Europe Pulse Protein Market

Taille du marché en milliards USD

TCAC :

%

USD

4.50 Billion

USD

7.67 Billion

2025

2033

USD

4.50 Billion

USD

7.67 Billion

2025

2033

| 2026 –2033 | |

| USD 4.50 Billion | |

| USD 7.67 Billion | |

|

|

|

|

Segmentation du marché européen des protéines de légumineuses, par source (lentilles noires, lentilles vertes, pois, haricots blancs, pois chiches, pois kaspa, haricots noirs, haricots rouges, lupins, fèves, haricots munga et autres), catégorie (biologique et conventionnelle), procédé d'extraction (traitement à sec et traitement humide), forme (isolats, concentrés et hydrolysats), fonction (solubilité, hydratation, émulsification, pouvoir moussant et autres), application (alimentation humaine et animale, produits pharmaceutiques et cosmétiques), utilisateur final (usage domestique, industrie des produits de grignotage, industrie de la farine et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché européen des protéines de légumineuses

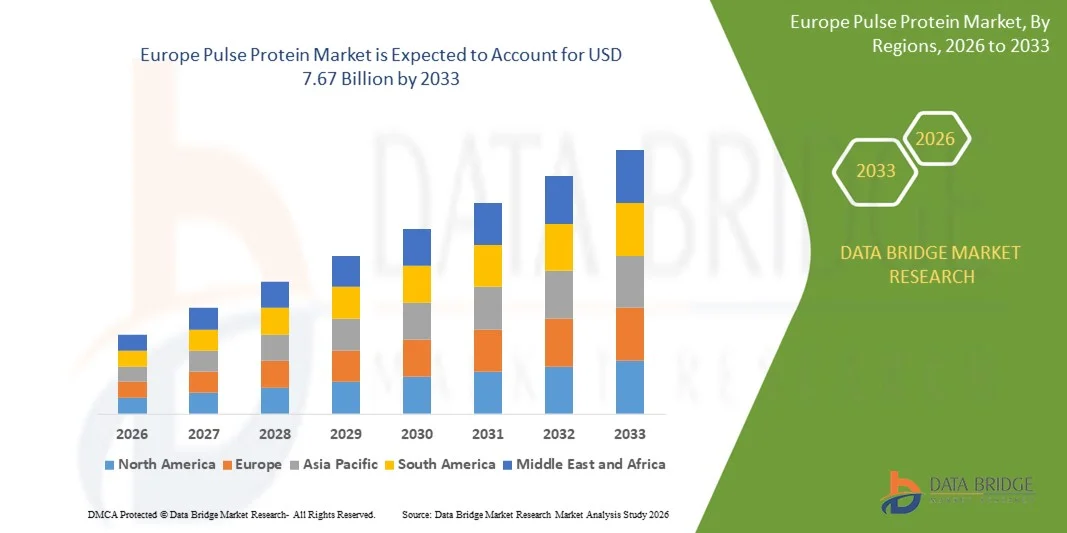

- Le marché européen des protéines de légumineuses était évalué à 4,50 milliards de dollars en 2025 et devrait atteindre 7,67 milliards de dollars d'ici 2033 , avec un TCAC de 6,9 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la préférence croissante des consommateurs pour les régimes à base de plantes et riches en protéines, elle-même motivée par une prise de conscience accrue des enjeux de santé, l'adoption croissante des modes de vie végétaliens et flexitariens, et la demande croissante de produits alimentaires fonctionnels et à étiquetage clair.

- De plus, l'utilisation croissante des protéines de légumineuses dans les produits de boulangerie, les boissons, les en-cas et les substituts de viande crée de nouvelles sources de revenus pour les fabricants de produits alimentaires. Ces tendances convergentes accélèrent l'adoption des protéines de légumineuses, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché européen des protéines de légumineuses

- Les protéines de légumineuses sont des ingrédients végétaux extraits de légumineuses telles que les pois, les pois chiches, les lentilles et les haricots. Elles sont utilisées pour améliorer la teneur en protéines, la texture et les propriétés fonctionnelles des produits alimentaires et des boissons. Elles constituent une alternative durable et sans allergènes aux protéines animales dans diverses applications.

- La demande croissante de protéines de légumineuses est principalement alimentée par le besoin accru de solutions alimentaires nutritives, végétales et durables, l'expansion du secteur de la santé et du bien-être, et l'incorporation croissante de protéines dans les aliments fonctionnels et enrichis, tant sur les marchés développés que sur les marchés émergents.

- L'Allemagne a dominé le marché des protéines de légumineuses en 2025, grâce à son industrie agroalimentaire performante, à une forte sensibilisation des consommateurs à la santé et au bien-être, et à un écosystème d'innovation de produits végétaux bien établi.

- Le Royaume-Uni devrait être le pays connaissant la croissance la plus rapide sur le marché des protéines de légumineuses au cours de la période de prévision, en raison de l'importance croissante accordée à une consommation soucieuse de la santé, à la durabilité et au respect des réglementations dans le secteur alimentaire.

- Le segment des pois a dominé le marché avec une part de 39,4 % en 2024, grâce à leur abondance, leur rendement élevé en protéines et leur goût neutre qui les rendent adaptés à de nombreuses applications alimentaires. La protéine de pois est largement utilisée dans les substituts de viande, la nutrition sportive et les alternatives végétales aux produits laitiers. Sa moindre allergénicité par rapport au soja et ses propriétés fonctionnelles supérieures, telles que la solubilité et l'émulsification, en font un ingrédient de choix pour les industriels de l'agroalimentaire. Son utilisation importante dans les boissons et les substituts de viande à base de plantes confirme sa position dominante.

Portée du rapport et segmentation du marché des protéines de légumineuses

|

Attributs |

Principales informations sur le marché des protéines de légumineuses |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché européen des protéines de légumineuses

Demande croissante de protéines végétales

- Le marché des protéines de légumineuses connaît une forte expansion, les consommateurs se tournant vers une alimentation végétale en raison de préoccupations croissantes liées à la santé, au développement durable et à l'éthique alimentaire. Les fabricants de produits alimentaires exploitent les protéines de légumineuses telles que les pois, les lentilles et les pois chiches pour formuler des alternatives à la viande, des substituts de produits laitiers et des en-cas enrichis en protéines qui séduisent un large public soucieux de sa santé.

- Par exemple, de grandes entreprises comme AGT Food and Ingredients et Ingredion ont investi dans le développement d'isolats de protéines de légumineuses polyvalents destinés à la fabrication de burgers végétaux, de barres protéinées et de laits végétaux. Des régions clés comme le Canada et l'Australie sont à la pointe de la production, contribuant ainsi au mouvement mondial en faveur d'un approvisionnement durable en protéines.

- Les innovations en matière d'extraction et de transformation favorisent l'adoption des protéines de légumineuses, améliorant leur solubilité, leur texture et leur goût pour une utilisation dans une large gamme d'aliments fonctionnels. L'augmentation du nombre de végétariens et de végétaliens, ainsi que la tendance flexitarienne, élargissent la clientèle mondiale pour les applications des protéines végétales.

- Les protéines de légumineuses sont présentées comme étant sans OGM, sans hormones ni antibiotiques et respectueuses de l'environnement grâce à une moindre utilisation des ressources que les protéines animales. Leur utilisation dans les nutraceutiques et les produits diététiques spécialisés favorise l'entrée sur de nouveaux marchés et le lancement de nouveaux produits à l'échelle mondiale.

- Le mouvement des aliments d'origine végétale, conjugué à un intérêt accru pour les étiquettes transparentes et la nutrition holistique, devrait soutenir la dynamique du marché des protéines de légumineuses. Face à l'évolution des normes réglementaires en matière d'étiquetage et de durabilité, les leaders du marché misent sur l'innovation et l'engagement des consommateurs pour maintenir leur croissance.

Dynamique du marché européen des protéines de légumineuses

Conducteur

Sensibiliser les consommateurs à la santé et au bien-être

- La sensibilisation croissante des consommateurs à la santé et au bien-être est l'un des principaux moteurs de la demande en protéines de légumineuses. Ces protéines sont riches en acides aminés essentiels, en fibres, en vitamines et en minéraux, tout en offrant des alternatives faibles en gras et sans allergènes pour les personnes souhaitant éviter les produits animaux et les allergènes courants tels que les produits laitiers et le soja.

- Par exemple, Beyond Meat promeut les protéines de pois et de lentilles dans ses substituts de repas, ses en-cas et ses compléments alimentaires pour sportifs afin de cibler les consommateurs soucieux de leur forme physique et de leur poids en Amérique du Nord et en Europe. Les bienfaits des protéines de légumineuses pour la santé cardiovasculaire et l'équilibre glycémique sont également mis en avant dans les nouveaux produits lancés sur les marchés asiatiques.

- Les recherches nutritionnelles établissant un lien entre les protéines de légumineuses et leurs bienfaits à long terme, tels que la réduction du cholestérol, la prévention du diabète et la récupération musculaire, gagnent en popularité. Un marketing transparent, sans additifs ni ingrédients artificiels, renforce la confiance des consommateurs et encourage les achats répétés.

- Les compléments alimentaires et les aliments fonctionnels connaissent une adoption rapide des protéines de légumineuses comme ingrédients principaux, contribuant ainsi à promouvoir un mode de vie sain pour tous les groupes d'âge. L'intérêt croissant pour l'enrichissement des aliments courants en protéines naturelles accélère la pénétration du marché.

- L'évolution mondiale vers une consommation axée sur le bien-être, soutenue par des initiatives politiques, l'éducation du public et la reformulation des produits par l'industrie agroalimentaire, continue de renforcer les perspectives positives du marché des protéines de légumineuses. Ceci garantit des perspectives de croissance soutenue, à mesure que de plus en plus de consommateurs intègrent des ingrédients sains d'origine végétale à leur alimentation quotidienne.

Retenue/Défi

Chaînes d'approvisionnement fluctuantes

- Le marché des protéines de légumineuses est confronté à des défis liés à la fluctuation des chaînes d'approvisionnement, qui influent sur la disponibilité des matières premières, les coûts des intrants et la constance des produits. La volatilité de la production mondiale de légumineuses, les perturbations des transports et l'évolution des politiques commerciales exercent des effets imprévisibles sur les producteurs et les marques.

- Par exemple, Cargill a connu une instabilité des prix des intrants et des pénuries ponctuelles pour les transformateurs et les fabricants de produits alimentaires en raison des tensions commerciales et des droits de douane sur les pois cassés et autres légumineuses sur des marchés d'exportation clés tels que l'Amérique du Nord, l'Europe et l'Australie.

- Les mauvaises récoltes liées aux conditions météorologiques et les obstacles agricoles régionaux, notamment en Inde et en Australie, contribuent à l'irrégularité des approvisionnements et ont des répercussions sur les prix des marchés mondiaux. Les fabricants sont contraints de diversifier leurs fournisseurs, d'investir dans le stockage ou de répercuter les coûts sur les consommateurs, ce qui met à l'épreuve l'accessibilité et la fiabilité des produits finis.

- Les variations de qualité et les différences de procédés de fabrication peuvent perturber davantage l'homogénéité de la chaîne d'approvisionnement, affectant ainsi la fonctionnalité des produits et la satisfaction des clients. L'évolution constante des enjeux de durabilité et de la réglementation, notamment en matière d'étiquetage et de sécurité alimentaire, exige une adaptation continue des fournisseurs.

- En conclusion, la fluctuation des chaînes d'approvisionnement demeure un défi majeur pour le secteur des protéines de légumineuses. La poursuite des investissements dans des stratégies d'approvisionnement résilientes, la transparence des chaînes d'approvisionnement et des pratiques agricoles durables sera essentielle pour assurer la croissance future et la stabilité du marché dans ce segment dynamique.

Portée du marché européen des protéines de légumineuses

Le marché est segmenté en fonction des sources, de la catégorie, du procédé d'extraction, de la forme, de la fonction, de l'application et de l'utilisateur final.

- Par les sources

D'après les sources, le marché est segmenté en lentilles noires, lentilles vertes, pois, haricots blancs, pois chiches, pois kaspa, haricots noirs, haricots rouges, lupins, fèves, haricots munga et autres. Les pois représentaient la plus grande part de revenus (39,4 %) en 2024, grâce à leur abondance, leur teneur élevée en protéines et leur goût neutre qui les rendent adaptés à de nombreuses applications alimentaires. La protéine de pois est largement utilisée dans les substituts de viande, la nutrition sportive et les alternatives végétales aux produits laitiers. Sa moindre allergénicité par rapport au soja et ses propriétés fonctionnelles supérieures, telles que la solubilité et l'émulsification, en font un ingrédient de choix pour les industriels de l'agroalimentaire. Son utilisation importante dans les boissons et les substituts de viande à base de plantes confirme sa position dominante.

Le segment des pois chiches devrait enregistrer le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par leur popularité croissante dans les en-cas riches en protéines, les produits de boulangerie sans gluten et les substituts de produits laitiers. Les protéines de pois chiches offrent une valeur nutritionnelle élevée ainsi qu'un profil gustatif attrayant, ce qui les rend attrayantes pour les consommateurs soucieux de leur santé. Leur intégration dans le régime méditerranéen, combinée à leur utilisation croissante dans les mélanges protéinés et l'enrichissement des farines, contribue à la demande du marché. De plus, les innovations en cours dans le domaine des isolats et des concentrés de protéines de pois chiches devraient générer une croissance significative.

- Par catégorie

Le marché est segmenté en fonction de la catégorie, en deux sous-catégories : biologique et conventionnelle. Le segment conventionnel a dominé la part de marché en 2024, principalement grâce à sa large disponibilité et à son rapport coût-efficacité, ce qui en fait le choix privilégié pour la transformation alimentaire en grande quantité. Les protéines de légumineuses conventionnelles sont largement utilisées dans les applications alimentaires et de boissons courantes, telles que la boulangerie, les snacks et les alternatives aux produits laitiers. Leur prix abordable les rend idéales pour les fabricants souhaitant approvisionner le marché de masse. Grâce à des chaînes d'approvisionnement établies et à une qualité constante, les protéines conventionnelles continuent de dominer les applications alimentaires à grande échelle à l'échelle mondiale.

Le segment biologique devrait connaître la croissance la plus rapide entre 2025 et 2032, la sensibilisation croissante des consommateurs à la santé, au développement durable et à la nutrition naturelle favorisant les protéines sans produits chimiques. Les protéines de légumineuses certifiées biologiques sont de plus en plus utilisées dans les produits de santé haut de gamme, les aliments fonctionnels et les boissons à étiquetage clair. Sur les marchés développés, les consommateurs sont disposés à payer plus cher pour des protéines végétales biologiques. L'augmentation des investissements dans l'agriculture biologique et l'élargissement des gammes de produits biologiques par les marques alimentaires internationales contribueront significativement à la croissance de ce segment.

- Par procédé d'extraction

Selon le procédé d'extraction, le marché se divise en deux catégories : le traitement à sec et le traitement par voie humide. Le traitement à sec détenait la part de marché dominante en 2024, principalement grâce à son rapport coût-efficacité, son caractère écologique et sa capacité à préserver la teneur en fibres naturelles et en amidon des légumineuses. Cette méthode est largement utilisée dans les industries de la farine et de la boulangerie où la pureté fonctionnelle n'est pas une exigence primordiale. La réduction de la consommation d'énergie et d'eau rend également le traitement à sec avantageux pour une production durable. Il demeure un choix privilégié pour les applications à grande échelle nécessitant des ingrédients protéiques abordables.

Le segment du traitement par voie humide devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à la production d'isolats de protéines de haute pureté présentant une solubilité, une digestibilité et une polyvalence fonctionnelle améliorées. L'extraction par voie humide permet d'adapter les protéines aux boissons, aux compléments alimentaires et aux préparations pour nourrissons, pour lesquels la pureté et la qualité sont essentielles. La demande croissante d'isolats de protéines dans la nutrition sportive et les boissons végétales stimule cette croissance. De plus, les innovations technologiques dans le domaine du traitement par voie humide le rendent plus efficace et adaptable à grande échelle, favorisant ainsi son adoption.

- Par formulaire

Selon leur forme, le marché se divise en isolats, concentrés et hydrolysats. Le segment des concentrés a dominé le marché en 2024, grâce à leur profil protéique équilibré, associé à des fibres et de l'amidon, ce qui les rend particulièrement adaptés à la boulangerie, aux snacks et à l'alimentation animale. Plus économiques que les isolats, les concentrés de protéines de légumineuses bénéficient d'une utilisation plus large dans les industries agroalimentaires. Leur capacité à préserver leurs composants naturels les rend intéressants pour les produits axés sur une nutrition globale. De plus, leur polyvalence dans les snacks extrudés et l'enrichissement des farines leur assure une position dominante.

Le segment des isolats devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la demande croissante de protéines de haute pureté dans les boissons végétales, la nutrition sportive et les aliments fonctionnels. Les isolats offrent une solubilité et une digestibilité supérieures, ce qui les rend idéaux pour les préparations prêtes à consommer et les produits destinés aux sportifs. La demande d'isolats est stimulée par les consommateurs soucieux de leur alimentation, tant sur les marchés développés que sur les marchés émergents. Les innovations croissantes dans le domaine des produits laitiers végétaux et des compléments nutritionnels devraient accélérer encore davantage l'adoption des isolats.

- Par fonction

En fonction de leur fonction, le marché est segmenté en solubilité, hydratation, émulsification, pouvoir moussant et autres. Le segment de l'émulsification a dominé le marché en 2024, les protéines de légumineuses étant largement utilisées pour stabiliser les mélanges huile-eau dans les substituts de viande végétale, les alternatives aux produits laitiers, les sauces et les vinaigrettes. Leur capacité à améliorer la texture, la consistance et la sensation en bouche les rend précieuses dans les formulations de produits. Les fabricants de produits alimentaires privilégient les protéines de légumineuses pour l'émulsification en raison de leur composition naturelle et de leur absence d'allergènes. La demande croissante de stabilisants naturels dans les systèmes alimentaires soutient fortement la domination de ce segment.

La fonction de solubilité devrait connaître la croissance la plus rapide entre 2025 et 2032, avec une utilisation accrue dans les boissons protéinées, les smoothies et les préparations nutritionnelles. Une solubilité élevée garantit une dispersion homogène et une meilleure expérience utilisateur dans les applications liquides. Face à la demande croissante de boissons enrichies et de boissons hyperprotéinées, les protéines de légumineuses solubles deviennent très attractives pour les formulateurs de produits alimentaires. Par ailleurs, les progrès des technologies de transformation améliorent la solubilité des isolats, renforçant ainsi le potentiel de croissance de ce segment.

- Sur demande

En fonction de l'application, le marché est segmenté en alimentation et boissons, alimentation animale et produits pharmaceutiques, et cosmétiques. Le segment de l'alimentation et des boissons a dominé l'année 2024, grâce à l'incorporation croissante de protéines de légumineuses dans les produits de boulangerie, les alternatives aux produits laitiers, les boissons et les substituts de viande. L'essor des populations végétaliennes et flexitariennes à travers le monde incite les fabricants de produits alimentaires à intégrer les protéines végétales à leurs offres courantes. La forte croissance des aliments fonctionnels et des boissons santé contribue également à cette adoption. La large applicabilité de ces protéines à différentes catégories d'aliments renforce la position de leader de ce segment.

Le secteur des cosmétiques devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par la demande croissante d'ingrédients naturels et d'origine végétale pour les soins personnels. Les protéines de légumineuses gagnent en popularité dans les formulations de soins de la peau et des cheveux grâce à leurs propriétés hydratantes, revitalisantes et filmogènes. Elles sont de plus en plus utilisées dans les produits anti-âge et réparateurs, où les ingrédients naturels sont privilégiés. Face à l'évolution des consommateurs vers des produits de beauté durables, l'adoption des protéines de légumineuses devrait s'accélérer dans l'industrie cosmétique.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en consommation domestique, industrie des snacks, industrie de la farine et autres. Le segment de l'industrie des snacks détenait la plus grande part de marché en 2024, porté par la demande croissante des consommateurs pour des en-cas plus sains et riches en protéines. Les protéines de légumineuses sont largement utilisées dans les barres énergétiques, les snacks extrudés et les chips cuites au four, séduisant les consommateurs actifs et soucieux de leur forme. Leur haute valeur nutritionnelle et leur polyvalence permettent aux fabricants d'innover dans de nombreuses catégories de snacks. La popularité croissante des en-cas nomades contribue fortement à la position dominante de ce segment.

Le secteur de la farine devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'incorporation croissante de protéines de légumineuses dans les farines traditionnelles afin d'en améliorer la teneur en protéines et la valeur nutritionnelle. La demande croissante de farines enrichies en boulangerie, en aliments fonctionnels et en cuisine domestique stimule cette adoption. Cette tendance est également alimentée par une prise de conscience accrue des carences en protéines dans les régions en développement. Les fabricants de farine étendent ainsi l'utilisation des protéines de légumineuses pour répondre à la demande des consommateurs en aliments de base plus sains.

Analyse régionale du marché européen des protéines de légumineuses

- L'Allemagne a dominé le marché des protéines de légumineuses en 2025, avec la plus grande part de revenus, grâce à son industrie agroalimentaire performante, à une forte sensibilisation des consommateurs à la santé et au bien-être, et à un écosystème d'innovation de produits végétaux bien établi.

- L'infrastructure de chaîne d'approvisionnement bien développée du pays, la recherche et le développement de pointe dans le domaine des aliments fonctionnels et la réglementation stricte en matière de sécurité alimentaire continuent de favoriser l'adoption généralisée des protéines de légumineuses dans les compléments alimentaires, les substituts de repas et les produits alimentaires enrichis.

- L'intérêt croissant pour l'alimentation végétale, la forte demande d'alternatives riches en protéines et sans allergènes, les investissements croissants des grandes marques alimentaires et la présence d'entreprises comme Rügenwalder Mühle renforcent la position de leader de l'Allemagne. L'innovation continue dans les formulations de protéines de légumineuses, la conformité aux directives européennes en matière de nutrition et d'étiquetage, ainsi que les partenariats stratégiques avec les fabricants en aval garantissent la domination de l'Allemagne sur le marché européen des protéines de légumineuses.

Analyse du marché britannique des protéines de légumineuses

Le Royaume-Uni devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide d'Europe sur le marché des protéines de légumineuses entre 2026 et 2033, grâce à l'importance croissante accordée à une consommation responsable, au développement durable et au respect des réglementations dans le secteur agroalimentaire. Par exemple, des marques britanniques comme Marigold Health Foods intègrent de plus en plus de protéines de pois et de lentilles dans leurs aliments fonctionnels, en-cas et boissons, ce qui favorise leur adoption par les consommateurs. L'intérêt croissant pour les produits « clean label » et sans allergènes, le développement de l'offre en nutrition sportive et en substituts de repas, ainsi que la sensibilisation accrue aux régimes alimentaires à base de plantes accélèrent la croissance du marché. Un cadre réglementaire strict, des investissements dans des formulations végétales innovantes et l'alignement sur les recommandations nutritionnelles européennes et nationales en constante évolution renforcent la position du Royaume-Uni en tant que marché à la croissance la plus rapide de la région.

Analyse du marché français des protéines de légumineuses

La France devrait connaître une croissance soutenue entre 2026 et 2033, portée par l'intérêt croissant des consommateurs pour les aliments sains d'origine végétale et les ingrédients fonctionnels. L'importance accrue accordée à la qualité nutritionnelle, la modernisation des techniques de transformation des aliments et l'intégration plus large des protéines de légumineuses dans les produits de boulangerie, les alternatives aux produits laitiers et les en-cas favorisent l'expansion du marché. La collaboration entre les fabricants français et les fournisseurs internationaux, ainsi que la préférence pour des sources de protéines durables et de haute qualité, encouragent une adoption constante. L'accent mis par le pays sur l'innovation produit axée sur le bien-être, les initiatives d'économie circulaire dans la production alimentaire et le respect des normes nutritionnelles de l'UE renforcent la croissance stable de la France sur le marché européen des protéines de légumineuses.

Part de marché des protéines de légumineuses en Europe

- Ingredion (États-Unis)

- Cargill Incorporated (États-Unis)

- AGT Aliments et Ingrédients (Canada)

- ADM (États-Unis)

- ET-Chem (Chine)

- Groupe Shandong Jianyuan (Chine)

- Axiom Foods, Inc. (États-Unis)

- Kerry Group plc. (Irlande)

- Vestkorn (Norvège)

- Glanbia PLC (Irlande)

- Roquette Frères (France)

- La société Scoular (États-Unis)

- Nutriati, Inc. (États-Unis)

- DuPont (États-Unis)

- Prolupin GmbH (Allemagne)

- FENCHEM (Chine)

- PURIS (États-Unis)

- Groupe Emsland (Allemagne)

- Burcon (Canada)

- SOTEXPRO (France)

- Yantai Shuangta Food Co. (Chine)

Dernières évolutions du marché européen des protéines de légumineuses

- En juin 2025, Roquette a lancé NUTRALYS T Pea 700XC, une protéine de pois texturée à gros morceaux, contenant 70 % de protéines et présentant une haute résistance thermique. Cette innovation répond à la demande croissante de textures consistantes, proches de celles de la viande, dans les plats cuisinés, les sauces et les recettes traditionnelles d'origine végétale, facilitant ainsi la création d'alternatives attrayantes et riches en protéines pour les fabricants de produits alimentaires. Son faible besoin en hydratation et son processus de formulation simplifié optimisent la production, tout en offrant aux consommateurs une expérience sensorielle améliorée. Avec ce produit, Roquette a renforcé son portefeuille sur le marché des protéines de légumineuses, répondant ainsi à la tendance croissante des ingrédients végétaux durables et polyvalents.

- En février 2024, Roquette a enrichi sa gamme de protéines végétales NUTRALYS avec quatre protéines de pois multifonctionnelles, conçues pour améliorer le goût, la texture et les propriétés fonctionnelles des aliments et produits nutritionnels d'origine végétale. Cet élargissement permet aux fabricants de produits alimentaires d'innover et de diversifier leur offre, tout en répondant à la demande croissante des consommateurs pour des solutions végétales riches en protéines. Cette initiative renforce la position de leader de Roquette sur le marché des protéines de légumineuses, en proposant des ingrédients polyvalents adaptés aux boissons, aux produits de boulangerie et aux en-cas enrichis en protéines, répondant ainsi aux préférences changeantes des consommateurs pour des protéines naturelles et durables.

- En octobre 2022, Roquette a lancé une nouvelle gamme d'ingrédients biologiques à base de pois, notamment de l'amidon et des protéines de pois biologiques, produits dans son usine canadienne. Ce lancement répondait à la demande croissante des consommateurs pour des ingrédients biologiques et végétaux, en fournissant aux fabricants des sources de protéines durables et de haute qualité. En proposant des alternatives biologiques, Roquette a renforcé sa position concurrentielle sur le marché des protéines de légumineuses et a accompagné la transition vers des produits alimentaires plus sains et respectueux de l'environnement. Cette initiative a également permis à l'entreprise de cibler les marchés émergents où les ingrédients biologiques et naturels prennent une importance croissante.

- En juin 2022, Roquette a lancé la gamme NUTRALYS, composée de protéines texturées biologiques issues de pois et de fèves. Ce lancement stratégique a permis à Roquette d'élargir sa clientèle en proposant aux fabricants de produits alimentaires des solutions saines, durables et riches en protéines. Ce lancement répondait à l'intérêt croissant des consommateurs pour les régimes à base de plantes et les aliments fonctionnels, aidant ainsi les marques à proposer des produits riches en protéines, à la texture et à la valeur nutritionnelle améliorées. En renforçant son engagement en faveur de l'innovation végétale, Roquette a consolidé sa présence sur le marché en pleine croissance des protéines de légumineuses.

- En juin 2021, Roquette a lancé la protéine de pois texturée P6511C au salon FI Europe, positionnée comme une alternative durable à la viande. Ce produit répond à la demande croissante des consommateurs pour des aliments d'origine végétale aux profils nutritionnels complets, permettant aux fabricants de créer des produits innovants riches en protéines, à la texture et à la polyvalence améliorées. En investissant ce créneau, Roquette a renforcé sa position concurrentielle sur le marché des protéines de légumineuses et a accompagné la transition du secteur vers des ingrédients durables et fonctionnels.

- En juillet 2020, Ingredion Incorporated EMEA a lancé un amidon natif fonctionnel biologique instantané pour répondre à la demande du secteur en ingrédients végétaux polyvalents et de haute qualité. Cette innovation a permis aux fabricants de produits alimentaires et de boissons de disposer d'amidons fonctionnels adaptés aux produits « clean label » et axés sur la santé. Ce lancement a permis à Ingredion d'anticiper une hausse de ses ventes et de renforcer sa présence sur le marché des protéines de légumineuses et des ingrédients végétaux, contribuant ainsi à la tendance plus large vers des solutions alimentaires durables et enrichies en protéines.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.