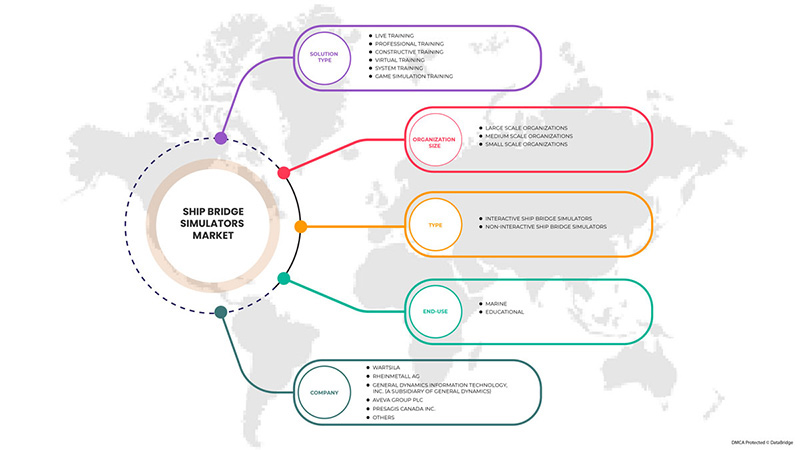

Marché européen des simulateurs de pont de navire, par type de solution ( formation en direct , formation professionnelle, formation constructive, formation virtuelle , formation système et formation par simulation de jeu ), type (simulateurs de pont de navire interactifs et simulateurs de pont de navire non interactifs), taille de l'organisation (organisations à grande échelle, organisations à moyenne échelle et organisations à petite échelle), utilisation finale ( marine et éducative) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des simulateurs de ponts de navires en Europe

Les simulateurs sont utilisés dans de nombreux domaines de l'industrie maritime, notamment le remorquage et la manutention des ancres, le contrôle des moteurs, la manutention des marchandises, les opérations de grue et la formation aux opérations offshore sur les navires et les plates-formes pétrolières. En plus des applications ci-dessus, les simulateurs marins sont également utilisés pour la formation navire-terre, les services de trafic maritime et la formation aux opérations de grue (VTS). Au cours de la période de prévision, le marché européen des simulateurs de pont de navire devrait être stimulé par le besoin croissant d'opérateurs ou d'officiers de quart formés sur un navire pour le traçage de cartes, la navigation, la conduite de tir, la surveillance météorologique, la surveillance, la recherche et la répétition de missions. Cependant, l'expansion du marché européen des simulateurs de pont de navire devrait être entravée par les coûts d'installation élevés liés à la création de simulateurs de pont de navire.

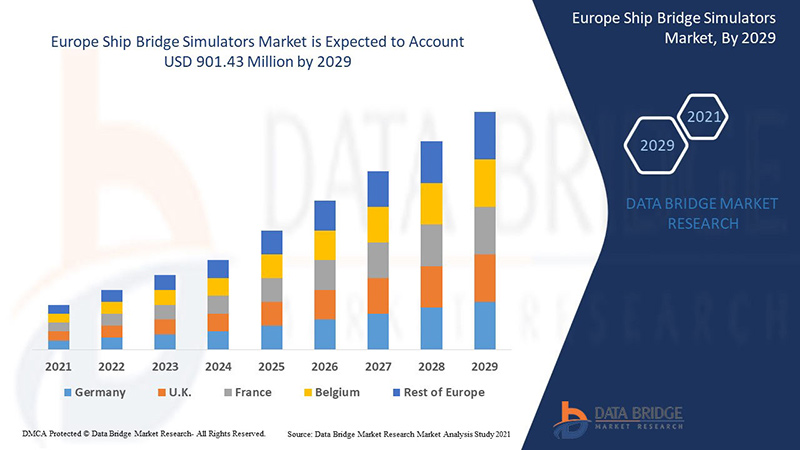

Selon les analyses de Data Bridge Market Research, le marché européen des simulateurs de ponts de navires devrait atteindre une valeur de 901,43 millions USD d'ici 2029, à un TCAC de 6,4 % au cours de la période de prévision. Le rapport sur le marché européen des simulateurs de ponts de navires couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable jusqu'en 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de solution (formation en direct, formation professionnelle, formation constructive, formation virtuelle, formation système et formation par simulation de jeu), type (simulateurs de pont de navire interactifs et simulateurs de pont de navire non interactifs), taille de l'organisation (organisations à grande échelle, organisations à moyenne échelle et organisations à petite échelle), utilisation finale (marine et éducative) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie et reste de l'Europe |

|

Acteurs du marché couverts |

Rheinmetall AG, AVEVA Group plc, BMT Group Ltd, General Dynamics Information Technology, Inc. (une filiale de General Dynamics), FORCE TECHNOLOGY, Wärtsilä, PC Maritime, Aboa Mare, ST Engineering, Image Soft, Presagis Canada Inc., Simwave BV, VSTEP BV, ARI Simulation, Synergy Group, SSPA, Kongsberg Digital (une filiale de Kongsberg Gruppen), entre autres |

Définition du marché

Les simulateurs de pont de navire sont des outils de manœuvre extrêmement avancés conçus spécifiquement pour la formation professionnelle et les tests de systèmes marins dans des environnements de simulation complexes et réalistes qui offrent une expérience réaliste. Ce sont des simulateurs de navire interactifs, qui se distinguent des simulateurs de navire non interactifs car ils offrent tous deux une formation conceptuelle, une formation aux compétences et une compréhension des systèmes marins. Ces simulateurs sont proposés sous forme d'options logicielles uniquement ou sous forme de combinaison logicielle et matérielle. Ces solutions logicielles peuvent être installées sur n'importe quel PC avec les exigences minimales. Ils offrent à l'utilisateur un environnement factice pour les tests système ou la formation d'experts. Les simulateurs de pont de navire sont spécialement conçus pour les tests système et sont utilisés dans la formation et le développement professionnel en direct, constructif, virtuel et par simulation de jeu.

Dynamique du marché des simulateurs de ponts de navires en Europe

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l'utilisation des technologies de guerre

La guerre électronique consiste à utiliser des signaux électromagnétiques tels que la radio, l'infrarouge ou le radar pour détecter, protéger et communiquer afin de protéger les ressources militaires contre des menaces potentielles. De plus, les cadets de la guerre électronique aident à protéger un avion, un hélicoptère ou un navire contre les missiles guidés par radar ou infrarouge. Ainsi, ces cadets ont été inventés il y a plus de 50 ans et se sont multipliés au fil des ans avec le développement de la technologie.

L'augmentation de l'innovation et l'adoption de technologies modernes telles que la réalité augmentée, l'intelligence artificielle et bien d'autres dans divers secteurs maritimes ont entraîné l'adoption de composants électroniques et de solutions modernes telles que les navires intelligents et les processus de travail autonomes en guerre pour défendre et attaquer les ennemis afin de réduire le risque à vie des cadets.

- Croissance croissante de l'automatisation et de la technologie dans l'industrie maritime

L'industrie maritime connaît une avancée technologique considérable avec la mise en œuvre du processus de travail autonome. L'utilisation d'appareils électroniques avancés contribue à développer l'automatisation et à adopter des techniques avancées telles que l'IA, la RA, la robotique et bien d'autres dans l'industrie maritime. De plus, l'automatisation et l'adoption de technologies dans diverses industries gagnent en importance d'année en année.

De plus, la technologie est un aspect qui change la donne pour tous les types de développements. L'adoption de solutions modernes telles que les processus de travail autonomes, les solutions d'analyse commerciale et bien d'autres est importante pour faire évoluer l'industrie maritime. Ainsi, la technologie plonge dans l'automatisation et l'adoption de capteurs, de propulsion et de nombreux aspects de la gestion des processus de travail du navire. Bien que la gestion de la navigation dans l'industrie maritime gagne en importance en raison de la compréhension de la position et de la vitesse précises pour garantir que le navire atteint sa destination en toute sécurité et de la manière la plus économique possible.

Opportunité

- Augmentation de l'adoption des techniques de simulation dans les établissements d'enseignement

L'évolution de l'environnement dynamique et des conditions économiques crée une demande de réorientation et de modification des programmes éducatifs. Les progrès technologiques ont accru les pratiques d'intégration dans l'éducation et l'adoption de simulations informatiques pour comprendre divers concepts à travers le monde.

Cependant, la méthode d'apprentissage conceptuel a été très pratique au cours des dernières décennies et n'est plus d'actualité en raison de la dynamique imprévisible du marché et des conditions organisationnelles complexes. Cela a conduit à la nécessité de modifier les méthodes d'enseignement et d'éducation avec l'intégration de nouvelles technologies.

Contraintes/Défis

- Réglementation stricte de la législation maritime pour une formation efficace

De nombreuses industries souffrent de la mise en œuvre de réglementations gouvernementales draconiennes en raison des obstacles irrationnels aux profits, à l'efficacité économique et à la création d'emplois. Les règles et réglementations strictes imposées à tout type d'industrie conduisent au développement de failles et à la violation des lois, ce qui conduit souvent à l'adoption de produits de mauvaise qualité et au non-respect des procédures standard à suivre, ce qui peut conduire à des solutions inefficaces.

De plus, la plupart des entreprises à travers le monde s’opposent généralement aux lois, réglementations ou prélèvements fiscaux qui restreignent les opérations commerciales et la rentabilité, ce qui diminue directement les investissements, en particulier parmi les entrepreneurs qui prennent les risques de démarrer et de gérer des entreprises, limitant ainsi le bassin d’épargne pour l’entreprise.

- Manque d'instructeurs qualifiés

De nos jours, les progrès technologiques dynamisent la dynamique du marché. L'introduction de diverses techniques et processus d'automatisation sur le marché est très fréquente ; par conséquent, l'apprentissage de ces techniques et de nouveaux processus de travail nécessite du temps et un équipement approprié.

De plus, l'automatisation permet aux réseaux de fonctionner de manière autonome. Les entreprises ont toujours besoin de personnes compétentes, telles que des formateurs et des instructeurs, pour former l'utilisateur final et l'aider à adopter des techniques permettant de mieux gérer les réseaux. Il est nécessaire de disposer d'instructeurs pour former et faire comprendre à l'utilisateur final les procédures de travail.

Impact post-COVID-19 sur le marché européen des simulateurs de ponts de navires

La COVID-19 a eu un impact négatif sur le marché européen des simulateurs de pont de navire en raison des réglementations de confinement et de la fermeture des installations de formation.

La pandémie de COVID-19 a eu un impact négatif sur le marché européen des simulateurs de pont de navire. Cependant, l'adoption croissante de la formation virtuelle dans le monde entier a contribué à la croissance du marché après la pandémie. En outre, la croissance a été élevée depuis l'ouverture du marché après le COVID-19, et on s'attend à ce qu'il y ait une croissance considérable dans le secteur en raison de la demande accrue de main-d'œuvre qualifiée dans l'industrie maritime.

Les fournisseurs de solutions prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans les simulateurs de pont de navire. Grâce à cela, les entreprises apporteront des technologies de pointe sur le marché. En outre, les initiatives gouvernementales pour l'utilisation de la technologie d'automatisation ont conduit à la croissance du marché.

Développements récents

- En septembre 2022, Kongsberg Digital a annoncé le lancement du jumeau numérique maritime. Ce nouveau lancement de produit aidera l'entreprise à diversifier son portefeuille et prend en charge la visualisation 3D du navire et la connaissance de la situation autour de celui-ci, y compris les conditions météorologiques, et attire les clients vers les solutions de simulation proposées par l'entreprise

- En septembre 2021, Wärtsilä a annoncé le lancement de Simulation and Training Solutions, la solution de simulation cloud de Wartsila Voyage, sur la plateforme d'apprentissage océanique d'Ocean Technologies Group (OTG). Cela aidera l'entreprise à étendre la portée de ses activités et de ses produits à un large éventail de clients et à améliorer l'utilisation des solutions pour améliorer les offres sur le marché

Portée du marché européen des simulateurs de ponts de navires

Le marché européen des simulateurs de ponts de navires est segmenté en fonction du type de solution, du type, de la taille de l'organisation et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les segments de croissance maigres dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de solution

- Formation en direct

- Formation professionnelle

- Formation constructive

- Formation virtuelle

- Formation système

- Formation à la simulation de jeu

Sur la base du type de solution, le marché européen des simulateurs de pont de navire est segmenté en formation en direct, formation professionnelle, formation constructive, formation virtuelle, formation système et formation par simulation de jeu.

Taper

- Simulateurs interactifs de ponts de navires

- Simulateurs de ponts de navires non interactifs

Sur la base du type, le marché européen des simulateurs de pont de navire est segmenté en simulateurs de pont de navire interactifs et simulateurs de pont de navire non interactifs.

Taille de l'organisation

- Organisations à grande échelle

- Organisations de taille moyenne

- Organisations à petite échelle

Sur la base de la taille de l'organisation, le marché européen des simulateurs de pont de navire est segmenté en organisations à grande échelle, organisations à moyenne échelle et organisations à petite échelle.

Utilisation finale

- Marin

- Pédagogique

Sur la base de l'utilisation finale, le marché européen des simulateurs de pont de navire est segmenté en maritime et éducatif.

Analyse/perspectives régionales du marché des simulateurs de ponts de navires en Europe

Le marché européen des simulateurs de pont de navire est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de solution, type, taille de l’organisation et utilisation finale, comme référencé ci-dessus.

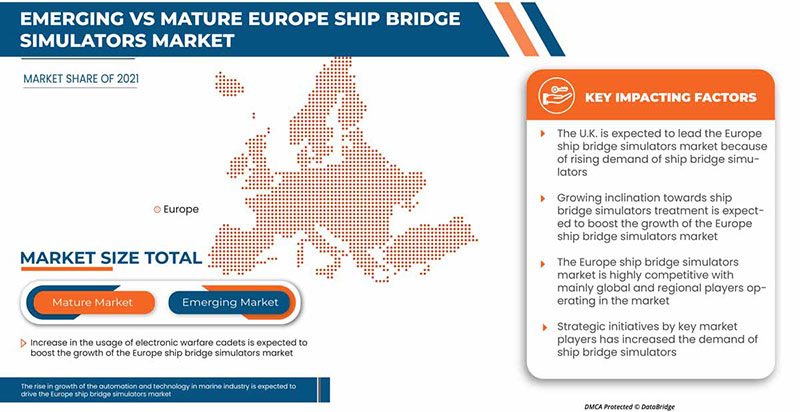

Certains pays couverts par le rapport sur le marché des simulateurs de ponts maritimes en Europe sont l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie et le reste de l'Europe. Le Royaume-Uni devrait dominer la région européenne en raison de l'augmentation des dépenses maritimes et d'expédition du pays.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données par pays.

Paysage concurrentiel et analyse des parts de marché des simulateurs de ponts de navires en Europe

Le paysage concurrentiel du marché des simulateurs de ponts de navires en Europe fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché européen des simulateurs de ponts de navires.

Certains des principaux acteurs opérant sur le marché européen des simulateurs de ponts de navires sont Rheinmetall AG, AVEVA Group plc, BMT Group Ltd, General Dynamics Information Technology, Inc. (une filiale de General Dynamics), FORCE TECHNOLOGY, Wärtsilä, PC Maritime, Aboa Mare, ST Engineering, Image Soft, Presagis Canada Inc., Simwave BV, VSTEP BV, ARI Simulation, Synergy Group, SSPA, Kongsberg Digital (une filiale de Kongsberg Gruppen), entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE SHIP BRIDGE SIMULATORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOLUTION TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDIES

4.1.1 FORCE TECHNOLOGY HAS OFFERED SERVICES TO MODERNIZE BRAZILIAN PORT

4.1.2 SINGAPORE MARITIME AND PORT AUTHORITY’S (SMPA), IN ALLIANCE WITH KONGSBERG SHIP’S BRIDGE SIMULATION CENTRE, TO PROVIDE EFFICIENT TRAINING

4.2 REGULATORY FRAMEWORK

4.3 TECHNOLOGY TRENDS

4.4 INVESTMENT VS ADOPTION MODEL

4.5 TOP WINNING STRATEGIES

4.6 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE USAGE OF WARFARE TECHNOLOGIES

5.1.2 RISE IN GROWTH OF THE AUTOMATION AND TECHNOLOGY IN MARINE INDUSTRY

5.1.3 RISE IN THE NEED FOR EFFECTIVE TRAINING FOR MARITIME OPERATIONS

5.2 RESTRAINTS

5.2.1 REQUIREMENT OF HUGE CAPITAL INVESTMENT

5.2.2 STRINGENT REGULATIONS BY MARITIME LEGISLATIVE FOR EFFECTIVE TRAINING

5.3 OPPORTUNITIES

5.3.1 INCREASE IN THE SAFETY STANDARDS DEMANDS TRAINING

5.3.2 RISE IN THE ACQUISITION AND PARTNERSHIP AMONG MARKET PLAYERS

5.3.3 RISE IN THE ADOPTION OF SIMULATION TECHNIQUES IN EDUCATIONAL INSTITUTES

5.3.4 RISE IN DIGITALIZATION TRENDS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED TRAINING INSTRUCTORS

6 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE

6.1 OVERVIEW

6.2 LIVE TRAINING

6.3 PROFESSIONAL TRAINING

6.4 CONSTRUCTIVE TRAINING

6.5 VIRTUAL TRAINING

6.6 SYSTEM TRAINING

6.7 GAME SIMULATION TRAINING

7 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY TYPE

7.1 OVERVIEW

7.2 INTERACTIVE SHIP BRIDGE SIMULATORS

7.3 NON-INTERACTIVE SHIP BRIDGE SIMULATORS

8 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE SCALE ORGANIZATIONS

8.3 MEDIUM SCALE ORGANIZATIONS

8.4 SMALL SCALE ORGANIZATIONS

9 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY END-USE

9.1 OVERVIEW

9.2 MARINE

9.2.1 LIVE TRAINING

9.2.2 PROFESSIONAL TRAINING

9.2.3 CONSTRUCTIVE TRAINING

9.2.4 VIRTUAL TRAINING

9.2.5 SYSTEM TRAINING

9.2.6 GAME SIMULATION TRAINING

9.3 EDUCATIONAL

9.3.1 LIVE TRAINING

9.3.2 PROFESSIONAL TRAINING

9.3.3 CONSTRUCTIVE TRAINING

9.3.4 VIRTUAL TRAINING

9.3.5 SYSTEM TRAINING

9.3.6 GAME SIMULATION TRAINING

10 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY REGION

10.1 EUROPE

10.1.1 U.K.

10.1.2 GERMANY

10.1.3 ITALY

10.1.4 FRANCE

10.1.5 SPAIN

10.1.6 TURKEY

10.1.7 RUSSIA

10.1.8 NETHERLANDS

10.1.9 BELGIUM

10.1.10 SWITZERLAND

10.1.11 REST OF EUROPE

11 EUROPE SHIP BRIDGE SIMULATORS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 WARTSILA

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SOLUTION PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 RHEINMETALL AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 GENERAL DYNAMICS INFORMATION TECHNOLOGY, INC. (A SUBSIDIARY OF GENERAL DYNAMICS)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 SOLUTION PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 AVEVA GROUP PLC

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 SOLUTION PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 PRESAGIS CANADA INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 ABOA MARE

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMC SEARCH LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 SERVICE PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AMERICAN NAUTICAL SERVICES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ARI SIMULATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 BMT GROUP LTD

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 SOLUTION PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 FORCE TECHNOLOGY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 SOLUTION PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 IMAGE SOFT

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JAPAN MARINE SCIENCE INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 KONGSBERG DIGITAL (A SUBSIDIARY OF KONGSBERG GRUPPEN)

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCTS PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 PC MARITIME

13.15.1 COMPANY SNAPSHOT

13.15.2 SOLUTION PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PIVOT MARITIME INTERNATIONAL

13.16.1 COMPANY SNAPSHOT

13.16.2 SOLUTION PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SIMWAVE B.V.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SSPA

13.18.1 COMPANY SNAPSHOT

13.18.2 SOLUTION PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 ST ENGINEERING

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 SOLUTION PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SYNERGY GROUP

13.20.1 COMPANY SNAPSHOT

13.20.2 SERVICE PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 VIRTUAL MARINE, INC.

13.21.1 COMPANY SNAPSHOT

13.21.2 SOLUTION PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 VSTEP BV

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE LIVE TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE PROFESSIONAL TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE CONSTRUCTIVE TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE VIRTUAL TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SYSTEM TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE GAME SIMULATION TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE INTERACTIVE SHIP BRIDGE SIMULATORS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE NON-INTERACTIVE SHIP BRIDGE SIMULATORS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE LARGE SCALE ORGANIZATIONS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE MEDIUM SCALE ORGANIZATIONS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE SMALL SCALE ORGANIZATIONS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 21 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.K. SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.K. SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.K. SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 30 U.K. SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 31 U.K. MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.K. EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 33 GERMANY SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 34 GERMANY SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 GERMANY SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 37 GERMANY MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 38 GERMANY EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 39 ITALY SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 40 ITALY SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ITALY SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 42 ITALY SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 43 ITALY MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 44 ITALY EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 45 FRANCE SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 46 FRANCE SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 FRANCE SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 48 FRANCE SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 49 FRANCE MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 50 FRANCE EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 51 SPAIN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 52 SPAIN SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 SPAIN SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 54 SPAIN SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 55 SPAIN MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 56 SPAIN EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 57 TURKEY SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 58 TURKEY SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 TURKEY SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 60 TURKEY SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 61 TURKEY MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 62 TURKEY EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 63 RUSSIA SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 64 RUSSIA SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 RUSSIA SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 66 RUSSIA SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 67 RUSSIA MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 68 RUSSIA EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 69 NETHERLANDS SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 70 NETHERLANDS SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NETHERLANDS SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 72 NETHERLANDS SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 73 NETHERLANDS MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 74 NETHERLANDS EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 75 BELGIUM SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 76 BELGIUM SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 BELGIUM SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 78 BELGIUM SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 79 BELGIUM MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 80 BELGIUM EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 81 SWITZERLAND SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 82 SWITZERLAND SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SWITZERLAND SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 84 SWITZERLAND SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 85 SWITZERLAND MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 86 SWITZERLAND EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 87 REST OF EUROPE SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE SHIP BRIDGE SIMULATORS MARKET: SEGMENTATION

FIGURE 2 EUROPE SHIP BRIDGE SIMULATORS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE SHIP BRIDGE SIMULATORS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE SHIP BRIDGE SIMULATORS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE SHIP BRIDGE SIMULATORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE SHIP BRIDGE SIMULATORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE SHIP BRIDGE SIMULATORS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE SHIP BRIDGE SIMULATORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE SHIP BRIDGE SIMULATORS MARKET: SEGMENTATION

FIGURE 10 RISE IN THE NEED FOR EFFECTIVE TRAINING FOR MARINE OPERATIONS IS EXPECTED TO DRIVE THE EUROPE SHIP BRIDGE SIMULATORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 LIVE TRAINING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE SHIP BRIDGE SIMULATORS MARKET IN 2022 & 2029

FIGURE 12 VALUE CHAIN ANALYSIS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE SHIP BRIDGE SIMULATORS MARKET

FIGURE 14 (2020-2025) – EUROPE ADOPTION RATE OF AUTOMATION IN INDUSTRIES

FIGURE 15 BENEFITS OF SIMULATION TECHNIQUE IN EDUCATION INDUSTRY

FIGURE 16 UNEMPLOYMENT RATE IN THE MIDDLE EAST & NORTH AFRICA REGION

FIGURE 17 EUROPE SHIP BRIDGE SIMULATORS MARKET: BY SOLUTION TYPE (2021)

FIGURE 18 EUROPE SHIP BRIDGE SIMULATORS MARKET: BY TYPE (2021)

FIGURE 19 EUROPE SHIP BRIDGE SIMULATORS MARKET: BY ORGANIZATION SIZE (2021)

FIGURE 20 EUROPE SHIP BRIDGE SIMULATORS MARKET: BY END-USE (2021)

FIGURE 21 EUROPE SHIP BRIDGE SIMULATORS MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE SHIP BRIDGE SIMULATORS MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE SHIP BRIDGE SIMULATORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE SHIP BRIDGE SIMULATORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE SHIP BRIDGE SIMULATORS MARKET: BY SOLUTION TYPE (2022-2029)

FIGURE 26 EUROPE SHIP BRIDGE SIMULATORS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.