Europe Preclinical Imaging Market

Taille du marché en milliards USD

TCAC :

%

USD

483.94 Million

USD

765.53 Million

2024

2032

USD

483.94 Million

USD

765.53 Million

2024

2032

| 2025 –2032 | |

| USD 483.94 Million | |

| USD 765.53 Million | |

|

|

|

|

Segmentation du marché européen de l'imagerie préclinique, par produit (systèmes et services), réactif (réactifs d'imagerie optique préclinique, réactifs d'imagerie nucléaire préclinique, agents de contraste IRM préclinique, agents de contraste échographiques précliniques et agents de contraste CT préclinique), application (recherche et développement, découverte de médicaments, biodistribution, détection de cellules cancéreuses, biomarqueurs, etc.), utilisateur final (organismes de recherche sous contrat, sociétés pharmaceutiques et biotechnologiques , instituts de recherche universitaires et gouvernementaux, centres de diagnostic, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché européen de l'imagerie préclinique

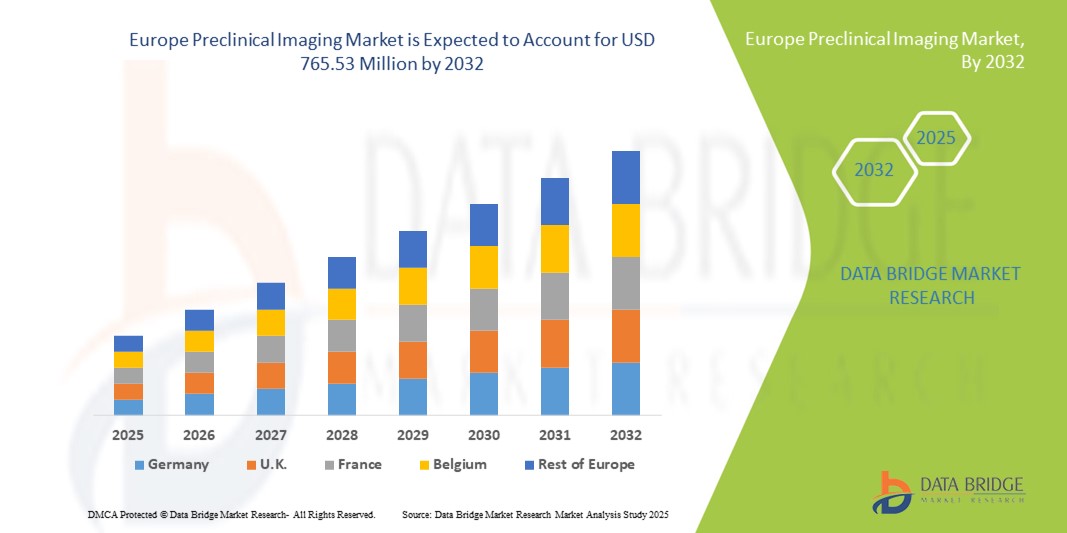

- La taille du marché européen de l'imagerie préclinique était évaluée à 483,94 millions USD en 2024 et devrait atteindre 765,53 millions USD d'ici 2032 , à un TCAC de 5,90 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante de technologies d'imagerie avancées dans la découverte et le développement de médicaments, soutenue par les progrès technologiques dans des modalités telles que la TEP, l'IRM et l'imagerie optique, conduisant à une plus grande numérisation et précision dans la recherche préclinique.

- Par ailleurs, la demande croissante de solutions d'imagerie précises, non invasives et haute résolution parmi les entreprises pharmaceutiques et biotechnologiques fait de l'imagerie préclinique un outil essentiel pour évaluer l'efficacité et la sécurité des médicaments. Ces facteurs convergents accélèrent l'adoption de ces solutions, stimulant ainsi significativement la croissance du secteur.

Analyse du marché européen de l'imagerie préclinique

- L'imagerie préclinique, impliquant des techniques de visualisation non invasives telles que le PET, le SPECT, l'IRM, le CT, l'échographie et l'imagerie optique, est une pierre angulaire de la recherche biomédicale, permettant une étude détaillée des modèles de maladies, le développement de médicaments et l'évaluation thérapeutique dans de multiples applications.

- La demande croissante d’imagerie préclinique est principalement motivée par l’augmentation des investissements dans la R&D pharmaceutique, l’importance croissante accordée à la recherche translationnelle et le besoin d’outils avancés pour évaluer la sécurité et l’efficacité des médicaments dans des modèles animaux avant les essais sur l’homme.

- L'Allemagne a dominé le marché européen de l'imagerie préclinique, avec une part de chiffre d'affaires de 34,6 % en 2024, grâce à son infrastructure de recherche de pointe, à sa forte concentration d'entreprises pharmaceutiques et biotechnologiques, et à son financement public de l'innovation dans les sciences de la vie. Le solide réseau d'institutions de recherche universitaires et les collaborations avec les leaders du secteur favorisent l'adoption de technologies d'imagerie avancées telles que l'IRM haute résolution et les systèmes hybrides TEP/IRM.

- La France devrait être le pays européen connaissant la croissance la plus rapide sur le marché de l'imagerie préclinique au cours de la période de prévision, avec un TCAC de 9,8 % entre 2025 et 2032, porté par la hausse des investissements publics dans la recherche biomédicale, le développement des réseaux de CRO et l'adoption croissante des techniques d'imagerie multimodale pour la recherche en oncologie et en neurologie. La présence croissante de centres de recherche spécialisés et l'adoption de l'analyse d'imagerie par l'IA accélèrent encore la croissance du marché dans le pays.

- Le segment des systèmes a dominé le marché avec la plus grande part de revenus de 65,4 % en 2024, principalement en raison de l'intégration généralisée de modalités d'imagerie avancées telles que la TEP, l'IRM, la TDM et l'imagerie optique dans les institutions de recherche et les sociétés pharmaceutiques.

Portée du rapport et segmentation du marché de l'imagerie préclinique

|

Attributs |

Aperçus clés du marché de l'imagerie préclinique |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché européen de l'imagerie préclinique

Des avancées améliorées grâce à l'intégration de l'imagerie multimodale

- Une tendance significative et croissante sur le marché européen de l'imagerie préclinique est l'adoption croissante de plateformes d'imagerie multimodales, combinant des modalités telles que la TEP/IRM, la TEP/TDM et la SPECT/TDM pour fournir des analyses structurales, fonctionnelles et moléculaires complémentaires au sein d'un flux de travail unique. Cette intégration permet des études précliniques plus complètes et plus précises.

- Par exemple, les systèmes PET/IRM permettent aux chercheurs de capturer des images de tissus mous à haute résolution à partir de l'IRM tout en obtenant simultanément des données métaboliques et fonctionnelles à partir de la TEP, ce qui les rend particulièrement précieux dans la recherche en oncologie et en neurologie.

- Les plateformes d'imagerie hybrides dans la recherche préclinique sont de plus en plus utilisées pour le développement de médicaments et les études translationnelles, car elles aident à corréler les processus biologiques au niveau moléculaire avec les détails anatomiques, améliorant ainsi la prévisibilité des résultats thérapeutiques.

- L'intégration de l'imagerie multimodale réduit également le besoin de plusieurs séances d'imagerie et minimise le stress sur les modèles animaux, améliorant ainsi la conformité éthique et l'efficacité de l'étude.

- La combinaison transparente des modalités permet aux chercheurs d’étudier la progression de la maladie et l’efficacité des médicaments sous différents angles, offrant une compréhension plus holistique des mécanismes biologiques sous-jacents.

- Cette tendance vers des systèmes multimodaux intégrés bouleverse fondamentalement les normes de recherche en imagerie préclinique. Par conséquent, des entreprises clés comme Bruker, PerkinElmer et MR Solutions se concentrent sur le développement de plateformes hybrides innovantes offrant une sensibilité, une résolution et des capacités d'analyse de données améliorées.

- La demande de solutions d'imagerie préclinique multimodales augmente rapidement dans les institutions universitaires, les sociétés pharmaceutiques et les CRO, car les parties prenantes accordent de plus en plus d'importance à la précision, à l'efficacité et à la pertinence translationnelle dans la recherche préclinique.

Dynamique du marché européen de l'imagerie préclinique

Conducteur

Besoin croissant en raison de la demande croissante d'imagerie non invasive dans le développement de médicaments

- La prévalence croissante des maladies chroniques et le développement croissant de nouveaux médicaments candidats sont des facteurs majeurs qui stimulent la demande en technologies d'imagerie préclinique. Les chercheurs et les laboratoires pharmaceutiques s'appuient fortement sur ces systèmes pour évaluer la progression de la maladie, l'efficacité thérapeutique et la sécurité sur des modèles animaux avant de passer aux essais cliniques.

- Par exemple, en mars 2023, Bruker a lancé une solution d'imagerie préclinique TEP/TDM avancée, conçue pour améliorer la sensibilité et la résolution des applications de recherche en oncologie et en neurologie. Ces innovations, mises en œuvre par des acteurs clés, devraient stimuler la croissance du secteur de l'imagerie préclinique durant la période de prévision.

- Avec le développement des secteurs pharmaceutique et biotechnologique, le besoin de données d'imagerie précises et reproductibles dans les études précliniques devient de plus en plus crucial. Les systèmes d'imagerie préclinique offrent des avantages uniques, tels que le suivi longitudinal, la réduction du nombre d'animaux utilisés et une pertinence translationnelle améliorée par rapport aux techniques conventionnelles.

- Par ailleurs, l'intérêt croissant pour la médecine de précision et les thérapies ciblées favorise l'adoption d'outils d'imagerie haute résolution comme l'IRM, la TEP et l'imagerie optique. Ces technologies permettent aux chercheurs de visualiser les interactions cellulaires et moléculaires, offrant ainsi une meilleure compréhension des mécanismes d'action des médicaments.

- La praticité des plateformes d'imagerie multimodales, qui combinent des informations structurelles et fonctionnelles dans un flux de travail unique, favorise leur adoption par la recherche universitaire, les CRO et les laboratoires pharmaceutiques. L'évolution vers des systèmes hybrides avancés et la disponibilité croissante de solutions d'imagerie préclinique intuitives contribuent également à la croissance globale du marché.

Retenue/Défi

Coûts d'équipement élevés et accessibilité limitée

- L'un des principaux obstacles au marché de l'imagerie préclinique est le coût élevé des équipements d'imagerie de pointe, notamment les systèmes TEP/IRM et IRM à haut champ. Ces dispositifs nécessitent des investissements importants, ainsi qu'une infrastructure spécialisée et un personnel qualifié, ce qui limite leur adoption par les petits instituts de recherche et les laboratoires aux budgets restreints.

- Par exemple, les rapports soulignent que le coût des systèmes d’imagerie préclinique hybrides peut atteindre des millions de dollars, ce qui crée des obstacles financiers à une mise en œuvre généralisée, en particulier dans les régions en développement.

- Relever ces défis liés aux coûts grâce à des conceptions de systèmes modulaires, des modèles de location d'équipements et des initiatives de recherche collaborative est essentiel pour élargir l'accessibilité. Des entreprises comme PerkinElmer et Bruker travaillent activement à l'introduction de systèmes rentables tout en maintenant une précision et une reproductibilité élevées.

- En outre, les exigences de maintenance et la nécessité de mises à niveau régulières des logiciels et du matériel augmentent les dépenses opérationnelles, ce qui décourage encore davantage l’adoption dans les environnements aux ressources limitées.

- Alors que les acteurs du secteur commercialisent des solutions d'imagerie plus compactes, portables et de paillasse, à des coûts relativement faibles, la perception de l'imagerie préclinique comme une technologie de pointe freine encore son utilisation généralisée. Surmonter ces obstacles grâce au financement public, aux collaborations entre le milieu universitaire et l'industrie et au développement de systèmes d'imagerie plus abordables sera essentiel pour assurer une croissance soutenue du marché.

Portée du marché européen de l'imagerie préclinique

Le marché est segmenté sur la base du produit, du réactif, de l’application et de l’utilisateur final.

- Par produit

Sur la base des produits, le marché européen de l'imagerie préclinique est segmenté en systèmes et services. Le segment des systèmes a dominé le marché avec la plus grande part de chiffre d'affaires (65,4 %) en 2024, principalement grâce à l'intégration généralisée de modalités d'imagerie avancées telles que la TEP, l'IRM, la TDM et l'imagerie optique au sein des institutions de recherche et des entreprises pharmaceutiques. Ces systèmes sont essentiels à la réalisation d'études longitudinales non invasives permettant aux chercheurs de suivre la progression de la maladie et la réponse au traitement au fil du temps. Leur capacité à fournir des images haute résolution, combinée à des capacités multimodales, les rend indispensables en oncologie, neurologie et recherche cardiovasculaire. Les entreprises pharmaceutiques dépendent également des systèmes d'imagerie préclinique pour réduire les taux d'échec des essais cliniques en acquérant des connaissances plus approfondies au stade préclinique. Les avancées technologiques continues dans les systèmes d'imagerie hybrides, associées au solide écosystème européen de R&D, renforcent encore la domination de ce segment. De plus, des investissements importants dans les infrastructures d'imagerie en Allemagne, en France et au Royaume-Uni renforcent son leadership sur le marché.

Le segment des services devrait enregistrer le TCAC le plus rapide, soit 8,9 % entre 2025 et 2032, porté par la demande croissante d'externalisation d'études d'imagerie complexes auprès de prestataires spécialisés et d'ORC. Face à la hausse des coûts et aux défis techniques liés à l'exploitation de systèmes d'imagerie avancés, de nombreuses entreprises pharmaceutiques et biotechnologiques préfèrent collaborer avec des prestataires de services pour accéder à des technologies de pointe sans investissements importants. En Europe, les ORC et les établissements universitaires proposent de plus en plus de services d'imagerie préclinique complets, incluant la conception des études, l'analyse des données et le soutien réglementaire. Cette tendance est particulièrement marquée chez les petites et moyennes entreprises de biotechnologie qui ne disposent pas d'infrastructures internes. La flexibilité des services sur mesure et l'accès à des professionnels experts en imagerie renforcent l'attrait de ce segment. De plus, les partenariats stratégiques entre les ORC et les entreprises pharmaceutiques accélèrent l'adoption de ces technologies, alimentant un fort potentiel de croissance pour ce segment dans les années à venir.

- Par réactif

En fonction des réactifs, le marché européen de l'imagerie préclinique est segmenté en réactifs d'imagerie optique préclinique, réactifs d'imagerie nucléaire préclinique, agents de contraste IRM préclinique, agents de contraste échographiques précliniques et agents de contraste CT préclinique. Le segment des réactifs d'imagerie optique préclinique a dominé le marché avec une part de chiffre d'affaires de 37,8 % en 2024, grâce à leur large application dans la visualisation des processus moléculaires et cellulaires avec une sensibilité et une spécificité élevées. Les réactifs optiques, tels que les sondes bioluminescentes et fluorescentes, sont largement utilisés en biologie du cancer, en analyse de l'expression génique et dans les études d'efficacité des médicaments. Leur rentabilité et leur simplicité d'utilisation, comparées à celles des autres agents d'imagerie, les rendent très accessibles aux institutions de recherche universitaires et commerciales. De plus, les réactifs optiques permettent une imagerie non invasive en temps réel des organismes vivants, ce qui améliore considérablement la précision et l'efficacité de la recherche. L'adoption généralisée des réactifs d'imagerie optique en Europe, notamment dans les projets universitaires et financés par les gouvernements, consolide leur position dominante. L’innovation continue dans le développement de sondes, telles que les marqueurs fluorescents ciblés, soutient encore davantage leur utilité croissante dans la recherche préclinique.

Le segment des réactifs d'imagerie nucléaire préclinique devrait connaître le TCAC le plus rapide, soit 9,7 % entre 2025 et 2032, soutenu par l'utilisation croissante des technologies TEP et SPECT pour le développement de médicaments de pointe. Les réactifs nucléaires offrent des capacités d'imagerie quantitative et une pénétration tissulaire profonde, ce qui les rend particulièrement précieux en oncologie, neurologie et recherche métabolique. L'utilisation croissante de radiotraceurs pour les études de biodistribution et de pharmacocinétique offre des informations précises sur l'efficacité des médicaments à un stade précoce. La solide infrastructure radiopharmaceutique européenne, notamment dans des pays comme l'Allemagne et la France, accélère l'adoption des réactifs d'imagerie nucléaire. De plus, les collaborations entre les laboratoires pharmaceutiques et les centres de recherche en médecine nucléaire élargissent l'accès à des radiotraceurs innovants. La demande croissante de médecine personnalisée et de recherche de précision en oncologie stimule également la croissance de ce segment, ce qui en fait l'un des secteurs les plus dynamiques du marché européen de l'imagerie préclinique.

- Par application

En fonction des applications, le marché européen de l'imagerie préclinique est segmenté entre recherche et développement, découverte de médicaments, biodistribution, détection des cellules cancéreuses, biomarqueurs, etc. En 2024, le segment de la recherche et développement détenait la plus grande part de chiffre d'affaires du marché, soit 41,5 %, principalement grâce aux investissements substantiels en R&D des institutions pharmaceutiques, biotechnologiques et universitaires européennes. L'imagerie préclinique joue un rôle essentiel dans la compréhension des mécanismes des maladies, la validation des cibles thérapeutiques et le suivi des résultats des traitements aux premiers stades du développement des médicaments. Sa capacité à fournir des données précises et non invasives en temps réel la rend indispensable à la recherche translationnelle. L'intérêt croissant pour la médecine de précision, combiné au solide réseau européen de programmes de recherche universitaires et gouvernementaux, renforce encore la domination de ce segment. Les instituts de recherche allemands, britanniques et français utilisent de plus en plus de systèmes d'imagerie avancés pour améliorer la productivité de la recherche et accélérer le développement des médicaments. Le leadership de ce segment est également renforcé par les initiatives de financement de l'UE et des gouvernements nationaux qui encouragent la R&D basée sur l'imagerie.

Le segment de la découverte de médicaments devrait enregistrer le TCAC le plus rapide, soit 10,3 % entre 2025 et 2032, grâce à l'accent croissant mis sur l'accélération du développement de nouvelles thérapies contre le cancer, les troubles neurologiques et les maladies rares. Les technologies d'imagerie préclinique permettent aux chercheurs de surveiller les interactions médicament-cible, la biodistribution et l'efficacité thérapeutique sur des modèles vivants, réduisant ainsi considérablement le temps et le coût de la découverte de médicaments. La demande de solutions d'imagerie à haut débit et haute résolution augmente à mesure que les entreprises pharmaceutiques se tournent vers les produits biologiques et les thérapies cellulaires. Les entreprises biopharmaceutiques européennes exploitent l'imagerie pour rationaliser les processus décisionnels dans les pipelines de médicaments en phase précoce. De plus, les avancées des plateformes d'imagerie multimodales combinant TEP, IRM et modalités optiques offrent des informations plus précises, ce qui en fait des outils précieux pour la découverte de médicaments. La forte collaboration entre l'industrie et le monde universitaire accélère encore l'innovation, positionnant ce segment comme celui qui connaît la croissance la plus rapide de la région.

- Par utilisateur final

En fonction de l'utilisateur final, le marché européen de l'imagerie préclinique est segmenté en organisations de recherche sous contrat (CRO), sociétés pharmaceutiques et biotechnologiques, instituts de recherche universitaires et gouvernementaux, centres de diagnostic, etc. Le segment des sociétés pharmaceutiques et biotechnologiques a dominé le marché avec une part de 44,6 % en 2024, reflétant la dépendance du secteur aux technologies d'imagerie préclinique pour soutenir les pipelines de développement de médicaments. Ces entreprises investissent massivement dans les systèmes d'imagerie pour mener des essais précliniques garantissant l'efficacité, la sécurité et la conformité réglementaire. L'imagerie permet de visualiser en temps réel les effets des médicaments, un élément essentiel au développement de produits biologiques complexes, de thérapies géniques et de médicaments de précision. La présence de pôles pharmaceutiques de premier plan en Allemagne, en Suisse et au Royaume-Uni renforce la force de ce segment. De plus, l'importance croissante accordée aux excipients d'origine végétale et aux produits « clean label » dans les formulations pharmaceutiques stimule indirectement la demande d'imagerie pour l'assurance qualité. Les sociétés pharmaceutiques développent également leurs partenariats avec des fournisseurs d'imagerie et des CRO afin d'améliorer l'efficacité de leur R&D et de consolider leur position dominante sur le marché.

Le segment des organismes de recherche sous contrat (CRO) devrait afficher le TCAC le plus rapide, soit 11,2 % entre 2025 et 2032. Les entreprises pharmaceutiques et biotechnologiques externalisent de plus en plus leurs études d'imagerie préclinique afin d'optimiser leurs coûts et d'accéder à une expertise spécialisée. Les CRO proposent des solutions d'imagerie complètes, incluant la conception d'études, l'imagerie multimodale et l'analyse avancée des données, souvent plus rentables que le développement de capacités internes. Cette tendance est particulièrement marquée chez les PME de biotechnologie qui manquent de ressources pour mettre en place des installations d'imagerie dédiées. En Europe, les CRO élargissent leur portefeuille de services en intégrant l'analyse d'images basée sur l'IA et des plateformes cloud, améliorant ainsi leur efficacité et leur évolutivité. Les partenariats stratégiques entre les CRO et les principaux acteurs pharmaceutiques créent également de nouvelles perspectives de croissance. Face au durcissement des exigences réglementaires en matière de validation préclinique, l'externalisation des services d'imagerie aux CRO garantit la conformité tout en réduisant les délais, faisant de ce segment la catégorie d'utilisateurs finaux connaissant la croissance la plus rapide.

Analyse régionale du marché européen de l'imagerie préclinique

- Le marché européen de l'imagerie préclinique devrait connaître une croissance à un TCAC substantiel tout au long de la période de prévision, principalement grâce à la demande croissante de technologies d'imagerie avancées dans la découverte de médicaments et la recherche biomédicale.

- La prévalence croissante des maladies chroniques, la croissance du développement des produits biologiques et le besoin d'outils de recherche translationnelle favorisent l'adoption de systèmes d'imagerie préclinique dans toute la région. La forte présence d'entreprises pharmaceutiques européennes, associée à une infrastructure universitaire et de recherche clinique robuste, soutient le développement et l'utilisation de techniques telles que la TEP, l'IRM, la TDM et l'imagerie optique.

- De plus, les financements publics et les projets collaboratifs entre l'industrie et le monde universitaire accélèrent l'intégration de plateformes d'imagerie haute résolution et multimodales. La région connaît une forte croissance dans les applications de recherche en oncologie, neurologie et cardiologie, l'imagerie préclinique étant de plus en plus utilisée pour améliorer l'efficacité, la précision et la prévisibilité des processus de développement de médicaments.

Aperçu du marché allemand de l'imagerie préclinique

Le marché allemand de l'imagerie préclinique a dominé le marché européen de l'imagerie préclinique, avec une part de chiffre d'affaires record de 34,6 % en 2024, grâce à son infrastructure de recherche de pointe, à sa forte concentration d'entreprises pharmaceutiques et biotechnologiques, et à un financement public de l'innovation en sciences de la vie. Le solide réseau d'institutions de recherche universitaires et les collaborations avec les leaders du secteur favorisent l'adoption de technologies d'imagerie avancées telles que l'IRM haute résolution et les systèmes hybrides TEP/IRM. La demande est particulièrement forte en recherche en oncologie et en neurologie, où l'Allemagne est un pôle majeur pour les études translationnelles. De plus, la présence de fabricants européens d'équipements d'imagerie et les investissements croissants dans l'analyse d'imagerie basée sur l'IA contribuent à sa position de leader dans la région.

Aperçu du marché français de l'imagerie préclinique

Le marché français de l'imagerie préclinique devrait connaître la croissance la plus rapide en Europe au cours de la période de prévision, avec un TCAC de 9,8 % entre 2025 et 2032, porté par la hausse des investissements publics dans la recherche biomédicale, l'expansion des réseaux de CRO et l'adoption croissante de techniques d'imagerie multimodale pour la recherche en oncologie et en neurologie. La présence croissante de centres de recherche spécialisés en France, ainsi que des partenariats public-privé dynamiques, stimulent la demande d'outils d'imagerie préclinique avancés. De plus, l'adoption de l'analyse d'imagerie par IA et de plateformes hybrides innovantes améliore l'efficacité des études précliniques. Ces facteurs, combinés à l'importance accordée par la France à l'innovation biomédicale de pointe, en font le marché à la croissance la plus rapide d'Europe.

Part de marché de l'imagerie préclinique en Europe

L’industrie de l’imagerie préclinique est principalement dirigée par des entreprises bien établies, notamment :

- PerkinElmer (États-Unis)

- FUJIFILM VisualSonics, Inc. (Canada)

- Bruker (États-Unis)

- LI-COR, Inc. (États-Unis)

- Aspect Imaging Ltd. (Israël)

- Berthold Technologies GmbH & Co. KG (Allemagne)

- MILabs BV (Pays-Bas)

- Trifoil Imaging LLC (États-Unis)

- Mediso Ltd. (Hongrie)

- IVIM Technology Inc. (Corée du Sud)

- MR Solutions (Royaume-Uni)

- Photon etc. (Canada)

- Siemens Healthineers AG (Allemagne)

- GE Healthcare (Royaume-Uni)

- Koninklijke Philips NV, (Pays-Bas)

- CANON MEDICAL SYSTEMS CORPORATION (Japon)

- NIKON CORPORATION (Japon)

- Olympus Corporation (Japon)

- Groupe Zeiss (Allemagne)

- Leica Microsystems (Allemagne)

- Thermo Fisher Scientific Inc. (États-Unis)

- Agilent Technologies, Inc. (États-Unis)

Derniers développements sur le marché européen de l'imagerie préclinique

- En avril 2025, Revvity, Inc. a présenté le système d'injection guidée par l'image VivoJect lors du congrès annuel de l'American Association for Cancer Research (AACR) à Chicago. Associé à l'échographie préclinique automatisée Vega, ce système améliore l'imagerie en temps réel et la précision des injections pour les études in vivo à haut débit. Il simplifie les flux de travail dans le développement de modèles tumoraux, l'administration ciblée de médicaments, la thérapie génique, la recherche sur les cellules souches et les études cardiaques.

- En mai 2025, MR Solutions a installé le premier système trimodal SPECT/IRM 7T à haut champ au monde à Houston Methodist. Cette installation témoigne de l'innovation continue en imagerie préclinique, offrant des capacités d'imagerie complètes pour des applications de recherche de pointe.

- En février 2024, Bruker Corporation a acquis Spectral Instruments Imaging LLC, enrichissant ainsi son portefeuille de produits dans le secteur de l'imagerie préclinique. Cette acquisition élargit la gamme de solutions précliniques de Bruker, notamment dans la recherche sur les maladies, répondant ainsi à la demande croissante de technologies d'imagerie avancées.

- En juillet 2024, MILabs a modernisé son système U-CT pour l'imagerie in vivo de modèles animaux atteints de COVID-19. Cette mise à niveau offre une imagerie pulmonaire non invasive à ultra-haute résolution, permettant une localisation précise des processus pathologiques chez les petits animaux, faisant ainsi progresser la recherche sur les maladies infectieuses.

- En septembre 2023, Revvity, Inc. a élargi son portefeuille d'imagerie préclinique en introduisant des systèmes avancés tels que les systèmes d'imagerie IVIS SpectrumCT 2, la solution d'imagerie microCT Quantum GX3 et l'échographie préclinique Vega. Ces systèmes permettent des découvertes révolutionnaires en recherche préclinique, offrant des capacités d'imagerie améliorées pour diverses applications.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.