Europe Skin Packaging For Fresh Meat Market

Taille du marché en milliards USD

TCAC :

%

USD

216.04 Million

USD

300.25 Million

2025

2033

USD

216.04 Million

USD

300.25 Million

2025

2033

| 2026 –2033 | |

| USD 216.04 Million | |

| USD 300.25 Million | |

|

|

|

|

Segmentation du marché européen des emballages sous film plastique pour la viande fraîche, par type (emballages sous film plastique thermoformables avec carte, emballages sous film plastique thermoformables sans carte), matériau (plastique, papier et carton, et autres), revêtement thermoscellable (à base d'eau, à base de solvant, et autres), remplissage d'air (sous vide et sans vide), fonction (conservation et protection, conformité à l'usage, étiquetage réglementaire, présentation, et autres), compatibilité micro-ondes et non micro-ondes, utilisation finale (viande, volaille et fruits de mer) - Tendances et prévisions du secteur jusqu'en 2033

Quelle est la taille et le taux de croissance du marché européen des emballages sous film plastique pour la viande fraîche ?

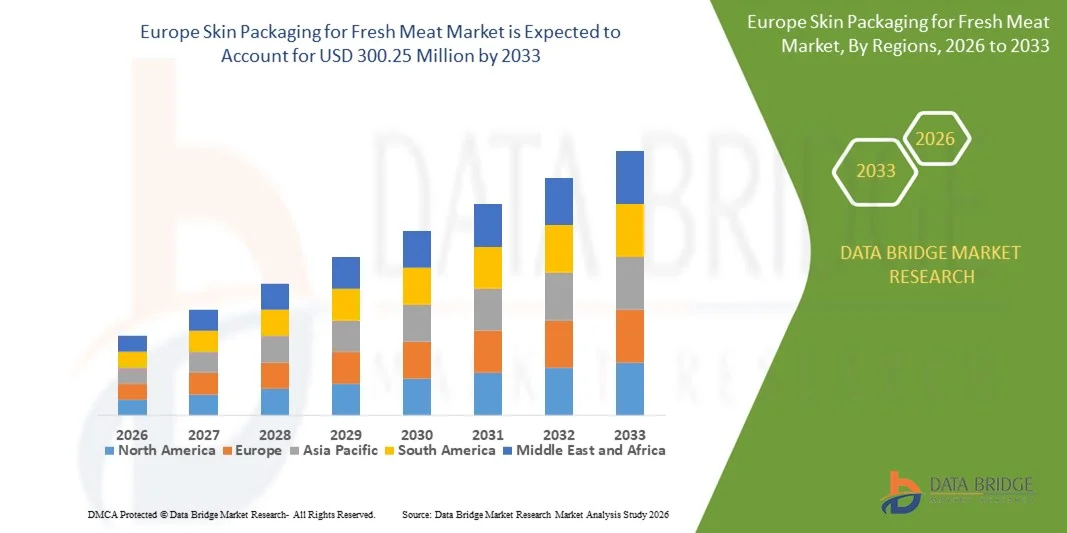

- Le marché européen des emballages sous film plastique pour la viande fraîche était évalué à 216,04 millions de dollars en 2025 et devrait atteindre 300,25 millions de dollars d'ici 2033 , soit un taux de croissance annuel composé (TCAC) de 4,20 % au cours de la période de prévision.

- La tendance actuelle indique une demande croissante d'emballages sous film plastique pour la viande fraîche, parallèlement à l'augmentation des investissements dans les secteurs agroalimentaires publics et privés. La croissance de ce marché est notamment due à une sensibilisation accrue du grand public aux questions de santé et aux progrès technologiques constants dans le domaine des emballages sous film plastique.

Quels sont les principaux enseignements à tirer du conditionnement sous film plastique pour le marché de la viande fraîche ?

- Avec la mondialisation rapide et l'augmentation des réglementations sur les produits alimentaires et les boissons dans divers pays et régions, le marché des emballages sous film plastique pour la viande fraîche connaîtra une croissance soutenue dans les années à venir.

- Les progrès et les nouvelles tendances en matière de technologies d'emballage sous film plastique, ainsi que la consommation croissante de viande fraîche conditionnée dans des emballages haut de gamme, stimuleront davantage la croissance du marché.

- L'Allemagne a dominé le marché européen des emballages sous vide pour la viande fraîche avec la plus grande part de revenus (32,8 %) en 2024, grâce à une forte demande d'emballages de haute qualité pour la viande fraîche, à des infrastructures de transformation alimentaire avancées et à l'adoption généralisée de l'emballage sous vide par les principaux détaillants et transformateurs de viande.

- Le marché français des emballages sous film plastique pour la viande fraîche connaît une croissance régulière, avec un TCAC de 8,7 %, soutenue par la consommation croissante de produits carnés frais et haut de gamme, l'expansion des formats de distribution modernes et une attention accrue portée à la réduction du gaspillage alimentaire.

- Le segment des emballages thermoformables sans carte a dominé le marché avec une part estimée à 41,6 % en 2025, grâce à une visibilité supérieure du produit, une excellente conformité du film et sa capacité à prolonger la durée de conservation sans support supplémentaire.

Portée du rapport et segmentation du marché de la viande fraîche par emballage sous film plastique

|

Attributs |

Emballage sous film plastique pour la viande fraîche : principales informations sur le marché |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des emballages sous film plastique pour la viande fraîche ?

Adoption croissante de solutions d'emballage sous film plastique à haute barrière, durables et prolongeant la durée de conservation

- Le marché des emballages sous film plastique pour la viande fraîche connaît une forte évolution vers des films à haute barrière, sous vide et spécifiques à certaines applications, conçus pour prolonger la durée de conservation et préserver la fraîcheur de la viande.

- Les fabricants privilégient de plus en plus les films multicouches, résistants à l'oxygène et à transparence accrue, qui améliorent la visibilité des produits tout en prévenant l'oxydation, la perte d'humidité et la prolifération microbienne.

- L'importance croissante accordée aux matériaux d'emballage recyclables, plus fins et biosourcés stimule l'innovation en réponse au durcissement des réglementations en matière de développement durable et aux engagements des détaillants.

- Par exemple, des entreprises comme Amcor, Sealed Air, Berry Global, Winpak et Klöckner Pentaplast investissent dans des films plastiques recyclables et des solutions d'emballage monomatériaux pour la viande fraîche.

- La demande croissante de durée de conservation prolongée, de réduction du gaspillage alimentaire et de présentation haut de gamme des viandes accélère l'adoption des formats d'emballage sous film plastique avancés.

- Avec l'évolution constante des normes dans le commerce de détail et la restauration, le suremballage devient essentiel pour améliorer la protection des produits, leur attrait visuel et l'efficacité de la chaîne d'approvisionnement.

Quels sont les principaux facteurs qui influencent le marché du conditionnement sous film plastique pour la viande fraîche ?

- La consommation croissante de produits carnés frais, réfrigérés et à valeur ajoutée dans les circuits de distribution et de restauration est un moteur de croissance majeur.

- Par exemple, entre 2024 et 2025, les principaux transformateurs et distributeurs de viande ont étendu l'utilisation du conditionnement sous film plastique afin d'améliorer la conservation des produits et de réduire les pertes dues au gaspillage.

- L'attention accrue portée à la sécurité alimentaire, à l'hygiène et à l'allongement des cycles de distribution dans les chaînes d'approvisionnement mondiales de viande accélère l'adoption des emballages sous film plastique.

- Les progrès réalisés dans l'extrusion de films, les technologies de scellage et les matériaux à haute transparence améliorent l'intégrité des emballages tout en préservant l'esthétique du produit.

- La préférence croissante des consommateurs pour des formats d'emballage pratiques, étanches et inviolables soutient l'expansion du marché

- Soutenu par les initiatives de développement durable, les objectifs de réduction du gaspillage alimentaire et la tendance à la montée en gamme, le marché des emballages sous film plastique pour la viande fraîche devrait connaître une croissance soutenue à long terme.

Quel facteur freine la croissance du marché des emballages sous film plastique pour la viande fraîche ?

- Les coûts élevés des matériaux et les exigences en matière d'équipements spécialisés associés aux films d'emballage sous film plastique avancés limitent leur adoption par les petits et moyens transformateurs de viande.

- Par exemple, entre 2024 et 2025, la fluctuation des prix de la résine et la hausse des coûts de l'énergie ont entraîné une augmentation des coûts de production des emballages.

- Les problèmes de compatibilité entre les films de protection, les barquettes et les machines de scellage peuvent créer des difficultés opérationnelles pour les transformateurs.

- Des réglementations strictes en matière de sécurité alimentaire, des normes de conformité des matériaux et des exigences de recyclabilité allongent les délais de développement et de certification.

- Les infrastructures de recyclage limitées pour les films plastiques multicouches posent des défis en matière de durabilité et de réglementation.

- Pour surmonter ces obstacles, les fabricants se concentrent sur des conceptions monomatériaux, des stratégies de réduction d'épaisseur et des innovations en matière de films économiques, favorisant ainsi la pénétration future du marché.

Comment le marché des emballages sous film plastique pour la viande fraîche est-il segmenté ?

Le marché est segmenté en fonction du type, du matériau, du revêtement thermoscellable, du remplissage d'air, de la fonction, de la nature et de l'utilisation finale .

- Par type

Le marché des emballages sous film rétractable pour la viande fraîche se divise en trois catégories : les emballages thermoformables sous film rétractable avec carte, les emballages thermoformables sous film rétractable sans carte et les emballages sous film rétractable. Le segment des emballages thermoformables sous film rétractable sans carte dominait le marché en 2025, avec une part de marché estimée à 41,6 %. Cette domination s’explique par une visibilité optimale du produit, une excellente adhérence du film et une durée de conservation prolongée sans support supplémentaire. Ce format est largement adopté par les grands transformateurs de viande et les distributeurs en raison de sa faible consommation de matériaux, de ses performances de mise sous vide améliorées et de sa compatibilité avec les lignes d’emballage automatisées.

Le segment des emballages thermoformables sous film plastique devrait enregistrer le taux de croissance annuel composé le plus rapide entre 2026 et 2033, porté par la demande croissante d'emballages haut de gamme pour la viande, offrant un espace de marque optimal et proposant des conditionnements à valeur ajoutée pour la vente au détail. L'adoption accrue de ces emballages pour les viandes de spécialité et l'exportation contribue également à cette croissance.

- Par matériau

Selon le matériau, le marché est segmenté en plastique, papier et carton, et autres. Le segment du plastique détenait la plus grande part de marché (68,9 %) en 2025, grâce à ses excellentes propriétés de barrière, sa flexibilité, son étanchéité et son adéquation aux applications sous vide. Les matières plastiques telles que le PET, le PE et les films multicouches sont largement utilisées pour empêcher la pénétration d'oxygène, la perte d'humidité et la contamination, garantissant ainsi une durée de conservation plus longue des produits carnés frais.

Le segment du papier et du carton devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la multiplication des initiatives de développement durable, l'engagement des détaillants à réduire leur consommation de plastique et les progrès réalisés dans le domaine des solutions de papier couché et traité barrière. Les innovations en matière d'emballages recyclables et à base de fibres devraient favoriser leur adoption à long terme.

- Revêtement thermoscellable

Le marché des emballages sous film plastique pour la viande fraîche est segmenté, selon le type de revêtement thermoscellable, en trois catégories : à base d’eau, à base de solvant et autres. En 2025, le segment des revêtements thermoscellables à base d’eau dominait le marché avec 45,3 % des revenus, grâce à ses faibles émissions de COV, sa conformité aux normes de sécurité alimentaire et sa compatibilité avec les initiatives d’emballage durable. Les revêtements à base d’eau offrent une étanchéité fiable tout en favorisant le recyclage et en répondant aux exigences réglementaires.

Le segment des adhésifs à base de solvants devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à son excellente adhérence et à ses performances dans les opérations d'emballage à grande vitesse. Malgré les préoccupations environnementales, son utilisation continue dans des applications exigeantes et les progrès réalisés dans les technologies de contrôle des émissions soutiennent la croissance de ce segment.

- Par remplissage à l'air

Selon le mode de remplissage (sous vide ou sans vide), le marché est segmenté en deux catégories : le conditionnement sous vide et le conditionnement sous vide. En 2025, ce dernier représentait la part la plus importante (72,4 %), car l’emballage sous vide améliore considérablement la durée de conservation, réduit la prolifération microbienne et préserve la texture et la couleur de la viande. Ce format est largement utilisé dans la vente au détail de viande fraîche, l’emballage pour l’exportation et les usines de transformation centralisées.

Le segment du remplissage sans vide devrait connaître la croissance annuelle composée la plus rapide au cours de la période de prévision, grâce à ses coûts d'équipement plus faibles et à son adéquation aux produits à courte durée de conservation et à la distribution locale. Les petits transformateurs et les fournisseurs de viande régionaux adoptent de plus en plus les solutions sans vide pour optimiser leurs coûts.

- Par fonction

Le marché est segmenté par fonction en quatre catégories : conservation et protection, conditionnement adapté à l’usage, étiquetage réglementaire, présentation et autres. Le segment « Conservation et protection » dominait le marché en 2025 avec une part de 39,8 %, porté par le besoin crucial de prolonger la durée de conservation, de réduire les pertes et de garantir la sécurité alimentaire. Le conditionnement sous film plastique minimise efficacement l’exposition à l’oxygène et la perte d’humidité, ce qui le rend indispensable à la conservation de la viande fraîche.

Le segment de la présentation devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la préférence croissante des consommateurs pour des emballages de viande haut de gamme et visuellement attrayants. Les détaillants utilisent de plus en plus le suremballage pour renforcer la différenciation des produits et l'image de marque.

- Par nature

Selon leur nature, les emballages sous film plastique pour la viande fraîche se divisent en deux catégories : les emballages micro-ondables et non micro-ondables. En 2025, le segment des emballages non micro-ondables détenait la part de marché dominante (63,7 %), la plupart des produits carnés frais étant destinés à une cuisson traditionnelle. Ce segment bénéficie d’une moindre complexité des matériaux et d’une large acceptation réglementaire.

Le segment des produits micro-ondables devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la demande croissante d'aliments pratiques, de produits carnés prêts à cuire et par les modes de vie urbains. Les progrès réalisés dans le domaine des films résistants à la chaleur et des emballages ergonomiques favorisent son adoption.

- Par utilisation finale

Selon l'utilisation finale, le marché est segmenté en viande, volaille et produits de la mer. Le segment de la viande dominait le marché en 2025 avec une part de chiffre d'affaires de 44,5 %, grâce à une forte consommation mondiale de bœuf, de porc et d'agneau, ainsi qu'à l'utilisation intensive d'emballages sous film plastique dans les circuits de distribution et d'exportation.

Le segment des produits de la mer devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la demande croissante de produits frais, d'emballages étanches et d'une présentation haut de gamme. L'essor des exportations de produits de la mer et le développement de la chaîne du froid contribuent également à cette croissance.

Quelle région détient la plus grande part du marché des emballages sous film plastique pour la viande fraîche ?

- L'Allemagne a dominé le marché européen des emballages sous vide pour la viande fraîche avec la plus grande part de revenus (32,8 %) en 2024, grâce à une forte demande d'emballages de haute qualité pour la viande fraîche, à des infrastructures de transformation alimentaire avancées et à l'adoption généralisée de l'emballage sous vide par les principaux détaillants et transformateurs de viande.

- L'industrie de transformation de la viande bien établie du pays, les réglementations strictes en matière de sécurité alimentaire et la forte pénétration des produits carnés haut de gamme et de marques de distributeur accélèrent la demande de solutions d'emballage sous film protecteur à haute barrière et prolongeant la durée de conservation.

- Les principaux acteurs du secteur de l'emballage, tels que MULTIVAC, Klöckner Pentaplast, Winpak et Schur Flexibles, investissent activement dans les films recyclables, les solutions monomatériaux et les emballages sous film transparent haute transparence, positionnant ainsi l'Allemagne comme un pôle de production et d'innovation pour le marché européen de l'emballage sous film pour la viande fraîche.

Analyse du marché français des emballages sous film plastique pour la viande fraîche

Le marché français du conditionnement sous vide pour la viande fraîche connaît une croissance soutenue, avec un TCAC de 8,7 %, portée par la hausse de la consommation de viande fraîche et haut de gamme, le développement des formats de distribution modernes et une attention accrue portée à la réduction du gaspillage alimentaire. Les transformateurs de viande français adoptent de plus en plus le conditionnement sous vide pour prolonger la durée de conservation, améliorer l'hygiène et valoriser la présentation des produits. L'accent mis par la réglementation sur les emballages durables, conjugué aux initiatives des distributeurs pour réduire les déchets plastiques et améliorer le recyclage, favorise l'adoption de matériaux d'emballage sous vide plus fins et recyclables. Les investissements dans la logistique du froid et la modernisation de l'approvisionnement en produits frais renforcent encore la position de la France sur le marché européen.

Analyse du marché britannique des emballages sous film plastique pour la viande fraîche

Le marché britannique des emballages sous film plastique pour la viande fraîche est en constante expansion, porté par la demande croissante de viande fraîche prête à consommer, la pénétration accrue des marques de distributeur et l'intérêt marqué des distributeurs pour une durée de conservation prolongée et une réduction du gaspillage. L'adoption des emballages sous vide et à haute transparence progresse pour le bœuf, la volaille et les produits de la mer. Distributeurs et transformateurs privilégient les emballages sous film plastique recyclables et monomatériaux afin de respecter leurs engagements en matière de développement durable et l'évolution des réglementations. Les investissements continus dans les lignes d'emballage automatisées et la présentation haut de gamme de la viande positionnent le Royaume-Uni comme un acteur majeur de la croissance du marché européen des emballages sous film plastique pour la viande fraîche.

Quelles sont les principales entreprises du secteur de l'emballage sous film plastique pour le marché de la viande fraîche ?

Le secteur de l'emballage sous film plastique pour l'industrie de la viande fraîche est principalement dominé par des entreprises bien établies, notamment :

- Dow, Inc. (États-Unis)

- Windmöller & Hölscher (Allemagne)

- Sealed Air Corporation (États-Unis)

- Klöckner Pentaplast (Luxembourg)

- Berry Global Inc. (États-Unis)

- Amcor plc (Suisse)

- Graphic Packaging International, LLC (États-Unis)

- FLEXOPACK SA (Grèce)

- WINPAK LTD. (Canada)

- Schur Flexibles Holding GesmbH (Autriche)

- Mannok Pack (Royaume-Uni)

- Spa G. Mondini (Italie)

- GROUPE CLONDALKIN (Pays-Bas)

- PLASTOPIL (Israël)

- MULTIVAC (Allemagne)

- ULMA Packaging (Espagne)

- JASA Packaging Solutions (Pays-Bas)

- Sealpac International bv (Pays-Bas)

- KM Packaging Services Ltd (Royaume-Uni)

- Bliston Packaging BV (Pays-Bas)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.