préférence croissante des consommateurs pour les régimes riches en protéines

La plupart des consommateurs préfèrent les régimes riches en protéines pour plusieurs raisons. En voici quelques-unes : les protéines sont les éléments constitutifs du corps humain et des muscles ; elles sont vitales pour les activités du corps et du cerveau ; elles sont importantes pour une vie saine et active. Le gluten est l'un des aliments riches en protéines qui peuvent être extraits du blé. Le gluten a une teneur élevée en protéines ainsi qu'en vitamines et minéraux tels que des antioxydants, des fibres, de la vitamine B, de la vitamine E , du magnésium, du fer, de l'acide folique et d'autres.

En outre, ces dernières années, les régimes et produits riches en protéines ont eu un impact réel sur la nutrition et ont transformé l'attitude des consommateurs à l'égard des protéines dans leur alimentation, car une alimentation adéquate est un aspect important d'un mode de vie sain pour tous les individus. Diverses études ont montré les bienfaits des protéines végétales pour la santé et la sensibilisation du public s'est accrue. En conséquence, les consommateurs préfèrent les régimes riches en protéines.

- Augmentation du nombre d'activités de R&D pour découvrir de nouvelles protéines végétales

La demande de régimes riches en protéines augmente de plus en plus chez les gens et, par conséquent, le nombre de recherches visant à découvrir les protéines a augmenté. Les protéines d'origine animale étant à l'origine de la plupart des risques pour la santé, les gens se tournent progressivement vers un mode de vie végétalien, partout dans le monde. Les protéines d'origine végétale sont riches en vitamines et en minéraux et présentent de grands avantages pour la santé, selon des études récentes. Le gluten de blé est l'une des protéines végétales utilisées comme alternative à la viande et comme régime riche en protéines par la plupart des gens dans le monde.

La majorité de la population humaine préfère les régimes riches en protéines d'origine végétale en raison de plusieurs avantages pour la santé et pour surmonter les maladies causées par la consommation de régimes à base de protéines animales. Ainsi, le nombre de recherches et développements augmente pour découvrir de nouvelles protéines végétales de diverses manières pour répondre à la demande.

Opportunités

-

Prise de conscience croissante des bienfaits des protéines végétales

Divers produits à base de protéines végétales sont disponibles sur le marché en raison de l'évolution des préférences gustatives des consommateurs. L'un d'entre eux est le gluten de blé et ses produits, qui sont très demandés. Le marché des protéines végétales telles que le gluten de blé connaît une forte demande et une forte croissance dans les boulangeries, les boissons fonctionnelles et autres aliments. Les protéines végétales sont facilement disponibles en raison de leur large utilisation dans diverses industries. Le gluten de blé est utilisé dans divers produits tels que les produits d'alimentation animale qui aident à minimiser la dépendance des agriculteurs aux sources traditionnelles de protéines. Le gluten de blé et les produits à base de protéines végétales contiennent plusieurs nutriments et sont infusés de protéines et d'arômes. La sensibilisation croissante aux modes de vie sains et à la gestion de la perte de poids, ainsi que la demande de barres protéinées à base de plantes parmi les consommateurs.

Par conséquent, la demande de gluten de blé dans divers produits constituera une opportunité de croissance du marché. Parallèlement, le gluten de blé est utilisé dans les produits gazeux pour rehausser les saveurs ajoutées.

-

Demande croissante de produits biologiques

La demande de produits biologiques augmente à grande vitesse. Les ingrédients alimentaires biologiques tels que les protéines végétales constituent une alternative protéinée parfaite à la viande ou à d’autres produits non végétariens que les consommateurs peuvent consommer quotidiennement. Tous les acides aminés essentiels et les fibres élevées présents dans les produits biologiques en font un substitut idéal aux protéines animales.

La demande d'ingrédients biologiques dans le gluten de blé et ses produits est due aux régimes alimentaires car ils présentent divers avantages pour la santé tels qu'un faible risque de diabète, une digestibilité facile, une bonne santé cardiovasculaire et d'autres. La sensibilisation croissante des consommateurs aux avantages pour la santé offerts par les ingrédients biologiques tels que les protéines végétales a augmenté la demande de produits alimentaires et de boissons.

Contraintes/Défis

- Augmentation des coûts de production et de fabrication

Le gluten de blé a ouvert la voie à l'amélioration et au soutien de la santé, ce qui joue un rôle majeur dans l'industrie alimentaire et des boissons. Mais d'un autre côté, il a entraîné des coûts importants liés à sa production et à sa fabrication.

Dans certains pays du monde, le gluten de blé est considéré comme une solution au problème du maintien d'un mode de vie sain. Cependant, sa fabrication et sa production sont confrontées à une multitude de défis tels qu'une main-d'œuvre intensive, une quantité croissante de matières premières et la nécessité d'une production plus rapide en raison de la demande accrue. Ces exigences doivent être satisfaites de manière efficace et efficiente. Le gluten de blé nécessite un investissement en capital élevé pour maintenir la R&D. Les nouvelles machines et équipements comprennent de nombreux essais pour tester le fonctionnement, ce qui entraîne des investissements en capital élevés pour les petites et moyennes entreprises.

- Augmentation des cas de maladies héréditaires et chroniques dues à l'intolérance au gluten

Le gluten est un type de protéine extraite du blé et d’autres céréales. Il existe de nombreux cas d’intolérance au gluten. Il existe plusieurs causes potentielles d’intolérance au gluten, notamment la maladie cœliaque, la sensibilité au gluten non cœliaque et l’allergie au blé. Ces trois formes d’intolérance au gluten peuvent provoquer des symptômes généralisés. La maladie cœliaque est la forme la plus grave d’intolérance au gluten. Il s’agit d’une maladie auto-immune qui touche environ 1 % de la population et peut entraîner des lésions du système digestif. Elle peut provoquer un large éventail de symptômes, notamment des problèmes de peau, des problèmes gastro-intestinaux, des changements d’humeur, etc. Les symptômes courants associés à la maladie non cœliaque sont les ballonnements, les maux de tête, les douleurs d’estomac, la fatigue, la diarrhée et la constipation, entre autres. De même, les symptômes associés à l’allergie au blé sont les éruptions cutanées, les problèmes digestifs, la congestion nasale et l’anaphylaxie, entre autres.

En raison de l’impact de l’intolérance au gluten, plusieurs troubles, notamment la maladie cœliaque, la maladie non cœliaque et les allergies au blé, sont causés, et sont chroniques et héréditaires dans certains cas.

Impact post-COVID-19 sur le marché européen du gluten de blé

Le COVID-19 a eu un impact négatif sur le marché européen du gluten de blé. Les confinements et l'isolement pendant la pandémie ont entraîné la fermeture de la plupart des magasins et l'approvisionnement en protéines végétales a été davantage affecté. Les achats en ligne d'alternatives à la viande végétale ont augmenté. Le COVID-19 a donc eu un impact négatif sur le marché.

Développements récents

- En octobre 2022, le groupe Crespel & Deiters a présenté des extrudats, des amidons de blé et des mélanges fonctionnels innovants pour des produits carnés et des substituts de viande améliorés. Sa présence au salon, consacré au marché de la viande et des protéines alternatives, présente de nouvelles options durables et économiques pour la production de produits carnés ou de produits végétaliens et végétariens à base d'ingrédients de blé fonctionnels. Il s'agit notamment des texturats innovants de la gamme Lory Tex pour les alternatives hybrides et végétales, ainsi que des protéines de blé hydrolysées. Cela a permis à l'entreprise d'accroître sa présence sur le marché européen.

- En septembre 2021, Roquette Frères a annoncé l’ouverture d’un centre d’expertise de 2 000 m² sur son site de Vic-Sur-Aisne, en France. Ce centre permet d’élargir le champ des possibles en matière d’innovation alimentaire, de développement de nouvelles protéines et de nouvelles technologies de production. Il a ainsi aidé l’entreprise à s’implanter à l’échelle mondiale.

Portée du marché du gluten de blé en Europe

Le marché européen du gluten de blé est segmenté en sept segments notables basés sur la catégorie, la fonction, la forme, l'application, l'emballage, le canal de distribution et l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Par catégorie

- Organique

- Inorganique

En fonction de la catégorie, le marché est segmenté en organique et inorganique.

Par fonction

- Émulsifiant

- Solidifiant

- Liant

- Autres

En fonction de la fonction, le marché est segmenté en émulsifiant, solidifiant, liant et autres.

Par formulaire

- Liquide

- Sec

En fonction de la forme, le marché est segmenté en liquide et sec.

Par application

- Alimentation et boissons

- Alimentation animale

- Autres

En fonction des applications, le marché est segmenté en aliments et boissons, aliments pour animaux et autres.

Par emballage

- Bouteille/Pot

- Pochettes et sacs

- Boîtes

- Autres

En fonction de l'emballage, le marché est segmenté en bouteilles/pots, pochettes et sacs, boîtes et autres.

Par canal de distribution

- Détaillants en magasin

- Détaillants non basés dans des magasins

En fonction du canal de distribution, le marché est segmenté en détaillants en magasin et en détaillants hors magasin.

Par utilisateur final

- Ménage/Commerce de détail

- Commercial

En fonction de l'utilisateur final, le marché est segmenté en ménages/détail et commerce.

Analyse/perspectives régionales du marché du gluten de blé en Europe

Le marché européen du gluten de blé est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, catégorie, fonction, forme, application, emballage, canal de distribution et utilisateur final.

Le marché européen du gluten de blé comprend les pays suivants : Allemagne, France, Royaume-Uni, Italie, Espagne, Pays-Bas, Russie, Danemark, Suède, Pologne, Suisse, Turquie, Suède et reste de l'Europe.

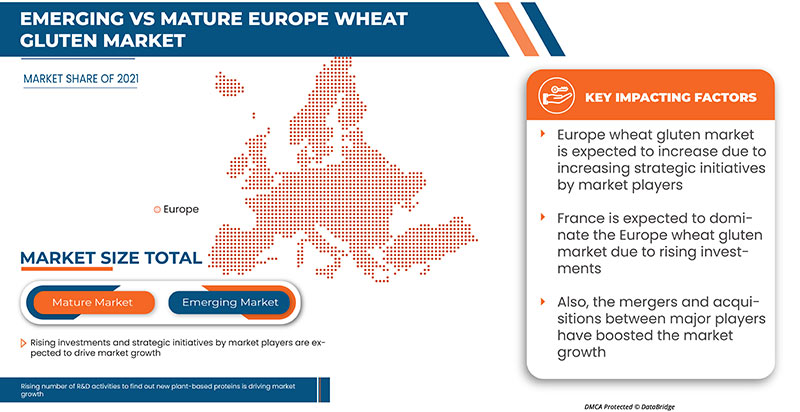

La France domine le marché européen du gluten de blé en termes de part de marché et de chiffre d'affaires et continuera à accroître sa domination au cours de la période de prévision.

La prise de conscience croissante des bienfaits des protéines végétales alimente encore davantage la croissance du marché. En outre, la demande croissante de produits biologiques et les initiatives des acteurs du marché stimulent également la croissance du marché.

Analyse du paysage concurrentiel et des parts de marché du gluten de blé en Europe

Le paysage concurrentiel du marché européen du gluten de blé fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs opérant sur le marché européen du gluten de blé sont Cargill, Incorporated, ADM, Crespel & Deiters Group, Glico Nutrition Co., Ltd., Sedamyl, Manildra Group, MGP, Roquette Frères, CropEnergies AG, Anhui Ante Food Co., Ltd., ARDENT MILLS, Bryan W Nash and Sons, Pioneer Industries Private Limited, Henan Tianguan Group Co. Ltd, Permolex, Meelunie BV, Mühlenchemie GmbH & Co. KG, Royal Ingredients Group, Kröner Stärke et z&f sungold corporation, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché Europe vs. Région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

Personnalisation disponible

Data Bridge Market Research est un leader dans la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'aux stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE WHEAT GLUTEN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PATENT ANALYSIS OF EUROPE WHEAT GLUTEN MARKET

4.2 CONSUMER BUYING BEHAVIOR

4.3 BRAND ANALYSIS

4.4 EUROPE WHEAT GLUTEN MARKET SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING

4.4.3 TRANSPORTATION OR LOGISTICS

4.4.4 MARKETING AND DISTRIBUTION

4.4.5 END-USER

4.5 EUROPE WHEAT GLUTEN MARKET UPCOMING TECHNOLOGIES AND TRENDS

4.5.1 CRISPR/CAS9 GENE EDITING OF GLUTEN IN WHEAT

4.5.2 RNA INTERFERENCE IN WHEAT GLUTEN

4.5.3 COLD ETHANOL TECHNOLOGY

5 REGULATORY FRAMEWORK

5.1 FDA

5.1.1 REGULATIONS ON ALLERGEN LABELING

5.2 EUROPEAN UNION (EU)

5.3 REGULATIONS IN INDIA

5.3.1 FSSAI PROPOSES STANDARDS RELATING TO GLUTEN AND NON-GLUTEN FOODS

5.4 REGULATIONS IN CHINA

5.5 REGULATIONS IN THE U.S.

5.6 REGULATIONS IN CANADA

5.7 REGULATIONS IN THAILAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT-ALTERNATIVES

6.1.2 RISING PREFERENCE OF CONSUMERS TOWARDS HIGH PROTEIN-RICH DIETS

6.1.3 RISING NUMBER OF RESEARCH AND DEVELOPMENT ACTIVITIES TO FIND OUT NEW PLANT-BASED PROTEINS

6.2 RESTRAINTS

6.2.1 RISING CASES OF HEREDITARY AND CHRONIC DISORDERS DUE TO GLUTEN INTOLERANCE

6.2.2 HIGHER COST OF PLANT-BASED PROTEINS

6.3 OPPORTUNITIES

6.3.1 GROWING AWARENESS REGARDING THE BENEFITS OF PLANT-BASED PROTEINS

6.3.2 RISING DEMAND FOR ORGANIC PRODUCTS

6.3.3 INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INCREASED COST OF PRODUCTION AND MANUFACTURING

6.4.2 RISING PREVALENCE OF DISEASES

6.4.3 GLUTEN SENSITIVITY AND AUTOIMMUNE REACTIONS IN PEOPLE

7 EUROPE WHEAT GLUTEN MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 ORGANIC

7.3 INORGANIC

8 EUROPE WHEAT GLUTEN MARKET, BY FUNCTION

8.1 OVERVIEW

8.2 BINDER

8.3 EMULSIFIER

8.4 SOLIDIFIER

8.5 OTHERS

9 EUROPE WHEAT GLUTEN, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 EUROPE WHEAT GLUTEN MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD & BEVERAGES

10.2.1 BAKERY & CONFECTIONARY PRODUCTS

10.2.1.1 CAKES, MUFFINS & DOUGHNUTS

10.2.1.2 BREADS

10.2.1.3 COOKIES, CRACKERS

10.2.1.4 PIE CRUSTS & PIZZA DOUGH

10.2.1.5 BATTER

10.2.1.6 OTHERS

10.2.2 CONVENIENCE FOOD

10.2.2.1 NOODLES AND PASTA

10.2.2.2 SOUPS & SAUCES

10.2.2.3 SEASONING & DRESSING

10.2.2.4 SNACKS & EXTRUDED SNACKS

10.2.2.5 READY TO EAT MEALS

10.2.2.6 OTHERS

10.2.3 MEAT ANALOGUES

10.2.4 SPORTS NUTRITION

10.2.5 BREAKFAST CEREALS

10.2.6 MEAT & POULTRY PRODUCTS

10.2.7 NUTRITIONAL BARS

10.2.8 BEVERAGES

10.2.9 OTHERS

10.3 ANIMAL FEED

10.3.1 PET FOOD

10.3.2 RUMINANT

10.3.3 SWINE

10.3.4 POULTRY

10.3.5 OTHERS

10.4 OTHERS

11 EUROPE WHEAT GLUTEN MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 POUCH & BAGS

11.3 BOXES

11.4 BOTTLE/JAR

11.4.1 PLASTIC

11.4.2 GLASS

11.4.3 METAL

11.4.4 PAPER

11.5 OTHERS

12 EUROPE WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 HYPERMARKETS/SUPER MARKETS

12.2.2 CONVENIENCE STORES

12.2.3 GROCERY STORES

12.2.4 SPECIALITY STORES

12.2.5 OTHERS

12.3 NON-STORE BASED RETAILERS

13 EUROPE WHEAT GLUTEN MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMERCIAL

13.2.1 BAKERY STORES

13.2.2 RESTAURANTS AND CAFES

13.2.3 HOTELS

13.2.4 CLOUD KITCHEN

13.2.5 OTHERS

13.3 HOUSEHOLD/RETAIL

14 EUROPE WHEAT GLUTEN MARKET, BY REGION

14.1 EUROPE

14.1.1 FRANCE

14.1.2 U.K.

14.1.3 GERMANY

14.1.4 NETHERLANDS

14.1.5 BELGIUM

14.1.6 SPAIN

14.1.7 ITALY

14.1.8 DENMARK

14.1.9 SWEDEN

14.1.10 RUSSIA

14.1.11 SWITZERLAND

14.1.12 POLAND

14.1.13 TURKEY

14.1.14 REST OF EUROPE

15 EUROPE WHEAT GLUTEN MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 ADM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CRESPEL & DEITERS GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 GLICO NUTRITION CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 SEDAMYL

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 ANHUI ANTE FOOD CO.,LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARDENT MILLS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BRYAN W NASH AND SONS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CROPENERGIES AG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HENAN TIANGUAN GROUP CO., LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 KRÖNER-STÄRKE GMBH

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 MANILDRA GROUP

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MEELUNIE B.V.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 MGP

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MUHLENCHEMIE GMBH & CO. KG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERMOLEX

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PIONEER INDUSTRIES PRIVATE LIMITED

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 ROQUETTE FRÈRES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ROYAL INGREDIENTS GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 Z&F SUNGOLD CORPORATION

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 2 EUROPE ORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE INORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE BINDER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE EMULSIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE SOLIDIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 10 EUROPE DRY IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE LIQUID IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE WHEAT GLUTEN MARKET, APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE ANIMAL FEED IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 EUROPE POUCH & BAGS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE BOXES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE WHEAT GLUTEN MARKET, DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 26 EUROPE STORE-BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION

TABLE 28 EUROPE NON-STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 EUROPE COMMERCIAL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 EUROPE HOUSEHOLD/RETAIL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE WHEAT GLUTEN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 EUROPE WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 EUROPE WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 37 EUROPE WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 43 EUROPE BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 44 EUROPE WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 EUROPE STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 EUROPE WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 EUROPE COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 FRANCE WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 FRANCE WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 50 FRANCE WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 FRANCE WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 FRANCE FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 FRANCE BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 FRANCE CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 FRANCE ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 FRANCE WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 57 FRANCE BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 58 FRANCE WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 FRANCE STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 FRANCE WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 FRANCE COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 U.K. WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 63 U.K. WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 64 U.K. WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 65 U.K. WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.K. FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.K. BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.K. CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 U.K. ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.K. WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 71 U.K. BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 72 U.K. WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 U.K. STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 74 U.K. WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 U.K. COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 GERMANY WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 GERMANY WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 GERMANY WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 GERMANY WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 GERMANY FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 GERMANY BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 GERMANY CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 GERMANY ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 GERMANY WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 85 GERMANY BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 GERMANY WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 GERMANY STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 GERMANY WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 GERMANY COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 NETHERLANDS WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 NETHERLANDS WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 92 NETHERLANDS WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 93 NETHERLANDS WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 NETHERLANDS FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 NETHERLANDS BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 NETHERLANDS CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 NETHERLANDS ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 NETHERLANDS WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 99 NETHERLANDS BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 100 NETHERLANDS WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 NETHERLANDS STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 NETHERLANDS WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 NETHERLANDS COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 BELGIUM WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 105 BELGIUM WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 106 BELGIUM WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 107 BELGIUM WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 BELGIUM FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 BELGIUM BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 BELGIUM CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 BELGIUM ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 BELGIUM WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 113 BELGIUM BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 114 BELGIUM WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 115 BELGIUM STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 BELGIUM WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 BELGIUM COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 SPAIN WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 119 SPAIN WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 120 SPAIN WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 SPAIN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 SPAIN FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 SPAIN BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SPAIN CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 SPAIN ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 SPAIN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 127 SPAIN BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 128 SPAIN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 SPAIN STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 SPAIN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 SPAIN COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 ITALY WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 133 ITALY WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 134 ITALY WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 135 ITALY WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 ITALY FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 ITALY BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 ITALY CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 139 ITALY ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 ITALY WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 141 ITALY BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 142 ITALY WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 143 ITALY STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 144 ITALY WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 145 ITALY COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 146 DENMARK WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 147 DENMARK WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 148 DENMARK WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 149 DENMARK WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 DENMARK FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 DENMARK BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 DENMARK CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 DENMARK ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 DENMARK WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 155 DENMARK BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 156 DENMARK WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 157 DENMARK STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 158 DENMARK WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 159 DENMARK COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 SWEDEN WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 161 SWEDEN WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 162 SWEDEN WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 163 SWEDEN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 SWEDEN FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 SWEDEN BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 SWEDEN CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 167 SWEDEN ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 SWEDEN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 169 SWEDEN BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 170 SWEDEN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 171 SWEDEN STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 172 SWEDEN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 173 SWEDEN COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 RUSSIA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 175 RUSSIA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 176 RUSSIA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 177 RUSSIA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 178 RUSSIA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 179 RUSSIA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 180 RUSSIA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 181 RUSSIA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 RUSSIA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 183 RUSSIA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 184 RUSSIA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 185 RUSSIA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 186 RUSSIA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 187 RUSSIA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 188 SWITZERLAND WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 189 SWITZERLAND WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 190 SWITZERLAND WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 191 SWITZERLAND WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 SWITZERLAND FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 193 SWITZERLAND BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 SWITZERLAND CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 195 SWITZERLAND ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 SWITZERLAND WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 197 SWITZERLAND BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 198 SWITZERLAND WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 199 SWITZERLAND STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 200 SWITZERLAND WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 201 SWITZERLAND COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 202 POLAND WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 203 POLAND WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 204 POLAND WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 205 POLAND WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 206 POLAND FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 207 POLAND BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 208 POLAND CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 209 POLAND ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 POLAND WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 211 POLAND BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 212 POLAND WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 213 POLAND STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 214 POLAND WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 215 POLAND COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 216 TURKEY WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 217 TURKEY WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 218 TURKEY WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 219 TURKEY WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 220 TURKEY FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 221 TURKEY BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 222 TURKEY CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 223 TURKEY ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 TURKEY WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 225 TURKEY BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 226 TURKEY WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 227 TURKEY STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 228 TURKEY WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 229 TURKEY COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 230 REST OF EUROPE WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 2 EUROPE WHEAT GLUTEN MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE WHEAT GLUTEN MARKET: DROC ANALYSIS

FIGURE 4 EUROPE WHEAT GLUTEN MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE WHEAT GLUTEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE WHEAT GLUTEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE WHEAT GLUTEN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE WHEAT GLUTEN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE WHEAT GLUTEN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 11 THE GROWING EXPENDITURE ON WHEAT GLUTEN TECHNOLOGY IS EXPECTED TO DRIVE THE EUROPE WHEAT GLUTEN MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE WHEAT GLUTEN MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE WHEAT GLUTEN MARKET

FIGURE 14 EUROPE WHEAT GLUTEN MARKET: BY CATEGORY, 2021

FIGURE 15 EUROPE WHEAT GLUTEN MARKET: BY CATEGORY, 2022-2029 (USD MILLION)

FIGURE 16 EUROPE WHEAT GLUTEN MARKET: BY CATEGORY, CAGR (2022-2029)

FIGURE 17 EUROPE WHEAT GLUTEN MARKET: BY CATEGORY, LIFELINE CURVE

FIGURE 18 EUROPE WHEAT GLUTEN MARKET: BY FUNCTION, 2021

FIGURE 19 EUROPE WHEAT GLUTEN MARKET: BY FUNCTION, 2022-2029 (USD MILLION)

FIGURE 20 EUROPE WHEAT GLUTEN MARKET: BY FUNCTION, CAGR (2022-2029)

FIGURE 21 EUROPE WHEAT GLUTEN MARKET: BY FUNCTION, LIFELINE CURVE

FIGURE 22 EUROPE WHEAT GLUTEN MARKET: BY FORM, 2021

FIGURE 23 EUROPE WHEAT GLUTEN MARKET: BY FORM, 2022-2029 (USD MILLION)

FIGURE 24 EUROPE WHEAT GLUTEN MARKET: BY FORM, CAGR (2022-2029)

FIGURE 25 EUROPE WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 26 EUROPE WHEAT GLUTEN MARKET: APPLICATION, 2021

FIGURE 27 EUROPE WHEAT GLUTEN MARKET: APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 EUROPE WHEAT GLUTEN MARKET: APPLICATION, CAGR (2022-2029)

FIGURE 29 EUROPE WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 30 EUROPE WHEAT GLUTEN MARKET: BY PACKAGING, 2021

FIGURE 31 EUROPE WHEAT GLUTEN MARKET: BY PACKAGING, 2022-2029 (USD MILLION)

FIGURE 32 EUROPE WHEAT GLUTEN MARKET: BY PACKAGING, CAGR (2022-2029)

FIGURE 33 EUROPE WHEAT GLUTEN MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 34 EUROPE WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2021

FIGURE 35 EUROPE WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 EUROPE WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 EUROPE WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 EUROPE WHEAT GLUTEN MARKET: BY END USER, 2021

FIGURE 39 EUROPE WHEAT GLUTEN MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 EUROPE WHEAT GLUTEN MARKET: BY END USER, CAGR (2022-2029)

FIGURE 41 EUROPE WHEAT GLUTEN MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 EUROPE WHEAT GLUTEN MARKET: SNAPSHOT (2021)

FIGURE 43 EUROPE WHEAT GLUTEN MARKET: BY COUNTRY (2021)

FIGURE 44 EUROPE WHEAT GLUTEN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 EUROPE WHEAT GLUTEN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 EUROPE WHEAT GLUTEN MARKET: CATEGORY (2022-2029)

FIGURE 47 EUROPE WHEAT GLUTEN MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.