Europe Reverse Logistics Market

Taille du marché en milliards USD

TCAC :

%

USD

33.10 Billion

USD

50.77 Billion

2025

2033

USD

33.10 Billion

USD

50.77 Billion

2025

2033

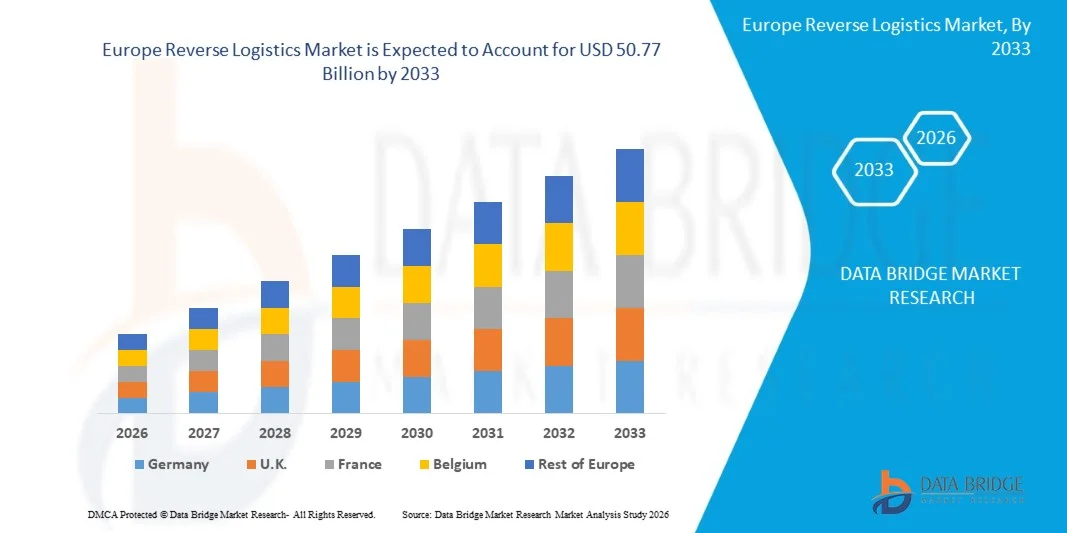

| 2026 –2033 | |

| USD 33.10 Billion | |

| USD 50.77 Billion | |

|

|

|

|

Marché européen de la logistique inverse, par type de produit (semi-conducteurs et équipements électroniques, composants automobiles et équipements de recharge pour véhicules électriques, équipements médicaux et de santé, alimentations industrielles, équipements d'automatisation et de robotique), par type de service (collecte, recyclage, remise à neuf, revente), par canal de distribution (B2B, B2C), par pays (Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Pays-Bas, Pologne, Turquie, Suisse, reste de l'Europe) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché européen de la logistique inverse

- Le marché européen de la logistique inverse était évalué à 33,10 milliards de dollars en 2025 et devrait atteindre environ 50,77 milliards de dollars d'ici 2033.

- Au cours de la période prévisionnelle allant de 2025 à 2032, le marché devrait croître à un TCAC de 5,6 % , principalement grâce à une sensibilisation accrue à la santé mentale, à la prévention des maladies chroniques et à l'adoption croissante de solutions de bien-être par les employeurs.

- Le marché européen de la logistique inverse se concentre sur la fourniture de solutions de bout en bout qui optimisent le retour, la réparation, la remise à neuf et le recyclage des produits, améliorant ainsi l'efficacité et la durabilité de la chaîne d'approvisionnement.

Analyse du marché européen de la logistique inverse

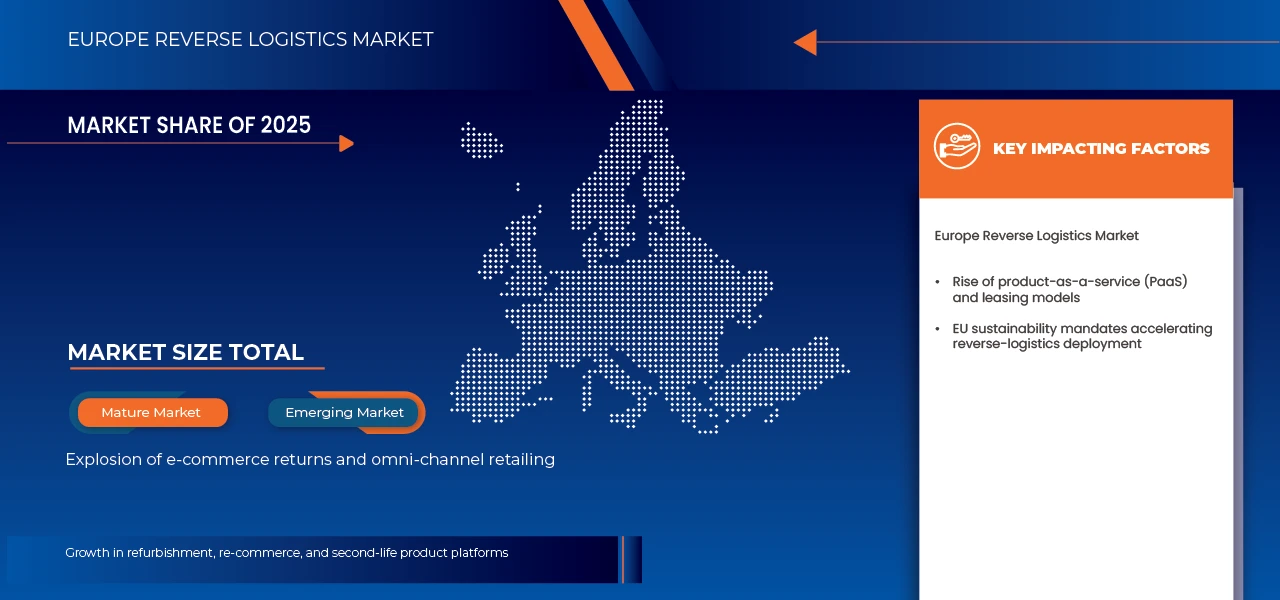

- Le marché européen de la logistique inverse est en pleine expansion, porté par la transition dynamique de la région vers une économie circulaire, des réglementations environnementales strictes et un taux élevé de retours consommateurs, notamment grâce au e-commerce. Les opérations de logistique inverse – retours de produits, remise à neuf, recyclage et réparation – deviennent des éléments clés des stratégies de chaîne d'approvisionnement, les marques cherchant à réduire leurs déchets, à valoriser leurs actifs et à se conformer aux directives européennes en matière de développement durable.

- La croissance du marché est fortement influencée par les cadres réglementaires de l'UE, tels que la directive relative aux déchets d'équipements électriques et électroniques (DEEE), la responsabilité élargie des producteurs (REP) et les prochaines révisions du plan d'action pour l'économie circulaire (PAEC). Ces politiques imposent aux fabricants de gérer les produits en fin de vie, ce qui accroît la demande de réseaux logistiques inverses structurés dans les secteurs de l'électronique, de l'automobile, de l'emballage et des biens de consommation.

- En 2025, les retours e-commerce représenteront la part la plus importante de l'activité de logistique inverse en Europe, en raison de taux de retour élevés (souvent de 25 à 40 % dans la mode et le commerce en ligne) et de l'essor rapide des achats en ligne transfrontaliers. Les détaillants investissent dans des centres de retour automatisés, des systèmes d'inspection basés sur l'IA et des ateliers de reconditionnement afin de réduire les délais de traitement et de valoriser les produits retournés.

- Au sein de l'écosystème européen de la logistique inverse, le recyclage et la valorisation des matériaux dominent le marché (plus de 40 % dans la plupart des pays), portés par une forte demande de matériaux recyclés, des engagements croissants en faveur de la neutralité carbone et la hausse du coût des matières premières. Les secteurs de l'automobile et de l'électronique sont les moteurs de ce segment, grâce aux initiatives de recyclage des batteries, à la réglementation du démantèlement des véhicules et aux modèles de production en boucle fermée adoptés par les constructeurs automobiles mondiaux.

Portée du rapport et segmentation du marché de la logistique inverse en Europe

|

Attributs |

Machines de remplissage de liquides en Europe : principales informations sur le marché |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également un suivi de l'innovation et une analyse stratégique, les avancées technologiques, le scénario du changement climatique, l'analyse de la chaîne d'approvisionnement, l'analyse de la chaîne de valeur, les critères de sélection des fournisseurs, l'analyse PESTLE, l'analyse de Porter, l'analyse des brevets, l'analyse de l'écosystème industriel, la couverture des matières premières, les droits de douane et leur impact sur le marché, la couverture réglementaire, le comportement d'achat des consommateurs, les perspectives de la marque, une analyse détaillée des coûts et le cadre réglementaire. |

Tendances du marché européen de la logistique inverse

« Besoin croissant d’audits de durabilité et de conseils en matière de chaîne d’approvisionnement circulaire »

- La demande croissante d'audits de durabilité et de conseils en matière de chaînes d'approvisionnement circulaires représente une opportunité substantielle pour le marché européen de la logistique inverse. Les entreprises étant tenues de retracer et de rendre compte des impacts environnementaux, sociaux et de gouvernance (ESG) tout au long du cycle de vie des produits et des chaînes de valeur, elles ont de plus en plus besoin d'un accompagnement en matière d'audit, de conseil et d'intégration de systèmes par des tiers.

- En avril 2024, un article publié sur Reuters indiquait que la directive relative au devoir de diligence en matière de développement durable des entreprises (CSDDD) avait été approuvée par le Parlement européen, obligeant les grandes entreprises à auditer leurs chaînes d'approvisionnement afin d'évaluer leur impact environnemental et le non-respect des droits humains. Cette évolution réglementaire ouvre la voie à des missions de conseil et d'audit concernant les flux de logistique inverse, la récupération des actifs, les programmes de reprise et les analyses de la chaîne d'approvisionnement.

- En mai 2025, un article d'Intereconomics sur l'analyse des politiques relatives à la réglementation des chaînes d'approvisionnement de l'UE indiquait que les entreprises auraient besoin de « cadres robustes de collecte de données, de transparence et d'assurance » tout au long des chaînes de valeur, ce qui implique une demande de services de conseil qui soutiennent la traçabilité des retours, des chaînes de remise à neuf et de la logistique de réutilisation en aval.

- En août 2025, la Commission européenne a lancé une consultation publique sur la future loi relative à l'économie circulaire, insistant sur la nécessité d'une participation accrue des parties prenantes afin d'identifier les obstacles et les opportunités liés à l'économie circulaire. Cette initiative témoigne d'un besoin en matière de conseils d'experts et de cadres d'audit informatisés pour les réseaux de logistique inverse.

Dynamique du marché européen de la logistique inverse

Conducteur

« Explosion des retours e-commerce et du commerce omnicanal »

- En octobre 2022, la Direction générale de la fiscalité et de l'union douanière a publié une note d'information sur les formalités douanières relatives au retour des marchandises dans le contexte du commerce électronique. Ce document constatait qu'après les modifications apportées en 2021 à la TVA sur le commerce électronique, les obligations administratives pour les marchandises retournées vers des pays hors UE s'étaient alourdies et que les douanes et les entreprises rencontraient des difficultés. Il détaille les procédures relatives aux déclarations d'exportation, à l'annulation des déclarations d'importation et au remboursement des droits de douane en cas de retour de marchandises issues de la vente à distance, reconnaissant ainsi que les retours massifs liés au commerce électronique constituent un défi opérationnel majeur pour les douanes et les chaînes logistiques de l'UE.

- En février 2025, la Commission européenne a adopté et présenté la communication « Une boîte à outils européenne complète pour un commerce électronique sûr et durable », accompagnée de l’article « Relever les défis des importations en ligne ». La Commission a constaté qu’en 2024, environ 4,6 milliards d’envois de faible valeur (150 euros ou moins) sont entrés dans l’UE, soit deux fois plus qu’en 2023 et trois fois plus qu’en 2022, et qu’environ 70 % des Européens font régulièrement des achats en ligne, y compris sur des plateformes non européennes.

- In January 2022, the European Commission’s Digital Economy and Society Index (DESI) 2022 thematic analysis placed particular emphasis on e-commerce The report confirms that e-commerce adoption by European enterprises has become a core indicator of digital transformation, signaling structurally higher volumes of online orders and, consequently, greater requirements for organized return flows, reverse inventory management and data-driven reverse-logistics planning.

Restraint/Challenge

“High operational complexity and cost of reverse flows”

- In September 2025, an IFA commentary “Returns and Reverse Logistics in Europe – from Cost Burden to Competitive Speed” stated that return operations, strict consumer-rights frameworks and customs procedures “can either drain margin or unlock recovery value”. This highlights that without proper infrastructure, returns act as a cost-drain.

- In July 2025, Landmark Global logistics insight report “High Pressure on Reverse Logistics and Returns Surge in …” described how seasonal spikes in returns, especially in fashion and footwear segments, combine with rising operational costs to create “growing pressure on an already complex part of the supply-chain”.

- In January 2023, MDPI research paper titled “A Framework for Adopting a Sustainable Reverse Logistics …” concluded that many supply chains in developed countries (including Europe) have inadequate resources to implement reverse-logistics solutions and that cost and service-quality shortfalls hinder sustainable returns flows.

- In January 2025, the article “Reverse Logistics: Solving Europe’s Return Management Problem” noted that studies show approximately 30 % of online purchases in Europe are returned (versus much lower in physical stores) and that this high volume creates a “logistical nightmare” for companies managing reverse flows.

Opportunity

Growth in refurbishment, re-commerce, and second-life product platforms

The growing demand for automated and aseptic filling solutions in emerging markets represents a significant opportunity for the global liquid filling machines industry. Rising consumer awareness of hygiene and safety, coupled with increasing consumption of beverages, dairy products, and pharmaceuticals, is compelling manufacturers to adopt advanced filling technologies that ensure sterility and minimize contamination risks. Automated and aseptic systems enhance production efficiency, minimize human intervention, and facilitate compliance with stringent regulatory standards.

- In January 2023, the Dutch government published “Reverse logistics for reusable packaging” which explores how shifting from single-use to reusable systems (pooling, returnable crates) in the Netherlands necessitates reverse-logistics networks and aligns with broader second-life and reuse platforms.

- In November 2024, Vanderlande announced the reopening of its Reverse Logistics Centre in Veghel (The Netherlands) explicitly to “drive reuse, remanufacturing and recycling” of returned materials — signalling corporate investment in reverse-logistics infrastructure to support second-life platforms.

- In March 2023, the European Commission Impact Assessment supporting the new repair and reuse legislative framework noted that “reuse by refurbishment … its potential is not sufficiently exploited” and called for policy support of refurbishment and second-life market platforms to unlock value from returns.

Europe Reverse Logistics Market Scope

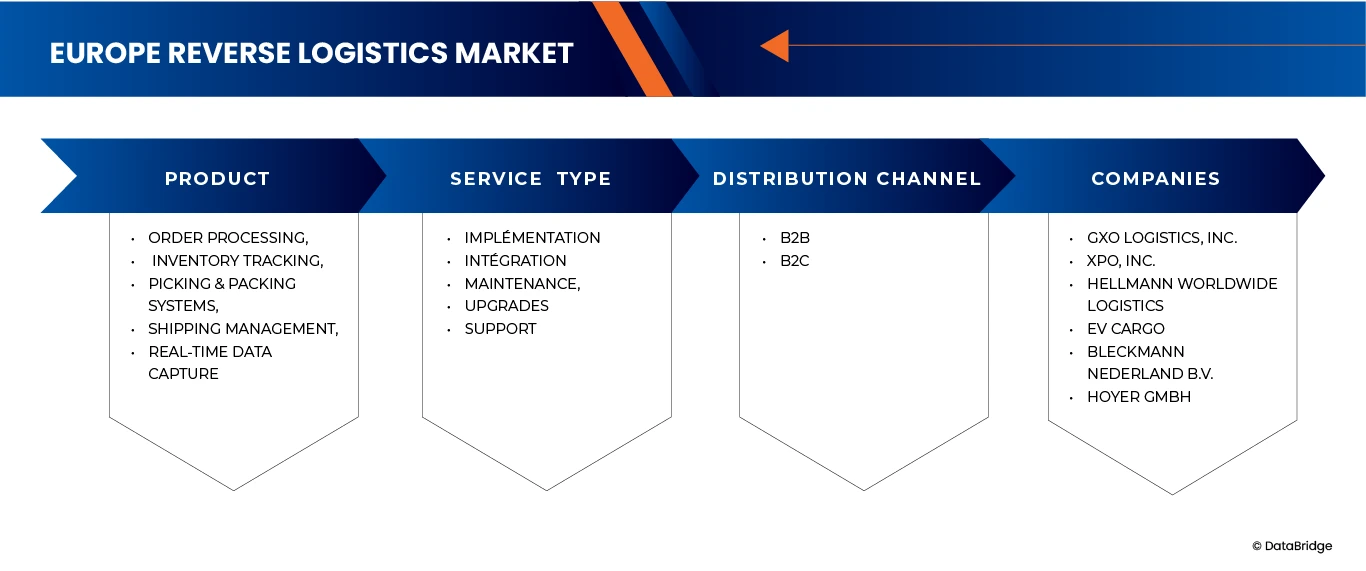

The Europe Reverse Logistics Market is segmented into three notable segments based on the product type, Service Type and Distribution Channel.

• By Product Type

On the basis of product type, Europe Reverse Logistics market has been segmented into Semiconductor & Electronics Equipment, Automotive Components & EV Charging Equipment, Medical & Healthcare Equipment, Industrial Power Supplies, Automation & Robotics Equipment. In 2026, Semiconductor & Electronics Equipment segment is expected to dominate the Europe Reverse Logistics market with 29.24%market share and is expected to reach USD 14,180,222.38 thousand by 2033, growing with the CAGR 4.9% due to the rising volume of electronic goods returns, rapid technology upgrades, and increasing regulatory pressure for responsible e-waste management. The segment benefits from high return cycles, component recovery opportunities, and strong demand for refurbishment and recycling of electronic devices across Europe.

• By Service Type

On the basis of Service Type, Europe Reverse Logistics market is segmented into Collection, Recycling, Refurbishment, Resale. In 2026, Collection segment is expected to dominate the Europe Reverse Logistics market with 35.85% market share and is expected to reach USD 17,402,815.14 thousand by 2033, growing with the CAGR of 4.9% due to the increasing need for efficient retrieval of returned, damaged, or end-of-life products. Expanding e-commerce activity, rising product recalls, and stricter EU waste-management regulations are driving investments in organized collection networks, enabling faster, cost-efficient reverse flows across industries.

- By Distribution Channel

Selon le canal de distribution, le marché européen de la logistique inverse se divise en B2B et B2C. En 2026, le segment B2B devrait dominer ce marché avec une part de 81,73 % et atteindre 41 359 939,65 milliards de dollars américains d'ici 2033, soit une croissance annuelle composée de 5,5 %. Cette croissance s'explique par le volume important de retours industriels, les programmes de récupération de composants et les services de logistique inverse contractuels proposés entre fabricants, distributeurs et prestataires de services. Les entreprises s'appuient de plus en plus sur des flux de retour structurés, des partenariats de remise à neuf et des systèmes de valorisation des actifs pour réduire les déchets, récupérer de la valeur et atteindre leurs objectifs de développement durable tout au long de la chaîne d'approvisionnement.

Analyse régionale du marché européen de la logistique inverse

- L'Europe occupe une place importante sur le marché européen de la logistique inverse, grâce à son cadre réglementaire solide, son écosystème de recyclage mature et le volume élevé de retours générés par des secteurs tels que l'électronique, l'automobile, la vente au détail et la santé.

- La région bénéficie d'infrastructures de collecte et de traitement bien établies, d'investissements croissants dans les initiatives d'économie circulaire et de directives européennes strictes qui imposent une gestion responsable des déchets, des programmes de reprise des produits et une gestion durable en fin de vie.

- La sensibilisation croissante des consommateurs, l'expansion rapide du commerce électronique et l'augmentation des taux de retour des produits dans des catégories comme les vêtements, l'électronique et les biens de consommation emballés accélèrent encore la croissance du marché en Europe.

- Les entreprises européennes adoptent de plus en plus les systèmes de tri automatisés, les plateformes de suivi numérique et les solutions de logistique inverse basées sur l'Internet des objets (IoT) pour améliorer la traçabilité, accroître la valeur de récupération et optimiser l'efficacité de la chaîne logistique inverse.

- De plus, l'accent mis sur la réduction des émissions de carbone, l'optimisation des ressources et les opérations de recyclage économes en énergie s'inscrit dans les objectifs de développement durable de l'Europe, encourageant les fabricants et les prestataires logistiques à mettre en œuvre des pratiques de logistique inverse plus écologiques et axées sur la technologie.

Analyse du marché allemand de la logistique inverse

L'Allemagne demeure le premier marché grâce à une forte pénétration du commerce électronique et à des politiques de recyclage strictes. Les taux de retour élevés dans les secteurs de la mode et de l'électronique ont incité les entreprises à investir dans des centres de logistique inverse dédiés. Par exemple, de grands détaillants en ligne exploitent des plateformes de retour automatisées dans le nord de l'Allemagne, où l'intelligence artificielle est utilisée pour catégoriser les articles en vue de leur revente, de leur remise à neuf ou de leur recyclage.

Les entreprises allemandes investissent massivement dans les technologies de tri automatisées, les systèmes d'inspection basés sur l'IA et les plateformes numériques de suivi et de traçabilité afin d'améliorer la rapidité, la précision et la transparence des processus de logistique inverse.

L'évolution vers une valorisation durable des matériaux, le strict respect des directives européennes telles que les réglementations DEEE, VHU et relatives aux déchets d'emballages, ainsi que les investissements continus en R&D dans les domaines de la robotique et de l'automatisation contribuent à l'accélération de la sophistication du marché. Les principaux acteurs nationaux et internationaux présents en Allemagne développent activement leurs capacités en matière de récupération de composants, de traitement des déchets électroniques et de reconditionnement à valeur ajoutée afin de soutenir les chaînes d'approvisionnement en boucle fermée et d'améliorer l'efficacité de l'utilisation des ressources.

Analyse du marché britannique de la logistique inverse

Le Royaume-Uni a connu une forte croissance de la logistique inverse, portée par l'essor du commerce en ligne et des politiques de retour avantageuses. Les retours de vêtements représentent une part importante de ces flux, et de nombreux détaillants ont noué des partenariats avec des prestataires externes pour la consolidation, le tri et le traitement des remboursements. Les plateformes logistiques des Midlands sont devenues des centres névralgiques du traitement des retours.

Au Royaume-Uni, les entreprises privilégient la numérisation, l'automatisation et des modèles de gestion des retours flexibles afin de gérer efficacement les flux de retours imprévisibles. La demande croissante de développement durable a accéléré les investissements dans les infrastructures de recyclage, l'automatisation des entrepôts et les pratiques de récupération des produits respectueuses de l'environnement.

Les initiatives gouvernementales promouvant l'économie circulaire et les engagements de réduction des émissions de carbone incitent les entreprises à déployer des plateformes de logistique inverse avancées, incluant des outils de suivi intelligents, des systèmes d'optimisation basés sur les données et des technologies de maintenance prédictive. Au Royaume-Uni, les principaux acteurs du secteur tirent parti de la robotique, de l'analyse en temps réel et des systèmes de gestion des retours dans le cloud pour améliorer leur productivité opérationnelle et réduire leurs coûts de manutention.

Part de marché de la logistique inverse en Europe

L'analyse concurrentielle du marché européen de la logistique inverse offre un aperçu détaillé des principaux acteurs du secteur opérant dans la région. Elle fournit des informations sur la présentation des entreprises, leur présence régionale et mondiale, leurs performances financières, la contribution des opérations de logistique inverse au chiffre d'affaires, le potentiel du marché, les investissements dans les infrastructures de recyclage et de remise à neuf, ainsi que les nouvelles initiatives visant à renforcer les pratiques d'économie circulaire.

Les principaux acteurs du marché sont :

- DB Schenker (Allemagne)

- Chaîne d'approvisionnement DHL / Deutsche Post DHL (Allemagne)

- Kuehne + Nagel (Suisse)

- GEODIS (France

- Rhenus Logistics SE & Co. KG (Allemagne)

- LOGISTEED, Ltd. (Japon)

- XPO, Inc. (États-Unis)

- GXO Logistics, Inc. (États-Unis)

- United Parcel Service of America, Inc. (États-Unis)

- Hellmann Worldwide Logistics (Allemagne)

- HOYER GmbH (Allemagne)

- Bleckmann Nederland BV (Pays-Bas)

- Asapreverse (Pays-Bas)

- Ambrogio Trasporti SPA (Italie)

- Moduslink Corporation (États-Unis)

- Transport de véhicules électriques (Royaume-Uni)

- Groupe de logistique inverse (RLG) (Allemagne)

- Nordlogway (Allemagne)

- Interzero (Allemagne)

- Taracell AG (Suisse)

Dernières évolutions du marché européen de la logistique inverse

- In October, UPS announced that it would acquire Happy Returns, a company known for its software-driven, hassle-free return system that lets customers make box-free, label-free returns at designated drop-off points. By bringing Happy Returns into its operations, UPS plans to significantly expand this convenient return network to over 12,000 locations, using both its own small-package logistics infrastructure and the extensive UPS Store network. The move strengthens UPS’s position in reverse logistics, making returns easier for consumers and more efficient for retailers.

- In January, Ambrogio Intermodal made a significant investment in its ordered 650 swap bodies and container chassis from Kässbohrer. It is depending heavily on a fleet that can handle diverse cargo types, including end-of-life materials and waste, in a cost-efficient and sustainable way. The lighter vehicles mean more cargo per trip, which reduces the number of trips required and thereby lowers emissions per unit transported.

- In October, Hellmann and SkyNet partnership covers returns management as part of their end‑to‑end cross‑border e‑commerce solution. Returns management is a core function of reverse logistics it involves handling goods coming back from customers, processing them (e.g., grading, repackaging, refunding duties), and integrating them back into the supply chain. Hellmann even provides a white‑label returns portal and supports duty refund (“Duty Drawback”) for returned items.

- November 2024, H&M selected Bleckmann to support the online launch of its Pre‑Loved Archive collection. Bleckmann carried out a renewal process grading, cleaning, invisible mending, inventory management, and product photography for used/pre‑loved garments at its Almelo DC. This restoration of second‑life items and preparing them for resale is a core reverse‑logistics activity. Bleckmann also used serialised SKUs to track each item’s repair history and status, giving transparency and control over the reverse-flowed inventory.

- In January, DHL Supply Chain acquired Inmar Supply Chain Solutions, adding 14 return centers and ~800 staff to become the largest provider of reverse logistics in North America.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 SECONDARY SOURCES

2.8 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 TREND ANALYSIS

3.1.1 BY PRODUCT

3.1.1.1 INDUSTRIAL POWER SUPPLIES

3.1.1.2 AUTOMATION & ROBOTICS EQUIPMENT

3.1.1.3 SEMICONDUCTOR & ELECTRONICS EQUIPMENT

3.1.1.4 MEDICAL & HEALTHCARE EQUIPMENT

3.1.1.5 AUTOMOTIVE COMPONENTS & EV CHARGING EQUIPMENT

3.1.2 BY SERVICE TYPE

3.1.2.1 COLLECTION

3.1.2.2 REFURBISHMENT

3.1.2.3 RECYCLING

3.1.2.4 RESALE

3.1.3 BY DISTRIBUTION CHANNEL

3.1.3.1 B2B

3.1.3.2 B2C

3.1.4 BY REGION

3.1.4.1 GERMANY

3.1.4.2 FRANCE

3.1.4.3 U.K.

3.1.4.4 POLAND

3.1.4.5 ITALY

3.1.4.6 SPAIN

3.1.4.7 RUSSIA

3.1.4.8 TURKEY

3.1.4.9 NETHERLANDS

3.1.4.10 SWITZERLAND

3.1.4.11 REST OF EUROPE

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 LIST OF KEY CONSUMERS IN THE EUROPE REVERSE LOGISTICS MARKET

4.2.1 ANALYST RECOMMENDATION – EUROPE REVERSE LOGISTICS MARKET

4.2.2 TRANSFORM REVERSE LOGISTICS INTO A VALUE-CREATION FUNCTION

4.2.3 INVEST IN DIGITAL VISIBILITY AND DATA-DRIVEN RETURNS MANAGEMENT

4.2.4 REIMAGINE RETURN POLICIES FOR PROFITABILITY AND LOYALTY

4.2.5 ALIGN WITH EU CIRCULAR ECONOMY DIRECTIVES AND REGULATORY COMPLIANCE

4.2.6 ACCELERATE GREEN REVERSE LOGISTICS AND LOW-CARBON RETURN NETWORKS

4.2.7 FORGE STRATEGIC ALLIANCES FOR SCALE AND SPECIALIZATION

4.2.8 STRATEGIC OUTLOOK

4.3 GO-TO-MARKET (GTM) STRATEGY

4.3.1 GO-TO-MARKET (GTM) STRATEGY MODEL

4.3.2 PENETRATION (NEW PRODUCT → NEW CONSUMER)

4.3.3 EXPANSION (NEW PRODUCT → EXISTING CONSUMER)

4.3.4 INNOVATION (EXISTING PRODUCT → NEW CONSUMER)

4.3.5 AGGRESSION (NEW PRODUCT → NEW CONSUMER)

4.4 COMPANY EVALUATION QUADRANT

4.5 CUSTOMERS OF REFURBISHED GOODS

4.5.1 B2C CONSUMER SEGMENTS

4.5.1.1 ECO-DRIVEN MILLENNIALS AND GENERATION Z

4.5.2 PRICE-CONSCIOUS FAMILIES SEEKING AFFORDABLE OPTIONS

4.5.2.1 FASHION-CONSCIOUS BARGAIN HUNTERS AND LUXURY RESALE CONSUMERS

4.5.3 B2B CUSTOMER SEGMENTS

4.5.3.1 WHOLESALERS PURCHASING BULK LOTS

4.5.3.2 CORPORATE BUYERS SOURCING REFURBISHED IT EQUIPMENT

4.5.3.3 RETAILERS OFFERING PRE-OWNED PRODUCT CATEGORIES

4.5.4 EXPORT BUYERS FROM AFRICA, THE MIDDLE EAST, AND EASTERN EUROPE

4.6 DEMAND & SUPPLY DRIVERS

4.6.1 GERMANY

4.6.2 FRANCE

4.6.3 UNITED KINGDOM (UK)

4.6.4 OTHERS

4.6.5 END-TO-END RETURNS MANAGEMENT PROCESS

4.6.6 STEP 1: SOURCES OF RETURNED GOODS

4.6.7 STEP 2: COLLECTION AND AGGREGATION

4.6.8 STEP 3: INSPECTION & SORTING

4.6.9 STEP 4: REFURBISHMENT AND REPAIR

4.6.10 STEP 5: REDISTRIBUTION

4.6.11 STEP 6: END CONSUMER

4.6.12 CONCLUSION

4.7 GEOGRAPHICAL FOOTPRINT

4.7.1 DOMESTIC EUROPEAN MARKETS

4.7.2 INTERNATIONAL EXPORT ROUTES

4.7.3 ROLE OF ONLINE PLATFORM IN DISTRIBUTION

4.8 MARKET ENTRY STRATEGIES

4.8.1 PARTNERSHIP-LED ENTRY WITH RETAILERS, OEMS & 3PLS–

4.8.2 BUILD A CENTRALIZED REFURBISHMENT & VALUE-RECOVERY HUB –

4.8.3 TECHNOLOGY-LED DIFFERENTIATION (AI-BASED REVERSE LOGISTICS PLATFORM)–

4.8.4 REGULATORY-LED ENTRY (COMPLIANCE-AS-A-SERVICE)–

4.8.5 SECONDARY MARKETPLACE & VALUE-RECOVERY INTEGRATION–

4.8.6 CONCLUSION

4.9 EUROPE REVERSE LOGISTICS MARKET: INDUSTRY CONTEXT AND EVOLUTION

4.9.1 INTRODUCTION:

4.9.2 REGULATORY ALIGNMENT WITH THE CIRCULAR ECONOMY FRAMEWORK

4.9.3 GROWTH OF RECOMMERCE AND CHANGING CONSUMER PERCEPTIONS

4.9.4 KEY MARKET DRIVERS

4.9.4.1 RISING E-COMMERCE RETURN VOLUMES

4.9.4.2 SUSTAINABILITY AND CARBON-NEUTRAL COMMITMENTS

4.9.4.3 EVOLVING CONSUMER ACCEPTANCE OF PRE-OWNED AND REFURBISHED GOODS

4.9.4.4 STRENGTHENING REGULATORY AND COMPLIANCE REQUIREMENTS

4.9.4.5 ECONOMIC INCENTIVES AND COST RECOVERY OPPORTUNITIES

4.9.5 REGIONAL DYNAMICS AND MAJOR MARKETS

4.9.6 CONCLUSION

4.1 INDUSTRY DYNAMICS — EUROPE REVERSE LOGISTICS MARKET

4.10.1 OVERVIEW

4.10.2 REGULATORY LANDSCAPE

4.10.3 STRUCTURAL AND OPERATIONAL DYNAMICS

4.10.4 REVERSE FLOWS TYPICALLY INCLUDE:

4.10.5 TECHNOLOGY AND DIGITALIZATION

4.10.6 COUNTRY-LEVEL DYNAMICS

4.10.7 CONCLUSION

4.11 ROI

4.12 VALUE CHAIN ANALYSIS

4.12.1 END CONSUMER (RETURN INITIATION):

4.12.2 RETURN SHIPPING

4.12.3 RETURN PROCESSED

4.12.4 MOVEMENT TO DISPOSITION

4.12.5 RECYCLE / REFURB

4.12.6 RESALE

4.12.7 END CONSUMER

4.12.8 CONCLUSION

4.13 TECHNOLOGICAL TRENDS — EUROPE REVERSE LOGISTICS MARKET

5 REGULATORY STANDARDS AND FRAMEWORK

5.1 GERMANY

5.2 FRANCE

5.3 SPAIN

5.4 ITALY

5.5 UNITED KINGDOM (UK)

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 EXPLOSION OF E-COMMERCE RETURNS AND OMNI-CHANNEL RETAILING

6.1.2 ADVANCEMENT IN REVERSE LOGISTICS SOFTWARE ECOSYSTEMS

6.1.3 RISE OF PRODUCT-AS-A-SERVICE (PAAS) AND LEASING MODELS

6.1.4 EU SUSTAINABILITY MANDATES ACCELERATING REVERSE-LOGISTICS DEPLOYMENT

6.2 RESTRAINT

6.2.1 HIGH OPERATIONAL COMPLEXITY AND COST OF REVERSE FLOWS

6.2.2 INADEQUATE DATA VISIBILITY ACROSS REVERSE-LOGISTICS NETWORKS

6.3 OPPORTUNITIES

6.3.1 GROWTH IN REFURBISHMENT, RE-COMMERCE, AND SECOND-LIFE PRODUCT PLATFORMS

6.3.2 GROWING NEED FOR SUSTAINABILITY AUDITING AND CIRCULAR SUPPLY CHAIN CONSULTING

6.3.3 SERVICE DIFFERENTIATION FOR 3PL/4PL AND PARCEL INTEGRATORS

6.4 CHALLENGES

6.4.1 CAPACITY AND CAPABILITY GAPS IN RECYCLING AND REPAIR INFRASTRUCTURE

6.4.2 MANAGING FRAUDULENT OR AVOIDABLE RETURNS IN E-COMMERCE

7 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SEMICONDUCTOR & ELECTRONICS EQUIPMENT

7.3 AUTOMOTIVE COMPONENTS & EV CHARGING EQUIPMENT

7.4 MEDICAL & HEALTHCARE EQUIPMENT

7.5 INDUSTRIAL POWER SUPPLIES

7.6 AUTOMATION & ROBOTICS EQUIPMENT

8 EUROPE REVERSE LOGISTICS MARKET, BY SERVICE TYPE

8.1 OVERVIEW

8.2 COLLECTION

8.3 RECYCLING

8.4 REFURBISHMENT

8.5 RESALE

9 EUROPE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 B2B

9.3 B2C

10 EUROPE REVERSE LOGISTICS MARKET, BY COUNTRY

10.1 OVERVIEW

10.2 EUROPE

10.2.1 GERMANY

10.2.2 U.K.

10.2.3 FRANCE

10.2.4 ITALY

10.2.5 SPAIN

10.2.6 RUSSIA

10.2.7 NETHERLANDS

10.2.8 POLAND

10.2.9 TURKEY

10.2.10 SWITZERLAND

10.2.11 REST OF EUROPE

11 EUROPE REVERSE LOGISTICS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ASAPREVERSE

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENTS

13.2 AMBROGIO TRASPORTI S.P.A.

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 BLECKMANN NEDERLAND BV

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 DHL

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 DB SCHENKER

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 EV CARGO

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 GEODIS.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 GXO LOGISTICS, INC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 HOYER GMBH

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 HELLMANN WORLDWIDE LOGISTICS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 INTERZERO.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 KUEHNE+NAGEL

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 LOGISTEED, LTD

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MODUSLINK CORPORATION (SUBSIDIARY OF STEEL PARTNERS HOLDINGS L.P.)

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 NORDLOGWAY, S.L

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 RHENUS LOGISTICS SE & CO..

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 RLG.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 TARACELL AG

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 UNITED PARCEL SERVICE OF AMERICA, INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 XPO, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 RELATED REPORTS

Liste des tableaux

TABLE 1 INNOVATION TYPES

TABLE 2 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 4 EUROPE REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 EUROPE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 6 EUROPE REVERSE LOGISTICS MARKET, BY COUNTRY, 2019-2033 (USD THOUSAND)

TABLE 7 EUROPE REVERSE LOGISTICS MARKET, BY COUNTRY, 2019-2033 (THOUSAND UNITS)

TABLE 8 EUROPE REVERSE LOGISTICS MARKET, BY COUNTRY, 2019-2033 (ASP/UNIT)

TABLE 9 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 10 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 11 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 12 EUROPE REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 13 EUROPE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 14 GERMANY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 15 GERMANY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 16 GERMANY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 17 GERMANY REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 18 GERMANY REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 19 U.K. REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 20 U.K. REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 21 U.K. REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 22 U.K. REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 23 U.K. REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 24 FRANCE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 25 FRANCE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 26 FRANCE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 27 FRANCE REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 28 FRANCE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 29 ITALY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 30 ITALY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 31 ITALY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 32 ITALY REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 33 ITALY REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 34 SPAIN REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 35 SPAIN REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 36 SPAIN REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 37 SPAIN REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 38 SPAIN REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 39 RUSSIA REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 40 RUSSIA REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 41 RUSSIA REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 42 RUSSIA REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 43 RUSSIA REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 44 NETHERLANDS REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 45 NETHERLANDS REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 46 NETHERLANDS REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 47 NETHERLANDS REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 48 NETHERLANDS REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 49 POLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 50 POLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 51 POLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 52 POLAND REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 53 POLAND REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 54 TURKEY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 55 TURKEY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 56 TURKEY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 57 TURKEY REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 58 TURKEY REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 59 SWITZERLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 60 SWITZERLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 61 SWITZERLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 62 SWITZERLAND REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 63 SWITZERLAND REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 64 REST OF EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 65 REST OF EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 66 REST OF EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 67 REST OF EUROPE REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 68 REST OF EUROPE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

Liste des figures

FIGURE 1 GLOBAL EUROPE REVERSE LOGISTICS MARKET

FIGURE 2 EUROPE REVERSE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REVERSE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REVERSE LOGISTICS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REVERSE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REVERSE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GO-TO-MARKET (GTM) STRATEGY MODEL

FIGURE 8 GO TO MARKET STRATEGY GROWTH MATRIX

FIGURE 9 COMPANY EVALUATION QUADRANT

FIGURE 10 REGIONAL BREAKDOWN OF PRODUCT CATEGORIES

FIGURE 11 REVERSE LOGISTICS SUPPLY CHAIN

FIGURE 12 THE EEA VISION FOR A CIRCULAR ECONOMY IN EUROPE

FIGURE 13 TREND IN ESG RATINGS OF COMPANIES OF THE EU STOXX 50 FROM 2019 TO 2024

FIGURE 14 KEY MATERIAL FLOW INDICATORS IN THE EU-27

FIGURE 15 EUROPE REVERSE LOGISTICS MARKET: BY PRODUCT TYPE, 2025

FIGURE 16 EUROPE REVERSE LOGISTICS MARKET: BY SERVICE TYPE, 2025

FIGURE 17 EUROPE REVERSE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 18 EUROPE REVERSE LOGISTICS MARKET: SNAPSHOT, 2025

FIGURE 19 EUROPE REVERSE LOGISTICS MARKET: COMPANY SHARE 2025 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.