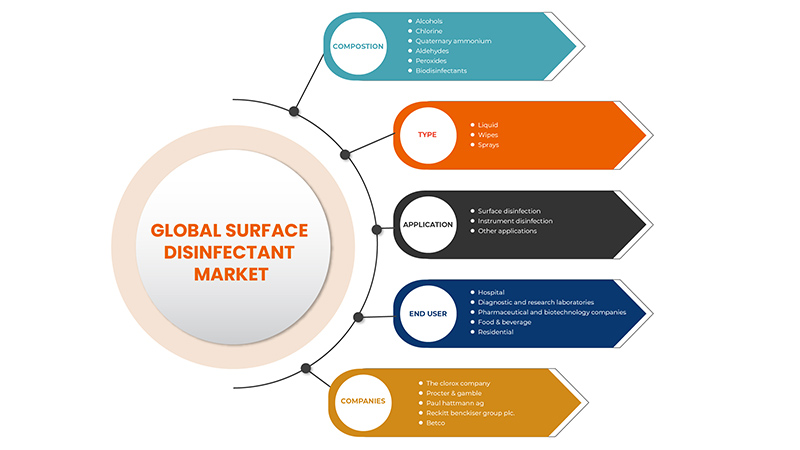

Europe Surface Disinfectants Market, By Composition (Alcohols, Chlorine, Quaternary Ammonium, Aldehydes, Peroxides, Biodisinfectants), Type (Liquid, Sprays, Wipes), Application (Surface Disinfection, Instrument Disinfection, And Other Applications), End User (Hospitals, Diagnostic and Research Laboratories, Pharmaceutical and Biotechnology Companies, Food & Beverage and Residential), Industry Trends and Forecast to 2029

Market Analysis and Insights

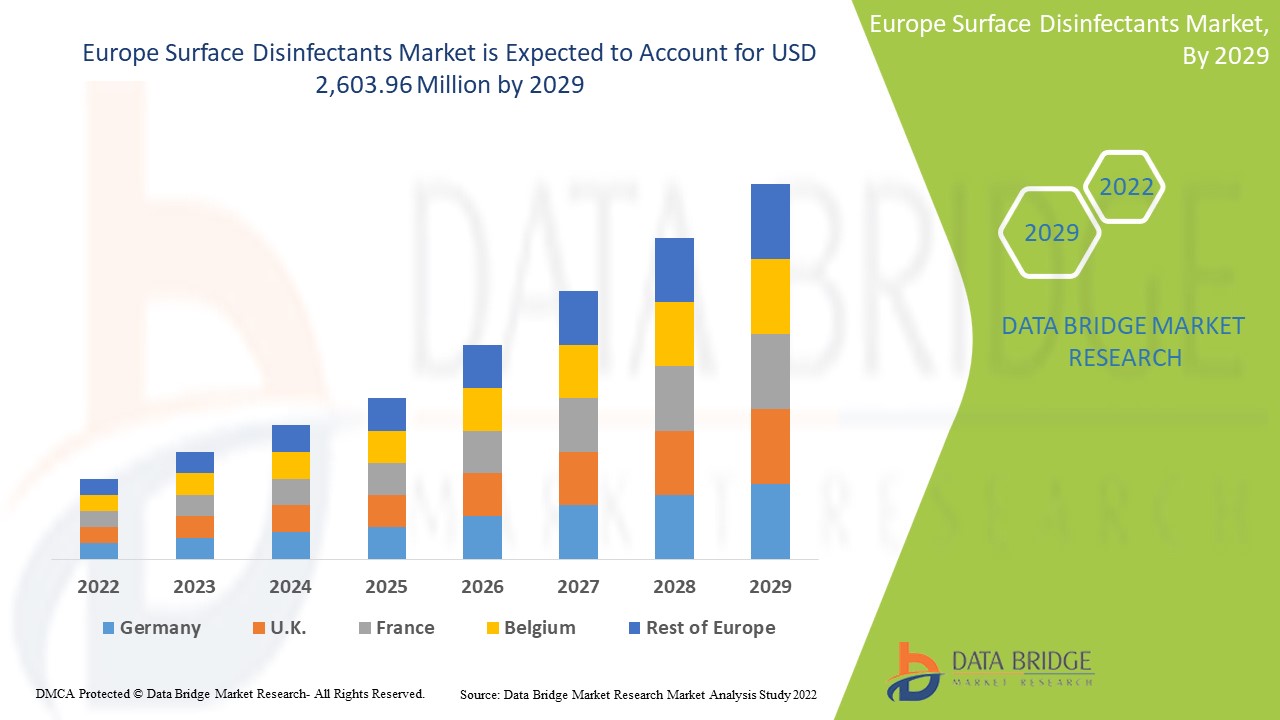

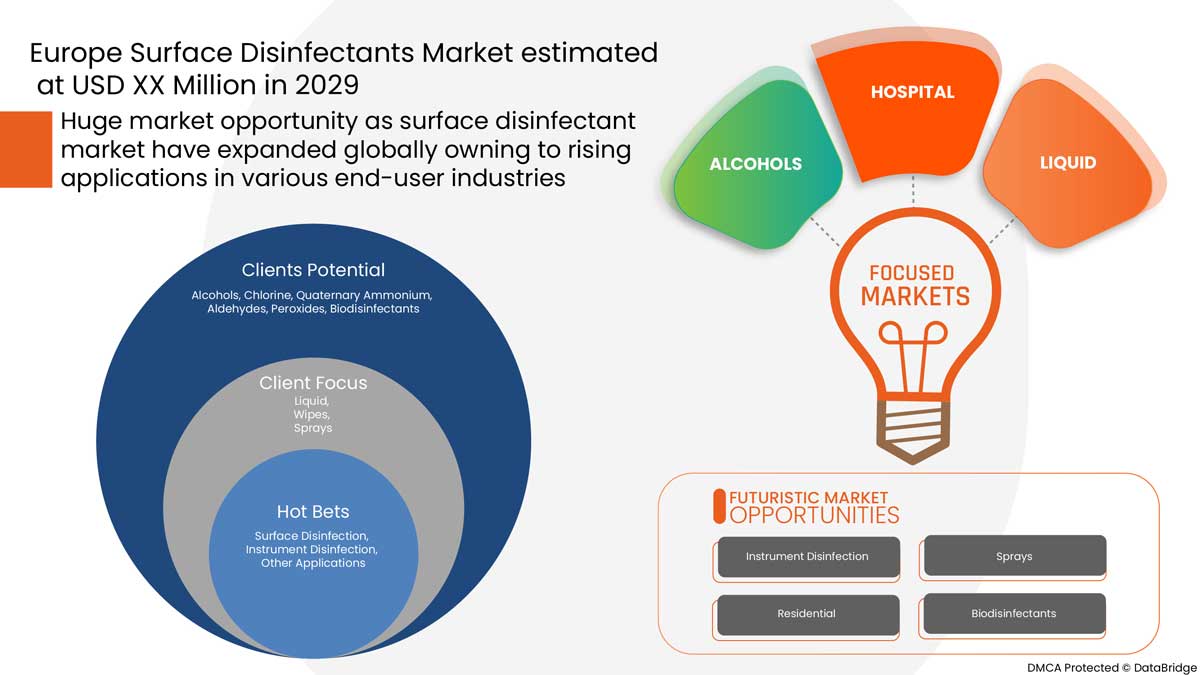

The Europe surface disinfectants market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.4% in the forecast period of 2022 to 2029 and is expected to reach USD 2,603.96 million by 2029. The primary factor driving the growth of the surface disinfectants market is the increasing demand from healthcare facilities, rise in occurrences of chronic disorders, rising product demand after Covid-19, and shifting consumers' preference toward the use of bio-based and nature-friendly disinfectants.

Disinfectants are the antimicrobials used to kill harmful bacteria, germs, and other microorganisms present on various surfaces and therefore are most usually used to disinfect floors, washrooms, tiles, furniture, and instruments.

A surface disinfectant is a chemical compound used to kill or inactivate microorganisms, usually on a solid surface. These disinfectants can be found in various chemical compounds and work in various pathways to destroy microorganisms. They can be incorporated in different forms, such as liquids, wipes, and sprays. The outbreak of COVID-19 increased the need for surface disinfection and cleaning practices significantly. All the known measures are being taken to curb the spread of the deadly virus, including disinfection and cleaning of surfaces. This increased the demand for the surface disinfectant to multiple folds.

The Europe surface disinfectants market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volume in Kilograms, Pricing in USD |

|

Segments Covered |

Par composition (alcools, chlore, ammonium quaternaire, aldéhydes, peroxydes, biodésinfectants), type (liquide, sprays, lingettes), application (désinfection des surfaces, désinfection des instruments et autres applications), utilisateur final (hôpitaux, laboratoires de diagnostic et de recherche, sociétés pharmaceutiques et biotechnologiques, alimentation et boissons et résidentiel) |

|

Pays couverts |

Royaume-Uni, Russie, France, Espagne, Italie, Allemagne, Turquie, Pays-Bas, Suisse, Belgique, Reste de l'Europe |

|

Acteurs du marché couverts |

Français : 3M, Ecolab, Gesco Healthcare Pvt. Ltd., Contec, Inc., BETCO, CARROLLCLEAN, Cetylite, Inc., GOJO Industries, Inc., Medalkan, Medline Industries, LP., Metrex Research, LLC., Spartan Chemical Company, Inc., RUHOF, ZEP Inc., KINNOS INC., PDI, Inc., Pal International, OXY PHARM, Reckitt Benckiser Group PLC., PurposeBuilt Brands, SC Johnson & Son Inc., Brulin, MEDIVATORS Inc., Pharmax Limited, Whiteley, Procter & Gamble, STERIS, The Clorox Company, PAUL HARTMANN AG et Diversey Holdings LTD. |

Définition du marché

La demande croissante des établissements de santé, l'augmentation des maladies chroniques et l'évolution des préférences des consommateurs en faveur des désinfectants d'origine biologique et respectueux de la nature devraient propulser la croissance du marché européen des désinfectants de surface. La sensibilisation croissante de la population et l'accent accru mis sur les initiatives de recherche et développement (R&D) offriront des opportunités sur le marché européen des désinfectants de surface. Cependant, les risques environnementaux et sanitaires associés aux désinfectants devraient remettre en cause la croissance du marché des désinfectants de surface.

Dynamique du marché des désinfectants de surface en Europe

Conducteurs

- Demande croissante des établissements de santé

Avec l'augmentation du nombre d'interventions chirurgicales pratiquées dans les hôpitaux, de plus en plus de désinfectants sont utilisés dans les procédures chirurgicales pour éviter les infections et assurer des soins de qualité aux patients et un maintien de l'hygiène. L'utilisation croissante de désinfectants pour désinfecter diverses surfaces telles que les instruments médicaux réutilisables comme les endoscopes, la stérilisation incorrecte du matériel médical et une désinfection de haut niveau insuffisante peuvent entraîner des effets graves et indésirables sur les patients.

- Augmentation des cas de maladies chroniques

L'augmentation de la population de patients âgés devrait modifier les systèmes de prestation et de travail des services de santé et créer un plus grand marché pour les désinfectants de surface, car la population âgée est sujette à contracter des infections nosocomiales (IAS). En outre, l'augmentation des maladies chroniques telles que les maladies cardiovasculaires et autres nécessite un séjour hospitalier prolongé. Par conséquent, le nombre de cas d'infections nosocomiales augmente avec ces séjours.

- Augmentation de la demande de produits après l'épidémie de Covid-19

La pandémie a perturbé tous les systèmes de santé du monde entier en raison de l'afflux croissant de patients dans les hôpitaux. Plusieurs hôpitaux temporaires ont également été mis en place pour faire face à une incidence croissante de la maladie afin de contrôler cette situation. Par conséquent, la propagation du COVID-19 a provoqué une augmentation de la demande de produits de nettoyage et de désinfection en raison de la sensibilisation croissante à la sécurité, à l'hygiène et à la santé. Par conséquent, l'augmentation des dépenses de santé et l'augmentation du nombre d'hôpitaux temporaires stimulent également la demande de désinfectants de surface. En outre, des facteurs tels que la demande croissante de lits d'hôpitaux et d'unités de soins intensifs et le nombre croissant d'installations d'isolement ont considérablement stimulé la demande de désinfectants de surface.

- Les préférences des consommateurs évoluent vers l’utilisation de désinfectants biosourcés et respectueux de la nature

Les désinfectants de surface biosourcés sont largement préférés par les consommateurs en raison de la tendance croissante à utiliser des produits respectueux de l'environnement et des produits qui n'ont pas d'effets toxiques sur la santé et l'environnement. De plus, les réglementations strictes concernant l'utilisation excessive de produits chimiques ont propulsé la croissance des désinfectants biosourcés au cours des dernières années. Les désinfectants de surface biosourcés sont également très efficaces. Ils aident à tuer les germes sans laisser de résidus chimiques toxiques et à éliminer les effets dangereux sur la peau, les yeux et le système respiratoire. Ces avantages ont attiré l'attention des consommateurs sur les produits désinfectants de surface biosourcés. En outre, l'accent croissant des fabricants de désinfectants de surface sur l'investissement dans la recherche et le développement pour développer de nouvelles formulations biosourcées et l'augmentation de l'utilisation de désinfectants de surface biosourcés comme alternative aux produits chimiques stimulent également la croissance du marché.

Opportunités

- Sensibilisation croissante d'une grande partie de la population

Les organisations gouvernementales et non gouvernementales telles que l'Organisation mondiale de la santé ont également lancé des programmes de sensibilisation et des directives visant à sensibiliser les consommateurs à la santé et à l'hygiène et à l'utilisation appropriée des désinfectants dans leurs lieux respectifs. Tout cela devrait offrir de nombreuses opportunités pour la croissance et le développement du marché européen des désinfectants de surface.

- Accent accru sur les initiatives de recherche et développement (R&D)

Les fabricants du marché des désinfectants de surface modernisent également leurs installations de production pour répondre à la demande accrue de désinfectants due à l'épidémie du nouveau coronavirus, en plus de lancer des produits avec de nouvelles formulations qui tuent efficacement les germes et les bactéries sur diverses surfaces. Par conséquent, l'accent croissant et le développement des initiatives de recherche et développement créeront des opportunités pour exploiter la croissance du marché européen des désinfectants de surface.

Contraintes/Défis

- Manque de compréhension concernant l'utilisation des pratiques de désinfection standard par les utilisateurs finaux

Dans les établissements de santé et environnementaux, le nettoyage est une intervention complexe de prévention et de contrôle des infections qui nécessite une approche multidimensionnelle. Cela comprend la formation, un suivi approprié, des audits et des retours d'information réguliers, des rappels et l'affichage des SOP dans les zones clés. La formation du personnel de nettoyage doit porter sur les politiques et les SOP de l'établissement de santé et sur les directives nationales de la région.

- Disponibilité de produits et technologies alternatifs sur le marché

Certaines technologies de désinfection comprennent la lumière UV et la vapeur. La vapeur à haute température, à faible teneur en humidité ou sèche ne laisse pas de résidus ni de film chimique. Elle est très efficace et convient à de nombreuses surfaces. La lumière UV-C est appropriée pour des applications de désinfection spécifiques. Elle peut désinfecter les salles médicales inoccupées et les appareils électroniques de haute technologie et peut être utilisée à l'intérieur des conduits d'aération pour désinfecter l'air. En outre, de nouvelles technologies de décontamination automatisées et sans contact ont été adoptées, notamment les aérosols et le peroxyde d'hydrogène vaporisé, les appareils mobiles qui émettent une lumière ultraviolette continue (UV-C) et la lumière à spectre étroit de haute intensité (405 nm). Ces technologies ont montré une réduction de la contamination bactérienne sur les surfaces. Par conséquent, la disponibilité d'une large gamme de produits et de technologies alternatifs aux désinfectants de surface sur le marché est le facteur limitant la croissance et, par conséquent, freine le développement du marché européen des désinfectants de surface.

- Risques environnementaux et sanitaires liés à l'utilisation de désinfectants

De nombreux désinfectants de surface se dégradent lentement ou biodégradent en produits chimiques plus toxiques, persistants et bioaccumulables, menaçant la vie aquatique. Des ingrédients tels que le phosphore ou l'azote contribuent à la charge en nutriments des plans d'eau, entraînant des effets néfastes sur la qualité de l'eau et la vie aquatique qui y est présente. De plus, les composés organiques volatils (COV) contenus dans les produits de nettoyage peuvent également affecter la qualité de l'air intérieur et contribuer à la formation de smog dans l'air extérieur. Les désinfectants de surface présentent divers effets néfastes et dangers, ce qui constitue un sérieux défi pour la croissance du marché européen des désinfectants de surface dans un avenir proche.

- Le prix plus élevé des désinfectants de surface à base chimique par rapport aux désinfectants à base biologique

Les désinfectants de surface à base chimique occupent une part importante du marché européen des désinfectants de surface en raison de leurs vastes applications dans diverses installations telles que les hôpitaux, les cliniques, les industries et les lieux publics. Par conséquent, leurs prix élevés auront un impact négatif sur le marché et constitueront un défi pour le marché européen des désinfectants de surface.

Le COVID-19 a eu un impact minime sur le marché européen des désinfectants de surface

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, un impact significatif a été constaté sur le marché des désinfectants de surface. Les opérations et la chaîne d'approvisionnement des désinfectants de surface, avec plusieurs installations de fabrication, étaient toujours en activité dans la région. Les prestataires de services ont continué à proposer des désinfectants de surface en suivant les mesures d'assainissement et de sécurité dans le scénario post-COVID.

Développement récent

- En mai 2022, BETCO a lancé deux nouveaux modules à la demande pour faciliter le partage d'informations précieuses sur la désinfection générale et la désinfection spécifique aux installations. Ces modules couvrent les désinfectants fonctionnant avec les types de désinfectants et comment recommander ou sélectionner les désinfectants les plus efficaces.

Portée du marché européen des désinfectants de surface

Le marché européen des désinfectants de surface est classé en fonction de la composition, du type, de l'application et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Composition

- Alcools

- Chlore

- Ammonium quaternaire

- Aldéhydes

- Peroxydes

- Biodésinfectants

En fonction de la composition, le marché européen des désinfectants de surface est classé en six segments : les alcools, le chlore, l'ammonium quaternaire, les aldéhydes, les peroxydes et les biodésinfectants.

Taper

- Liquide

- Lingettes

- Sprays

En fonction du type, le marché européen des désinfectants de surface est classé en trois segments : liquides, lingettes et sprays.

Application

- Désinfection des surfaces

- Désinfection des instruments

- Autres applications

En fonction de l’application, le marché européen des désinfectants de surface est segmenté en désinfection de surface, désinfection d’instruments et autres applications.

Utilisateur final

- Hôpital

- Laboratoires de diagnostic et de recherche

- Sociétés pharmaceutiques et biotechnologiques

- Alimentation et boissons

- Résidentiel

En fonction de l'utilisateur final, le marché européen des désinfectants de surface est segmenté en hôpitaux, laboratoires de diagnostic et de recherche, sociétés pharmaceutiques et biotechnologiques, agroalimentaire et résidentiel.

Analyse/perspectives régionales du marché des désinfectants de surface en Europe

Le marché européen des désinfectants de surface dans le secteur de la santé est segmenté en fonction de la composition, du type, de l'application et de l'utilisateur final.

Les pays du marché européen des désinfectants de surface sont le Royaume-Uni, la Russie, la France, l’Espagne, l’Italie, l’Allemagne, la Turquie, les Pays-Bas, la Suisse, la Belgique et le reste de l’Europe.

L'Allemagne domine le marché européen des désinfectants de surface en termes de part de marché et de chiffre d'affaires et continuera à accroître sa domination au cours de la période de prévision. Cela est dû à l'augmentation de la fréquentation des hôpitaux et des centres de diagnostic.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances technologiques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des désinfectants de surface en Europe

Le paysage concurrentiel du marché européen des désinfectants de surface fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation des entreprises vers le marché européen des désinfectants de surface.

Français Certains des principaux acteurs opérant sur le marché européen des désinfectants de surface sont 3M, Ecolab, Gesco Healthcare Pvt. Ltd., Contec, Inc., BETCO, CARROLLCLEAN, Cetylite, Inc, GOJO Industries, Inc., Medalkan, Medline Industries, LP., Metrex Research, LLC., Spartan Chemical Company, Inc., RUHOF, ZEP Inc., KINNOS INC, PDI, Inc, Pal International, OXY PHARM, Reckitt Benckiser Group PLC., PurposeBuilt Brands, SC Johnson & Son Inc., Brulin, MEDIVATORS Inc, Pharmax Limited, Whiteley, Procter & Gamble, STERIS, The Clorox Company, PAUL HARTMANN AG et Diversey Holdings LTD.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des tailles d'échantillon importantes. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, les grilles de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'Europe par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE SURFACE DISINFECTANTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 COMPOSITION LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 U.S SURFACE DISINFECTANT ANALYSIS

4.2 EPIDEMIOLOGY

4.2.1 INCIDENCE

4.2.2 TREATMENT RATE

4.2.3 MORTALITY RATE

4.2.4 PATIENT TREATMENT SUCCESS RATE

4.3 INDUSTRIAL INSIGHTS:

4.3.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.3.2 KEY PRICING STRATEGIES

4.3.2.1 PRICES OF RAW MATERIALS:

4.3.2.2 FLUCTUATION IN DEMAND AND SUPPLY

4.3.2.3 LEVELS OF DISINFECTION

4.3.3 QUALITY:

4.3.4 KEY CONSUMER ENROLLMENT STRATEGIES

4.3.5 INTERVIEWS WITH DISINFECTION PRODUCT MANUFACTURERS

4.3.6 INTERVIEWS WITH INFECTIOUS DISEASE SCIENTISTS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.5.1 THREAT OF NEW ENTRANTS:

4.5.2 THREAT OF SUBSTITUTES:

4.5.3 CUSTOMER BARGAINING POWER:

4.5.4 SUPPLIER BARGAINING POWER:

4.5.5 INTERNAL COMPETITION (RIVALRY):

5 EUROPE SURFACE DISINFECTANT MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FROM HEALTHCARE FACILITIES

6.1.2 RISE IN OCCURRENCES OF CHRONIC DISORDERS

6.1.3 RISING PRODUCT DEMAND POST THE OUTBREAK OF COVID-19

6.1.4 SHIFTING CONSUMERS' PREFERENCE TOWARD USE OF BIO-BASED AND NATURE-FRIENDLY DISINFECTANTS

6.2 RESTRAINTS

6.2.1 LACK OF UNDERSTANDING REGARDING THE USE OF STANDARD DISINFECTION PRACTICES BY END-USERS

6.2.2 AVAILABILITY OF ALTERNATIVE PRODUCTS AND TECHNOLOGIES IN THE MARKET

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS AMONG A LARGE PERCENTAGE OF POPULATION

6.3.2 INCREASING FOCUS ON RESEARCH AND DEVELOPMENT (R&D) INITIATIVES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL & HEALTH HAZARDS ASSOCIATED WITH THE USE OF DISINFECTANTS

6.4.2 HIGHER PRICE OF CHEMICAL-BASED SURFACE DISINFECTANTS COMPARED TO BIO-BASED DISINFECTANTS

7 EUROPE SURFACE DISINFECTANTS MARKET, COMPOSITION

7.1 OVERVIEW

7.2 ALCOHOLS

7.3 CHLORINE

7.4 QUATENARY AMMONIUM

7.5 ALDEHYDES

7.6 PEROXIDES

7.7 BIO DISINFECTANTS

8 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 LIQUID

8.3 WIPES

8.4 SPRAYS

9 EUROPE SURFACE DISINFECTANTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SURFACE DISINFECTION

9.3 INSTRUMENT DISINFECTION

9.4 OTHER APPLICATIONS

10 EUROPE SURFACE DISINFECTANTS MARKET, END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 DIAGNOSTIC AND RESEARCH LABORATORIES

10.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.5 FOOD & BEVERAGES

10.6 RESIDENTIAL

11 EUROPE SURFACE DISINFECTANTS MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 NETHERLANDS

11.1.8 SWITZERLAND

11.1.9 BELGIUM

11.1.10 TURKEY

11.1.11 REST OF EUROPE

12 EUROPE SURFACE DISINFECTANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.1.1 COLLABORATION

12.1.2 PRODUCT LAUNCHES

12.1.3 PARTNERSHIP

12.1.4 EVENT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 THE CLOROX COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATE

14.2 PAUL HARTMANN AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 PROCTER & GAMBLE

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATE

14.4 DIVERSEY HOLDINGS LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 RECKITT BENCKISER GROUP PLC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 BETCO

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BRULIN

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CARROLLCLEAN

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 CETYLITE, INC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CONTEC, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 ECOLAB

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT UPDATES

14.12 GESCO HEALTHCARE PVT. LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATE

14.13 GOJO INDUSTRIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATE

14.14 KINNOS INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 MEDALKAN

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 MEDIVATORS, INC

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 MEDLINE INSUSTRIES, LP.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 METREX RESEARCH, LLC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 OXY PHARM

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 PAL INTERNATIONAL

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

14.21 PDI, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 PHARMAX LIMITED

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATES

14.23 PURPOSEBUILT BRANDS

14.23.1 COMPANY SNAPSHOT

14.23.2 RECENT UPDATE

14.24 RUHOF

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATE

14.25 S.C. JOHNSON & SON INC.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT UPDATES

14.26 SPARTAN CHEMICAL COMPANY, INC.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT UPDATES

14.27 STERIS

14.27.1 COMPANY SNAPSHOT

14.27.2 REVENUE ANALYSIS

14.27.3 PRODUCT PORTFOLIO

14.27.4 RECENT UPDATES

14.28 WHITELEY

14.28.1 COMPANY SNAPSHOT

14.28.2 PRODUCT PORTFOLIO

14.28.3 RECENT UPDATES

14.29 ZEP INC.

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT UPDATES

14.3 3M

14.30.1 COMPANY SNAPSHOT

14.30.2 REVENUE ANALYSIS

14.30.3 PRODUCT PORTFOLIO

14.30.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF DISINFECTANTS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES; HS CODE – 380894 (USD THOUSAND)

TABLE 2 EXPORT DATA OF DISINFECTANTS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES; HS CODE – 380894 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 EUROPE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ALCOHOLS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE CHLORINE IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE QUATERNARY AMMONIUM IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ALDEHYDES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE PEROXIDES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE BIO DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 13 EUROPE LIQUID IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE WIPES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE SPRAYS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE SURFACE DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE INSTRUMENT DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OTHER APPLICATIONS IN SURFACE DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 EUROPE HOSPITALS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE DIAGNOSTIC AND RESEARCH LABORATORIES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGIES COMPANIES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FOOD & BEVERAGES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE RESIDENTIAL IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE SURFACE DISINFECTANTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 EUROPE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 30 EUROPE SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 GERMANY SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 33 GERMANY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 GERMANY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 35 GERMANY SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 GERMANY SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 U.K. SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 38 U.K. SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 40 U.K. SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 U.K. SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 FRANCE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 43 FRANCE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 FRANCE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 45 FRANCE SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 FRANCE SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 ITALY SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 48 ITALY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ITALY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 50 ITALY SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ITALY SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 SPAIN SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 53 SPAIN SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SPAIN SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 55 SPAIN SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SPAIN SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 RUSSIA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 58 RUSSIA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 RUSSIA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 60 RUSSIA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 RUSSIA SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 63 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 65 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 68 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 70 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 72 BELGIUM SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 73 BELGIUM SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 BELGIUM SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 75 BELGIUM SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 BELGIUM SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 TURKEY SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 78 TURKEY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 TURKEY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 80 TURKEY SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 TURKEY SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 REST OF EUROPE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 2 EUROPE SURFACE DISINFECTANTS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE SURFACE DISINFECTANTS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE SURFACE DISINFECTANTS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE SURFACE DISINFECTANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE SURFACE DISINFECTANTS MARKET: COMPOSITION LIFE LINE CURVE

FIGURE 7 EUROPE SURFACE DISINFECTANTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE SURFACE DISINFECTANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE SURFACE DISINFECTANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE SURFACE DISINFECTANTS MARKET: END USER COVERAGE GRID

FIGURE 11 EUROPE SURFACE DISINFECTANTS MARKET: CHALLENGE MATRIX

FIGURE 12 EUROPE SURFACE DISINFECTANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE SURFACE DISINFECTANTS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 INCREASING DEMAND FROM HEALTH CARE FACILITIES IS EXPECTED TO DRIVE THE EUROPE SURFACE DISINFECTANTS MARKET IN THE FORECAST PERIOD

FIGURE 16 ALCOHOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE SURFACE DISINFECTANTS MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE SURFACE DISINFECTANTS MARKET

FIGURE 18 EUROPE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2021

FIGURE 19 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2021

FIGURE 20 EUROPE SURFACE DISINFECTANTS MARKET, APPLICATION, 2021

FIGURE 21 EUROPE SURFACE DISINFECTANTS MARKET, END USER, 2021

FIGURE 22 EUROPE SURFACE DISINFECTANTS MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE SURFACE DISINFECTANTS MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE SURFACE DISINFECTANTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE SURFACE DISINFECTANTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE SURFACE DISINFECTANTS MARKET: BY COMPOSITION (2022 - 2029)

FIGURE 27 EUROPE SURFACE DISINFECTANT MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.