Europe Tahini Market

Taille du marché en milliards USD

TCAC :

%

USD

229.93 Million

USD

338.58 Million

2024

2032

USD

229.93 Million

USD

338.58 Million

2024

2032

| 2025 –2032 | |

| USD 229.93 Million | |

| USD 338.58 Million | |

|

|

|

Segmentation du marché du tahini en Europe, par type de produit (tahini en pâte/pur, tahini assaisonné et autres), source (sésame décortiqué et sésame décortiqué), nature (biologique et conventionnel/inorganique), catégorie (OGM et sans OGM), couleur (blanc et noir), type d'emballage (pots, bouteilles, fûts/seaux, boîtes de conserve, bacs, sachets et autres), allégation (sans produits laitiers, sans matières grasses, sans noix, sans soja, sans gluten, sans conservateur, sans OGM, végétalien, avec toutes les allégations ci-dessus et ordinaire (sans allégation)), utilisateur final (domestique/ménage, secteur de la restauration, industrie alimentaire et autres) - Tendances et prévisions de l'industrie jusqu'en 2032.

Analyse du marché du tahini en Europe

Les bienfaits pour la santé associés à la consommation de tahini et la popularité croissante des saveurs et des spécialités ethniques arabes devraient stimuler la demande sur le marché européen du tahini. Cependant, le prix élevé des produits utilisant du tahini comme ingrédient et les effets secondaires associés à la consommation de graines de sésame pourraient encore limiter la croissance du marché.

Taille du marché du tahini en Europe

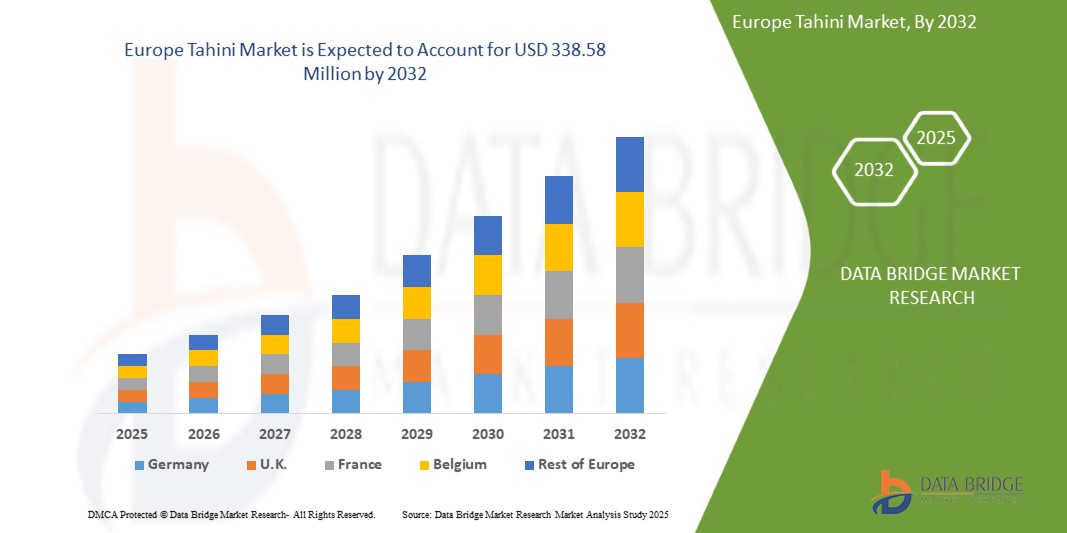

La taille du marché européen du tahini a été évaluée à 229,93 millions USD en 2024 et devrait atteindre 338,58 millions USD d'ici 2032, avec un TCAC de 3,95 % au cours de la période de prévision de 2025 à 2032.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché du tahini |

|

Segmentation |

|

|

Pays couverts |

Allemagne, Grèce, Royaume-Uni, Pays-Bas, Pologne, France, Italie, Turquie, Russie, Espagne, Belgique, Danemark, Suisse, Suède et reste de l'Europe |

|

Principaux acteurs du marché |

Français HAITOGLOU BROS SA, Prince Tahina Ltd., Sesame & Tahina Food Industries Ltd., Meridian Foods Limited, Grecious, Beyda Gida San. Tic. AS, Inci Food Industry, Dipasa Europe BV, Tahini Royal, Shamir, Al'Fez, Skoulikas Bedford Ltd, TAMPICO TRADING GmbH, meletiadis.gr., EDN, Carleys, Citir Susam, MED CUISINE, Al Wadi Al Akhdar et BIONA entre autres. |

Définition du marché du tahini en Europe

Le tahini, également appelé tahina, est une pâte de sésame moulue traditionnellement utilisée dans la cuisine du Moyen-Orient. Il est composé principalement de trois ingrédients : des graines de sésame décortiquées, de l'huile et parfois du sel . Les graines de sésame constituent la base du tahini ; elles peuvent être décortiquées ou non. Les graines de sésame décortiquées sont de couleur plus claire et ont un goût moins amer. Les graines de sésame non décortiquées peuvent également être transformées en pâte, mais elle est plus foncée et plus amère. Elle est fabriquée à partir de graines de sésame trempées dans de l'eau puis écrasées pour séparer le son des grains. C'est un ingrédient très polyvalent et peut être utilisé dans des applications salées et sucrées.

Le tahini est relativement faible en calories mais riche en fibres, en protéines et en diverses vitamines importantes telles que les vitamines E, B2, B1, B15, B3 et B5 et en minéraux tels que le fer, le zinc et les protéines. C'est surtout une bonne source de cuivre et il est également riche en sélénium. Le tahini a un effet positif sur la santé cardiaque en diminuant les facteurs de risque. Il contient du sésamol, un composé naturel qui peut protéger contre le cancer.

Dynamique du marché du tahini en Europe

Conducteurs

- Bienfaits pour la santé associés à la consommation de tahini

Le tahini est riche en nutriments et offre de nombreux bienfaits pour la santé. Il regorge de graisses saines, de vitamines et de minéraux. Il contient relativement peu de calories, mais il est riche en fibres, en protéines et en une variété d'autres vitamines et minéraux importants. Il contient une quantité de protéines plus élevée que les noix et le lait. En raison de la présence d'un profil nutritionnel impressionnant, le tahini est associé à une variété de bienfaits pour la santé. Les bienfaits pour la santé comprennent un meilleur bien-être cardiaque, une réduction de l'inflammation et des effets potentiels de lutte contre le cancer. C'est une riche source de vitamine B, qui stimule l'énergie et la fonction cérébrale. La vitamine E présente dans le tahini protège contre diverses maladies telles que les accidents vasculaires cérébraux et les maladies cardiaques. Il agit également comme une source de minéraux importants tels que le fer, le magnésium et le calcium. En outre, la prise de conscience croissante de la santé parmi les gens et l'augmentation de la demande de produits plus sains augmentent la demande de produits à base de tahini et devraient donc stimuler la demande du marché.

- Popularité croissante des saveurs et des délices ethniques arabes

L'Europe connaît une demande florissante de produits authentiques à base de sésame arabes et méditerranéens, comme le tahini. La popularité croissante de ces aliments est due au multiculturalisme croissant. L'influence de différentes cultures alimentaires suscite la curiosité des Européens pour différents produits étrangers. Les marques alimentaires et les restaurateurs adoptent ou copient ces produits avec de nouvelles saveurs et expériences culinaires. La généralisation de ces aliments ethniques et l'intérêt croissant pour la nourriture végétalienne contribuent à la croissance du marché. En outre, des facteurs tels que la mondialisation, l'évolution du niveau de vie, la santé et le bien-être et la durabilité sont les raisons de la croissance phénoménale des emballages souples au cours des dernières années. Cela, à son tour, augmente la demande de tahini et devrait stimuler la croissance du marché.

- Portée croissante de l'adoption des graines de sésame dans diverses cuisines

Les graines de sésame sont un ingrédient bien connu dans toute l'Europe et sont utilisées dans une grande variété d'aliments, comme garniture sur des produits de boulangerie tels que le pain, les bagels et les pains à hamburger. Elles peuvent être utilisées pour préparer des snacks, des crackers, des confiseries et des bonbons. Elles sont également utilisées dans diverses cuisines ethniques telles que le tahini, le houmous, les sushis et le halva, entre autres. Les consommateurs soucieux de leur santé utilisent les salades comme graines, vinaigrettes et sauces. Les graines de sésame ne sont pas seulement utilisées dans plusieurs produits de snacking, mais différentes marques biologiques les utilisent. Elles ont une teneur élevée en calcium et en protéines et ont le potentiel de remplacer à la fois la viande et les produits laitiers. Cela s'est reflété dans le développement de divers nouveaux produits alimentaires tels que les barres énergétiques au sésame et les boissons au sésame. En conclusion, la capacité des graines de sésame à être utilisées comme ingrédient dans de nombreuses applications alimentaires devrait stimuler la croissance du marché.

- Croissance dans le secteur de la restauration

Le tahini est largement utilisé comme produit alimentaire dans l'industrie de la restauration sous forme d'ingrédients pour diverses cuisines. L'industrie de la restauration comprend entre autres les restaurants, les hôtels, les cafés et les services de restauration. Les consommateurs voyagent à travers le monde et découvrent de nouveaux aliments et de nouvelles saveurs. Ils souhaitent également connaître la provenance et l'origine de ces plats. L'industrie de la restauration a connu des développements drastiques ces derniers temps. La demande croissante de services de restauration mobiles tels que les food trucks et les restaurants pénètre le marché. Le nombre de chaînes de restauration rapide et de points de vente de nourriture augmente également de manière constante en raison des horaires de travail difficiles et des modes de vie chargés, ce qui a créé une demande d'options pratiques et faciles en termes de cuisines et de services. Par conséquent, la croissance et le développement de l'industrie de la restauration devraient stimuler la croissance du marché.

Opportunités

- Innovation dans les produits alimentaires en termes d'ingrédients et de saveurs

Le tahini est devenu un ingrédient essentiel du houmous. Il est un ingrédient important dans une grande variété de plats du Moyen-Orient. Les produits trouvent des opportunités à mesure que les chefs et les consommateurs découvrent de nouvelles façons d'utiliser le condiment dans divers produits tels que les salades, les sandwichs et les filets de poisson, entre autres. Il est mélangé avec du cacao et de l'orange, amélioré par des probiotiques et servi avec du miel et des bâtonnets de sésame pour attirer une clientèle plus large. Divers facteurs tels que la pénétration d'Internet, l'augmentation du nombre d'utilisateurs de smartphones et l'influence des médias sociaux, entre autres, ont stimulé le secteur du commerce électronique. L'utilisation généralisée des plateformes de services d'épicerie et de livraison en ligne a récemment contribué à une croissance substantielle de l'achat et de la vente en ligne de produits alimentaires. En outre, les nouveaux modes de vie, les revenus disponibles plus élevés et la sensibilisation des consommateurs créent une demande pour des produits alimentaires diversifiés et innovants. Cela devrait offrir de nouvelles opportunités de croissance au marché.

- Demande croissante de produits biologiques et riches en nutriments

Les produits alimentaires biologiques sont devenus l'un des facteurs les plus importants influençant les décisions d'achat des consommateurs. Les consommateurs préfèrent les produits alimentaires sains et biologiques. La demande d'aliments d'origine biologique ne cesse de croître. Par conséquent, les producteurs et fournisseurs de tahini doivent proposer des produits biologiques. Les préoccupations croissantes concernant la présence de produits chimiques dans les aliments d'origine conventionnelle ont augmenté la demande de produits biologiques. De plus, la demande croissante de produits alimentaires biologiques et riches en nutriments en raison de leurs divers avantages pour la santé et la sensibilisation croissante des consommateurs aux autres effets positifs des aliments biologiques offriront de nouvelles opportunités de croissance au marché. En outre, la volonté croissante des consommateurs de payer plus cher pour ces produits, ainsi que le soutien des politiques gouvernementales, pourraient offrir de nouvelles opportunités de croissance au marché.

Contraintes/Défis

- Prix élevés des produits utilisant le tahini comme ingrédient

Le tahini est une pâte à base de graines de sésame moulues et contient une très grande quantité d'huile. C'est un ingrédient clé de divers plats tels que le houmous, le baba ghanoush et les sauces à tremper, entre autres. C'est un aliment très nutritif et calorique qui contient forcément de nombreuses vitamines et minéraux. La plupart des graines de sésame sont cultivées dans des environnements à forte intensité de main-d'œuvre, les coûts de culture sont donc élevés. Les graines de sésame sont importées en Europe depuis d'autres pays. La demande pour ces graines est basée sur différents types et qualités. Outre les coûts élevés des produits à base de tahini, l'environnement réglementaire est un facteur majeur qui peut limiter la croissance du marché. Par conséquent, le prix élevé des produits à base de tahini et les règles et réglementations strictes peuvent entraver la croissance du marché.

- Effets secondaires associés à la consommation de graines de sésame

Bien que le tahini présente plusieurs avantages nutritionnels, il faut également tenir compte de certains effets secondaires. Le sésame étant une source riche en huile, les graines ont une consistance huileuse et lisse lorsqu'elles sont moulues en pâte. Les graines de sésame doivent toujours être consommées avec modération. Une consommation excessive peut entraîner une irritation des intestins et du côlon. Dans certains cas, elles peuvent également déclencher des allergies. L'anaphylaxie est un effet secondaire lorsque le système immunitaire libère des niveaux élevés de certains produits chimiques. Ces produits chimiques induisent un choc anaphylactique qui abaisse la tension artérielle et obstrue le processus respiratoire. L'allergie au sésame peut provoquer des nausées, des vomissements, des douleurs abdominales, de l'urticaire, des démangeaisons de la bouche et de la toux. Les graines de sésame sont des allergènes alimentaires qui peuvent provoquer des problèmes de santé légers à graves. Par conséquent, la teneur élevée en acides gras polyinsaturés oméga-6, les risques d'allergie au sésame et d'indigestion peuvent entraver la croissance du marché.

- Falsification dans les produits à base de tahini

La falsification consiste à ajouter des substances nocives ou délétères au tahini pour en augmenter la quantité et le profit. Ces produits alimentaires à base de tahini falsifiés sont nocifs pour la santé des consommateurs. La falsification du tahini est courante dans l'industrie alimentaire. Dans certains cas, la pâte de sésame est fabriquée dans de petits ateliers, en particulier lorsque la capacité de gestion et le capital d'exploitation sont faibles. Afin de réduire les coûts de production, des matières premières de mauvaise qualité sont souvent utilisées et d'autres cultures oléagineuses telles que les arachides et le maïs sont ajoutées. Dans de nombreux cas, des additifs alimentaires sont également utilisés pour améliorer l'arôme de la pâte de sésame en raison de la mauvaise qualité du sésame utilisé. Ainsi, la falsification effectuée par les fabricants de produits à base de tahini pour augmenter leurs ventes en utilisant des ingrédients de mauvaise qualité, ce qui affecte la santé des consommateurs, devrait remettre en cause la croissance du marché.

- Une concurrence intense sur le marché

La rentabilité de l'industrie du tahini est favorable, c'est pourquoi de nouvelles entreprises veulent profiter des avantages de l'industrie. Les entreprises du secteur devraient croître encore davantage, créant une forte concurrence sur le marché. Elles mettent de plus en plus en œuvre de nouvelles technologies telles que l'intelligence artificielle (IA) pour gérer efficacement l'approvisionnement, la production et la distribution des produits à base de tahini. En outre, elles explorent les fusions et acquisitions pour acquérir de nouvelles technologies et s'étendre à de nouvelles zones géographiques. Les entreprises conçoivent les produits dans des emballages attrayants et en quantités variables et présentent leurs produits sur diverses plateformes en ligne et canaux de vente au détail tels que les supermarchés, les hypermarchés et les magasins de proximité. Ainsi, la présence de nombreux acteurs devrait défier les nouveaux entrants et intensifier la concurrence sur le marché.

Portée du marché européen du tahini

Le marché européen du tahini est segmenté en huit segments notables en fonction du type de produit, de la source, de la nature, de la catégorie, de la couleur, du type d'emballage, de la revendication et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Pâte/Tahini pur

- Tahini assaisonné

- Autres

Source

- Sésame décortiqué

- Sésame décortiqué

Nature

- Conventionnel/Inorganique

- Organique

Catégorie

- OGM

- Sans OGM

Couleur

- Blanc

- Noir

Type d'emballage

- Bouteilles

- Baignoires

- Sachets

- Pots

- Boîtes de conserve

- Tambour/Seau

- Autres

Réclamer

- Sans produits laitiers

- Sans gras

- Sans noix

- Sans soja

- Sans gluten

- Sans conservateur

- Sans OGM

- Végétalien

- Avec toutes les revendications ci-dessus

- Régulier (sans réclamation)

Utilisateur final

- Domestique/Ménager

- Secteur de la restauration

- Industrie alimentaire

- Autres

Analyse régionale du marché du tahini en Europe

Le marché européen du tahini est analysé et des informations sur la taille et les tendances du marché sont fournies par type de produit, source, nature, catégorie, couleur, type d'emballage, allégation et utilisateur final, comme référencé ci-dessus.

Le marché européen du tahini couvre des pays tels que l'Allemagne, la Grèce, le Royaume-Uni, les Pays-Bas, la Pologne, la France, l'Italie, la Turquie, la Russie, l'Espagne, la Belgique, le Danemark, la Suisse, la Suède et le reste de l'Europe.

L'Allemagne devrait dominer le marché en raison d'une forte augmentation de la demande, car les gens utilisent principalement les produits à base de tahini sous forme de vinaigrette ou sont soucieux de leur santé. De plus, les producteurs ont conclu de nombreux partenariats, participations, événements, collaborations et activités avec des entreprises locales ainsi qu'avec des acteurs internationaux pour sensibiliser davantage aux bienfaits des produits à base de tahini.

La section par pays de ce rapport de marché fournit également des facteurs d'impact sur les marchés individuels et les changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché du tahini

Le paysage concurrentiel du marché européen du tahini fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises sur le marché européen du tahini.

Les leaders du marché du tahini opérant sur le marché sont :

- HAITOGLOU BROS SA

- Prince Tahina Ltée.

- Industries alimentaires Sésame et Tahina Ltée.

- Aliments Méridien Limitée

- Génial

- Beyda Gida San. Tic. AS

- Industrie alimentaire Inci

- Dipasa Europe BV

- Tahini Royal

- Shamir

- Al'Fez

- Skoulikas Bedford Ltée

- TAMPICO TRADING GmbH

- meletiadis.gr.

- ÉDN

- Les Carley

- Citir Susam

- CUISINE MEDICALE

- Al Wadi Al Akhdar

- BIONA

Les derniers développements sur le marché du tahini

- En octobre 2021, Meridian Foods Limited a lancé The Deforesters Arms pour mettre en lumière la menace de la déforestation. L'événement a été organisé par son ambassadeur orang-outan, Pongo. Ils ont présenté leurs produits sans huile de palme et les avantages de l'utilisation de ces produits. Cela aidera l'entreprise à se connecter avec des consommateurs soucieux de l'environnement et à montrer ses initiatives en matière de développement durable.

- En août 2020, Tahini Royal a reçu un certificat d'audit de SALSA, un système de certification de sécurité alimentaire robuste et efficace adapté aux producteurs et fournisseurs de produits alimentaires. Il est accordé aux fournisseurs qui peuvent démontrer à un auditeur qu'ils peuvent produire et fournir des aliments sûrs et légaux et qu'ils s'engagent à respecter en permanence les exigences de la norme SALSA. Cette certification a démontré que l'entreprise respecte des normes satisfaisantes pour la fabrication du tahini.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.