Marché européen des emballages autoclavables , par type de produit (sachets, plateaux, cartons et autres), matériau (PET, polypropylène, feuille d'aluminium, polyamide (PA), papier et carton, EVOH et autres), canal de distribution (hors ligne et en ligne), utilisation finale (aliments, boissons, produits pharmaceutiques et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché

L'industrialisation et l'urbanisation ont modifié les techniques de traitement et les modes de transport des fluides, ce qui a entraîné la nécessité d' emballages en autoclave dans presque toutes les industries où les fluides jouent un rôle majeur. Par conséquent, le marché des emballages en autoclave a été stimulé par la nécessité d'une production plus sûre et d'une infrastructure adéquate.

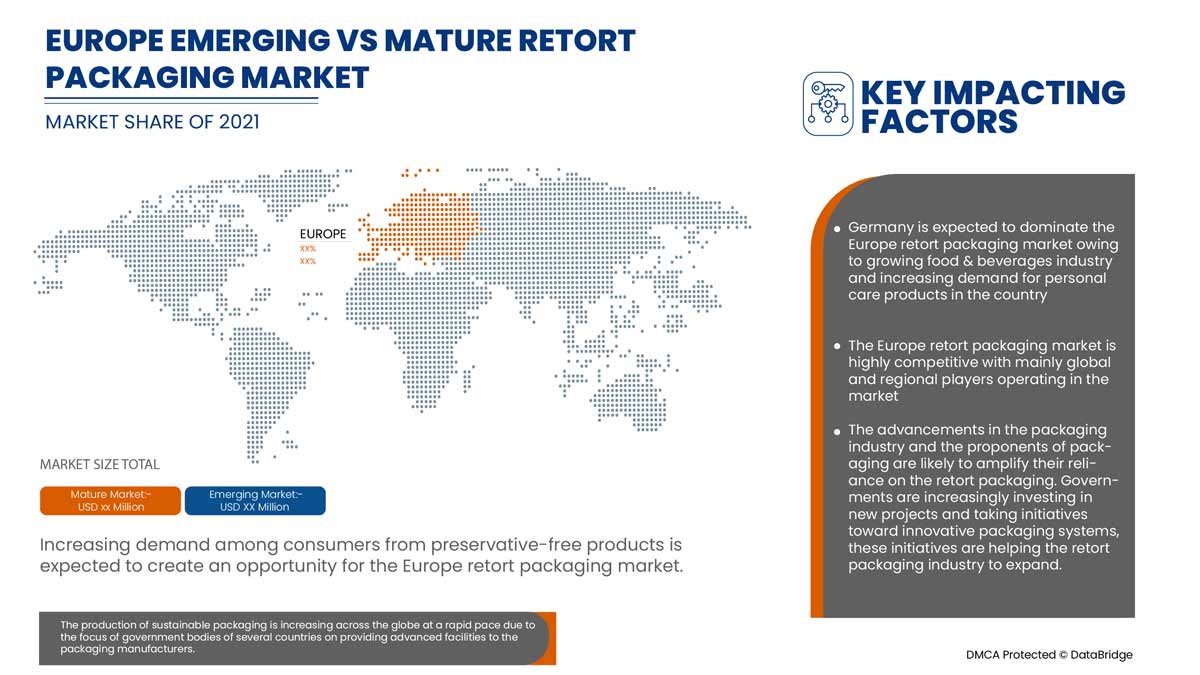

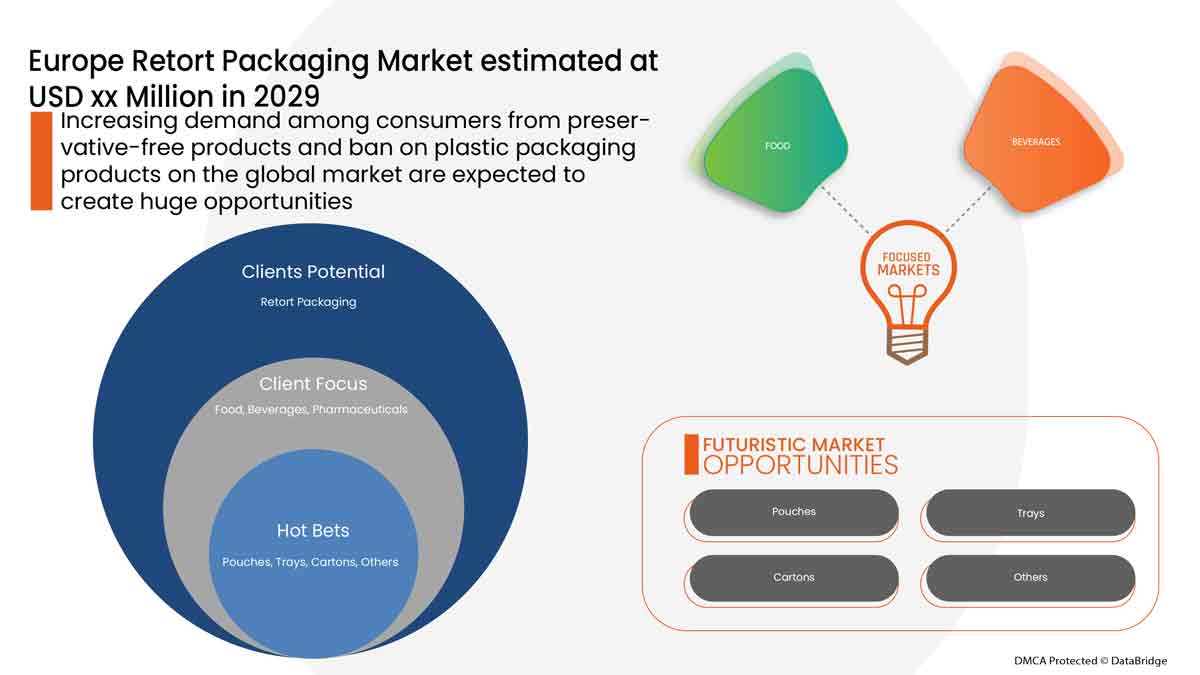

Certains des facteurs qui stimulent le marché sont la demande croissante des consommateurs pour des produits sans conservateurs, la demande croissante de solutions d'emballage durables et esthétiques et la demande croissante d'emballages intelligents pour éviter le gaspillage alimentaire. Cependant, le coût élevé associé aux activités de recherche et développement constitue un frein à la croissance du marché.

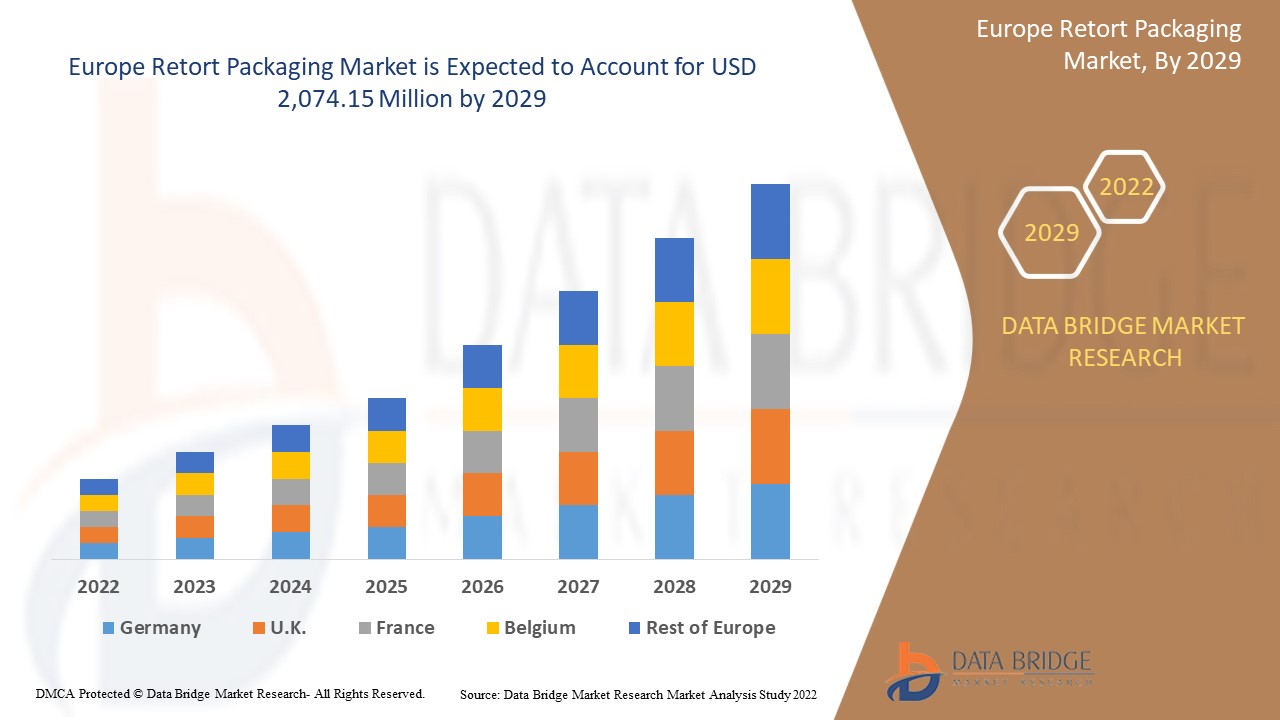

Data Bridge Market Research analyse que le marché des emballages autoclavables devrait atteindre la valeur de 2 074,15 millions USD d'ici 2029, à un TCAC de 5,6 % au cours de la période de prévision. Les « sachets » représentent le segment de type de produit le plus important sur le marché des emballages autoclavables en raison des développements rapides des voies technologiques pour commercialiser l'utilisation d'emballages conventionnels alternatifs. Le rapport sur le marché des emballages autoclavables couvre également l'analyse des prix, l'analyse des brevets et les avancées technologiques en profondeur.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de produit (sachets, barquettes, cartons et autres), par matériau (PET, polypropylène, feuille d'aluminium, polyamide (PA), papier et carton, EVOH et autres), par canal de distribution (hors ligne et en ligne), par utilisation finale (aliments, boissons, produits pharmaceutiques et autres) |

|

Pays couverts |

Royaume-Uni, Allemagne, France, Espagne, Italie, Pays-Bas, Suisse, Russie, Belgique, Turquie, Luxembourg et le reste de l'Europe, |

|

Acteurs du marché couverts |

Coveris, FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak, Clifton Packaging Group Limited, entre autres. |

Définition du marché

L'emballage stérilisable est un type d'emballage alimentaire fabriqué à partir d'un stratifié de plastique souple et de feuilles métalliques. Il permet l'emballage stérile d'une grande variété d'aliments et de boissons traités par un traitement aseptique et est utilisé comme alternative aux méthodes de mise en conserve industrielles traditionnelles. Les aliments emballés vont de l'eau aux repas entièrement cuits, thermostabilisés (traités thermiquement) et riches en calories (1 300 kcal en moyenne) comme les repas prêts à consommer (MRE), qui peuvent être consommés froids, réchauffés en les immergeant dans de l'eau chaude ou chauffés avec un réchauffeur de ration sans flamme, un composant de repas introduit pour la première fois par l'armée en 1992. Les rations de campagne, la nourriture spatiale, les produits à base de poisson, les repas de camping, les nouilles rapides et les entreprises comme Capri Sun et Tasty Bite utilisent tous des emballages stérilisables.

Au départ, les emballages en autoclave ont été développés pour des applications industrielles et pour les orgues à tuyaux. Progressivement, la conception a été adaptée dans l'industrie biopharmaceutique pour les méthodes de stérilisation en utilisant des matériaux conformes. Et maintenant, ils sont utilisés dans presque tous les secteurs pour une production sûre et une infrastructure adéquate, comme l'alimentation et les boissons, et la transformation chimique, entre autres.

Dynamique du marché des emballages stérilisés

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Demande croissante des consommateurs pour des produits sans conservateurs

Le conditionnement sous vide consiste à sceller hermétiquement des produits non stériles, ce qui signifie littéralement un emballage non stérile. L'emballage est chargé dans un récipient sous pression et soumis à de la vapeur sous pression. Le produit est également exposé à des températures élevées pendant une période beaucoup plus longue que lors du remplissage à chaud. Ce temps supplémentaire peut détériorer considérablement la qualité globale et la valeur nutritionnelle du produit.

La demande croissante des consommateurs du monde entier pour des produits sans conservateurs est un facteur clé pour le marché européen des emballages stérilisables. Les consommateurs étant de plus en plus préoccupés par les effets nocifs des conservateurs dans leurs boissons, la demande de produits sans conservateurs atteint son apogée.

- Augmentation de la demande d'emballages stérilisables par les compagnies aériennes

Récemment, les consommateurs se tournent de plus en plus vers des emballages durables et respectueux de l'environnement, ce qui a conduit à l'introduction d'emballages entièrement recyclables et de sacs à fond plat de différents modèles. En plus d'offrir des avantages environnementaux, les emballages durables peuvent également aider les entreprises à augmenter leurs profits et à éliminer les pièces de rechange de fabrication inutiles, améliorant ainsi la sécurité des lignes de production et minimisant les coûts d'élimination. L'objectif principal de l'emballage n'est pas seulement de protéger le produit contre les dommages pendant le transport, mais également de protéger l'entrepôt et les magasins de détail avant la vente du produit. Différents types d'emballages sont utilisés pour différents types de produits. En outre, l'emballage stérilisé est utilisé pour les produits alimentaires lourds et volumineux, mais également pour d'autres produits.

- Demande croissante d'emballages intelligents pour éviter le gaspillage alimentaire

Les emballages intelligents offrent diverses solutions pour réduire le gaspillage alimentaire car ils fournissent différents indicateurs pour éviter la détérioration des aliments. Ainsi, l'augmentation du gaspillage alimentaire incite les consommateurs à acheter des aliments avec des emballages intelligents.

Les emballages intelligents comprennent des indicateurs (indicateurs de temps et de température, indicateurs d'intégrité ou de gaz, indicateurs de fraîcheur), des codes-barres et des étiquettes d'identification par radiofréquence (RFID), des capteurs (biocapteurs, capteurs de gaz, capteurs d'oxygène à fluorescence), entre autres. Ainsi, les emballages intelligents aident les fabricants de produits alimentaires à suivre l'état de leurs produits alimentaires en temps réel, contribuant ainsi à réduire le gaspillage alimentaire.

En outre, les emballages intelligents peuvent également servir d'outil principal pour permettre aux consommateurs de choisir leurs produits au niveau du commerce de détail, car les concepts d'emballage intelligent peuvent permettre aux consommateurs d'évaluer la qualité des produits. Par conséquent, les emballages intelligents devraient jouer un rôle majeur pour attirer les consommateurs.

- Coût élevé associé aux activités de recherche et développement

Les dépenses de recherche et développement sont directement liées à la recherche et au développement des biens ou des services d'une entreprise et à toute propriété intellectuelle générée au cours du processus. Une entreprise engage généralement des dépenses de recherche et développement dans le cadre du processus de recherche et de création de nouveaux produits ou services.

Les entreprises d'emballage dépendent fortement de leurs capacités de recherche et développement. Elles peuvent donc accroître leurs dépenses de recherche et développement. Par exemple, elles peuvent modifier les préférences des consommateurs en passant d'emballages classiques à des emballages intelligents et actifs, ou encore accroître la sensibilisation des consommateurs à la sécurité alimentaire. Les entreprises doivent donc investir dans des activités de recherche et développement pour diversifier leurs activités et trouver de nouvelles opportunités de croissance à mesure que la technologie continue d'évoluer.

- Interdiction des emballages plastiques sur le marché européen

En raison de l'augmentation des préoccupations environnementales dans plusieurs régions, le gouvernement a pris des mesures strictes pour interdire les produits en plastique à usage unique et les emballages non biodégradables sur le marché. En effet, les produits en plastique mettent plus de temps à se décomposer et sont dangereux pour les animaux aquatiques et terrestres.

Par exemple,

L'environnement naturel estime qu'environ 100 000 tortues de mer et autres animaux marins meurent chaque année parce qu'ils s'étranglent dans des sacs ou les confondent avec de la nourriture.

En Amérique du Nord, les sacs en plastique à usage unique utilisés pour l'emballage des produits alimentaires et des biens de consommation sont interdits. Par conséquent, la demande en carton et en emballages stérilisables augmente dans la région.

Différents types d'emballages sont utilisés dans différentes applications, ce qui entraîne la production de déchets et est très nocif pour l'environnement. Les emballages en plastique sont utilisés pour les emballages de biens de consommation, ce qui produit des déchets d'emballage en plastique non biodégradables, libère des gaz toxiques dans le sol, ce qui est dangereux pour les animaux et les eaux souterraines. Par conséquent, des mesures ont été prises pour interdire les emballages en sacs plastiques car ils sont nocifs pour l'environnement.

- Perturbation de la chaîne d'approvisionnement en raison de la pandémie

La COVID-19 a perturbé la chaîne d'approvisionnement et a fait décliner les marchés des emballages stérilisables dans le monde entier. Les perturbations ont entraîné un retard dans les stocks de produits ainsi qu'une diminution de l'accès et de l'approvisionnement en produits alimentaires et en boissons. Avec la persistance persistante de la COVID-19, des restrictions ont été imposées sur le transport, l'importation et l'exportation de matériaux. De plus, avec la restriction des déplacements des travailleurs, la fabrication d'emballages stérilisables a été affectée, ce qui n'a pas permis de satisfaire la demande des consommateurs. De plus, avec les restrictions à l'importation et à l'exportation, il est devenu difficile pour les fabricants de fournir les matières premières et leurs produits finis dans les pays du monde, ce qui a également eu un impact sur les prix des emballages stérilisables. Ainsi, avec les restrictions en cours dues à la COVID-19, la chaîne d'approvisionnement des emballages stérilisables a été perturbée, ce qui constitue un défi majeur pour les fabricants.

Avec la persistance du COVID-19 et les restrictions de mouvement, il y a une perturbation de la chaîne d'approvisionnement qui pose un défi majeur pour le marché européen des emballages autoclavables.

Impact post-COVID-19 sur le marché des emballages stérilisables

La COVID-19 a eu un impact majeur sur le marché des emballages stérilisables, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui font face à cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

En raison de l'apparition de la pandémie causée par le virus, de nombreux petits secteurs ont été fermés et d'autre part, certains secteurs ont décidé de licencier certains de leurs employés, ce qui a entraîné un chômage majeur. Les emballages autoclavables sont également utilisés dans l'emballage de produits ainsi que dans les industries. En raison de l'apparition d'une pandémie, la demande pour ces produits a augmenté dans une certaine mesure, en particulier pour le secteur médical, les soins de santé, les produits pharmaceutiques, l'épicerie, le commerce électronique et divers autres secteurs. Mais la demande inattendue, ainsi que les capacités de production limitées et les interruptions de la chaîne d'approvisionnement continuent de causer des difficultés dans toutes ces industries.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans l'emballage sous vide. Grâce à cela, les entreprises mettront sur le marché des contrôleurs avancés et précis. En outre, l'utilisation d'emballages sous vide par les autorités gouvernementales dans les aliments et les boissons a entraîné la croissance du marché.

Développement récent

- En février 2022, Tetra Pak investit dans quatre nouvelles installations de recyclage, permettant au recyclage mondial des emballages de dépasser les cinquante milliards par an. Tetra Pak a co-investi plus de 11,5 millions d'euros avec des recycleurs et des acteurs du secteur, pour aider à mettre en place quatre solutions de recyclage entièrement nouvelles pour les emballages en Turquie, en Arabie saoudite, en Ukraine et en Australie. Cet investissement contribue à améliorer le portefeuille de produits et la présence mondiale de l'entreprise.

- En avril 2022, Amcor lance des emballages plus durables pour les produits pharmaceutiques. De nouveaux laminés High Shield plus durables viennent enrichir son portefeuille d'emballages pharmaceutiques. Les nouvelles options d'emballage à faible teneur en carbone et recyclables répondent à deux objectifs : répondre aux exigences élevées en matière de barrière et de performance nécessaires à l'industrie tout en soutenant les programmes de recyclabilité des sociétés pharmaceutiques. Ces nouveaux lancements contribueront à élargir le portefeuille de produits et les bénéfices. Ils renforceront encore la présence mondiale de l'entreprise.

Portée du marché européen des emballages autoclavables

Le marché des emballages autoclavables est segmenté en fonction du type de produit, du matériau, du canal de distribution et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Plateaux

- Pochettes

- Cartons

- Autres

Sur la base du type de produit, le marché européen des emballages autoclavables est segmenté en plateaux, sachets, cartons et autres.

Matériel

- ANIMAL DE COMPAGNIE

- Polypropylène

- Feuille d'aluminium

- Polyamide (PA)

- Papier et carton

- EVOH

- Autres

Sur la base du matériau, le marché européen des emballages autoclavables a été segmenté en PET, polypropylène, feuille d'aluminium, polyamide (PA), papier et carton, EVOH et autres.

Canal de distribution

- Hors ligne

- En ligne

Sur la base du canal de distribution, le marché européen des emballages autoclaves a été segmenté en hors ligne et en ligne.

Utilisation finale

- Nourriture

- Boissons

- Médicaments

- Autres

Sur la base de l'utilisation finale, le marché européen des emballages autoclavables a été segmenté en aliments, boissons, produits pharmaceutiques et autres.

Analyse/perspectives régionales du marché des emballages stérilisés

Le marché des emballages autoclavables est analysé et des informations et tendances sur la taille du marché sont fournies par type de produit, matériau, canal de distribution et industrie d’utilisation finale, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des emballages autoclaves sont le Royaume-Uni, l'Allemagne, la France, l'Espagne, l'Italie, les Pays-Bas, la Suisse, la Russie, la Belgique, la Turquie, le Luxembourg et le reste de l'Europe,

L'Allemagne domine le marché européen des emballages stérilisables, en raison de l'augmentation des investissements pour la croissance des emballages stérilisables. En outre, la demande dans cette région devrait être stimulée par l'augmentation de la demande d'emballages stérilisables dans le secteur des aliments et des boissons.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des emballages autoclavables

Le paysage concurrentiel du marché des emballages stérilisables fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des emballages stérilisables.

Certains des principaux acteurs opérant sur le marché de l'emballage sous vide sont Coveris, FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak, Clifton Packaging Group Limited, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 introduction

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE RETORT PACKAGING MARKET

1.4 Currency and Pricing

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 geographicAL scope

2.3 years considered for the study

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 primary interviews with key opinion leaders

2.6 DBMR MARKET POSITION GRID

2.7 vendor share analysis

2.8 Multivariate Modeling

2.9 PRODUCT type timeline curve

2.1 MARKET APPLICATION COVERAGE GRID

2.11 secondary sourcEs

2.12 assumptions

3 EXECUTIVE SUMMARY

4 premium insights

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1.1 overview

4.1.2 development of advanced smart packaging products

4.1.3 temperature balancing smart packaging

4.1.4 smart packaging to improve consumer safety

4.2 regulations

4.2.1 overview

4.2.2 Food and Drug Administration

4.2.3 european Food Packaging Regulations

4.2.4 Food Safety and Standards Authority of India (FSSAI)

4.3 EMERGING TREND

4.4 PRICE TREND ANALYSIS

4.5 production consumption analysis

4.6 import-export scenario

4.7 porter’s five force analysis

4.8 SUPPLIER OVERVIEW

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 market overview

5.1 drivers

5.1.1 increasing demand among consumers for preservative-free products

5.1.2 rising demand for sustainable and aesthetic packaging solutions

5.1.3 growing demand for intelligent packaging to avoid food wastage

5.1.4 growing consumption of packaged products

5.2 restraints

5.2.1 high costS associated with research and development activities

5.2.2 availability of ALTERNATIVES IN THE MARKET

5.3 opportunities

5.3.1 ban on plastic packaging products in the Europe market

5.3.2 recent innovation and new product launches

5.3.3 increasing cases of food contamination

5.4 challenge

5.4.1 supply chain disruption due to pandemic

6 EUROPE Retort packaging market, BY product type

6.1 overview

6.2 Pouches

6.2.1 STAND-UP-POUCHES

6.2.2 GUSSETED POUCHES

6.2.3 BACK-SEAL QUAD

6.2.4 SPOUTED POUCHES

6.3 Trays

6.4 cartons

6.5 others

7 EUROPE Retort packaging market, BY Material

7.1 overview

7.2 PET

7.3 Polypropylene

7.4 ALUMINIUM Foil

7.5 Polyamide (PA)

7.6 Paper & Paperboard

7.7 EVOH

7.8 Others

8 EUROPE Retort packaging market, BY Distribution channel

8.1 overview

8.2 Offline

8.3 Online

9 EUROPE Retort packaging market, BY End-Use

9.1 overview

9.2 Food

9.2.1 Ready to Eat Meals

9.2.2 Meat, Poultry, & Sea Food

9.2.3 Pet Food

9.2.4 Baby Food

9.2.5 Soups & Sauces

9.2.6 Spices & Condiments

9.2.7 Others

9.3 Beverages

9.3.1 NON-ALCOHOLIC

9.3.2 Alcoholic

9.4 Pharmaceuticals

9.5 Others

10 Europe Retort packaging Market, by REGION

10.1 Europe

10.1.1 GERMANY

10.1.2 ITALY

10.1.3 FRANCE

10.1.4 SPAIN

10.1.5 U.K.

10.1.6 RUSSIA

10.1.7 BELGIUM

10.1.8 SWITZERLAND

10.1.9 NETHERLANDS

10.1.10 TURKEY

10.1.11 LUXEMBURG

10.1.12 REST OF EUROPE

11 EUROPE Retort packaging market: COMPANY landscape

11.1 company share analysis: EUROPE

12 swot analysis

13 company profile

13.1 Tetra Pak

13.1.1 COMPANY snapshot

13.1.2 company share analysis

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 Sealed Air

13.2.1 COMPANY snapshot

13.2.2 REVENUE ANALYSIS

13.2.3 company share analysis

13.2.4 Product PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 Sonoco Products Company

13.3.1 COMPANY snapshot

13.3.2 REVENUE ANALYSIS

13.3.3 company share analysis

13.3.4 Product PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 proampac

13.4.1 COMPANY snapshot

13.4.2 company share analysis

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 Amcor plc

13.5.1 COMPANY snapshot

13.5.2 REVENUE ANALYSIS

13.5.3 company share analysis

13.5.4 Product PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 berry Europe inc.

13.6.1 COMPANY snapshot

13.6.2 COMPANY snapshot

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 Clifton Packaging Group Limited

13.7.1 COMPANY snapshot

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 Constantia Flexibles

13.8.1 COMPANY snapshot

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 coveris

13.9.1 COMPANY snapshot

13.9.2 RODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DNP America, LLC.

13.10.1 COMPANY snapshot

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 flair flexible packaging corporation

13.11.1 COMPANY snapshot

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 Floeter India Retort Pouches (P) Ltd

13.12.1 COMPANY snapshot

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 Huhtamaki

13.13.1 COMPANY snapshot

13.13.2 REVENUE ANALYSIS

13.13.3 Product PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 impak corporation

13.14.1 COMPANY snapshot

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LD PACKAGING CO .,LTD

13.15.1 COMPANY snapshot

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 Mondi

13.16.1 COMPANY snapshot

13.16.2 REVENUE ANALYSIS

13.16.3 Product PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 Paharpur 3P

13.17.1 COMPANY snapshot

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 portco packaging

13.18.1 COMPANY snapshot

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 Printpack

13.19.1 COMPANY snapshot

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 WINPAK LTD.

13.20.1 COMPANY snapshot

13.20.2 REVENUE ANALYSIS

13.20.3 Product PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 questionnaire

15 related reports

Liste des tableaux

TABLE 1 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 3 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 5 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 8 EUROPE CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 10 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 12 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 14 EUROPE PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 16 EUROPE POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 18 EUROPE ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 20 EUROPE POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 22 EUROPE PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 24 EUROPE EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 26 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 28 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 30 EUROPE OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 32 EUROPE ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 34 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 36 EUROPE FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 38 EUROPE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 41 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 44 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 46 EUROPE RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 EUROPE RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 48 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 53 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 55 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 56 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 57 EUROPE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 GERMANY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 GERMANY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 61 GERMANY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 GERMANY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 63 GERMANY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 64 GERMANY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 GERMANY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 66 GERMANY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 67 GERMANY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 68 GERMANY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 GERMANY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 70 ITALY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 ITALY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 72 ITALY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 ITALY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 ITALY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 75 ITALY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 ITALY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 77 ITALY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 78 ITALY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 79 ITALY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 80 ITALY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 FRANCE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 83 FRANCE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 85 FRANCE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 86 FRANCE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 FRANCE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 88 FRANCE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 89 FRANCE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 90 FRANCE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 FRANCE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 SPAIN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SPAIN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 94 SPAIN POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 SPAIN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 SPAIN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 97 SPAIN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 SPAIN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 99 SPAIN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 101 SPAIN FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 103 U.K. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.K. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 105 U.K. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.K. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 U.K. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 108 U.K. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 U.K. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 110 U.K. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 111 U.K. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 112 U.K. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 113 U.K. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 116 RUSSIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 119 RUSSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 RUSSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 121 RUSSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 123 RUSSIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 125 BELGIUM RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 BELGIUM RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 127 BELGIUM POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 BELGIUM RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 129 BELGIUM RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 130 BELGIUM RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 BELGIUM RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 132 BELGIUM RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 133 BELGIUM RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 134 BELGIUM FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 135 BELGIUM BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 136 SWITZERLAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 SWITZERLAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 138 SWITZERLAND POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 SWITZERLAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 140 SWITZERLAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 141 SWITZERLAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 SWITZERLAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 143 SWITZERLAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 144 SWITZERLAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 145 SWITZERLAND FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 146 SWITZERLAND BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 149 NETHERLANDS POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 152 NETHERLANDS RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 NETHERLANDS RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 154 NETHERLANDS RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 156 NETHERLANDS FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 158 TURKEY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 TURKEY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 160 TURKEY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 TURKEY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 162 TURKEY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 163 TURKEY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 164 TURKEY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 165 TURKEY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 167 TURKEY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 168 TURKEY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 169 LUXEMBURG RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 LUXEMBURG RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 171 LUXEMBURG POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 LUXEMBURG RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 173 LUXEMBURG RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 174 LUXEMBURG RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 LUXEMBURG RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 176 LUXEMBURG RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 177 LUXEMBURG RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 178 LUXEMBURG FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 179 LUXEMBURG BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 180 REST OF EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 181 REST OF EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

Liste des figures

FIGURE 1 EUROPE RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE RETORT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE RETORT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE RETORT PACKAGING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE RETORT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE RETORT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE RETORT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE RETORT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE RETORT PACKAGING MARKET: END-USE COVERAGE GRID

FIGURE 10 EUROPE RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS IS EXPECTED TO DRIVE THE EUROPE RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 POUCHES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE RETORT PACKAGING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE EUROPE RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF EUROPE RETROT PACKAGING MARKET

FIGURE 15 THE BELOW PIE CHART SHOWS THE RESULT OF FOODBORNE OUTBREAKS IN 2018

FIGURE 16 EUROPE RETORT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 EUROPE RETORT PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 18 EUROPE RETORT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 EUROPE RETORT PACKAGING MARKET: BY END-USE, 2021

FIGURE 20 EUROPE RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 25 EUROPE RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.