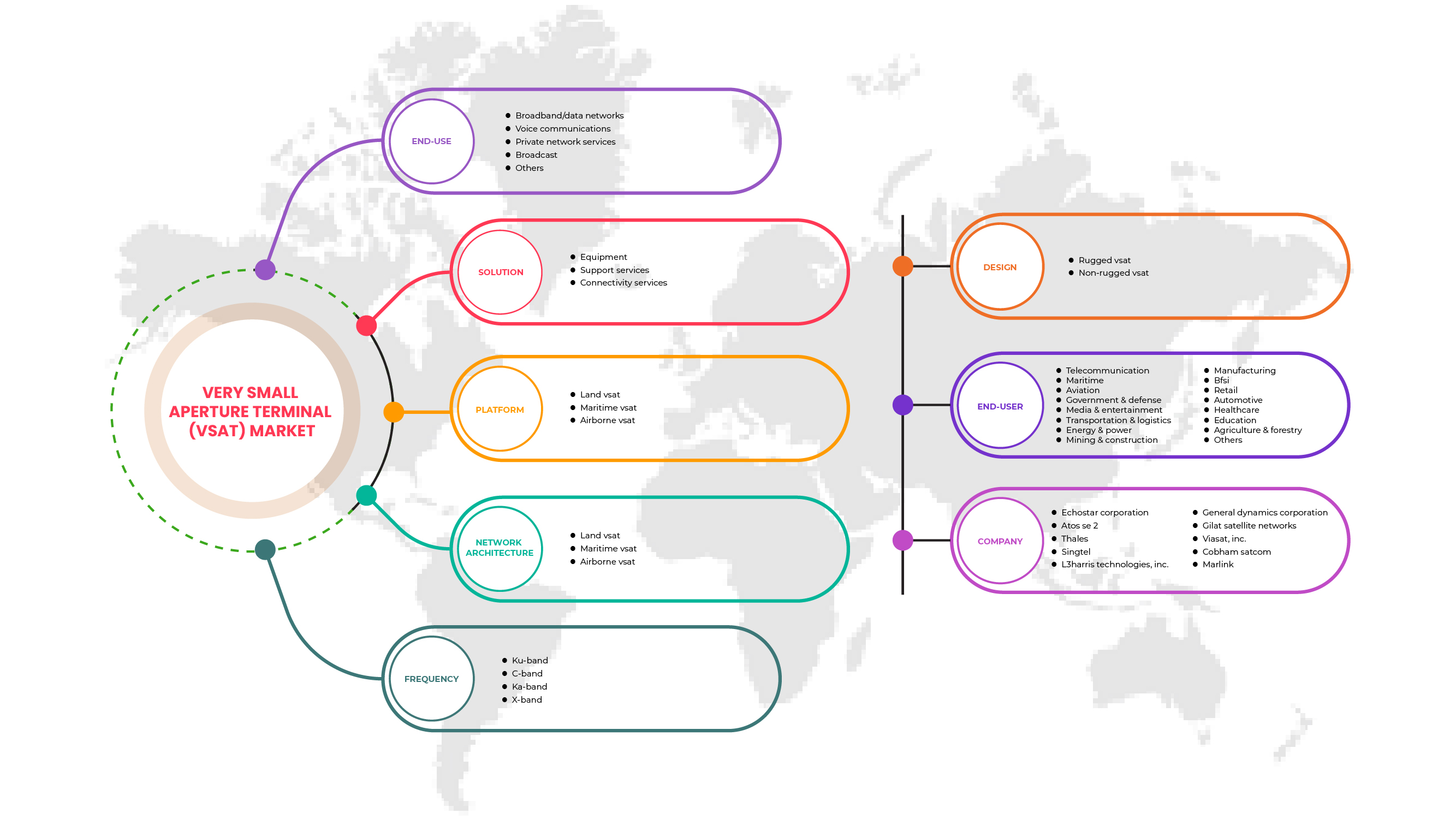

Marché européen des terminaux à très petite ouverture (VSAT), par solution (équipement, services d'assistance, services de connectivité), plate-forme (VSAT terrestre, VSAT maritime, VSAT aéroporté), fréquence (bande Ku, bande C, bande Ka, bande X), architecture réseau (topologie en étoile, topologie maillée, topologie hybride, liaisons point à point), conception (VSAT robuste et VSAT non robuste), vertical (télécommunications, maritime, aviation, gouvernement et défense, médias et divertissement, transport et logistique, énergie et électricité, mines et construction, fabrication, BFSI, vente au détail, automobile, transport et logistique, soins de santé, éducation, agriculture et foresterie et autres), utilisation finale (réseau haut débit/données, communication vocale, service de réseau privé, diffusion et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des terminaux à très petite ouverture (VSAT) en Europe

La croissance massive de la capacité satellitaire a entraîné une baisse significative des prix, faisant des terminaux à très petite ouverture (VSAT) une solution viable pour de nombreuses industries et régions pour la première fois. En outre, la technologie VSAT a été de plus en plus adoptée dans des secteurs tels que le transport maritime, le pétrole et le gaz, l'aviation, entre autres. Ces systèmes fournissent également la connectivité requise entre les utilisateurs d'applications médicales, de bases de données, de vidéo et de téléphones situés à des endroits éloignés, et permettent la communication avec des sites distants et mobiles.

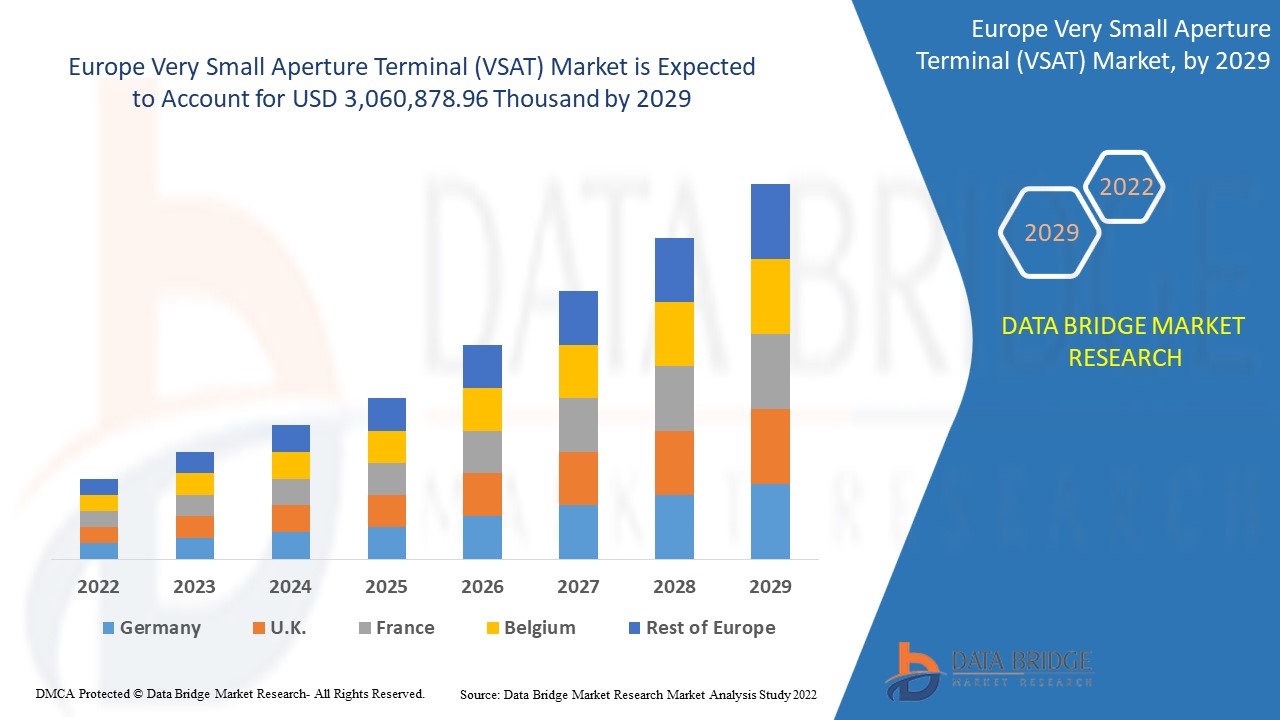

Data Bridge Market Research estime que le marché européen des terminaux à très petite ouverture (VSAT) devrait atteindre la valeur de 3 060 878,96 milliers de dollars d'ici 2029, à un TCAC de 8,9 % au cours de la période de prévision. Le rapport sur le marché des terminaux à très petite ouverture (VSAT) couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par solution (équipement, services de soutien, services de connectivité), plateforme (VSAT terrestre, VSAT maritime, VSAT aéroporté), fréquence (bande Ku, bande C, bande Ka, bande X), architecture réseau (topologie en étoile, topologie maillée, topologie hybride, liaisons point à point), conception (VSAT robuste et VSAT non robuste), vertical (télécommunications, maritime, aviation, gouvernement et défense, médias et divertissement, transport et logistique, énergie et électricité, exploitation minière et construction, fabrication, BFSI, vente au détail, automobile, transport et logistique, soins de santé, éducation, agriculture et foresterie et autres), utilisation finale (réseau haut débit/données, communication vocale, service de réseau privé, diffusion et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Suède, Reste de l'Europe |

|

Acteurs du marché couverts |

Singtel, Marlink, Thuraya Telecommunications Company, Speedcast, NSSLEurope, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, Nisshinbo Holdings Inc., General Dynamics Corporation, Honeywell International Inc., Cobham Satcom, Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., CPI International Inc., Global Invacom |

Définition du marché

Un système de communication par satellite bidirectionnel est appelé VSAT (Very Small Aperture Terminal). L'antenne parabolique de ce système mesure généralement moins de 3,8 mètres de diamètre. L'efficacité d'un système VSAT peut être affectée négativement par les conditions météorologiques . En outre, trois topologies de réseaux VSAT sont généralement utilisées : en étoile, en maille ou hybride. Par conséquent, les systèmes VSAT fournissent la connectivité requise entre les utilisateurs d' applications médicales , de bases de données , de vidéo et de téléphones situés à distance, et permettent la communication avec des sites distants et mobiles.

Dynamique du marché européen des terminaux à très petite ouverture (VSAT)

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de communication sécurisée pour les applications IoT maritimes

La technologie VSAT est devenue un enjeu majeur pour l'industrie maritime. Elle est utilisée pour les communications bidirectionnelles par satellite pour Internet, les données et la téléphonie, généralement dans les zones rurales et les environnements difficiles. Ces dernières années, on a assisté à une évolution progressive de l'écosphère IoT maritime. Cette écosphère est desservie par divers composants électroniques standard, c'est-à-dire le matériel intégré à divers logiciels. Les services IoT par satellite permettent aux entreprises d'accéder aux données des actifs de la manière la plus abordable. Par conséquent, les navires en mer sont éloignés, les navires et autres entités discrètes adoptent des systèmes numériques dans le cadre de réseaux IoT plus vastes. L'utilisation d'appareils IoT et de systèmes de capteurs sur les navires/la flotte permet d'obtenir un avantage concurrentiel, en permettant aux entreprises d'exploiter tout le potentiel des données pour des opérations et une prise de décision plus efficaces.

- Adoption croissante de la technologie VSAT dans l'industrie pétrolière et gazière

De nos jours, le secteur pétrolier et gazier connaît une profonde mutation en raison des diverses innovations numériques. Les exigences sont multiples, notamment en matière de sécurité, de sûreté, d'exploration de nouvelles zones pétrolières et d'augmentation de la visibilité entre la plateforme et le siège social, tout en maîtrisant les coûts d'exploitation. Par conséquent, les opérateurs de plateformes sont constamment poussés à prendre des décisions plus rapides et à gérer les opérations plus efficacement. En outre, l'industrie pétrolière et gazière opère dans des environnements terrestres et offshore éloignés où l'utilisation de communications terrestres n'est ni pratique ni fiable. Par conséquent, de nombreuses entreprises ont commencé à mettre en œuvre la technologie VSAT afin que les opérateurs de plateformes puissent prendre des décisions rapides et plus éclairées, ce qui réduira les coûts d'exploitation, augmentera la productivité et offrira des conditions de travail plus sûres à l'équipage, quel que soit l'endroit.

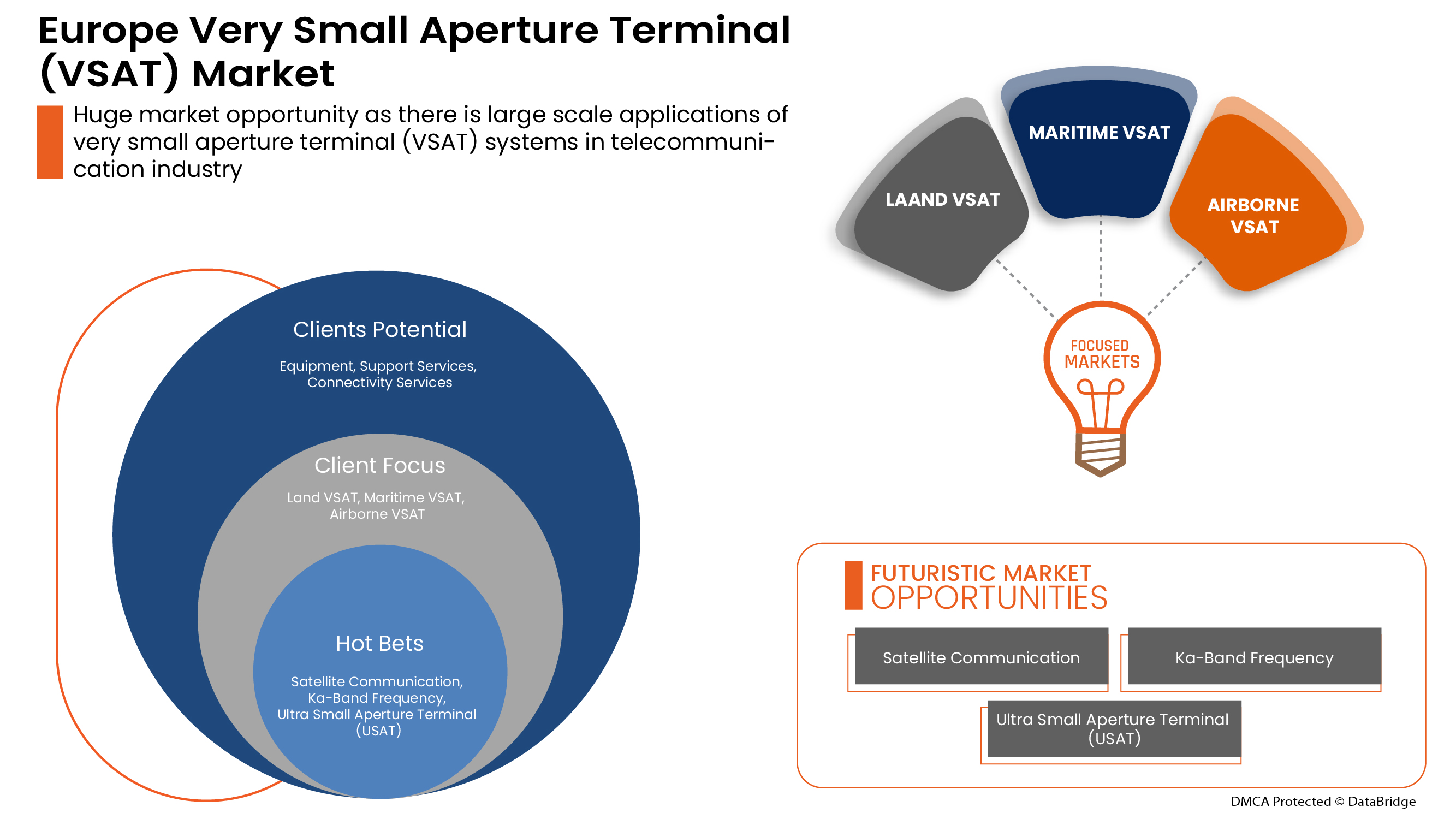

Opportunités

- Accroître le partenariat stratégique et l'acquisition entre diverses organisations

La coordination et l'investissement dans les projets sont essentiels pour obtenir des améliorations durables dans le secteur des terminaux à très petite ouverture (VSAT). C'est pourquoi le gouvernement et d'autres organisations privées s'efforcent, par le biais de partenariats et d'acquisitions, d'accélérer la croissance des industries. Cela contribue à accroître la notoriété et les bénéfices de l'organisation et crée ainsi un espace pour une nouvelle invention dans l'industrie. De plus, grâce aux partenariats, l'entreprise peut investir davantage dans des technologies avancées pour fournir des services et des solutions de terminaux à très petite ouverture (VSAT) plus sûrs et plus fiables. En outre, cela aide les deux entreprises à se faire connaître sur le marché concurrentiel, générant ainsi des bénéfices dans une certaine mesure.

Contraintes/Défis

- Inquiétudes croissantes en matière de cybersécurité et violations de données

Les problèmes de cybercriminalité/piratage informatique et de cybersécurité ont augmenté de 600 % pendant la pandémie dans tous les secteurs. Les failles de sécurité des réseaux ou des logiciels sont exploitées par les pirates informatiques pour effectuer des actions non autorisées au sein d'un système.

Selon le récent rapport publié dans le cadre de l'enquête sur la cybersécurité maritime par Safety at Sea et BIMCO, au cours des 12 mois précédant février 2020, 31 % des organisations ont été victimes de cyberattaques, ce qui représente une augmentation de 9 % par rapport à 2019. Selon un autre rapport publié par Robert Rizika, responsable des opérations nord-américaines chez Naval Dome, les cyberattaques sur la technologie opérationnelle (OT) de l'industrie maritime ont augmenté de 900 %, passant de 50 % en 2017 à 120 % et 310 % en 2018 et 2019 respectivement.

- Problèmes liés à la fiabilité du réseau de terminaux à très petite ouverture (VSAT) en cas de mauvais temps

La météo spatiale perturbe les communications radio entre la Terre et les satellites car elle peut provoquer des perturbations de l'ionosphère qui réfléchissent, réfractent ou absorbent les ondes radio. Étant donné que les signaux satellite doivent parcourir de grandes distances dans les airs, les services Internet par satellite pour les utilisateurs ruraux peuvent être vulnérables aux intempéries. Bien que le vent affecte rarement les signaux radio, il peut faire vaciller, vibrer ou même déplacer des équipements comme les antennes paraboliques. La latence et l'affaiblissement dû à la pluie sont deux facteurs particuliers qui affectent la capacité des satellites à envoyer des signaux. La pluie et l'humidité atmosphérique sont les principales causes de l'affaiblissement dû à la pluie, qui peut affaiblir ou dégrader le signal satellite aux fréquences plus élevées des bandes Ku et Ka.

Impact de la pandémie de COVID-19 sur le marché européen des terminaux à très petite ouverture (VSAT)

La COVID-19 a eu un impact négatif sur le marché des terminaux à très petite ouverture (VSAT) en raison des réglementations de confinement et de la fermeture des installations de fabrication.

La pandémie de COVID-19 a eu un impact négatif sur le marché des terminaux à très petite ouverture (VSAT). Cependant, la forte demande de systèmes de sécurité de détresse maritime européens dans le monde entier a contribué à la croissance du marché après la pandémie. En outre, la croissance a été élevée après l'ouverture du marché après COVID-19, et on s'attend à une croissance considérable du secteur en raison de la prolifération croissante des communications par satellite dans le secteur militaire et de la défense.

Les fournisseurs de solutions prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans le terminal à très petite ouverture (VSAT). Grâce à cela, les entreprises apporteront des technologies avancées au marché. En outre, les initiatives gouvernementales pour l'utilisation de la technologie d'automatisation ont conduit à la croissance du marché

Développements récents

- En avril 2022, General Dynamics a annoncé la signature d'un contrat de fourniture de 1 000 bandes Tr à Boeing pour une installation en ligne sur des AVIONS COMMERCIAUX ET MILITAIRES. Ce contrat aidera l'entreprise à accélérer la croissance de ses ventes et à renforcer sa position sur le marché.

- En avril 2021, NSSL Europe a annoncé un partenariat avec DDK Positioning pour améliorer les systèmes de navigation par satellite européens (GNSS). Ce partenariat aidera l'entreprise à élargir son portefeuille de produits maritimes pour offrir une large gamme de produits et renforcer sa position sur le marché.

Portée du marché européen des terminaux à très petite ouverture (VSAT)

Le marché européen des terminaux à très petite ouverture (VSAT) est segmenté en fonction de la solution, de la plate-forme, de la fréquence, de l'architecture réseau, de la conception, du secteur vertical et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Solution

- Équipement

- Services de soutien

- Services de connectivité

Sur la base de la solution, le marché européen des terminaux à très petite ouverture (VSAT) est segmenté en équipements, services de support et services de connectivité.

Plate-forme

- VSAT terrestre

- VSAT maritime

- VSAT aéroporté

Sur la base de la plateforme, le marché européen des terminaux à très petite ouverture (VSAT) a été segmenté en VSAT terrestre, VSAT maritime et VSAT aéroporté.

Fréquence

- Bande Ku

- Bande C

- Bande Ka

- Bande X

Sur la base de la fréquence, le marché européen des terminaux à très petite ouverture (VSAT) a été segmenté en bande Ku, bande C, bande Ka et bande X.

Architecture réseau

- Topologie en étoile

- Topologie maillée

- Topologie hybride

- Liens point à point

Sur la base de l'architecture du réseau, le marché européen des terminaux à très petite ouverture (VSAT) a été segmenté en topologie en étoile, topologie en maille, topologie hybride et liaisons point à point.

Conception

- VSAT robuste

- VSAT non robuste

Sur la base de la conception, le marché européen des terminaux à très petite ouverture (VSAT) est segmenté en VSAT robustes et VSAT non robustes.

Verticale

- Télécommunication

- Maritime

- Aviation

- Gouvernement et défense

- Médias et divertissement

- Transport et logistique

- Énergie et électricité

- Exploitation minière et construction

- Fabrication

- BFSI

- Vente au détail

- Automobile

- Transport et logistique

- Soins de santé

- Éducation

- Agriculture et sylviculture

- Autres

Sur la base de la verticale, le marché européen des terminaux à très petite ouverture (VSAT) est segmenté en télécommunications, maritime, aviation, gouvernement et défense, médias et divertissement, transport et logistique, énergie et électricité, mines et construction, fabrication, BFSI, vente au détail, automobile, transport et logistique, soins de santé, éducation, agriculture et foresterie, autres.

Utilisation finale

- Réseau à large bande/données

- Communication vocale

- Service de réseau privé

- Diffuser

- Autres

Sur la base de l'utilisation finale, le marché européen des terminaux à très petite ouverture (VSAT) est segmenté en réseau haut débit/données, communication vocale, service de réseau privé, diffusion, autres.

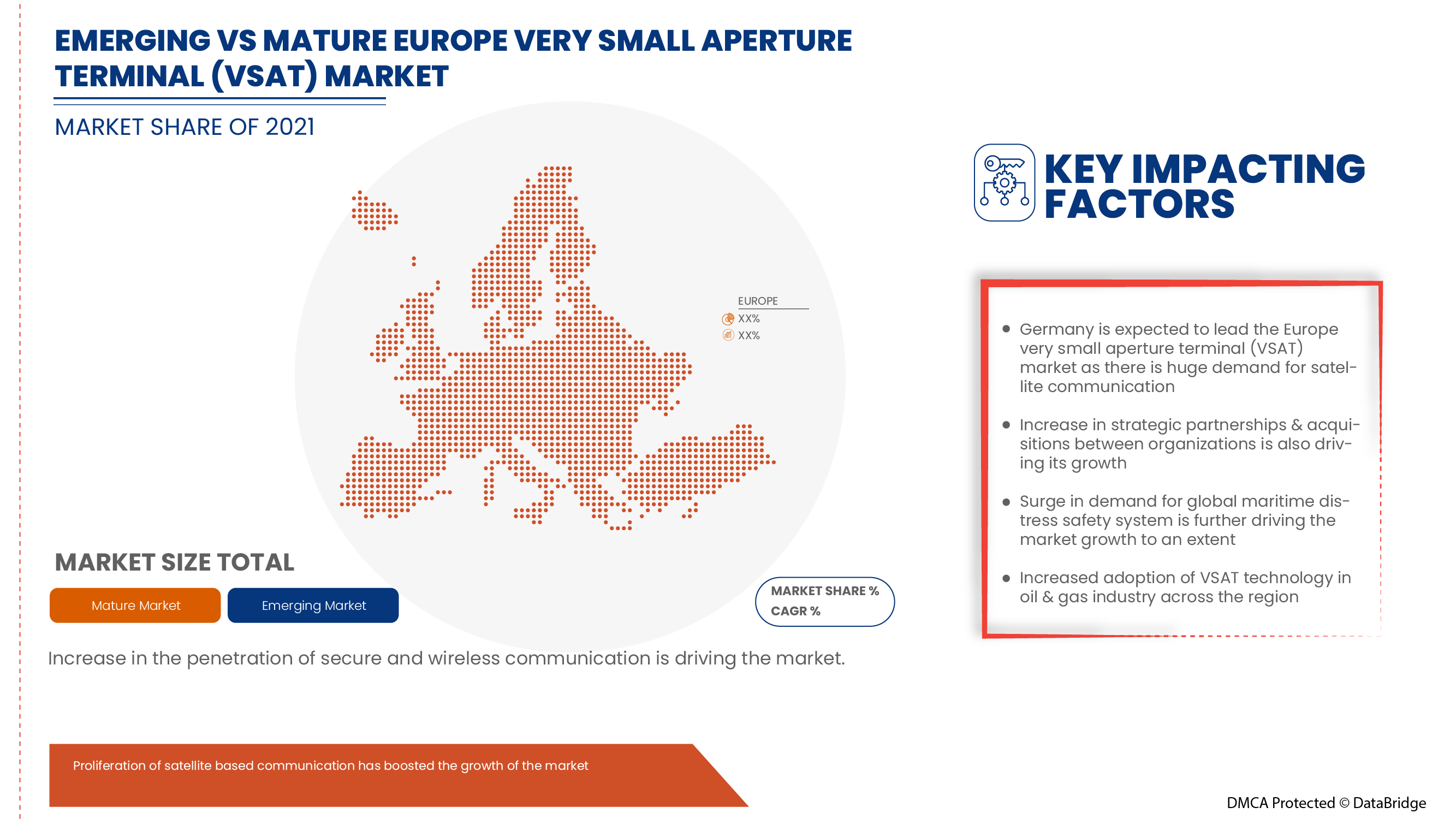

Analyse/perspectives régionales du marché européen des terminaux à très petite ouverture (VSAT)

Le marché européen des terminaux à très petite ouverture (VSAT) est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de matériau, processus de fabrication et industrie d’utilisation finale, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché européen des terminaux à très petite ouverture (VSAT) sont l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, la Suède et le reste de l'Europe.

L’Allemagne domine l’Europe en raison de la demande croissante de communication sécurisée pour les applications IoT maritimes et aériennes.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Very Small Aperture Terminal (VSAT) Market Share Analysis

Europe very small aperture terminal (VSAT) market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the very small aperture terminal (VSAT) market.

Some of the major players operating in the Europe very small aperture terminal (VSAT) market are Singtel, Marlink, Thuraya Telecommunications Company, Speedcast, NSSLEurope, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, Nisshinbo Holdings Inc., General Dynamics Corporation, Honeywell International Inc., Cobham Satcom, Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., CPI International Inc., Global Invacom

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOLUTION TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET PLATFORM COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 RELIABLE VSAT CONNECTIVITY IMPROVES OPERATIONAL STABILITY FOR SUN ENTERPRISES

4.3.2 CUSTOMER WINS MAJOR OIL AND GAS CONTRACT USING WINEGARD'S SECRET WEAPON

4.3.3 VIZOCOM'S SATELLITE SOLUTION PROVIDES THE DEPARTMENT OF DEFENSE EDUCATION ACTIVITY (DODEA) WITH INTERNET CONNECTIVITY TO PUERTO RICO AFTER HURRICANE MARIA IN 2017

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS

5.1.2 INCREASED ADOPTION OF VSAT TECHNOLOGY IN THE OIL AND GAS INDUSTRY

5.1.3 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR

5.2 RESTRAINTS

5.2.1 RISING CYBER SECURITY CONCERNS AND DATA BREACHES

5.2.2 ISSUES RELATED TO DATA LATENCY IN VSAT TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 SURGE IN DEMAND FOR EUROPE MARITIME DISTRESS SAFETY SYSTEM

5.3.2 INCREASING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG VARIOUS ORGANIZATIONS

5.3.3 ADVENT OF VSAT SERVICE PROVIDERS IN VARIOUS ENTERPRISE SECTORS

5.4 CHALLENGES

5.4.1 HIGHER HARDWARE AND INSTALLATION COSTS OF VSAT SYSTEMS

5.4.2 ISSUES RELATED TO RELIABILITY OF VSAT NETWORK DURING BAD WEATHER

5.4.3 HIGHER CHANCES OF INTERFERENCE IN VERY SMALL APERTURE TERMINAL (VSAT) NETWORKS

6 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION

6.1 OVERVIEW

6.2 EQUIPMENT

6.2.1 OUT-DOOR UNITS

6.2.1.1 ANTENNAS

6.2.1.2 RF FREQUENCY CONVERTERS

6.2.1.3 AMPLIFIERS

6.2.1.4 DIPLEXERS

6.2.1.5 OTHERS

6.2.2 IN-DOOR UNITS

6.2.2.1 SATELLITE MODEM

6.2.2.2 SATELLITE ROUTER

6.2.3 MOUNTS

6.2.4 ANTENNA CONTROL UNITS

6.2.5 OTHERS

6.2.6 SUPPORT SERVICES

6.2.6.1 PROFESSIONAL SERVICES

6.2.6.1.1 MAINTENANCE & SUPPORT SERVICES

6.2.6.1.2 ENGINEERING & CONSULTATION

6.2.6.1.3 TRAINING

6.2.6.2 MANAGED SERVICES

6.2.6.2.1 INSTALLATION & SETUP

6.2.6.2.2 NETWORK DESIGN & OPTIMIZATION

6.2.6.2.3 NETWORK OPERATIONS

6.3 CONNECTIVITY SERVICES

7 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM

7.1 OVERVIEW

7.2 LAND VSAT

7.2.1 FIXED

7.2.1.1 EARTH STATION

7.2.1.2 COMMERCIAL BUILDINGS

7.2.1.3 COMMAND & CONTROL CENTERS

7.2.2 ON-THE-MOVE

7.2.2.1 COMMERCIAL VEHICLES

7.2.2.2 MILITARY VEHICLES

7.2.2.3 TRAINS

7.2.2.4 EMERGENCY VEHICLES

7.2.2.5 UNMANNED GROUND VEHICLES

7.2.3 PORTABLE/MANPACKS

7.3 MARITIME VSAT

7.3.1 COMMERCIAL SHIP

7.3.2 MILITARY SHIP

7.3.3 UNMANNED MARINE SHIP

7.4 AIRBORNE VSAT

7.4.1 COMMERCIAL AIRCRAFT

7.4.2 MILITARY AIRCRAFT

7.4.3 UNMANNED MARINE SHIP

8 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE

8.1 OVERVIEW

8.2 STAR TOPOLOGY

8.3 MESH TOPOLOGY

8.4 HYBRID TOPOLOGY

8.5 POINT-TO-POINT LINKS

9 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY

9.1 OVERVIEW

9.2 KU-BAND

9.3 C-BAND

9.4 KA-BAND

9.5 X-BAND

10 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN

10.1 OVERVIEW

10.2 RUGGED VSAT

10.3 NON- RUGGED VSAT

11 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 TELECOMMUNICATION

11.2.1 EQUIPMENT

11.2.2 SUPPORT SERVICES

11.2.3 CONNECTIVITY SERVICES

11.3 MARITIME

11.3.1 EQUIPMENT

11.3.2 SUPPORT SERVICES

11.3.3 CONNECTIVITY SERVICES

11.4 AVIATION

11.4.1 EQUIPMENT

11.4.2 SUPPORT SERVICES

11.4.3 CONNECTIVITY SERVICES

11.5 GOVERNMENT & DEFENSE

11.5.1 EQUIPMENT

11.5.2 SUPPORT SERVICES

11.5.3 CONNECTIVITY SERVICES

11.6 MEDIA & ENTERTAINMENT

11.6.1 EQUIPMENT

11.6.2 SUPPORT SERVICES

11.6.3 CONNECTIVITY SERVICES

11.7 TRANSPORTATION & LOGISTICS

11.7.1 EQUIPMENT

11.7.2 SUPPORT SERVICES

11.7.3 CONNECTIVITY SERVICES

11.8 ENERGY & POWER

11.9 MINING & CONSTRUCTION

11.9.1 EQUIPMENT

11.9.2 SUPPORT SERVICES

11.9.3 CONNECTIVITY SERVICES

11.1 MANUFACTURING

11.10.1 EQUIPMENT

11.10.2 SUPPORT SERVICES

11.10.3 CONNECTIVITY SERVICES

11.11 BFSI

11.12 RETAIL

11.12.1 EQUIPMENT

11.12.2 SUPPORT SERVICES

11.12.3 CONNECTIVITY SERVICES

11.13 AUTOMOTIVE

11.13.1 EQUIPMENT

11.13.2 SUPPORT SERVICES

11.13.3 CONNECTIVITY SERVICES

11.14 HEALTHCARE

11.15 EDUCATION

11.16 AGRICULTURE & FORESTRY

11.16.1 EQUIPMENT

11.16.2 SUPPORT SERVICES

11.16.3 CONNECTIVITY SERVICES

11.17 OTHERS

12 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE

12.1 OVERVIEW

12.2 BROADBAND/DATA NETWORKS

12.3 VOICE COMMUNICATIONS

12.4 PRIVATE NETWORK SERVICES

12.5 BROADCAST

12.6 OTHERS

13 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 SPAIN

13.1.5 ITALY

13.1.6 RUSSIA

13.1.7 NETHERLANDS

13.1.8 SWITZERLAND

13.1.9 SWEDEN

13.1.10 BELGIUM

13.1.11 TURKEY

13.1.12 REST OF EUROPE

14 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY LANDSCAPE

15 SWOT ANLYSIS

16 COMPAMY PROFILE

16.1 ECHOSTAR CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ATOS SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 THALES

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SINGTEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 L3HARRIS TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 GENERAL DYNAMICS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 GILAT SATELLITE NETWORKS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 C-COM SATELLITE SYSTEMS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 COBHAM SATCOM

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CPI INTERNATIONAL INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 EUROPE INVACOM

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICES PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 HONEYWELL INTERNATIONAL INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 IRIDIUM COMMUNICATIONS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 KVH INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SOLUTION PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 MARLINK

16.15.1 COMPANY SNAPSHOT

16.15.2 SOLUTION PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NISSHINBO HOLDINGS INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NSSL EUROPE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ORBIT COMMUNICATIONS SYSTEMS LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SPEEDCAST

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 ST ENGINEERING

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 THURAYA TELECOMMUNICATIONS COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 ULTRA

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 VIASAT, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 VIZOCOM COMPANY

16.24.1 COMPANY SNAPSHOT

16.24.2 SOLUTION PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 X2NSAT

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 CYBER-ATTACKS ON VESSELS/MARITIME INDUSTRY

TABLE 2 TYPICAL HARDWARE AND INSTALLATION COSTS

TABLE 3 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE OUT-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE IN-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE PROFESSIONAL SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE MANAGED SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE CONNECTIVITY SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE FIXED IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE ON-THE-MOVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE STAR TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE MESH TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE HYBRID TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE POINT-TO-POINT LINKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE KU-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE C-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE KA-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE X-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE NON- RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 44 EUROPE MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE ENERGY & POWER IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 EUROPE MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 51 EUROPE MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 52 EUROPE MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 53 EUROPE BFSI IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 54 EUROPE RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 EUROPE RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 56 EUROPE AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 EUROPE AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 58 EUROPE HEALTHCARE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 EUROPE EDUCATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 EUROPE AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 61 EUROPE AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 62 EUROPE OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 64 EUROPE BROADBAND/DATA NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 65 EUROPE VOICE COMMUNICATIONS NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 EUROPE PRIVATE NETWORK SERVICES NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 67 EUROPE BROADCAST IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 EUROPE OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 69 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 2 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 10 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE WHEREAS ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD

FIGURE 12 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR EUROPE VERY SMALL APERTURE TERMINAL MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 13 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 14 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN 2022 & 2029

FIGURE 15 IMPACT OF VARIOUS SATELLITE TECHNOLOGY TRENDS AND INNOVATIONS IN 2022

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET

FIGURE 17 REGIONAL MARKET SHARE IN SERVICE ENTERPRISE FOR THE YEAR 2016

FIGURE 18 EUROPE SHIPPING LOSSES BY THE NUMBER OF VESSELS OVER THE YEARS

FIGURE 19 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, SOLUTION, 2021

FIGURE 20 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, PLATFORM, 2021 (USD THOUSAND)

FIGURE 21 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, NETWORK ARCHITECTURE, 2021 (USD THOUSAND)

FIGURE 22 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, FREQUENCY, 2021 (USD THOUSAND)

FIGURE 23 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, DESIGN, 2021 (USD THOUSAND)

FIGURE 24 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, VERTICAL, 2021

FIGURE 25 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, END-USE, 2021 (USD THOUSAND)

FIGURE 26 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 27 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 28 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 31 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.