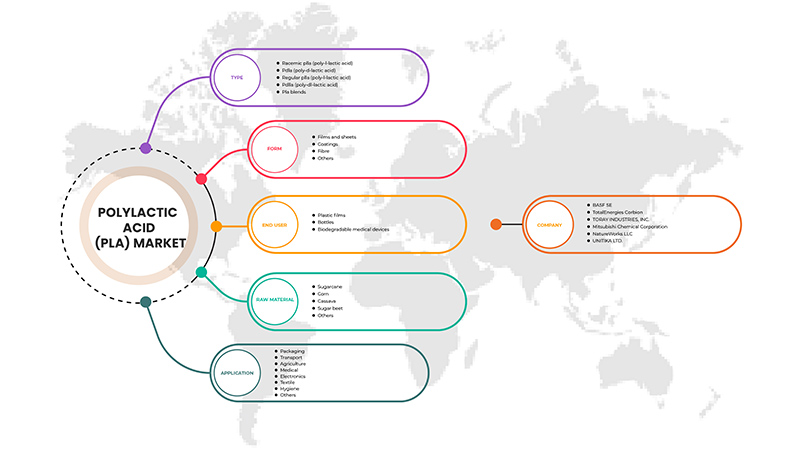

Marché européen de l'acide polylactique (PLA), par type (PLLA racémique (acide poly-L-lactique), PLLA ordinaire (acide poly-L-lactique), PDLA (acide poly-D-lactique) et PDLLA (acide poly-Dl-lactique)), matière première (maïs, manioc, canne à sucre, betterave sucrière et autres), forme ( films et feuilles , revêtements, fibres, autres), application (emballage, transport, agriculture, médical, électronique, textile, hygiène, autres), utilisateur final (films plastiques, bouteilles, dispositifs médicaux biodégradables ) - Tendances et prévisions jusqu'en 2029.

Analyse et perspectives du marché européen de l'acide polylactique (PLA)

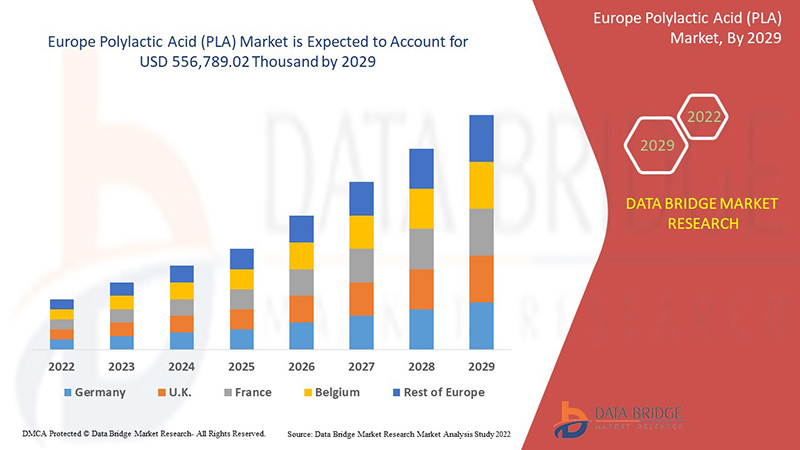

Français Le marché européen de l'acide polylactique (PLA) devrait croître de manière significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 11,4 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 556 789,02 milliers de dollars d'ici 2029. Le principal facteur à l'origine de la croissance du marché de l'acide polylactique (PLA) est la demande croissante d'emballages multicouches pour empêcher la perméation de l'oxygène et de l'eau, la demande croissante d' alternatives d'emballage biodégradables de la part de l'industrie de l'emballage, le PLA peut être une alternative aux polymères à base de pétrole, la demande croissante de films plastiques biosourcés dans l'agriculture, l'imposition de réglementations strictes sur la sécurité environnementale par divers gouvernements.

L'acide polylactique (PLA) est un type de plastique renouvelable principalement dérivé de matières renouvelables comme l'amidon de maïs et la canne à sucre. L'acide polylactique (PLA) possède plusieurs propriétés mécaniques avantageuses par rapport aux autres polymères biodégradables . L'acide polylactique (PLA) est un polymère aliphatique thermoplastique, et ce bioplastique est produit à partir de la cristallisation de l'acide lactique. Ayant une formule chimique (C3H4O2) n, l'acide polylactique (PLA) est un polymère hydrophobe semi-cristallin et biodégradable. L'acide polylactique (PLA) peut être décomposé en une gamme de composants biodégradables, ce qui le rend idéal pour une application dans un large éventail d'applications.

Le rapport sur le marché européen de l'acide polylactique (PLA) fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volume en kilotonnes |

|

Segments couverts |

Par type (PLLA racémique (acide poly-L-lactique), PLLA ordinaire (acide poly-L-lactique), PDLA (acide poly-D-lactique) et PDLLA (acide poly-Dl-lactique)), matière première (maïs, manioc, canne à sucre, betterave sucrière et autres), forme (films et feuilles, revêtements, fibres, autres), application (emballage, transport, agriculture, médecine, électronique, textile, hygiène, autres), utilisateur final (films plastiques, bouteilles, dispositifs médicaux biodégradables) |

|

Pays couverts |

Royaume-Uni, Russie, France, Espagne, Italie, Allemagne, Turquie, Pays-Bas, Suisse, Belgique, Reste de l'Europe |

|

Acteurs du marché couverts |

Français BASF SE, Futerro, NatureWorks LLC, TotalEnergies Corbion, Sulzer Ltd, Mitsubishi Chemical Corporation, TORAY INDUSTRIES, INC., Merck KGaA, Musashino Chemical Laboratory, Ltd., Evonik Industries AG, Polyvel Inc., UNITIKA LTD., Jiangxi Academy of Sciences Biological New Materials Co., Ltd., Shanghai Tong-jie-liang Biomaterials Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd., et Radici Partecipazioni SpA. |

Définition du marché

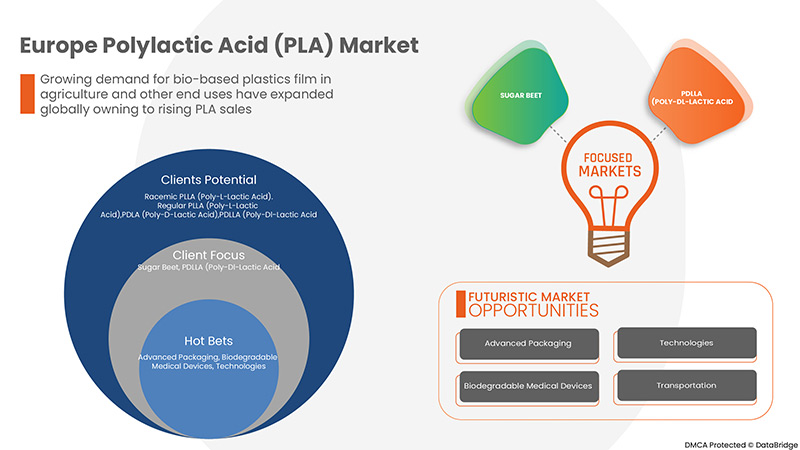

La demande croissante d'alternatives d'emballage biodégradables de la part de l'industrie de l'emballage est un moteur important pour le marché européen de l'acide polylactique (PLA). Le PLA peut être une alternative aux polymères à base de pétrole. La demande croissante de films plastiques biosourcés dans l'agriculture devrait stimuler la croissance du marché européen de l'acide polylactique (PLA). Les multifonctionnalités du PLA et l'inclination croissante des consommateurs pour les produits plastiques respectueux de l'environnement sont reconnues comme offrant des opportunités au marché européen de l'acide polylactique (PLA). Cependant, les problèmes de performances médiocres par rapport au plastique conventionnel remettent en cause la croissance du marché européen de l'acide polylactique (PLA).

Dynamique du marché européen de l'acide polylactique (PLA)

Conducteurs

- Demande croissante d'alternatives d'emballage biodégradables de la part de l'industrie de l'emballage

La pandémie a eu un impact positif sur la croissance de l'industrie de l'emballage. Elle a entraîné une forte demande d'emballages en plastique, notamment de substituts écologiques aux plastiques tels que les matériaux d'emballage en PLA. Les fabricants de produits alimentaires, qui avaient initialement opté pour d'autres types d'emballages, ont commencé à utiliser des emballages à base de PLA, car les produits sont économiques, sûrs et durables. De plus, en raison de l'augmentation de la durabilité dans l'industrie de l'emballage pour maintenir la qualité des produits, les matériaux d'emballage en biopolymères tels que les matériaux à base de PLA augmentent, car le PLA se décompose en eau et en dioxyde de carbone en environ 47 à 90 jours. Quatre fois plus vite que les sacs à base de PET utilisés dans divers emballages. De plus, leur faible coût, leurs matières premières renouvelables et leur utilisation de déchets agro-industriels stimulent leur demande, car l'acide polylactique est obtenu à partir de sources renouvelables.

- Le PLA peut être une alternative aux polymères à base de pétrole

En outre, l'acide polylactique est utilisé dans la fabrication de divers composants utilisés dans le secteur automobile. Les acides polylactiques sont utilisés dans des applications telles que les pièces intérieures et les composants sous le capot. Ces produits sont connus pour réduire leur empreinte carbone en raison de leur teneur élevée en bio. Le PLA offre de nombreuses propriétés telles que la résistance aux UV, la résistance aux chocs, une brillance élevée, une stabilité dimensionnelle et une capacité de coloration. Ces facteurs en font une alternative à la plupart des plastiques traditionnels composés de produits pétroliers et de matières premières telles que le polyéthylène téréphtalate, le polycarbonate, le polybutylène téréphtalate et l'acrylonitrile butadiène styrène, ainsi que le polyamide, qui sont préférés pour les compartiments et intérieurs de moteurs automobiles et d'autres utilisations également.

- Demande croissante de films plastiques biosourcés dans l'agriculture

Avec la prise de conscience croissante des problèmes d'élimination des films non dégradables, les applications des films de paillage à base d'acide polylactique devraient augmenter dans le secteur agricole. Les films de paillage sont largement utilisés dans la culture des fruits et légumes. Les propriétés mécaniques du PLA sont comparables à celles des films de paillage existants et présentent l'avantage d'être entièrement biodégradables en une seule saison de croissance. Cela aura un impact positif sur la croissance du marché et agira comme un moteur pour le marché européen de l'acide polylactique (PLA).

- Imposition de réglementations strictes en matière de sécurité environnementale par divers gouvernements

En raison des préoccupations environnementales et des facteurs de changement climatique rapide, les autorités réglementaires, telles que l'EPA, la FDA et bien d'autres, optent de plus en plus pour des plastiques biodégradables tels que l'acide polylactique (PLA) et se concentrent sur la sensibilisation accrue des consommateurs concernant la nécessité d'utiliser des produits biodégradables.

Opportunités

- Multifonctionnalités du PLA

Français Les multifonctions et l'utilisation extensive du PLA dans différentes industries et applications offriront des opportunités lucratives de croissance sur le marché européen de l'acide polylactique (PLA). Bas L'acide polylactique est biodégradable et compostable industriellement. Parmi les premiers polymères renouvelables, nous pouvons rivaliser avec les polymères existants, en combinant leurs caractéristiques fonctionnelles, telles que la transparence, la brillance et la rigidité. L'acide polylactique est actuellement utilisé dans de nombreuses industries et applications, notamment l'emballage, la vaisselle à usage unique, les textiles, le pétrole et le gaz, l'électronique, l'automobile et l'impression 3D. En raison des utilisations diverses et polyvalentes de l'acide polylactique dans de multiples industries et des multifonctions des acides polylactiques, le marché devrait connaître des opportunités de croissance importantes dans un avenir proche.

- Inclination croissante des consommateurs vers des produits en plastique respectueux de l'environnement

En outre, la richesse de la biomasse, les ressources issues de la recherche, la forte demande industrielle en aval, l’approvisionnement en matériaux et le soutien des politiques gouvernementales ont créé d’importantes opportunités commerciales pour les bioplastiques dans ces régions. La croissance a également été soutenue par une meilleure sensibilisation des consommateurs aux solutions plastiques durables et par des efforts accrus pour éliminer l’utilisation de plastiques conventionnels non biodégradables comme le PLA. Les plastiques à base de pétrole traditionnellement utilisés mettent des décennies à se décomposer ou à se dégrader et restent longtemps dans les décharges. Le PLA se décompose plus rapidement lorsqu’il est jeté et réabsorbé dans le système naturel. De plus, le taux de décomposition des plastiques biodégradables tels que le PLA par les activités des micro-organismes est beaucoup plus rapide que celui des plastiques traditionnels.

Contraintes/Défis

- Préoccupations concernant le coût et le système spécifique de compostage industriel

L'utilisation d'acides polylactiques dans les petites et moyennes entreprises est difficile en raison du manque de ressources ou de la technologie et des installations nécessaires à l'extraction et à la fermentation d'acide lactique et d'acide polylactique de haute qualité. De plus, la sélection de la bonne composition d'acide polylactique est un aspect clé que de nombreuses entreprises n'ont pas compris avec précision. Cela augmente le coût de production de l'acide polylactique en raison d'un manque de technologie et de techniques appropriées. La sélection de la bonne composition d'acide lactique pour la production d'acide polylactique est une méthode complexe qui nécessite une validation à l'échelle du laboratoire et de l'usine.

- Des prix des matières premières imprévisibles

Les coûts de production de l'acide polylactique et des produits connexes connaissent une augmentation significative en raison des coûts plus élevés des matières premières ainsi que du transport, de l'énergie consommée et des produits chimiques, ce qui réduit les marges des fabricants, des distributeurs et des fournisseurs. Cela entraîne des prix d'application élevés pour l'utilisateur final.

- Problèmes de performances médiocres par rapport au plastique conventionnel

Les faibles propriétés de barrière à l'air, à l'eau et à l'oxygène et la faible résistance à la chaleur sont quelques-uns des principaux problèmes de performance liés au PLA par rapport aux plastiques conventionnels. Cela limite sa pénétration dans diverses industries, notamment l'électronique et l'automobile. De plus, les mauvaises propriétés mécaniques telles que la faible résistance aux chocs et à la traction et les capacités de traitement limitent la pénétration du PLA dans diverses applications. Ces limitations de performance du PLA constituent un défi majeur pour la croissance du marché. De plus, le PLA est un polymère biosourcé et biodégradable construit à partir de molécules d'acide lactique. Étant un polyester thermoplastique, il se ramollit lorsqu'il est chauffé et durcit lorsqu'il est refroidi.

Développement récent

En juin 2022, le fabricant australien d'emballages alimentaires Confoil et BASF se sont associés pour développer une barquette alimentaire certifiée compostable et pouvant aller au four à double paroi à base de papier. L'intérieur de la barquette en papier est recouvert d'ecovio PS 1606 de BASF, un biopolymère partiellement biosourcé et certifié compostable spécialement développé pour le revêtement des emballages alimentaires en papier ou en carton. Ce partenariat intensifiera les opérations de l'entreprise sur le marché européen.

Portée du marché européen de l'acide polylactique (PLA)

Le marché européen de l'acide polylactique (PLA) est classé en fonction du type, de la matière première, de la forme, de l'application et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- PLLA racémique (acide poly-l-lactique)

- PDLA (acide poly-D-lactique)

- PLLA régulier (acide poly-l-lactique)

- PDLLA (acide poly-dl-lactique)

- Mélanges PLA

En fonction du type, le marché européen de l'acide polylactique (PLA) est classé en cinq segments, à savoir le PLLA racémique (acide poly-l-lactique), le PDLA (acide poly-d-lactique), le PLLA ordinaire (acide poly-l-lactique), le PDLLA (acide poly-dl-lactique) et les mélanges de PLA.

Matière première

- Canne à sucre

- Maïs

- Manioc

- Betterave à sucre

- Autres

Sur la base des matières premières, le marché européen de l'acide polylactique (PLA) est classé en canne à sucre, maïs, manioc, betterave sucrière et autres.

Formulaire

- Films et feuilles

- Revêtements

- Fibre

- Autres

En fonction de la forme, le marché européen de l'acide polylactique (PLA) est classé en films et feuilles, revêtements, fibres et autres.

Application

- Conditionnement

- Transport

- Agriculture

- Médical

- Électronique

- Textile

- Hygiène

- Autres

En fonction des applications, le marché européen de l'acide polylactique (PLA) est segmenté en emballage, transport, agriculture, médecine, électronique, textile, hygiène et autres.

Utilisateur final

- Films plastiques

- Bouteilles

- Dispositifs médicaux biodégradables

En fonction de l’utilisateur final, le marché européen de l’acide polylactique (PLA) est classé en films plastiques, bouteilles et dispositifs médicaux biodégradables.

Analyse/perspectives régionales du marché de l'acide polylactique (PLA) en Europe

Le marché européen de l’acide polylactique (PLA) est segmenté en fonction du type, de la matière première, de la forme, de l’application et de l’utilisateur final.

Les pays du marché européen de l'acide polylactique (PLA) sont le Royaume-Uni, la Russie, la France, l'Espagne, l'Italie, l'Allemagne, la Turquie, les Pays-Bas, la Suisse, la Belgique et le reste de l'Europe. L'Allemagne domine le marché européen de l'acide polylactique (PLA) en termes de part de marché et de chiffre d'affaires en raison de la tendance croissante des consommateurs à l'égard des produits en plastique respectueux de l'environnement.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'acide polylactique (PLA) en Europe

Le paysage concurrentiel du marché européen de l'acide polylactique (PLA) fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché européen de l'acide polylactique (PLA).

Français Certains des principaux acteurs opérant sur le marché européen de l'acide polylactique (PLA) sont BASF SE, Futerro, NatureWorks LLC, TotalEnergies Corbion, Sulzer Ltd, Mitsubishi Chemical Corporation, TORAY INDUSTRIES, INC., Merck KGaA, Musashino Chemical Laboratory, Ltd., Evonik Industries AG, Polyvel Inc., UNITIKA LTD., Jiangxi Academy of Sciences Biological New Materials Co., Ltd., Shanghai Tong-jie-liang Biomaterials Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd. et Radici Partecipazioni SpA.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, les grilles de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché Europe vs. Région et fournisseur. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE POLYLACTIC ACID (PLA) MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 LEGAL FRAMEWORK

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES

4.4.1 THREAT OF NEW ENTRANTS

4.4.2 THREAT OF SUBSTITUTES

4.4.3 CUSTOMER BARGAINING POWER

4.4.4 SUPPLIER BARGAINING POWER

4.4.5 INTERNAL COMPETITION (RIVALRY)

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 REGULATORY COVERAGE

4.7 RUSSIA AND UKRAINE CONFLICT ANALYSIS – EUROPE POLYLACTIC ACID (PLA) MARKET

4.8 TECHNOLOGY ADVANCEMENT

4.8.1 SORONA FIBERS FROM DUPONT:

4.8.2 DEVELOPMENT AND DEPLOYMENT OF NOVEL SEPARATIONS TECHNOLOGIES

4.8.3 SULZER TECHNOLOGY TURNKEY PROJECTS WITH SUGAR:

4.9 VENDOR SELECTION CRITERIA

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 MANUFACTURING AND PACKING

4.10.3 MARKETING AND DISTRIBUTION

4.10.4 END USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR BIODEGRADABLE PACKAGING ALTERNATIVES FROM THE PACKAGING INDUSTRY

5.1.2 PLA CAN BE AN ALTERNATIVE TO PETROLEUM-BASED POLYMERS

5.1.3 GROWING DEMAND FOR BIO-BASED PLASTICS FILM IN AGRICULTURE

5.1.4 IMPOSITION OF STRICT REGULATIONS ON ENVIRONMENTAL SAFETY BY VARIOUS GOVERNMENTS

5.2 RESTRAINTS

5.2.1 CONCERNS OVER COST AND SPECIFIC INDUSTRIAL COMPOSTING SYSTEM

5.2.2 UNPREDICTABLE RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 MULTI-FUNCTIONALITIES OF PLA

5.3.2 GROWING CONSUMER INCLINATION TOWARDS ECO-FRIENDLY PLASTIC PRODUCT

5.4 CHALLENGES

5.4.1 POOR PERFORMANCE ISSUES AS COMPARED TO CONVENTIONAL PLASTIC

6 EUROPE POLYLACTIC ACID (PLA) MARKET, TYPE

6.1 OVERVIEW

6.2 RACEMIC PLLA (POLY-L-LACTIC ACID)

6.3 PDLA (POLY-D-LACTIC ACID)

6.4 REGULAR PLLA (POLY-L-LACTIC ACID)

6.5 PDLLA (POLY-DL-LACTIC ACID)

6.6 PLA BLENDS

7 EUROPE POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 SUGARCANE

7.3 CORN

7.4 CASSAVA

7.5 SUGAR BEET

7.6 OTHERS

8 EUROPE POLYLACTIC ACID (PLA) MARKET, BY FORM

8.1 OVERVIEW

8.2 FILMS AND SHEETS

8.3 COATINGS

8.4 FIBER

8.5 OTHERS

9 EUROPE POLYLACTIC ACID (PLA) MARKET, APPLICATION

9.1 OVERVIEW

9.2 PACKAGING

9.2.1 FLEXIBLE FILMS FOR FOOD APPLICATIONS

9.2.2 LIGHT CARRIER BAGS/FRUITS & VEGETABLE BAGS/TRASH LINERS

9.2.3 CLING FILMS

9.2.4 INDUSTRIAL FILMS: STRETCH FILMS

9.2.5 RIGID APPLICATIONS

9.2.5.1 CUTLERY

9.2.5.2 TRAY

9.2.5.3 POTS

9.2.5.4 PODS

9.3 TRANSPORT

9.4 AGRICULTURE

9.4.1 MULCHING FILM

9.4.2 HORTICULTURAL POTS

9.4.3 CLIPS

9.5 MEDICAL

9.6 ELECTRONICS

9.7 TEXTILE

9.8 HYGIENE

9.8.1 NON-WOVEN FIBERS

9.8.2 DIAPERS

9.8.3 FILTERS

9.9 OTHERS

10 EUROPE POLYLACTIC ACID (PLA) MARKET, END USER

10.1 OVERVIEW

10.2 PLASTIC FILMS

10.3 BOTTLES

10.4 BIODEGRADABLE MEDICAL DEVICES

10.4.1 SCREWS

10.4.2 PINS

10.4.3 PLATES

10.4.4 RODS

11 EUROPE POLYLACTIC ACID (PLA) MARKET, BY GEOGRAPHY

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 SWITZERLAND

11.1.8 TURKEY

11.1.9 BELGIUM

11.1.10 NETHERLANDS

11.1.11 REST OF EUROPE

12 EUROPE POLYLACTIC ACID (PLA) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.1.1 PARTNERSHIP

12.1.2 PRODUCT LAUNCHES

12.1.3 AWARD

12.1.4 FACILITY EXPANSION

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BASF SE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 TOTALENERGIES CORBION

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATES

14.3 TORAY INDUSTRIES, INC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 MITSUBISHI CHEMICAL CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATES

14.5 NATUREWORKS LLC.

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

14.6 UNITIKA LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT UPDATES

14.7 EVONIK INDUSTRIES AG

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 ZHEJIANG HISUN BIOMATERIALS CO., LTD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 MERCK KGAA

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATES

14.1 SULZER LTD

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT UPDATES

14.11 MUSASHINO CHEMICAL LABORATORY, LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 FUTERRO

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 SHANGHAI TONG-JIE-LIANG BIOMATERIALS CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 POLYVEL INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 JIANGXI ACADEMY OF SCIENCES BIOLOGICAL NEW MATERIALS CO., LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 RADICI PARTECIPAZIONI SPA

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF POLYLACTIC ACID, IN PRIMARY FORMS; HS CODE - PRODUCT: 390770 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYLACTIC ACID, IN PRIMARY FORMS; HS CODE - PRODUCT: 390770 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 TIME TAKEN FOR GARBAGE TO DECOMPOSE IN THE ENVIRONMENT (2015)

TABLE 5 EUROPE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 7 EUROPE RACEMIC PLLA (POLY-L-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE RACEMIC PLLA (POLY-L-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 EUROPE PDLA (POLY-D-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE PDLA (POLY-D-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 EUROPE REGULAR PLLA (POLY-L-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE REGULAR PLLA (POLY-L-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 EUROPE PDLLA (POLY-DL-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE PDLLA (POLY-DL-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 EUROPE PLA BLENDS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE PLA BLENDS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 17 EUROPE POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE SUGARCANE IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE CORN IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE CASSAVA IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE SUGAR BEET IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE OTHERS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE POLYLACTIC ACID (PLA) MARKET, FORM, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE FILMS AND SHEETS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE COATINGS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE FIBER IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE TRANSPORT IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE MEDICAL IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE ELECTRONICS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE TEXTILE IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE OTHERS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE PLASTIC FILMS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE BOTTLES IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 EUROPE BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 48 EUROPE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 50 EUROPE POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 51 EUROPE POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 EUROPE POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 EUROPE PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 EUROPE RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 EUROPE AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 EUROPE HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 EUROPE POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 58 EUROPE BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 59 GERMANY POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 GERMANY POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 61 GERMANY POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 62 GERMANY POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 GERMANY POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 GERMANY PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 GERMANY RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 GERMANY AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 GERMANY HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 GERMANY POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 69 GERMANY BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 70 U.K. POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 U.K. POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 72 U.K. POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 73 U.K. POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 74 U.K. POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 U.K. PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 76 U.K. RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 U.K. AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 U.K. HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 U.K. POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 80 U.K. BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 81 FRANCE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 FRANCE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 83 FRANCE POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 84 FRANCE POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 85 FRANCE POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 86 FRANCE PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 87 FRANCE RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 88 FRANCE AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 FRANCE HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 FRANCE POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 91 FRANCE BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 92 ITALY POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 94 ITALY POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 96 ITALY POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 ITALY RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 102 ITALY BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 103 SPAIN POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 SPAIN POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 105 SPAIN POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 106 SPAIN POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 107 SPAIN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 SPAIN PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 SPAIN RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 SPAIN AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 SPAIN HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 SPAIN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 113 SPAIN BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 114 RUSSIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 RUSSIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 116 RUSSIA POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 117 RUSSIA POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 RUSSIA POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 RUSSIA PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 RUSSIA RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 RUSSIA AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 RUSSIA HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 123 RUSSIA POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 124 RUSSIA BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 125 SWITZERLAND POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 SWITZERLAND POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 127 SWITZERLAND POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 128 SWITZERLAND POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 129 SWITZERLAND POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 SWITZERLAND PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 131 SWITZERLAND RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 SWITZERLAND AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 SWITZERLAND HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 134 SWITZERLAND POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 135 SWITZERLAND BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 136 TURKEY POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 TURKEY POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 138 TURKEY POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 139 TURKEY POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 140 TURKEY POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 141 TURKEY PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 142 TURKEY RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 143 TURKEY AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 144 TURKEY HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 145 TURKEY POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 146 TURKEY BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 147 BELGIUM POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 BELGIUM POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 149 BELGIUM POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 150 BELGIUM POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 151 BELGIUM POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 152 BELGIUM PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 BELGIUM RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 154 BELGIUM AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 155 BELGIUM HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 156 BELGIUM POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 157 BELGIUM BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 158 NETHERLANDS POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 NETHERLANDS POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 160 NETHERLANDS POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 161 NETHERLANDS POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 162 NETHERLANDS POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 NETHERLANDS PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 164 NETHERLANDS RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 165 NETHERLANDS AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 166 NETHERLANDS HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 167 NETHERLANDS POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 168 NETHERLANDS BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 169 REST OF EUROPE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 170 REST OF EUROPE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 EUROPE POLYLACTIC ACID (PLA) MARKET

FIGURE 2 EUROPE POLYLACTIC ACID (PLA) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE POLYLACTIC ACID (PLA) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE POLYLACTIC ACID (PLA) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE POLYLACTIC ACID (PLA) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE POLYLACTIC ACID (PLA) MARKET: THE TYPE LIFELINE CURVE

FIGURE 7 EUROPE POLYLACTIC ACID (PLA) MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE POLYLACTIC ACID (PLA) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE POLYLACTIC ACID (PLA) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE POLYLACTIC ACID (PLA) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 EUROPE POLYLACTIC ACID (PLA) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE POLYLACTIC ACID (PLA) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE POLYLACTIC ACID (PLA) MARKET: SEGMENTATION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE EUROPE POLYLACTIC ACID (PLA) MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING DEMAND FOR BIO-BASED PLASTICS FILM IN AGRICULTURE IS DRIVING EUROPE POLYLACTIC ACID (PLA) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 RACEMIC PLLA (POLY-L-LACTIC ACID) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE POLYLACTIC ACID (PLA) MARKET IN 2022 & 2029

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 SUPPLY CHAIN ANALYSIS- EUROPE POLYLACTIC ACID (PLA) MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE POLYLACTIC ACID (PLA) MARKET

FIGURE 20 EUROPE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2021

FIGURE 21 EUROPE POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2021

FIGURE 22 EUROPE POLYLACTIC ACID (PLA) MARKET,BY FORM, 2021

FIGURE 23 EUROPE POLYLACTIC ACID (PLA) MARKET, APPLICATION, 2021

FIGURE 24 EUROPE POLYLACTIC ACID (PLA) MARKET, END USER, 2021

FIGURE 25 EUROPE POLYLACTIC ACID (PLA) MARKET: SNAPSHOT (2021)

FIGURE 26 EUROPE POLYLACTIC ACID (PLA) MARKET: BY COUNTRY (2021)

FIGURE 27 EUROPE POLYLACTIC ACID (PLA) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 EUROPE POLYLACTIC ACID (PLA) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 EUROPE POLYLACTIC ACID (PLA) MARKET: BY TYPE (2022-2029)

FIGURE 30 EUROPE POLYLACTIC ACID (PLA) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.