Europe Walk In Refrigerators And Freezers Market

Taille du marché en milliards USD

TCAC :

%

USD

3.78 Billion

USD

5.63 Billion

2025

2033

USD

3.78 Billion

USD

5.63 Billion

2025

2033

| 2026 –2033 | |

| USD 3.78 Billion | |

| USD 5.63 Billion | |

|

|

|

|

Segmentation du marché européen des chambres froides et congélateurs, par type (autonomes, à condensation déportée, à condensation multiplexe et autres), type de système (systèmes déportés, systèmes déportés pré-assemblés, systèmes à montage supérieur standard, systèmes à montage latéral, systèmes à montage en selle, systèmes de réfrigération pour combles hauts, systèmes à enroulement et autres), type de porte (porte simple, porte double, porte triple et autres), technologie (manuelle, semi-automatique et entièrement automatique), type de rideau (rideaux à lanières et rideaux d'air), canal de distribution (vente directe/B2B, commerce électronique , magasins spécialisés et autres), utilisateur final (commercial, résidentiel et autres) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché européen des chambres froides et des congélateurs de plain-pied ?

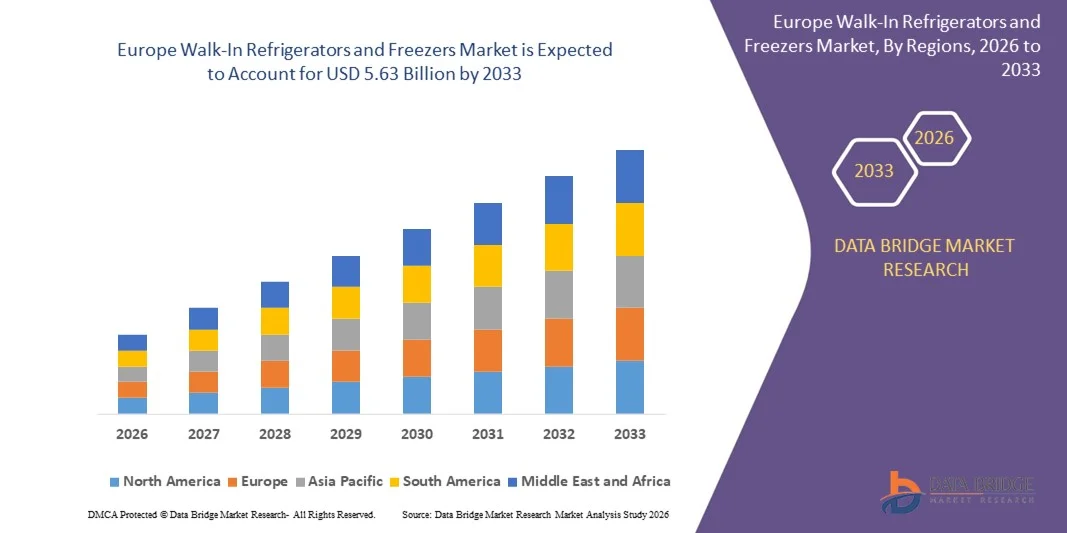

- Le marché européen des chambres froides et des congélateurs de plain-pied était évalué à 3,78 milliards de dollars en 2025 et devrait atteindre 5,63 milliards de dollars d'ici 2033 , avec un TCAC de 5,1 % au cours de la période de prévision.

- Les progrès technologiques dans les technologies de compression et de refroidissement stimulent la demande sur le marché européen des chambres froides et des congélateurs.

- La forte consommation d'énergie et l'empreinte carbone importante freinent la demande sur le marché européen des chambres froides et des congélateurs.

Quels sont les principaux enseignements du marché des chambres froides et des congélateurs ?

- L'urbanisation et les changements de mode de vie des consommateurs qui en découlent constituent une opportunité pour le marché européen des chambres froides et des congélateurs.

- La réglementation gouvernementale stricte concernant les émissions de CFC constitue un frein à la demande sur le marché européen des chambres froides et des congélateurs.

- L'Allemagne a dominé le marché européen des chambres froides et des congélateurs avec une part de marché estimée à 47,8 % en 2025, grâce à une industrie agroalimentaire dynamique, une forte pénétration de la grande distribution, une adoption généralisée des infrastructures de la chaîne du froid et des réglementations strictes en matière de sécurité et de stockage des aliments dans les établissements commerciaux et industriels.

- L'Italie devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 9,85 %, entre 2026 et 2033 sur le marché européen des chambres froides, grâce à l'expansion des points de vente de restauration, à la croissance des exportations de produits frais et surgelés et à l'augmentation des investissements dans les installations de stockage frigorifique modernes.

- Le segment des unités autonomes a dominé le marché avec une part estimée à 42,3 % en 2025, grâce à sa facilité d'installation, son encombrement réduit et son adéquation aux cuisines commerciales et aux points de vente de petite et moyenne taille.

Portée du rapport et segmentation du marché des chambres froides et congélateurs

|

Attributs |

Chambres froides et congélateurs : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des chambres froides et des congélateurs ?

Demande croissante de réfrigérateurs et congélateurs de chambre froide haut de gamme, à saveur améliorée et spécialisés

- Le marché des chambres froides et des congélateurs connaît une adoption croissante des variétés haut de gamme, artisanales et aux arômes naturels, conçues pour offrir un goût authentique et des expériences gastronomiques aux consommateurs à la recherche de produits laitiers de haute qualité.

- Les fabricants proposent des chambres froides et des congélateurs spécialisés, composés d'ingrédients naturels, d'un minimum d'additifs, issus de procédés de fumage naturels et présentant des profils de saveurs régionales uniques, afin de répondre aux préférences changeantes des consommateurs.

- L'intérêt croissant pour les produits gastronomiques, les plateaux de fromages artisanaux et les applications culinaires spécialisées accélère l'adoption des chambres froides et des congélateurs dans les secteurs du commerce de détail, de l'hôtellerie et de la restauration.

- Par exemple, des entreprises comme Arla Foods, Saputo, Sargento, Leprino Foods et Dairygold élargissent leurs gammes de produits avec du cheddar fumé, du gouda, de la mozzarella et des mélanges de spécialités haut de gamme.

- La popularité croissante des repas à domicile de type restaurant, des collations à base de fromage et des offres de vente au détail haut de gamme aux États-Unis, en Europe et en Asie-Pacifique stimule l'expansion du marché.

- Alors que les consommateurs privilégient les saveurs audacieuses et les expériences haut de gamme, les chambres froides et les congélateurs restent un segment essentiel du marché des fromages de spécialité.

Quels sont les principaux facteurs de croissance du marché des chambres froides et des congélateurs ?

- La préférence croissante des consommateurs pour les produits laitiers savoureux et les fromages de qualité supérieure stimule fortement l'adoption des chambres froides et des congélateurs.

- Par exemple, entre 2024 et 2025, des entreprises comme Saputo, Arla Foods et Sargento ont lancé de nouvelles références et de nouveaux formats d'emballage adaptés aux segments de la vente au détail, du commerce électronique et de la restauration.

- La demande croissante de plats cuisinés prêts à consommer, de sandwichs gourmands, de cuisines fusion et de snacks à base de fromage élargit l'utilisation des chambres froides et des congélateurs dans les foyers et les établissements commerciaux.

- L'expansion des points de vente modernes, des fromageries spécialisées et des plateformes d'épicerie en ligne améliore l'accessibilité des produits et la portée auprès des consommateurs.

- La hausse de la consommation dans les chaînes de restauration, les restaurants à service rapide et les établissements de restauration décontractée renforce la croissance du marché.

- Soutenu par la hausse des revenus disponibles, l'évolution des préférences gustatives et les innovations dans la transformation des produits laitiers, le marché des chambres froides devrait connaître une croissance soutenue à long terme.

Quel facteur freine la croissance du marché des chambres froides ?

- Les coûts de production élevés associés au fumage naturel, à l'approvisionnement en lait de qualité supérieure et aux périodes de maturation prolongées limitent la compétitivité des prix des chambres froides et des congélateurs.

- Entre 2024 et 2025, la volatilité des prix du lait cru, de l'énergie et de la logistique a accru les dépenses opérationnelles des fabricants mondiaux.

- La durée de conservation plus courte et les exigences strictes en matière de chaîne du froid limitent la distribution, notamment sur les marchés émergents.

- Le manque de sensibilisation des consommateurs dans les régions en développement aux chambres froides spécialisées freine leur adoption.

- La concurrence des fromages transformés, des pâtes à tartiner aromatisées et des alternatives végétales exerce une pression sur les prix et l'espace en rayon.

- Pour relever ces défis, les entreprises se concentrent sur l'optimisation des processus, les solutions d'emballage innovantes, l'expansion des réseaux de distribution et l'éducation des consommateurs afin d'accélérer l'adoption mondiale des chambres froides et des congélateurs.

Comment le marché des chambres froides est-il segmenté ?

Le marché est segmenté en fonction du type, du type de système, du type de porte, de la technologie, du type de rideau, du canal de distribution et de l'utilisateur final .

- Par type

Le marché des chambres froides se segmente, selon le type, en quatre catégories : autonomes, à condensation déportée, à condensation multiplexe et autres. Le segment des unités autonomes dominait le marché en 2025, avec une part de marché estimée à 42,3 %. Cette domination s’explique par leur facilité d’installation, leur faible encombrement et leur adéquation aux cuisines professionnelles et aux commerces de détail de petite et moyenne taille. Les unités autonomes offrent des compresseurs intégrés, une maintenance simplifiée et des coûts d’acquisition réduits, ce qui les rend populaires auprès des cafés, restaurants et supérettes.

Le segment des systèmes de condensation multiplex devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à leur déploiement croissant dans les grandes surfaces, les hôtels et les entrepôts frigorifiques industriels. Les systèmes multiplex offrent évolutivité, efficacité énergétique et gestion centralisée, permettant aux opérateurs de gérer simultanément plusieurs unités de réfrigération et favorisant ainsi leur adoption dans les environnements commerciaux à haute capacité.

- Par type de système

Selon le type de système, le marché est segmenté en systèmes déportés, systèmes déportés pré-assemblés, systèmes à montage supérieur standard, systèmes à montage latéral, systèmes à montage en selle, systèmes penthouse, systèmes enroulables et autres. Le segment des systèmes déportés dominait le marché en 2025 avec une part de 38,7 %, grâce à une efficacité de refroidissement supérieure, une grande flexibilité d'installation et une adéquation aux chambres froides de grande capacité.

Les systèmes de contrôle à distance préassemblés devraient connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à une installation plus rapide, des coûts de main-d'œuvre réduits et des exigences minimales d'assemblage sur site. Leur adoption croissante par les chaînes de supermarchés, les cuisines professionnelles et les établissements de restauration accélère la croissance des solutions préassemblées.

- Par type de porte

Selon le type de porte, le marché est segmenté en portes simples, doubles, triples et autres. Le segment des portes doubles dominait le marché avec une part de 44,1 % en 2025, grâce à une meilleure accessibilité, une efficacité énergétique accrue et une compatibilité avec les cuisines professionnelles à fort trafic.

Le segment des entrepôts à triple porte devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, sous l'impulsion de la demande des grands restaurants, des hôtels et des exploitants d'entrepôts frigorifiques qui nécessitent plusieurs compartiments pour un accès simultané et une gestion efficace des stocks.

- Par la technologie

En fonction de la technologie, le marché est segmenté en chambres froides et congélateurs manuels, semi-automatiques et entièrement automatiques. Le segment semi-automatique dominait le marché en 2025 avec une part de 47,5 %, offrant un bon compromis entre maîtrise des opérations, fiabilité et efficacité énergétique.

Les systèmes entièrement automatiques devraient connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à l'adoption croissante de la réfrigération connectée, de la surveillance intelligente et du contrôle automatisé de la température dans les installations commerciales et industrielles.

- Par type de rideau

Le marché est segmenté en rideaux à lanières et rideaux d'air. Le segment des rideaux à lanières détenait la plus grande part de marché (63,2 %) en 2025, grâce à leur facilité d'installation, aux économies d'énergie qu'ils permettent et à leur capacité à prévenir les pertes d'air froid dans les chambres froides.

Le segment des rideaux d'air devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, soutenu par la demande des commerces de détail haut de gamme, des chaînes de restauration et des installations d'entreposage frigorifique industrielles nécessitant une gestion avancée des flux d'air et le respect des normes d'hygiène.

- Par canal de distribution

En fonction du mode de distribution, le marché est segmenté en vente directe/B2B, commerce électronique, magasins spécialisés et autres. Le canal de vente directe/B2B dominait le marché avec une part de 52,8 % en 2025, grâce aux commandes groupées des supermarchés, des hôtels et des cuisines professionnelles.

Le commerce électronique devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, sous l'impulsion de l'augmentation des achats en ligne effectués par les petits restaurants, les détaillants spécialisés et les entreprises à domicile qui recherchent des options de commande pratiques et la livraison à domicile.

- Par l'utilisateur final

Selon l'utilisateur final, le marché est segmenté en trois catégories : commercial, résidentiel et autres. Le segment commercial dominait le marché en 2025 avec une part de 58,4 %, grâce à une utilisation intensive dans les restaurants, les cafés, les hôtels et les entrepôts frigorifiques industriels.

Le segment résidentiel devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, alimenté par l'adoption croissante de la cuisine gastronomique à domicile, des cuisines haut de gamme et de la demande croissante de réfrigérateurs résidentiels grand format dans les ménages urbains.

Quelle région détient la plus grande part du marché des chambres froides et des congélateurs ?

- L'Allemagne a dominé le marché européen des chambres froides et des congélateurs avec une part de marché estimée à 47,8 % en 2025, grâce à une industrie agroalimentaire dynamique, une forte pénétration de la grande distribution, une adoption généralisée des infrastructures de la chaîne du froid et des réglementations strictes en matière de sécurité et de stockage des aliments dans les établissements commerciaux et industriels.

- La demande croissante des supermarchés, des hypermarchés, des chaînes de restauration, des entrepôts pharmaceutiques et des installations d'entreposage frigorifique industriel stimule considérablement l'adoption de systèmes de réfrigération et de congélation de grande capacité et à haut rendement énergétique dans toute la région.

- De solides capacités de production nationales, des technologies de réfrigération avancées, des normes strictes d'efficacité énergétique de l'UE et des investissements continus de la part des fabricants mondiaux et régionaux d'équipements frigorifiques continuent de renforcer le leadership de l'Europe sur le marché des chambres froides et des congélateurs.

Analyse du marché français des chambres froides et congélateurs

En France, la croissance soutenue du marché est portée par une forte demande des secteurs de la restauration, de l'hôtellerie, de la boulangerie et de la transformation laitière. Les chambres froides et les congélateurs sont largement utilisés dans les restaurants, les hôtels, les supermarchés et les unités de production alimentaire afin de respecter les normes d'hygiène et de contrôle de la température. L'adoption croissante de systèmes économes en énergie, de systèmes de surveillance intelligente de la température et de fluides frigorigènes écologiques s'inscrit dans les objectifs nationaux de développement durable. L'expansion du commerce de détail de produits alimentaires haut de gamme, du tourisme et de la logistique du froid contribue également à la croissance stable et durable du marché.

Analyse du marché italien des chambres froides et congélateurs

L'Italie devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide de 9,85 % entre 2026 et 2033 sur le marché européen des chambres froides, grâce à l'expansion des établissements de restauration, la croissance des exportations de produits frais et surgelés et l'augmentation des investissements dans les installations de stockage frigorifique modernes. L'adoption croissante de ces équipements par les restaurants, les chaînes de restauration rapide, les entreprises agroalimentaires et les entrepôts pharmaceutiques stimule la demande. L'innovation en matière de conception modulaire, de systèmes compacts et de solutions de réfrigération écoénergétiques continue de consolider la trajectoire de croissance italienne.

Quelles sont les principales entreprises du marché des chambres froides et des congélateurs ?

Le secteur des chambres froides et des congélateurs est principalement dominé par des entreprises bien établies, notamment :

- Lancer Worldwide (États-Unis)

- Haier Inc. (Chine)

- Réfrigérateur Foster (Royaume-Uni)

- BSH Hausgeräte GmbH (Allemagne)

- AB Electrolux (Suède)

- Precision Refrigeration Ltd (Royaume-Uni)

- Société Hussmann (Panasonic) (États-Unis)

- Danfoss A/S (Danemark)

- Kolpak (Welbilt, Inc.) (États-Unis)

- Master-Bilt (États-Unis)

- Norlake, Inc. (États-Unis)

- Amerikooler LLC (États-Unis)

- Brun impérial (États-Unis)

- Thermo-Kool (États-Unis)

- Bally Refrigerated Boxes, Inc. (États-Unis)

- USA Cooler (États-Unis)

Quels sont les développements récents sur le marché mondial des chambres froides et des congélateurs ?

- En août 2025, Everidge a lancé sa gamme de chambres froides mobiles Cool on the Move, proposant des unités de 1,8 x 2,4 m, 1,8 x 3,7 m et 1,8 x 4,8 m faisant office de réfrigérateurs et de congélateurs et fonctionnant sur des prises 120 V standard ou des générateurs. Conçues pour des secteurs tels que la restauration, la santé et les services d'urgence, ces unités garantissent un stockage frigorifique fiable pendant le transport et les interventions sur site. Ce lancement témoigne de la demande croissante de solutions de stockage frigorifique mobiles et flexibles dans de nombreux secteurs d'activité.

- En juin 2025, Amerikooler a lancé la chambre froide AK Series 3 Quick Ship Walk-In, conçue pour une livraison et une installation rapides tout en garantissant une haute efficacité énergétique. Dotée d'une isolation AK-XPS de qualité compresseur R-29, d'un plancher en acier robuste et d'un système de surveillance numérique intégré, cette solution s'adresse aux clients exigeant un déploiement rapide sans compromis sur les performances. Ce développement souligne l'importance accordée par le marché à la rapidité, à l'efficacité et à la fiabilité opérationnelle.

- En novembre 2024, KPS Global a dévoilé DEFENDOOR, un système de protection avancé conçu pour renforcer la durabilité des portes et réduire les coûts de maintenance des chambres froides et congélateurs dans les environnements à fort trafic. En minimisant les dommages aux portes et en prolongeant la durée de vie des produits, ce système aide les exploitants de la grande distribution et de la restauration à optimiser leurs coûts à long terme. Cette innovation témoigne de l'importance croissante accordée à la durabilité et à la valeur du cycle de vie des infrastructures de stockage frigorifique.

- En janvier 2024, Hussmann, une société de Panasonic, a lancé Evolve Technologies afin de soutenir les solutions de réfrigération à faible potentiel de réchauffement climatique utilisant des fluides frigorigènes durables tels que le R-744 (CO₂) et le R-290 (propane). Cette initiative répond aux exigences réglementaires et aux préoccupations environnementales tout en améliorant la durabilité des systèmes de réfrigération. Ce lancement témoigne de la transition du secteur vers des technologies de réfrigération écologiques et tournées vers l'avenir.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.