Europe Refractive Surgery Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

422.98 Million

USD

746.40 Million

2021

2029

USD

422.98 Million

USD

746.40 Million

2021

2029

| 2022 –2029 | |

| USD 422.98 Million | |

| USD 746.40 Million | |

|

|

|

Marché européen des dispositifs de chirurgie réfractive , par type de produit (laser, lentille intraoculaire phaque (IOL), aberromètre/aberrométrie de front d'onde, instruments et accessoires chirurgicaux, kits de chirurgie réfractive, diamètres pupillaires, épikératomes, microkératomes, thermokératoplastie, kits d'incision de relaxation limbique et autres), type de chirurgie (LASIK (kératomileusis in situ au laser, kératectomie photoréfractive (PRK), lentilles intraoculaires phaques (IOL), kératotomie astigmatique (AK), kératoplastie lamellaire automatisée (ALK), anneau intracornéen (INTACS), kératoplastie thermique au laser (LTK), kératoplastie conductrice (CK), kératotomie radiale (RK) et autres), application (myopie (myopie), hypermétropie (hypermétropie), astigmatisme et presbytie), utilisateur final (hôpitaux, spécialité) Cliniques, centres de chirurgie ambulatoire et autres, canaux de distribution (appels d'offres directs, distributeurs tiers et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Définition et perspectives du marché

Les appareils de chirurgie réfractive sont utilisés pour améliorer ou corriger les défauts de réfraction tels que la myopie, l'hypermétropie, la presbytie ou l'astigmatisme. Ces appareils comprennent les lasers excimer, les lasers YAG, les microkératomes et les lasers femtosecondes. Les chirurgies réfractives réduisent considérablement la dépendance aux lunettes ou aux lentilles de contact. Divers appareils réfractifs sont utilisés sur le marché pour traiter les défauts de vision.

Les erreurs de réfraction sont causées par une forme incorrecte de la cornée ou des globes oculaires. La chirurgie réfractive consiste à remodeler les globes oculaires ou la cornée à l'aide de divers dispositifs de chirurgie réfractive tels que des lasers avancés, des traitements LASIK, une kératectomie photoréfractive et diverses lentilles telles que des lentilles intraoculaires phaques et des lentilles intraoculaires toriques.

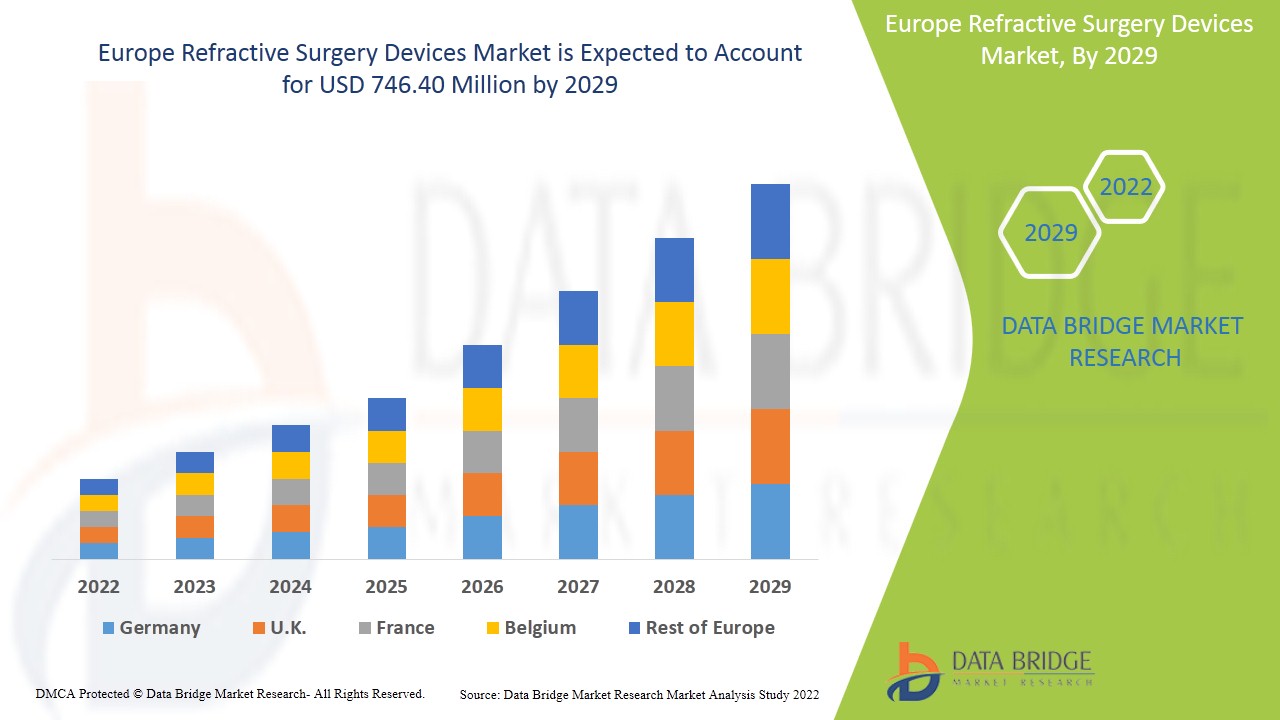

Le marché des dispositifs de chirurgie réfractive devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,6 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 746,40 millions USD d'ici 2029 contre 422,98 millions USD en 2021.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (laser, lentille intraoculaire phaque (IOL), aberromètres/aberrométrie de front d'onde, instruments et accessoires chirurgicaux, kits de chirurgie réfractive, appareils de mesure du diamètre pupillaire, épikératomes, microkératomes, thermokératoplastie, kits d'incision de relaxation limbique et autres), type de chirurgie (LASIK (kératomileusis in situ au laser, kératectomie photoréfractive (PRK), lentilles intraoculaires phaques (IOL), kératotomie astigmatique (AK), kératoplastie lamellaire automatisée (ALK), anneau intracornéen (INTACS), kératoplastie thermique au laser (LTK), kératoplastie conductrice (CK), kératotomie radiale (RK) et autres), application (myopie, hypermétropie, astigmatisme et presbytie), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire) et autres), canal de distribution (appel d'offres direct, distributeurs tiers et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Pays-Bas, Russie, Suisse, Belgique, Turquie, Autriche, Norvège, Hongrie, Lituanie, Irlande, Pologne Reste de l'Europe |

|

Acteurs du marché couverts |

Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (une filiale de Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, entre autres |

La dynamique du marché des dispositifs de chirurgie réfractive comprend

Conducteurs

- Augmentation du progrès technologique

L'accélération du développement technologique dans le secteur de la santé a considérablement augmenté au cours des dernières années. Les progrès de la technologie des appareils de chirurgie réfractive permettent un traitement indolore et simple lors de la gestion d'une maladie. De plus, l'innovation et la mise à niveau de divers appareils de chirurgie réfractive contribuent à un résultat précis et rapide du diagnostic de la maladie. L'innovation dans les appareils de chirurgie réfractive permet également la rentabilité des outils thérapeutiques basés sur la technologie lors du traitement de la maladie.

Par exemple,

- Selon Contoura Vision India, la chirurgie oculaire Contoura est la dernière avancée en matière de chirurgie oculaire dans le domaine de l'élimination des lunettes. Il s'agit de l'une des avancées technologiques les plus sûres en matière de chirurgie oculaire, qui corrige non seulement la puissance des lunettes, mais également les irrégularités cornéennes.

- Selon l'organisation Eye and Laser Centre, en mai 2017, il a été découvert que la technologie laser femtoseconde Visumax est l'un des traitements chirurgicaux réfractifs les plus avancés. Elle est capable de traiter les défauts visuels des yeux

Les progrès technologiques croissants dans divers dispositifs de chirurgie réfractive, tels que les progrès dans le balayage à spot variable au laser, devraient stimuler le marché des dispositifs de chirurgie réfractive. Par conséquent, l'innovation croissante et les progrès technologiques dans les dispositifs de chirurgie réfractive devraient soutenir la croissance du marché au cours de la période de prévision.

- Hausse des dépenses de santé

Au cours de la dernière décennie, les dépenses de santé ont augmenté de manière drastique pour améliorer les services de santé aux patients. Les États-Unis sont le plus grand marché de la santé, où les dépenses totales de santé ont augmenté de manière drastique au cours des dernières années. L'objectif fondamental de la croissance des dépenses est de fournir des appareils de chirurgie réfractive appropriés, abordables et de haute qualité. Pour promouvoir une population en meilleure santé et répondre aux urgences sanitaires dans les pays développés et en développement, les organismes gouvernementaux et les organisations de santé concernés prennent l'initiative d'accélérer les dépenses de santé.

Par exemple,

- Selon l'Organisation des affaires de santé, les dépenses de santé aux États-Unis ont augmenté de 9,7 % pour atteindre 4 100 milliards de dollars en 2020, soit un rythme beaucoup plus rapide que celui observé en 2019.

- Selon le gouvernement britannique, en 2020, le gouvernement a débloqué près de 250 millions de livres sterling, soit environ 300 millions de dollars américains, pour numériser et faire progresser les soins de diagnostic dans l'ensemble du NHS (National Health Service) en utilisant les dernières technologies. Ce financement a été alloué spécifiquement aux améliorations technologiques des services de diagnostic du NHS afin de détecter et de commencer à traiter les problèmes de santé le plus tôt possible

- L'Initiative nationale de services de diagnostic gratuits a été lancée dans le cadre de la Mission nationale de santé par le gouvernement indien. Il était important de fournir des soins de santé complets et de qualité gratuitement sous un même toit. Grâce à cette initiative du gouvernement indien, plusieurs États ont essayé plusieurs modèles pour garantir la disponibilité des diagnostics dans les établissements de santé publique

L'augmentation des dépenses de santé est également bénéfique pour la croissance économique et la croissance du secteur de la santé. Elle affecte considérablement le développement de nouveaux tests de diagnostic et de nouveaux outils chirurgicaux. Par conséquent, des dépenses de santé importantes constituent un facteur favorable à la croissance du marché.

Opportunité

- Réalisations en chirurgie LASIK

Le taux de réussite ou les résultats du LASIK sont bien connus, avec des milliers d'études cliniques examinant l'acuité visuelle et la satisfaction des patients. Des recherches récentes ont montré que 99 % des patients obtiennent une vision supérieure à 20/40, et plus de 90 % obtiennent une vision de 20/20 ou plus. De plus, le LASIK affiche un taux de satisfaction des patients sans précédent de 96 %, le plus élevé de toutes les procédures électives.

Par exemple,

- Une étude de 2016 publiée dans le Journal of Cataract & Refractive Surgery a révélé que le LASIK avait un taux de satisfaction des patients de 96 %

Selon l'article « LASIK : Connaître les avantages et les risques », 2018

- Le Dr Eric Donnenfeld, ancien président de l'American Society of Cataract and Refractive Surgery, a réalisé environ 85 000 interventions au cours de ses 28 ans de carrière.

- Selon Market Scope, environ 10 millions d'Américains ont subi une chirurgie LASIK depuis que la FDA l'a approuvée pour la première fois en 1999. Environ 700 000 chirurgies LASIK sont pratiquées chaque année, mais ce chiffre est en baisse par rapport au pic de 1,4 million enregistré en 2000.

Désormais, le nombre croissant d'opérations LASIK réussies dans le monde est positivement associé au développement, à l'enregistrement et au lancement de produits. Ainsi, cela devrait stimuler le marché des dispositifs de chirurgie réfractive dans les années à venir.

- Initiatives stratégiques des acteurs du marché

L'augmentation du nombre d'erreurs de réfraction dans le monde a créé une demande accrue pour le marché des dispositifs de chirurgie réfractive. L'objectif principal est d'améliorer la gestion de la santé grâce au développement de produits et de types de chirurgie innovants pour des soins de qualité avec une application pratique. Les principaux acteurs du marché des dispositifs de chirurgie réfractive ont pris des initiatives stratégiques, qui incluent des lancements de produits, des acquisitions et bien d'autres, et devraient diriger et créer davantage d'opportunités sur le marché des dispositifs de chirurgie réfractive.

Par exemple,

- En juin 2021, Glaukos Corporation a reçu l'approbation réglementaire de la Therapeutic Goods Administration (TGA) d'Australie pour PRESERFLO MicroShunt. PRESERFLO MicroShunt vise à réduire la pression intraoculaire (PIO) dans les yeux des patients atteints de glaucome primaire à angle ouvert, où la PIO resterait incontrôlable, tout en étant le traitement médical maximal toléré et/ou lorsque la progression du glaucome nécessite une intervention chirurgicale

- En juin 2021 : Bausch & Lomb Incorporated a signé un accord avec Lochan, une société du secteur des services informatiques. Ces sociétés avaient pour objectif de développer la prochaine génération du logiciel d'aide à la décision clinique eyeTELLIGENCE de Bausch & Lomb Incorporated. En utilisant l'infrastructure cloud actuelle d'eyeTELLIGENCE, ce logiciel serait développé pour permettre aux chirurgiens de combiner sans effort tous les facteurs des procédures de chirurgie de la cataracte, de la rétine et de la réfraction afin d'améliorer l'efficacité globale de leur pratique

- En mars 2021, NIDEK a dévoilé le RT-6100 CB pour Windows, un logiciel de contrôle optionnel pour le réfracteur intelligent RT-6100 et le système de réfraction de table TS-610. Ce logiciel s'adapte aux exigences distinctes des patients et des opérateurs. De plus, le logiciel permet des réfractions qui répondent aux exigences de distanciation sociale

Ces nombreux produits stratégiques lancés et les acquisitions par les grandes entreprises du marché des dispositifs de chirurgie réfractive ont ouvert une opportunité pour les entreprises du monde entier. Ces stratégies permettent aux entreprises de renforcer leur présence sur le marché. Par conséquent, il est prévu que l'initiative stratégique soit l'occasion en or pour les acteurs du marché d'accélérer la croissance de leurs revenus sur le marché.

Défis/Restrictions

- Manque de sensibilisation et de confiance des gens quant aux avantages de la procédure

Dans de nombreux pays, la population n'est pas au courant de la chirurgie réfractive ni de ses divers avantages pour les défauts de réfraction tels que la myopie, l'astigmatisme, la presbytie et autres. Les gens ont peur de la chirurgie car elle peut entraîner des effets secondaires graves qui devraient représenter un grand défi pour le marché.

Par exemple,

- Selon l'étude de l'Institut national de la santé (NIH) de 2021, les personnes refusaient de subir une intervention chirurgicale parce qu'elles craignaient des complications et manquaient d'informations sur la procédure. De plus, l'étude a montré que 82,5 % des participants ne savaient pas que la chirurgie réfractive pouvait améliorer leur acuité visuelle en raison du manque de sensibilisation

- Selon l’étude réalisée par l’International Journal of Medicine in Developing Countries en 2019, il a été déclaré que-

- 32,2 % du total des participants pensaient que la chirurgie réfractive était dangereuse et 9,5 % pensaient qu'elle entraînait des complications avancées

- En outre, l’étude menée en Inde a montré que 64 % des participants ne savaient pas que la chirurgie réfractive pouvait améliorer leur vision.

Le manque de sensibilisation aux avantages de la chirurgie réfractive et la peur des complications chirurgicales devraient constituer un défi majeur pour la croissance du marché.

- Manque d'établissements de santé pour le traitement des yeux

Les populations pauvres des pays à revenu faible et intermédiaire souffrent davantage de cécité et de troubles ophtalmiques que les populations plus aisées. Les progrès et les plans stratégiques adoptés dans les pays développés ne sont pas mis en œuvre de la même manière dans les pays à faible revenu. De nombreux pays à faible revenu s'appuient généralement sur des agents de santé communautaires, des assistants médicaux et des chirurgiens de la cataracte pour leurs premiers soins oculaires primaires. L'ophtalmologie dans les pays à faible revenu (PFR) est très difficile en raison de ses complexités telles que les climats tropicaux, la fragilité des réseaux électriques, la médiocrité des infrastructures routières et hydrauliques, les capacités de diagnostic limitées et les options de traitement limitées.

Par exemple,

- Selon l'article « Outils de diagnostic innovants pour l'ophtalmologie dans les pays à faible revenu », le rapport 2020 indique que la prévalence de la cécité et des troubles oculaires dans les pays à revenu élevé est de 0,3 pour 1 000 personnes, mais dans les pays à faible revenu, l'estimation est de 1,5 pour 1 000. Cela montre le besoin non satisfait de soins ophtalmologiques dans les pays à faible revenu

Un autre problème majeur dans les pays à faible revenu est le manque de sensibilisation de la population aux douleurs oculaires et à d’autres troubles. De nombreuses études de recherche font état des besoins élevés des pays à faible revenu en matière de soins oculaires, et leurs besoins non satisfaits continuent de susciter l’attention de nombreuses organisations de soins de santé.

Par exemple,

- En 2014, le British Journal of Ophthalmology rapportait que le plan Vision 2020 initié par le gouvernement était encore loin d’être atteint en raison du manque d’initiatives prises ciblant les pays à revenu moyen et faible.

Par conséquent, les faibles capacités de soins de santé pour les traitements oculaires dans les pays à revenu faible et intermédiaire sont considérées comme le plus grand défi à la croissance du marché des dispositifs de chirurgie réfractive.

Impact post-COVID-19 sur le marché des dispositifs de chirurgie réfractive

Le COVID-19 a affecté le marché. Les confinements et l'isolement pendant les pandémies ont restreint les déplacements des masses. En conséquence, les dates et heures des opérations chirurgicales ont été retardées. Par conséquent, la pandémie a eu un impact négatif sur ce marché

Développement récent

- En juillet 2021, Johnson & Johnson Vision a lancé le VERITAS Vision System, un système de phacoémulsification (phaco) de nouvelle génération. Ce système a été développé pour répondre à trois domaines importants : l'efficacité du chirurgien, la sécurité du patient et le confort. Cela a permis d'élargir le portefeuille de produits de l'entreprise

Portée du marché des dispositifs de chirurgie réfractive

Le marché des dispositifs de chirurgie réfractive est segmenté en type de produit, type de chirurgie, application, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Laser

- Lentille intraoculaire phaque (LIO)

- Aberromètres / Aberrométrie de front d'onde

- Instruments et accessoires chirurgicaux

- Kits de chirurgie réfractive

- Appareils de mesure du diamètre pupillaire

- Épikératomes

- Microkératomes

- Thermokératoplastie

- Kits d'incision pour relaxation limbique

- Autres

Sur la base du type de produit, le marché des dispositifs de chirurgie réfractive est segmenté en laser, lentille intraoculaire phaque (IOL), aberromètre/aberrométrie de front d'onde, instruments et accessoires chirurgicaux, kits de chirurgie réfractive, mesureurs de diamètre pupillaire, épikératomes, microkératomes, thermokératoplastie, kits d'incision de relaxation limbique et autres.

Type de chirurgie

- Lasik (kératomileusie in situ au laser)

- Kératectomie photoréfractive (PRK)

- Lentilles intraoculaires phaques (LIO)

- Kératotomie astigmate (KA)

- Kératoplastie lamellaire automatisée (ALK)

- Anneau intracornéen (INTACS)

- Kératoplastie thermique au laser (LTK)

- Kératoplastie conductrice (CK)

- Kératotomie radiale (RK)

- Autres

Sur la base du type de chirurgie, le marché des dispositifs de chirurgie réfractive est segmenté en LASIK (kératomileusis in situ au laser), kératectomie photoréfractive (PRK), lentilles intraoculaires phaques (IOL), kératotomie astigmatique (AK), kératoplastie lamellaire automatisée (ALK), anneau intracornéen (INTACS), kératoplastie thermique au laser (LTK), kératoplastie conductrice (CK), kératotomie radiale (RK) et autres.

Application

- Myopie

- Hypermétropie

- Astigmatisme

- Presbytie

Sur la base de l'application, le marché des dispositifs de chirurgie réfractive est segmenté en myopie, hypermétropie, astigmatisme et presbytie.

Utilisateur final

- Hôpitaux

- Cliniques spécialisées

- Centres de chirurgie ambulatoire

- Autres

Sur la base de l'utilisateur final, le marché des dispositifs de chirurgie réfractive est segmenté en hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire et autres.

Canal de distribution

- Appel d'offres direct

- Distributeurs tiers

- Autres

Sur la base du canal de distribution, le marché des dispositifs de chirurgie réfractive est segmenté en appels d'offres directs, distributeurs tiers et autres.

Analyse/perspectives régionales du marché des dispositifs de chirurgie réfractive

Le marché des dispositifs de chirurgie réfractive est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de produit, type de chirurgie, application, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des dispositifs de chirurgie réfractive sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, les Pays-Bas, la Russie, la Suisse, la Belgique, la Turquie, l'Autriche, la Norvège, la Hongrie, la Lituanie, l'Irlande, la Pologne et le reste de l'Europe.

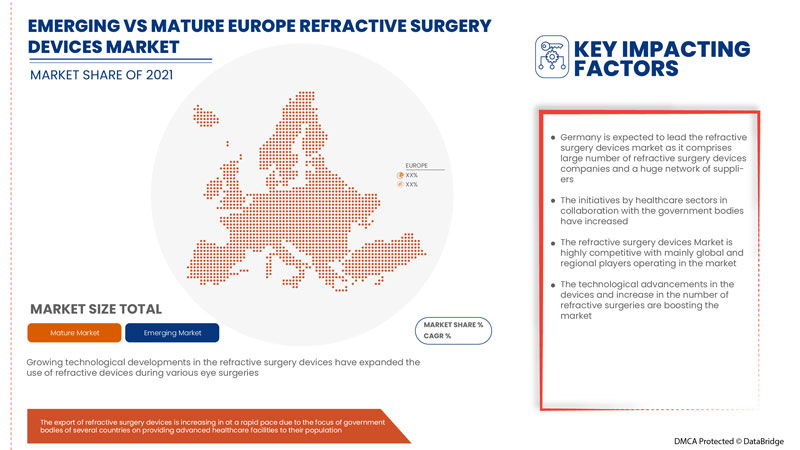

L’Allemagne devrait dominer le marché en raison de l’adoption croissante des chirurgies mini-invasives.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des dispositifs de chirurgie réfractive

Le paysage concurrentiel du marché des dispositifs de chirurgie réfractive fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des dispositifs de chirurgie réfractive.

Certaines des principales entreprises évoluant sur le marché des dispositifs de chirurgie réfractive sont Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (Une filiale de Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport aux régions et la part des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

Personnalisation disponible

Data Bridge Market Research est un leader dans la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'aux stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez pour obtenir des données dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Factbook) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE REFRACTIVE SURGERY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 EUROPE REFRACTIVE SURGERY DEVICES MARKET: REGULATIONS

4.3.1 REGULATION IN THE U.S.

4.3.2 REGULATIONS IN EUROPE

4.3.3 REGULATIONS IN SINGAPORE

4.3.4 REGULATIONS IN AUSTRALIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TECHNOLOGICAL ADVANCEMENT

5.1.2 RISE IN HEALTHCARE EXPENDITURE

5.1.3 INCREASE IN POPULATION WITH MACULAR DEGENERATION

5.1.4 RISE IN ADOPTION OF MINIMALLY INVASIVE SURGERIES

5.2 RESTRAINTS

5.2.1 STRINGENT RULES AND REGULATIONS

5.2.2 HIGH COST ASSOCIATED WITH REFRACTIVE SURGERY DEVICES

5.2.3 SIDE EFFECTS OF SURGERY

5.3 OPPORTUNITIES

5.3.1 ACHIEVEMENTS IN LASIK SURGERIES

5.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.3 INCREASING GERIATRIC POPULATION

5.3.4 EXCESSIVE USAGE OF DIGITAL DEVICES

5.4 CHALLENGES

5.4.1 DEARTH OF SKILLED PROFESSIONALS

5.4.2 LACK OF HEALTHCARE FACILITIES FOR EYE TREATMENT

6 COVID-19 IMPACT ON EUROPE REFRACTIVE SURGERY DEVICES MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY

6.4 STRATEGIC DECISIONS BY MANUFACTURERS

6.5 CONCLUSION

7 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 LASER

7.2.1 EXCIMER LASERS

7.2.2 FEMTOSECOND LASER/ULTRASHORT PULSE LASER

7.2.3 OTHERS

7.3 PHAKIC INTRAOCULAR LENS (IOL)

7.4 ABERROMETERS / WAVEFRONT ABERROMETRY

7.5 SURGICAL INSTRUMENTS & ACCESSORIES

7.6 REFRACTIVE SURGERY KITS

7.7 PUPILLARY DIAMETER METERS

7.8 EPIKERATOMES

7.9 MICROKERATOMES

7.1 THERMOKERATOPLASTY

7.11 LIMBAL RELAXING INCISION KITS

7.12 OTHERS

8 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY SURGERY TYPE

8.1 OVERVIEW

8.2 LASIK (LASER IN-SITU KERATOMILEUSIS)

8.3 PHOTOREFRACTIVE KERATECTOMY (PRK)

8.4 PHAKIC INTRAOCULAR LENSES (IOL)

8.5 ASTIGMATIC KERATOTOMY (AK)

8.6 AUTOMATED LAMELLAR KERATOPLASTY (ALK)

8.7 INTRACORNEAL RING (INTACS)

8.8 LASER THERMAL KERATOPLASTY (LTK)

8.9 CONDUCTIVE KERATOPLASTY (CK)

8.1 RADIAL KERATOTOMY (RK)

8.11 OTHERS

9 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NEARSIGHTEDNESS (MYOPIA)

9.3 FARSIGHTEDNESS (HYPEROPIA)

9.4 PRESBYOPIA

9.5 ASTIGMATISM

10 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K.

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 NETHERLANDS

12.1.7 RUSSIA

12.1.8 SWITZERLAND

12.1.9 BELGIUM

12.1.10 TURKEY

12.1.11 AUSTRIA

12.1.12 NORWAY

12.1.13 HUNGARY

12.1.14 LITHUANIA

12.1.15 IRELAND

12.1.16 POLAND

12.1.17 REST OF EUROPE

13 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 JOHNSON AND JOHNSON SERVICES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.1.5.1 PRODUCT LAUNCH

15.2 ALCON INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.2.5.1 ACQUISITION

15.2.5.2 PRODUCT LAUNCH

15.3 STAAR SURGICAL

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAUSCH + LOMB INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 ACQUISITION

15.4.5.2 CE APPROVAL

15.5 TOPCON CANADA INC., (A SUBSIDIARY OF TOPCON CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PARTNERSHIP

15.5.5.2 ACQUISITION

15.6 AAREN SCIENTIFIC INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMPLITUDE LASER

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.3.1 PARTNERSHIP

15.8 BD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.8.4.1 CONFERENCE

15.8.4.2 PRODUCT LAUNCH

15.9 GLAUKOS CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 PRODUCT LAUNCH

15.9.4.2 ACQUISITION

15.1 HOYA SURGICAL OPTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 CONFERENCE

15.11 IVIS TECHNOLOGIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LENSAR INC. (A SUBSDIARY OF PDL BIOPHARMA, INC.)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MORIA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 NIDEK CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 WEBSITE LAUNCH

15.15 OPHTEC BV

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 PRODUCT LAUNCH

15.16 RAYNER INTRAOCULAR LENSES LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.16.3.1 NEW DISTRIBUTION UNIT

15.16.3.2 ACQUISITION

15.16.3.3 ACQUISITION

15.17 REICHERT, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.17.3.1 CONFERENCE

15.18 ROWIAK GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.18.3.1 R&D FACILITY

15.19 SCHWIND EYE-TECH-SOLUTIONS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TRACEY TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 R&D FACILITY

15.21 ZIEMER OPHTHALMIC SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 AGREEMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE PHAKIC INTRAOCULAR LENS (IOL) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ABBEROMETERS/WAFEFRONT ABERROMETRY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SURGICAL INSTRUMENT & ACCESSORIES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE REFRACTIVE SURGERY KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PUPILLARY DIAMETER METERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE EPIKERATOMES IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE MICROKERATOMES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE THERMOKERATOPLASTY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE LIMBAL RELAXING INCISION KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE LASIK (LASER IN-SITU KERATOMILEUSIS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PHOTOREFRACTIVE KERATECTOMY (PRK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE PHAKIC INTRAOCULAR LENSES (IOL) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ASTIGMATIC KERATOTOMY (AK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE AUTOMATED LAMELLAR KERATOPLASTY (ALK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE INTRACORNEAL RING (INTACS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE LASER THERMAL KERATOPLASTY (LTK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE CONDUCTIVE KERATOPLASTY (CK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE RADIAL KERATOTOMY (RK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE NEARSIGHTEDNESS (MYOPIA) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE FARSIGHTEDNESS (HYPEROPIA) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE PRESBYOPIA IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ASTIGMATISM IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 EUROPE HOSPITALS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE SPECIALTY CLINICS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE AMBULATORY SURGICAL CENTERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 EUROPE DIRECT TENDER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE THIRD PARTY DISTRIBUTORS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 49 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 FRANCE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 ITALY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 67 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SPAIN LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 NETHERLANDS LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 SWITZERLAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 91 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 BELGIUM LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 97 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 TURKEY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 103 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 AUSTRIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 109 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 NORWAY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 115 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 118 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 HUNGARY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 121 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 LITHUANIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 127 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 IRELAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 133 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 135 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 POLAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 139 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 REST OF EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REFRACTIVE SURGERY DEVICES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REFRACTIVE SURGERY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE REFRACTIVE SURGERY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE REFRACTIVE SURGERY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING TECHNOLOGICAL ADVANCEMENTS IN THE REFRACTIVE SURGERY DEVICES ARE EXPECTED TO DRIVE THE EUROPE REFRACTIVE SURGERY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE REFRACTIVE SURGERY DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE REFRACTIVE SURGERY DEVICES MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR EUROPE REFRACTIVE SURGERY DEVICES MARKET

FIGURE 15 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 17 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2021

FIGURE 20 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2021

FIGURE 24 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2021

FIGURE 28 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.