Marché européen des technologies de conférence portables, par offre (matériel, logiciel et services), type de conférence ( audioconférence et vidéoconférence ), mode de déploiement (sur site et cloud ), taille de l'organisation (petite et moyenne organisation et grande organisation), application (grand public et entreprise), utilisation finale (entreprise, éducation, santé, gouvernement et défense, banque, services financiers et assurances (BSFI), médias et divertissement et autres), pays (Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Pays-Bas, Belgique, Suisse, Turquie et reste de l'Europe) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché : marché européen des technologies de conférence portables

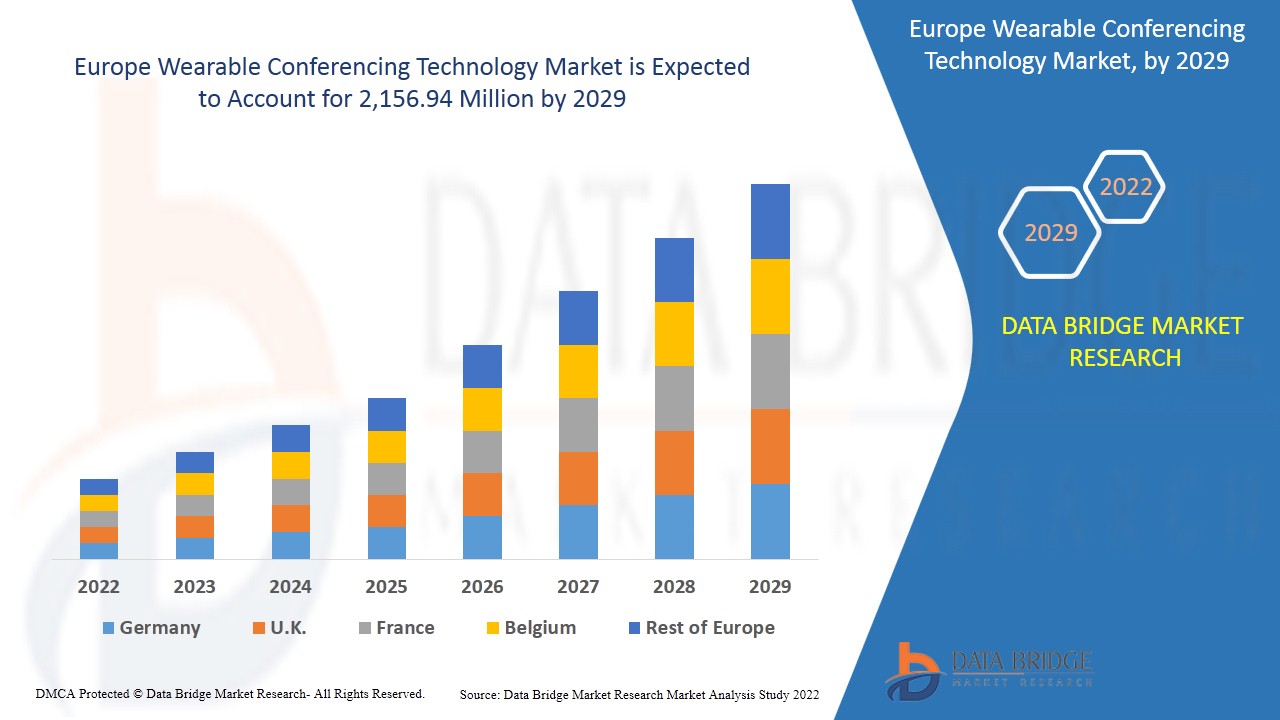

Le marché européen des technologies de conférence portables devrait connaître une croissance de marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 12,7 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 2 156,94 millions USD d'ici 2029. L'accent croissant et l'adoption de la culture du travail à distance stimulent le marché européen des technologies de conférence portables.

La technologie portable, souvent appelée « wearables », est une classe d'appareils électroniques qui peuvent être portés sur le corps. Les gadgets sont des appareils mains libres dotés d'applications pratiques, alimentés par des microprocesseurs et capables d'envoyer et de recevoir des données via Internet. La coopération en temps réel entre plusieurs appareils est possible grâce aux solutions de conférence. Les participants peuvent rejoindre un seul lieu numérique à l'aide de leurs appareils mobiles, ordinateurs portables ou ordinateurs personnels (PC) à l'aide d'une plate-forme de conférence. Les utilisateurs peuvent utiliser une connexion Internet pour accéder aux technologies de conférence fournies sous forme de logiciel en tant que service (SaaS). Une plate-forme de conférence Web peut également être fournie sur site, en utilisant les capacités du centre de données d'une organisation. Il s'agit donc d'une technologie utilisée dans des appareils tels que Google Glass ou Microsoft HoloLens pour l'application de conférence et de collaboration via un support audio ou vidéo. Actuellement, ce marché a de larges applications dans le monde de l'entreprise pour les collaborations professionnelles et dans les secteurs de l'éducation et de la formation.

L'intérêt croissant et l'adoption de la culture du travail à distance agissent comme un moteur sur le marché européen des technologies de conférence portables. La nature intermittente de l'énergie éolienne s'avère être un défi. Cependant, l'augmentation de diverses décisions stratégiques telles que les partenariats devrait offrir des opportunités pour le marché européen des technologies de conférence portables. Le coût élevé de l'infrastructure de conférence peut s'avérer être un frein pour le marché.

Le rapport sur le marché européen des technologies de conférence portables fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché européen des technologies de conférence portables, contactez Data Bridge Market Research pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des technologies de conférence portables en Europe

Le marché européen des technologies de conférence portables est segmenté en fonction de l'offre, du type de conférence, du mode de déploiement, de la taille de l'organisation, de l'application et de l'utilisation finale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- En fonction de l'offre, le marché européen des technologies de conférence portables est segmenté en matériel, logiciels et services. Le matériel est ensuite subdivisé en caméra, microphone et autres. En outre, les services sont subdivisés en services gérés et services professionnels. En 2022, le matériel devrait dominer le marché européen des technologies de conférence portables, car il offre des fonctionnalités telles que la collaboration en direct dans la fabrication et fournit une plate-forme sur laquelle le logiciel peut fonctionner.

- En fonction du type de conférence, le marché européen des technologies de conférence portables est segmenté en audioconférence et en vidéoconférence . En 2022, le segment de la vidéoconférence devrait dominer car il offre des réunions virtuelles et une collaboration à l'échelle mondiale, ce qui améliore la portée de l'entreprise pour mieux organiser des réunions avec une aide visuelle.

- En fonction du mode de déploiement, le marché européen des technologies de conférence portables est segmenté en sur site et en cloud. En 2022, le segment sur site devrait dominer le marché car il contribue à assurer la sécurité et la confidentialité de l'infrastructure de l'entreprise. Il permet également d'enregistrer en toute sécurité la vidéo pour référence ultérieure, augmentant ainsi sa demande sur le marché.

- En fonction de la taille de l'entreprise, le marché européen des technologies de conférence portables est segmenté en petites et moyennes entreprises et en grandes entreprises. En 2022, le segment des grandes entreprises devrait dominer le marché, car la solution aide l'entreprise à progresser plus efficacement vers ses objectifs en améliorant la productivité et en optimisant les opérations.

- En fonction des applications, le marché européen des technologies de conférence portables est segmenté en grand public et en entreprise. En 2022, le segment des entreprises devrait dominer le marché, car il aide les employés à travailler à distance en toute simplicité et à mener à bien leurs opérations d'entreprise.

- En fonction de l'utilisation finale, le marché européen des technologies de conférence portables est segmenté en entreprises, éducation, santé , gouvernement et défense, banque, services financiers et assurances (BSFI), médias et divertissement, etc. Tous les segments sont subdivisés en mode de déploiement et taille de l'organisation. Le mode de déploiement comprend les déploiements sur site et dans le cloud. La taille de l'organisation comprend les petites et moyennes organisations et les grandes organisations. En 2022, le segment des entreprises devrait dominer le marché, car les solutions de conférence aident les employés à collaborer et à travailler sur des projets avec efficacité et en temps réel.

Analyse du marché des technologies de conférence portables en Europe au niveau des pays

Le marché européen des technologies de conférence portables est analysé, ainsi que la taille du marché, le type de conférence, le mode de déploiement, la taille de l'organisation, l'application et l'utilisation finale comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché européen des technologies de conférence portables sont l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, la Russie, les Pays-Bas, la Belgique, la Suisse, la Turquie et le reste de l'Europe. L'Allemagne domine le marché européen des technologies de conférence portables en raison de la forte demande des grandes entreprises qui disposent d'installations de fabrication à distance réparties dans le monde entier et nécessitent une assistance à distance. Le Royaume-Uni occupe la deuxième place avec la demande croissante de nouvelles applications comme les soins de santé et l'éducation pour dispenser des formations à distance. La France occupe la troisième place avec la recherche technologique dans le secteur de la santé et la demande dans les installations de fabrication à distance.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

La pénétration croissante des appareils intelligents et des services Internet stimule la croissance du marché européen des technologies de conférence portables

Le marché européen des technologies de conférence portables vous fournit également une analyse de marché détaillée pour la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2011 à 2020.

Paysage concurrentiel et analyse des parts de marché des technologies de conférence portables en Europe

Le paysage concurrentiel du marché européen des technologies de conférence portables fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché européen des technologies de conférence portables.

Les principales entreprises qui s'occupent de la technologie de conférence portable en Europe sont Logitech, Vuzix Corporation, Vidyo, Inc., Ricoh, Zoom Video Communications, Inc., Microsoft, LogMeIn, Inc., RealWear, Inc., DIALPAD, INC., Google (une filiale d'Alphabet Inc.), Chironix, Seiko Epson Corporation, Iristick, Robert Bosch GmbH, ezTalks, HTC Corporation, Sony Corporation, Lenovo, EON Reality, TeamViewer, entre autres acteurs nationaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux contrats et accords sont également initiés par les entreprises du monde entier, ce qui accélère le marché européen des technologies de conférence portables.

Par exemple,

- En octobre 2021, LogMeIn, Inc. a lancé GoToConnect Legal, une nouvelle version de sa plateforme de communications unifiées en tant que service (UCaaS). La plateforme est conçue pour répondre aux demandes des professionnels du droit en facilitant la collaboration avec les clients et les collègues afin de maximiser les heures facturables. La solution permettra de minimiser le temps non facturé, de maximiser les revenus, de gérer les réglementations des organismes directeurs et de maintenir un niveau de sécurité élevé dans leur pratique. Ainsi, l'entreprise contribuera à fournir des services de haute qualité et facilement facturables à ses clients.

- En décembre 2021, Vidyo, Inc. a dévoilé de nouvelles interfaces VidyoRoom Solutions, dont trois nouvelles expériences de visioconférence au bureau conçues pour offrir le meilleur environnement de collaboration aux équipes hybrides. De nouvelles interfaces pour les salles de réunion, les salles de conférence et les salles de conseil, y compris les commandes de conférence et la prise en charge des expériences immersives, deviendront de plus en plus vitales à mesure que les employés tentent de retourner au bureau après la pandémie, tandis que d'autres continuent de travailler à distance. Grâce à cela, l'entreprise sera en mesure d'offrir une expérience conviviale à ses clients.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF Europe Wearable conferencing technology Market

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- type timeline curve

- MARKET APPLICATION COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- surging focus and adoption of remote working culture

- INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES

- RISE IN ADOPTION OF conferencing technology BY EDUCATIONAL INSTITUTES

- RESTRAINTS

- high cost of conferencing infrastructure

- LOSS OF DATA AND PRIVACY

- OPPORTUNITIES

- INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

- RISE IN Initiatives by government

- Challenges

- EUROPE ECONOMIC SLOWDOWN LIMITS

- Electronic components are pushing smart glasses boundAries

- IMPACT ANALYSIS OF COVID-19 on Europe Wearable conferencing technology market

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- Strategic decision by manufacturers and government initiatives after covid-19

- Impact on demand

- PRICE IMPACT

- Impact on supply chain

- Conclusion

- Europe Wearable conferencing technology Market, BY offering

- overview

- Hardware

- Camera

- Microphone

- Others

- Software

- Services

- Managed Services

- Professional Services

- Europe Wearable conferencing technology Market, BY conferencing type

- overview

- Video Conferencing

- Audio Conferencing

- Europe Wearable conferencing technology Market, BY deployment mode

- overview

- on-premise

- cloud

- Europe Wearable conferencing technology Market, BY organization size

- overview

- large organization

- small & medium organization

- Europe Wearable conferencing technology Market, BY application

- overview

- enterprise

- consumer

- Europe Wearable conferencing technology Market, BY end use

- overview

- Corporate

- Market By deployment mode

- ON-PREMISE

- CLOUD

- Market By organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Education

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Healthcare

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Government and Defense

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Media and Entertainment

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Banking, Financial Services and Insurance (BFSI)

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Other

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Europe Wearable conferencing technology Market, by REGION

- EUROPE

- germany

- u.k.

- france

- italy

- spain

- russia

- netherlands

- belgium

- switzerland

- turkey

- rest of europe

- EUROPE Wearable conferencing technology market: COMPANY landscape

- company share analysis: EUROPE

- swot analysis

- Company profile

- GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- MICROSOFT

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- LENEVO

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- RICOH

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SEIKO EPSON CORPORATION

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- CHIRONIX

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- DIALPAD, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- EON REALITY

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- EZTALKS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HTC CORPORATION

- COMPANY PROFILE

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- IRISTICK

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- LOGITECH

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- LOGMEIN, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- REALWEAR, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ROBERT BOSCH GMBH

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- SONY CORPORATION

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- TEAMVIEWER

- COMPANY SNAPSHOT

- REVNUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- VIDYO, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- VUZIX CORPORATION

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ZOOM VIDEO COMMUNICATIONS, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

Liste des tableaux

TABLE 1 Europe Wearable conferencing technology Market, BY offering, 2020-2029 (USD Million)

TABLE 2 Europe Hardware in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 3 Europe Hardware in wearable conferencing technology Market, By Type, 2020-2029 (USD Million)

TABLE 4 Europe Software in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 5 Europe Services in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 6 Europe Services in wearable conferencing technology Market, By Type, 2020-2029 (USD Million)

TABLE 7 Europe Wearable conferencing technology Market, BY conferencing type, 2020-2029 (USD Million)

TABLE 8 Europe Video Conferencing in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 9 Europe Audio Conferencing in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 10 Europe Wearable conferencing technology Market, BY deployment mode, 2020-2029 (USD Million)

TABLE 11 Europe on-premise in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 12 Europe cloud in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 13 Europe Wearable conferencing technology Market, BY organization size, 2020-2029 (USD Million)

TABLE 14 Europe large organization in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 15 Europe small & medium organization in wearable conferencing technology Market, By Region, 2020-2029 (USD Million)

TABLE 16 Europe Wearable conferencing technology Market, BY application, 2020-2029 (USD Million)

TABLE 17 Europe enterprise in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 18 Europe consumer in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 19 Europe Wearable conferencing technology Market, BY end use, 2020-2029 (USD Million)

TABLE 20 Europe Corporate in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 21 Europe Corporate in wearable conferencing technology Market, By Deployment Mode, 2020-2029 (USD Million)

TABLE 22 Europe Corporate in wearable conferencing technology Market, By Organization Size, 2020-2029 (USD Million)

TABLE 23 Europe Education in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 24 Europe Education in wearable conferencing technology Market, By Deployment Mode, 2020-2029 (USD Million)

TABLE 25 Europe Education in wearable conferencing technology Market, By Organization Size, 2020-2029 (USD Million)

TABLE 26 Europe Healthcare in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 27 Europe Healthcare in wearable conferencing technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 28 Europe Healthcare in wearable conferencing technology Market, By organization size, 2020-2029 (USD Million)

TABLE 29 Europe Government and Defense in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 30 Europe Government and Defense in wearable conferencing technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 31 Europe Government and Defense in wearable conferencing technology Market, By organization size, 2020-2029 (USD Million)

TABLE 32 Europe Media and Entertainment in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 33 Europe Media and Entertainment in wearable conferencing technology Market, By Deployment Mode, 2020-2029 (USD Million)

TABLE 34 Europe Media and Entertainment in wearable conferencing technology Market, By Organization Size, 2020-2029 (USD Million)

TABLE 35 Europe Banking, Financial Services and Insurance (BFSI) in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 36 Europe Banking, Financial Services and Insurance (BFSI) in wearable conferencing technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 37 Europe Banking, Financial Services and Insurance (BFSI) in wearable conferencing technology Market, By organization size, 2020-2029 (USD Million)

TABLE 38 Europe Other in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 39 Europe Other in wearable conferencing technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 40 Europe Other in wearable conferencing technology Market, By Organization Size, 2020-2029 (USD Million)

TABLE 41 Europe Wearable Conferencing Technology Market, By Country, 2020-2029 (USD Million)

TABLE 42 Europe Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 43 Europe hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 44 Europe Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 45 Europe Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 46 Europe Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 47 Europe Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 48 Europe Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 49 Europe Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 50 Europe corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 51 Europe corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 52 Europe education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 53 Europe education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 54 Europe healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 55 Europe healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 56 Europe government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 57 Europe government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 58 Europe media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 59 Europe media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 60 Europe banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 61 Europe BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 62 Europe other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 63 Europe other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 64 germany Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 65 GERMANY hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 66 GERMANY Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 67 GERMANY Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 68 GERMANY Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 69 GERMANY Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 70 GERMANY Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 71 GERMANY Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 72 GERMANY corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 73 GERMANY corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 74 GERMANY education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 75 GERMANY education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 76 GERMANY healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 77 GERMANY healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 78 GERMANY government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 79 GERMANY government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 80 GERMANY media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 81 GERMANY media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 82 GERMANY banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 83 GERMANY BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 84 GERMANY other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 85 GERMANY Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 86 U.K. Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 87 U.K. hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 88 U.K. Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 89 U.K. Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 90 U.K. Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 91 U.K. Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 92 U.K. Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 93 U.K. Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 94 U.K. corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 95 U.K. corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 96 U.K. education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 97 U.K. education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 98 U.K. healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 99 U.K. healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 100 U.K. government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 101 U.K. government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 102 U.K. media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 103 U.K. media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 104 U.K. banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 105 U.K. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 106 U.K. other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 107 U.K. Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 108 France Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 109 France hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 110 France Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 111 France Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 112 France Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 113 France Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 114 France Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 115 France Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 116 France corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 117 France corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 118 France education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 119 France education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 120 France healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 121 France healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 122 France government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 123 France government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 124 France media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 125 France media and entertainment Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 126 France banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 127 France BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 128 France other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 129 France Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 130 Italy Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 131 Italy hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 132 Italy Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 133 Italy Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 134 Italy Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 135 Italy Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 136 Italy Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 137 Italy Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 138 Italy corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 139 Italy corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 140 Italy education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 141 Italy education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 142 Italy healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 143 Italy healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 144 Italy government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 145 Italy government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 146 Italy media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 147 Italy media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 148 Italy banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 149 Italy BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 150 Italy other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 151 Italy Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 152 Spain Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 153 Spain hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 154 Spain Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 155 Spain Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 156 Spain Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 157 Spain Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 158 Spain Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 159 Spain Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 160 Spain corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 161 Spain corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 162 Spain education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 163 Spain education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 164 Spain healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 165 Spain healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 166 Spain government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 167 Spain government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 168 Spain media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 169 Spain media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 170 Spain banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 171 Spain BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 172 Spain other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 173 Spain Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 174 Russia Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 175 Russia hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 176 Russia Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 177 Russia Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 178 Russia Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 179 Russia Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 180 Russia Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 181 Russia Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 182 Russia corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 183 Russia corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 184 Russia education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 185 Russia education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 186 Russia healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 187 Russia healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 188 Russia government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 189 Russia government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 190 Russia media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 191 Russia media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 192 Russia banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 193 Russia BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 194 Russia other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 195 Russia Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 196 Netherlands Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 197 Netherlands hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 198 Netherlands Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 199 Netherlands Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 200 Netherlands Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 201 Netherlands Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 202 Netherlands Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 203 Netherlands Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 204 Netherlands corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 205 Netherlands corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 206 Netherlands education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 207 Netherlands education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 208 Netherlands healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 209 Netherlands healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 210 Netherlands government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 211 Netherlands government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 212 Netherlands media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 213 Netherlands media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 214 Netherlands banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 215 Netherlands BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 216 Netherlands other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 217 Netherlands Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 218 Belgium Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 219 Belgium hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 220 Belgium Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 221 Belgium Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 222 Belgium Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 223 Belgium Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 224 Belgium Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 225 Belgium Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 226 Belgium corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 227 Belgium corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 228 Belgium education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 229 Belgium education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 230 Belgium healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 231 Belgium healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 232 Belgium government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 233 Belgium government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 234 Belgium media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 235 Belgium media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 236 Belgium banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 237 Belgium BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 238 Belgium other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 239 Belgium Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 240 Switzerland Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 241 Switzerland hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 242 Switzerland Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 243 Switzerland Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 244 Switzerland Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 245 Switzerland Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 246 Switzerland Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 247 Switzerland Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 248 Switzerland corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 249 Switzerland corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 250 Switzerland education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 251 Switzerland education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 252 Switzerland healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 253 Switzerland healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 254 Switzerland government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 255 Switzerland government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 256 Switzerland media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 257 Switzerland media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 258 Switzerland banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 259 Switzerland BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 260 Switzerland other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 261 Switzerland Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 262 Turkey Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 263 Turkey hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 264 Turkey Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 265 Turkey Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 266 Turkey Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 267 Turkey Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 268 Turkey Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 269 Turkey Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 270 Turkey corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 271 Turkey corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 272 Turkey education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 273 Turkey education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 274 Turkey healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 275 Turkey healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 276 Turkey government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 277 Turkey government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 278 Turkey media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 279 Turkey media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 280 Turkey banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 281 Turkey BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 282 Turkey other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 283 Turkey Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 284 Rest of Europe Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

Liste des figures

FIGURE 1 Europe Wearable conferencing technology Market: segmentation

FIGURE 2 Europe Wearable conferencing technology Market: data triangulation

FIGURE 3 Europe Wearable conferencing technology market: DROC ANALYSIS

FIGURE 4 Europe Wearable conferencing technology Market: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 Europe Wearable conferencing technology Market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe Wearable conferencing technology Market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe Wearable conferencing technology Market: DBMR MARKET POSITION GRID

FIGURE 8 Europe Wearable conferencing technology Market: vendor share analysis

FIGURE 9 Europe Wearable conferencing technology Market: MARKET APPLICATION COVERAGE GRID

FIGURE 10 Europe Wearable conferencing technology market: SEGMENTATION

FIGURE 11 Rising preference for remote working is EXPECTED TO DRIVE EUROPE WEARABLE CONFERENCING TECHNOLOGY MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE segment is expected to account for the largest share of Europe Wearable conferencing technology marketin 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGEs OF Europe WEARABLE CONFERENCING TECHNOLOGY Market

FIGURE 14 Europe Wearable conferencing technology Market: BY offering, 2021

FIGURE 15 Europe Wearable conferencing technology Market: BY conferencing type, 2021

FIGURE 16 Europe Wearable conferencing technology Market: BY deployment mode, 2021

FIGURE 17 Europe Wearable conferencing technology Market: BY organization size, 2021

FIGURE 18 Europe Wearable conferencing technology Market: BY application, 2021

FIGURE 19 Europe Wearable conferencing technology Market: BY end use, 2021

FIGURE 20 EUROPE Wearable Conferencing Technology MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE WEARABLE CONFERENCING TECHNOLOGY MARKET: by Country (2021)

FIGURE 22 EUROPE Wearable Conferencing Technology MARKET: by Country (2022 & 2029)

FIGURE 23 EUROPE Wearable Conferencing Technology MARKET: by Country (2021 & 2029)

FIGURE 24 EUROPE Wearable Conferencing Technology MARKET: by offering (2022-2029)

FIGURE 25 Europe Wearable conferencing technology Market: company share 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.