Marché des contenants de stockage des aliments en Europe, aux États-Unis et au Japon, par produit (boîtes et bacs, bocaux et boîtes, tasses et bacs, canettes et bouteilles), type (stockage à sec, articles de stockage pour réfrigérateur, ustensiles de cuisine, ustensiles de cuisson, ustensiles pour micro-ondes, ustensiles de service, ustensiles de congélation et ustensiles de cuisson), type de matériau (plastique, métal, papier, verre, acrylique, céramique, silicone et autres), objectif (récipient hermétique, compatible avec les micro-ondes et autres), forme (ronde, carrée, rectangulaire, ovale et autres), capacité (501-1000 ML, 1000-1500 ML, 1500-2000 ML, plus de 2000 ML, 101-500 ML et moins de 100 ML), technologie (extrusion, moulage par injection, thermoformage, moulage par étirage-soufflage et autres), apparence (transparent et coloré), fonction (stockage, Transport et convoyage, prélèvement et manutention, applications (B2C et B2B) - Tendances et prévisions du secteur jusqu'en 2030.

Analyse et perspectives du marché des conteneurs de stockage des aliments en Europe, aux États-Unis et au Japon

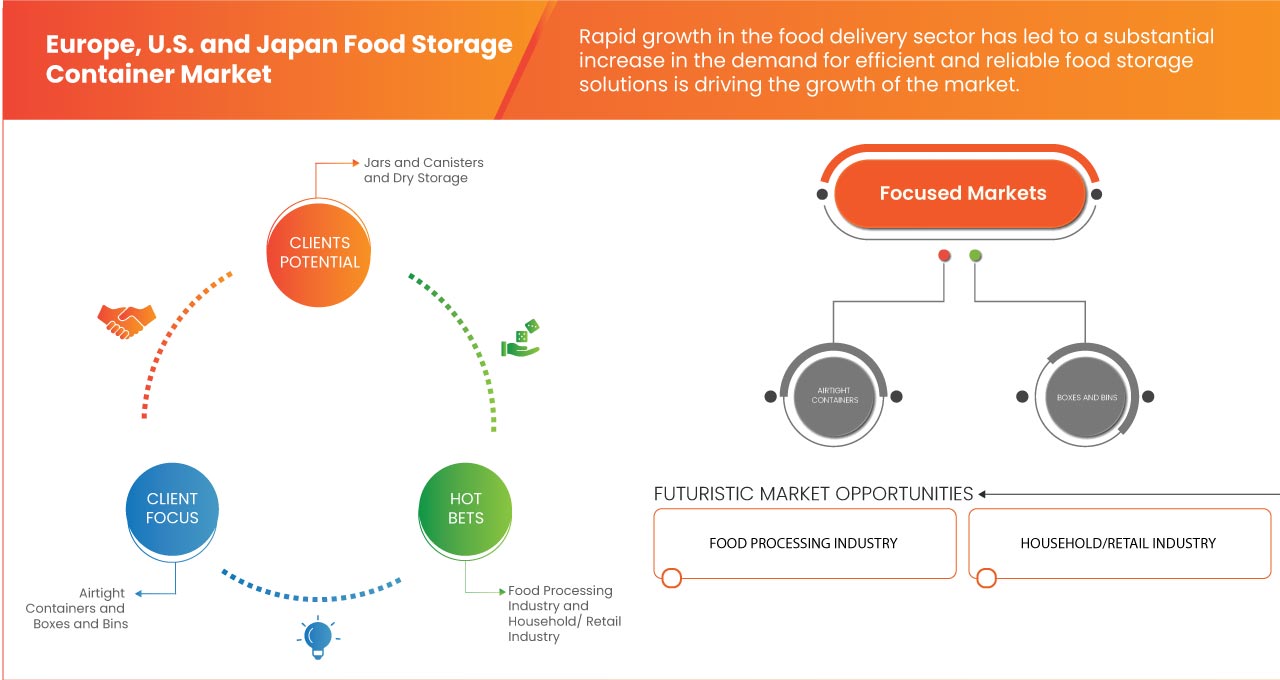

Le facteur clé qui alimente l'expansion du marché des conteneurs de stockage des aliments est la demande croissante de produits alimentaires prêts à l'emploi. Le secteur croissant du commerce électronique et de la vente au détail en ligne stimule l'expansion du marché. En outre, l'expansion des efforts de recherche et développement et la modernisation des produits récemment lancés sur le marché ouvriront davantage de potentiel commercial pour le marché des conteneurs de stockage des aliments.

Le principal frein au marché est le coût élevé associé à certains produits. Les opportunités pour le marché sont les innovations croissantes dans les matériaux et les conceptions. Certains des défis importants associés au marché des conteneurs de stockage des aliments sont la concurrence féroce des produits alternatifs et les préoccupations environnementales associées aux conteneurs.

La demande de contenants de stockage alimentaire augmente et les fabricants se concentrent désormais davantage sur ce point et participent au lancement de nouveaux produits, à la promotion, aux récompenses, à la certification et à la participation aux événements sur le marché. Ces décisions favorisent en fin de compte la croissance du marché.

Data Bridge Market Research analyse que le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon connaîtra un TCAC de 5,1 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Produit (boîtes et bacs, bocaux et boîtes, tasses et bacs, canettes et bouteilles), type (stockage à sec, articles de stockage au réfrigérateur, ustensiles de cuisine, ustensiles de cuisson au four, ustensiles pour micro-ondes, ustensiles de service, ustensiles de congélation et ustensiles de pâtisserie), type de matériau (plastique, métal, papier, verre, acrylique, céramique, silicone et autres), objectif (récipient hermétique, compatible avec les micro-ondes et autres), forme (ronde, carrée, rectangulaire, ovale et autres), capacité (501-1000 ML, 1000-1500 ML, 1500-2000 ML, plus de 2000 ML, 101-500 ML et moins de 100 ML), technologie (extrusion, moulage par injection, thermoformage, moulage par étirage-soufflage et autres), aspect (transparent et coloré), fonction (stockage, transport et prélèvement et manutention), Candidature (B2C et B2B) |

|

Pays couverts |

États-Unis, Japon, Allemagne, France, Royaume-Uni, Italie, Pays-Bas, Turquie, Espagne, Belgique, Russie, Pologne, Suisse, Suède, Danemark et reste de l'Europe |

|

Acteurs du marché couverts |

Silgan Holdings, Tupperware Brands Corp, Pactive Evergreen Inc., Newell Brands, The Clorox Company, Graham Packaging Company, Anchor Glass Container Corporation, EMSA GmbH, OXO, Locknlock Co, Lindar Corp, Molded Fiber Glass Tray Company, Lenox Corporation, Thermos LLC, CL Smith, Inno-Pak, Glasslock USA, Freshware et Vremi |

Définition du marché

Le récipient de stockage des aliments est un récipient spécialement conçu pour stocker et conserver divers types d'aliments pendant de longues périodes. Ces récipients sont disponibles dans une variété de matériaux tels que le plastique, le verre, l'acier inoxydable et le silicone, et ils sont équipés de joints hermétiques pour maintenir la fraîcheur et éviter la détérioration des aliments stockés. Dans les applications industrielles B2C (Business-to-Consumer), les récipients de stockage des aliments sont largement utilisés par les entreprises de vente au détail qui s'adressent directement aux consommateurs finaux. Ils constituent un accessoire de cuisine populaire pour les ménages, permettant aux particuliers de stocker les restes, les préparations de repas et les denrées périssables de manière pratique et organisée.

En outre, dans les segments B2B (Business-to-Business), les conteneurs de stockage des aliments jouent un rôle crucial dans le secteur de la restauration. Les restaurants, les cafés, les traiteurs et autres entreprises du secteur alimentaire dépendent fortement de ces conteneurs pour un stockage et un transport efficaces des aliments. La demande du marché B2B est en grande partie motivée par le besoin de conteneurs durables, étanches et empilables qui répondent aux normes de sécurité alimentaire.

Dynamique du marché des conteneurs de stockage des aliments en Europe, aux États-Unis et au Japon

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de produits alimentaires prêts à consommer

La commodité est devenue un facteur clé qui influence le comportement des consommateurs dans l'industrie alimentaire. Les gens se tournent de plus en plus vers des aliments prêts à consommer et faciles à préparer en raison de l'évolution des modes de vie, de l'urbanisation et des horaires de plus en plus chargés. Ces contenants jouent un rôle crucial dans la préservation de la fraîcheur et de la qualité des aliments prêts à consommer, contribuant ainsi à la croissance du marché des contenants de stockage des aliments dans ces régions.

Les aliments pratiques doivent être stockés correctement pour conserver leur goût, leur texture et leur valeur nutritionnelle. Les contenants de stockage des aliments aident à prévenir la détérioration, les brûlures de congélation et la contamination, garantissant ainsi que les aliments pratiques restent attrayants et sûrs à consommer. De nombreux aliments pratiques sont vendus en plus grandes quantités qu'une seule portion.

Les boîtes de conservation des aliments permettent aux consommateurs de diviser et de stocker ces aliments en portions gérables, réduisant ainsi le gaspillage et garantissant que les aliments restent frais jusqu'à leur consommation. Les boîtes de conservation des aliments modernes sont conçues pour passer au micro-ondes et au congélateur. Cette caractéristique améliore la commodité du réchauffage et de la conservation des aliments prêts à l'emploi, en s'alignant sur les préférences des consommateurs pour des solutions de repas rapides et sans tracas.

- Croissance du secteur du commerce électronique et de la vente au détail en ligne

Le secteur mondial du commerce électronique et de la vente au détail en ligne a connu une croissance remarquable au cours de la dernière décennie, transformant la façon dont les consommateurs achètent divers produits, y compris les contenants de stockage des aliments. Le commerce électronique a ouvert de nouvelles voies de croissance et d'expansion sur le marché des contenants de stockage des aliments en permettant aux fabricants et aux détaillants d'atteindre un public plus large, d'offrir une gamme diversifiée de produits et d'améliorer la commodité des clients. Le secteur du commerce électronique a révolutionné le paysage de la vente au détail en offrant aux consommateurs la commodité de faire leurs achats depuis leur domicile, leur bureau ou en déplacement. Les consommateurs peuvent facilement parcourir, comparer et acheter des produits, en quelques clics avec l'avènement des marchés en ligne et des plateformes numériques.

Le secteur florissant du commerce électronique et de la vente au détail en ligne a joué un rôle essentiel dans la croissance du marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon. Les fabricants et les détaillants ont élargi leur portée commerciale en exploitant la puissance des plateformes numériques, en diversifiant leur offre de produits et en améliorant l'expérience client. Sa relation symbiotique avec le marché des conteneurs de stockage alimentaire, à mesure que le commerce électronique continue d'évoluer, devrait favoriser davantage la croissance, l'innovation et l'expansion du marché.

Opportunité

- Innovation croissante dans les matériaux et les designs

Les contenants de stockage des aliments jouent un rôle crucial dans la préservation de la fraîcheur, de la saveur et de la qualité des aliments. Alors que la demande des consommateurs en matière de commodité, de durabilité et de sécurité alimentaire continue d'augmenter, le marché des contenants de stockage des aliments subit une transformation importante.

De plus, des matériaux de pointe dotés de propriétés antimicrobiennes inhibent la croissance bactérienne, prolongeant ainsi la durée de conservation des aliments stockés. La nanotechnologie est utilisée pour créer des contenants aux surfaces autonettoyantes, réduisant ainsi le besoin de lavage fréquent.

L'intégration de matériaux et de designs innovants dans les contenants de stockage des aliments devrait stimuler une croissance significative du marché aux États-Unis, au Japon et en Europe. La volonté des consommateurs d'investir dans des contenants de haute qualité et technologiquement avancés contribuera à cette croissance. Les fabricants qui investissent dans la recherche et le développement de nouveaux matériaux et designs bénéficieront d'un avantage concurrentiel en répondant aux préférences changeantes des consommateurs et aux préoccupations en matière de durabilité.

Retenue/Défi

- Coût élevé associé à certains produits

Les contenants de stockage des aliments jouent un rôle crucial dans la préservation de la fraîcheur, de la qualité et de la sécurité des produits alimentaires, réduisant ainsi le gaspillage alimentaire et favorisant la durabilité. Ces dernières années, le marché des contenants de stockage des aliments a connu une augmentation des produits innovants et avancés qui offrent des fonctionnalités, une durabilité et un attrait esthétique améliorés.

Par exemple,

- En avril 2022, selon une publication de Research Gate, diverses solutions de stockage alimentaire intelligentes basées sur l'IoT ont été développées par des chercheurs pour maintenir la qualité des aliments. Ce type de stockage alimentaire intelligent peut entraîner des coûts plus élevés que les conteneurs de stockage conventionnels.

Le coût élevé des nouveaux contenants de stockage alimentaire élégants constitue un obstacle majeur à l'expansion des marchés européens, japonais et américains des contenants de stockage alimentaire. Les préoccupations concernant l'accessibilité, la fragmentation du marché, la concurrence des alternatives traditionnelles et l'évolution des priorités des consommateurs sont autant de facteurs qui vont à l'encontre de l'acceptation générale de ces articles haut de gamme.

Développement récent

- En septembre 2022, LocknLock Co. a annoncé le lancement de la nouvelle boîte pour aliments pour bébés. Parmi les parents de nourrissons et de jeunes enfants, la série de boîtes pour aliments pour bébés a été un succès de vente. Ce type de lancement de produits a aidé l'entreprise à gagner un plus large éventail de consommateurs et une grande valeur de marque.

Portée du marché des conteneurs de stockage des aliments en Europe, aux États-Unis et au Japon

Le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est segmenté en dix segments notables basés sur le produit, le type, le type de matériau, l'objectif, la forme, la capacité, la technologie, l'apparence, la fonction et l'application. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Boîtes et bacs

- Pots et boîtes

- Tasses et pots

- Canettes

- Bouteilles

Sur la base du produit, le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est segmenté en boîtes et bacs, bocaux et bidons, tasses et bacs, canettes et bouteilles.

Taper

- Stockage à sec

- Articles de rangement pour réfrigérateur

- Ustensiles de cuisine

- Plats allant au four

- Ustensiles pour micro-ondes

- Ustensiles de service

- Congélateur

- Ustensiles de cuisson

Sur la base du type, le marché est segmenté en ustensiles de stockage à sec, ustensiles de stockage au réfrigérateur, ustensiles de cuisine, ustensiles de four, ustensiles à micro-ondes, ustensiles de service, ustensiles de congélation et ustensiles de cuisson.

Type de matériau

- Plastique

- Métal

- Papier

- Verre

- Acrylique

- Céramique

- Silicone

- Autres

Sur la base du type de matériau, le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est segmenté en plastique, métal, papier, verre, acrylique, céramique, silicone et autres.

But

- Récipient hermétique

- Compatible avec les micro-ondes

- Autres

Sur la base de l'objectif, le marché des conteneurs de stockage des aliments en Europe, aux États-Unis et au Japon est segmenté en conteneurs hermétiques, compatibles avec les micro-ondes et autres.

Forme

- Rond

- Carré

- Rectangle

- Ovale

- autres

Sur la base de la forme, le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est segmenté en rond, carré, rectangulaire, ovale et autres.

Capacité

- 501-1000 ML

- 1000-1500 ML

- 1500-2000 ML

- Plus de 2000 ML

- 101-500 ML

- Moins de 100 ML

Sur la base de la capacité, le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est segmenté en 501-1000 ml, 1000-1500 ml, 1500-2000 ml, plus de 2000 ml, 101-500 ml et moins de 100 ml.

Technologie

- Extrusion

- Moulage par injection

- Thermoformage

- Moulage par étirage-soufflage

- Autres

Sur la base de la technologie, le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est segmenté en extrusion, moulage par injection, thermoformage, moulage par étirage-soufflage et autres.

Apparence

- Transparent

- Coloré

Sur la base de l'apparence, le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est segmenté en transparent et coloré.

Fonction

- Stockage

- Convoyage et transport

- Cueillette et manutention

Sur la base de la fonction, le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est segmenté en stockage, transport et préparation de commandes et manutention.

Application

- B2B

- B2C

Sur la base des applications, le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est segmenté en B2C et B2B.

Analyse/perspectives régionales du marché des conteneurs de stockage des aliments en Europe, aux États-Unis et au Japon

Le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon est analysé, et des informations et tendances sur la taille du marché sont fournies en fonction du produit, du type, du type de matériau, de l'objectif, de la forme, de la capacité, de la technologie, de l'apparence, de la fonction et de l'application, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des conteneurs de stockage des aliments en Europe, aux États-Unis et au Japon sont les États-Unis, le Japon, l'Allemagne, la France, le Royaume-Uni, l'Italie, les Pays-Bas, la Turquie, l'Espagne, la Belgique, la Russie, la Pologne, la Suisse, la Suède, le Danemark et le reste de l'Europe.

L'Europe devrait dominer le marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon en termes de part de marché et de chiffre d'affaires. Elle devrait maintenir sa domination au cours de la période de prévision en raison de la forte demande croissante de raisins secs dans diverses industries et de la demande croissante des consommateurs de la part des utilisateurs finaux.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des conteneurs de stockage des aliments en Europe, aux États-Unis et au Japon

Le paysage concurrentiel du marché des conteneurs de stockage alimentaire en Europe, aux États-Unis et au Japon fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise sur le marché.

Certains des principaux acteurs opérant sur le marché des conteneurs de stockage des aliments sont Silgan Holdings, Tupperware Brands Corp, Pactive Evergreen Inc., Newell Brands, The Clorox Company, Graham Packaging Company, Anchor Glass Container Corporation, EMSA GmbH, OXO, Locknlock Co, Lindar Corp, Molded Fiber Glass Tray Company, Lenox Corporation, Thermos LLC, CL Smith, Inno-Pak, Glasslock USA, Freshware et Vremi, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 EUROPE FOOD STORAGE CONTAINER MARKET : PRODUCT LIFELINE CURVE

2.1 U.S. FOOD STORAGE CONTAINER MARKET : PRODUCT LIFELINE CURVE

2.11 JAPAN FOOD STORAGE CONTAINER MARKET : PRODUCT LIFELINE CURVE

2.12 MARKET END USER COVERAGE GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR CONVENIENCE FOOD ITEMS

5.1.2 GROWING E-COMMERCE AND ONLINE RETAIL SECTOR

5.1.3 RISING DEMAND FOR SUSTAINABLE AND BIODEGRADABLE STORAGE CONTAINERS

5.2 RESTRAINT

5.2.1 HIGH COST ASSOCIATED WITH CERTAIN PRODUCTS

5.3 OPPORTUNITIES

5.3.1 GROWING INNOVATION IN MATERIALS AND DESIGNS

5.3.2 RISING FOOD-DELIVERY AND TAKE-OUT SERVICE

5.4 CHALLENGES

5.4.1 ENVIRONMENT AND RECYCLING ISSUES WITH PLASTIC CONTAINERS

5.4.2 HIGH COMPETITION FROM SUBSTITUTE PRODUCTS

6 EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET : BY REGION

7 COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: EUROPE, U.S., AND JAPAN

7.2 COMPANY SHARE ANALYSIS: U.S.

7.3 COMPANY SHARE ANALYSIS: EUROPE

7.4 COMPANY SHARE ANALYSIS: JAPAN

8 COMPANY PROFILE

8.1 SILGAN HOLDINGS INC.

8.1.1 COMPANY SNAPSHOT

8.1.2 REVENUE ANALYSIS

8.1.3 SWOT ANALYSIS

8.1.4 PRODUCT PORTFOLIO

8.1.5 RECENT DEVELOPMENTS

8.2 TUPPERWARE BRANDS CORP.

8.2.1 COMPANY SNAPSHOT

8.2.2 REVENUE ANALYSIS

8.2.3 SWOT ANALYSIS

8.2.4 PRODUCT PORTFOLIO

8.2.5 RECENT DEVELOPMENT

8.3 PACTIV EVERGREEN INC.

8.3.1 COMPANY SNAPSHOT

8.3.2 REVENUE ANALYSIS

8.3.3 SWOT ANALYSIS

8.3.4 PRODUCT PORTFOLIO

8.3.5 RECENT DEVELOPMENTS

8.4 NEWELL BRANDS

8.4.1 COMPANY SNAPSHOT

8.4.2 REVENUE ANALYSIS

8.4.3 SWOT ANALYSIS

8.4.4 PRODUCT PORTFOLIO

8.4.5 RECENT DEVELOPMENT

8.5 THE CLOROX COMPANY

8.5.1 COMPANY SNAPSHOT

8.5.2 REVENUE ANALYSIS

8.5.3 SWOT ANALYSIS

8.5.4 PRODUCT PORTFOLIO

8.5.5 RECENT DEVELOPMENTS

8.6 ANCHOR GLASS CONTAINER CORPORATION

8.6.1 COMPANY SNAPSHOT

8.6.2 PRODUCT PORTFOLIO

8.6.3 RECENT DEVELOPMENTS

8.7 CL SMITH

8.7.1 COMPANY SNAPSHOT

8.7.2 PRODUCT PORTFOLIO

8.7.3 RECENT DEVELOPMENT

8.8 EMSA GMBH

8.8.1 COMPANY SNAPSHOT

8.8.2 PRODUCT PORTFOLIO

8.8.3 RECENT DEVELOPMENT

8.9 FRESHWARE

8.9.1 COMPANY SNAPSHOT

8.9.2 PRODUCT PORTFOLIO

8.9.3 RECENT DEVELOPMENT

8.1 GLASSLOCK USA

8.10.1 COMPANY SNAPSHOT

8.10.2 PRODUCT PORTFOLIO

8.10.3 RECENT DEVELOPMENT

8.11 GRAHAM PACKAGING COMPANY

8.11.1 COMPANY SNAPSHOT

8.11.2 PRODUCT PORTFOLIO

8.11.3 RECENT DEVELOPMENTS

8.12 INNO-PAK

8.12.1 COMPANY SNAPSHOT

8.12.2 PRODUCT PORTFOLIO

8.12.3 RECENT DEVELOPMENT

8.13 LENOX CORPORATION

8.13.1 COMPANY SNAPSHOT

8.13.2 PRODUCT PORTFOLIO

8.13.3 RECENT DEVELOPMENTS

8.14 LINDAR CORP.

8.14.1 COMPANY SNAPSHOT

8.14.2 PRODUCT PORTFOLIO

8.14.3 RECENT DEVELOPMENT

8.15 LOCKNLOCK CO

8.15.1 COMPANY SNAPSHOT

8.15.2 REVENUE ANALYSIS

8.15.3 PRODUCT PORTFOLIO

8.15.4 RECENT DEVELOPMENTS

8.16 MOLDED FIBER GLASS TRAY COMPANY

8.16.1 COMPANY SNAPSHOT

8.16.2 PRODUCT PORTFOLIO

8.16.3 RECENT DEVELOPMENT

8.17 OXO

8.17.1 COMPANY SNAPSHOT

8.17.2 PRODUCT PORTFOLIO

8.17.3 RECENT DEVELOPMENT

8.18 THERMOS L.L.C.

8.18.1 COMPANY SNAPSHOT

8.18.2 PRODUCT PORTFOLIO

8.18.3 RECENT DEVELOPMENT

8.19 VREMI

8.19.1 COMPANY SNAPSHOT

8.19.2 PRODUCT PORTFOLIO

8.19.3 RECENT DEVELOPMENTS

9 QUESTIONNAIRE

10 RELATED REPORTS

Liste des figures

FIGURE 1 EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET : SEGMENTATION

FIGURE 2 EUROPE FOOD STORAGE CONTAINER MARKET : DATA TRIANGULATION

FIGURE 3 U.S. FOOD STORAGE CONTAINER MARKET : DATA TRIANGULATION

FIGURE 4 JAPAN FOOD STORAGE CONTAINER MARKET : DATA TRIANGULATION

FIGURE 5 EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET : DROC ANALYSIS

FIGURE 6 EUROPE FOOD STORAGE CONTAINER MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 7 U.S. FOOD STORAGE CONTAINER MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 8 JAPAN FOOD STORAGE CONTAINER MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 9 EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 10 EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 11 EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET : DBMR MARKET POSITION GRID

FIGURE 12 EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET : MARKET APPLICATION COVERAGE GRID

FIGURE 13 EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FOR CONVENIENCE FOOD ITEMS IS DRIVING THE GROWTH OF EUROPE FOOD STORAGE CONTAINER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 GROWING E-COMMERCE AND ONLINE RETAIL SECTOR IS DRIVING THE GROWTH OF THE U.S. FOOD STORAGE CONTAINER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 RISING DEMAND FOR CONVENIENCE FOOD ITEMS IS DRIVING THE GROWTH OF JAPAN FOOD STORAGE CONTAINER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 17 BOXES AND BINS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE FOOD STORAGE CONTAINER MARKET IN 2023 & 2030

FIGURE 18 BOXES AND BINS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. FOOD STORAGE CONTAINER MARKET IN 2023 & 2030

FIGURE 19 BOXES AND BINS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE JAPAN FOOD STORAGE CONTAINER MARKET IN 2023 & 2030

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET

FIGURE 21 EUROPE FOOD STORAGE CONTAINER MARKET : SNAPSHOT (2022)

FIGURE 22 EUROPE, U.S. AND JAPAN FOOD STORAGE CONTAINER MARKET: COMPANY SHARE 2022 (%)

FIGURE 23 U.S. FOOD STORAGE CONTAINER MARKET: COMPANY SHARE 2022 (%)

FIGURE 24 EUROPE FOOD STORAGE CONTAINER MARKET: COMPANY SHARE 2022 (%)

FIGURE 25 JAPAN FOOD STORAGE CONTAINER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.