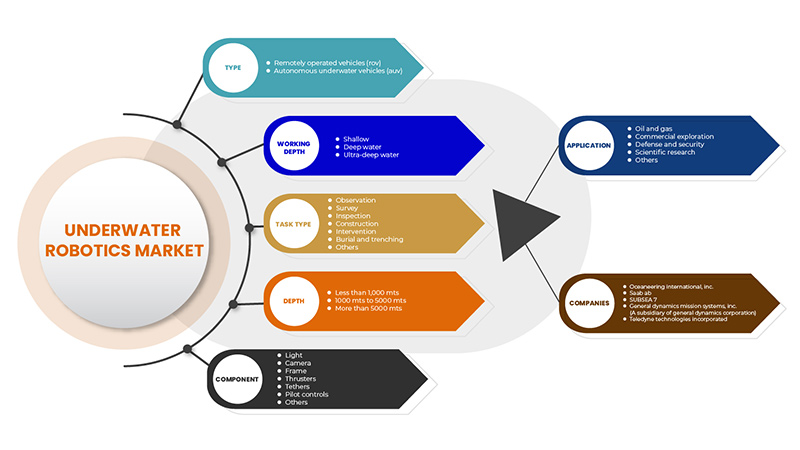

Marché européen de la robotique sous-marine, par type (véhicules télécommandés (ROV) et véhicule sous-marin autonome (AUV)), profondeur de travail (eau peu profonde, eau profonde et eau ultra-profonde), type de tâche (observation, relevé , inspection, construction , intervention, enfouissement et creusement de tranchées et autres), profondeur (moins de 1 000 m, de 1 000 à 5 000 m et plus de 5 000 m), composant (lumière, caméra , cadre, propulseurs, attaches, commandes de pilotage et autres), application ( pétrole et gaz, exploration commerciale, défense et sécurité , recherche scientifique et autres) – Tendances et prévisions de l’industrie jusqu’en 2029.

Analyse et taille du marché

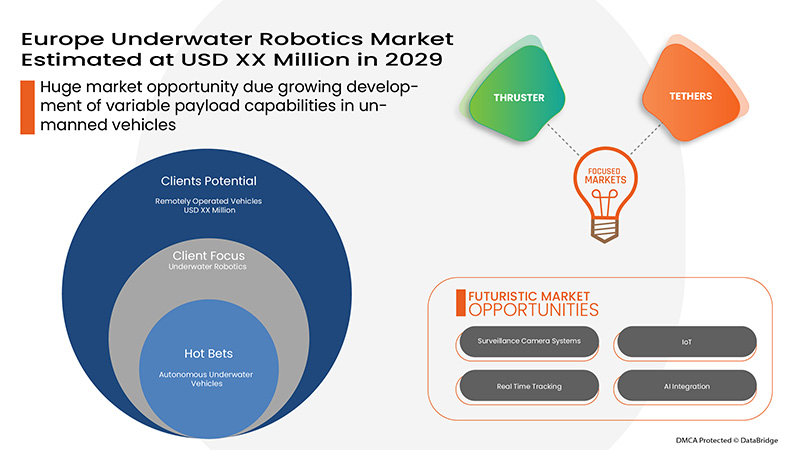

Le marché européen de la robotique sous-marine est principalement stimulé par la demande croissante de ROV dans les industries pétrolières et gazières offshore et par son besoin essentiel d'exploration marine et de recherche scientifique. En outre, les applications de la robotique sous-marine pour les opérations de sauvetage et de réparation stimulent la croissance du marché à un rythme rapide. Cependant, le coût élevé des ROV et des AUV après ajouts et les menaces liées à la cybersécurité peuvent freiner la croissance du marché européen de la robotique sous-marine. En outre, la barrière technique à la navigation et à la communication des AUV et des ROV dans les forts courants d'eau et sous les calottes glaciaires peut remettre en cause la croissance du marché. En outre, la lenteur des progrès dans la technologie des capteurs et la grande complexité technique de la robotique sous-marine peuvent entraver la croissance du marché. Cependant, le développement croissant des capacités de charge utile variable dans les véhicules sous-marins et l'intégration de technologies avancées pour augmenter l'efficacité et le fonctionnement de la robotique sous-marine offrent des opportunités lucratives au marché européen de la robotique sous-marine.

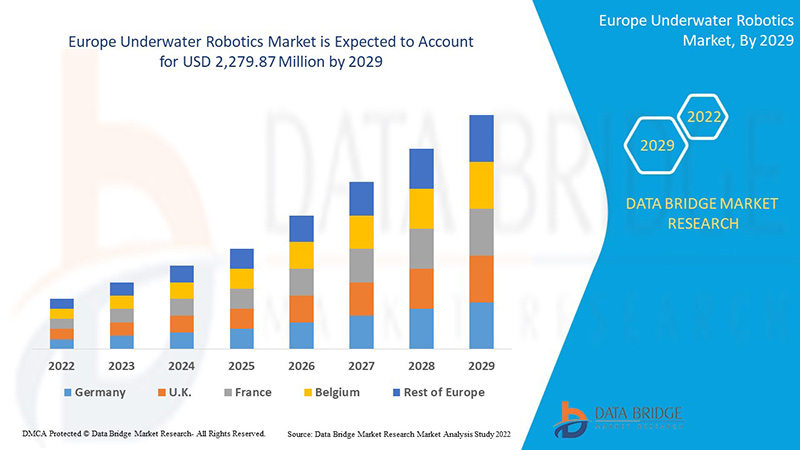

Selon les analyses de Data Bridge Market Research, le marché européen de la robotique sous-marine devrait atteindre 2 279,87 millions USD d'ici 2029, à un TCAC de XX % au cours de la période de prévision. Les « véhicules télécommandés (ROV) » représentent le segment de type le plus important sur le marché concerné. Le rapport de marché élaboré par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (véhicules télécommandés (ROV) et véhicule sous-marin autonome (AUV)), profondeur de travail (eau peu profonde, eau profonde et eau ultra-profonde), type de tâche (observation, relevé, inspection, construction, intervention, enfouissement et creusement de tranchées et autres), profondeur (moins de 1 000 m, de 1 000 m à 5 000 m et plus de 5 000 m), composant (lumière, caméra, châssis, propulseurs, attaches, commandes de pilotage et autres), application (pétrole et gaz, exploration commerciale, défense et sécurité, recherche scientifique et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Suède, Belgique, Russie, Italie, Espagne, Turquie et le reste de l'Europe. |

|

Acteurs du marché couverts |

Français ATLAS ELEKTRONIK GmbH, General Dynamics Mission Systems, Inc., ECA GROUP, Eddyfi, Boeing, Soil Machine Dynamics Ltd., MacArtney A/S, Oceaneering International, Inc., Saab AB, Forum Energy Technologies, Inc., TechnipFMC plc, SUBSEA 7, Fugro, Rovco Ltd, Total Marine Technology Pty Ltd, Teledyne Marine, KONGSBERG, Mitsui E&S Holdings Co., Ltd. |

Définition du marché

La robotique sous-marine est une branche de la robotique qui couvre la recherche et le développement, la conception, la fabrication et l'application de robots fonctionnant dans des environnements sous-marins. Le terme peut désigner tout robot fonctionnant au niveau de l'eau ou en dessous (systèmes robotiques marins). Cependant, il désigne généralement spécifiquement les véhicules autonomes conçus pour être utilisés sous l'eau. Un robot sous-marin, également appelé véhicule sous-marin autonome, est une machine qui peut être commandée à distance. Il est conçu pour travailler sous l'eau pour une surveillance océanique continue. La robotique a été utilisée dans la fabrication au cours des dernières années. Cette merveilleuse expansion les a rendus plus cultivés et plus fiables pour les applications militaires et de mise en œuvre du droit. Les robots sous-marins jouent un rôle important dans l'expansion de l'industrie offshore. En outre, il a de nombreuses implémentations dans la biologie marine, l'archéologie sous-marine et la sécurité maritime.

La dynamique du marché de la robotique sous-marine en Europe comprend :

- Utilisation croissante de la robotique sous-marine à des fins militaires et de sécurité

En Europe, l'utilisation et les applications des véhicules sous-marins augmentent en raison de leur engagement dans les forces militaires, navales et policières pour des opérations telles que la lutte contre le terrorisme, la collecte de renseignements, les enquêtes et la recherche. Ce secteur devrait croître à l'avenir et constitue un moteur pour le marché européen de la robotique sous-marine.

- Utilisation croissante des ROV dans les industries pétrolières et gazières

La présence de diverses industries pétrolières et gazières offshore et les conditions climatiques difficiles en Europe ont rendu la présence d'un véhicule sous-marin dans cette industrie essentielle. L'exploration du nouveau site offshore et l'augmentation des fonctionnalités de la robotique sous-marine devraient stimuler le marché européen de la robotique sous-marine.

- Demande croissante d'AUV pour l'exploration sous-marine et la recherche scientifique

L'utilisation des AUV, notamment pour l'exploration sous-marine et la recherche scientifique, est en augmentation en Europe. Cela est dû à la facilité d'utilisation et aux fonctionnalités croissantes des AUV au fil des ans, qui ont permis aux chercheurs de découvrir de nouvelles choses.

- Demande croissante de robotique sous-marine pour les opérations de recherche, de sauvetage et de réparation

Le développement constant de véhicules sous-marins en fonction des besoins nécessaires aux opérations telles que la recherche et le sauvetage et la réparation sous-marine dans des endroits éloignés et dans des conditions hostiles stimule la demande de ROV, ce qui devrait agir comme un moteur pour le marché européen de la robotique sous-marine.

Contraintes/défis rencontrés par le marché européen de la robotique sous-marine

- Coût élevé des robots/véhicules sous-marins

L'utilisation et le besoin de véhicules sous-marins augmentent rapidement dans divers secteurs tels que le pétrole et le gaz et d'autres applications telles que la recherche et le sauvetage, l'armée, la surveillance et la recherche scientifique, entre autres. Mais le coût élevé des robots sous-marins a empêché de nombreuses entreprises de s'en servir dans le cadre de missions et d'opérations.

- Menaces et préoccupations en matière de cybersécurité et de sécurité opérationnelle

Le système de communication utilisé pour faire fonctionner ces AUV et collecter des données au centre d'opérations peut être piraté. Cela représente un risque de sécurité et une préoccupation pour les opérateurs d'AUV et implique des secteurs tels que l'armée, la biologie marine, le pétrole et le gaz et les secteurs de l'énergie offshore. Ces menaces et préoccupations en matière de cybersécurité et de sécurité opérationnelle des véhicules sous-marins peuvent freiner la croissance du marché européen de la robotique sous-marine.

Développements récents

- En mars 2022, Saab AB a annoncé la découverte des épaves perdues du célèbre navire de l'explorateur polaire Sir Ernest Shackleton après 107 ans. L'entreprise a utilisé son véhicule sous-marin pour la mission de recherche à 3 000 mètres de profondeur, et le robot a fait face à un environnement froid et rigoureux, mais une navigation appropriée a conduit à la découverte de l'épave. L'entreprise a ainsi démontré son potentiel technique et son potentiel de véhicule sous-marin sur le marché de la robotique sous-marine.

- En mars 2022, SUBSEA 7 a remporté un contrat auprès d'Equinor pour l'étude d'ingénierie et de conception préliminaire (FEED) des installations marines associées au projet de développement de Krafla, au large de la Norvège. Cela permettra à l'entreprise d'utiliser son portefeuille de produits dans le projet et de le promouvoir sur le marché européen pour le prochain contrat. L'entreprise espère générer davantage de revenus grâce à ce contrat.

Portée du marché européen de la robotique sous-marine

Le marché européen de la robotique sous-marine est segmenté en fonction du type, de la profondeur de travail, du type de tâche, de la profondeur, du composant et de l'application, comme indiqué ci-dessus. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Véhicules télécommandés (ROV)

- Véhicule sous-marin autonome (AUV)

Sur la base du type, le marché européen de la robotique sous-marine est segmenté en véhicules télécommandés (ROV) et véhicules sous-marins autonomes (AUV).

Profondeur de travail

- Peu profond

- Eau profonde

- Eaux ultra profondes

Sur la base de la profondeur de travail, le marché européen de la robotique sous-marine est segmenté en eaux peu profondes, profondes et ultra-profondes.

Type de tâche

- Observation

- Enquête

- Inspection

- Construction

- Intervention

- Enfouissement et creusement de tranchées

- Autres

Sur la base du type de tâche, le marché européen de la robotique sous-marine est segmenté en observation, étude, inspection, construction, intervention, enfouissement et creusement de tranchées, et autres.

Profondeur

- Moins de 1000 Mts

- 1000 à 5000 mètres

- Plus de 5000 Mts

Sur la base de la profondeur, le marché européen de la robotique sous-marine est segmenté en moins de 1 000 mètres, de 1 000 à 5 000 mètres et plus de 5 000 mètres.

Composant

- Lumière

- Caméra

- Cadre

- Propulseurs

- Attaches

- Commandes du pilote

- Autres

Sur la base des composants, le marché européen de la robotique sous-marine est segmenté en lumière, caméra, cadre, propulseurs, attaches, commandes pilotes et autres.

Application

- Pétrole et gaz

- Exploration commerciale

- Défense et sécurité

- Recherche scientifique

- Autres

Sur la base des applications, le marché européen de la robotique sous-marine est segmenté en pétrole et gaz, exploration commerciale, défense et sécurité, recherche scientifique et autres.

Analyse/perspectives régionales du marché européen de la robotique sous-marine

Le marché européen de la robotique sous-marine est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, flexibilité, canal et application, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché européen de la robotique sous-marine sont l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Suède, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie et le reste de l'Europe.

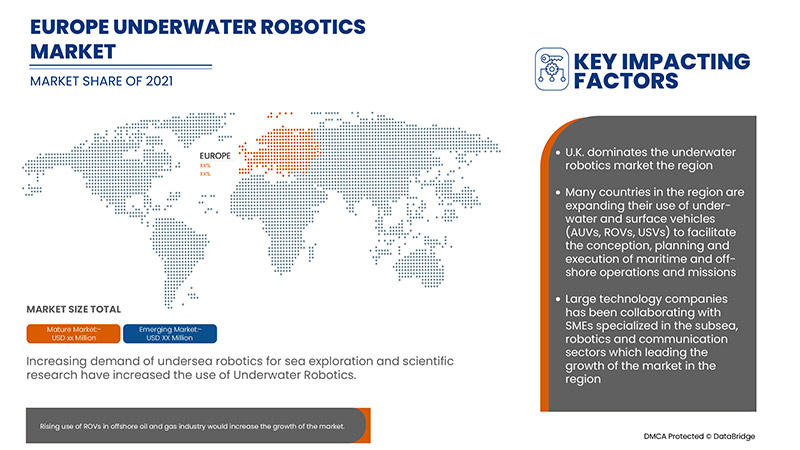

Le Royaume-Uni domine le marché européen de la robotique sous-marine, la région ayant connu une forte présence de fabricants de premier plan. En outre, la région a connu des investissements importants dans les équipements de recherche et de sauvetage, les équipements militaires, les loisirs et la découverte, l'aquaculture, la biologie marine, le pétrole, le gaz, l'énergie offshore, le transport maritime, les infrastructures immergées, etc.

Le Royaume-Uni devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029 en raison des investissements croissants dans les équipements de robotique offshore.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la robotique sous-marine en Europe

Le paysage concurrentiel du marché de la robotique sous-marine fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché européen de la robotique sous-marine.

Certains des principaux acteurs opérant sur le marché européen de la robotique sous-marine sont ATLAS ELEKTRONIK GmbH, General Dynamics Mission Systems, Inc., ECA GROUP, Eddyfi, Boeing, Soil Machine Dynamics Ltd., MacArtney A/S, Oceaneering International, Inc., Saab AB, Forum Energy Technologies, Inc., TechnipFMC plc, SUBSEA 7, Fugro, Rovco Ltd, Total Marine Technology Pty Ltd, Teledyne Marine, KONGSBERG, Mitsui E&S Holdings Co., Ltd. entre autres.

Méthodologie de recherche : Marché européen de la robotique sous-marine

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, l'analyse des experts, l'analyse des importations/exportations, l'analyse des prix, l'analyse de la consommation de production, le scénario de la chaîne climatique, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché des fournisseurs et des régions et de l'Europe. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE UNDERWATER ROBOTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 GENERAL DYNAMICS AND MIT PARTNERED DURING THE U.S. NAVY'S BIENNIAL ICE EXERCISE (ICEX 2020) TO TEST THE BLUEFIN-21 UNMANNED UNDERWATER VEHICLE (UUV) UNDER THE ICE AT THE ARCTIC CIRCLE

4.3.2 OCEANEERING INTERNATIONAL, INC. DEVELOPED ISURUS ROV, WHICH REDUCES COST AND CARBON FOOTPRINT WHILE SHORTENING THE PROJECT SCHEDULE

4.3.3 RESULTS:

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 SOUTH AMERICA

5.5 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES

6.1.2 RISING USE OF ROVS IN THE OIL AND GAS INDUSTRY

6.1.3 INCREASING DEMAND FOR AUVS FOR UNDERWATER EXPLORATION AND SCIENTIFIC RESEARCH

6.1.4 GROWING DEMAND FOR UNDERWATER ROBOTICS FOR SEARCH, RESCUE, AND REPAIR OPERATIONS

6.2 RESTRAINTS

6.2.1 HIGH COST OF UNDERWATER ROBOTS/VEHICLES

6.2.2 THREATS AND CONCERNS FOR CYBER SECURITY AND OPERATIONAL SECURITY

6.3 OPPORTUNITIES

6.3.1 GROWING DEVELOPMENT OF VARIABLE PAYLOAD CAPABILITIES IN UNDERWATER VEHICLE

6.3.2 INCREASING DEVELOPMENTS IN UNDERWATER ROBOTICS SYSTEMS

6.3.3 INTEGRATION OF ADVANCED TECHNOLOGIES IN UNDERWATER VEHICLES

6.3.4 INCREASING WORKING DEPTH OF UNDERWATER ROBOTS

6.4 CHALLENGES

6.4.1 THE TECHNICAL BARRIER IN NAVIGATION AND COMMUNICATION OF AUV

6.4.2 SLOW TECHNICAL PROGRESS IN UNDERWATER ROBOT SENSING TECHNOLOGIES

6.4.3 HIGH TECHNICAL COMPLEXITY IN UNDERWATER ROBOTICS

7 EUROPE UNDERWATER ROBOTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 REMOTELY OPERATED VEHICLES (ROV)

7.2.1 BY CONFIGURATION

7.2.1.1 OPEN OR BOX FRAME ROVS

7.2.1.2 TORPEDO SHAPED TOVS

7.2.2 BY CLASS TYPE

7.2.2.1 CLASS III (WORK CLASS VEHICLES)

7.2.2.2 CLASS II (OBSERVATION WITH PAYLOAD OPTIONS)

7.2.2.3 CLASS IV (SEABED-WORKING VEHICLES)

7.2.2.4 CLASS I (PURE OBSERVATION)

7.2.2.5 CLASS V (PROTOTYPE OR DEVELOPMENT VEHICLES)

7.3 AUTONOMOUS UNDERWATER VEHICLES

7.3.1 BY SHAPE

7.3.1.1 TORPEDO

7.3.1.2 STREAMLINED RECTANGULAR STYLE

7.3.1.3 LAMINAR FLOW BODY

7.3.1.4 MULTI-HULL VEHICLE

8 EUROPE UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH

8.1 OVERVIEW

8.2 DEEP WATER

8.3 SHALLOW

8.4 ULTRA-DEEP WATER

9 EUROPE UNDERWATER ROBOTICS MARKET, BY TASK TYPE

9.1 OVERVIEW

9.2 INSPECTION

9.3 SURVEY

9.4 INTERVENTION

9.5 OBSERVATION

9.6 BURIAL AND TRENCHING

9.7 CONSTRUCTION

9.8 OTHERS

10 EUROPE UNDERWATER ROBOTICS MARKET, BY DEPTH

10.1 OVERVIEW

10.2 1,000 MTS TO 5,000 MTS

10.3 LESS THAN 1,000 MTS

10.4 MORE THAN 5,000 MTS

11 EUROPE UNDERWATER ROBOTICS MARKET, BY COMPONENT

11.1 OVERVIEW

11.2 THRUSTERS

11.3 TETHERS

11.4 CAMERA

11.4.1 HIGH-RESOLUTION DIGITAL STILL CAMERA

11.4.2 DUAL-EYE CAMERAS

11.5 LIGHTS

11.6 FRAME

11.7 PILOT CONTROLS

11.8 OTHERS

12 EUROPE UNDERWATER ROBOTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 OIL & GAS

12.3 DEFENCE & SECURITY

12.4 SCIENTIFIC RESEARCH

12.5 COMMERCIAL EXPLORATION

12.6 OTHERS

13 EUROPE UNDERWATER ROBOTICS MARKET, BY GEOGRAPHY

13.1 EUROPE

13.1.1 U.K.

13.1.2 FRANCE

13.1.3 GERMANY

13.1.4 SPAIN

13.1.5 ITALY

13.1.6 RUSSIA

13.1.7 TURKEY

13.1.8 SWEDEN

13.1.9 NETHERLANDS

13.1.10 BELGIUM

13.1.11 SWITZERLAND

13.1.12 REST OF EUROPE

14 EUROPE UNDERWATER ROBOTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 OCEANEERING INTERNATIONAL, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAAB AB

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GENERAL DYNAMICS MISSION SYSTEMS, INC. (A SUBSIDIARY OF GENERAL DYNAMICS CORPORATION)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCTS PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SUBSEA 7

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 TELEDYNE TECHNOLOGIES INCORPORATED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ATLAS ELEKTRONIK GMBH

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCTS PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BOEING

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCTS PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DEEP TREKKER INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCTS PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 ECA GROUP (A SUBSIDIARY OF GROUPE GORGÉ COMPANY)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCTS PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 EDDYFI

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCTS PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FORUM ENERGY TECHNOLOGY, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCTS PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 FUGRO

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE AND PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 HUNTINGTON INGALLS INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 KONGSBERG MARITIME

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 MACARTNEY AS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCTS PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MITSUI E&S HOLDINGS CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 ROVCO LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 SEAROBOTICS CORP.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SOIL MACHINE DYNAMICS LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCTS PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 TECHNIPFMC PLC

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCTS PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 TOTAL MARINE TECHNOLOGY PTY LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 PHOENIX INTERNATIONAL HOLDINGS, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCTS PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VIDEORAY LLC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCTS PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPARATIVE CHARACTERISTICS OF AUV

TABLE 2 EUROPE UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY REGION 2020-2029 (USD MILLION)

TABLE 4 EUROPE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 9 EUROPE DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE SHALLOW IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ULTRA-DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE INSPECTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE SURVEY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE INTERVENTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE OBSERVATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE BURIAL AND TRENCHING IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE CONSTRUCTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 21 EUROPE 1,000 MTS TO 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LESS THAN 1,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE MORE THAN 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 25 EUROPE THRUSTERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE TETHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE CAMERA IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE LIGHTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE FRAME IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE PILOT CONTROLS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE OIL & GAS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE DEFENSE & SECURITY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE SCIENTIFIC RESEARCH IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE COMMERCIAL EXPLORATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE UNDERWATER ROBOTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 EUROPE UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 45 EUROPE UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 47 EUROPE UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 48 EUROPE CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 U.K. UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.K. REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 U.K. REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 54 U.K. UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 55 U.K. UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.K. UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 57 U.K. UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 58 U.K. CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 FRANCE UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 62 FRANCE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 63 FRANCE AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 64 FRANCE UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 65 FRANCE UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 66 FRANCE UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 67 FRANCE UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 68 FRANCE CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 FRANCE UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 GERMANY UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 72 GERMANY REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 73 GERMANY AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 74 GERMANY UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 75 GERMANY UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 76 GERMANY UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 77 GERMANY UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 78 GERMANY CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 GERMANY UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 SPAIN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 SPAIN REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 82 SPAIN REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 83 SPAIN AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 84 SPAIN UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 85 SPAIN UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 86 SPAIN UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 87 SPAIN UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 88 SPAIN CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SPAIN UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 ITALY UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ITALY REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 92 ITALY REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 93 ITALY AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 94 ITALY UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 95 ITALY UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 96 ITALY UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 97 ITALY UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 98 ITALY CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 ITALY UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 RUSSIA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 RUSSIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 102 RUSSIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 103 RUSSIA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 104 RUSSIA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 105 RUSSIA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 106 RUSSIA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 107 RUSSIA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 108 RUSSIA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 RUSSIA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 TURKEY UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 112 TURKEY REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 113 TURKEY AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 114 TURKEY UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 115 TURKEY UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 116 TURKEY UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 117 TURKEY UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 118 TURKEY CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 TURKEY UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 SWEDEN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SWEDEN REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 122 SWEDEN REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 123 SWEDEN AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 124 SWEDEN UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 125 SWEDEN UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 126 SWEDEN UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 127 SWEDEN UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 128 SWEDEN CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SWEDEN UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 NETHERLANDS UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 NETHERLANDS REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 132 NETHERLANDS REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 133 NETHERLANDS AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 134 NETHERLANDS UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 135 NETHERLANDS UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 136 NETHERLANDS UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 137 NETHERLANDS UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 138 NETHERLANDS CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 NETHERLANDS UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 BELGIUM REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 142 BELGIUM REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 143 BELGIUM AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 144 BELGIUM UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 145 BELGIUM UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 146 BELGIUM UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 147 BELGIUM UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 148 BELGIUM CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 BELGIUM UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 SWITZERLAND UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 SWITZERLAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 152 SWITZERLAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 153 SWITZERLAND AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 154 SWITZERLAND UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 155 SWITZERLAND UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 157 SWITZERLAND UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SWITZERLAND UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 REST OF EUROPE UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 2 EUROPE UNDERWATER ROBOTICS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE UNDERWATER ROBOTICS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE UNDERWATER ROBOTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE UNDERWATER ROBOTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE UNDERWATER ROBOTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE UNDERWATER ROBOTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE UNDERWATER ROBOTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE UNDERWATER ROBOTICS MARKET: END-USER COVERAGE GRID

FIGURE 10 EUROPE UNDERWATER ROBOTICS MARKET: CHALLENGE MATRIX

FIGURE 11 EUROPE UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 12 THE INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES IS EXPECTED TO BE A KEY DRIVER FOR THE EUROPE UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 REMOTELY OPERATED VEHICLES (ROVS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD 2022 & 2029

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE EUROPE UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE UNDERWATER ROBOTICS MARKET

FIGURE 16 EUROPE UNDERWATER ROBOTICS MARKET: BY TYPE, 2021

FIGURE 17 EUROPE UNDERWATER ROBOTICS MARKET: BY WORKING DEPTH, 2021

FIGURE 18 EUROPE UNDERWATER ROBOTICS MARKET: BY TASK TYPE, 2021

FIGURE 19 EUROPE UNDERWATER ROBOTICS MARKET: BY DEPTH, 2021

FIGURE 20 EUROPE UNDERWATER ROBOTICS MARKET: BY COMPONENT, 2021

FIGURE 21 EUROPE UNDERWATER ROBOTICS MARKET: BY APPLICATION, 2021

FIGURE 22 EUROPE UNDERWATER ROBOTICS MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE UNDERWATER ROBOTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE UNDERWATER ROBOTICS MARKET: BY TYPE (2022-2029)

FIGURE 27 EUROPE UNDERWATER ROBOTICS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.