Marché européen des polyols, par type (polyols de polyéther et polyols de polyester), application (mousse de polyuréthane flexible, mousse de polyuréthane rigide, revêtements, adhésifs et produits d'étanchéité, élastomères et autres), utilisateur final (construction, mobilier, transport, emballage, support de tapis et autres) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des polyols en Europe

Les polyols sont des composés organiques. Ce composé organique est un composé qui contient du carbone lié de manière covalente à d'autres atomes, en particulier carbone-carbone et carbone-hydrogène. Une classe de polyols appelés alcools de sucre comprend ceux qui sont dérivés des sucres. Ils peuvent être présents naturellement ou produits industriellement. La demande croissante de mousses de polyuréthane, la demande croissante dans le secteur de la construction et des infrastructures, et l'accent croissant mis sur les matériaux d'isolation économes en énergie et les produits durables sont les principaux facteurs qui agissent comme un facteur moteur pour le marché européen des polyols. Cependant, les réglementations environnementales et les préoccupations en matière de durabilité, les coûts élevés associés aux polyols agissent comme des facteurs limitatifs pour la croissance du marché européen des polyols. La demande croissante de polyols pour les matériaux d'emballage, l'utilisation de polyols dans les applications d'isolation et la demande croissante de produits d'origine biologique devraient offrir des opportunités de croissance pour le marché européen des polyols. Cependant, les fluctuations des prix des matières premières, les limitations technologiques et les exigences de performance créent un environnement difficile pour la croissance du marché européen des polyols.

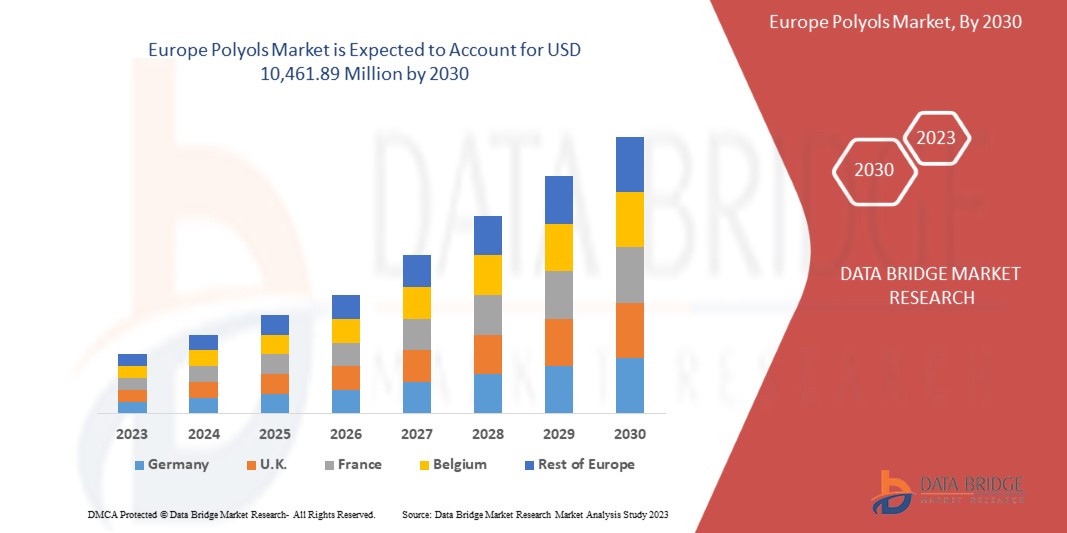

Selon les analyses de Data Bridge Market Research, le marché européen des polyols devrait atteindre une valeur de 10 461,89 millions USD d'ici 2030, à un TCAC de 5,1 % au cours de la période de prévision. Le rapport sur le marché européen des polyols couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type (polyols de polyéther et polyols de polyester), application (mousse de polyuréthane souple, mousse de polyuréthane rigide, revêtements, adhésifs et produits d'étanchéité, élastomères et autres), utilisateur final (construction, mobilier, transport, emballage, support de tapis et autres) |

|

Pays couverts |

Allemagne, Royaume-Uni, France, Italie, Pays-Bas, Espagne, Suisse, Russie, Turquie, Belgique et reste de l'Europe |

|

Acteurs du marché couverts |

Huntsman International LLC, Repsol, Biesterfeld AG, DIC CORPORATION, Tosoh Corporation, Arkema, BASF SE, Dow, Cargill, Incorporated, LANXESS, Shell plc, Mitsubishi Chemical Corporation, Vertellus, Wanhua, Stepan Company, Gulshan Polyols Ltd, Perstorp Holding AB (filiale du groupe PETRONAS Chemicals), Emery Oleochemicals LLC, Covestro AG, Coim Group et Shakun Industries, entre autres |

Définition du marché

Les polyols sont des alcools contenant plus d'un groupe hydroxyle et constituent l'une des principales matières premières pour la fabrication du polyuréthane. Ils sont couramment utilisés comme matières premières clés dans la fabrication de divers produits, tels que les mousses de polyuréthane , les revêtements, les adhésifs, les produits d'étanchéité, les élastomères, etc. Les polyols sont principalement dérivés de sources pétrochimiques ou de ressources renouvelables comme les huiles végétales et les dérivés du sucre. Ils peuvent être classés en différents types en fonction de leur structure chimique, notamment les polyéther polyols et les polyester polyols. Chaque type possède des propriétés spécifiques et convient à différentes applications. Les différents types de polyols sont les polyéther polyols et les polyester polyols. Les polyols sont utilisés dans différentes applications sous différentes formes telles que la mousse de polyuréthane flexible, la mousse de polyuréthane rigide, les revêtements, les adhésifs et les produits d'étanchéité, les élastomères, etc. Les polyuréthanes sont polyvalents, modernes et sûrs. Ils ont une vaste gamme d'applications pour créer toutes sortes de produits industriels et de produits de consommation de base pour rendre notre vie plus pratique, confortable et respectueuse de l'environnement. Le polyuréthane est un matériau plastique présenté sous différentes formes. Il peut être utilisé sous différentes formes, telles que rigide ou flexible, et est préféré en fonction du matériau dans une large gamme d'applications. L'un de ces polyols est Repsol, qui propose un portefeuille de polyols polyéther développés avec une technologie maison avec une large gamme d'alternatives.

Dynamique du marché des polyols en Europe

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de mousses de polyuréthane

Les polyols sont l'un des deux principaux composants utilisés dans la production de mousses de polyuréthane, l'autre composant étant les isocyanates. Les polyols sont des composés polymères qui contiennent plusieurs groupes fonctionnels hydroxyle (-OH). Ils peuvent être dérivés de diverses sources, telles que le pétrole, les huiles végétales ou les polyesters. Dans le processus de fabrication de la mousse de polyuréthane, les polyols réagissent avec les isocyanates pour former un réseau polymère. La demande croissante de mousses de polyuréthane devrait stimuler le marché européen des polyols. Les mousses de polyuréthane sont des matériaux polyvalents utilisés dans diverses industries telles que la construction, l'automobile, l'ameublement et l'emballage en raison de leurs excellentes propriétés d'isolation, d'amortissement et de durabilité.

Opportunité

- Demande croissante de polyols pour les matériaux d'emballage

Les matériaux d'emballage sont utilisés pour enfermer, protéger et contenir les produits pour le stockage, la distribution et la vente. L'emballage remplit diverses fonctions, notamment la préservation de la qualité et de l'intégrité des produits, la garantie de leur sécurité pendant le transport, la fourniture d'informations aux consommateurs et la facilitation de la manutention et du stockage. Les matériaux d'emballage peuvent être fabriqués à partir d'une grande variété de matériaux, notamment les plastiques, le papier et le carton, le verre, les métaux et les matériaux composites. Les matériaux d'emballage jouent un rôle essentiel pour garantir la sécurité, la conservation et la présentation des produits. Ils contribuent à l'expérience globale du consommateur et fournissent des informations essentielles sur le produit, telles que les ingrédients, les valeurs nutritionnelles et les instructions d'utilisation. Des matériaux d'emballage efficaces aident à protéger les produits contre les dommages, à prolonger leur durée de conservation et à améliorer leur commercialisation

Contraintes/Défis

- Coût élevé associé aux polyols

Le coût des polyols dépend de divers facteurs tels que les matières premières, le processus de fabrication et la demande du marché. Les prix des matières premières utilisées pour la production de polyols, telles que l'oxyde de propylène et l'oxyde d'éthylène, sont volatils et peuvent fluctuer fréquemment, ce qui entraîne une augmentation du coût de production des polyols. De plus, le processus de production des polyols est complexe et nécessite un équipement et une expertise spécialisés, ce qui entraîne des coûts d'investissement et d'exploitation plus élevés.

- Fluctuation des prix des matières premières

Les matières premières pour la production de polyol peuvent varier en fonction du type de polyol produit, comme les polyéther polyols et les polyester polyols.

Développements récents

- En septembre 2022, Covestro AG a annoncé le lancement de polyols de polyéther à base de matières premières biocirculaires. L'entreprise sera en mesure de proposer des prépolymères sélectifs pour diverses applications adhésives et sa clientèle. Les principaux composants des polyuréthanes seront à base de matières premières alternatives. Cette étape aide l'entreprise à proposer des substituts à diverses industries et à améliorer son image de marque sur le marché.

- En septembre 2022, Wanhua a annoncé le lancement d'un nouveau produit chimique qui a développé un polyol d'origine biologique pour réduire son empreinte carbone. Les nouveaux bioproduits ont été lancés pour contribuer à un environnement durable et à accroître l'efficacité de la production. Cela aidera l'entreprise à améliorer son portefeuille de produits.

Portée du marché européen des polyols

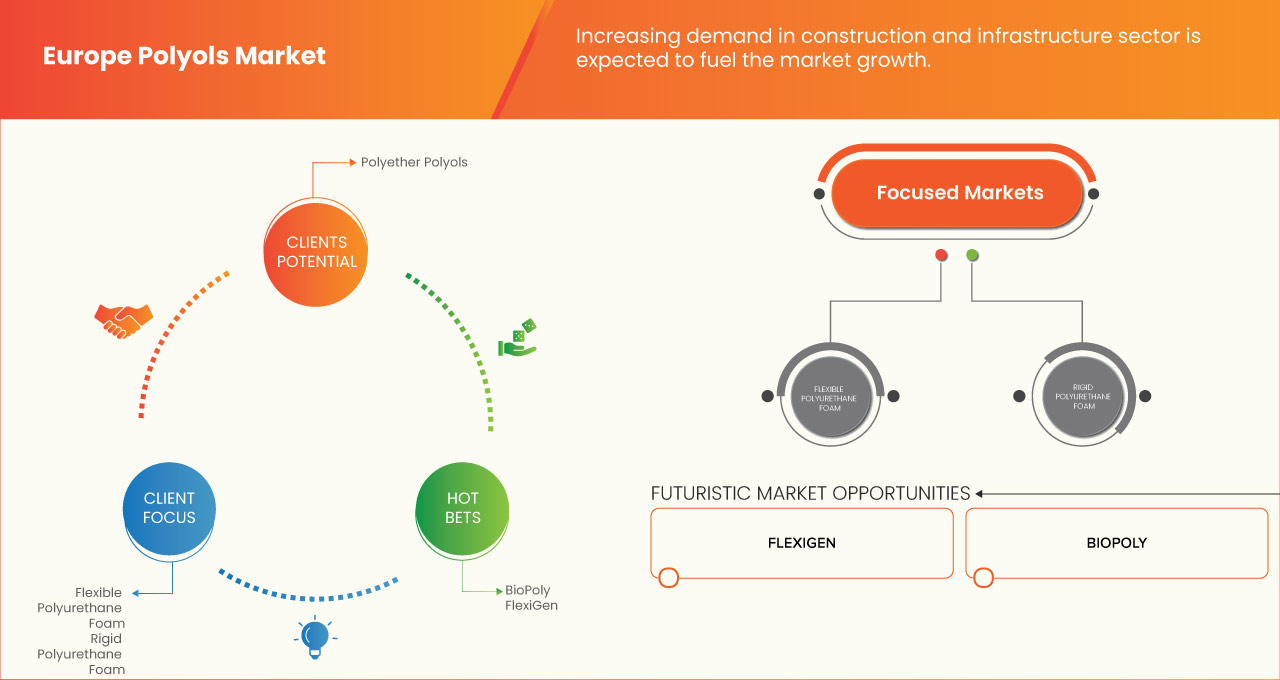

Le marché européen des polyols est segmenté en trois segments notables basés sur le type, l'application et l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Polyols de polyéther

- Polyols de polyester

Sur la base du type, le marché européen des polyols est segmenté en polyéther polyols et polyester polyols.

Application

- Mousse de polyuréthane flexible

- Mousse de polyuréthane rigide

- Revêtements

- Adhésifs et produits d'étanchéité

- Élastomères

- Autres

Sur la base de l'application, le marché européen des polyols est segmenté en mousse de polyuréthane flexible, mousse de polyuréthane rigide, revêtements, adhésifs et produits d'étanchéité, élastomères et autres.

Utilisateur final

- Construction

- Meubles

- Transport

- Conditionnement

- Support de tapis

- Autres

Sur la base de l'utilisateur final, le marché européen des polyols est segmenté en construction, mobilier, transport, emballage, support de tapis et autres.

Analyse/perspectives régionales du marché européen des polyols

Le marché européen des polyols est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type, application et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché européen des polyols sont l’Allemagne, le Royaume-Uni, la France, l’Italie, les Pays-Bas, l’Espagne, la Suisse, la Russie, la Turquie, la Belgique et le reste de l’Europe.

L'Allemagne devrait dominer le marché européen des polyols, car elle abrite une industrie automobile robuste, qui est un consommateur important de matériaux à base de polyols. Les polyols sont utilisés dans les intérieurs automobiles, les mousses de sièges, les matériaux isolants et d'autres composants. La demande de matériaux légers et durables dans le secteur automobile a stimulé la croissance des applications de polyol, ce qui a entraîné une demande accrue de produits à base de polyol en Allemagne.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données régionales.

Analyse du paysage concurrentiel et des parts de marché des polyols en Europe

Le paysage concurrentiel du marché européen des polyols fournit des détails sur le concurrent. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché européen des polyols.

Certains des principaux acteurs opérant sur le marché européen des polyols sont, Huntsman International LLC, Repsol, Biesterfeld AG, DIC CORPORATION, Tosoh Corporation, Arkema, BASF SE, Dow, Cargill, Incorporated, LANXESS, Shell plc, Mitsubishi Chemical Corporation, Vertellus, Wanhua, Stepan Company, Gulshan Polyols Ltd, Perstorp Holding AB (filiale de PETRONAS Chemicals Group), Emery Oleochemicals LLC, Covestro AG, Coim Group et Shakun Industries, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE POLYOLS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT-EXPORT DATA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR POLYURETHANE FOAMS

5.1.2 INCREASING DEMAND IN THE CONSTRUCTION AND INFRASTRUCTURE SECTOR

5.1.3 ADVANCEMENTS IN POLYOLS TECHNOLOGY

5.1.4 GROWING DEMAND IN THE AUTOMOTIVE INDUSTRY

5.2 RESTRAINTS

5.2.1 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY CONCERNS

5.2.2 HIGH COST ASSOCIATED WITH POLYOLS

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FOR POLYOLS FOR PACKAGING MATERIALS

5.3.2 USE OF POLYOLS IN INSULATION APPLICATIONS

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 HIGH DEMAND FOR BIO-BASED AND SUSTAINABLE POLYOLS

5.4 CHALLENGES

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 TECHNOLOGICAL LIMITATIONS AND PERFORMANCE REQUIREMENTS

6 EUROPE POLYOLS MARKET, BY TYPE

6.1 OVERVIEW

6.2 POLYETHER POLYOLS

6.3 POLYESTER POLYOLS

7 EUROPE POLYOLS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 FLEXIBLE POLYURETHANE FOAM

7.3 RIGID POLYURETHANE FOAM

7.4 COATINGS

7.5 ADHESIVES & SEALANTS

7.6 ELASTOMERS

7.7 OTHERS

8 EUROPE POLYOLS MARKET, BY END USER

8.1 OVERVIEW

8.2 CONSTRUCTION

8.2.1 POLYETHER POLYOLS

8.2.2 POLYESTER POLYOLS

8.3 FURNITURE

8.3.1 POLYETHER POLYOLS

8.3.2 POLYESTER POLYOLS

8.4 TRANSPORT

8.4.1 POLYETHER POLYOLS

8.4.2 POLYESTER POLYOLS

8.5 PACKAGING

8.5.1 POLYETHER POLYOLS

8.5.2 POLYESTER POLYOLS

8.6 CARPET BACKING

8.6.1 POLYETHER POLYOLS

8.6.2 POLYESTER POLYOLS

8.7 OTHERS

8.7.1 POLYETHER POLYOLS

8.7.2 POLYESTER POLYOLS

9 EUROPE POLYOLS MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 FRANCE

9.1.3 ITALY

9.1.4 NETHERLANDS

9.1.5 U.K.

9.1.6 SPAIN

9.1.7 BELGIUM

9.1.8 RUSSIA

9.1.9 SWITZERLAND

9.1.10 TURKEY

9.1.11 REST OF EUROPE

10 EUROPE POLYOLS MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILINGS

12.1 SHELL PLC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 COVESTRO AG

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 WANHUA

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 LANXESS

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT AND SOLUTION PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 HUNTSMAN INTERNATIONAL LLC

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ARKEMA

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BASF SE

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 BIESTERFELD AG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 CARGILL, INCORPORATED.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT AND SERVICE PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 COIM GROUP

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 DOW

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 DIC CORPORATION

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 EMERY OLEOCHEMICALS LLC

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 GULSHAN POLYOLS LTD.

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 MITSUBISHI CHEMICAL CORPORATION

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENTS

12.16 PERSTORP HOLDING AB (SUBSIDIARY OF PETRONAS CHEMICALS GROUP)

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 REPSOL

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENTS

12.18 SHAKUN INDUSTRIES

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENT

12.19 STEPAN COMPANY

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENTS

12.2 TOSOH CORPORATION

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENT

12.21 VERTELLUS

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 EUROPE POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 3 EUROPE POLYETHER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 EUROPE POLYETHER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (MT)

TABLE 5 EUROPE POLYESTER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 EUROPE POLYESTER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (MT)

TABLE 7 EUROPE POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 EUROPE FLEXIBLE POLYURETHANE FOAM IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE RIGID POLYURETHANE FOAM IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 EUROPE COATINGS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 EUROPE ADHESIVES & SEALANTS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 EUROPE ELASTOMERS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 EUROPE OTHERS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 EUROPE POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 15 EUROPE CONSTRUCTION IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 EUROPE FURNITURE IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 EUROPE FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 EUROPE TRANSPORT IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 EUROPE TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 EUROPE PACKAGING IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 EUROPE PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 EUROPE CARPET BACKING IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 EUROPE CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 EUROPE OTHERS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 EUROPE OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 EUROPE POLYOLS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 28 EUROPE POLYOLS MARKET, BY COUNTRY, 2021-2030 (MT)

TABLE 29 EUROPE POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 EUROPE POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 31 EUROPE POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 EUROPE POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 EUROPE CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 EUROPE FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 EUROPE TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 EUROPE PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 EUROPE CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 EUROPE OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 GERMANY POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 GERMANY POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 41 GERMANY POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 GERMANY POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 GERMANY CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 GERMANY FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 GERMANY TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 GERMANY PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 GERMANY CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 GERMANY OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 FRANCE POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 FRANCE POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 51 FRANCE POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 FRANCE POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 53 FRANCE CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 FRANCE FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 FRANCE TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 FRANCE PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 FRANCE CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 FRANCE OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 ITALY POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 ITALY POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 61 ITALY POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 62 ITALY POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 63 ITALY CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 ITALY FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 ITALY TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 ITALY PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 ITALY CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 ITALY OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 NETHERLANDS POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 NETHERLANDS POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 71 NETHERLANDS POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 NETHERLANDS POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 73 NETHERLANDS CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 NETHERLANDS FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 NETHERLANDS TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 NETHERLANDS PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 NETHERLANDS CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 NETHERLANDS OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 U.K. POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 U.K. POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 81 U.K. POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 82 U.K. POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 83 U.K. CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 U.K. FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 U.K. TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.K. PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 U.K. CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 U.K. OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 SPAIN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 SPAIN POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 91 SPAIN POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 SPAIN POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 93 SPAIN CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 SPAIN FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 SPAIN TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 SPAIN PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 SPAIN CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 SPAIN OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 BELGIUM POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 BELGIUM POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 101 BELGIUM POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 102 BELGIUM POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 103 BELGIUM CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 BELGIUM FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 BELGIUM TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 BELGIUM PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 BELGIUM CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 BELGIUM OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 RUSSIA POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 RUSSIA POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 111 RUSSIA POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 112 RUSSIA POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 113 RUSSIA CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 RUSSIA FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 RUSSIA TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 RUSSIA PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 RUSSIA CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 RUSSIA OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SWITZERLAND POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 SWITZERLAND POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 121 SWITZERLAND POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 122 SWITZERLAND POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 123 SWITZERLAND CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 SWITZERLAND FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 SWITZERLAND TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 SWITZERLAND PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 SWITZERLAND CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 SWITZERLAND OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 TURKEY POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 TURKEY POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 131 TURKEY POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 132 TURKEY POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 133 TURKEY CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 TURKEY FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 TURKEY TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 TURKEY PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 TURKEY CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 TURKEY OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 REST OF EUROPE POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 REST OF EUROPE POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

Liste des figures

FIGURE 1 EUROPE POLYOLS MARKET: SEGMENTATION

FIGURE 2 EUROPE POLYOLS MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 EUROPE POLYOLS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE POLYOLS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE POLYOLS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE POLYOLS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE POLYOLS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE POLYOLS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE POLYOLS MARKET: MULTIVARIATE MODELLING

FIGURE 10 EUROPE POLYOLS MARKET: TYPE CURVE

FIGURE 11 EUROPE POLYOLS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 EUROPE POLYOLS MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND IN THE CONSTRUCTION AND INFRASTRUCTURE SECTOR IS EXPECTED TO BE A KEY DRIVER FOR EUROPE POLYOLS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 POLYETHER POLYOLS ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE POLYOLS MARKET FROM 2023 TO 2030

FIGURE 15 GRAPH 1: EXPORT DATA OF COUNTRIES ACROSS THE GLOBE (FROM JANUARY TO MAY 2023)

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE POLYOLS MARKET

FIGURE 17 EUROPE POLYOLS MARKET: BY TYPE, 2022

FIGURE 18 EUROPE POLYOLS MARKET: BY APPLICATION, 2022

FIGURE 19 EUROPE POLYOLS MARKET: BY END USER, 2022

FIGURE 20 EUROPE POLYOLS MARKET: SNAPSHOT (2022)

FIGURE 21 EUROPE POLYOLS MARKET: BY COUNTRY (2022)

FIGURE 22 EUROPE POLYOLS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 EUROPE POLYOLS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 EUROPE POLYOLS MARKET: BY TYPE (2023-2030)

FIGURE 25 EUROPE POLYOLS MARKET: COMPANY SHARE 2022(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.